Transcription

THE EGYPT CONSTRUCTIONPROJECTS MARKETAnalysis of market potentialEverything Infrastructure & Construction.Building the New Egypt.

MARKETSIZEEgypt is in the midst of a constructionboom. In total, more than 20bn worthof real estate and civil infrastructureprojects valued 50m or above have beenawarded over the past two years alone.Value of contracts awarded in Egyptall sectors, 2015-18 ( m)Everywhere across Cairo, huge billboardsadvertise dozens of new real estatedevelopments demonstrating vividly thescale of opportunity.30,000The Egyptian construction sector isenjoying an unprecedented boom asthe real estate market benefits from animproved economy, high demand for newhousing to back substantial populationgrowth, and government incentives tostimulate the market.Egypt is in fact the only country in theMiddle East & North Africa (MENA)where overall spending on projects hasgrown in the past two years, and it hasovertaken Saudi Arabia as the secondlargest single projects market in theregion as a whole, recording in 2018more than 33bn of contract awards.20,00010,00002015201620172018

KEYDRIVERSThe drivers for this construction renaissance are clear.With the Arab world’s largest population of around 100million people, Egypt already has a considerable latentdemand for housing and social infrastructure. Butpopulation growth of more than 1 million each year, apopulation density rate of 46,000 per square kilometre inCairo, and the fact that more than 50% of the populationis below the age of 25, these are the perfect ingredientsfor a sustainable construction boom for years, if notdecades, to come.The market has been favored by strong economic growthof more than 5% in 2018, and a construction-focusedgovernment which is prioritising delivery of projects andindustrialisation strategy. Egypt’s rapid repositioningfrom a net gas importer four years ago to net exportertoday, thanks to the fast-tracked development of theoffshore Zohr gas field, has helped underpin thiseconomic recovery and support the state’s projects drive.EGYPT ECONOMIC INDICATORS, 2018Nominal GDP ( bn), 2017299Real GDP growth, 2017e (%)4.2Real GDP growth, 2018f (%)5.2Non-oil real GDP growth, 2018f (%)4.2Oil real GDP growth, 2018f (%)22.8Crude oil production (million b/d)0.6Natural gas production (billion cf/d)5.1Fiscal breakeven oil price ( /barrel)55.0Fiscal balance (% of GDP)-10.0Government debt (% of GDP)91.2Current account balance (% of GDP)-4.4Official reserves ( bn)35.5CPI inflation (%)10.4Unemployment rate (% of labour force)11.1

2018SELECTEDEGYPTCONTRACTAWARDSThe key and perhaps best-known active construction project in Egyptis the new Administrative Capital to the east of Cairo. Involving thecreation of a totally new from the ground-up city, the multi-billiondollar project will host the government when it is complete as well astens of thousands of new residents. Work on the massive project iswell under way, with hundreds of individual contracts already awarded.Other significant active real estate and civil infrastructure contractsinclude the huge new New Alamein City on the North Coast, thenew Egyptian Grand Museum, a host of new hotel and tourismdevelopments, and the expansion of the existing Cairo metro network.PROJECTVALUE ( M)ACCUD - The Capital Cairo: Central Business District3,000ACCUD - The Capital Cairo: Central Business District Phase 22,800NUCA - The New Mansoura City1,350NAT - Cairo Metro Network: Line 3 - Phase 3:El-Thawra Line Civil Work1,244NAT - Light Rail Transit : LRT Line (66 kms)1,240NAT - Cairo Metro Network: Line 4: Phase 1:Civil Package 1 (CP 401)950Hassan Allam Properties El Mostakbal City HAPTown Residential Complex800MHUUD - Rod El Farag Highway790Madaar Development - Azha Ain El-Sokhna (Phase I)750Almarasem Development - Fifth Square745SCZONE - Al Sokhna Port Second Basin Development600NAT - Cairo Metro Network : Line 3 - Phase 4: Package 4B535NAT - Cairo Metro Network: Line 3 - Phase 3:Electromechanical Works530Palm Hills / Madinet Nasr : Capital Garden500MAF - Almaza City Centre450Egypt National Cancer Institute - National Cancer Institute400

TOPCLIENTSIn terms of the leading clients, therankings highlight that the marketis comprised of both governmentand private sector developers,unlike other markets where statebodies dominate.The local projects market hasbecome increasingly attractive toGulf real estate developers, likeEmaar and Al-Futtaim, as theGCC market slows and becauseEgypt has considerable long-termpotential.Egypt selected top construction and infrastructureclients by value of work under execution ( m)0SUEZ CANAL AUTHORITYEGYPT MINISTRY OF HOUSING UTILITIES& URBAN COMMUNITIESEL MOSTAKBAL URBAN DEVELOPMENTEMAAR MISREGYPT MINISTRY OF TRANSPORTCITYSTARSAL FUTTAIM GROUPCAPITAL GROUP PROPERTIES2,0004,0006,0008,00010,000

TOPCONTRACTORSIt is a similar story among the leadingcontractors. Both local and internationalfirms have been able to take advantage ofthe opportunity which again demonstratesthe openness of the local market. Chinesecontractors which have been able to bringfinancing have in particular beensuccessful in the market.Egypt selected top construction and infrastructurecontractors by value of work under execution ( m)0CHINA STATE CONSTRUCTION &HASSAN ALLAM CONSTRUCTIONPETROJETSIAC CONSTRUCTIONAL MARASEM INTERNATIONALCHINA HARBOUR ENGINEERINGVINCICHINA RAILWAYERYUAN1,0002,0003,0004,0005,0006,000

Value of Egypt planned and un-awardedcontracts by sector ( m)120,000100,00080,00060,00040,00020,0000Chemical ConstructionGasOilTransportFUTUREPIPELINEEgypt has a project pipeline largerthan any other regional market afterSaudi Arabia and the UAE which isover 300bn of known planned andun-awarded projects. Construction isby far the largest future market in thecountry with more than 120bn worthof planned projects and growing.

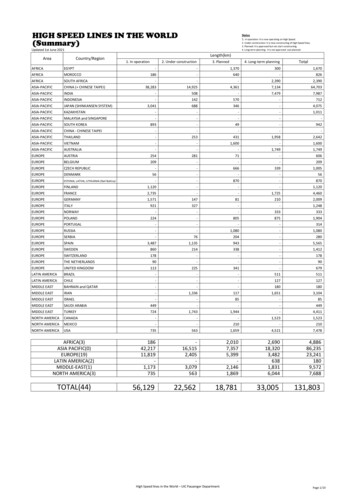

FUTURESELECTEDEGYPTPROJECTSThere are hundreds of futureconstruction and civil infrastructurecontracts across Egypt ranging fromlarge-scale real estate and tourismprojects to high speed railway andmetro schemes. In all, there hasnever been a better time to invest inthe Egyptian market.PROJECTVALUE ( M)MFTI - Golden Triangle Mining and Urban Development29,000MoHUUD – Egypt’s Social Housing Program16,600Al Habtoor Group - Al Habtoor City in Cairo8,500Palm Hills Developments - 6 October City: Badya8,494MOT - Alexandria-Aswan High Speed Railway Line:Cairo to Luxor6,335MOT - Luxor-Hurghada Railway Line4,730Saudi MOT / Egypt MOT JV King Salman Causeway (Tiran Causeway)4,000NAT - Cairo Metro Network: Line 64,000Heliopolis For Housing & Development / SODIC Mixed Use Project in Cairo3,800NAT - Cairo Metro Network: Line 53,500Egypt MOT - Alexandria: Max New Port3,378NUCA - 6th October City Residential Community3,000

FUTURESELECTEDEGYPTPROJECTS(CONTINUED)PROJECTVALUE ( M)NUCA / Mountain View / Sisban Holding JV Mountain View I-City 6th October2,000Jumeirah Real Estate / Sakan Developments JV Jumeirah Bay Ras El Hekma1,680MoH - JANNA Housing Project Egypt1,500Atraba Integrated Holding –Integrated Medical City Project in Cairo1,000MoHUD – Alamein City Hotels DevelopmentProgram at Matrouh1,000DPA - Second Container Terminal (DEPCO)1,000

SOMEACTIVEPROJECTS

01.NEW GRANDEGYPTIANMUSEUMGIZA, GREATER CAIRO

02.NEWEL-ALAMEINCITYMARKAZ AL ALAMEIN

03.NEWADMINISTRATIVECAPITALGREATER CAIRO

04.HIGH-SPEEDRAIL PLANS

05.RODAL-FARAGAXISCAIRO

06.BADYA PALMHILLSGIZA GOVERNORATE

07.JUMEIRAH BAYRAS EL-HEKMARAS ELHEKMA

MARCH 2019Prepared by Ed JamesDirector of Content & Analysis, MEED ProjectsEdward.james@meed.co

ACCUD - The Capital Cairo: Central Business District Phase 2 2,800 NUCA - The New Mansoura City 1,350 NAT - Cairo Metro Network: Line 3 - Phase 3: 1,244 El-Thawra Line Civil Work NAT - Light Rail Transit : LRT Line (66 kms) 1,240 NAT - Cairo Metro Network: Line 4: Phase 1: 950 Civil Package 1 (CP 401) Hassan Allam Properties - 800