Transcription

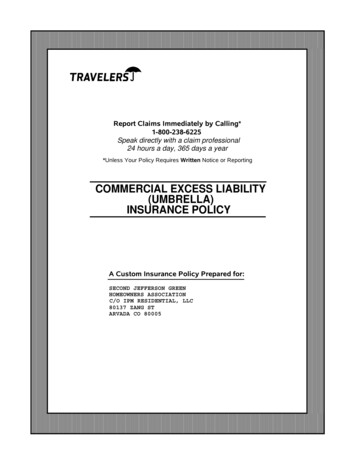

Report Claims Immediately by Calling*1-800-238-6225Speak directly with a claim professional24 hours a day, 365 days a year*Unless Your Policy Requires Written Notice or ReportingCOMMERCIAL EXCESS LIABILITY(UMBRELLA)INSURANCE POLICYA Custom Insurance Policy Prepared for:SECOND JEFFERSON GREENHOMEOWNERS ASSOCIATIONC/O IPM RESIDENTIAL, LLC80137 ZANG STARVADA CO 80005

This policy consists of this policy cover, the Policy Declarations and the Policy Forms, and endorsements listedin that declaration form.In return for payment of the premium, we agree with the Named Insured to provide the insurance afforded by thispolicy. That insurance will be provided by the company indicated as insuring company in the Declarations by theabbreviation of its name.One of the companies listed below (each a stock company) has executed this policy, but it is valid only if countersigned on the Declarations by our authorized representative.The Travelers Indemnity Company (IND)Travelers Property Casualty Company of America (TIL)The Travelers Indemnity Company of Connecticut (TCT)SecretaryPresident(Rev. 04-10)

POLICY DECLARATIONSCOMMERCIAL EXCESS LIABILITY(UMBRELLA) INSURANCE POLICYPOLICY NO.: CUP-9J447204-18-42ISSUE DATE: 12/14/2018INSURING COMPANY:THE TRAVELERS INDEMNITY COMPANY1. NAMED INSURED AND MAILING ADDRESS:SECOND JEFFERSON GREENHOMEOWNERS ASSOCIATIONC/O IPM RESIDENTIAL, LLC80137 ZANG STARVADA CO 80005THIS POLICY DOES NOTCOVER LIABILITYARISING OUT OFASBESTOS MATERIALSEE ENDORSEMENTUM 01 96 07 962. THE NAMED INSURED IS A:X CORPORATIONSOLE PROPRIETORPARTNERSHIP OR JOINT VENTUREOTHER3. POLICY PERIOD: From 12/15/2018 to 12/15/201912:01 A.M. Standard Time at your mailing address. 4. PREMIUM: ** DIRECT BILL12,182X Flat Charge5. LIMITS OF INSURANCE:COVERAGESAGGREGATE LIMITS OF LIABILITYCOVERAGE A - Bodily Injury andProperty DamageLiabilityCOVERAGE B - Personal andAdvertising InjuryLiabilityAdjustable (See premium schedule)LIMITS OF LIABILITY10,000,00010,000,000Products/Completed Operations AggregateGeneral Aggregate10,000,000any one occurrence subject to the Products/Completed Operations and the GeneralAggregate Limitsany one person or organization subject tothe General Aggregate Limit of Liability10,000,0005,000RETAINED LIMIT6. SCHEDULE OF UNDERLYING INSURANCE:POLICYLIMITS (000 omitted)any one occurrence or offenseCOVERAGECOMPANYSEE ENDORSEMENT CG D0 23 04 967. On the effective date shown in Item 3, the Commercial Excess Liability (Umbrella) Insurance Policynumbered above includes this Declarations Page and the Policy Jacket (Form UM 00 76 which contains theNuclear Energy Liability Exclusion) and any endorsements listed hereafter:SEE END. IL T8 01 01 01COUNTERSIGNED BY:NAME AND ADDRESS OF AGENT OR BROKER:SYNERGY INS ADVISORSDJZ5210700 E GEDDES AVE STE 125Authorized RepresentativeENGLEWOODCO 80112DATE:CG T0 14 04 96OFFICE: DENVER COPage 1 of 1

POLICY NUMBER:CUP-9J447204-18-42EFFECTIVE DATE:12/15/2018ISSUE DATE:12/14/2018LISTING OF FORMS, ENDORSEMENTS AND SCHEDULE NUMBERSTHIS LISTING SHOWS THE NUMBER OF FORMS, SCHEDULES AND ENDORSEMENTSBY LINE OF BUSINESSCG T0 14 04 96IL T8 01 01 01POLICY DECLARATIONS COMMERCIAL EXCESS LIABILITYUMBRELLAFORMS ENDORSEMENTS AND SCHEDULE NUMBERSUMBRELLA / EXCESSCG D0 23 04 96UM 00 01 11 03UM 03 59 11 03UM 02 59 02 903009010702011007070310029697021108080911UM 06 50 01 15UM 01 20 11 03UM 03 98 11 11SCHEDULE OF UNDERLYING INSURANCECOMMERCIAL EXCESS LIABILITY UMBRELLA INSURANCEEXCLUSION - REAL ESTATE DEVELOPMENT ACTIVITIES COMPLETED OPERATIONSKNOWLEDGE AND NOTICE OF OCCURRENCE OR OFFENSEUNINTENTIONAL OMISSIONEMPLOYERS LIABILITY - FOLLOWING FORMAMENDMENT OF DEFENSE OF CLAIMS OR SUITSWAIVER OF OUR RIGHT TO RECOVER FROM OTHERSAMEND OF COV B - PERSONAL INJURY AND ADVERTISINGINJURY LIABILITYCRISIS MANAGEMENT SERVICES EXPENSESAMENDMENT OF SPOUSE - PARTY TO A CIVIL UNIONAMEND-FIN INT IN FOREIGN INS ORG - UMAMENDMENT OF COVERAGE - NAMED INSUREDREASONABLE FORCE - BODILY INJURY OR PROPERTY DAMAGENUCLEAR ENERGY LIABILITY EXCLUSION ENDORSEMENTBROADFORMWAR EXCLUSIONEXCLUSION - ASBESTOSEXCLUSION - LEADFUNGI OR BACTERIA EXCLUSIONEXCLUSION - UNSOLICITED COMMUNICATIONSAMENDMENT OF WATERCRAFT OR AIRCRAFT EXCLUSIONAUTO LIABILITY EXCLUSION - LIMITED FOLLOWING FORMEXCLUSION - DISCRIMINATIONEXCLUSION - VIOLATION OF CONSUMER FINANCIAL PROTECTIONLAWSEXCLUSION - ACCESS OR DISCLOSURE OF CONFIDENTIAL ORPERSONAL INFORMATIONCO MANDATORY ENDORSEMENTAMENDMENT OF COVERAGE - PROPERTY DAMAGEINTERLINE ENDORSEMENTSIL T3 68 01 15IL T4 14 01 15IL T8 01 01 01FEDERAL TERRORISM RISK INSURANCE ACT DISCLOSURECAP ON LOSSES FROM CERTIFIED ACTS OF TERRORISMPAGE:1OF1

UMBRELLAPOLICY NUMBER: CUP-9J447204-18-42ISSUE DATE: 12/14/2018THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.SCHEDULE OF UNDERLYING INSURANCEThis endorsement modifies insurance provided under the following:COMMERCIAL EXCESS LIABILITY (UMBRELLA) INSURANCEItem 6 of the Declarations to include:POLICY680-009H963553-18LIMITS (000 OMITTED)COVERAGECOMPANY1,000TILEACH OCCURRENCEGENERAL LIABILITY2,000GENERAL AGGREGATE2,000PROD/COMP OPS AGGThe policies shown above are issued in one or more of the Travelers Companies. The above company(s)translates as follows:TIL TRAVELERS PROPERTY CASUALTY COMPANY OF AMERICA“(If you have any employee exposure in the State of New York,the Employers Liability Limits are applicable only to bodily injury to your"non-subject employees" as defined under Rule VIII - Limits of Liability,A.2., of the WC/EL Manual of the State of New York)”PRODUCER: SYNERGY INS ADVISORSCG D0 23 04 96OFFICE: DENVER COPage 1052of 1

UMBRELLACOMMERCIAL EXCESS LIABILITY (UMBRELLA)INSURANCEVarious provisions in this policy restrict coverage. Read the entire policy carefully to determine rights, duties andwhat is and is not covered.Throughout this insurance the words "you" and "your" refer to the Named Insured shown in the Declarations. Thewords "we", "us" and "our" refer to the Company providing this insurance.The word "insured" means any person or organization qualifying as such under SECTION II – WHO IS AN INSURED.Other words and phrases that appear in quotation marks have special meaning. Refer to SECTION V – DEFINITIONS.SECTION I – COVERAGESCOVERAGE A. BODILY INJURY AND PROPERTYDAMAGE LIABILITY; and COVERAGE B. PERSONAL INJURY AND ADVERTISING INJURYLIABILITY.1. INSURING AGREEMENT.a. We will pay on behalf of the insured the "ultimate net loss" in excess of the "applicableunderlying limit" which the insured becomeslegally obligated to pay as damages becauseof "bodily injury", "property damage", "personal injury" or "advertising injury" to whichthis insurance applies.This insurance applies to "bodily injury" or"property damage" only if:(i) The "bodily injury" or "property damage"is caused by an "occurrence" that takesplace anywhere in the world;(ii) The "bodily injury" or "property damage"occurs during the policy period;(iii) Prior to the policy period, no insuredlisted under Paragraph 1. of SECTION II– WHO IS AN INSURED and no employee authorized by you to give or receive notice of an "occurrence" or claim,knew that the "bodily injury" or "propertydamage" had occurred, in whole or inpart. If such a listed insured or authorizedemployee knew, prior to the policy period,that the "bodily injury" or "property damage" occurred, then any continuation,change or resumption of such "bodily injury" or "property damage" during or afterthe policy period will be deemed to havebeen known prior to the policy period.UM 00 01 11 03This insurance applies to "personal injury" or"advertising injury" caused by an "offense"committed during the policy period, anywherein the world.b. Damages because of "bodily injury" includedamages claimed by any person or organization for care, loss of services or death resulting at any time from the "bodily injury".c. "Property damage" that is loss of use of tangible property that is not physically injuredshall be deemed to occur at the time of the"occurrence" that caused it.d. The amount we will pay for damages is limited as described in SECTION III – LIMITSOF INSURANCE.The following provisions apply only with respectto Parts 1.a.(i), (ii) and (iii) above:1. "Bodily injury" or "property damage" whichoccurs during the policy period and was not,prior to the policy period, known to have occurred by any insured listed under Paragraph1. of Section II – Who Is An Insured or anyemployee authorized by you to give or receive notice of an "occurrence" or claim, includes any continuation, change or resumption of that "bodily injury" or "propertydamage" after the end of the policy period.2. "Bodily injury" or "property damage" will bedeemed to have been known to have occurred at the earliest time when any insuredlisted under Paragraph 1. of SECTION II –WHO IS AN INSURED or any employee authorized by you to give or receive notice of an"occurrence" or claim:(a) Reports all, or any part, of the "bodily injury" or "property damage" to us or anyother insurer;Copyright, The Travelers Indemnity Company, 2003Page 1 of 13

UMBRELLA(b) deposited in court:(b) Receives a written or verbal demand orclaim for damages because of "bodily injury" or "property damage"; orthe part of the judgment that is within the"applicable limit of insurance".(c) Becomes aware by any other means that"bodily injury" or "property damage" hasoccurred or has begun to occur.(6) Prejudgment interest awarded against theinsured on that part of the judgment wepay. If we make an offer to pay the "applicable limit of insurance", we will notpay any prejudgment interest based onthat period of time after the offer.2. DEFENSE OF CLAIMS OR SUITS.a. We will have no duty to defend any claim or"suit" that any other insurer has a duty to defend. If we elect to join in the defense of suchclaims or "suits", we will pay all expenses weincur.b. We will have the right and duty to defend any"suit" for damages which are payable underCoverages A or B (including damages whollyor partly within the "retained limit") but whichare not payable by a policy of "underlying insurance", or any other available insurance,because:These payments will not reduce the limits ofinsurance.In any jurisdiction outside the United States ofAmerica (including its territories and possessions), Puerto Rico or Canada where we may beprevented by law or some other factor beyond ourcontrol from carrying out the agreements under 1.INSURING AGREEMENT or 2. DEFENSE OFCLAIMS OR SUITS above:(1) Such damages are not covered; ora. You must arrange to investigate, defend orsettle any claim or "suit".(2) The "underlying insurance" has been exhausted by the payment of claims.b. You will not make any settlement without ourconsent.c. We may investigate and settle any claim or"suit" in b. above at our discretion.d. Our right and duty in b. above end when wehave used up the "applicable limit of insurance" in the payment of judgments or settlements.e. We will pay, with respect to any claim or "suit"we defend in b. above:(1) All expenses we incur.(2) The cost of appeal bonds and bonds torelease attachments, but only for bondamounts within the "applicable limit of insurance". We do not have to furnishthese bonds.(3) All reasonable expenses incurred by theinsured at our request to assist us in theinvestigation or defense of the claim or"suit", including actual loss of earnings upto 250 a day because of time off fromwork.(4) All costs taxed against the insured in the"suit".(5) All interest on the full amount of anyjudgment that accrues after entry of thejudgment and before we have:(a) paid, or offered to pay; orPage 2 of 13c.We will pay expenses incurred with our consent.3. EXCLUSIONS.This insurance does not apply to:a. Expected or Intended Injury"Bodily injury" or "property damage" expectedor intended from the standpoint of the insured. This exclusion does not apply to "bodily injury" resulting from the use of reasonableforce to protect persons or property.b. "Advertising Injury" "Offenses"(1) Breach of Contract"Advertising injury" arising out of a breachof contract, except an implied contract touse another's advertising idea in thecourse of advertising your goods, products or services.(2) Quality Or Performance Of Goods –Failure To Conform To Statements"Advertising injury" arising out of the failure of goods, products or services to conform with any statement of quality or performance made in the course ofadvertising your goods, products or services.Copyright, The Travelers Indemnity Company, 2003UM 00 01 11 03

UMBRELLA(3) Wrong Description Of Prices"Advertising injury" arising out of thewrong description of the price of goods,products or services stated in the courseof advertising your products, goods orservices.c. Employment-Related Practices"Bodily injury" or "personal injury" to:1. A person arising out of any:(a) Refusal to employ that person;(b) Termination of that person's employment; or(c) Employment-related practices, policies, acts or omissions, such as coercion, demotion, evaluation, reassignment, discipline, defamation,harassment, humiliation or discrimination directed at that person; or2. The spouse, child, parent, brother or sister of that person as a consequence of"bodily injury" or "personal injury" to thatperson at whom any of the employmentrelated practices described in paragraphs(a), (b) or (c) above is directed.This exclusion applies whether the insuredmay be held liable as an employer or in anyother capacity; and, to any obligation to sharedamages with or repay someone else whomust pay damages because of the injury.d. Contractual Liability"Bodily injury", "property damage", "personalinjury" or "advertising injury" for which the insured assumed liability under a contract oragreement. This exclusion does not apply to"bodily injury", "property damage", "personalinjury" or "advertising injury" to which any policy of "underlying insurance" listed in theSCHEDULE OF UNDERLYING INSURANCEof the DECLARATIONS of this insurance, orany renewal or replacement thereof, appliesor would apply but for the exhaustion of itslimits of liability. Coverage provided will followthe same provisions, terms, definitions, exclusions, limitations and conditions of the policy(ies) of "underlying insurance" listed in theSCHEDULE OF UNDERLYING INSURANCEof the DECLARATIONS of this insurance.e. Workers Compensation And Similar LawsAny obligation of the insured under a workerscompensation, disability benefits or unem-UM 00 01 11 03ployment compensation law or any similarlaw.f.Pollution"Bodily injury", "property damage", "personalinjury" or "advertising injury" arising out of theactual, alleged or threatened discharge, dispersal, seepage, migration, release or escapeof "pollutants", or any loss, cost, expense ordamages resulting therefrom, but this exclusion does not apply to "bodily injury", "property damage", "personal injury" or "advertisinginjury" to which any policy of "underlying insurance" listed in the SCHEDULE OF UNDERLYING INSURANCE of the DECLARATIONS of this insurance, or any renewal orreplacement thereof, applies or would applybut for the exhaustion of its limits of liability.Coverage provided will follow the same provisions, terms, definitions, exclusions, limitations and conditions of the policy(ies) of "underlying insurance" listed in the SCHEDULEOF UNDERLYING INSURANCE of the DECLARATIONS of this insurance.g. Watercraft Or Aircraft"Bodily injury" or "property damage" arisingout of the ownership, maintenance, operation,use, including loading or unloading, or entrustment to others of any watercraft or anyaircraft.This exclusion does not apply to:(1) A watercraft while ashore on premisesyou own or rent;(2) Liability assumed under any contract oragreement for the ownership, maintenance or use of a watercraft;(3) A watercraft over 50 feet in length whichis chartered with crew by or on behalf ofany insured;(4) A watercraft less than 50 feet long whichyou own; or(5) A watercraft less than 50 feet long whichyou do not own and is not being used tocarry persons or property for a charge.This exclusion applies even if the claimsagainst any insured allege negligence orother wrongdoing in the supervision, hiring,employment, training or monitoring of othersby that insured, if the "occurrence" whichcaused the "bodily injury" or "property damage" involved the ownership, maintenance,Copyright, The Travelers Indemnity Company, 2003Page 3 of 13

UMBRELLAuse or entrustment to others of any watercraftor any aircraft that is owned or operated by orrented or loaned to any insured."underlying insurance" listed in theSCHEDULE OF UNDERLYING INSURANCE of the DECLARATIONS of this insurance.h. "Personal Injury" Or "Advertising Injury""Offenses"(6) Insureds In Media And Internet TypeBusinesses(1) Knowing Violation Of Rights Of Another"Personal injury" or "advertising injury"committed by an insured whose businessis:"Personal injury" or "advertising injury"caused by or at the direction of the insured with the knowledge that the actwould violate the rights of another andwould inflict "personal injury" or "advertising injury".(1) Advertising, broadcasting, publishingor telecasting;(2) Designing or determining content ofwebsites for others; or(2) Material Published With Knowledge OfFalsity(3) An Internet search, access, contentor service provider."Personal injury" or "advertising injury"arising out of oral, written or electronicpublication of material, if done by or at thedirection of the insured with knowledge ofits falsity.However, this exclusion does not apply toParagraphs a., b. and c. of the "personalinjury" definition in SECTION V – DEFINITIONS .For the purposes of this exclusion, theplacing of frames, borders or links, or advertising, for you or others anywhere onthe Internet, is not by itself, consideredthe business of advertising, broadcasting,publishing or telecasting.(3) Material Published Prior To Policy Period"Personal injury" or "advertising injury"arising out of oral, written or electronicpublication of material whose first publication took place before the beginning ofthe policy period. All "personal injury" or"advertising injury" arising out of publication of the same or similar material subsequent to the beginning of the policy period is also excluded.(7) ElectronicBoardsBulletin(8) Unauthorized Use Of Another's NameOr Product"Personal injury" or "advertising injury"arising out of a criminal act committed byor at the direction of the insured."Personal injury" or "advertising injury"arising out of the unauthorized use of another's name or product in your e-mailaddress, domain name or metatag, or anyother similar tactics to mislead another'spotential customers.(5) Contractual LiabilityPage 4 of 13Or"Personal injury" or "advertising injury"arising out of an electronic chatroom orbulletin board the insured hosts, owns, orover which the insured exercises control.(4) Criminal Acts"Personal injury" or "advertising injury" forwhich the insured has assumed liability ina contract or agreement. This exclusiondoes not apply to "personal injury" or "advertising injury" to which any policy of"underlying insurance" listed in theSCHEDULE OF UNDERLYING INSURANCE of the DECLARATIONS of this insurance, or any renewal or replacementthereof, applies or would apply but for theexhaustion of its limits of liability. Coverage provided will follow the same provisions, terms, definitions, exclusions, limitations and conditions of the policy(ies) ofChatroomsi.Damage To Property"Property damage" to:(1) Property you own, rent or occupy, including any costs or expenses incurred byyou, or any other person, organization orentity, for repair, replacement, enhancement, restoration or maintenance of suchproperty for any reason, including prevention of injury to a person or damage toanother's property;Copyright, The Travelers Indemnity Company, 2003UM 00 01 11 03

UMBRELLA(2) Premises you sell, give away or abandon,if the "property damage" arises out of anypart of those premises;(1) A defect, deficiency, inadequacy or dangerous condition in "your product" or"your work"; or(3) Property loaned to you;(2) A delay or failure by you or anyone actingon your behalf to perform a contract oragreement in accordance with its terms.(4) Personal property in the care, custody orcontrol of the insured;(5) That particular part of real property onwhich you or any contractors or subcontractors working directly or indirectly onyour behalf are performing operations, ifthe "property damage" arises out of thoseoperations; or(6) That particular part of any property thatmust be restored, repaired or replacedbecause "your work" was incorrectly performed on it.Paragraphs (1), (3) and (4) of this exclusiondo not apply to "property damage" (other thandamage by fire) to premises, including thecontents of such premises, rented to you for aperiod of 7 or fewer consecutive days.Paragraph (2) of this exclusion does not applyif the premises are "your work" and werenever occupied, rented or held for rental byyou.Paragraphs (3), (4), (5) and (6) of this exclusion do not apply to liability assumed under asidetrack agreement.Paragraph (6) of this exclusion does not applyto "property damage" included in the "products-completed operations hazard".j.Damage To Your Product"Property damage" to "your product" arisingout of it or any part of it.k. Damage To Your Work"Property damage" to "your work" arising outof it or any part of it and included in the"products-completed operations hazard".This exclusion does not apply if the damagedwork or the work out of which the damagearises was performed on your behalf by asubcontractor.l.Damage To Impaired Property Or PropertyNot Physically Injured"Property damage" to "impaired property" orproperty that has not been physically injured,arising out of:UM 00 01 11 03This exclusion does not apply to the loss ofuse of other property arising out of suddenand accidental physical injury to "your product" or "your work" after it has been put to itsintended use.m. Recall Of Products, Work Or ImpairedPropertyDamages claimed for any loss, cost or expense incurred by you or others for the loss ofuse, withdrawal, recall, inspection, repair, replacement, adjustment, removal or disposalof:(1) "Your product";(2) "Your work"; or(3) "Impaired property";if such product, work, or property is withdrawnor recalled from the market or from use byany person or organization because of aknown or suspected defect, deficiency, inadequacy or dangerous condition in it.n. Uninsured Motorists, Underinsured Motorists, "Auto" No-Fault, Medical ExpensesBenefits and Income Loss BenefitsAny liability imposed on the insured, or the insured's insurer, under any of the followinglaws:(1) Uninsured Motorists;(2) Underinsured Motorists;(3) "Auto" No-Fault Laws or other first partypersonal injury laws; or(4) Medical Expense Benefits and IncomeLoss Benefits Laws of any applicablestate or jurisdiction.o. Liquor Legal Liability"Bodily injury" or "property damage" for whichany insured may be held liable by reason of:(1) Causing or contributing to the intoxicationof any person;(2) The furnishing of alcoholic beverages to aperson under the legal drinking age orunder the influence of alcohol; orCopyright, The Travelers Indemnity Company, 2003Page 5 of 13

UMBRELLA(3) Any statute, ordinance or regulation relating to the sale, gift, distribution or use ofalcoholic beverages.borrow while it is being used in your business.None of the following is an insured under (1)or (2) above:This exclusion applies only if you are in thebusiness of manufacturing, distributing, selling, serving or furnishing alcoholic beverages.This exclusion does not apply to "bodily injury" or "property damage" to which any policyof "underlying insurance" listed in theSCHEDULE OF UNDERLYING INSURANCEof the DECLARATIONS of this insurance, orany renewal or replacement thereof, appliesor would apply but for the exhaustion of itslimits of liability. Coverage provided will followthe same provisions, terms, definitions, exclusions, limitations and conditions of the policy(ies) of "underlying insurance" listed in theSCHEDULE OF UNDERLYING INSURANCEof the DECLARATIONS of this insurance.(a) Any person employed by or engagedin the duties of an auto sales agency,repair shop, service station, storagegarage or public parking place thatyou do not operate;(b) The owner or lessee of any "auto"hired by or for you or loaned to you,and any agent or employee of suchowner or lessee.b. Except as respects the "auto hazard":(1) Your executive officers, employees, directors or stockholders while acting withinthe scope of their duties; and(2) Any person or organization while actingas real estate manager for you.SECTION II – WHO IS AN INSURED.1. If you are designated in the Declarations as:a. An individual, you and your spouse are insureds, but only with respect to the conduct of abusiness of which you are the sole owner.b. A partnership or joint venture, you are an insured. Your members, your partners, andtheir spouses are also insureds, but only withrespect to the conduct of your business.c. A limited liability company, you are an insured. Your members are also insureds, butonly with respect to the conduct of your business. Your managers are insureds, but onlywith respect to their duties as your managers.d. An organization other than a partnership, jointventure or limited liability company, you arean insured.c. Any organization you newly acquire or form,other than a partnership or joint venture, andover which you maintain ownership or majority interest, will be deemed to be a Named Insured. However, coverage does not apply to:(1) "Bodily injury" or "property damage" thatoccurred before you acquired or formedthe organization; and(2) "Personal injury" or "advertising injury"arising out of an "offense" committed before you acquired or formed the organization.d. Any person or organization having propertemporary custody of your property if you die,but only:(1) With respect to liability arising out of themaintenance or use of that property; ande. A trust, you are an insured. Your trustees arealso insureds, but only with respect to theirduties as trustees.2. Each of the following is also an insured:a. As respects the "auto hazard":(1) Anyone using an "auto" you own, hire orborrow including any person or organization legally responsible for such use provided it is with your permission; and(2) Any of your executive officers, directors,partners, employees or stockholders, operating an "auto" you do not own, hire orPage 6 of 13(2) Until your legal representative has beenappointed.e. Your legal representative if you die, but onlywith respect to duties as such. That representative will have all your rights and duties under this insurance.f.Any other person or organization insured under any policy of the "underlying insurance"listed in the SCHEDULE OF UNDERLYINGINSURANCE of the DECLARATIONS of thisinsurance for whom you have agreed in awritten contract executed prior to loss to provide insurance. This insurance is subject to allCopyright, The Travelers Indemnity Company, 2003UM 00 01 11 03

UMBRELLAthe limitations upon coverage under such policy of "underlying insurance", and, the limitsof insurance afforded to such person or organization will be:(i) The difference between the "underlyinginsurance" limits and the minimum limitsof insurance which you agreed to provide;or(ii) The limits of insurance of this policywhichever is less.If the minimum limits of insurance you agreedto provide such person or organization in awritten contract are wholly within the "underlying insurance", this policy shall not apply.No person or organization is an insured with respect to the conduct of any current or past partnership or joint venture that is not shown as aNamed Insured in the Declarations.No person is an insured as respects "bodily injury" to a fellow employee unless insurance forsuch liability is afforded by the "underlying insurance".SECTION III – LIMITS OF INSURANCE.1. The Limits of Insurance shown in the Declarationsand the rules below fix the most we will pay regardless of the number of:a. Insureds;b. Claims made or "suits" brought; orc. Persons or organizations making claims orbringing "suits".2. The Products-Completed Operations AggregateLimit is the most we will pay under Coverage Afor damages because of injury and damage included in the "products-completed operationshazard".3. The General Aggregate Limit is the most we willpay for damages under Coverage A and Coverage B, except:a. Damages because of injury and damage included in the "products-completed operationshazard"; andb. Damages because of injury and damage included in the "auto hazard".4. Subject to 3. above, the Personal and AdvertisingInjury Limit is the most we will pay under Coverage B for the sum of all damages because of all"personal injury" and all "advertising injury" sustained by any one person or organization.UM 00 01 11 03Non cumulation of Personal and Advertising Injury Limit – If "personal injury" and/or "advertisinginjury" is sustained by any one person or organization during the policy period and during the policy period of one or more prior and/or future policies that include a COMMERCIAL EXCESSLIABILITY (UMBRELLA) INSURANCE policy forthe insured issued by us or any affiliated insurance company, the amount we will pay is limited.This policy's Personal and Advertising Injury Limitwill be reduced by the amount of each paymentmade by us and any affiliated insurance companyunder the other policies because of such "personal injury" and/or "advertising injury".5. Subject to 2. or 3. above, whichever applies, theEach Occurrence Limit is the most we will pay forthe sum of damages under Coverage A becauseof all "bodily injury" and "property damage" arisingout of any one "occurrence".Non cumulation of Each Occurrence Limit – I

commercial excess liability issue date: (umbrella) insurance policy insuring company: 1. named insured and mailing address: 2. the named insured is a: corporation sole proprietor partnership or joint venture other 4. premium: flat charge adjustable (see premium schedule) 5. limits of insurance: coverages limits of liability aggregate limits .