Transcription

Offshore CompaniesLAWS OF MALAYSIAReprintAct 441offshore companiesact 1990Incorporating all amendments up to 1 January 2006Published byThe Commissioner of Law revision, MalaysiaUnder the Authority of the Revision of Laws Act 1968in Collaboration withPercetakan Nasional Malaysia Bhd2006

Act 441Laws of Malaysiaoffshore companies act 1990Date of Royal Assent. 22 August 1990Date of publication in the Gazette . 30 August 1990Previous ReprintFirst Reprint.2001

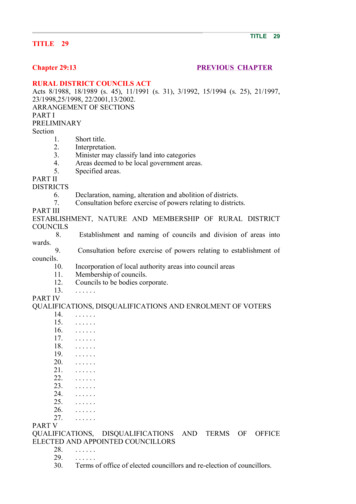

Offshore CompaniesLAWS OF MALAYSIAAct 441offshore companies act 1990ARRANGEMENT OF SECTIONSPart IPRELIMINARYSection1. Short title2. Interpretation3. Definition of subsidiary and holding company4.Related companies5. Non-application of Companies Act 19656.Resident doing any act under this Act deemed to be non-resident7. Permitted purpose for incorporationPart IIADMINISTRATION OF ACT8.Registrar of Companies9. Lodging of documents9a. Electronic lodgement or filing of documents9b. Evidentiary value of electronically lodged or filed documents9c. Original copies to be kept at office of trust company10. Approved auditors11.Company auditors12. Approved liquidator13.Registers

Laws of MalaysiaAct 441Part IIICONSTITUTION OF COMPANIESDivision 1IncorporationSection14. Formation of companies15.Registration and incorporation16. Application for registration of foreign company as being continuedin Labuan17. Prior approval in principle18.Requirements as to memorandumDivision 2Status and Name19. Powers of companies20. Ultra vires transactions21. Names of offshore companies22.Change of name23. Articles of association24. Alteration of memorandum or articles25.Copies of memorandum and articles26. Transactions and establishment of a branch27. Prohibition against carrying on business when offshore company has nomembersPart IVSHARES, DEBENTURES AND CHARGESDivision 1Prospectuses28.Restriction on inviting investments from public29. Invitation to public30.Requirement to issue forms of application for shares or debentures withprospectus31. Invitations to public to lend money to or deposit money with an offshorecompany or a foreign offshore company

Offshore Companies Section32. Approval of Registrar, or compliance with regulations, as regardsissue of prospectuses33. Advertisements34.Retention of over-subscriptions in debenture issues35.Registration of prospectus36. Document containing offer of shares to be deemed prospectus37. Expert’s consent to issue of prospectus containing statement by him38.Civil liability for mis-statement in prospectus39.Criminal liability for mis-statement in prospectusDivision 2Restrictions on Allotment40. Trust company as agent in public offer41. Prohibition of allotment unless minimum subscription received42. Application moneys to be held in trust until allotmentDivision 3Shares43.Return of allotment44.Calls45.Reserve liability46. Share premium account47. Power to issue shares and voting rights48. Dealing by an offshore company in its own shares, etc.49.Cancellation of reacquired shares by an offshore company50. Issues of shares at a discount51. Alteration of share capital52. Validation of shares improperly issued53. Special resolution for reduction of share capital54.Rights of holders of preference shares to be set out in articles55.Redeemable preference shares

Laws of MalaysiaAct 441Division 4DebenturesSection56. Interpretation57. Power to issue debentures58. Offshore company to maintain register of debentures holders59. Perpetual debentures60. Reissue of redeemed debentures61. Trustee for debenture holders62. Duties of trustee63. Obligations of directors of borrowing company64. Obligation of guarantor company to furnish information65. Loan and deposits to be immediately repayable on certain eventsDivision 5Interests other than Shares, Debenture,etc.66. Interpretation67. Approved deeds68. Approval of deeds69. Interests to be issued by an offshore company or a foreign offshorecompany only70. Statement to be issued71. No issue without approved deed72. Register of interest holders73. Penalty for contravention of Division, etc.74. Winding up of schemes, etc.75. Liability of trusteesDivision 6Title and Transfers76. Nature of shares77. Numbering of shares78. Certificate to be evidence of title79. An offshore company may have share seal80. Instruments of transfer and transfer by personal representative81. Duties of offshore company with respect to issue of certificate

Offshore Companies Division 7Register of ChargesSection82. Non-application of Division83.Register of charges84. Notice of creation and satisfaction of chargePart VMANAGEMENT AND ADMINISTRATIONDivision 1Office and Name85.Registered office of an offshore company86. Name to be displayed at all offices and to appear on seals, letters, etc.Division 2Directors and Officers87. Directors88.Consent to act as director89. Validity of acts of directors90.Registrar’s power to restrain persons from managing offshore companies91. Disclosure of interest in contracts, property, offices, etc.92. Duty and liability of officers93. Secretary94.Register of directors and secretaries94a. Offence against any provision of this Act committed by directors andsecretaries.Division 3Meetings and Proceedings95. Meetings of members96. Notice of meetings of members97.Quorum, chairman, voting, etc., at meetings98. Voting by members99. Action by consent of members in writing100. Power of Court to direct meetings to be called

Laws of MalaysiaAct 441Section101. Special resolution102.Resolution requiring special notice103. Lodgement of copies of certain resolutions and agreements104. Minutes of proceedingsDivision 4Register of Members105.Register of members106. Where register to be kept107.Consequences of default by agent108. Power of Court to rectify registerDivision 5Annual Return109. Annual returnPart VIACCOUNTS AND AUDITDivision 1Accounts110. Accounts to be kept111. Audited accounts to be laid before meeting112. Audited accounts to be sent to membersDivision 2Audit113. Auditor to be appointed113a. Auditor not required in certain circumstances114.Removal and resignation of auditors115.Remuneration of auditor116. Auditor may attend meetings117.Rights and duties of auditors

Offshore Companies Part VIIARRANGEMENTS AND RECONSTRUCTIONSSection118. Arrangements119.Regulations in respect of takeovers and mergersPart VIIIFOREIGN OFFSHORE COMPANIES120. Interpretation121.Registration of foreign offshore companies122. Prohibition and restriction on foreign offshore company123.Registered office of foreign offshore companies124.Return to be lodged where documents, etc., altered125. Service on foreign offshore companies126.Cessation of business in Labuan127. Liquidation or dissolution of company in place of incorporation or origin128. Names of foreign offshore companies129.Returns by foreign offshore companies130. Application of this Part to certain foreign companies registered underCompanies Act 1965Part VIIIaCOMPANY MANAGEMENT130a. Interpretation130b. Register of management companies130c. Licensing130d. Application for licence130e. Grant of licence130f. Power to grant exemptions130g. Licensing procedure130h. Annual fees130i. Revocation of licences130j. Access to information and records130k. Immunity of and actions by the Registrar130l. Offences and penalties130m. Transitional

10Laws of MalaysiaAct 441Part IXMISCELLANEOUSSection131.Receivership and winding up132. Service of documents on companies133. Transfer from Labuan134.Costs of proceedings before the Court135. Security for costs136. Disposal of shares of shareholder whose whereabouts are unknown137. Power to grant relief138. Irregularities in proceedings139. Translation of instruments140. Dividends payable from profits only141. Use of word “Corporation”, etc.142.General penalty143. Default penalties144.Compounding of offences145. Procedure where none laid down146.Regulations147. Investment in domestic company148. Prohibition by Minister149. Secrecy150. Power of exemption151. Fees, penalties and striking off151a. Company struck off liable for fees, etc.151b. Fees payable to Registrar151c. Effect of striking off152. Non-application of specified written lawsSchedule

Offshore Companies11LAWS OF MALAYSIAAct 441OFFSHORE COMPANIES ACT 1990An Act to provide for the incorporation, registration and administration of offshore companies and foreign offshore companiesand for matters connected therewith.[1 October 1990, P.U. (B) 591/1990]BE IT ENACTED by the Seri Paduka Baginda Yang di-PertuanAgong with the advice and consent of the Dewan Negara andDewan Rakyat in Parliament assembled, and by the authority ofthe same, as follows:Part IPRELIMINARYShort title1. This Act may be cited as the Offshore Companies Act1990.Interpretation2. (1) In this Act, unless the context otherwise requires—“allot” includes sell, issue, assign, and convey; and “allotment”has a corresponding meaning;“annual fee payment date” means the date on which the annual fee of an offshore company shall be payable pursuant tosubsection 15(6);“annual return” means the return required to be made by anoffshore company under section 109 and includes any document

12Laws of MalaysiaAct 441accompanying the return;“approved auditor” means a person approved undersubsection 10(1);“approved liquidator” means a person approved undersubsection 12(1);“books” includes any register or other record of information andany accounts or accounting records, however compiled, recordedor stored, and also includes any document;“certified” means certified in the prescribed manner to be aparticular document or to be a true copy thereof;“charge” includes a mortgage and any agreement to give orexecute a charge or mortgage whether upon demand or otherwise;“contributory”, in relation to an offshore company, means aperson liable to contribute to the assets of the company in theevent of its being wound up, and includes the holder of fully paidshares in the company and, prior to the final determination ofthe persons who are contributories, includes any person allegedto be a contributory;“corporation” means a domestic company, an offshore company,a foreign company or a foreign offshore company;“Court” means the High Court or a judge thereof;“debenture” includes debenture stock, bonds, notes and anyother securities of a corporation whether constituting a chargeon the assets of the company or not;“director” means any person, by whatever name called, occupying the position of director of an offshore company or a foreignoffshore company, and includes a person in accordance withwhose directions or instructions the directors of such a companyare accustomed to act and an alternate or substitute director;“document” includes summons, order and other legal process,and notice and register;

Offshore Companies13“dollar” means a dollar unit of the currency of the UnitedStates of America;“domestic company” means a company incorporated under theCompanies Act 1965 [Act 125];“expert” includes engineer, valuer, accountant, auditor and anyother person whose profession or reputation gives authority to astatement made by him;“foreign company” means—(a) a company, society, association or other body incorporatedoutside Malaysia; or(b) an unincorporated society, association or other bodywhich under the law of its place of origin may sue orbe sued, or hold property in the name of the secretaryor other officer of the society, association or body dulyappointed for that purpose, and which does not have itshead office or principal place of business in Malaysia;“foreign offshore company” means a foreign company registeredunder Part VIII;“issued share capital”, in relation to par value shares, means,at any particular time, the sum of the par value of all shares ofan offshore company that have been issued;“Labuan” means the Federal Territory of Labuan;“lodged” means lodged in accordance with the provisions ofthis Act;“memorandum”, in relation to an offshore company, means thememorandum of association of that company for the time beingin force; and, in relation to a foreign offshore company, meansthe charter, statute, memorandum of association or instrumentconstituting or defining the constitution of the company;“Minister” means the Minister for the time being charged withthe responsibility for finance;

14Laws of MalaysiaAct 441“month” means a period of thirty days;“officer”, in relation to an offshore company or a foreignoffshore company, includes—(a) any director, secretary or employee of the company;(b) any receiver and manager of any part of the undertakingof the company appointed under a power contained inany instrument; and(c) any liquidator of the company appointed in a voluntarywinding up,but does not include—(d) any receiver who is not also a manager;(e) any receiver and manager appointed by the Court; or(f) any liquidator appointed by the Court or by the creditors;“offshore company” means a company incorporated, or deemedto be incorporated, under this Act;“person” includes a corporation, partnership, a body of personsand a corporation sole;“post” includes communication by mail, courier, freight, telexor facsimile;“printed” includes typewritten or lithographed or reproducedby any mechanical means;“prescribed” means prescribed by or under this Act;“promoter”, in relation to a prospectus issued by or in connection with an offshore company, means a promoter of the companywho was a party to the preparation of the prospectus or of anyrelevant portion thereof, but does not include any person by reason only of his acting in a professional or advisory capacity;“prospectus” means any prospectus, notice, circular, advertisement or invitation inviting applications or offers from thepublic to subscribe for or purchase, or offering to the public for

Offshore Companies15subscription or purchase, any shares in or debentures of, or anyunits of shares in or units of debentures of, an offshore companyor a proposed offshore company;“Registrar” means the Labuan Offshore Financial Services Authority established under the Labuan Offshore Financial ServicesAuthority Act 1996 [Act 545];“regulations” means regulations under this Act;“resident” means—(a) in relation to a natural person, a citizen or permanentresident of Malaysia; or(b) in relation to any other person, a person who has establisheda place of business, and is operating, in Malaysia,and includes a person who is declared to be a resident pursuantto section 43 of the Exchange Control Act 1953 [Act 17];“secured debenture” means—(a) any debenture which is stated on its face to be a secureddebenture; or(b) any debenture which is issued on terms affording theholder of that debenture rights and powers to vote anddemand a poll in respect of the business and undertaking of the company (whether in addition to the rightsof members of the company or in substitution for thoserights);“share”, in relation to an offshore company, means a share inthe share capital of that company, and includes stock;“trust company” means a domestic company or foreign company incorporated for the purpose of undertaking or offering toundertake, as a whole or a part of its business, all or any of theduties of a trustee, and registered under the Labuan Trust Companies Act 1990 [Act 442].(2) For the purposes of this Act, a person shall be deemed tohold a beneficial interest in a share—(a) if that person, either alone or together with other persons,is entitled (otherwise than as a trustee for, on behalf of,or on account of, another person) to receive, directly

16Laws of MalaysiaAct 441or indirectly, any dividends in respect of the share orto exercise, or to control the exercise of, any rights attaching to the shares; or(b) if that person, being a corporation, holds any beneficialinterest in a share of another corporation which holds,or a subsidiary of which holds, any beneficial interestin the first-mentioned share.(3) Whenever in this Act any person holding or occupyinga particular office or position is mentioned or referred to, suchmention or reference shall, unless the contrary intention appears,be taken to include all persons who shall at any time thereafteroccupy for the time being the said office or position.(4) Any provision of this Act overriding or interpreting a corporation’s articles shall, except where otherwise provided by thisAct, apply in relation to articles in force at the commencementof this Act, as well as to articles coming into force thereafter,and shall apply also in relation to a corporation’s memorandumas it applies in relation to its articles.Definition of subsidiary and holding company3. (1) For the purposes of this Act, a corporation shall, subjectto the provisions of subsection (3), be deemed to be a subsidiaryof another corporation if—(a) that other corporation—(i) controls the composition of the board of directorsof the first-mentioned corporation;(ii) controls more than half of the voting power of thefirst-mentioned corporation; or(iii) holds more than half of the issued share capitalof the first-mentioned corporation (excluding anypart thereof which carries no right to participatebeyond a specified amount in a distribution ofeither profits or capital); or(b) the first-mentioned corporation is a subsidiary of any corporation which is that other corporation’s subsidiary.(2) For the purposes of subsection (1), the composition of acorporation’s board of directors shall be deemed to be controlled

Offshore Companies17by another corporation if that other corporation, by the exerciseof some power exercisable by it without the consent or concurrence of any other person, can appoint or remove all or a majority of the directors, and for the purposes of this provision thatother corporation shall be deemed to have power to make suchan appointment if—(a) a person cannot be appointed as a director without theexercise in his favour by that other corporation of sucha power; or(b) a person’s appointment as a director follows necessarilyfrom his being a director or other officer of that othercorporation.(3) In determining whether one corporation is a subsidiary ofanother corporation—(a) any shares held or power exercisable by that other corporation in a trustee or fiduciary capacity shall be treatedas not held or exercisable by it;(b) subject to paragraphs (c) and (d), any shares held orpower exercisable—(i) by any person as a nominee for that other corporation(except where that other corporation is concernedonly in a trustee or fiduciary capacity); or(ii) by, or by a nominee for, a subsidiary of that othercorporation, not being a subsidiary which is concerned only in a trustee or fiduciary capacity,shall be treated as held or exercisable by that other corporation;(c) any shares held or power exercisable by any person byvirtue of the provisions of any debentures of the firstmentioned corporation or of a trust deed for securingany issue of such debentures shall be disregarded; and(d) any shares held or power exercisable by, or by a nomineefor, that other corporation or its subsidiary (not beingheld or exercisable as mentioned in paragraph (c)) shallbe treated as not held or exercisable by that other corporation if the ordinary business of that other corporation or its subsidiary, as the case may be, includes thelending of money and the shares are held or power isexercisable as aforesaid by way of security only for the

18Laws of MalaysiaAct 441purposes of a transaction entered into in the ordinarycourse of that business.(4) A reference in this Act to the holding company of a corporation shall be read as a reference to a corporation of whichthe last-mentioned corporation is a subsidiary.Related companies4. Where a corporation—(a) is the holding company of another corporation;(b) is a subsidiary of another corporation; or(c) is a subsidiary of the holding company of another corporation,that first-mentioned corporation and that other corporation shall forthe purposes of this Act be deemed to be related to each other.Non-application of Companies Act 19655. Except as otherwise expressly provided in this Act, the provisions of the Companies Act 1965 shall not apply to an offshorecompany or a foreign offshore company incorporated or registeredunder this Act.Resident doing any act under this Act deemed to be nonresident6. A resident of Malaysia who does any act permitted by thisAct to be done by such resident shall be deemed to be a nonresident for the purposes of section 8 of the Labuan Trust Companies Act 1990.Permitted purpose for incorporation7. (1) Subject to subsection (2), an offshore company may beincorporated for any lawful purpose, and may carry on in, fromor through Labuan any business which may lawfully be carriedon in Malaysia, but it shall not carry on the business of bankingor insurance or any such similar business unless it is licensed soto do under the laws currently in force in Malaysia.

Offshore Companies19(2) An offshore company shall only carry on business in, fromor through Labuan.(3) No offshore company shall—(a) carry on business with a resident of Malaysia except aspermitted by the Offshore Banking Act 1990 [Act 443]or by the Registrar;(b) carry on banking business except as permitted by theOffshore Banking Act 1990;(c) carry on business in the Malaysian currency except fordefraying its administrative and statutory expenses andwhere section 147 applies;(d) carry on business as an insurance or a reinsurance company except as permitted by the Offshore Insurance Act1990 [Act 444];(e) carry on shipping operations in Malaysia; or(f) carry on any business of a trust company.(4) For the purposes of paragraph (3)(a), an offshore companyshall not be treated as carrying on business with persons residentin Malaysia by reason only that—(a) it makes or maintains deposits with a person carrying onbusiness within Malaysia;(b) it makes or maintains professional contact with any counseland attorney, accountant, book-keeper, trust company,domestic company wholly owned by a trust companymade available by the trust company to act or be appointed as a resident director or a resident secretary ofan offshore company, management company, investmentadviser or other similar person carrying on businesswithin Malaysia;(c) it prepares or maintains books and records within Malaysia;(d) it holds, within Malaysia, meetings of its directors ormembers;(e) it acquires or holds any lease of any property for thepurposes of its operation or as accommodation for itsofficers or employees;(f) it holds shares, debt obligations or other securities in acompany incorporated under this Act or in a domesticcompany in accordance with section 147, or it holds

20Laws of MalaysiaAct 441shares, debt obligations or other securities for the purposes of a transaction entered into in the ordinary courseof business in connection with the lending of money;or(g) a resident of Malaysia holds shares in that offshore company.Part IIADMINISTRATION OF ACTRegistrar of Companies8. (1) Subject to the general direction and control of the Registrar and to such restrictions and limitations as may be prescribed,anything by this Act appointed or authorized or required to bedone or signed by the Registrar may be done or signed by anyRegional Registrar, Deputy Registrar or Assistant Registrar andshall be as valid and effectual as if done or signed by the Registrar.(2) No person dealing with any Regional Registrar, DeputyRegistrar or Assistant Registrar shall be concerned to see or inquirewhether any restrictions or limitations have been prescribed, andevery act or omission of a Regional Registrar, Deputy Registrar orAssistant Registrar, so far as it affects any such person, shall beas valid and effectual as if done or omitted by the Registrar.(3) All courts, judges and persons acting judicially shall takejudicial notice of the seal and signature of the Registrar and of anyRegional Registrar, Deputy Registrar or Assistant Registrar.(4) For the purpose of ascertaining whether an offshore companyor a foreign offshore company is complying with the provisionsof this Act, the Registrar or any person authorized by him mayinspect any book, minute book, register or record required by orunder this Act to be kept by the company.(5) An offshore company or a foreign offshore company orany officer thereof shall, on being required by the Registrar orany person authorized by him, produce any such book, registeror record.(6) An offshore company or a foreign offshore company orany officer thereof shall not obstruct or hinder the Registrar orany person authorized by him while exercising any of the powersreferred to in subsection (4).

Offshore Companies21(7) Any person who, except for the purposes of this Act orin the course of any criminal proceedings, makes a record of,or divulges or communicates to any other person, any information which he has acquired by reason of an inspection undersubsection (4) shall be guilty of an offence against this Act.(8) There shall be paid to the Registrar such fees as may beprescribed.Lodging of documents9. (1) Every document required or permitted to be lodged orfiled with the Registrar under the provisions of this Act shall belodged or filed through a trust company.(2) Every application to the Registrar for any certificate to beissued under this Act or for any extract or copy of any certificateissued under this Act or of any document lodged or filed withthe Registrar shall be made through a trust company:Provided that this subsection shall not apply—(a) where an application is made in respect of an offshorecompany or a foreign offshore company by a memberof that company and the document, certificate, extractor copy is for his own personal use; or(b) where an application is made by an offshore company ora foreign offshore company for a licence for the purposeof undertaking or offering to undertake the business ofa management company under Part VIIIa.Electronic lodgement or filing of documents9a. (1) The Registrar may provide a service for the electroniclodgement or filing of documents required by this Act to belodged or filed with the Registrar.(2) A trust company shall become a subscriber to the serviceprovided under subsection (1) and shall pay the prescribed feeand comply with such terms and conditions as may be determinedby the Registrar.

22Laws of MalaysiaAct 441(3) A document electronically lodged or filed under this sectionshall be deemed to have satisfied the requirement for lodgementor filing if the document is communicated or transmitted to theRegistrar in such manner as may be specified or approved bythe Registrar.(4) The Registrar may, by notice in writing, specify the documents that may be electronically lodged or filed.(5) A document that is required to be certified or authenticatedshall, if it is to be electronically lodged or filed, be certified orauthenticated in such manner as may be specified or approvedby the Registrar.(6) Where a document is electronically lodged or filed with theRegistrar, the Registrar or his authorized agents shall not be liablefor any loss or damage suffered by any person by reason of anyerror or omission of whatever nature or however arising appearing in any document obtained by any person under the servicereferred to in subsection (1) if such error or omission was madein good faith and in the ordinary course of the discharge of theduties of the Registrar or of his authorized agents or occurred orarose as a result of any defect or breakdown in the service or inthe equipment used for the provision of the service.Evidentiary value of electronically lodged or filed documents9b. A copy of or an extract from any document electronicallylodged or filed with the Registrar under section 9a duly certifiedby the Registrar as a true copy of or extract from that documentshall be admissible in evidence in any proceedings as of equalvalidity as the original document.Original copies to be kept at office of trust company9c. (1) The original copies of the documents specified or approved by the Registrar to be electronically lodged or filed withthe Registrar by the trust company shall, at all times, be kept atthe office of the trust company.(2) A trust company that fails to comply with subsection (1)shall be guilty of an offence against this Act.

Offshore Companies23Penalty: Ten thousand ringgit. Default penalty.Approved auditors10. (1) Subject to such conditions as he deems fit to impose, theRegistrar may approve any person to be an approved auditor forthe purposes of this Act.(2) No person shall perform the duties of auditor of an offshorecompany unless he is an approved auditor.(3) The Registrar may revoke any approval given undersubsection (1).(4) The Registrar shall keep a register of approved auditors.(5) An approved auditor shall pay to the Registrar such annualfee as may be prescribed.Company auditors11. (1) A person shall not knowingly consent to be appointed,and shall not knowingly act, as auditor for any offshore company under this Act and shall not prepare for or on behalf ofthe company any report required by this Act to be prepared byan approved auditor—(a) if he is not an approved auditor;(b) if he is indebted to the company or to a company whichis deemed to be related to that company by virtue ofsection 4 in an amount exceeding five thousand dollarsor an equivalent amount in any other currency;(c) if he is—(i) an officer of the company;(ii) a partner, employer or employee of an officer ofthe company;(iii) a partner, or employee of an employee of an officerof the company;(iv) a spouse of an officer of the company;(v) a spouse of an employee of an officer of the company; or(vi) a shareholder, or the spouse of a shareholder, of a

24Laws of MalaysiaAct 441corporation whose employee is an officer of thecompany; or(d) if he is responsible for, or if he is the partner, employeror employee of a person responsible for, the keepingof the register of members or the register

25. service on foreign offshore companies 26. Cessation of business in labuan 27. liquidation or dissolution of company in place of incorporation or ori-gin 28. names of foreign offshore companies 29. Returns by foreign offshore companies 30. application of this part to certain foreign companies registered under Companies act 965 Part viiia