Transcription

From The Office Of State AuditorClaire McCaskillReport No. 2004-76September 28, 2004www.auditor.mo.govAUDIT REPORTWRIGHT COUNTY, MISSOURIYEARS ENDED DECEMBER 31, 2003 AND 2002

September 2004IMPORTANT: The Missouri State Auditor is required by state law to conductaudits once every 4 years in counties, like Wright, that do not have a county auditor.In addition to a financial and compliance audit of various county operating funds,the State Auditor's statutory audit covers additional areas of county operations, aswell as the elected county officials, as required by Missouri's ------------------This audit of Wright County included additional areas of county operations, as well as theelected county officials. The following concerns were noted as part of the audit:YELLOW SHEETOffice Of TheState Auditor Of MissouriClaire McCaskill The county's controls and procedures over county expenditures needimprovement. Bids were not always solicited, adequate supporting documentationwas not always retained, disbursements were not properly monitored, and mileagepaid to the sheriff was not adequately documented. The county has not established procedures to monitor collateral securities pledgedby its depositary bank, and as a result, funds were undercollateralized byapproximately 870,000 and 777,000 during January 2004 and 2003,respectively. County Commission minutes were not prepared to document the matters discussedin closed meetings and open meeting minutes did not always document thereasons for closing the meeting, or the final disposition of matters discussed inclosed meetings. A Title IV-D (Child Support Enforcement) Program claim form was not filedtimely with the Missouri Department of Social Services (DSS) resulting in 1,969in lost revenue to the county. The Prosecuting Attorney authorized a transfer of 1,969 from the Prosecuting Attorney Bad Check Fund to reimburse the GeneralRevenue Fund. Numerous problems were noted relating to Prosecuting Attorneys' accountingcontrols and procedures. Bad check collection procedures need improvement,court ordered restitution is not adequately monitored, and the bad check accountand restitution account had 3,441 and 2,356 in unidentified funds, respectively.Additionally, improvements are needed with segregation of accounting duties andcontrols over receipts. Further, concerns were noted with the compensation paidto employees from the Prosecuting Attorney Bad Check Fund and ProsecutingAttorney Delinquent Tax Fund. The County Collector withheld excess commissions totaling approximately 9,400 onrailroad and utility taxes, and 4,000 on surtax collections. Additionally, surtax distributions

need to be reviewed. Prior audit reports have addressed the inadequacy of the Sheriff’s accounting controls andprocedures; however, weaknesses still exist in controls over receipts and monthly bankreconciliation procedures. Receipts were not deposited timely, receipt slips were not alwaysissued, and bank accounts were not properly reconciled. At June 30, 2004, the reconciledbalance in the Sheriff's Civil Fees account was only 2,403. Approximately 1,230 of thebalance was being held as civil process fees and 1,740 was due to the County Treasurer,resulting in a shortage of 567. Additionally, improvements are needed with the segregationof accounting duties, controls over seized property, and controls over fuel usage. The Juvenile Detention Center (JDC) has not established procedures to maintain accuratefinancial information, and operating costs have not been analyzed to ensure the JDC recoversall costs. In addition, budgets were incomplete, and the actual cash balance was notaccurately reported on the 2003 and 2002 budgets. Further, accounting duties are notadequately segregated and controls over expenditures need improvement at the JDC andJuvenile Office.Also included in the audit were recommendations related to budgetary practices, payroll, property taxsystem, preparation of the county's schedule of federal awards, and a road and bridge maintenanceplan. The audit also suggested improvements in the procedures of the County Treasurer, Ex OfficioRecorder of Deeds, Associate Circuit Division, Health Center and Developmentally Disabled Board.All reports are available on our website: www.auditor.mo.gov

WRIGHT COUNTY, MISSOURITABLE OF CONTENTSPageFINANCIAL SECTIONState Auditor's Reports: . 2-6Financial Statements and Supplementary Schedule of Expendituresof Federal Awards. 3-4Compliance and Internal Control Over Financial Reporting Based onan Audit of Financial Statements Performed in Accordance WithGovernment Auditing Standards. 5-6Financial Statements: . 7-18ExhibitA-1A-2BDescriptionStatement of Receipts, Disbursements, andChanges in Cash - Various FundsYear Ended December 31, 2003 .8Year Ended December 31, 2002 .9Comparative Statement of Receipts, Disbursements,and Changes in Cash - Budget and Actual - Various Funds,Years Ended December 31, 2003 and 2002 . 10-18Notes to the Financial Statements. 19-23Supplementary Schedule:. 24-27Schedule of Expenditures of Federal Awards, Years EndedDecember 31, 2003 and 2002 . 25-27Notes to the Supplementary Schedule . 28-30FEDERAL AWARDS - SINGLE AUDIT SECTIONState Auditor's Report:. 32-34Compliance With Requirements Applicable to Each Major Program andInternal Control Over Compliance in Accordance With OMB Circular A-133. 33-34Schedule:. 35-38-i-

WRIGHT COUNTY, MISSOURITABLE OF CONTENTSPageFEDERAL AWARDS - SINGLE AUDIT SECTIONSchedule of Findings and Questioned Costs (Including Management'sPlan for Corrective Action), Years Ended December 31, 2003 and 2002 . 36-38Section I - Summary of Auditor's Results.36Section II - Financial Statement Findings .37Section III - Federal Award Findings and Questioned Costs.37Number03-1.DescriptionSchedule of Expenditures of Federal Awards.37Follow-Up on Prior Audit Findings for an Audit of Financial StatementsPerformed in Accordance With Government Auditing Standards. 39-40Summary Schedule of Prior Audit Findings in AccordanceWith OMB Circular A-133 . 41-42MANAGEMENT ADVISORY REPORT SECTIONManagement Advisory Report - State Auditor's Findings . nty Expenditures.46Budgetary Practices and Published Financial Statements.49Property Tax Controls.51Collateral Securities .52Closed Meeting Minutes .52Personnel Policies and Procedures.54Road and Bridge Maintenance Plan.55Title IV-D Reimbursement Claims .56County Treasurer's Records and Procedures.56County Collector's Distributions.58Prosecuting Attorney Records and Procedures .60Sheriff's Accounting Controls and Procedures .66Ex Officio Recorder of Deed's Controls and Procedures.72Associate Circuit Division Procedures .73Juvenile Detention Center and Juvenile Office Records and Procedures .74Health Center Accounting Controls and Procedures .80Developmentally Disabled Board .82-ii-

WRIGHT COUNTY, MISSOURITABLE OF CONTENTSPageMANAGEMENT ADVISORY REPORT SECTIONFollow-Up on Prior Audit Findings . 85-91STATISTICAL SECTIONHistory, Organization, and Statistical Information . 93-97-iii-

FINANCIAL SECTION-1-

State Auditor's Reports-2-

CLAIRE C. McCASKILLMissouri State AuditorINDEPENDENT AUDITOR'S REPORT ON THE FINANCIALSTATEMENTS AND SUPPLEMENTARY SCHEDULE OFEXPENDITURES OF FEDERAL AWARDSTo the County CommissionandOfficeholders of Wright County, MissouriWe have audited the accompanying Statements of Receipts, Disbursements, and Changesin Cash - Various Funds and Comparative Statement of Receipts, Disbursements, and Changes inCash - Budget and Actual - Various Funds of Wright County, Missouri, as of and for the yearsended December 31, 2003 and 2002. These financial statements are the responsibility of thecounty's management. Our responsibility is to express an opinion on these financial statementsbased on our audit.We conducted our audit in accordance with auditing standards generally accepted in theUnited States of America and the standards applicable to financial audits contained inGovernment Auditing Standards, issued by the Comptroller General of the United States. Thosestandards require that we plan and perform the audit to obtain reasonable assurance aboutwhether the financial statements are free of material misstatement. An audit includes examining,on a test basis, evidence supporting the amounts and disclosures in the financial statements. Anaudit also includes assessing the accounting principles used and the significant estimates madeby management, as well as evaluating the overall financial statement presentation. We believethat our audit provides a reasonable basis for our opinion.As discussed in Note 1 to the financial statements, these financial statements wereprepared on the cash basis of accounting, which is a comprehensive basis of accounting otherthan accounting principles generally accepted in the United States of America.In our opinion, the financial statements referred to in the first paragraph present fairly, inall material respects, the receipts, disbursements, and changes in cash of various funds of WrightCounty, Missouri, and comparisons of such information with the corresponding budgetedinformation for various funds of the county as of and for the years ended December 31, 2003 and2002, on the basis of accounting discussed in Note 1.-3P.O. Box 869 Jefferson City, MO 65102 (573) 751-4213 FAX (573) 751-7984

In accordance with Government Auditing Standards, we also have issued our report datedAugust 10, 2004, on our consideration of the county's internal control over financial reportingand on our tests of its compliance with certain provisions of laws, regulations, contracts, andgrants. That report is an integral part of an audit performed in accordance with GovernmentAuditing Standards and should be read in conjunction with this report in considering the resultsof our audit.Our audit was conducted for the purpose of forming an opinion on the financialstatements, taken as a whole, that are referred to in the first paragraph. The accompanyingSchedule of Expenditures of Federal Awards is presented for purposes of additional analysis asrequired by U.S. Office of Management and Budget (OMB) Circular A-133, Audits of States,Local Governments, and Non-Profit Organizations, and is not a required part of the financialstatements. Such information has been subjected to the auditing procedures applied in the auditof the financial statements and, in our opinion, is fairly stated, in all material respects, in relationto the financial statements taken as a whole.The accompanying History, Organization, and Statistical Information is presented forinformational purposes. This information was obtained from the management of Wright County,Missouri, and was not subjected to the auditing procedures applied in the audit of the financialstatements referred to above. Accordingly, we express no opinion on the information.Claire McCaskillState AuditorAugust 10, 2004 (fieldwork completion date)The following auditors participated in the preparation of this report:Director of Audits:Audit Manager:In-Charge Auditor:Audit Staff:Thomas J. Kremer, CPADonna Christian, CPA, CGFMApril McHaffie Lathrom, CPAJody Vernon, CPATed Fugitt, CPAMark Hubbell-4-

CLAIRE C. McCASKILLMissouri State AuditorINDEPENDENT AUDITOR'S REPORT ON COMPLIANCEAND ON INTERNAL CONTROL OVER FINANCIAL REPORTINGBASED ON AN AUDIT OF FINANCIAL STATEMENTS PERFORMEDIN ACCORDANCE WITH GOVERNMENT AUDITING STANDARDSTo the County CommissionandOfficeholders of Wright County, MissouriWe have audited the financial statements of various funds of Wright County, Missouri, asof and for the years ended December 31, 2003 and 2002, and have issued our report thereondated August 10, 2004. We conducted our audit in accordance with auditing standards generallyaccepted in the United States of America and the standards applicable to financial auditscontained in Government Auditing Standards, issued by the Comptroller General of the UnitedStates.ComplianceAs part of obtaining reasonable assurance about whether the financial statements ofvarious funds of Wright County, Missouri, are free of material misstatement, we performed testsof the county's compliance with certain provisions of laws, regulations, contracts, and grants,noncompliance with which could have a direct and material effect on the determination offinancial statement amounts. However, providing an opinion on compliance with thoseprovisions was not an objective of our audit, and accordingly, we do not express such an opinion.The results of our tests disclosed no instances of noncompliance that are required to be reportedunder Government Auditing Standards. However, we noted certain immaterial instances ofnoncompliance which are described in the accompanying Management Advisory Report.Internal Control Over Financial ReportingIn planning and performing our audit of the financial statements of various funds of WrightCounty, Missouri, we considered the county's internal control over financial reporting in order todetermine our auditing procedures for the purpose of expressing our opinion on the financialstatements and not to provide assurance on the internal control over financial reporting. Ourconsideration of the internal control over financial reporting would not necessarily disclose allmatters in the internal control that might be material weaknesses. A material weakness is a condition-5P.O. Box 869 Jefferson City, MO 65102 (573) 751-4213 FAX (573) 751-7984

in which the design or operation of one or more of the internal control components does notreduce to a relatively low level the risk that misstatements in amounts that would be material inrelation to the financial statements being audited may occur and not be detected within a timelyperiod by employees in the normal course of performing their assigned functions. We noted nomatters involving the internal control over financial reporting and its operation that we considerto be material weaknesses. However, we noted other matters involving the internal control overfinancial reporting which are described in the accompanying Management Advisory Report.This report is intended for the information and use of the management of Wright County,Missouri; federal awarding agencies and pass-through entities; and other applicable governmentofficials. However, pursuant to Section 29.270, RSMo 2000, this report is a matter of publicrecord and its distribution is not limited.Claire McCaskillState AuditorAugust 10, 2004 (fieldwork completion date)-6-

Financial Statements-7-

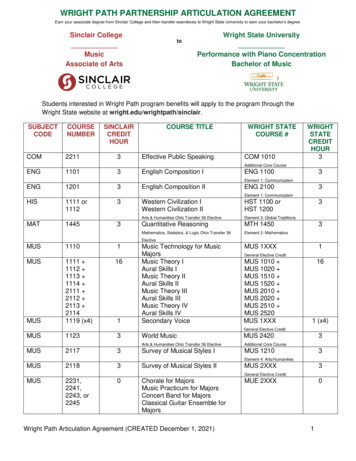

Exhibit AWRIGHT COUNTY, MISSOURISTATEMENT OF RECEIPTS, DISBURSEMENTS, AND CHANGES IN CASH - VARIOUS FUNDSYEAR ENDED DECEMBER 31, 2003FundGeneral RevenueSpecial Road and BridgeAssessmentLaw Enforcement TrainingProsecuting Attorney TrainingProsecuting Attorney Bad CheckLocal Emergency Planning CommissionRecorder User FeeDomestic ShelterComputer Upgrade/RemodelingSheriff Civil FeesElection ServicesCollector's Tax MaintenanceRecorder TechnologyPlat BookJuvenile Detention CenterDevelopmentally DisabledHealth CenterAssociate Circuit Division InterestCircuit Clerk InterestLaw LibraryProsecuting Attorney Delinquent TaxChildren's HomeInmate SecurityLocal Law Enforcement Block GrantTotal Cash,January h,December 651,674,246The accompanying Notes to the Financial Statements are an integral part of this statement.-8-

Exhibit AWRIGHT COUNTY, MISSOURISTATEMENT OF RECEIPTS, DISBURSEMENTS, AND CHANGES IN CASH - VARIOUS FUNDSYEAR ENDED DECEMBER 31, 2002FundGeneral RevenueSpecial Road and BridgeAssessmentLaw Enforcement TrainingProsecuting Attorney TrainingProsecuting Attorney Bad CheckLocal Emergency Planning CommissionRecorder User FeeDomestic ShelterComputer Upgrade/RemodelingSheriff Civil FeesElection ServicesChildren's HomeDrugJuvenile Detention CenterDevelopmentally DisabledHealth CenterAssociate Circuit Division InterestCircuit Clerk InterestLaw LibraryProsecuting Attorney Delinquent TaxCollector's Tax MaintenanceRecorder TechnologyTotal Cash,January 151,6364,8622,22800Cash,December The accompanying Notes to the Financial Statements are an integral part of this statement.-9-

Exhibit BWRIGHT COUNTY, MISSOURICOMPARATIVE STATEMENT OF RECEIPTS, DISBURSEMENTS, AND CHANGES IN CASH - BUDGET AND ACTUAL - VARIOUS FUNDYear Ended December 31,2003BudgetTOTALS - VARIOUS FUNDSRECEIPTSDISBURSEMENTSRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER )1,7862,218Total ReceiptsDISBURSEMENTSCounty CommissionCounty ClerkElectionsBuildings and groundsEmployee fringe benefitCounty TreasurerCounty CollectorRecorder of DeedsCircuit ClerkAssociate Circuit CourtCourt administrationPublic AdministratorSheriffJailProsecuting AttorneyJuvenile OfficerCounty CoronerPublic health and welfare serviceOtherTransfers outEmergency (2,438)14,4411,817705(28,860)196,18437,825Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 1)438,899327,088115,943157,9500157,950GENERAL REVENUE FUNDRECEIPTSProperty taxesSales taxesIntergovernmentalCharges for servicesInterestOtherTransfers in 6,170(2,748)9,1466,398

Exhibit BWRIGHT COUNTY, MISSOURICOMPARATIVE STATEMENT OF RECEIPTS, DISBURSEMENTS, AND CHANGES IN CASH - BUDGET AND ACTUAL - VARIOUS FUNDYear Ended December 31,2003BudgetSPECIAL ROAD AND BRIDGE FUNDRECEIPTSProperty taxesSales taxesIntergovernmentalCharges for servicesInterestOtherTransfers 0)Total ReceiptsDISBURSEMENTSSalariesEmployee fringe benefitSuppliesInsuranceRoad and bridge materialsEquipment repairsRentalsEquipment purchasesConstruction, repair, and maintenanceDistribution to special road districOtherTransfers outEmergency ,0553,3120Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 65553,24829,606(8,710)131(545)2,973(4,094)Total 53,41310,224Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 1)ASSESSMENT FUNDRECEIPTSIntergovernmentalCharges for servicesInterestOtherTransfers in-11-217,051145,9240145,924

Exhibit BWRIGHT COUNTY, MISSOURICOMPARATIVE STATEMENT OF RECEIPTS, DISBURSEMENTS, AND CHANGES IN CASH - BUDGET AND ACTUAL - VARIOUS FUNDYear Ended December 31,2003BudgetLAW ENFORCEMENT TRAINING FUNDRECEIPTSCharges for servicesInterestOtherTotal ReceiptsDISBURSEMENTSSheriffTransfers outTotal DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 31PROSECUTING ATTORNEY TRAINING FUNDRECEIPTSCharges for servicesInterestTotal ReceiptsDISBURSEMENTSProsecuting 7141,353Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER TING ATTORNEY BAD CHECK FUNDRECEIPTSCharges for 46023,680527(2,487)67Total ReceiptsDISBURSEMENTSProsecuting AttorneyTransfers 5)6,013Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER (5,132)0(5,132)-12-1,91910,287010,287

Exhibit BWRIGHT COUNTY, MISSOURICOMPARATIVE STATEMENT OF RECEIPTS, DISBURSEMENTS, AND CHANGES IN CASH - BUDGET AND ACTUAL - VARIOUS FUNDYear Ended December 31,2003BudgetLOCAL EMERGENCY PLANNING COMMISSION Total ReceiptsDISBURSEMENTSDomestic violence (88)Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 1360(88)(861)0(861)Total ReceiptsDISBURSEMENTSEmergency PlanningTransfers outTotal DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 31RECORDER USER FEE FUNDRECEIPTSCharges for servicesInterestTotal ReceiptsDISBURSEMENTSRecorderTotal DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 31DOMESTIC SHELTER FUNDRECEIPTSCharges for servicesInterest-13-

Exhibit BWRIGHT COUNTY, MISSOURICOMPARATIVE STATEMENT OF RECEIPTS, DISBURSEMENTS, AND CHANGES IN CASH - BUDGET AND ACTUAL - VARIOUS FUNDYear Ended December 31,2003BudgetCOMPUTER UPGRADE/REMODELING FUNDRECEIPTSInterestTransfers al ReceiptsDISBURSEMENTSComputersBuilding 0,000Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 8471002,3281710Total ReceiptsDISBURSEMENTSSheriffTransfers 44270215,911(702)29,157026,96002,1970Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 3,600089894532,937893,026SHERIFF CIVIL FEES FUNDRECEIPTSIntergovernmentalCharges for servicesInterestOtherELECTION SERVICES FUNDRECEIPTSIntergovernmentalInterestOtherTotal ReceiptsDISBURSEMENTSElection expenseTransfers outTotal DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER 31-14-3,1472,93702,937

Exhibit BWRIGHT COUNTY, MISSOURICOMPARATIVE STATEMENT OF RECEIPTS, DISBURSEMENTS, AND CHANGES IN CASH - BUDGET AND ACTUAL - VARIOUS FUNDYear Ended December 31,2003BudgetCOLLECTORS TAX MAINTENANCE FUNDRECEIPTSCharges for Actual15,00050014,588112(412)(388)Total 004,868(168)Total DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER otal DisbursementsRECEIPTS OVER (UNDER) DISBURSEMENTSCASH, JANUARY 1CASH, DECEMBER AT

WRIGHT COUNTY, MISSOURI YEARS ENDED DECEMBER 31, 2003 AND 2002 From The Office Of State Auditor Claire McCaskill Report No. 2004-76 September 28, 2004 www.auditor.mo.gov. Office Of The September 2004 . Numerous problems were noted relating to Prosecuting Attorneys' accounting controls and procedures. Bad check collection procedures need .