Transcription

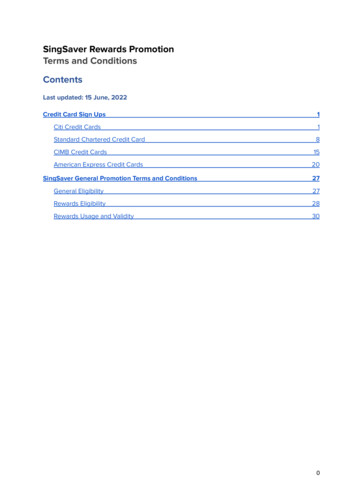

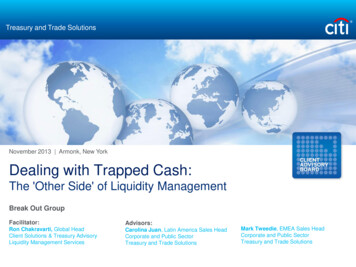

Treasury and Trade SolutionsNovember 2013 Armonk, New YorkDealing with Trapped Cash:The 'Other Side' of Liquidity ManagementBreak Out GroupFacilitator:Advisors:Ron Chakravarti, Global HeadClient Solutions & Treasury AdvisoryLiquidity Management ServicesCarolina Juan, Latin America Sales HeadCorporate and Public SectorTreasury and Trade SolutionsMark Tweedie, EMEA Sales HeadCorporate and Public SectorTreasury and Trade Solutions

Backdrop

2

Trapped Cash: CAB Survey ResultsApproximately what % of your cash would you say is 20-30% 30%What are you doing to leverage trapped cash? Please check all that apply.Mitigate trapped cash through reorganization ofthird-party and intercompany flows36%Whenever local funding is needed, activelyevaluate all available options to use "leastcosts" toolsDeploy best available local liquidity structures tooptimize onshore cash usage before moving inliquidity from offshoreUse an efficient global cash forecastingprogram to maintain tight control on localsubsidiary funding and repatriationStay up to date with the latest local regulatorychanges and tools available in all key markets345%36%50%91%

What are the Sources of Trapped Cash?Broadly speaking, companies have two types of cross-border transactions, commercial and financial.Regulatory restrictions in certain markets on outgoing financial flows result in trapped cash.“Restrictions”DebtFinancial Flows(Capital Account)Equity3rd Party TransactionsCommercial Flows(Current Account)Intercompany Transactions4

CFForecastingA/cStructureLocalPoolingSub. Funding ngDividendRepatriationWorking CapitalManagementCommercial FlowsProcessCentralization5DSO/DPO Opt.Netting CenterTradingModelMgmt Fee &RoyaltiesLiquidity & Funding tural StrategiesFinancial FlowsWhat Do Companies Do? Here’s What We See:

Liquidity & Funding Strategies

Decision Tree to Optimize Liquidity / Funding ApproachesA decision tree framework helps bucket different markets depending upon the levels of restrictions.Q1: LCYconvertibleoffshore?Q2: Allow LCYcross-borderIntercompanylending?LCYSweep / Cash PoolQ2: Allow FCYcross-borderIntercompanylending?Q3: Possible toopen FCYoffshore AC forresident entity?Q3: Possible toopen FCYoffshore AC forresident entity?FCYSweep /Cash Poole.g. MalaysiaUse offshoreFCY AC tofund LCYTrapped cashFCY offshoreA/CTrapped cashe.g. Iraqe.g. Nigeria(1)(1) Cross-border intercompany lending and opening of FCY offshore A/c are allowed, but impractical due to cumbersome regulatory restrictions.7

Keeping Up With RegulationCiti uses tools such as its client market guides and regulatory grids to structure solutions.Market Guides for Treasury provide clients withregulatory overview of key marketsRegulatory grids are used in our liquiditysolution structuring processesLocalCurrencyOperating AccountNRRLCYLCYOnshore sta RicaDominican RepublicEcuadorEl araguayPeruPuerto RicoTrinidad and ercompany LendingR - NRFX ControlNR - RLCYFCYLCYFCYLCY - 1112111111115- Allowed, No Material Restrictions- Allowed, Straightforward regulations, approval, or license- Allowed, Challenging regulatory approval or license- Allowed, subject to a complex set of rulesLCY DebitTaxNNNYNYNNNNNNNNNNNYNNNN

Structural Strategies

Netting Center (“NC”)Netting Centers to settle intercompany transactions also allow the ability to lag payments into manufacturingsubsidiaries and lead receipts out of sales subsidiaries in restricted markets, thus reducing trapped cash.Without NCWith NCManufacturingSubsidiary (China)Sales Subsidiary(India)ManufacturingSubsidiary (China)Sales Subsidiary(India) Goods Goods Goods“LagStrategy” Sales Subsidiary(Japan)ManufacturingSubsidiary(Hong Kong)Sales Subsidiary(Japan) Netting Center(Singapore)“LeadStrategy” ManufacturingSubsidiary(Hong Kong) Subsidiaries receive or pay single transaction from / to the NC NC helps centralization of cash & FX management and enhances visibility and control NC helps to reduce trapped cash through ‘Lead or Lag Strategy’ on settlements (i.e., acceleration or deceleration of intercompanypayments)Restricted Market10Goods

Procurement Center (“PC”)Setting procurement centers for purchasing economies of scale in freer markets allow leadingpayments out of manufacturing subsidiaries in restricted markets, thus reducing trapped cash.With PCWithout PC3rd PartySupplier3rd PartySupplier3rd PartySupplier3rd PartySupplier Invoice nufacturingSubsidiaryInvoice ManufacturingSubsidiaryInvoice InvoiceSalesSubsidiary SalesSubsidiary PCs typically located in lower tax and non-regulated jurisdictions PC negotiates purchasing contract with suppliers and makes purchases of goods to resell to the manufacturers PC helps to reduce trapped cash through ‘Lead Strategy’ on settlements (i.e., acceleration of intercompany settlements)Restricted Market11

Re-invoicing Center (“RIC”)Setting re-invoicing centers as an intermediary for intercompany transactions in freer markets allowlagging payments into manufacturing subsidiaries and leading receipts out of sales subsidiaries inrestricted markets, thus reducing trapped cash.Without RICWith anufacturingSubsidiaryManufacturingSubsidiary Invoice Goods “Lag e)“Lead Sales Subsidiary(Korea) RICs typically located in lower tax and non-regulated jurisdictions RIC bears market, inventory, price, FX, and volume risks RIC helps to reduce trapped cash through ‘Lead or Lag Strategy’ on settlements (i.e. Acceleration or deceleration of intercompanypayments)Restricted Market12

Special VehiclesSetting up an offshore fund for purchasing receivables originated by subsidiaries in freer markets,and enabling subsidiaries in restricted markets to buy shares issued by the fund, would put at workliquidity that would otherwise be trapped.Cash CollectionInstructions Offshore FundInvestors(1)Quotes Investment onFixed-IncomeMarket Bonds. Receivables BorrowingSubsidiariesRelationship that originatedthe credit rightsCash-generating subsidiary subscribe for the Offshore Fund sharesBorrowing subsidiaries transfer the receivables for the Offshore FundThe Offshore Fund pays for the receivable discounted by a defined discount rate described on the By-law of the fundThe Drawees pay for each receivable at the due dateCash not used on the receivables acquisition is invested on fixed income or marked bonds (T-Bills or T-Bonds)(1) Subsidiaries limited by jurisdiction restrictions.13Drawee(Third partydebtor )

“Renting” LiquidityWhen other options are exhausted and there still remains trapped cash, efforts can focus on P&Lbenefits - “renting” liquidity in exchange for lower procurement costs and/or higher sales12Shortening DPOShortening Days PayableOutstanding (DPO) in exchange for areduced procurement cost is aneffective way to reduce COGS COGS Procurement Cost SalesBenefitBenefitLiquidityRiskExtending Days Sales Outstanding(DSO) is an effective way to increasesales revenue RevenueOtherP&LBenefitsDPO 30SupplierExtending DSOCompanyDPO 60CreditRiskDSO 60BuyerDSO 30Original DPO/DSOAdjusted DPO/DSORisk profile changes as liquidity risk emergesdue to shortening DPOs. A bank solution can bestructured in a way to neutralize the contingentexposure through a back-stop facilityBankSupportRisk profile changes as credit risk emerges whileextending receivables maturity dates. A banksolution can be structured in a way to neutralizethe contingent exposure through receivablefinancing for the additional days grantedcompared with initial scenario{P&L Benefits – cost to neutralize additional risks} Any possible alternative14

IRS Circular 230 Disclosure: Citigroup Inc. and its affiliates do not provide tax or legal advice. Any discussion of tax matters in these materials (i) is not intended or written to be used, and cannot beused or relied upon, by you for the purpose of avoiding any tax penalties and (ii) may have been written in connection with the "promotion or marketing" of any transaction contemplated hereby("Transaction"). Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor.Any terms set forth herein are intended for discussion purposes only and are subject to the final terms as set forth in separate definitive written agreements. This presentation is not a commitment to lend, syndicate afinancing, underwrite or purchase securities, or commit capital nor does it obligate us to enter into such a commitment, nor are we acting as a fiduciary to you. By accepting this presentation, subject to applicable lawor regulation, you agree to keep confidential the information contained herein and the existence of and proposed terms for any Transaction.Prior to entering into any Transaction, you should determine, without reliance upon us or our affiliates, the economic risks and merits (and independently determine that you are able to assume these risks) as well asthe legal, tax and accounting characterizations and consequences of any such Transaction. In this regard, by accepting this presentation, you acknowledge that (a) we are not in the business of providing (and youare not relying on us for) legal, tax or accounting advice, (b) there may be legal, tax or accounting risks associated with any Transaction, (c) you should receive (and rely on) separate and qualified legal, tax andaccounting advice and (d) you should apprise senior management in your organization as to such legal, tax and accounting advice (and any risks associated with any Transaction) and our disclaimer as to thesematters. By acceptance of these materials, you and we hereby agree that from the commencement of discussions with respect to any Transaction, and notwithstanding any other provision in this presentation, wehereby confirm that no participant in any Transaction shall be limited from disclosing the U.S. tax treatment or U.S. tax structure of such Transaction.We are required to obtain, verify and record certain information that identifies each entity that enters into a formal business relationship with us. We will ask for your complete name, street address, and taxpayer IDnumber. We may also request corporate formation documents, or other forms of identification, to verify information provided.Any prices or levels contained herein are preliminary and indicative only and do not represent bids or offers. These indications are provided solely for your information and consideration, are subject to change at anytime without notice and are not intended as a solicitation with respect to the purchase or sale of any instrument. The information contained in this presentation may include results of analyses from a quantitativemodel which represent potential future events that may or may not be realized, and is not a complete analysis of every material fact representing any product. Any estimates included herein constitute our judgmentas of the date hereof and are subject to change without any notice. We and/or our affiliates may make a market in these instruments for our customers and for our own account. Accordingly, we may have a positionin any such instrument at any time.Although this material may contain publicly available information about Citi corporate bond research, fixed income strategy or economic and market analysis, Citi policy (i) prohibits employees from offering, directly orindirectly, a favorable or negative research opinion or offering to change an opinion as consideration or inducement for the receipt of business or for compensation; and (ii) prohibits analysts from being compensatedfor specific recommendations or views contained in research reports. So as to reduce the potential for conflicts of interest, as well as to reduce any appearance of conflicts of interest, Citi has enacted policies andprocedures designed to limit communications between its investment banking and research personnel to specifically prescribed circumstances.The material and information contained in this communication is for information purposes only and without regard to any particular user's objectives or financial situation. Information herein is gathered from varioussources (including public website, tax content provider, etc) on a reasonable effort basis and is not validated by Citigroup Inc. or its affiliates ("Citi"). Citi do not warrant its accuracy or completeness. Informationprovided herein may be a summary or translation. Citi is not obligated to update the material in light of future events.This communication does not constitute a recommendation to take any action and Citi is not providing investment, tax or legal advice. Citi accepts no liability for any loss whatsoever (whether direct, indirect orconsequential) for any use of this communication or any action taken or refraining from action based on or arising from the material contained herein. Citi and its employees are not in the business of providing tax orlegal advice to any taxpayer outside of Citi. This communication is not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any suchtaxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. 2013 Citibank, N.A. All rights reserved. Citi and Arc Design is a registered service mark of Citigroup Inc.In January 2007, Citi released a Climate Change Position Statement, the first US financial institution to do so. As a sustainability leader in the financial sector, Citi has taken concrete steps to address this importantissue of climate change by: (a) targeting 50 billion over 10 years to address global climate change: includes significant increases in investment and financing of alternative energy, clean technology, and other carbonemission reduction activities; (b) committing to reduce GHG emissions of all Citi owned and leased properties around the world by 10% by 2011; (c) purchasing more than 52,000 MWh of green (carbon neutral) powerfor our operations in 2006; (d) creating Sustainable Development Investments (SDI) that makes private equity investments in renewable energy and clean technologies; (e) providing lending and investing services toclients for renewable energy development and projects; (f) producing equity research related to climate issues that helps to inform investors on risks and opportunities associated with the issue; and (g) engaging witha broad range of stakeholders on the issue of climate change to help advance understanding and solutions.Citi works with its clients in greenhouse gas intensive industries to evaluate emerging risks from climate change and, where appropriate, to mitigate those risks.efficiency, renewable energy & mitigation

Without NC With NC Subsidiaries receive or pay single transaction from / to the NC NC helps centralization of cash & FX management and enhances visibility and control NC helps to reduce trapped cash through 'Lead or Lag Strategy' on settlements (i.e., acceleration or deceleration of intercompany payments) Restricted Market