Transcription

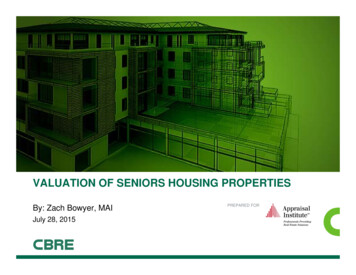

VALUATION OF SENIORS HOUSING PROPERTIESBy: Zach Bowyer, MAIJuly 28, 2015PREPARED FOR

PRESENTATION OVERVIEWValuation of Seniors Housing Properties Industry Overview Valuation Overview Market Analysis Income Approach Sales Comparison Approach Allocation of the Going Concern Final Considerations2VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWIndependent Living Community (ILC)3VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWAssisted Living Residence (ALR)4VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWSkilled Nursing Facility (SNF)5VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWContinuing Care Retirement Community (CCRC)6VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWSummary of Property TypesShelterActivities55 Real Estate ComponentILReal Estate ComponentALReal Estate ComponentMCReal Estate ComponentNCReal Estate ComponentTransport,LaundryBasic CareServicesMealsADL CareServicesSpecializedMCLong-TermChonic CareServices ComponentServices ComponentServices ComponentServices ComponentSource: NIC Investment GuideResident ChoiceRelative InfluenceRelative Choice7Doctor ChoiceVALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWImplied Market ValuesBillions 1,400 1,200 1,000Skilled Nursing 800Assisted Living 600Independent Living 400 200 0Seniors HousingHotelsApartmentsSource: NCREIF & NIC8VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWNumber of Publicly Announced Acquisitions3503002502001501005001994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014Source: The Senior Care Acquisition Report, 20th Edition, Irving Levin Assoc.9VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWVolume of Publicly Announced Acquisitions (Billions) 30 25 20 15 10 5 01220132014Source: The Senior Care Acquisition Report, 20th Edition, Irving Levin Assoc.10VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWCapitalization Rate Trends & ultifamily6.0010Y 97.40.00Source: NIC, Senior Care Investor, and CBRE Econometric Advisors11VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWProperty Level Returns181614% Levered Returns12Seniors 1 Year3 Years5 Years8 YearsSource: NCREIF & NIC12VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWDemographic TrendsSource: CBRE Econometric Advisors , Claritas13VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWDo the MathAverage Age of NEW AL resident (84) – Age of Leading-Edge Baby Boomer (67) 17 Years14VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWSeniors Housing Demand Vs. SupplySource: NIC MAP and US Census Bureau15VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWNational Operating TrendsSource: NIC MAP16VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INDUSTRY OVERVIEWOccupancy Trends vs. Home Values 240,0000.94 220,0000.92 200,000Occupancy0.9 180,000IL, Stand AloneAL, Stand Alone0.88 160,000All CCRCHome Values0.86 140,0000.84 120,0000.82 100,000Source: NIC MAP and CBRE Econometric Advisors17VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

PRESENTATION OVERVIEWValuation of Seniors Housing Properties Industry Overview Valuation Overview Market Analysis Income Approach Sales Comparison Approach Allocation of the Going Concern Final Considerations18VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

VALUATION OVERVIEWAppraisal ProcessDefinition of the ProblemScope of WorkData Collection and AnalysisMarket AnalysisHighest and Best UseApplication of Approaches to ValueIncome ApproachSales Comparison ApproachCost ApproachReconciliation of Value Indicators and Final Value OpinionReport Defined Value OpinionsAllocation of the Going Concern19VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

VALUATION OVERVIEWApproaches to Value Income Approach The underlying operations of the business are what drives overall value of the real estate Most appraisals will assume experienced and capable management Utilized as primary determinant of value Sales Comparison Approach Primarily utilized to extract market pricing and a test or reasonability for the conclusionsderived from the income approach Utilized Paired Sales, NOI Analysis, and EGIM Analysis Comparables are selected from a regional if not national geography Cost Approach Least reliable and often omitted Primarily utilized as a method of allocating the Going Concern or project feasibility20VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

PRESENTATION OVERVIEWValuation of Seniors Housing Properties Industry Overview Valuation Overview Market Analysis Income Approach Sales Comparison Approach Allocation of the Going Concern Final Considerations21VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

MARKET ANALYSISQuantifying Net Market DemandA Primary Market Area (PMA) can be identified by a radius, node(s), submarket(s), zip code(s), county(s)or township(s), or any variety of such defining terms.We define a PMA as representing where approximately 80% of the residents currently occupying the subjectresided prior to moving in to the subject property.In analyzing a market, CBRE employs two quantitative methods, each independent of the other1. Penetration Analysis Competitive Supply / Age Qualified Households Simple, yet allows for apples-to-apples comparison to other markets Requires comparable local, regional, and national data-points to understanding of the extracted rate The penetration must be considered with occupancy to properly understand full meaning Used to determine market depth and impact of future supply on current market balance2. Demand Coverage Analysis Delineates PMA by age and income qualified population Recognizes healthcare or ADL (Activities of Daily Living) requirements specific to each care level Identifies Net Demand in terms of actual number of units by property type Identifies impact of state subsidies and /- net immigrations outside market norm PMA specificDummy Factors, Apples-to-Apples, Accurate Inputs, Boots on the Ground22VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

MARKET ANALYSISPenetration AnalysisSENIORS HOUSING MARKET STATISTICSCategorySubject's PMASubject MSAMAP PrimaryAssisted LivingStabilized/Average Occupancy87.39%92.20%90.40%Average Monthly Rent 4,726 4,251 0%2.10%10.30%5.70%4.80%Property CountInventory (Units)Construction (Units)Projected 3-Year Inventory GrowthPenetrationSource: NIC MAPMARKET 2%Assisted LivingAge Qualified Households (75 )Total AL SupplyIndicated AL/MC Penetration Rate:Compiled by CBRE23VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

MARKET ANALYSISPenetration AnalysisPenetration Rates Alone Have Multiple Meanings:Low Penetration/ High Occupancy: Local population is accepting the subject’s product type, significant roomfor expansion, higher than typical ratio of residents emanating from outside the defined PMA. Expect strongoccupancy levels, stable rent growth, and healthy absorption for proposed properties. Most favorable.Low Penetration/ Low Occupancy: Local population is either not accepting the subject property type or aretraveling outside the defined PMA to obtain their respective needs. Market opportunity does exist, but will likelyrequire additional marketing efforts in order to achieve a stabilized occupancy level.High Penetration/ High Occupancy: Equally as attractive as low penetration with low occupancy. Competitivemarket, yet presumes the local population is generally receptive and well educated with the respective propertytype. Requires less marketing efforts in terms of product education, but may require more resources from anoverall competitive standpoint or the offering of something unique to the market, such as superior quality oraffordable rents. Prevalence of state subsidies are also common in this market (MA).High Penetration/ Low Occupancy: This combination is the least favorable and depicts a saturated market.Decreasing rental rates, prevalence of concessions, and less than favorable occupancy can be expected.24VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

MARKET ANALYSISDemand Coverage AnalysisDEMAND COVERAGE2014ALTotal Demand1,181Frictional Vacancy12.61%Total Adjusted Demand1,352Total Supply1,746Net Surplus Demand (Units)-394Market Balance2019Over SupplyTotal Demand1,437ALFrictional Vacancy12.61%Total Adjusted Demand1,644Total Supply1,836Net Surplus Demand (Units)-192Market BalanceOver SupplyCompiled By: CBRE25VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

PRESENTATION OVERVIEWValuation of Seniors Housing Properties Industry Overview Valuation Overview Market Analysis Income Approach Sales Comparison Approach Allocation of the Going Concern Flags and Considerations for Assessment Purposes26VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHGeneral OverviewThe income capitalization approach reflects the subject’s income-producing capabilities. The 'active management' component is viewed as adding incremental risk and complexity versus the conventionalcommercial real estate asset classes, which translates into higher return expectations by investors- Property Management will “make or brake” market value Market value appraisals involving not-for-profit or government, and poor operators should reflect the likely buyers’perspective, and in most cases, that would be from the perspective of for-profit entities, which may take a differentview of future operations Proper rental comparables and operating expense comparables are essential in achieving accurate underwriting- Per resident day is the most accurate unit of measure for underwriting purposes- % of EGI can have multiple meanings depending on property specific operating format and should only be usedas a secondary test of reasonableness The direct capitalization method is the most commonly used in deriving an estimate of market value per this approach The market derived capitalization rate is applied to the subject’s stabilized EBITA, which includes replacementreserves and management fees- Management Fee – 3% to 7% of EGI- Replacement Reserves - 350 to 650 per unit, annum27VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHCase Study – Passive vs. Active ManagementSkilled Nursing Facility 120-bed, purpose built skilled nursing facility, developed in 1973, secondgeneration family owned and operated. Good quality property in average condition. Excellent bones and design. Buyer was regional owner-operator with properties surrounding states andlooking to expand their presence in within subject state. Buyer contacted the seller directly. No broker on deal. Above market operating expenses. Did not use part time staff - paid overtimeto full employees. Below market occupancy and quality mix- recognized by seller.Property Summary Below market private pay rates – recognized by buyer.Year Built1973 Not maximizing Medicare utilization.Beds120Care LevelSNF Favorable rated market by NIC MAP in high barrier to entry location in closeproximity to a number of hospitals.Purchased 6,000,000DateJune 20132012 NOI 273,006Buyer Y2 NOI 2,623,908 Seller executed with buyer due to comfort level and trust. Buyer’s short term goal to increase operating efficiencies. Invest anadditional 3mm and offer more sub acute rehab services. Seller’s goal - retire.28VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHOPERATING SUMMARY2012 Actual (Seller)Reporting PeriodTotalYear 1 (Buyer)Year 2 Stabilized (Buyer)BedsOcc.AMRRes DaysBedsOcc.AMRRes DaysBedsOcc.AMRRes Days12076% 6,11133,38412087% 7,48937,97912092% 8,07440,150Total% EGI /Unit /RDTotal% EGI /Unit /RDTotal% EGI /Unit /RDIncomeSkilled Nursing Private Pay 1,245,92414.1%10,383 37.32 1,635,20015.0%13,627 43.06 1,752,00014.9%14,600 43.64Skilled Nursing ,150120.544,439,14737.8%36,993110.56Skilled Nursing 41 73,597 264.55 90,914 287.25Skilled Nursing InsuranceAncillary ChargesEffective Gross IncomeExpensesReal Estate Taxes 8,831,699 100.0% 10,909,655 100.0% 11,751,102 100.0% 97,9263.11 292.68 131,2741.5%1,094 3.93 137,8221.3%1,149 3.63 3302.6%2,3617.46283,3302.4%2,3617.06Administrative & .00Ancillary 600,0005.1%5,00014.94Culinary 642,4005.5%5,35316.00Laundry & .99401,5003.4%3,34610.00Repairs & 9150,0001.3%1,2503.74Program & 140,0001.2%1,1673.49Payroll Taxes & 625,0005.3%5,20815.57Property InsuranceAdvertising & LeasingResident CareOtherOperating ExpensesNet Operating IncomeManagement Fee ¹-350,000 ,9178.72 8,516,69396.4%70,972 255.11 8,048,64573.8% 67,072211.92 8,500,26672.3%70,836211.71 315,0063.6%2,625 9.44 2,861,01026.2%23,842 75.33 3,250,83527.7%27,090 80.97 14.57-0.0%- 0.00545,4835.0%4,545.69 %350.001.1142,0000.4%350.001.05Adjusted Operating Expenses8,558,69396.9%71,322 256.378,636,12879.2%71,968 227.399,127,19477.7%76,060 227.33Adjusted Net Operating Income 273,0063.1% 2,273,52720.8% 59.86 2,623,90821,866 65.35Reserves for Replacement2,275 8.1818,94622.3%Source: Property operating statements & buyer proforma29VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHCase Study – Revenue ProjectionsOccupancyCensus MixSubject100%76.00%CompsNIC Metro60%90.10%NIC aid0%80%100%Daily Private Pay 91.00%8%17%Effective Gross Income Per Resident Day 300 265Comps 363NIC Metro 250 375NIC 31 200 278Buyer 265 320Current 296 262 273 293 293BuyerCurrent 150 270 100 100 150 200 250 300 350Subject 400Comp Min. Comp Max.Comp Avg.“Subject “data points represent the seller’s 2012 Actual. “Current” represents the buyer’s October 2013 Actual30VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHCase Study – Expense Projections and NOIOperating Costs Per Resident Day (PRD)SubjectExpense Ratio (Before Mgt Fee & Reserves)100% 255.51Comp Min.80% 204.39Comp Max.60% 240.32Comp Avg. 228.06Buyer40% 211.92Current97%78%81%83%72%84%20% 253.120% 100 150 200 250 300Subject 350Profit Margin (Before Mgt Fee & Reserves)SubjectComp Min. Comp Max.Comp Avg.BuyerCurrentNOI PRD (Before Mgt Fee & Reserves) 703.60% 60Comp Avg.17.80%Comp Max. 5022.40%Comp Min. 40 308.60%Buyer 2027.70%Current 00%5%10%15%20% 32 1016.00%25%30% 40 36 8Subject35% 60 59Comp Min. Comp Max.Comp Avg.BuyerCurrent“Subject “data points represent the seller’s 2012 Actual. “Current” represents the buyer’s October 2013 Actual31VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHCase Study - ResultsThe “current” data points detailed in the following table represents four months of property operationsby the buyer.At Purchase(June 2013)Current(Oct 2013 Ann.)Buyer’s Stabilized 273,006 1,108,218 2,623,908 6,000,000 6,000,000 6,000,000CapEx & Cary------ 3,000,000Total Cost--- 6,000,000 9,000,000N/A 50,000/ Bed 8,500,000 71,000/ bed 20,200,000 168k/ bed4.55%18.47%29.15%NOIPurchase PriceIndicated Value @NIC Average CapRateReturn on Cost32VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHSummary of Operating MetricsPer Resident Day (PRD) is the most accurate unit of measure when underwriting a seniors housing property type.Expense ratio, profit margin, and per unit indicators are all used as secondary measures.ILALSNF91%88.4%87.9%Average Monthly Rent 2,892 4,264 - 5,833 289/ DayAverage Length of Stay29.2 Months21.7 Months3.2 MonthsTotal Revenues PRD 72.07 151.55 268.93Operating Expenses PRD 44.39 104.67 232.230.220.450.9835% - 45%25% - 40%10% - 20%7.1%7.7%12.3% 173,200 173,200 65,100Occupancy (1Q15)Average FTE PRDAverage Operating MarginCapitalization RateAverage Price Per UnitSource: NIC , American Seniors Housing Assoc., & Irving Levin Assoc.,33VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHCBRE Capitalization Rate SurveySource: CBRE Seniors Housing Investor Survey34VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

INCOME APPROACHCBRE Capitalization Rate SurveySource: CBRE Seniors Housing Investor Survey35VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

PRESENTATION OVERVIEWValuation of Seniors Housing Properties Industry Overview Valuation Overview Market Analysis Income Approach Sales Comparison Approach Allocation of the Going Concern Final Considerations36VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

SALES APPROACHSummary of Methodologies and AnalysisSales ComparisonNOI AnalysisEGIM Analysis Regional/ national comp set isacceptable Provides most realistic pricing utilizedby market participants Easy to extract from market Adjustments are mostly qualitative andchallenging to support Infers all physical property andlocational differences Not utilized by market participants Utilizes regression analysis toestimate a per unit/ bed indication Do not overlay NOI adjustments37 Does not include operating expensesin pricing Select EGIM for subject byanalyzing expense ratio of subjectrespective of comparable setVALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

SALES APPROACHNet Operating Income AnalysisNET OPERATING INCOME ANALYSIS 465,205Comparable SalesSubject Indication 415,205TrendlinePrice per Unit 396,517.13 365,205 315,205 265,205 215,205 15,327 20,327 25,327 30,327NOI per UnitCompiled by CBRE38VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

PRESENTATION OVERVIEWValuation of Seniors Housing Properties Industry Overview Valuation Overview Market Analysis Income Approach Sales Comparison Approach Allocation of the Going Concern Final Considerations39VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

ALLOCATION OF THE GOING CONCERNMethodologiesCost Residual: The value of the business/intangibles are estimated by taking the market value of the subjectand deducting the estimated personal property, land and real estate property value. The remaining valuerepresents the contribution of the business/intangibles. Straight forward approach Widely accepted and utilized in the appraisal industry Utilizes estimates contained in the Cost Approach which is considered the less reliable indication of valueand often omitted due to various physical property attributes Not utilized by market participantsManagement Extraction: Business Enterprise Value is calculated based upon the capitalized value of themanagement fee. The total value of the going concern is calculated with NO deductions for management feesor reserves. The Concluded business value and FF&E are then deducted to get to the real estate onlyallocation. Additional BEV is inherent in the operations, resulting in a possible omission of this allocation Capitalization rates applied to the Management Fee are difficult to accurately extract from the market withthe applied rate considered to be highly subjective Not utilized by market participants40VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

ALLOCATION OF THE GOING CONCERNMethodologiesLease Coverage Analysis: A market derived lease coverage ratio is applied to the concluded net operating income forthe subject. The result is an indicated annual market lease payment for the subject. A net lease cap rate is applied to theestimated lease payment in order to obtain the value attributed to the real estate. Lease Coverage Ratios and Net Lease Cap Rates are easily and accurately extracted from the market Only arm’s length leases should be utilized – no RIDEA Know where FF&E fits in. Part of Lease or owned separately by tenant Market lease coverage rations will range from 1.10 to 1.30 for IL and AL, and 1.50 to 2.00 for SNFs Net lease cap rates typically fall 200 to 300 bps below a going concern cap rate, all else equal Higher the coverage, higher the spread (lower risk) Utilized by market participants41VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

ALLOCATION OF THE GOING CONCERNMethodologies – Lease Coverage AnalysisLEASE COVERAGE ANALYSISAs Is onApril 18, 2014Concluded Stabilized NOI 4,325,432Divided Lease Coverage Ratio1.20Inferred Market Lease Payment (Absolute Net) 3,604,527Absolute Net Lease Cap Rate5.75%Inferred Leased Fee/ Real Property Value 62,687,420Concluded Market Value of the Going Concern 69,200,000FF&E 963,125Inferred Leased Fee/ Real Property Value 62,687,420Indicated Business Value 5,549,455ALLOCATION OF THE GOING CONCERNAs Is onApril 18, 2014Real Property 62,687,420FF & E 963,125Business Value 5,549,455Market Value of the Going Concern42 69,200,000VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

PRESENTATION OVERVIEWValuation of Seniors Housing Properties Industry Overview Valuation Overview Market Analysis Income Approach Sales Comparison Approach Allocation of the Going Concern Final Considerations43VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

FINAL CONSIDERATIONS Understand the property specific operations and understand the market; understand where yourproperty fits in the market; current property trend lines may not be telling the whole story. There isno one size fits all. Have boots on the ground and take the time to speak with the competition. The most sophisticatedanalysis is useless of your inputs are not accurate, well researched, and properly understood. The appraisal should identify the assets being valued and distinguish the assets not being valuedwith the client in the development of the scope of work and in the report. This should reflect actionstaken by market participants. Multiple entities often control the total assets of the business. Ownership structure must be fullyunderstood in order to fully understand value appropriate cash flows. Market value appraisals involving not-for-profit entities or governmental entities should reflect thelikely buyers’ perspective, and in most cases, that would be from the perspective of for-profitentities, which may take a different view of future operations. Comparable sales should be verified directly with source. Purchase price reported on deeds rarelyreflect the total consideration with only the allocated real estate value being reported.44VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

FINAL CONSIDERATIONS Only the specific sub-property type should be utilized for comparable purposes. Ie: don’t useindependent living sales to compare to memory care. This is even more critical SNF to assistedand independent living sales, and applies to all comparable purposes (sales, operations, rents,etc). Standard commercial adjustments do not always apply and may in-fact be counterintuitive to whatwe are taught as general commercial appraisers. Ie: size adjustments, expense ratios as anindication of market operations. Market participants do not contemplate the value by adding the value of the real estate to theseparate values of the tangible and intangible personal property; they focus on the overall valuewhich is derived by their expectations of cash flow and applied return requirement. In place cashflow is considered, but often adjusted by the buyer for pricing purposes. The magnitude of theadjustment will be reflected in the applied pricing rate(s). 45VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

FINAL CONSIDERATIONSSeniors Housing Data Providers NIC (National Investment Center for the Seniors Housing & Care Industry) ASHA (American Seniors Housing Assoc.) American Health Care Association Irving Levin & Assoc. -SeniorCare Investor-Senior Housing News-Annual SeniorCare Investor ReportCBRE Seniors Housing Valuation & Advisory Services-Annual Cap Rate Survey & Market Outlook-Please take full advantage of our platform46VALUATION OF SENIORS HOUSING PROPERTIES ZACH BOWYER, MAI

For more information regarding this presentation please contact:Zach Bowyer, MAIManaging Director & Seniors Housing Practice LeaderT 1 617 217.6032zach.bowyer@cbre.comwww.cbre.com

Most appraisals will assume ex perienced and capable management Utilized as primary determinant of value Sales Comparison Approach Primarily utilized to extract market pricing and a test or reasonability for the conclusions derived from the income approach Utilized Paired Sales, NOI Analysis, and EGIM Analysis