Transcription

COMPETITIVE ANALYSISIDC MarketScape: Worldwide Performance Management inIntegrated Talent Management 2012 Vendor AnalysisLisa RowanGlobal Headquarters: 5 Speen Street Framingham, MA 01701 USAP.508.872.8200F.508.935.4015www.idc.comIDC OPINIONThis IDC study represents a vendor assessment of the performance managementcapabilities offered as part of an integrated talent management solution through theIDC MarketScape model. This research is a quantitative and qualitative assessmentof the characteristics that explain a vendor's success in the marketplace and helpanticipate the vendor's ascendancy. The evaluation is based on a comprehensive andrigorous framework that assesses vendors relative to the criteria and one another andhighlights the factors expected to be the most influential to success in the market,both short and long term. Key findings include: The year was dominated by acquisitions and market consolidation, leaving fewerpure-play talent management vendors than a year ago. There were large, highprofile acquisitions, such as SAP's acquisition of SuccessFactors and Oracle'sacquisition of Taleo, and best-of-suite actions, such as SuccessFactors'acquisition of Plateau. Some acquisitions reflected building out of a full functionalportfolio, while others demonstrated the desire to focus on an end-to-end HCMsolution that bundles talent with core. Regardless of the reason, it is universallyapparent that talent represents the hottest submarket in HCM. While recruiting is seen as the most important talent function according to IDC'srecent survey of 512 HR executives, performance management was a closesecond. Overall, all of the functions were shown to be important to respondents.This escalating level of importance is driving greater demand for integrationamong the talent functions and in turn is leading to greater interest in solutionsthat are part of an integrated suite from a single vendor. The vendors serving the market for performance management as part of anintegrated talent management suite have advanced their offerings in features andfunctions through both organic development and acquisition. Through buyerresearch, IDC sees that buyers are generally pleased with the depth of theirvendor offerings. However, buyers generally would like better integration withcore HR and more meaningful reporting and analytics. From IDC's perspective,the majority of vendors could do more to socialize the flow of employeefeedback.Filing Information: June 2012, IDC #235598, Volume: 1HR, Talent and Learning Strategies and Services: Competitive Analysis

IN THIS STUDYThis IDC study represents a vendor assessment of performance managementcapabilities offered as part of an integrated talent management solution through theIDC MarketScape model. This assessment discusses both quantitative and qualitativecharacteristics that explain a vendor's success in this emerging market.This MarketScape examines the performance management capabilities of a variety ofvendors that participate in the integrated talent management market. The vendors'performance management offerings covered in this analysis were analyzed on theirfull suite in IDC MarketScape: Worldwide Integrated Talent Management 2011Vendor Analysis (IDC #234365,April 2012). The evaluation is based on acomprehensive and rigorous framework that assesses vendors relative to the criteriaand one another and highlights the factors expected to be the most influential tosuccess in the market, both short and long term.This study is made up of two sections. The first part is a definition of whatcharacteristics IDC believes lead to success in the integrated talent managementmarket. These characteristics are based on buyer and vendor surveys and keyanalyst observations of best practices.The second part of this study is a visual presentation of multiple vendors into a singlebubble chart format. This format concisely displays the observed and quantifiedscores of the reviewed vendors.The document concludes with IDC's essential guidance to support continued growthand improvement of these vendors' offerings.Vendor information, including versions covered and ownership, is as of December 31,2011.MethodologyIDC MarketScape criteria selection, weightings, and vendor scores represent wellresearched IDC judgment about the market and specific vendors. IDC analysts tailorthe range of standard characteristics by which vendors are measured throughstructured discussions, surveys, and interviews with market leaders, participants, andend users. Market weightings are based on user interviews, buyer surveys, and theinput of a review board of IDC experts in each market. IDC analysts base individualvendor scores, and ultimately vendor positions, on the IDC MarketScape, detailedsurveys and interviews with the vendors, publicly available information, and end-userexperiences in an effort to provide an accurate and consistent assessment of eachvendor's characteristics, behavior, and capability.IDC conducted an end-user survey of 512 HR executives of firms with 500 employeesor more that completed in December 2011. Included in the survey were specificquestions about vendors covered in this analysis. Questions included satisfaction witha variety of factors for each talent module. Questions included but were not limited to 2012 IDC#2355981

depth and completeness of solution, appropriateness of delivery model, comfort withupgrade release schedules, integration, and customer service.SITUATION OVERVIEWIDC defines talent management as those functions that serve to attract, develop,reward, and retain the workforce. Made up of a variety of functions, talentmanagement includes the areas of recruiting and staffing, learning and development,performance management, compensation management, and career and successionplanning, all supported by a base of competency management and assessment (seeFigure 1).IDC depicts talent management as a continuous circle to represent theinterdependency of the various functions.This MarketScape focuses on the market for solutions and services comprising theperformance management function shown in Figure 1 that serves as part of theintegrated talent management market. While talent management is still a youngmarket, it is beginning to mature, with greater market penetration. It is a market thathas gained and continues to gain a lot of attention and is of interest to both buyersand suppliers. Subsequent sections of this document offer definitions and thecharacteristics IDC identifies as important for success in this market.FIGURE 1Talent Management Value CycleSource: IDC, 20122#235598 2012 IDC

BackgroundThe market for talent management has evolved from one that largely focused on asingle function, such as recruiting, to a more mature one that considers the manyfacets of talent. Both senior line management and HR executives are considering howtalent strategies might affect business outcomes such as improved customersatisfaction. To answer such a question, one needs to think about all facets of talent.Improving customer satisfaction may entail choosing the right job candidates from a"success profile" formed from assessing those doing the job well today. It may meanthat key skills are lacking and need to be improved, or it may mean sharpeningretention strategies for high performers.The market for performance management solutions is nascent when compared withthe markets for recruiting and learning, and we have just recently begun to enjoy thebenefits of formal linking of performance management with the other talentmanagement functions. While there are standalone systems from vendors that offeronly performance management, this MarketScape looks at performance managementfrom vendors offering a broader suite. There is a market for standalone solutions, butIDC's research points to greater buyer interest in integrated talent.Figure 2 shows the results of IDC's December 2011 survey of 512 HR executives,where IDC asked the respondents to indicate the importance of various talentfunctions to their organization on a scale of 1 to 5. While there are some differences— with recruiting indicated as most important with performance management a closesecond — all functions rated well over 3.0, meaning that importance is being placedacross the gamut of talent.FIGURE 2Importance Level of Talent FunctionsQ.How important are the following talent functions to your organization on a scale of 1 to 5,where 1 is not at all important and 5 is very important.n 512Source: IDC's Survey of HR Executives, 2012 2012 IDC#2355983

Overview of Performance Management in the Integrated TalentManagement MarketThe business imperative to tie talent strategies to business objectives and outcomeshas created a market category for integrated talent management solutions. Providerscome to this market from a variety of backgrounds — some from learning anddevelopment, some from recruiting, some from the broader HR systems market, andsome from compensation and performance — each looking to meet the end-to-endtalent management need.Most but not all of the integrated talent management vendors offer their ownperformance management module. Performance management applications aredesigned to automate the aggregation and delivery of information pertinent to thelinking of job roles and the mission and goals of the organization. More specifically,the system allows users to automate the performance review process by usingmechanisms such as training and key performance indicators (KPIs) to constantlytrack and monitor the progress of an individual employee, work team, and division.Key features include: Assessment of individual and organizational skill gaps that impede performanceand job advancement, as in ability testing Continuous reviews and establishing milestones 360-degree evaluation and real-time feedback Performance appraisal automation Competency assessment and management Goal setting and tracking Employee surveys Alignment of workforce objectives to corporate objectives Development and career planning Fast tracks for top performers Succession planningEach of the talent functions is important in its own right, but bringing them togetherprovides even greater value to each and in total. The potential benefits are toonumerous to cover, but as examples, consider the integration of performance withother talent functions and the resulting use cases: Work with compensation to set and monitor salaries and incentives that areperformance based4#235598 2012 IDC

With career and succession to help identify the path for the individual and identifyfuture leaders With recruiting to provide it with an initial talent profile with which to seek the rightcandidates From and with recruiting to determine a quality of hire metric that is trulyperformance basedIDC MarketScape Vendor Inclusion CriteriaThis MarketScape looks at performance management in the context of the talentmanagement suite and so criteria for inclusion is the same as it was for the integratedtalent management MarketScape published in IDC MarketScape: WorldwideIntegrated Talent Management 2011 Vendor Analysis (IDC #234365, April 2012). Thecriteria for inclusion of vendors in this MarketScape analysis are as follows: For inclusion, vendors must have solutions for a minimum of four of the fivemajor talent management functions of recruiting, learning, performancemanagement, career and succession planning, and compensation in generalrelease as of December 31, 2011. Vendors must have a minimum of 750,000 employees/users live on acombination of two or more of the major talent management functions ofrecruiting, learning, performance management, career and succession planning,and compensation.Solutions analyzed were reviewed as they were in general availability as of December2011.Demonstration ScenariosAll participating vendors presented the same demonstration scenarios for theirsolutions. These included: Employee experience Manager experience Feedback — formal, informal, and within and external to the system Succession Goal setting Integration — show how performance links to learningMarket StrategiesThis section includes an introduction of market-specific weightings definitions andweightings tables. 2012 IDC#2355985

The integrated talent management market exhibits the characteristics laid out inTables 1 and 2, which suppliers must take into consideration when crafting a futurestrategy and in leveraging existing capabilities to best advantage. Factors for futurestrategy are found in Table 1, with factors for leveraging existing capabilities in Table2.The weightings for the various criteria are a bit different than those in the end-to-endtalent MarketScape (see IDC MarketScape: Worldwide Integrated TalentManagement 2012 Vendor Analysis, IDC #234365, April 2012) to put additionalemphasis on the performance management offering itself.IDC believes that in addition to the criteria for success having varying weights, theaggregate criteria (offering, go to market, and business) should also be weighted.Table 3 shows the relative weights used in this analysis. These too have beenmodified slightly from the end-to-end talent MarketScape (see IDC MarketScape:Worldwide Integrated Talent Management 2012 Vendor Analysis, IDC #234365, April2012). Greater emphasis is placed on the product offering, reflecting the importanceof the currently delivered solution and plans for the solution.TABLE 1Key Strategy Measures for Success for Performance Management in IntegratedTalent Management VendorsSubcriteriaWeightingStrategies CriteriaCriteria for SuccessOffering strategyStrategies reflect the current development of offerings that will be relevant andattractive to customers over the next three to five years.Functionality oroffering road mapA successful solution offers an easy-to-use experience for the employee, themanager, and the HR/talent professional and is fully integrated on a singledatabase and underlying architecture with the vendor's other talent functions.Success is further demonstrated by the depth of capability of the offering, whichcan be and is supported as a standalone offering.4.00Delivery modelExcellence is marked by plans to support emerging architectures such as SOA.1.00Cost managementSuperior service calls for ways by which the vendor can help clients justifyexpenditures, including ROI models, and provide clear paths by which the clientcan lower costs.0.50Portfolio strategyA true portfolio strategy ensures that the client makes the most effective use of thetechnology for business transformation, so this focuses on services offered insupport of talent transformation.1.00New release strategyThis explores the extensibility of the offering and ease of upgrades. It also exploresclient options for accepting, rejecting, or deferring options.2.00Globalization (otheroffering strategies)Talent management is moving to a global scale. Excellence is determined byexisting presence and plans for global reach to serve both North America–basedmultinationals and foreign-headquartered firms.1.50Offering strategy total610.00#235598 2012 IDC

TABLE 1Key Strategy Measures for Success for Performance Management in IntegratedTalent Management VendorsSubcriteriaWeightingStrategies CriteriaCriteria for SuccessGo-to-marketstrategyStrategies include those that maximize the connection between the offering andcustomers, including choosing to target customer segments that offer the greatestopportunity over the next three to five years.Pricing modelSuperior planning for future pricing alignment with market direction and pricingplans that will encourage adoption of full suite are integral to success, especially ina troubled economy.3.00Sales/distributionchannel strategyBuyers in different vertical industries and of various client sizes are interested ininvestment in talent management solutions that service their unique needs.Excellence is demonstrated by plans to serve new markets such as SMB forenterprise suppliers or enterprise for SMB suppliers, or specific industries.2.00Marketing strategySuccessful firms have an eye toward and well-articulated plans for how they willgrow the firm in the future through either acquisition or unique competitivepositioning.2.00Customer servicestrategyWhatever the current client retention rate is today, superior firms have a wellarticulated plan for lowering client churn.3.00Go-to-marketstrategy total10.00Business strategyTo be successful, vendors need to have strategies to grow the business that isaligned with market trends and future opportunities over the next three to fiveyears.Growth strategySuccess is based on viability and specificity of strategic plans for growth over thenext three to five years.3.00Innovation/R&D paceand productivityStrength is demonstrated by strategic plans for attaining or retaining functionalsuperiority over competition. The release schedule for the next 12–18 monthsreflects understanding of market need.3.00Financial/fundingmodelBuyers should and do concern themselves with vendor viability. Success requiresvendors to have a viable funding strategy for the next three to five years, along withgood revenue per employee and plans to improve upon it.2.00Employee strategyIt is important that a company involved in offering talent management solutionshave a clearly articulated plan for developing and retaining its own talent.2.00Business strategytotal10.00Source: IDC, 2012 2012 IDC#2355987

TABLE 2Key Capabilities Measures for Success for Performance Management inIntegrated Talent Management VendorsCapabilities CriteriaSubcriteriaWeightingCriteria for SuccessOffering capabilitiesFunctionality/offeringdeliveredThe ideal solution offers an easy-to-use experience for the employee, the manager,and the HR/talent professional and is fully integrated on a single database andunderlying architecture with the vendor's other talent functions. Success is furtherdemonstrated by the depth of capability of the offering, which can be and issupported as a standalone offering.4.00Delivery modelappropriateness andexecutionBuyers are given flexibility in delivery to meet their culture and needs with optionsincluding software as a service and hosting — both on- and off-premise and behindthe firewall. The hosting site is well protected and has disaster recovery plans wellarticulated.1.00Cost competitivenessPricing must reflect volume discounts in terms of number of both modules andemployees served and must be competitive with the market.1.00Portfolio benefitsdeliveredThis speaks to the depth of capability offered by each module in the suite. Eachseparate function could and does stand alone and has been sold as a best-ofbreed module on its own merits.3.00ScalabilityThis explores vendors' support of multitenancy and the ability to affordably scale tosupport many clients. It also explores client experience in both response times anduptime availability.0.00Integration (otheroffering capabilities)It is important that all talent functions be fully integrated for buyers to realize thebenefits of seamless process flow and data exchange. Minimally, modules flowfrom one to another without reinitiation or additional authentication. Ideally, allmodules share a common database and architecture and are developed on thesame platform. Also important is strong linkage to the HR system of record.1.00Offering abilities include those that maximize the connection between the offerings andcustomers, such as delivery, partnerships, pricing, marketing, sales, and service.Pricing model optionsand alignmentOptions include flexible arrangements such that the client can choose to be billedup front, monthly, quarterly, or yearly. Implementation fees are reasonable as workrequired is important to market success.3.00Sales/distributionchannel structure,capabilitiesNo one vendor can meet all of its customers' needs. Excellence is shown by havingthe right partners and a strong system that engages partners at the right time.Excellence is also shown by having a strong partner ecosystem. The right partnersfor talent management include firms that have strong consulting expertise inupfront talent strategy, strong technical skills around talent system implementation,or strong expertise in a particular talent area — or that have demonstrated theability to market talent management technology as part of a larger talent consultingengagement.2.00#235598 2012 IDC

TABLE 2Key Capabilities Measures for Success for Performance Management inIntegrated Talent Management VendorsSubcriteriaWeightingCapabilities CriteriaCriteria for SuccessMarketingIt is important to have a clear view of the ideal client. Successful vendors offersolutions that are geared toward well-defined target market(s). The message to thetarget audience needs to be concise and appropriate for each of the targetmarkets.0.00Customer serviceCustomer service excellence is marked by high client satisfaction and retention anda good ratio of client services staff to clients.5.00Go-to-marketcapabilities total10.00BusinesscapabilitiesFinancial, employee, partner, and R&D management (among others) are inagreement with current market opportunities.Growth strategyexecutionMarket momentum and growth are shown through acquisition of new clients. Thiswill be measured by market growth in integrated talent management.3.33Innovation/R&D paceand productivitySuccess requires that sufficient new development is taking place to stay ahead ofor in line with competition. Technology in use should be open and not nce is marked by strong cash flow and financial acumen and restraint.0.00EmployeemanagementStrength in managing talent is a key factor for firms in the talent managementmarket. Success is in part demonstrated by a high employee retention rate.3.34Using what one sells(other businesscapabilities)Using what one sells is a strong indicator of a well-run business. Excellence can bedemonstrated through the degree to which solutions offered are used internally.0.00Business capabilitiestotal10.00Source: IDC, 2012 2012 IDC#2355989

TABLE 3Aggregate Criteria Weighting for Performance Management in Integrated TalentManagement 0Go to urce: IDC, 2012FUTURE OUTLOOKIDC MarketScape Performance Management inIntegrated Talent Management MarketVendor AssessmentThe IDC vendor assessment for the performance management in integrated talentmanagement market represents IDC's opinion on which vendors are well positionedtoday through current capabilities and which are best positioned to gain market shareover the next few years. Positioning in the upper right of the grid indicates thatvendors are well positioned to gain market share. For the purposes of discussion, IDCdivided potential key strategy measures for success into two primary categories:capabilities and strategy.IDC's most critical criteria for positioning on the y-axis and x-axis are as follows: Positioning on the y-axis reflects the vendor's current capabilities and menu ofservices and how well aligned it is to customer needs. The capabilities categoryfocuses on the capabilities of the company and product today, here, and now.Under this category, IDC analysts look at how well a vendor is building/deliveringcapabilities that enable it to execute its chosen strategy in the market. Positioning on the x-axis or strategy axis indicates how well the vendor's futurestrategy aligns with what customers will require in three to five years. The strategycategory focuses on high-level strategic decisions and underlying assumptionsabout offerings, customer segments, business, and go-to-market plans for thefuture, in this case defined as the next three to five years. Under this category,10#235598 2012 IDC

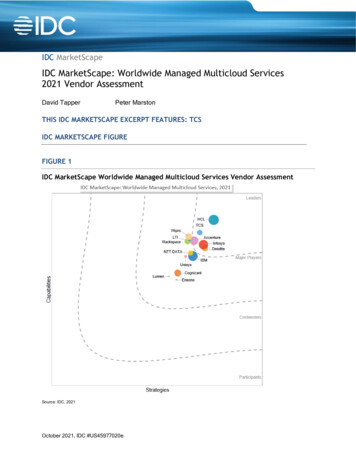

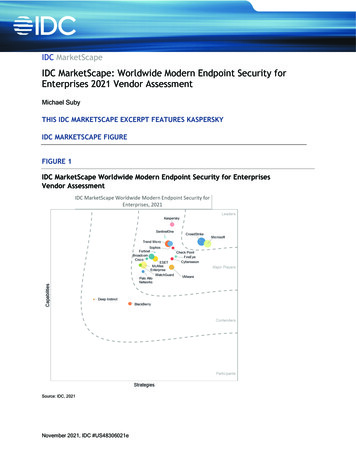

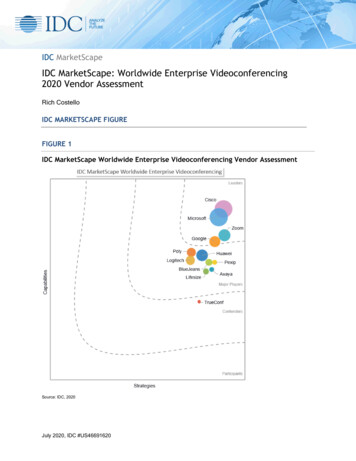

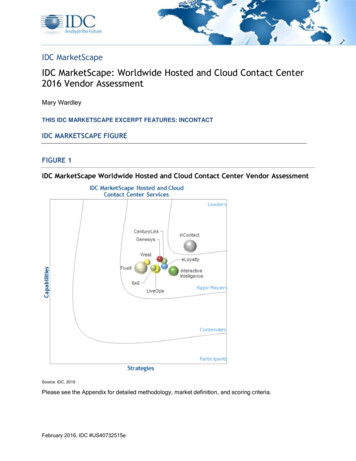

analysts look at whether or not a supplier's strategies in various areas are alignedwith customer requirements (and spending) over a defined future time period.Figure 3 shows each vendor's position in the vendor assessment chart. The numberof client employees in organizations using the performance management module isindicated by the size of the bubble, and a ( ), (-), or () icon indicates whether or notthe vendor is growing faster, slower, or even with overall market growth.FIGURE 3IDC MarketScape Performance Management Capabilities inIntegrated Talent Management Vendor AssessmentSource: IDC, 2012 2012 IDC#23559811

Market Analysis — Consolidation Continuesand Differentiation Coming from Four PillarsCurrent capabilities are very close among the vendors covered as indicated by theclustering on the y-axis. The vendors covered in this analysis come from variedbackgrounds. Some come to the talent management market from a recruitingperspective, others from a learning management market, and others from the overallHRIS or ERP market. There are also those vendors that began their market entry withperformance management. All vendors are beginning to set themselves apart byexploring more linkages with mobile, social, and analytics, with social performancemanagement in particular an area that offered differentiation across the field. The fieldfor performance management itself has grown smaller in recent years because ofmuch market consolidation.Market Strengths and WeaknessesIn terms of current capabilities, the areas of greatest strength across the field remainthe quality of the existing offering, integration of performance with learning anddevelopment, and goal setting and goal management. Strategic plans for the nextyear indicate vendors plan to further deepen their capabilities in mobile and socialenablement and are looking to expand globally.Turning to weaknesses in the solutions currently being offered, clients are looking formore in the way of mobile and social capabilities. From IDC's perspective, moreprogress can be made in offering more informal "anywhere" social feedback. Whilesome do social feedback well, the majority have room for improvement.Vendor Summary AnalysisThis section briefly explains the key observations that resulted in a vendor's positionin the vendor assessment graph. While each vendor was evaluated against each ofthe strategy and capability characteristics (refer back to Tables 1 and 2), thedescriptions here provide a brief excerpt of the findings that represent the vendor'sscore.A number of scores are taken directly from the mean of clients' responses to IDC'sDecember 2011 survey of 512 HR executives.It is worth noting that because of the maturity of the market and the various vendorofferings, there are no vendors in the contender or the participant categories — all areMajor Players or Leaders.Vendors are listed in alphabetical order by their name/ownership in place as ofDecember 31, 2011.ADPAutomatic Data Processing Inc. (ADP), with about 10 billion in revenue andapproximately 570,000 clients, is one of the world's largest providers of businessoutsourcing solutions. Leveraging over 60 years of experience, ADP offers a wide12#235598 2012 IDC

range of human resource, payroll, tax, and benefits administration solutions from asingle source as well as talent management. ADP first entered the large market fortalent management in recruiting through its 2006 acquisition of VirtualEdge. ADPfurther extended its talent management reach by acquiring Workscape in 2010. ADPnow offers all talent functions including learning management through a recent sourcecode acquisition. ADP goes to market by employer size, with major accounts havingfewer than 1,000 employees and national accounts having more than 1,000employees. This analysis considers the talent solutions that postdate the Workscapeacquisition that are largely focused on national accounts.ADP is a Major Player in this analysis. ADP offers good manager and employeeexperiences and a highly visual and intuitive succession planning capability.According to clients, ADP could improve reporting. ADP should also be offering moresocial feedback to employees as journaling within the application alone will becomelimiting.ADP is publicly traded on Nasdaq: ADP.Cornerstone OnDemandCornerstone OnDemand was founded in 1999 and launched its initial public offeringin March 2011. The company's roots are in learning management, and CornerstoneOnDemand has since built out other talent management components organically, nowoffering all functions. Historically, the Cornerstone OnDemand portfolio was targetedat large enterprises, but the company also rolled out a Business Edition geared to themidmarket. Cornerstone OnDemand has recently acquired New Zealand–basedSonar6, which it will now turn to for its SMB market efforts. Cornerstone OnDemandalso offers pro bono software and services to nonprofits through its foundation, and ithas recently rolled out a solution for volunteer management.Cornerstone OnDemand is a Leader in this analysis. Strengths include very highscores from clients in customer service, depth of capability of individual modules, costappropriateness, and timeliness of releases. In particular, Cornerstone OnDemanddoes a very good job with goal setting. According to customer feedback, room forimprovement could come from better integration with core HR systems.Cornerstone OnDemand is publicly traded on Nasdaq: CSOD.Halogen SoftwareOntario-based Halogen Software was founded in 2001 and introduced performancemanagement–related functionality as its initial entrée into talent management, and itnow offers solutions for all functions. Halogen tailors its go-to-market offerings tovertical industries, having begun with healthcare. Other vertical solutions includeprofessional services, financial services, education, the public sector, the hospitalitysector, and the manufacturing sector. Halogen largely targets the midmarketcomprising firms with 200–10,000 employees. Halogen has expanded bey

This MarketScape looks at performance managementin the context of the talent management suite and so criteria for inclusion is the same as it was for the integrated talent management MarketScape published in IDC MarketScape: Worldwide Integrated Talent Management 2011 Vendor Analysis(IDC #234365, April 2012). The