Transcription

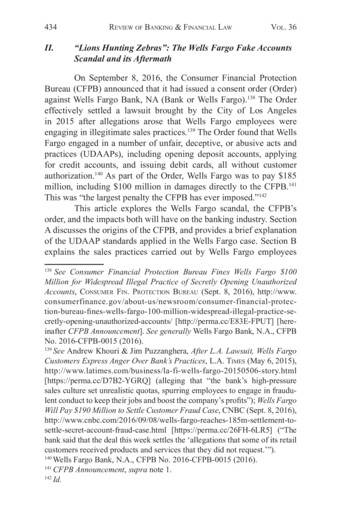

2Q21 Quarterly Supplement

Wells Fargo & Company and SubsidiariesQUARTERLY FINANCIAL DATATABLE OF CONTENTSIn second quarter 2021, we elected to change our accounting method for low-income housing tax credit (LIHTC) investments. We also elected to change the presentation of investment tax credits relatedto solar energy investments. Prior period financial statement line items have been revised to conform with the current period presentation. Prior period risk-based capital and certain other regulatoryrelated metrics were not revised. For additional information, including the financial statement line items impacted by these changes, see page 30.PagesConsolidated ResultsSummary Financial Data3Consolidated Statement of Income5Consolidated Balance Sheet6Average Balances and Interest Rates (Taxable-Equivalent Basis)7Reportable Operating Segment ResultsCombined Segment Results8Consumer Banking and Lending10Commercial Banking12Corporate and Investment Banking14Wealth and Investment Management16Corporate17Credit-Related InformationConsolidated Loans Outstanding – Period End Balances, Average Balances, and Average Interest Rates18Net Loan Charge-offs19Changes in Allowance for Credit Losses for Loans20Allocation of the Allowance for Credit Losses for Loans21Nonperforming Assets (Nonaccrual Loans and Foreclosed Assets)22Commercial and Industrial Loans and Lease Financing by Industry23Commercial Real Estate Loans by Property Type24EquityTangible Common Equity25Risk-Based Capital Ratios Under Basel III – Standardized Approach27Risk-Based Capital Ratios Under Basel III – Advanced Approach28OtherDeferred Compensation and Related Hedges29Changes in Accounting Policy for Low-Income Housing Tax Credit Investments and Solar Energy Investments30Financial results reported in this document are preliminary. Final financial results and other disclosures will be reported in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, and may differmaterially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information.

Wells Fargo & Company and SubsidiariesSUMMARY FINANCIAL DATAQuarter endedMar 31,2021Dec 31,2020Sep 30,2020Jun 4,80215,22914,5513,6874,0873,7357699,534Jun 30,2021(in millions, except per share amounts)Jun 30, 2021% Change fromMar 31,2021Jun 30,20209%11Six months endedJun 30,2021Jun 30,2020%ChangeSelected Income Statement DataTotal revenue Noninterest 029(20)NM(2,308)13,539NM(5) (1)6,9294,543(1,260)(1,048)Wells Fargo net income NMWells Fargo net income (loss) applicable to common Diluted earnings (loss) per common ds declared per common x pre-provision profit (PTPP) (1)Provision for credit losses(179)Common Share DataCommon shares ��Average common shares ��4,132.94,105.21Diluted average common shares outstanding 2.1531.52411Total equity193,127188,034185,712181,727178,63538Common stockholders' e common equity (4)143,577138,702136,727132,874129,842411Book value per common share (3)Tangible book value per common share (3)(4 ) Selected Equity Data (period-end)Performance Ratios(0.30)Return on average assets (ROA)(5)1.25 %0.970.640.66(0.79)1.11 %Return on average equity (ROE)(6)13.610.36.67.2(10.2)12.0(4.7)Return on average tangible common equity 0762.022.052.152.132.252.042.42Efficiency ratio (7)Net interest margin on a taxable-equivalent basisNM – Not meaningful(1)Pre-tax pre-provision profit (PTPP) is total revenue less noninterest expense. Management believes that PTPP is a useful financial measure because it enables investors and others to assess the Company’s ability to generate capital to cover credit losses through acredit cycle.(2)For second quarter 2020, diluted average common shares outstanding equaled average common shares outstanding because our securities convertible into common shares had an anti-dilutive effect.(3)Book value per common share is common stockholders' equity divided by common shares outstanding. Tangible book value per common share is tangible common equity divided by common shares outstanding.(4)Tangible common equity, tangible book value per common share, and return on average tangible common equity are non-GAAP financial measures. For additional information, including a corresponding reconciliation to GAAP financial measures, see the “TangibleCommon Equity” tables on pages 25 and 26.(5)Represents Wells Fargo net income (loss) divided by average assets.(6)Represents Wells Fargo net income (loss) applicable to common stock divided by average common stockholders’ equity.(7)The efficiency ratio is noninterest expense divided by total revenue (net interest income and noninterest income).-3-

Wells Fargo & Company and SubsidiariesSUMMARY FINANCIAL DATA (continued)Quarter endedJun 30,2021( in millions, unless otherwise noted)Mar 31,2021Dec 31,2020Sep 30,2020Jun 30,2020Jun 30, 2021% Change fromMar 31,2021Jun 30,2020(2)%(12)Six months endedJun 30,2021Jun 30,2020%Change(11)%Selected Balance Sheet Data 64,041968,156Assets � 80,1001,399,0281,386,656341,414,7651,362,3094Debt 18,04319,71320,47120,436(9)(20)Selected Balance Sheet Data (period-end)Allowance for credit losses for loansEquity (2)2(6)Headcount (#) (period-end)Capital and other metrics (1)Risk-based capital ratios and components (2):Standardized Approach:CET112.1 %11.811.611.411.0Tier 1 capital13.713.513.313.112.6Total capitalRisk-weighted assets (RWAs) (in billions) 213.1Advanced Approach:CET112.7 %12.611.911.511.1Tier 1 capital14.514.413.713.212.8Total 172.01,195.48.0Risk-weighted assets (RWAs) (in billions) Tier 1 leverage ratio8.5 %8.48.38.1Supplementary Leverage Ratio (SLR) (3)7.17.98.17.87.5Total Loss Absorbing Capacity (TLAC) Ratio (4)25.125.225.725.825.3Liquidity Coverage Ratio (LCR) (5)123127133134129(1)(2)(3)(4)(5)Ratios and metrics for June 30, 2021, are preliminary estimates.See the tables on pages 27 and 28 for more information on Common Equity Tier 1 (CET1), tier 1 capital, and total capital. The information presented reflects fully phased-in CET1, tier 1 capital, and RWAs, but reflects total capital in accordance with transitionrequirements.In April 2020, the Board of Governors of the Federal Reserve System (FRB) issued an interim final rule that temporarily allowed a bank holding company to exclude on-balance sheet amounts of U.S. Treasury securities and deposits at Federal Reserve Banks from thecalculation of its total leverage exposure in the denominator of the SLR. The interim final rule expired on April 1, 2021.Represents TLAC divided by the greater of RWAs determined under the Standardized and Advanced Approaches, which is our binding TLAC ratio.Represents high-quality liquid assets divided by projected net cash outflows, as each is defined under the LCR rule.-4-

Wells Fargo & Company and SubsidiariesCONSOLIDATED STATEMENT OF INCOMEJun 30, 2021% Change fromQuarter ended(in millions, except per share amounts)Interest incomeInterest expense Net interest incomeJun 30,2021Mar 31,2021Dec 31,2020Sep 30,2020Jun 30,2020Mar ,8131,921(4)%(28)(18)(54)Six months endedJun 30,2020 Jun 30,2021Jun rest incomeDeposit-related feesLending-related feesInvestment advisory and other asset-based feesCommissions and brokerage services feesInvestment banking ,7601,227938—717(1)21Card feesMortgage bankingNet gains (losses) from trading 590361797317807131353212,0262,6621,68969620282Net gains (losses) on debt securitiesNet gains (losses) from equity securitiesLease (31)Total noninterest ,19415,237Total 596Provision for credit 0)NM1615,229Noninterest expensePersonnelTechnology, telecommunications and equipmentOccupancyOperating lossesProfessional and outside servicesLeases (1)Advertising and promotionRestructuring chargesOtherTotal noninterest 27,599Income (loss) before income tax expense (benefit)Income tax expense )(2,001)4660NMNM13,7802,346(4,679)(1,648)NMNMNet income (loss) before noncontrolling interestsLess: Net income (loss) from noncontrolling 16(3,846)10,676(2,930)NM297380350315Wells Fargo net income (loss) Less: Preferred stock dividends and other31430NM(22)(5) 677926(1)(27)Wells Fargo net income (loss) applicable to common stock 5,7434,2562,7412,901(4,160)35NM 9,999(3,856)NMPer share informationEarnings (loss) per common shareDiluted earnings (loss) per common share NM 2.422.40(0.94)(0.94)NMNMNM – Not meaningful(1)Represents expenses for assets we lease to customers.-5-

Wells Fargo & Company and SubsidiariesCONSOLIDATED BALANCE SHEETJun 30, 2021% Change fromJun 30,2021Mar 31,2021Dec 31,2020Sep 30,2020Jun )———12(7)(2)(3)(1)1227(15) ) n millions)AssetsCash and due from banksInterest-earning deposits with banks Total cash, cash equivalents, and restricted cashFederal funds sold and securities purchased under resale agreementsDebt securities:Trading, at fair valueAvailable-for-sale, at fair valueHeld-to-maturity, at amortized costLoans held for saleLoansAllowance for loan lossesNet loansMortgage servicing rightsPremises and equipment, netGoodwillDerivative assetsEquity securitiesOther assetsTotal assetsLiabilitiesNoninterest-bearing depositsInterest-bearing depositsTotal depositsShort-term borrowingsDerivative liabilitiesAccrued expenses and other liabilitiesLong-term debtTotal liabilitiesMar 31,2021(11)%(4)EquityWells Fargo stockholders’ equity:Preferred stockCommon stock – 1-2/3 par value, authorized 9,000,000,000 shares; issued 5,481,811,474 sharesAdditional paid-in capitalRetained earningsCumulative other comprehensive income (loss)Treasury stock (1)Unearned ESOP 98)(69,050)(875)(2)——355(2)—Total Wells Fargo stockholders’ equityNoncontrolling 67860177,900735265Total equityTotal liabilities and equity(1) 2641,952,9111,920,3991,967,048Number of shares of treasury stock were 1,373,813,200, 1,340,691,115, 1,337,799,931, 1,349,294,592, and 1,362,252,882 at June 30, and March 31, 2021, and December 31, September 30, and June 30, 2020, respectively.-6-Jun 30,202025815438(1)(1)

Wells Fargo & Company and SubsidiariesAVERAGE BALANCES AND INTEREST RATES (TAXABLE-EQUIVALENT BASIS)(1)Jun 30, 2021% Change fromQuarter ended( in millions)Jun 30, 2021Mar 31, 2021Dec 31, 2020Sep 30, 2020Jun 30, 671 718931,11659,082198,34028,875Total interest-bearing liabilitiesNoninterest-bearing demand depositsOther noninterest-bearing liabilities1,199,070494,07855,763Total liabilitiesTotal equityMar 31, 2021Six months endedJun 30, 2020Jun 30, 2021Jun 30, 2020%ChangeAverage BalancesAssetsInterest-earning deposits with banksFederal funds sold and securities purchased under resale agreementsTrading debt securitiesAvailable-for-sale debt securitiesHeld-to-maturity debt securitiesLoans held for saleLoansEquity securitiesOther 14 181,3771,763,108184,072 1,939,8791,934,4251,925,0131,945,9111,947,1800.11 0.13(0.08)1.861.33Total interest-earning assetsTotal noninterest-earning assetsTotal assetsLiabilitiesInterest-bearing depositsShort-term borrowingsLong-term debtOther liabilitiesTotal liabilities and equity 15632,4757,5731,758,553178,6141,781,230166,795(1)7 )41,747,141190,0261,762,043185,982(1)2—— 1,937,1671,948,025(1) 57 %(21)(13)(18)4025(11)(9)23Average Interest RatesInterest-earning assetsInterest-earning deposits with banksFederal funds sold and securities purchased under resale agreementsTrading debt securitiesAvailable-for-sale debt securitiesHeld-to-maturity debt securitiesLoans held for saleLoansEquity securitiesOtherTotal interest-earning assetsInterest-bearing liabilitiesInterest-bearing depositsShort-term borrowingsLong-term debtOther liabilitiesTotal interest-bearing liabilitiesInterest rate spread on a taxable-equivalent basis (2)Net interest margin on a taxable-equivalent basis (2)(1)(2)0.11 51.932.042.212.42The average balance amounts represent amortized costs. The interest rates are based on interest income or expense amounts for the period and are annualized, if applicable. Interest rates include the effects of hedge and risk management activities associated withthe respective asset and liability categories.Includes taxable-equivalent adjustments predominantly related to tax-exempt income on certain loans and securities. The federal statutory tax rate utilized was 21% for the periods presented.-7-

Wells Fargo & Company and SubsidiariesCOMBINED SEGMENT RESULTS (1)Quarter ended June 30, 2021(in millions)Net interest incomeConsumerBanking andLendingCommercialBankingCorporate 52,9263,3278,6862,1083,3383,5363,023 Noninterest incomeTotal revenueProvision for credit losses(367)(382)(501)Noninterest expense6,2021,4431,805Income (loss) before income tax expense e tax expense (benefit)Net income before noncontrolling interestsLess: Net income (loss) from noncontrolling interestsNet income Wealth andInvestmentManagement24Corporate (2)ReconcilingItems —704—7044651,130—6,040(2)1,5236,744Quarter ended March 31, 2021Net interest income Noninterest incomeTotal revenueProvision for credit ninterest expense6,267Income (loss) before income tax expense (benefit)Income tax expense (benefit)Net income (loss) before noncontrolling interestsLess: Net income from noncontrolling interestsNet income 919014,690—1——53—54 2,1046371,555419(79)—4,636 r ended June 30, 2020Net interest incomeNoninterest incomeTotal revenue9,892Provision for credit losses3,1022,2953,756255126—9,534Noninterest ,524)(1,741)2081Income (loss) before income tax expense (benefit)Income tax expense (benefit)Net income (loss) before noncontrolling interestsLess: Net income from noncontrolling interestsNet income )(1,333)156301——47—156254—— 3,798)48(3,846)The management reporting process is based on U.S. GAAP and includes specific adjustments, such as for funds transfer pricing for asset/liability management, shared revenues and expenses, and taxable-equivalent adjustments to consistently reflect income fromtaxable and tax-exempt sources, which allows management to assess performance across the operating segments. We define our operating segments by type of product and customer segment.All other business activities that are not included in the reportable operating segments have been included in Corporate. Corporate includes corporate treasury and enterprise functions, net of allocations (including funds transfer pricing, capital, liquidity and certainexpenses), in support of the reportable operating segments, as well as our investment portfolio and affiliated venture capital and private equity businesses. Corporate also includes certain lines of business that management has determined are no longer consistentwith the long-term strategic goals of the Company, as well as previously divested businesses. In March 2021, we announced an agreement to sell our Corporate Trust Services business and, in second quarter 2021, we moved the business from the Commercial Bankingoperating segment to Corporate. Prior period balances have been revised to conform with the current period presentation.Taxable-equivalent adjustments related to tax-exempt income on certain loans and debt securities are included in net interest income, while taxable-equivalent adjustments related to income tax credits for low-income housing and renewable energy investments areincluded in noninterest income, in each case with corresponding impacts to income tax expense (benefit). Adjustments are included in Corporate, Commercial Banking, and Corporate and Investment Banking and are eliminated to reconcile to the Company’sconsolidated financial results.-8-

Wells Fargo & Company and SubsidiariesCOMBINED SEGMENT RESULTS (continued) (1)Six months ended June 30, 2021ConsumerBanking andLending(in millions)Net interest income Noninterest incomeTotal revenueProvision for credit lossesCorporate andInvestmentBankingWealth 296Net income before noncontrolling ��(2,308)—2,2315,6574,242—5,9191,415 633,638Income (loss) before income tax expense (benefit)Less: Net income (loss) from noncontrolling lingItems (3)6,107Income tax expense (benefit)Net incomeCorporate (2)11,233(786)Noninterest Six months ended June 30, 2020Net interest income Noninterest incomeTotal revenueProvision for credit erest expense13,1903,1533,9145,4001,942—27,599Income (loss) before income tax expense 0)Income tax expense (benefit)Net income (loss) before noncontrolling interestsLess: Net income (loss) from noncontrolling interestsNet income (loss)(1)(2)(3)— (1,159)2(1,353)—(1,021)The management reporting process is based on U.S. GAAP and includes specific adjustments, such as for funds transfer pricing for asset/liability management, shared revenues and expenses, and taxable-equivalent adjustments to consistently reflect income fromtaxable and tax-exempt sources, which allows management to assess performance across the operating segments. We define our operating segments by type of product and customer segment.All other business activities that are not included in the reportable operating segments have been included in Corporate. Corporate includes corporate treasury and enterprise functions, net of allocations (including funds transfer pricing, capital, liquidity and certainexpenses), in support of the reportable operating segments, as well as our investment portfolio and affiliated venture capital and private equity businesses. Corporate also includes certain lines of business that management has determined are no longer consistentwith the long-term strategic goals of the Company, as well as previously divested businesses. In March 2021, we announced an agreement to sell our Corporate Trust Services business and, in second quarter 2021, we moved the business from the Commercial Bankingoperating segment to Corporate. Prior period balances have been revised to conform with the current period presentation.Taxable-equivalent adjustments related to tax-exempt income on certain loans and debt securities are included in net interest income, while taxable-equivalent adjustments related to income tax credits for low-income housing and renewable energy investments areincluded in noninterest income, in each case with corresponding impacts to income tax expense (benefit). Adjustments are included in Corporate, Commercial Banking, and Corporate and Investment Banking and are eliminated to reconcile to the Company’sconsolidated financial results.-9-

Wells Fargo & Company and SubsidiariesCONSUMER BANKING AND LENDING SEGMENTJun 30, 2021% Change fromQuarter ended( in millions)Income StatementNet interest incomeNoninterest income:Deposit-related feesCard feesMortgage bankingOther Total noninterest incomeTotal revenueNet charge-offsChange in the allowance for credit lossesJun 30,2021Mar 31,2021Dec 31,2020Sep 30,2020Jun 113,0683,0392,8723,2288,6868,6548,6139,146Mar 31,2021—%Six months endedJun 30,2020(2) Jun 30,2021Jun 43,497(38)NMProvision for credit lossesNoninterest 93312(1)NM(11)(786)12,4694,67113,190NM(5)Income (loss) before income tax expense (benefit)Income tax expense 50)22NMNM5,6571,415(1,604)(445)NMNM 2,1382,1041,364871(1,777)2NM 4,242(1,159)NM 4,7144,5504,7014,7214,40147 )40147(16)4,2992,7098182503,3532,5717683032857(17) 8,6868,6548,6139,1467,608—14 17,34016,2577 (8)3(3)(7)(5)(15)2(6)26(23) 2,3016,578(14)1(9)58(23) 331,892353,081373,869379,783369,631(6)(10) 00715,14448,0006—17— (5)42(21)(2)(15)4(3)(9)(20) 37,765784,565759,425746,602—13Net income (loss)Revenue by Line of BusinessConsumer and Small Business BankingConsumer Lending:Home LendingCredit CardAutoPersonal LendingTotal revenueSelected Balance Sheet Data (average)Loans by Line of Business:Home LendingAutoCredit CardSmall BusinessPersonal LendingTotal loansTotal depositsAllocated capitalSelected Balance Sheet Data (period-end)Loans by Line of Business:Home LendingAutoCredit CardSmall BusinessPersonal LendingTotal loansTotal depositsNM – Not 548,00019— 8,1166,113(15)4(3)(9)(20) 326,760368,753(11)840,434746,60213

Wells Fargo & Company and SubsidiariesCONSUMER BANKING AND LENDING SEGMENT (continued)Jun 30, 2021% Change fromQuarter endedJun 30,2021Mar 31,2021Dec 31,2020Sep 30,2020Jun 30,202017.3 (15.5)91133,8765,30031.125.21.5 31,54436.916.353.233.618.251.832.321.653.965.6 %769.46,7170.87 %0.5175.8801.07,5360.940.56 25.53231.46 % ( in millions, unless otherwise noted)Mar 31,2021Six months endedJun 30,2020Jun 30,2021Jun 30,2020%ChangeSelected MetricsConsumer Banking and Lending:Return on allocated capital (1)Efficiency ratio (2)Headcount (#) (period-end)Retail bank branches (#)Digital active customers (# in millions) (3)Mobile active customers (# in millions) (3)Consumer and Small Business Banking:Deposit spread (4)Debit card purchase volume ( in billions) (5)Debit card purchase transactions (# in millions) (5)Home Lending:Mortgage banking:Net servicing incomeNet gains on mortgage loan originations/salesTotal mortgage bankingOriginations ( in billions):RetailCorrespondentTotal originations% of originations held for sale (HFS)Third party mortgage loans serviced (period-end) ( in billions) (6)Mortgage servicing rights (MSR) carrying value (period-end)Ratio of MSR carrying value (period-end) to third party mortgage loans servicedHome lending loans 30 days or more delinquency rate (7)(8)Credit Card:Point of sale (POS) volume ( in billions)New accounts (# in thousands) (9)Credit card loans 30 days or more delinquency rate (8)Auto:Auto originations ( in billions)Auto loans 30 days or more delinquency rate (8)Personal Lending:New funded balances(1)(2)(3)(4)(5)(6)(7)(8)(9) 1.893.12,027(6)%(1)(1)—17.2 %72116,1854,87832.626.8(13)(8)5612113124 (666)92225638(11)8934 (8)352 32.828.861.630.528.759.210(10)21(43) 3(10) .31.30 21.6 98(51)16070.534.5105.053.653.6107.232(36)70.7 %769.46,7170.87 ) 17.52552.1021214627 46.65891.46 %37.45702.102535.41.675.61.701948 15.31.30 %12.11.70263233153779 978982—Return on allocated capital is segment net income (loss) applicable to common stock divided by segment average allocated capital. Segment net income (loss) applicable to common stock is segment net income (loss) less allocated preferred stock dividends.Efficiency ratio is segment noninterest expense divided by segment total reven

WellsFargo & Company and Subsidiaries. QUARTERLYFINANCIALDATA TABLEOF CONTENTS. Insecond quarter 2021, we elected to change our accounting method for low-incomehousing tax credit (LIHTC) investments.We also elected to change the presentationof investmenttax credits related