Transcription

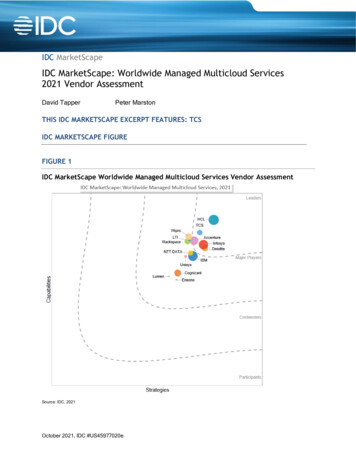

IDC MarketScapeIDC MarketScape: Worldwide Enterprise Videoconferencing2020 Vendor AssessmentRich CostelloIDC MARKETSCAPE FIGUREFIGURE 1IDC MarketScape Worldwide Enterprise Videoconferencing Vendor AssessmentSource: IDC, 2020July 2020, IDC #US46691620

Please see the Appendix for detailed methodology, market definition, and scoring criteria.IDC OPINIONThis IDC study represents the vendor assessment model called the IDC MarketScape. This researchis a quantitative and qualitative assessment of the characteristics that explain a vendor's chances forpresent and future success worldwide. This study assesses the capability and business strategy of 12global enterprise videoconferencing vendors. This evaluation is based on a comprehensive frameworkand a set of parameters expected to be most conducive to success in providing enterprisevideoconferencing solutions, for both the short term and the long term.Key criteria, among others, that contribute to a successful enterprise videoconferencing offer includesthe following: A video/unified communications and collaboration (UC&C) solution that can alsointegrate/embed with business processes and applications to be transformative for thebusiness A robust portfolio that can be clearly demonstrated, including the ability to support a range ofvideo uses in collaborative applications, especially in huddle rooms for two to three people andfor desktop, browser, and mobile video scenarios Flexible delivery options for customers and partners as part of the video portfolio offering(premises, managed, hosted, and cloud) Competitive strategies from a cost standpoint (e.g., industry-standard hardware, software,cloud services, licensing, offshore R&D, and manufacturing) Business partnerships and sales channels that open new markets for video vendor andservice provider offerings, yet still enable them to maintain a high level of support andcustomer careIDC MARKETSCAPE VENDOR INCLUSION CRITERIAThis research includes an analysis of 12 enterprise videoconferencing providers spanning IDC'sresearch coverage and with a measurable presence in major global regions. This assessment isdesigned to evaluate the characteristics of each firm — as opposed to its size or the breadth of itsservices. It is conceivable, and in fact the case, that specialty firms can compete with multidisciplinaryfirms on an equal footing. As such, this evaluation should not be considered a "final judgment" on thefirms to consider for a particular project. An enterprise's specific objectives and requirements will playa significant role in determining which firms should be considered as potential candidates for anengagement.For inclusion in this IDC MarketScape assessment, providers had to demonstrate at least two years ofgeneral worldwide availability of standards-based enterprise videoconferencing products/solutions aswell as a quantifiable number of shipments, subscribers, and/or revenue.ADVICE FOR TECHNOLOGY BUYERSIDC sees the increasing use of videoconferencing within organizations being driven by a desire to: 2020 IDC#US466916202

Collaborate more effectively (via high-resolution video, audio, and data content and other toolsand capabilities) with most, if not all, coworkers working from home (WFH) in 2020. In 2021,organizations expect a rise in permanent WFHers (i.e., 41% of 100 IDC's June 2020 (V1)COVID-19 Tech Index Survey respondents said up to 25% of workers, 37% said 25–50%, 17%said 50–75%, and 5% said 75% ). Integrate/embed video with key business processes and applications (e.g., customer service,human resources [HR], remote diagnostics, and distance learning).As such, IDC recommends organizations evaluating enterprise videoconferencing solutions considerthe following: The end-user experience continues to rule within organizations. This involves not only thequality and reliability of the videoconference itself but also a richer, more intuitive userinterface (UI) — basically a single software-based interface to manage video collaboration fromwhatever device, from any location, with data content, across any applications that may beintegrated with one or more company business processes. Vendors and providers can demonstrate that video integration with UC&C solutions (i.e.,telephony, presence, instant messaging [IM], web conferencing, and other collaborationapplications) increases the overall value of video solutions for customers and shows avendor/partner commitment to selling solutions compared with just selling standalonevideoconferencing systems. Vendors and providers should work with customers to identify/develop specific video usecases within their organizations via usage behavior analysis and best practices. A good videouse case can lead to proliferation of video to other areas of the organization as well. Video-as-a-service (VaaS) and infrastructure-as-a-service (IaaS) offerings provide muchneeded flexibility and scalability and are less capital-intensive options for customers toconsider for videoconferencing (versus deploying video infrastructure on premises). Video cloud services should be considered for those organizations lacking the IT skills andresources to manage and support their own enterprise video infrastructure. Video cloudservices can enable companies to deploy video with limited IT resources, provide end-useraccess to video sessions regardless of location for a monthly fee per client or endpoint, andsimplify firewall integration, traversal, and management. In short, cloud can help change theeconomics of videoconferencing for many companies, especially small and midsizecompanies. For capturing, storing, and managing the many video collaboration sessions that occur withinorganizations for on-demand access by employees, solutions such as video contentmanagement, rich media content streaming, and application sharing continue to drawsignificant interest from customers.VENDOR SUMMARY PROFILESThis section explains IDC's key observations resulting in a vendor's position in the IDC MarketScape.While every vendor is evaluated against each of the criteria outlined in the Appendix, the descriptionhere provides a summary of each vendor's strengths and challenges.AvayaAvaya is positioned as a Major Player in this IDC MarketScape. Avaya has a global, diverse customerbase ranging in size from small businesses employing a few employees to large government agencies 2020 IDC#US466916203

and multinational companies with over 100,000 employees. As of September 2019, Avaya had apresence in more than 100 countries worldwide, and during the past three fiscal years, it has servicedmore than 90% of the Fortune 100. Avaya customers operate in a broad range of industries includingfinancial services, manufacturing, retail, transportation, energy, media and communications,hospitality, healthcare, education, and government. These customers represent companies from theForbes Global 2000 from industries such as airlines, auto and truck manufacturers, hotels and motels,major banks, and investment services.Where available (85 countries and expanding), Avaya's new cloud-based persistent teamcollaboration, meeting, and video collaboration service — Avaya Spaces — will be included in everyUC&C subscription seat. This bundling approach increases the value of a customer's investment aswell as provides the customers with a compelling option to introduce Avaya cloud-based video withintheir enterprise. With this approach, Avaya is targeting global expansion across all verticals andsegments. In addition, Avaya announced in early April 2020 that Avaya Cloud Office (ACO) willsupport the new RingCentral Video offering.Avaya Spaces is a born-in-the-cloud solution that combines Avaya's intellectual property for real-timeaudio/video services with elastically scalable cloud technology. This approach allows for massivescalability while keeping costs low using Avaya's patented "Multi-share Video" cloud technology.Avaya is partnering with Google and others to embed artificial intelligence (AI) functions into themeeting experience, with additional partnerships being developed to augment the core servicesoffered by Avaya.Avaya expects a substantial amount of innovation in the area of artificial intelligence over the next 18months. In early 2020, Avaya Spaces added virtual assistant functions accessible by voice and text.The company is investing heavily in voice, video, and text analytics to help users gain insight andcontrol of their experience with virtual assistants. The Spaces video back end includes VXML, speechrecognition, Dialog flow, noise suppression, and video processing (object detection/imagemanipulation). These core technologies will enable an ecosystem of text, voice, and video AI includinginnovation at the customer edge. The video engine under Spaces will also be open to third-partydevelopers through Avaya's CPaaS offering so that external developers will be able to create new AIenabled video applications through easy-to-consume APIs.In addition, Avaya Spaces will enable integrated digital workplace calling as the industry continues toshift away from transactional, PBX voice to omni-channel, smart interactions. Spaces will injectrelevant actions into pre- and post-call actions (e.g., set the context for the call and create follow-uptasks), as well as during the call (e.g., virtual assistant features).Avaya Spaces' Essential tier provides unlimited one-on-one video calls, but no multipartyvideoconferencing support. Customers will need Business tier (up to 200 participants) or Power tier (upto 500 participants) licensing for multiparty videoconferencing capability.Recently, Avaya has added several new features to Avaya Spaces including: Integrated and downloadable in-space recording "Meeting Cards" that track meeting details such as duration, attendees, and whether recorded A new Private Space feature to provide even more advanced security control options withinAvaya Spaces (Spaces can be customized for members only and prohibit guest or"unsecured" connections from joining.) 2020 IDC#US466916204

Spaces Room integration with the CU360 collaboration unit, enabling users to join Spacesmeetings from their CU360 via a simple QR or verification code processAvaya's CU360 all-in-one room solution is used in home or office and is packable to travel (when thattime comes). It can load Google Play Store apps, so it works with other business and consumerservices as well. Avaya has also expanded global Spaces meeting capacity with three new mediaservers in the United States, India, and the United Kingdom.Strengths Avaya is universally viewed as a strong engineering company with well-regarded technologyand product solutions. Avaya has a huge, diverse customer base ranging in size from small businesses employing afew employees to large government agencies and multinational companies with over 100,000employees. As of September 2019, Avaya had a presence in more than 100 countriesglobally, and during the past three fiscal years, it has serviced more than 90% of the Fortune100. Avaya Spaces has three pricing tiers (Essential, Business, and Power) that include a freemiumoffer: Essential includes messaging, limited file sharing, task management, unlimited one-onone video calls, and up to 50 participant audioconferencing/web conferencing calls for free.Challenges Video collaboration is newer technology that requires different skills and modified salesmotions for some legacy Avaya channel partners. The company helps its partners ramp uptheir skills and become certified/authorized on Avaya video solutions through Avaya Edge, itsworldwide channel program. Feedback IDC received is that Avaya has noticeably increased its focus on customers,customer service, and changing its culture (e.g., trying to get younger), but the company is stillbeing challenged to fully overcome its roots as a "phone company."Consider Avaya WhenYou are a midsize or large enterprise organization having enterprise-class communications andcollaboration requirements (including telephony, contact center, video) and services requirements(cloud, premises, or hybrid) across all global regions, especially organizations interested in enterpriseclass public and private cloud solutions.BlueJeansBlueJeans Network is positioned as a Major Player in this IDC MarketScape. BlueJeans is amultitenant, elastic, and cloud videoconferencing and events platform that can scale to anyorganization's needs; there is no maximum number of concurrent connections. BlueJeans' customerscan have an unlimited number of meetings at the same time without hitting a capacity ceiling. Thecompany does, however, cap total meeting sizes to 200 and event sizes to 50,000.BlueJeans continues to maintain its direct and indirect presence, mostly in North America, EMEA, andAPAC, and pursues growth across the board. In some countries such as Germany and Australia,BlueJeans is primarily partner led, whereas in the United States, the United Kingdom, and France, itsdirect teams align with channel partners to effectively cover the market.On April 16, 2020, Verizon announced a definitive agreement to buy BlueJeans Network, and the dealclosed on May 15, 2020. The transaction combines BlueJeans' trusted meeting platform with Verizon's 2020 IDC#US466916205

Advanced Communications business immediately. Customers will benefit from BlueJeans' enterprisegrade video experience on Verizon's high-performance global networks, as well as continued jointinnovation around video collaboration use cases enabled by Verizon's push into 5G and mobile edgecomputing, such as telemedicine, field support, and distance learning.Within the videoconferencing market, BlueJeans sees a market divergence between two key trends:UC as a service (UCaaS) and meeting productivity. As part of Verizon, BlueJeans expects to integratewith Verizon's UCaaS offerings, including One Talk, as well as continue its innovation to grow share inmeeting productivity. BlueJeans currently has a global operation that serves every market segmentand vertical. But it has also identified specific roles and personas (e.g., program management, accountmanagement) where these types of employees receive outsized benefits with regard to BlueJeans'focus around capturing and contextualizing critical meeting moments to drive productivity outcomes.The company will continue to serve the broadest possible videoconferencing audience but createtailor-made features and launch focused integrations that will drive increased value for BlueJeanspower users.Across thousands of customer conversations, BlueJeans has validated that a best-of-breed approachis the preferred application strategy for its customers. This means that BlueJeans has a responsibilityto successfully integrate not only with UC&C vendors but also with all vendors aligned to the digitalworkplace. These integrations are fundamental to its growth and the reason why BlueJeans hasdeveloped strong relationships with partners such as Microsoft, Google, Slack, and Facebook. Thecompany will continue to explore new integrations and believes that thoughtful programs around thetechnology and go-to-market execution will unlock more value for BlueJeans. The company hassegmented its business process integrations across categories such as sales, marketing, learningmanagement, business productivity, HR interviewing, and real-time event translation.Specifically, within the videoconferencing market, the company sees a huge opportunity to rethink howindividuals make decisions about attending meetings, collaborating in meetings, and capitalizing onwhat was discussed. Therefore, BlueJeans' innovation will focus squarely on the outcome of meetingproductivity — and with this distinct focus, the company will be able to create new pre-, during, andpost-meeting experiences that will enhance focus in meetings and make it simpler to share meetingoutcomes with those parties that were unable to attend the meeting. BlueJeans has laid the foundationfor these capabilities through its Smart Meetings initiative and will continue to drive this vision forward.In addition, the company is seeing more meetings on the go (i.e., mobile) than ever before. While thenetwork conditions in an office environment, or even a home office environment, can be relativelystable, BlueJeans sees more and more workers using their mobile devices to join meetings, and thesedevices' network conditions are much more variable. In partnership with Verizon and Samsung,BlueJeans has been working on innovative approaches for unlocking the power of 5G, with powerfulmobile devices and enterprise-grade videoconferencing. By acquiring BlueJeans, Verizon will now beone of the rare communications service providers able to deliver an in-house solution integrating 5Glinks as part of a UC&C platform.Strengths As a best-of-breed solution, integrations are vitally important to BlueJeans — integrating notjust with UC&C vendors but with all vendors aligned to the digital workplace. BlueJeans is a Certified Microsoft Teams Partner for its cloud video interoperability solution,BlueJeans Gateway for Microsoft Teams. 2020 IDC#US466916206

According to business partners and reviewers, BlueJeans' mobile apps are described as "afirst-class mobile experience" and, as of this assessment, had 4.6 and 4.7 ratings in theAndroid and Apple App stores, respectively. BlueJeans audio is powered by Dolby Voice to provide a world-class audio experience,regardless of background noise.Challenges In December 2019, the company made the strategic decision to reduce its workforce by about30% in a move it described as " a march toward profitability in tandem with an optimization ofresources for go-to-market efficiency." The streamlined go-to-market model and enhancedecommerce experience delivered in 4Q19 set BlueJeans up for the 3x year-over-yearbookings growth it experienced in 1Q20. As a best-of-breed provider, BlueJeans competes in a global UC&C market with bundledsolutions supporting a range of seamless functionality — telephony/voice, video collaboration,meetings, messaging, and so forth. BlueJeans indicates that across thousands of customerconversations, it has validated that a best-of-breed approach is the preferred applicationstrategy for its customers. Those customers preferring a UCaaS option will be able to takeadvantage of BlueJeans' integrations with Verizon's UCaaS offerings as those integrationsbecome available. Getting penetration in a hypercompetitive market that includes Zoom, Cisco Webex, MicrosoftTeams, and Google G Suite Meetings, among others, made it challenging for BlueJeans tothrive. Now with access to Verizon's 5G Labs, global networks, and go-to-market engine,BlueJeans should be well positioned for growth.Consider BlueJeans WhenYou are a small, midsize, or large enterprise organization seeking a best-of-breed cloud-basedplatform for high-quality and reliable video, audio, web meetings, and larger events, especially asBlueJeans transitions to ownership by Verizon.CiscoCisco is positioned as a Leader in this IDC MarketScape. In addition to its networking portfolio, Ciscofeatures a broad collaboration portfolio of integrated on-premises, cloud, and hybrid services,applications, and endpoints. Cisco solutions combine voice, video, messaging, presence,conferencing, data content, mobile, and web applications, enabling workers to connect/collaborateanywhere, on any device, and on any workload. Cisco is a global partner-centric company with over90% of its collaboration sales through partners, with all sales, marketing, and service resourcesaligned to partner success. It has over 3,500 collaboration partners globally and over 67,000 registeredpartners across all aspects of its business.Workplace experience, cloud, and cognitive collaboration are key strategic areas of growth anddevelopment for Cisco for addressing customer needs and market opportunities.Collaboration and adoption of collaboration technology have increasingly becoming part of the overallworkplace experience organizations offer to employees, partners, and customers. Cisco will beinvesting more into integrating collaboration services with digital tools for workplace/facility experienceand management with use cases such as integrated room booking and workspace utilization analyticsand diagnostics. This exposes collaboration technology to new buying centers such as facility 2020 IDC#US466916207

managers and HR, which are looking for new ways to meet demand from a newer generation ofworkforce, drive employee engagement, and determine ROI on real estate usage.To provide a more scalable, persistent, and accessible platform for collaboration, Cisco will continue todrive investment into its secure and reliable cloud offering. Cisco video has long been among theleaders in overall quality experience for video meetings with high attention to video, audio, and userinteraction. The company is committed to maintaining high standards on quality and user experienceas it strives to make the Webex platform more available to companies of all sizes. Cisco will also drivesimplification and unification across use cases by delivering a single modular Webex client andexpanded collaboration and workplace services delivered to every mobile, desk, and meeting roomfrom the Webex platform. With Cisco Webex Unified Application across desktop, mobile, and web,users can get consistent experiences across on-premises and cloud services while allowing ITadministrators to seamlessly migrate to cloud at their convenience.Cisco will deliver outcome-oriented user experiences through artificial intelligence to increaseefficiency, engagement, and better collaboration by automation to secure a quality meetingexperience, simplify/automate routine tasks, better support workflow — before, during, and aftermeetings. Cisco will provide users access to insight on people attending and agenda and contextualinformation before meetings, support for co-creation and ideation processes during meetings, andextract intelligence through automated transcriptions, actions, and meeting highlights after meetings.In addition, Cisco will leverage intelligent integrated sensors within its Webex Rooms devices toenable a more cognitive workspace experience — for example, meeting rooms that adjust lighting andHVAC preferences, provide more insight to utilization in real time, and more.Strengths Cisco offers a broad global portfolio of video collaboration solutions and endpoints, designedto integrate with its extensive UC&C portfolio in a one-stop vendor approach. Cisco's focus onenterprise-grade security, scale, and management functionality are selling points forcustomers. Cisco recently introduced hardware-as-a-service (HaaS) buying model option for videodevices to allow customers to get the latest Cisco IP phones, headsets, and Webex Roomsdevices through an affordable monthly or annual subscription payment. With the acquisition of BroadSoft, Cisco has expanded Webex market coverage throughcarrier partnerships across the globe and a strong installed SMB base. Many of the carrierpartners that use BroadSoft also have a Webex partnership, which means they can create acompelling calling and meetings bundle with an integrated experience.Challenges Feedback IDC received is that the Cisco product portfolio is broad and ever expanding,sometimes challenging customers to understand how new Cisco offerings fit into theirenvironments without overlapping or disrupting Cisco functionality they may already have inplace. Cisco counters that it has made great strides in simplifying video collaboration,meetings, and integrations across collaboration technologies and applications to createpowerful interactions across organizations (including with customers and partners). The Cisco Collaboration Flex Plan offers user-based and enterprisewide subscription optionsthat enable subscribers to flexibly consume their calling, meeting, and video entitlementseither on premises or in the cloud. It provides a path for on-premises solution customers (e.g.,UCM, Jabber) to gradually move to the cloud over the term of their agreement. A challenge for 2020 IDC#US466916208

Cisco is to continue enticing its huge installed base of premises-based customers to adoptFlex Plan.Consider Cisco WhenYou are a small, a midsize, or an enterprise organization — especially with existing investment in Cisconetworking infrastructure or leveraging cloud-based services — looking for a broad portfolio of secure,high-quality, and intelligent video collaboration solutions and endpoints.GoogleGoogle is positioned as a Leader in this IDC MarketScape. Growth will come from making it easier forusers to use Google Meet across G Suite. The company will unify its communications tools, making iteasier for users to seamlessly transition between other surfaces and Meet video calling without contextswitching. In late April 2020, the company announced that Google Meet premium video meetings arefree through September 30, 2020. The free trial includes premium video calling for up to 100 meetingparticipants and unlimited minute meetings. (Note: The company will enforce the 60-minute meetinglimit after September 30.) In addition, for organizations that aren't already G Suite customers, Googleintroduced G Suite Essentials and G Suite Enterprise Essentials editions, which provide access toMeet's more advanced features as well as access to Google Drive, Docs, Sheets, and Slides forcontent creation and real-time collaboration (plus Calendar for Enterprise Edition). Until now, Meet hadonly been available as part of G Suite, Google's collaboration and productivity solution for businesses,organizations, and schools. Meet will be available to anyone (i.e., individuals) for free on the web andvia mobile apps for iOS or Android.The company's strategy over the next few years is focused on building smart, seamless, secure, andscalable meeting tools that power the collaboration of the modern workforce: Smart: Make meetings smarter and more productive with AI. Google's DNA in knowledge,artificial intelligence, and machine learning (ML) will continue to make meetings more effectivewith a smarter, more assistive experience for users and administrators. Last year, Googleintroduced basic voice commands in meetings and live transcription while continuing toimprove smart scheduling in Calendar. The company will accelerate its investment to makemeetings smarter and more productive across the pre-meeting experience (e.g., scheduling,room booking), during meeting experience (e.g., voice commands, meeting effectiveness, androom hardware innovations), and post-meeting experience (e.g., recording, transcription,action items, and notes). This includes a convergence of the assistive functionality acrossconsumer and business products that enable productivity and support digital well-being. Seamless: Empower collaboration in the modern workplace. Google wants to enableorganizations to equip their workforce to stay productive and engaged across both knowledgeand frontline workers. It will do this by further unifying its communications tools to provide theright tool for the right task at the right moment. This includes seamless workflows forescalating a chat conversation into a video meeting or voice call, as well as scheduling ameeting or starting a chat room from an email thread. Google will continue building deeperintegrations between its meeting solutions and G Suite tools to empower users to be moreproductive. This includes integrations such as note-taking, transcriptions, and action items inGoogle Docs and presenting a slide deck directly from Slides. Scalable: Enable the video-first culture anywhere, anytime. The company will continue itsinvestment into developing cost-effective and easy-to-manage meeting room hardware andapps that enable intuitive team collaboration and brainstorming no matter the location ordevice. This includes developing new and improved touch points that provide smarter meeting 2020 IDC#US466916209

features such as facial recognition and occupancy detection, along with support for meetingrooms of any size, ad hoc meetings, and brainstorming sessions. Google will also continue toprovide tools for administrators to manage their meeting environment including bandwidth,quality, and room hardware health. More proactive alerts to administrators will ensure meetingrooms are always ready for the next meeting and quality issues are detected and fixedautomatically, in real time. Google will expand on its meeting room space management to helporganizations get more value out of their real estate and help spread the video-firstconferencing culture. Finally, Google will continue its focus on providing quality meetings byoptimizing bandwidth usage and providing more tools for IT to measure and proactively ensurea high-quality meeting experience. Secure: Video meetings built on a secure foundation. Google is taking a safety-first approachwhen it comes to security. Google Meet's security controls are turned on by default, whichensures that the right protections are in place as you unbox Meet. The video codes arecomplex and resilient to brute force attacks; no plug-ins are needed to use Meet on the web.Since Meet works entirely in Chrome and other browsers, organizations need to do less patchmanagement. Google is also offering its Advanced Protection Program for Meet users toprotect user accounts from account hijacking. From a scalability perspective, Meet operatesthe same secure infrastructure as the rest of Google's services such as Gmail. In addition,Google offers many compliance certifications to support regulatory requirements.G Suite meeting solutions are a unified family of communication tools that help enterprises worksmarter by adopting a video-first collaborative meeting culture at scale. Google enables teams to bemore efficient, productive, interactive, and innovative and provides IT

collaboration requirements (including telephony, contact center, video) and services requirements (cloud, premises,or hybrid) across all global regions, especially organizations interested in enterprise-class public and private cloudsolutions. BlueJeans BlueJeans Networkis positioned as a Major Player in this IDC MarketScape. BlueJeans is a