Transcription

IMPROVING DATA COLLECTIONClickto editMastertitle styleFORDIGITALFINANCIALSERVICESSUPERVISIONPhoto: Nyani Quarmyne / IFCDenise Dias, Wilson Kamali,Maciej PiechockiJune 27, 2018

Logistics1. This is an audio broadcast. Attendee microphones willremain muted during the entire webinar session.2. To ask questions during the webinar, please use theChat box on the right-hand side of the Webex session.Please submit your question at any time during thewebinar presentation.3. To ensure your question is seen by the moderator, select“All Participants” from the drop down menu whensending your question.4. The webinar recording will be emailed to all attendeesand registrants.2 CGAP 2017

SpeakersDenise DiasWilson KamaliMaciej PiechockiCGAPNational Bank ofRwandaBearingPoint3 CGAP 2017

Agenda1Data challenges for digital financial servicessupervisors2SupTech solutions3Bank of Rwanda4Panel discussion5Q&A4 CGAP 2017

Data challenges for digitalfinancial servicessupervisorsCGAP research

Good DFS data is key0011101011Effective digitalfinancial services(DFS) supervision isessential forsustained, healthyfinancial inclusion CGAP 2017Data is at the coreof financialsupervision001110010Quality DFSdata iscentral for effectiveDFS supervision

CGAP research on DFS dataDesk researchIn-person or phone interviewsLeading emerging markets and developingeconomies (EMDE) where DFS forfinancial inclusion have achieved scaleor are growing rapidlyPrimary responsibility for supervisionof the institutions that offer DFS (centralbanks or supervisory authorities). InMexico, Consar (pensions regulator)also includedDeveloped economies for comparisonEMDEs that have either or both agentregulations and e-money regulationsEuropean Union (EU), because of itswealth of relevant material and thepotential application of certain practicesto DFS supervision in EMDEs CGAP 2017Some DFS providers and providers ofIT and consulting solutions

Types data collected by DFS supervisorsQuantitative and qualitative, financial and operationalPeriodic reporting of DFS data in the researchedcountries focuses on operational dataQuantitativeQualitative CGAP 2017FINANCIALOPERATIONALFinancial statements(balance sheet, cash flow,income statement) Volume and value of transactions Financial ratios(capital adequacy ratio,liquidity ratio, and others) Number of transaction points(e.g., agents, ATM, point of sale)Number of accounts and total balancesLosses from frauds, consumercompensationsExplanations to financialstatements Policies and procedures Description of fraud and actions taken,actions taken on consumer complaints,IT systems, risk management practices,accounts of service disruptions

Types of DFS data collected Financial data one-money issuersOperational data one-money issuers ande-money operationsRisky andsuspicioustransactions9 CGAP 2017

Types of operational dataon e-money issuersNumber andtypes of accountsand clients CGAP 2017TransactiondataData one-moneyagents

Types of risk data and suspicioustransactionsAlmost all studied countries require statistics on suspicious transactionreports (STRs) and statistics and descriptions of:– fraud– data security breaches– service disruptionsOnly a few require reporting of volumes and values of failed andpending transactions, reversals CGAP 2017

Important to limit compliance costsKeeping compliance costs down isimportant for DFS in a financial inclusioncontext. Relative cost of dedicating staff timeto regulatory reporting can affect inclusiveproviders more.Some researched countries havelower or no reporting requirementsfor small nonbank e-money issuers. 12 CGAP 2017

Costs depend on data collectionmechanisms Regulatory reportingcosts depends moreon the data collectionmechanism than onthe amount of data. Reporting a small amount of data that needto be aggregated and formatted into separatereport templates can be more costly thanreporting a larger quantity of granular datathrough an automated process that does notuse report templates.13 CGAP 2017

Findings on DFS data reporting/collectionTransparency is greater inadvanced economiesThere is no single recipe for DFS reporttemplate that would work in multiple countries Broad DFS data categories do not varymuch but sub-categories vary widely Multiple combinations of sub-categories Variation in key terms and concepts Periodicity varies Only a minority of countriespublish report templatesMost EMDEs do not detailthe reporting requirementsin their websites CGAP 2017

Weaknesses in DFS data reporting?InconsistenciesUnclear or inconsistentuse of key terms withinreport templates andacross report templates CGAP 2017GapsGaps and inconsistencyof consumer complaintsreporting requirementsacross different typesof institutionsDuplicationsBanks subject to detailedreporting on agentswhile nonbanks are not,when there is no singleagent regulation

The process to create/change reportingrequirementsInformal and unstructured,limited to the departmentthat requests the dataFormal, standardized proceduresthat involve coordinationamong multiple departmentsand authorities and consultationwith the industry16 CGAP 2017

Centralized data collectionA unit that functions as acentral data source for allother departments, beingresponsible for prioritizingand implementing allperiodic electronic datacollection, includingDFS dataAct as the interfacebetween differentdepartments whencreating/changingreporting requirementsand when implementingimprovements in the datacollection mechanismKeep a single catalogof all regulatory reportsimposed on all typesof institutions helpsto avoid duplicaterequirements, whichcould help in estimatingthe total reporting burden17 CGAP 2017

Manual processes persist in reporting Multiple systems (e.g., product systemsor modules, AML/CFT, customer care,core banking, mobile money, etc.). Systems that are incompatible with thesystem used by the compliance unit to fillin the report templates. Reporting formats that create difficultiesgiven the IT architecture of an institution. Systems housed at different departmentsor outside the institution (e.g., AML/CFT,customer care). Gaps or errors in the automated aggregationand standardization of raw granular data. CGAP 2017Difficulties may alsobe caused by thesystem put in placeby the supervisoryauthority, such asreporting portals.—Office of FinancialResearch 2015

Manual report submission managementManaging regulatory submissionsis less time-consuming and moreeffective when using IT tools. InEurope, most supervisors keepautomated controls of regulatorysubmissionsIn studied EMDEscontrols of submissionsare mostly donemanually using Excelspreadsheets. CGAP 2017Automating submissionmanagement involvesdeveloping IT systemsto collect, store, andperiodically updatemaster data.

Standardization of DFS dataLack of standardizationThese words can mean different things for different institutionsAgentMobile walletAgent pointE-moneyaccountAgent tillTransactiontypesAccount typesSorting transactioncategoriesTransaction deviceMobile moneyaccountCash-inCash pointLocationCash-outSuper-agentMaster agentMerchant CGAP 2017Client typesTransfersRetail (final)Customer/accountsWholesale (corporate)customers (includesagent and merchantaccounts)

Lack of hese categoriesare importantfor monitoringoperational sDormantAccountDormant agents or accountsare usually those that have beeninactive for a certain period CGAP 2017Most countries in the study consideran account or agent active whenthere is at least one transactionin the past 30 or 90 days, but not allcountry regulations define these terms

Impact of observed weaknessesThe observed weaknesses can lead to: Inaccurate, delayed reported data Not comparable data across institutions More time spent by supervisor fixing data problems (“cleaning data”) Higher compliance costs Reduced effectiveness of DFS supervisionHow to address weaknessesBetter planning and standardization.Technology to reform collection mechanism. CGAP 2017

Emerging supervisory approachesrequire better dataShifting fromaggregated togranular dataShifting from focuson reports tounderlying dataExpanding and automatingthe collection and analysisof unstructured dataIncreasing thescope of dataReducing the timeto report andmanual proceduresThe higher the level of data granularity, frequency, and scope,the greater the need to reform the data collection mechanism.RegTech and SupTech offers solutions for data reporting and collection. CGAP 2017

Shift to granular dataIf adequate analytical skills and resources are availableGreater flexibility for richer supervisory insights– Supervisors calculate any desired indicator– Ensure calculations are correct and standardized– Limitless number of analyses— Manipulating, combining— Finding relationships across data points— Not constrained by predefined indicators CGAP 2017Most of today’s EMDE DFSsupervisors not accustomedto granular dataDepending on the datacollection mechanism, granulardata could reduce compliancecosts for institutions

Deciding about granularityIs there legalimpedimentfor collectinggranular data?How wouldgranularity impactcompliance costs?Is there analyticalcapacity to standardize,validate, and analyzegranular data?What extrainsights couldgranular dataprovide?Would a reform of the data collection mechanismbe required to avoid excessive compliance costsand ensure data quality? CGAP 2017Would thesupervisorbe risking itsreputation?

Types of data collection mechanisms– Separate files (Excel, PDF, Word, TXT, etc.)that are sent electronically (email attachments,web portal, or another file transfer system) orprovided in hard media (e.g., memory stick)– Automated processes or a mix of automatedand manual processes– Input approach, in which sets of granulardata are uploaded automatically by theinstitution into a database at or accessedby the supervisor.– Pull approach, in which raw granular dataare extracted (pulled) by the supervisor fromthe institution’s IT systems. CGAP 2017

New tech-fueled 01Data inputapproach CGAP 2017Data pullapproachReportingutilities

New data collection in EMDEsEMDEs lack heavy legacysystems, practices,infrastructure, and fullydeveloped regulatory andsupervisory frameworksGradual steps taken by,and the approaches currentlyadopted in, advancedeconomies may not benecessary for EMDEs CGAP 2017

Hurdles to new solutionsSome RegTech and SupTech solutionsrely on technologies that may notbe well-understood, well-accepted,or legally permitted in certain EMDEs,such as cloud computing. CGAP 2017

DFS data as part of wider strategySome EMDE authorities lackan overarching strategy andinterdepartmental coordinationfor improving regulatory databeyond DFS data.OverarchingStrategyThis may result inFragmented, duplicateand uneven data qualityOutdated mechanisms co-existingwith state-of-the-art mechanismsEncompassing reforms of data collectionmechanisms to support effectivesupervision should be pursued. CGAP 2017

Data collection and analytical capacityImproving DFS or any data collectionwill bring limited benefit if there is noadequate analytical capacity atsupervisory authorities to transform thedata into supervisory intelligence.Capacity may be lacking to map dataneeds in the first place, and tostandardize data effectively. CGAP 2017

SupTech SolutionsBearingPoint

Improving data collection for DFS supervisionExperiences with integrated approach for collection,processing, validation, analytics and dissemination ofmicro and aggregated data CGAP 2017

We provide end-to-end solutions for all stakeholdersalong the regulatory value chain. From a single financialproduct to an individual organization, from a particularasset class to a market sector, in one country andacross borders at the micro and macro level. We servefinancial institutions, intermediary regulatory platforms,central banks, and supervisory authorities with ourRegTech product suite. CGAP 2017

BCBS 415: Sound Practices: Implications of FinTech developmentsfor banks and bank supervisors #RegTech #SupTechRevitalised or relegated? #BaselCommittee report looks at #Fintech effects on banks & banksupervisors http://www.bis.org/bcbs/publ/d415.htm “Regtech could address a wide array ofrequirements related to regulatory reporting,financial crime, operational risk (including cybersecurity and fraud detection), consumerprotection and data protection regulation.Examples in these domains includeBearingPoint’s Abacus solution forcompliance with the European supervisoryreporting requirements ” CGAP 2017

World Bank & G20 Global Partnership for Financial Inclusion (GPFI)quotes BearingPoint Institute and highlights the AuRep project in itsreport#GPFI referencing our #RegTech & the AuRep project in the #G20 report on Digital FinancialInclusion: Creating an Enabling Legal and Regulatory FrameworkAuRep project as notable exception for leveraging technology to build oversightcapacity automating Regulatory Reporting and Supervision input-based”approach that enable regulators to capture more granular data on financial sectoractivity, including on activity by new market entrants, or related to new digitallyenabled delivery mechanisms or products, while reducing the reporting burdenon regulated institutions. CGAP 2017

Abacus360 RegulatorModular solution for data collection, risk-based supervision, regulatory analytics anddisseminationAbacus360 RegulatorRegulatedFIsSupervisory and Statistical Processes12XBRLvalidationand FilingRulesImport12SDMXvalidationand FilingRulesXML,XBRL,SDMX . CGAP 2017ImportBasel / Solvency XBRL collection6453InternalchecksKPI/KRIcalculationand breachreportingVisualisation andaggregatedreportsGranular/ CCR collections453Internalchecks123Data inputOnlinevalidationsImportKPI/KRIcalculationand breachreportingVisualisation andaggregatedreportsAd-hoc collection45KPI &disseminat.SDMX7Remittance &disseminat.ISO20022

Portal architecture with highly secured collection, validation anddistribution at the National Bank of RomaniaRomanianBanks (40)ExcelXMLXBRLABACUS/RegulatorXBRLSupervision Process NBRFirms ateViewCommentCorrectAnalyzeRemit"We managed to report with ABACUS/Regulator in July, and the data was good quality. Both sides were proud of the performance.“Simona Chiochiu, head of IT at the National Bank of Romania (December 2015) CGAP 2017

ABACUS/Regulator for Solvency 2 and Basel III ICAAP collection,aggregation and distributionInsurancecompanies(450 )QRTsinXBRLQRTsinXBRLABACUS/RegulatorSupervisory and Statistical nt,correctZIS54Allocate,aggregateAnalyse, exportSDMXSHSQRTsinXBRLBanks(1900 yse,export.KPIs/KRIscalculationsXBRL“They sent very good consultants from the beginning who really knew what our experts were talking about The goalwas always very clear, and the way to reach the goal was very straightforward” major European Central Bank CGAP 2017ECBSystems

Austrian regulatory data collection model“The Austrian model ‘ensures consistent, and highly qualitative data, whilst ‘reducing the amount of checking wehave to do The big win for the banks is that they are not burdened with the problem of completing templates onmany different topics’.”Johannes Turner, director of statistics at the National Bank of Austria (March 2015)Template basedapproachCube ormationAustrianMFI‘s CGAP tCheckvaluesSub

Largest regulatory data collection, aggregation and distributionfactory worldwide”ABACUS/GMP is still being rolled out, but thesigns are positive so far. It works, it really works”Johannes Turner, director of statistics at theNational Bank of Austria (December 2015)“ regulators still struggle with legacy systems, andthe pace of reporting and monitoring modernization is often behind where it needs to be given the rateof growth with notable exceptions”, G20 GlobalPartnership for Financial InclusionGMP UserBank WorkplaceGMP UserInternetAnonymousUserApproximately 1200registered GMP usersAuthenticationGMP Portal (Single Point of Access for all Platform Applications)All major Austrian bankinggroups (over 1000 MFI withtarget for m KIGBasic Cube EnrichmentSmart Cube CreationRegulatory Reporting Application ABACUS/GMP(Reporting Functions and Process, Security, Data Protection)Interface Cubes(XML, CSV )Reports(Mefisto, XML )OeNB DataInterfaceTransfer Cubes(XML, CSV )Reports(Mefisto, XML )KIK GMP ZoneKIK GMP ZoneKIK GMP ZoneKIK GMP ZoneBackfeed InterfaceReference DataAcknowledgmentData InquiryFile, Data MartKIK GMP ZoneReporting (OLAP)BI Data MartKIK GMP ZoneSupport Services2 000 000 000 granulardata sets per date(loans, securities, counterparties)18 000 files per ceDeskDemandManagementDeploymentManagementService mManagementChangeManagementReleaseManagementIT Operation 2016 Austrian Reporting Services GmbHAll rights reserved. The name AuRep and Logo are registered trademarks. CGAP 2017To OeNBKIK GMP ZoneBackfeed InterfaceSmart CubesCorrection LogReference DataTo KIGOeNB InterfaceFrom OeNBOeNB Reporting SystemTest-/ProductionData Load & Quality CheckKIG DataInterfaceSecured ConnectionTestManagementGMP Platform ApplicationsReporting Data TransferKIG DatacentersABACUS/GMP

Abacus360 Regulator @ numerous regulators in EuropeFully integrated solution for granular data collection and central credit registerReportingagentsAbacus360 RegulatorStatistical Processes1Dataloading1SDMX,XML CGAP 2017XMLvalidationand FilingRulesAnaCredit data rparty checkNonschemavalidationsXML6AnalyticsStatistical data collection (Phase II)3456InternalchecksKPI/KRIcalculation andbreachreportingVisualisati-on andaggregated minat.SDMX

Abacus360 RegulatorIntegrated platform for collection, analysis and dissemination of supervisoryand statistical data for central banks and regulatory authorities CGAP 2017

http://reg.techDr. Maciej PiechockiPartnerBearingPointSpeicherstraße 160327 FrankfurtT 49 69 13022 6167M 49 152 ngpoint.com CGAP 2017#RegTech

National Bank of RwandaThe new data collection system

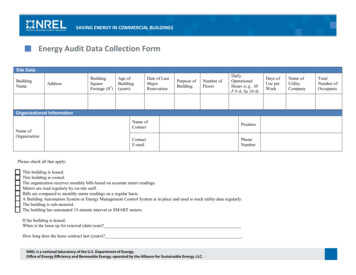

Why an electronic data warehouse? Develop efficient and integrated data repository centerEliminate statistical inconsistenciesEnable efficient data captureEnable efficient access to data and informationCreate environment for efficient data sharingIntegrate data from multiple sourcesDevelop centralized approach to data analysis andreporting Enable development and utilization of business intelligenttools and strategies46 CGAP 2017

Addressed challenges of old reporting frameworkManual reporting(externalstakeholders)Data consolidation(NBR)Regulatory reporting Heavy resource requirements Time-consuming and inefficient High costs and information comes after reportingperiod Data spread across multiple systems Manual consolidation time consuming Data integrity issues Central bank reporting manual and time-consuming High cost of errors, inaccuracies, audits, andcompliance issues No audit trails in case of any manual reporting47 CGAP 2017

Other benefitsDataConsolidate and improve the quality of countrywide financial data.Single sourceof truthBI for key decisionmakersRegulatory reportingTurnaround timesPerformance trend analysisKey financial indicatorsEveryone in Rwanda looks at the same numbers and information.Providing accurate, complete and timely information helpsin formulating the right policy at the right time.Automating entire BNR reporting not only savedtime and cost for all stakeholders but also improvedaccuracy and efficiency.Improve reporting turnaround time by usingan efficient & seamless reporting tool acrossthe region.Deep dive analytics by segments,products, customers, regions as well asanalyze trends across dimensions.To take course corrections aheadof time rather than analyzing thedata at end of the period.48 CGAP 2017

ArchitectureExternal StakeholdersStaging AreaBanksMFIsExtractData Marts eport BANKINGMETADATA LAYERNonFinancialsOLAPAnalyticsOperational49 CGAP 2017

Data Flow ADF/Uploads Architecture and ComponentsData Transmission(Internet/Intranet)BanksInsuranceMNOs tsInterface (DB link, WebService, Adpater)Frequency (Daily ,Weekly, Monthly,Annual)Data Connectivity(Push, Pull, Push &Pull)External auInternalStatisticsaPublicationsInternal StakeholdersFile Type (XBRL,XML,Excel, CSV)Staging AreaData Integrity /ValidationData Controls(Console, Auditing,Alerts, Checklist)Database50 CGAP 2017

Initial Requirements from External Stakeholders Name of core systemOther applicationsDatabase typeNetwork typeDedicated focal persons (here most institutions havenominated)51 CGAP 2017

Type of Digital Financial Services Data52 CGAP 2017

What’s NextCurrent status All MNOs now connected and data pulled on a daily or monthly basis.Challenges Gaps in business processes leading to not capturing most importantcustomer information (e.g., sender or receiver location). MIS gaps missing some important fields for KYC (e.g., gender). Initially poor coordination and ownership caused delays in implementation.Next steps Data validation before complete cut off of manual reporting (by Dec 2018). MNOs to update core systems in order to capture KYC requirements. MNOs to automate business processes (e.g., complaint and fraud handlingand management).53 CGAP 2017

Thank youTo learn more, please visitwww.cgap.org

www.cgap.org CGAP 2017

The higher the level of data granularity, frequency, and scope, the greater the need to reform the data collection mechanism. RegTech and SupTech offers solutions for data reporting and collection. Increasing the scope of data Expanding and automating the collection and analysis of unstructured data Reducing the time to report and manual procedures