Transcription

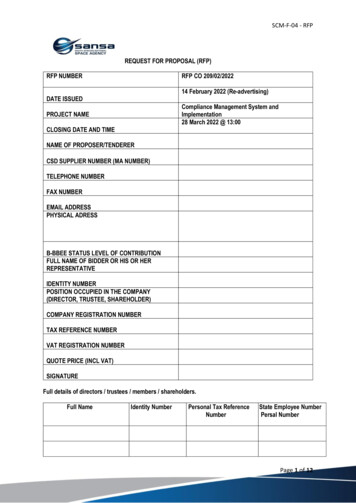

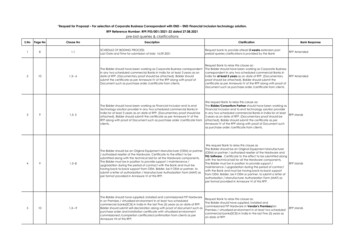

“Request for Proposal – For selection of Corporate Business Correspondent with END – END Financial Inclusion technology solution.RFP Reference Number: RFP/FID/001/2021-22 dated 27.08.2021pre-bid queries & clarificationsS.NoPage NoClause No181.12345109910DescriptionClarificationBank ResponseSCHEDULE OF BIDDING PROCESS:Last Date and Time for submission of bids- 16.09.2021Request bank to provide atleast 2 weeks extension postprebid queries clarifications is provided by the Bank1.3-- 6The Bidder should have been working as Corporate Business correspondentin any two scheduled commercial Banks in India for at least 3 years as ondate of RFP. (Documentary proof should be attached). Bidder shouldsubmit the certificate as per Annexure IV of the RFP along with proof ofDocument such as purchase order /certificate from clients.Request Bank to relax this clause as:The Bidder should have been working as Corporate Businesscorrespondent in any two scheduled commercial Banks inIndia for at least 2 years as on date of RFP. (DocumentaryRFP Amendedproof should be attached). Bidder should submit thecertificate as per Annexure IV of the RFP along with proof ofDocument such as purchase order /certificate from clients.1.3- 5The Bidder should have been working as Financial Inclusion end to endtechnology solution provider in any two scheduled commercial Banks inIndia for at least 3 years as on date of RFP. (Documentary proof should beattached). Bidder should submit the certificate as per Annexure IV of theRFP along with proof of Document such as purchase order /certificate fromclients.We request Bank to relax this caluse as:The Bidder/Consortium Partner should have been working asFinancial Inclusion end to end technology solution providerin any two scheduled commercial Banks in India for at leastRFP stands3 years as on date of RFP. (Documentary proof should beattached). Bidder should submit the certificate as perAnnexure IV of the RFP along with proof of Document suchas purchase order /certificate from clients.1.3--8The Bidder should be an Original Equipment Manufacturer (OEM) or partner/ authorized reseller of the Hardware. Certificate to the effect to besubmitted along with the technical bid for all the Hardware components.The Bidder must be in position to provide support / maintenance /upgradation during the period of contract with the Bank and must behaving back-to-back support from OEM. Bidder, be it OEM or partner, tosubmit a letter of authorization / Manufacturer Authorization Form (MAF) asper format provided in Annexure VI of this RFP.We request Bank to relax this clause asThe Bidder should be an Original Equipment Manufacturer(OEM) or partner / authorized reseller of the Hardware andFIG Software . Certificate to the effect to be submitted alongwith the technical bid for all the Hardware components.The Bidder must be in position to provide support /RFP standsmaintenance / upgradation during the period of contractwith the Bank and must be having back-to-back supportfrom OEM. Bidder, be it OEM or partner, to submit a letter ofauthorization / Manufacturer Authorization Form (MAF) asper format provided in Annexure VI of this RFP.1.3---9The Bidder should have supplied, installed and commissioned FIP Hardwarein on Premises / virtualised environment in at least two scheduledcommercial banks(SCB) in India in the last Five (5) years as on date of RFP.Bidder should submit self-declaration along with proof of document such aspurchase order and installation certificate with virtualised environmentcommissioned /completion certificate/confirmation from clients as perAnnexure VII of this RFP.Request Bank to relax this clause as:The Bidder should have supplied, installed andcommissioned FIP Hardware in Vendor's Premises/onPremises / virtualised environment in at least two scheduledcommercial banks(SCB) in India in the last Five (5) years ason date of RFP.RFP AmendedRFP stands

6781111161.3.101.41.9.1--5Bidder's Qualification Criteia - The Bidder has its own service centers /authorized franchise / authorized service center in Chennai andHyderabad. Bidder to ensure that server certified professional areemployed in these locations and should submit the details of service centersuch as address, number of engineers attached to the service center ofwhich Server Specialists etc.Request Bank to clarify this clause.Whether bidder's servicecenters / authorized franchise / authorized service center inChennai and Hyderabad would be device support center,call center or data center?Successful bidders shall be engaged as Corporate Business Correspondentswith capability of managing minimum 5000 BC locations along with FItechnology i.e., End to End solution for FI (Deployment of Software,CBC has to develop application/software,integrate withHardware & Field BC Agents) exclusively for the Bank. However, thisbank system and deploy devices in field. Please specify thislocation is subject to change as per the requirements of the Bank. Theclause.solution provided by the successful bidder shall be required to maintain andmanage any change in the locations during the contract period.All technical SupportAll the requirements from ENDto END required for successfulimplementation of theproposed FI solution as per thescope.Total number of BCAs working in SCB ( Scheduled Commercial Banks)Request Bank To modify this scoring as below:Total number of BCAs working in SCB ( ScheduledCommercial Banks) 3500 ---- 10 marks 2000 to 3500-- 7 marks 1000 to 2000 ---5 marksGeographical coverage of states through deployment of BCRequest Bank To modify this scoring as below:Geographical coverage of states through deployment of BC 20 states -- 10 marksRFP stands 15 to 20 states-- 7 marks 15 states -- 5 marksRFP stands9161.9.1--710168TSP (Technology Service Provider) working as CBC in Same BankWe request Bank to allow existing experience withcustortium partnerRFP stands11168 4 Bank- 10 Marks 2 to 4 Banks - 7 Marks 2 Bnaks- 2 MarksWe request Bnak to relax this caluse as 4 Bank- 10 Marks 2 to 4 Banks - 7 Marks 1 or 2 Bnaks- 5 Marksplease refer Amendment 212169Transaction Processing Capacity of FI Application ( Annually)We requesting Bank to considered consortuim partnersexperience for this clauseRFP stands13181.1Request Bank to clarify what Call center services Bank isThe selected Vendor will undertake to provide the Contact cum call centerrefering to? What is the SOW for Call center andservices required in this RFP to the Bankdeliverables from sleected vendorCall Center services to beprovided to the BCAs and aticketing system is to bemaintained. Also IVR supportfor common queries raised byBCAs to be framed andanswered and it will also be apart of the scope of RFP.

14181.115282.29.h1635Annexure 11735No Outsorcing /sub contracting by vendor - The selected Vendor willundertake to provide the Contact cum call center services required in thisRFP to the Bank and will not outsource or subcontract any or all of theservices being offered to Bank to any company or to a company fully /partly owned by the Vendor, except with the written consent of the Bank.However, any payment to such subcontract/outsourcing is to be paid bythe Bidder and the Bank will not pay any amount other than the fixedamount quoted for that particular assignment.Call center established by CBC will handle customerqueries/complaints directly. Please clarify.Call Center services to beprovided to the BCAs and aticketing system is to bemaintained. Also IVR supportfor common queries raised byBCAs to be framed andanswered and it will also be apart of the scope of RFP.Other Terms & Conditions - SB and its employees, technical resources,agents, contractors, subcontractors or its authorized agents shall provide fullRequest Bank to provide details of other agencies working in It will be provided afterco-operation to other agencies working in the premises and shall follow thethe premises.selecting TC 1 bidder.instruction of site in charge. No extra claims shall be entertained onaccount of any hindrance in work.Scope of Work:Migration of Existing FI SolutionRequets bank to provide details on the current FIG providerand estimation of data to be migratedCurrent FI solution provider isM/s TCS Ltd., andapproximately 2000GBAnnexure 1Scope of Work:2. Selected Bidder has to host FI Gateway and to provide end to endsolution in technology.Request Bank to clarify if Bank with provide the FI Gatewayor selected bidder needs to provide itFI Gateway means FIapplication FI applicationLicense hardwares hardware license and othersoftwares required forintegration with CBS by FIsolutionAdditional arrangement would be in addition to 5000 pointsdeployed by CBC. Please clarify.Additional arrangement wouldbe in addition to the existingBC points which are alreadyavailable in the RFP and mayextend up to 5000 BC points.1835Annexure 1Scope of the Project (7) - Bank may require additional BC agents atlocations as per the road map given by RBI/ DFS/ State Governments . TheSuccessful Bidder is required to deploy BC agents on same terms andconditions at those locations.1935Annexure 1Scope of the Project (8) - The Bank reserves the right to add/modify/deleteRequest bank to give adequate time to CBC in case ofany locations from the existing locations as per the requirement from time toadd/modify/delete any location from the existing locations.time.Timeline wiil be fixed afterselection of the bidder.Successful Bidder to install intermediary FI (App/Web/DB) servers andintegrate the same with bank’s FI Gateway both at Primary Data Centreand Disaster Recovery Centre. This intermediary server shall be capable ofdriving MicroATM/Tablet/Mobile Devices. The Server will also drive banksMicroATMs. FI intermediary Server should be compatible with the latestversion of Micro-ATMs certified by IDRBT/STQC. Licence for the same to beobtained by bidder with the Specific Standard as perIBRBT/UIDAI/NPCI/RBI/DFSNo, Bank will not provide any FIGateway solution, Sucessfulvendor is responsible fordevelopment of FIGapplication & integration withCBS Domain.20364Will Bank's provide the FIG? If Yes then who is FIG vendor ofthe bank?

2136Annexure 1Detailed Scope of the Project (3) - This is an end to end project and the allthe items required for making the solution operational should be consideredby the bidder, even if the same is not explicitly mentioned in this RFPRequest bank to specify this clause in detail.document and a detailed design document needs to be submitted as partof the bid.2237Annexure 1Detailed Scope of the Project (6) - Successful Bidder shall provide services ofan intermediate system that is owned and maintained and managed byRequest bank to please clarify offline transaction modethe bidder that is handling transaction in online/offline modes from a large mentioned in this clause.no of devices deployed in this project.There will not be any Offlinetransactions please referAmendment23377Successful Bidder Shall provide interface and establish connectivitybetween front end system and intermediate system and CBSPlease provide CBS details , Provider and Version ?our CBS is FinacleCBC would develop application to give real time access tobank to generate various reports/dash boards. PleasespecifyCBC should develop anapplication/real timeDashboard for use of theBranches/RegionalOffices/Central office togenerate variuos reports anddata required for analysingvarious performance of BCAswithout any additional cost tothe Bank.2438All the requirements from ENDto END required for successfulimplementation of theproposed FI solution as per thescope.Annexure 1A. Deatiled Scope of the Project (21) - Successful Bidder has to provide atool/application to enable Bank users to generate various reports/ Dashboards with real time data required by the Bank to monitor BC operationswithout any cost to Bank and also should put in place alert mechanism.A. Deatiled Scope of the Project (25) - Following MIS reports to be provided:(i) BC master report as per DFS GIS report format with Coordinates. (ii)Realtime BC login reports with State wise/ District wise/ Zone Wise as per DFSRequest bank to clarify whether the reports mentioned informat (iii)Real time inactive BC report (iv)BC transaction report productthe clause would be shared by CBC over mail or CBCwise (v) Reconciliation reports (vi) Cash position report BCA wise (vii)BCwould share these reports via SFTP.commission reports (viii)Failed/ unsettled transactions reports (ix) DisputeManagement reports for which complaints are raised by the customer (x)BC activity reports (xi)BC onus and Offus transactions with InterchangeAs decided by the Bank fromtime to time.2539Annexure 1263929Successful Bidder is responsible for supply, installation and maintenance ofDR system for FI server (App, Web, DR) at Bank’s DR location and ensure online replication of data between primary and DR FI servers. SuccessfulBidder to perform DR Drill once in a quarterAny specific preferance for Servers and Database makeand model ?Refer RFP Amendment273929Successful Bidder is responsible for supply, installation and maintenance ofDR system for FI server (App, Web, DR) at Bank’s DR location and ensure online replication of data between primary and DR FI servers. SuccessfulBidder to perform DR Drill once in a quarterWill Banks provide all the API/Messaging to connect withdifferent component for fullfilment of requirement ?The requirements will befinalised after selection of theBidder.

Bank will provide a tentativetargets to all BCAs permonth/week based on therequirement of the Bank andother regulators. Customizedmessages would be providedby the Bank for displaying onthe devices by CBC.2840Annexure 1B. Technical Capabilities (2) - Successful Bidder should provide a centralisedsolution to monitor end to end operations performed by the BC agents.Request bank to clarify whether banner/customise msg/Centralised solution and application software deployed in the field devices daya to day targets displayed on devices by CBC would beshall be capable of displaying banners/ customised messages/targets toprovided by bank.the BCAs on day to day basis.2941Annexure 1C. Responsibilities of succesfull Bidder (8) - Successful Bidder should analysethe transactions on regular basis and submit a report to bank on failure oftransactions with reasons. Successful Bidder should device a plan andinitiate necessary steps to reduce failure of transactions.Request bank to clarify this clause.Reason for failures should beexplained to the Bank andtime line should be adhered asdecided by the Bank.Annexure 1C. Responsibilities of succesfull Bidder (8) - Successful Bidder should havecapability to levy different types of variable /fixed charges on the customer Request bank to clarify this clause.transactions on the basis of customer type, transaction type.This clause is related tocollection of charges fromcustomer for transactions, theproposed solution should havethe option for it.30413141ANNEXURE I-SCOPE OF WORK324263342Annexure 1How much fixed customer service point banking is planningto open under this RFP. Also, please specify the minimuminfrastructure required at each fixed customer service point.This clause is Amended. Pleaserefer to the Amendments.The system should be scalable and interoperable and work with differenttypes of handheld devices empanelled by IBA.Proposed system by us will be certified and as per MicroATM standards 1.5.1; however notsure why they should beIBA empanelled. Request Bank to remove IBAempanellment clause.The system should be scalableand interoperable and workwith different types ofhandheld devices as per thestandards ofUIDAI/NPCI/RBI/DFS from timeto time and anydeviation/penalty in thisregard shall be responsibility ofthe bidder.D. Technical Specifications - The Successful Bidder should be able to roll outthe system at short notice.Request Bank to provide adequate timeline CBC to can rollout solution and to execute project on field.The timelines will be finalisedafter selection of the Bidder.6.One fixed Customer Service Point (CSP) shall be established at each ofthe identified centres by the corporate BC.

34423543364337443845C. Responsibility of success Bidder (18) - Corporate BC should arrangerefresher course to BC agents for one day once in every three months toupdate and enable them to discharge their duties more effectively.CBC will impart training to agents on different bankproducts. Request bank to clarify on refresher courseprogramme for BC agents.Refresher course means arfreshment training to theagents such as one day workshop for more clarity on theoperations or the products.E. Incidence Mnagement (1) - Successful Bidder shall provide a help deskwith adequate number of phone lines for online support of BC agents andalso for the Bank customers. The toll free number should be printed on thetransaction receipt.Bank customers of targetted area would only have theaccess of CBC call center and toll free number deployedby CBC. Please clarifyRefer RFP AmendmentD. Technical Specification (8) - Bank’s internal & external auditors willconduct security drill & VAPT (Vulnerability assessment & penetrationtesting) for all the systems from time to timeRequest Bank to please specify frequency of security drilland VAPT that will be conducted by bank's internal andexternal auditors.As decided by the Bank fromtime to time.Annexue 1F. Software Management - Bidder should host a portal for Regional Offices/Branches which facilitates BCA on boarding, Transactions monitoring,Grievance addresal, etcRequest bank to specify on grievence addressal activitythat would be implemented by CBC.Grievence redressal for theBCA.Annexure 1G.Centralised Monitoring, Reconciliation, Settlement and DisputeRequest Bank to relax this clause and increase ratio ofManagement - Corporate BC shall have the supervisors and coordinatorsAgent to supervisor from 1:25 to 1:50 and ratio of Supervisoras follows:(i)One supervisor referred to as BC Supervisor (BCS) for 20-25 BCAs.to Coordinator from 1:10 to 1:25.(ii)One Coordinator referred to as BC coordinators for 8-10 supervisors .RFP standsAnnexure 1I. Basic Functions of the Application (2) - The Bank may intend to provideany other special products and/or services which the Bank may conceiveat any later date and the BC and/or his Business Agent (BA) should beadequately equipped to undertake such services within 30 days of notice.The required training shall be arranged by the corporate BC to the BCAs.Request bank to sufficient time to CBC incase ofdeployment of any special product/services/equipment.RFP standsRFP standsAnnexure 1Annexure 1Annexure 139474049Annexure 1K. Cash Operations by the Business Correspondent (3) -The BCA shall berequired to handle recovery of loans.Request Bank to relax this clause as its would be difficult forBCAs to act as loan recovery agent for bank.4149Annexure 1K. Cash Operations by the Business Correspondent (5) -Bank reserves theright to revise transaction limits of the customers/ turnover limits of the BCagents at any point of time as per Banks discretion / regulatory guidelines.Request Bank to notify and provide adequate time to CBCto implement revised transaction limits for customers/agents RFP standsapplication.4250LRESIDENT PERSONNEL FOR MIGRATION:Successful Bidder (SB) shall deploy support team including Team Leader atbank’s Central office for the complete duration of the projectRequest Bank to clarify if Bank needs support team onlyduring migration & Implementation period or for entire 5years of the contract1.Successful Bidder has to ensure installation of App, web & DB servers (FIServers) with each server having redundancy, bidder needs to providetape drive & tape libraries for data backup on tape drive as per Bank ISpolicy. The servers at DC may work in active-active or active passivecombination. The bidders also needs to provide App, web & DB servers atDR Chennai, servers redundancy is not required at DR site.All the application and server are hosted in Bank DC and DRBank premises onlyor Vendor premises? Please give clarity on the same.Buulet Point 1: Successful Bidder (SB) shall deploy support team includingTeam Leader at bank’s Central office for the complete duration of theprojectIs Team Lead is required onsite for complete projectduration i.e. 5 year or till the system Go-Live? Please giveclarity on the same.43554457J. FI SERVER:L. RESIDENT PERSONNEL FORMIGRATIONEntire 5 yearsEntire duration of the project.

4557L. RESIDENT PERSONNEL FORMIGRATION4667ANNEXURE III-FORMAT FORCOMMERCIAL BIDBuulet Point 4: SB shall submit the details of the Onsite Team to be deployedfor the Bank’s project along with the project document. No changes to thisteam shall be allowed for the duration of the contract without the priorwritten consent of BankPlease specify how much onsite support team required bybank for complete project duration.It is responsibility of the SB todecide the requirements asper the RFP.Note - Point 3: FBCs are given at least 80% of the commission earned ineach monthSince the project required huge CAPEX investment and thisneed to recover in monthly billing. Hence we request withbank to make FBCs share between 60-70%.RFP Amended47GeneralDeployment TimeKindly Specify the timeline to implement and make thisproject Go -liveThe timelines will be finalisedafter selection of the Bidder.48GeneralFirewall/Switch and rackSince all the servers are going to be hosted in Bank DC, willbank provide/share thier firwall and switches.Refer RFP Amendment49GenralDC-DR replicationWill bank provide required bandwitdh for DC-DR replication. Refer RFP Amendment50GenralDC-DR replicationWhat is RPO/RTO value expected as a BCP.RPO - 15 mins and RTO - 30 mins51GenralTape libraryWhat is the retention period for backup, and what is YoYback growth, and current backup size?Refer RFP Amendment andretention period for Back up is30days, current Back up size is1200 GB52GeneralDatabaseWill bank provide Database license?Refer RFP AmendmentFIG Solution applicationWe request Bank to allow consortium partner for FIGapplicationFIG has to be brought by thevendor and no consortiumpartner allowed, the vendorshould be the OEM.The bidder has registered an average turnover of 100 Crores (Rupees OneHundred Crores) (Financial year shall mean an accounting period of 12months. Figures for an accounting period exceeding 12 months will not beacceptable) in the immediate preceding 3 financial years (2017-18,201819& 2019-20) as per audited accounts. Annual reports of 2017-18, 2018-19and 2019-20 should be attached.Request you to lower the Average Turnover of bidder from100 Cr to 50 Cr average. & Consider the Turnover of FY 201819, 2019-20 & FY 2020-21. Reason: As average 100 Cr is toohigh considering the cost of the project over 5 years.Lowering the Av. Turnover criteria to 50 Cr is not going tohamper the quality of Bidders as 100 Cr also doesn’t confirmof getting best of quality bidders. By making it 50 Cr, a largerRFP standsnumber of bidders can participate giving better andcompetitive choice to the bank. Many Companies thosewho have complete focus on Financial Inclusion will not beable to participate in the bid and hence the Bid will lose thecompetitive edge. The Avg Turnover of 100 Cr is too high ascompared to the one asked in recent tenders floated byother PSB banks.General535491.3 Bidder’s Qualification CriteriaPoint 2

55101.3 Bidder’s Qualification CriteriaPoint 3We request bank to ask for net profit in all last three financialyears instead of two. It should be in line with the turnoverThe bidder has registered net profit (after tax) for at least two financial yearsasked. Profitability in true sense shows the financial health of(Financial year shall mean an accounting period of 12 months. Figures forthe company. Some company shouldn’t get the unduean accounting period exceeding 12 months will not be acceptable) in theadvantage in bidding because of this relaxation in net profit RFP standsimmediate preceding 3 financial years (2017-18,2018-19 & 2019-20) as perclause. As a true indicator of financial capacity, positive netaudited accounts. Annual reports of 2017-18, 2018-19 and 2019-20 should beworth as on 31st march 2020 should be asked for. This isattached.missing from the eligibility criteria. We request the bank toask for minimum 20 Cr positive net worth.56101.3 Bidder’s Qualification CriteriaPoint 5 & 6The Bidder should have been working as Financial Inclusion end to endtechnology solution provider in any two scheduled commercial Banks inIndia for at least 3 years as on date of RFP.We would like to place some facts here; Currently, MajorPSB banks are taking technology services from TCS. Thereare only 2-3 companies providing End to End Technologyservices to banks. Since, there are limited players inRFP standsproviding technology services to bank, we request bank tolower down the criteria from 2 PSB/Schedule CommercialBank to 1 PSB bank so that bank can get good participationof bidders in the RFP process making it more competitive.57151.9.1 Technical Bid EvaluationParameter (Position as on 31.03.2020We request bank to consider the latest PerformanceParameters of bidder (Position as on 31.03.2021)RFP stands58151.9.1 Technical Bid Evaluation Point 1Average Turnover of last 3 years (FY 2017-18, 2018-19 & 2019-20)We request bank to lower down the Annual Turnover from100 Cr to 50 Cr and the Marks allocation can be as below;75 Cr & Above 10 Marks Less than 75 Cr 7 MarksRFP standsNet Profit Position of last 3 years (FY 2017-18,2018-19 & 2019-20)We request bank to amend the Net Profit Position of last 3years (FY 2018-19, 2019-20 & 2020-21) and the Marksallocation can be as below;All 3 FY (In Ascending Order) 10 Marks All 3 FY (In any Order) 7 Marks(ConsistentPerforming Company will get advantage in marking system)RFP standsWe request bank to add ISO 20000-1 This Certification is forInformation Technology Service Management System. Thiscertificate covers the requirements of Scope of Work of theRFP. The Marks allocation can be as below;All 3 Certificates 5 MarksAny 2 Certificate 3 MarksAny 1 Certificate 2MarksRFP stands59151.9.1 Technical Bid Evaluation Point 260151.9.1 Technical Bid Evaluation Point 3ISO 9001 / 2700161161.9.1 Technical Bid Evaluation Point 8TSP (Technology Service Provider) working as CBC in Same Bank 4 Banks10 We request bank to amend the marking system as below; 2 Banks to 4 Banks7 2 Banks22 or More Banks 10, 1 Banks 562161.9.1 Technical Bid Evaluation Point 9Transaction Processing Capacity of FI Application ( Annually)We request bank to remove this parameter the reason is asfollows;1. The Transaction Capacity of applicationcannot be analyzed or quantified only by number oftransactions.2. Thetransaction Capacity also depends on bank performanceand accounts in the BC allocated.RFP standsRFP stands

Request & Suggestion63SUGGESTIONS:We request bank to float a separate tender for Fieldoperations and BC Management and Technology as done by all other PSBbanks.64We suggest bank to separate the tenders for technologyand Corporate BC. The rationale behind this is as below; 1.In case of a common vendor for Technology andCorporate BC, bank can appoint only one vendor asimplementation partner increasing the risk of failures. Thereis no provision for contingencies. 2. Bank loses thecompetitive edge: If technology and Corporate BC areRFP standsappointed separately, bank can appoint more than onevendor to offer the BC services. Technology can be withone vendor only. By appointing more than one vendor forBC services, bank can expect better rates, better servicesdue to competition to perform etc.3. Almost all banks haveseparate vendors for Technology and corporate BC services.Reason:Reason:1. Single Tender for Technology and field Operations will givelimited bidders for the bank and thus there are largerchances that bank may not get a competitive bid.2. Single Tender and selection of a single bidder may forcethe project and ultimately bank at high risk.RFP stands3. Many vendors are providing BCA services i.e fieldoperations. In current case, they may not get chance to bid.4. Due to past experience and above mentioned treats NObanks are currently going for Technology and BC operationscommon Tender.Reason:Looking at the high Eligibility Criteria and evaluation systemmentioned in the RFP;SUGGESTIONS:65We request bank to allow a Consortium.A Joint SPV (Consortium) bid may provide both the expertiseRFP standsi.e (Technology Solution and Field Operations) to bank andhelp bank to make the project successful.In current scenario, There are very few companies who canprovide both technology and field operations all together.669 1.2 Cost of Bid Documents1. Cost of Bid document (Refer clause 2.3 of the RFP) - Amt Rs. 15000/2. EMD (Refer clause 2.3of the RFP) - Amt Rs. 50,00,000/-Amount prescribed for EMD is on a very higher side. In linewith Ministry of Finance Office Memorandum No. F.9/4/2020RFP AmendedPPD dated 12.11.2020; the Bidder should allow submit “BidSecurity Declaration” in lieu of EMD. Copy of officeMemorandum is attached herewith

10 1.3 Bidders Qualification Criteria9. The Bidder should have supplied, installed and commissioned FIPHardware in on Premises / virtualised environment in at least two scheduledcommercial banks (SCB) in India in the last Five (5) years as on date of RFP.Bidder should submit self-declaration along with proof of document such aspurchase order and installation certificate with virtualised environmentcommissioned /completion certificate/confirmation from clients as perAnnexure VII of this RFP. (Documentary proof should be attached).The Bidder has its own servicecenters / authorized franchise / authorized service center in Chennai andHyderabad. Bidder to ensure that server certified professional areemployed in these locations and should submit the details of service centersuch as address, number of engineers attached to the servi

"Request for Proposal - For selection of Corporate Business Correspondent with END - END Financial Inclusion technology solution. RFP Reference Number: RFP/FID/001/2021-22 dated 27.08.2021 pre-bid queries & clarifications S.No Page No Clause No Description Clarification Bank Response 1 8 1.1 SCHEDULE OF BIDDING PROCESS: