Transcription

We are India’slargest and trustedstandalone healthinsurance providerStar Health and AlliedInsurance Company LimitedAnnual Report FY2020-21

ContentsCorporate overview02Corporate snapshot10This is what we have to show for our 15 years inbusiness12How we strengthened our business model duringa challenging FY2020-2114The rationale for Star Health’s presence in thehealth insurance sector20Culture, character and competence22Star Health’s biggest strength lies in its brand24At Star Health, our principal competitive advantageis derived from our talent capital28When a customer seeks a health insurance policy,Star Health is never far away32Star Health is wired across levels and locations toservice with speed, sensitivity and smile36We have created a modern, networked, digitalisedand future-ready Star Health38Our commitment to ESG and value-creation44Management discussion and analysis50How we manage risk at Star HealthStatutory section51AGM Notice53Board’s report62Corporate governance reportFinancial section76Financial statementsForward-looking statementIn this Annual Report, we have disclosed forward-lookinginformation to enable investors to comprehend ourprospects and take informed investment decisions. Thisreport and other statements - written and oral - that weperiodically make, contain forward-looking statements thatset out anticipated results based on the management’splans and assumptions. We have tried wherever possibleto identify such statements by using words such as‘anticipates’, ‘estimates’, ‘expects’, ‘projects’, ‘intends’,‘plans’, ‘believes’ and words of similar substance inconnection with any discussion of future performance. Wecannot guarantee that these forward-looking statementswill be realised, although we believe we have been prudentin our assumptions. The achievement of results is subjectto risks, uncertainties and even inaccurate assumptions.Should known or unknown risks or uncertaintiesmaterialise, or should underlying assumptions proveinaccurate, actual results could vary materially from thoseanticipated, estimated or projected. Readers should bearthis in mind. We undertake no obligation to publicly updateany forward-looking statements, whether as a result ofnew information, future events or otherwise.Online Annual reportwww.starhealth.in

PART ONEPersonality andperformance

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21Scale, scopeand successIn the short span of 15 years,Star Health and Allied InsuranceCompany Limited has emergedas the largest standalone healthinsurance company in India.This rapid growth has beenachieved because it has providedcustomers with a peace of mind.This peace of mind has beendelivered through policiescustomised around customerneeds, situations, possibilities anda service standard that is sensitiveand timely.The result is that when it comesto buying a health insurance policyand the possibility of appraisingStar Heath, the normal responsecomes down to one over-ridingemotion.Complete trust.02

03Corporate overviewStatutory Reports169Million, number of livesinsured by us in the last 15years ending Fiscal 2021That is more than six times the entirepopulation of a country like AustraliaFinancial Statments

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-2104

05Corporate overviewStatutory ReportsFinancial StatmentsAt Star Health,we believe thatwhat you areis the result ofthe vision youhold dearVisionMissionTo become the largestTo offer wide range ofand the most preferred innovative products /Health Insuranceservices.Company in India.To provide prompt,To provide financialcourteous andsecurity for health care quality service to themanagement.customers.To leverage stateof art technology forcustomer satisfaction.To adopt the bestmanagement practicesin business operations.

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21At Star Health, weare not engagedin the business tosell more insurancepolicies as muchas we are in thebusiness to serveand protectOur commitmentWe shall Make availableinsurance coverageto every segment ofthe population.Expand productlines and servicescontinually.Conduct thebusiness operationswith customer as thefocal point.Create insuranceawareness as partof Corporate SocialResponsibility.Build andmaintain enduringrelationships with thecustomers.06

07Corporate overviewStatutory ReportsFinancial StatmentsProvide access tocustomers throughinternet & call centrehelplines.Enhance the contentand quality ofcommunication inmass media like thePress, Television,Radio, Social Mediaetc.Standards for access to informationWe shall Educate the publicand the customersof multiple optionsin products andservices.Distribute brochureson products andservices.Spread informationon products andservices throughinternet, interactivevoice responsesystem andinformation kiosksetc.Benchmarks for servicingOn settlement of claims, we shall Decide on preauthorisation forcashless facilitywithin 4 hoursfrom the receiptof the request.Decide onreimbursementclaims within30 days ofthe receiptof completedocuments/clarifications.Standards for fairness indealing with customersWe shall Strive todeal with thecustomers inan open andtransparentmanner.On underwriting, we shall Enable thecustomers toknow the claimstatus within 3days of receipt ofthe documents.Issue policieson individualHealth, PersonalAccident,Corporateand OverseasMediclaimPolicies instantly.Confirmunderwritingdecision within7 days fromthe receipt ofmedical reports- whereverpre-medicalexamination isrequired.Send renewalnotice 45 daysbefore the expiryof the policy.Standards for redressalof grievancesWe shall Explain therationale behinddecisionsconsistent withthe businesspractice.Ensure effectiveGrievanceRedressalMechanism forthe customerswho approachus throughthe IntegratedGrievanceManagementSystem (IGMS)/ CustomerCare Dept /the GrievancesDept / PublicGrievancePortal / NationalConsumerHelpline.Register allgrievancesand send theacknowledgementswithin 3 days.Resolvegrievanceswithin 15 days ofreceipt.Informcustomers aboutthe availabilityof InsuranceOmbudsmanas a redressalforum.

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21Corporate snapshotStar Health and AlliedInsurance CompanyLimited.India’s first standalonehealth insurance provider.In fifteen years, StarHealth is India’s largestand trusted standalonehealth insurance provider.Giving millions of itscustomers more than justa health insurance policy.Providing them with apeace of mind instead.08

09BackgroundStar Health and Allied Insurance Co.Ltd. commenced operations in 2006as India’s first Standalone HealthInsurance provider (the Companyhas widened its coverage to Health,Personal Accident and OverseasTravel Insurance). The Companyprovides policies customised aroundthe needs of individuals, familiesand companies. These servicesare provided through a distributionnetwork comprising agents, brokersand the online format. Star Healthis also prominently engaged inbancassurance on the basis of itslong-standing relationships withbanks.DistributionStar Health enjoys a presence in26 States and 4 Union Territories.This presence is supported by 737branch offices across the country.Corporate overviewStatutory ReportsEmployeesThe employees possess domainexpertise and rich functionalcompetencies comprisingactuarial, risk management, claimsmanagement, financial, marketing,information technology, humanresource management, distributionand administration capabilities.ServiceStar Heath is respected for itssensitive and timely service.The Company has one of thelargest health insurance hospitalnetworks in India comprisingmore than 10,870 hospitals as of31st March, 2021. The company’sinconvenience-free in-house claimssettlement (without the interventionof TPA) has been complemented bya service standard that comprisespersonalised doctor visits forcustomers getting hospitalised anda free second medical opinion.Financial StatmentsAwards and recognitionThe strength of our founding teamand management has led to ourCompany receiving a number ofindustry awards and accolades:NIM CARE W.H.O Award ofExcellence from the President ofIndia in 2017The Vajra Award for Recognitionof Overall Performance in LabourWelfare for 2018 by the Governmentof Kerala in 2019Tamil Nadu’s Best Employer BrandAward 2020Dream Companies to Work forInsurance - Private Sector at theWorld HRD Congress in 2021Most Innovative New ProductLaunches or Customer Propositions”at the 13th Global InsuranceE-Summit and Award by theAssociated Chambers of Commerceand Industry of India (ASSOCHAM)in 2021The company’s key managerial personnelMr. V. JagannathanChairman and CEOMr. A G GajapathySenior Executive Director, ClaimsDr. S. PrakashManaging DirectorMr. K C KumarSenior Executive Director , HRMr. Anand RoyManaging DirectorMr. Nilesh KambliChief Financial OfficerMr. S. SundaresanChief Claims OfficerMr. Aneesh SrivastavaChief Investment OfficerMr. V. JayaprakashChief Compliance OfficerMr. Chandrashekhar DwivediAppointed ActuaryDr. P.M. NairSenior Executive Director, VigilanceMr. R MargabandhuChief Risk OfficerDr. K. HarikrishnanSenior Executive Director, MarketingMs. Jayashree SethuramanCompany Secretary

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21Ouraccomplishments in15 years of business16.917,211Crore, lives covered withinsurance since inceptionH Crore, claims amount paidsince inception0.4687Million, agentsrepresenting theCompany across India% of cashless claimssettled in less thantwo hours610,870Million, claims settledsince inceptionNumber of network hospitals10

11Corporate overviewStatutory ReportsFinancial StatmentsThe soul of Star HealthEmployees relate their first-hand experiences of working at Star Health“The four key pillars of StarHealth are respect, care,culture and recognition.A colleague from theadministration departmentwas enthusiastic to work inthe compliance team and theorganisation made that switchhappen. During the pandemic,when claims were criticalto manage, the Companyprovided flexible workingoptions. Feeding mothers andpregnant ladies were givenspecial attention in terms ofsafeguarding them; a cancersurvivor was given due care formanaging her wellness.”Radhika Nagarajan, GeneralManager (Chairman’s Secretariat)“The remarkable thing aboutworking at Star Health is thebonding with colleagues onehas been with for years: morethan 5,000 people (out of14,000) possess an experienceof five years or more, 2,000people have nearly ten yearsof experience and another70-odd possess an experienceof 15 years with the Company.Besides, the ‘family culture’(as opposed to a ‘professionalculture’ makes all thedifference.”Dr. Sriharsha. A. Achar, ChiefHuman Resource Officer“Last year, my entire familywas affected by Covid. Ilost my mother; there weremedical issues that warrantedhospitalisation. Star Healthcoordinated through theHR team and facilitated theadmission of all our familymembers to hospital. Everysingle family member hadbeen covered by the company.”R. Margabandhu, Vice President(Chief Risk Officer)“The most remarkable thingabout working in Star Healthinsurance is the leadershipof our Chairman. Everymorning and evening, ourChairman would walk intoour cubicle, sit with us andask about customer service,grievance and feedback. Oneday, a customer walked intoour cubicle; the Chairmanimmediately retrieved a chairfrom the adjoining cubicle,made him sit, began engagingwith him and addressed hisrequirement. That was alearning for all of us!Chandrabose S, GeneralManager (Customer service &Client relationship)“At Star Health, theremuneration is one of thebest across the industry. StarHealth is the most recognisedbrand as far as industry isconcerned and the employeesfeel proud to explain wherethey work. Our weekly meetingwith senior team membershelped counsel attendees. Wewere happy to return to officewhen it re-opened after thelockdown restrictions wererelaxed. The most remarkablething: the Company did sowell in spite of all challengesand vaccinated most of theemployees”Vikas Sharma, Executive Director

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-2112How we strengthened ourbusiness model during achallenging FY 2020-21Product rangeThe Company offers a range offlexible and comprehensive coverageoptions for the following insurancetypes:Retail health insurance, which ispaid for by private individuals orfamilies, generally through out-ofpocket expenses or private insuranceGroup health insurance, which ispaid for by employers typically in theform of company health insuranceplans that could involve co-paymentsby the employeeGovernment health insurance,which is paid for by the government,typically in the form of central orstate government health insuranceprogrammesThe Company also offers personalaccident and travel insurance, paidfor by individuals or families oremployersRetail health insuranceOur retail health products targeta variety of customer segments,including individuals, families,students, senior citizens and personswith pre-existing medical conditionsacross the broader middle marketcustomer segment.Our products include family floaterproducts, such as our Family HealthOptima, in which the single suminsured covers the family, followingthe payment of a premium (quarterlyor annually); individual products suchas Mediclassic and Accident Carecan be tailored to the needs of theindividual; specialised products likeSenior Citizens Red Carpet HealthInsurance Policy, Diabetes Safe, HIVCare and Star Cardiac Care InsurancePolicy, address customers with preexisting conditions.In FY 2020-21, the following fourproducts accounted for nearly 90% ofour retail health business:Family Health Optima InsurancePlan: A family floater single policycoverage for the family, targetingthose from 18 to 65.for an entire family under the familyfloater plan.MediClassic: This health insuranceplan is available for individuals andfamily.Senior Citizens Red Carpet HealthInsurance Policy: This healthinsurance plan addresses individualsfrom 60 to 75 and covers pre-existingdiseases from the second yearonwards with guaranteed lifetimerenewals.Star Comprehensive: A completehealthcare protection plan forindividuals under an individual plan orGroup HealthOur group health insurance policiesprovide coverage to employees ofcorporates, including SMEs, throughthe company health insuranceplans. Our group health policies aregenerally sold through our corporateagents and brokers, while certaingroup health insurance products aresold in collaboration with corporateagent banks and online channelpartners (web aggregators). Thegroup health segment consists ofpolicies purchased by corporates,including SMEs, as employeebenefits, that may involve copayments by employees. Grouphealth accounted for 10.8% of ourtotal GWP in Fiscal 2021

13Corporate overviewStatutory ReportsFinancial StatmentsGovernment HealthGovernment health insuranceconstituted a large portion of ourGWP at one time and providedus with rich experience. In 2010,the company shifted from thegovernment health businesstowards the attractive retail healthinsurance segment (even as wecontinued to offer government healthinsurance through our participationin Government Ayushmaan Bharathealth programme addressing lowincome households).from personal accident insuranceincreased from H1,162.04 Million inFiscal 2019 to H1,692.61 Million inFiscal 2021.available to permanent residents inIndia, corporate executives abroadfor business purposes between 18and 70 years and students studyingabroad.Kavach policy, Star Health and AlliedInsurance Co. Ltd” and “CoronaRakshak policy, Star Health and AlliedInsurance Co. Ltd.premium payment for products likeFamily Health Optima Insurance Plan,Senior Citizens Red Carpet HealthInsurance Policy, Arogya SanjeevaniPolicy and Young Star InsurancePolicy.Personal AccidentPersonal accident insuranceprovides benefit-based coverage topolicyholders for accidents. Our GWPTravelWe offer health insurance assistancecover for domestic and foreign travelthrough three plans. Our plans areProduct launchesThe company launched threeproducts (Arogya Sanjeevani, YoungStar Insurance Policy, PA Floater)in the Fiscal 2021.The Companyalso launched products customisedaround the pandemic CoronaConvenience: The Companyintroduced instalment facilities forHow we strengthened our claim service improvements for COVID-19We engage with customersthrough our in-house tele-medicineservice called TALK TO STAR,which provides customers accessto experienced doctors who canprovide second opinions andalternative medical solutions on thetelephone or through the internetand, wherever possible, real-timeupdates.We strengthened our wellnesssystem for preventive health careawareness and a special caretakerfor Star customers.We launched a work diary for dailytask tracking across Star HealthTeams and new/improved serviceprogrammes, which improvedproductivity.We re-engineered the claimsprocesses (without physical bills,based on a scanned copy) forspeedy claims settlement.We complied with all guidelinesissued by IRDAI relating to Covid-19We achieved higher customer andhospital satisfaction in clearingclaims with speed and sensitivity .We utilised digitalisation andtechnology integration acrossvarious arenas like systemassigned claims to address first-infirst-out processing, claims billautomation, customer onboardingand hospital relations etc.We instituted a dedicatedClaims Relationship Cell tohandhold customers during thehospitalisation and post-dischargestages.

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21PART TWOThe rationale for StarHealth’s presence in thehealth insurance sector14

15Corporate overviewStatutory ReportsWhat were thereasons for thesuccess of StarHealth in just15 years?In the followingpages, we haveattempted toanswerFinancial Statments

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-2116

17Corporate overviewStatutory ReportsFinancial StatmentsNational perspectiveIndia.Insurancesector.Star Health.How the growth of a country and buoyancy ofa sector translated into sustainable growth forour companyAttractive: The overall Indian health insurance space isincreasingly attractive.Under-penetrated: The Indian retail segment within India’shealth insurance space is under-penetrated and compelling.First-mover: Star Health has combined first-mover status,scale and share of market.Distribution: Star Health’s competence has been derivedfrom the breadth and depth of its distribution footprint.Customise: Star Health’s success is the result of a capacityto create a product for every need.Customer delight: Star Health’s recall has been reinforcedthrough customer delight.Hospital network: Star Health supports customers throughone of the largest health insurance hospital networks alnetworkDistributionCustomerdelightCustomise

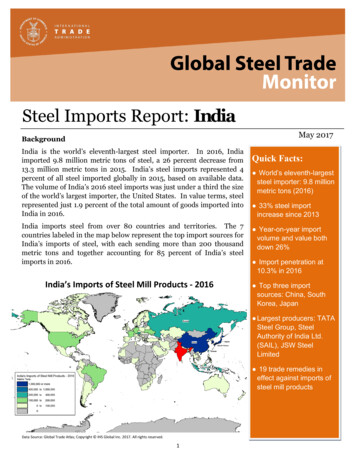

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-2118Focus on Indian health insuranceThe overall Indianhealth insurancespace is increasinglyattractive UnderpenetratedIndia’s health insurancepenetration was a mere 0.36%of GDP in 2019 compared to aglobal average of 2.0% of GDP(Source: Crisil Research)Low densityIndia’s health insurance density,based on per capita premium,was US 5 in 2019, lower than thecorresponding global numbers(Source: Crisil Research)Life expectancyThe Indian population is expected togrow to approximately 1.4 Billion by2026 and the population of personsover 60 years old is expected toincrease even faster, both of whichwill increase the need for healthcareservices. (Source: Crisil Research)Direct health spendingIn India, the out-of-pocket expenditure onhealthcare was nearly 63% of total healthexpenditure as of 2018, indicating thatmost households and individuals do nothave health insurance or adequate cover(Source: Crisil Research)PandemicThe pandemic increasedhospitalisation, related costsand the awareness for healthinsurance

19Corporate overviewStatutory ReportsFinancial StatmentsThe retail segment of India’s insurance sectorThe Indian retail segmentwithin India’s healthinsurance space is underpenetrated and compelling Value-addedLower claimsThe retail segment within the healthinsurance sector in India generatesa considerably higher share of theoverall premiums pool, making it anattractive segment for insurancecompaniesThe retail segment is marked bya lower claims ratio, making it anattractive space for private retail healthinsurance companies9% of the total number of livescovered by health insurance marketin India in Fiscal 2020 is contributedby Retail health insurance73% of claims in the retailhealth segment, Fiscal2020 (Source: Crisil)59% of claims amongSAHI39% share of the total health GWPin the overall health insurancemarket in Fiscal 202092% of claims in the governmenthealth segment (Source: Crisil)67% of claims among privatesector insurers99% of claims in the group healthsegment, Fiscal 2020(Source: Crisil)92% of claims among private andpublic sector insurers in Fiscal 2020(Source: Crisil)

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21PART THREECulture,character andcompetence20

21Corporate overviewStatutory ReportsFinancial StatmentsStar Health.The vision withwhich we wentinto businessOur senior management team includes ourfounder Mr. V Jagannathan, Dr. S Prakashand Mr. Anand Roy, who have been withthe company since the first year followinginception.They are driven by a vision toprovide affordable and innovative health caresolutions.Driven by a philosophy based arounda ‘family culture’, balancing the bestof professional excellence withoutcompromising the personalised humantouch.Catalysed by a commitment to share ourprosperity with all stakeholders.The result of this differentiated resolution– with no reference to revenue growth,margins or Return on Capital Employed –has helped the company emerge as one ofthe largest retail standalone health insurancecompanies in India today.

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21Success driverStar Health issynonymous withHealth Insurance22

23Corporate overviewStatutory ReportsFinancial StatmentsOverviewTrust constituentsOutcomesIn the course of the 15 years sincewe went into business, the biggestasset that Star Health has created anintangible strength that does not evenfigure on the company’s BalanceSheet.Over the last decade-and-a-half,Star Health’s brand recall has beeninfluenced in various ways.The outcomes of the brand trust isreflected in the company’s RetailHealth segment leadership in thegeneral insurance industry acrossIndia.The biggest asset created by thecompany is the recall of the StarHealth brand among thousands ofcustomers across India.During the last decade-and-a half,Star Health has been described invarious ways and tongues. However,each of these responses haseventually come to mean: a trustedbrand, health insurance specialist,personalised attention and a cultureof caring.This recall has been manifested invarious moments of truth – momentsof engagement when the companyinterfaces with the customer –when the company has selected tolisten, advise, guide and handholdcustomers towards making the rightdecision. The result is a generalconsensus: ‘Star Health will sell usonly what will be in our best interest.’31.30%, market share inRetail Health GWPalone across thegeneral insuranceindustryThe Company is easy to reach,whether it is the website or its 737offices in 26 states and 4 unionterritories across the vast Indianlandmass.The Company communicates in alanguage that is simple and friendly,making it possible for customers tounderstand.The Company provides an extensiverange of policies to select from,virtually customised around everypossibility, age and economicbackground.The Company services claims withspeed and sensitivity, standing by therelatives of its customers in their hourof distress and anguish.The Company’s representatives havebeen trained to advise only in thecustomer’s interest, convinced thatthis will widen the company’s brand,accelerate sales of more policies andserve mutual benefit and our agentspresent all over the country act asambassadors of the Company.16%, market share inthe Overall HealthGWP (Retail Group)across the generalinsurance industry4.71The brand has grown year-on-year,irrespective of some of the mostchallenging economic meltdowns,slowdowns and lockdowns during theperiod.The Company’s persistency rateshave been acknowledged among thebest in India’s insurance sector.The Company’s business growth hasbeen reinforced by a consistent inflowof customers seeking to port theirexisting health insurance policy toStar Health.The result is that a Star Heath policyis a reflexive action across a numberof points in an individual’s life –marriage and the birth of children.The Company accounts for nearlya third of India’s retail gross writtenpremiums alone across the generalinsurance industry.Making Star Heath’s insurance policysynonymous with security and wellbeing.%, market share ofthe overall generalinsurance industry59.50%, market shareamong standalonehealth insurers(SAHI)

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21Human capitalAt Star Health, ourprincipal competitiveadvantage is derivedfrom our talent capital24

25OverviewAt Star Health, we are increasinglyrecognised among the mostsuccessful standalone healthinsurers in India. We believe thatthis position has been achieved bythe virtue of having built among thelargest and richest knowledge poolswithin the sector, extending across arange of capabilities. Our knowledgepool comprises attributes in theareas of effective communication,interpersonal relationships,business acumen, belongingness,entrepreneurial drive, passionfor excellence, responsiveness,customer-centricity and customersensitivity.The domain knowledgeand functional competenciescomprise underwriting skills, salespitch, claims processing, medicalexpertise, analytical skills, businessanalytics, market research andproduct innovation. The ability toshare knowledge has helped liberateknowledge from select pockets intoan overarching environment with aspecialised understanding of medicalrealities leading to health insuranceneeds.CultureStar Health’s competitiveness hasbeen derived from its family culture,which has celebrated collaborativeworking, caring, fairness, respectfor dignity and ethical integrity. Theresult is that Star Health is less animpersonal business organisationCorporate overviewStatutory Reportsas much as it is a bonded teamin the pursuit of a larger goal toeconomically protect customers inthe event of medical emergencies.The effectiveness of the culture isreflected in the company’s high talentretention, helping effectively retainknowledge and experience.Financial StatmentsThe Company’s talent profilecomprises medically qualified andtrained doctors who facilitate productdevelopment in the areas of cancerand cardiac care, providing coverfor people with cancer, surgery formorbid obesity and payment of donorexpenses for organ transplants.These professionals facilitate medicalunderwriting, claims managementwith hospitals, fraud detection cummitigation as well as grievancehandling.of an engagement ease. Thisease is influenced by a strategicorganisational clarity, engagementin a goal that takes humankindahead, equitable employee treatment,performance appraisal transparency,fair remuneration and deploymentof technology-aided tools thatenhance operational efficiency. TheElectronic Work Diary for employeeshas enhanced transparency inday-to-day workflows. Besides,a modernised human resourceengagement process - EmployeeSelf-service portal, Online Attendance& Leave Management, Payroll,Reimbursements, Recruitment,Joining formalities, Onboarding,Performance Management Systems,Rewards & Recognition Programs,Structured exit formalities, MISreporting, analytics etc. – havestrengthened talent retention.Value packageProtectionInformed engagementStar Health’s talent retention strategycomprised morale building throughan attractive rewards and recognitionprogramme, which compriseda year of employee initiatives,employee engagement activities,compensation & benefits structure,career progression, employee welfareprogrammes, loan schemes andESOP.Ease of engagementAt Star Health, we have attractedand retained talent on the basisDuring the pandemic, the companyprotected its talent capital throughthe flexibility of working from home,WFRL and hybrid attendance.The company redefined its workculture (New Code of Work)comprising supportive policies toenhance morale, productivity andperformance through a strengthenedIT infrastructure, learning &development activities, higherengagement levels, process support,guidelines and WFH etiquette.

Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21CaringStar Health launched Talk to Star app,Covid advisory helpline and emotionalwellness helpline for employeesand family members to seek advicefrom doctors on health issues;Covid management and medicalcounselling helped the companyevaluate emotional challenges andprovide support.Gender-agnostic recruiterThe company’s recruitment ofwomen increased year-on-year inthe two years ending FY2020-21from 3077 in FY2018-19 to 3477in FY2019-20 to 3852 in FY202021. The proportion of women in thecompany was around 27% during theOutperformanceyear under review, a reflection of itsfairness in recruitment and gendersensitive policies.Training and skill renewalThe company is strengthening itspositioning as a company that tookthe skills and competencies of itsemployees ahead through continuoustraining. The training programmesconducted comprised programmesthat focused on induction, refresher,process, product launch, regulatory,bridge gap, leadership and skilldevelopment. Even as the numberof employees increased 30% acrossthe two years ending FY2020-21, thequantum of person-t

health insurance provider. In fifteen years, Star Health is India's largest and trusted standalone health insurance provider. Giving millions of its customers more than just a health insurance policy. Providing them with a peace of mind instead. Corporate snapshot Star Health and Allied Insurance Co. Ltd. Annual Report 2020-21 08