Transcription

HEALTHCAREQ4 2020 Q1 2021The Healthcare M&A Train Keeps RollingA once-in-a-century pandemic proved to be nothing more than a briefunscheduled stop in the still expanding healthcare M&A market. Whiletransaction volume came to a screeching halt early in the second quarter of 2020, investors made up for lost time in the third and fourthquarters, driving total transaction volume for 2020 to the third highesttotal in the past decade. That torrid rate only accelerated in the firstquarter of 2021 as 530 healthcare transactions were completed, putting2021 on pace to establish a new record. Whether this pace continues,or even accelerates further, may depend on the size and effective dateof an increase in the capital gains rate.As the chart on the final page of this report illustrates, valuations as amultiple of EBITDA also remain high. Private equity groups and strategicbuyers alike have ample cash they would like to invest. They are seekingbusinesses that adapted well to the pandemic, proving they had superior management teams, technology, and/or market position. By standing out in an unusually challenging time, these targets have been ableto command premium valuations. We expect strong competition fordeals to keep valuations high throughout the remainder of 2021, withone potential caveat. If the effective date of a capital gains tax increaseis ultimately set prospectively, a flood of last-minute sellers may temporarily drive down valuations.Healthcare Transactions by Sector (LTM)Source: EdgePoint Proprietary Database, Company Filings, CapIQ,News ReleasesHealthcare Transactions by Year(Strategic Buyers Include Private Equity Owned Companies)Source: CapIQEdgePoint 2000 Auburn Drive, Suite 330 Beachwood, OH 44122 (800) 217-7139 www.edgepoint.com

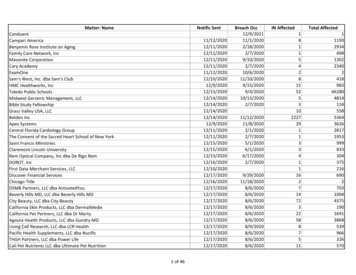

Noteworthy Home Health & Hospice Care Transactions Q1 - Q2 2017(continued)Q4 2020 Q1 2021HEALTHCAREPhysician Practices Sector ProfileAfter bottoming out in May 2020, M&A transaction volume involving physician practices has climbed steadily over the ensuing tenmonths, reaching new heights during the first quarter of 2021. Eye Care Partners has been particularly active, acquiring ten ophthalmology and two optometry practices during the fourth quarter of 2020 and the first quarter of 2021; but activity has been strongacross a wide spectrum of specialties including otolaryngology (ENT), gastroenterology, and urology which are much earlier in theirconsolidation phase than ophthalmology and dermatology. We expect deal activity and valuation multiples to remain high throughPhysician Practice Public Company EV/EBITDAPhysician Practice M&A Transaction VolumeSource: CapIQSource: CapIQNotable Physician Practice TransactionsDate ClosedBuyer / evate ENT (Audax PrivateEquity)South Florida ENT Associates,P.A.ENT practice in Texas3/26/2021ENT and Allergy Associates, LLPChelsea Otolaryngology, PLLCENT practice in New York1/5/2021ENT Partners (Harvey &Company)Arlington ENT Associates PCENT practice in VirginiaGastroenterology3/1/2021Gastro Health (Audax PrivateEquity)Digestive Disease Associates,P.A.GI practice in Maryland2/26/2021One GI (Webster Equity)Dayton Gastroenterology,LLCGI practice in Ohio11/24/2020U.S. Digestive Health (Amulet /Ashlar)Practices of BurnhanHameed, Neal Patel, MichaelPawlowsky and DrewRonnermanGI practices in PennsylvaniaObGyn2/11/2021Shore Capital Partners10/28/2020ObGyn PracticesEastside Gynecology Obstetrics/ Comprehensive Woman'sCareThe Women's Health Group, P.C.EdgePoint 2000 Auburn Drive, Suite 330 Beachwood, OH 44122 (800) 217-7139 www.edgepoint.com

Noteworthy Home Health & Hospice Care Transactions Q1 - Q2 2017(continued)Q4 2020 Q1 2021HEALTHCARENotable Physician Practice Transactions (Cont)Date ClosedBuyer / InvestorTargetDescriptionOphthalmology / Optometry Q4 2020—Q1 2021Eye Care Partners (PartnersGroup)10 Ophthalmology and2 Optometry practices Frisco Eye Associates/ Assets of Woodlands EyecarePrecision Vision Surgery Center LLCCataract Institute of Oklahoma, LLC/ BSB Equipment,LLC/ Sudden Valley Holdings, LLC/ Barby-Bogie LLCEye Associates Of Oklahoma PLLC/ Precision VisionCare, LLC/ Eye Physicians Optical, LLCThomas J Byrd MD, PLLCTuscaloosa Ophthalmology, Inc./Riverside Optical, Inc./Vision Correction Center, LLCDouble Vision PCFive Eyes First Vision Centers in US of EyeCare Management, LLCTukel-Kozlow Eye Center, P.C.Epic Vision/Eye Care OklahomaEast Texas Eye Care Associates, PLLC/ Eye Surgery Center of East Texas, PLLCBlue Sky Vision, LLC12/22/20202/25/20211/11/2021EyeSouth Partners (ShoreCapital)Ophthalmology PracticesEye Center Of Texas LLPNorth Georgia Eye Clinic, P.C.MidWest Eye Center1/28/2021CEI Vision Partners(Revelstroke Capital Partners)Tidewater Eye Centers, Inc.Ophthalmology practice in VirginiaUrology3/2/20211/12/2021Solaris Health LLC(Lee Equity Partners)Urology practices in IL andPAAssociated Urological Specialists, LLCMidLantic Urology LLC1/11/2021CUA OPCO, LLCUrological Associates OfSouthern Arizona, P.C./Arizona Institute of UrologyUrology practice in AZ11/2/2020Middlesex UrologyMiddlesex Health UrologyUrology practice in CTOther1/7/2021Smile Partners (Silver OakService Partners)PEDIADentistry practice3/3/20213/3/2021U.S. Orthopedic Partners (FFLPartners)Orthopedic and pain management practicesOxford Orthopedics and Sports Medicine, PLLCJackson Anesthesia Pain Center, PLLC3/30/2021SOC Telemed, Inc.(NasdaqGS:TLMD)Access Physicians Management Services Organization,LLCMultispecialty group specializing in telemedicineEdgePoint 2000 Auburn Drive, Suite 330 Beachwood, OH 44122 (800) 217-7139 www.edgepoint.com

Noteworthy Home Health & Hospice Care Transactions Q1 - Q2 2017(continued)Q4 2020 Q1 2021HEALTHCAREHome Health & Hospice Sector ProfileHome health public company valuation multiples have moderated a bit of late, but they remain high relative to historical valuationsand other healthcare service providers (see our comparison on page 8). Investors continue to place a premium on services that reduce the total cost of care, are well-positioned to benefit from the demographic tide of baby boomers hitting their 70s, and cater topatients seeking alternatives to a nursing home. We anticipate that transaction volume and valuations will remain strong throughout2021 as concerns over the pandemic dissipate.Home Health & Hospice Company EV/EBITDAHome Health & Hospice M&A Transaction VolumeSource: CapIQSource: CapIQNotable Home Health and Hospice TransactionsBuyer / InvestorTarget12/4/202011/11/202011/2/2020Addus HomeCare Corporation(NasdaqGS:ADUS)Two home health companiesand one hospice companySunLife Home Care, LLCQueen City Hospice, LLCCounty HomeMakers, Inc.1/21/202112/15/2020Amazing Care Home HealthServices Inc.Private duty and HomeHealth companiesIvy Lane PediatricsLakeway Home HealthAveanna Healthcare HoldingsInc. (NasdaqGS:AVAH)Recover Health, Inc.Midwest based home health company10/30/2020Centerbridge Partners, L.P.;The Vistria Group, LLCHelp At Home, LLC(OTCPK:HAHI)Home care services2/16/202110/13/2020Charter Health Care Group, LLCTwo hospice providersPhysmed, Incorporated/Serene Care HospiceHeartwood Home Health & Hospice, LLC/ Phoenix HomeCare, Inc.1/25/2021Grant Avenue Capital, LLCValeo Home Health and HospiceHome health and hospice company based in Utah10/19/2020H.I.G. Capital, LLCSt. Croix Hospice, LLCHospice provider11/12/202011/9/202010/1/2020LHC Group, Inc.(NasdaqGS:LHCG)Three hospice providersGrace Hospice of Oklahoma, LLCEast Valley Hospice/ East Valley Palliative CareSanta Rita Hospice, Inc.1/19/202111/2/2020The Pennant Group, Inc.(NasdaqGS:PNTG)Two home health agenciesSacred Heart Home Healthcare LLCRiverside Home Health Care1/5/202112/1/2020Traditions Health, LLCFive home health agenciesCombined operations of four home health businessesHospice Of America, Inc.12/7/2020VersiCare GroupAssociates in PediatricTherapy, LLCPediatric home healthDate Closed2/1/2021DescriptionEdgePoint 2000 Auburn Drive, Suite 330 Beachwood, OH 44122 (800) 217-7139 www.edgepoint.com

Noteworthy Home Health & Hospice Care Transactions Q1 - Q2 2017(continued)Q4 2020 Q1 2021HEALTHCAREBehavioral Health Sector ProfileThe pandemic brought the importance of integrating behavioral health better with medical care to maintain good community healthinto sharp focus for providers, payers, and investors. Behavioral health providers adapted quickly to using telemedicine to meet thesurging demand for mental health services, which in turn attracted even greater investment in an already robust M&A market sector.While we anticipate that acquisitions of addiction treatment centers will remain the most active subsector, the number of privateequity firms investing in a broader scope of mental health services is growing rapidly. We expect to see M&A transaction volume andvaluations continuing to rise through 2021.Behavioral Health Company EV/EBITDABehavioral Health M&A Transaction VolumeSource: CapIQSource: CapIQNotable Behavioral Health TransactionsDate Closed3/26/20212/17/2021Buyer / InvestorAppleGate RecoveryTargetDescriptionTwo addiction treatmentbusinesses in TennesseeMontgomery Addiction Clinic, PLLCRedemption Recovery Center 20BayMark Health Services Inc.Outpatient and MATtreatment businessesThe Foundation for Contemporary Mental HealthEcho Treatment Center, LLCChoices of Louisiana, Inc.Liberty Bay Recovery Center, LLCLimestone Health, LLC11/2/202010/16/202010/2/2020Behavioral Health Group, Inc.MAT treatment centersWellness Ambulatory Care IncHuntsville Recovery, Inc./ Stevenson Recovery, Inc.Center for Treatment & Recovery (CTR), LLCBrightView, LLCRenew Recovery LLCOutpatient addiction treatmentKelso & Company, L.P.Refresh Mental Health, IncDiversified mental health company1/4/2021Odyssey Behavioral HealthcareLLCShoreline Center in LongBeach and Laguna Hills,CaliforniaEating disorder treatment center1/11/2021Summit Behavioral Healthcare,LLCThe Pavilion/The FarleyCenterPsychiatric services and PHP/IOP addiction treatment2/8/2021Bridges Inc.Proud Moments LicensedBehavior Analysts PLLCAutism services3/2/2021Community PsychiatryManagement, LLCHarbor Psychologist, Inc.Community mental health1/6/202112/10/2020EdgePoint 2000 Auburn Drive, Suite 330 Beachwood, OH 44122 (800) 217-7139 www.edgepoint.com

Noteworthy Home Health & Hospice Care Transactions Q1 - Q2 2017(continued)Q4 2020 Q1 2021HEALTHCAREEquipment & Supplies Sector ProfileCompanies involved in the manufacture and distribution of medical equipment and supplies accounted for nearly one of every sevenhealthcare transactions over the past year. Transaction volume in this sector rebounded more rapidly than other sectors, returningto pre-COVID levels in April and maintaining that average through September before accelerating rapidly in the fourth quarter of2020 and the first quarter of 2021. Public company valuation multiples also remain strong, reflecting continued robust demand forproducts despite disruption to the supply chain due to the pandemic. We expect this sector to remain stable for the remainder of2021.Equipment & Supplies Company EV/EBITDAEquipment & Supplies M&A Transaction VolumeSource: CapIQSource: CapIQNotable Equipment & Supplies TransactionsDate ClosedBuyer / InvestorTargetDescription1/12/2021Audax Management Company,LLC; Linden LLCSLMP, LLCManufactures and supplies consumable supplies to anatomicpathology laboratories12/11/2020DJO Global, Inc.LiteCure, LLCDesigns and manufactures medical devices for medical andveterinary healthcare professionals1/19/2021DJO, LLCTrilliant Surgical, LLCManufactures podiatric products for small bone orthopediccorrection10/22/2020Havencrest CapitalManagement, LLCThermoTek, Inc.Designs and manufactures medical devices and precisionthermal management solutions3/12/2021Hellman & Friedman LLCCordis CorporationDevelops interventional medical devices for cardiovascular,endovascular, and biliary duct (liver) treatments.10/6/2020STERIS Corporation(BOVESPA:S1TE34)Key Surgical, Inc.Manufactures sterile processing, operating room, and otherinstrument care supplies1/12/2021STERIS plc (NYSE:STE)Cantel Medical Corp.(NYSE:CMD)Provides infection prevention and control products andservices for the healthcare market1/5/2021Stryker Corporation (NYSE:SYK)OrthoSensor, Inc.Develops and commercializes orthopedic devices and dataservices to surgeons and hospitals.10/28/2020Teleflex Incorporated(NYSE:TFX)Z-Medica, LLCEngages in the development, production, marketing, andsale of hemorrhage control products12/1/2020Zimmer Biomet Holdings, Inc.(NYSE:ZBH)A&E Medical CorporationManufactures and sells medical devicesEdgePoint 2000 Auburn Drive, Suite 330 Beachwood, OH 44122 (800) 217-7139 www.edgepoint.com

Noteworthy Home Health & Hospice Care Transactions Q1 - Q2 2017(continued)Q4 2020 Q1 2021HEALTHCARELong-Term Care Sector ProfileM&A transaction volume in the long-term care sector, which had been on the decline since early 2019, dropped precipitously inMarch and April 2020 as the tragic impact of COVID-19 on senior facilities filled media reports. The industry is struggling to regaincensus even as a successful roll-out of vaccines appears to have reduced the incidence of new infections among the elderly significantly; but demographic trends still favor the industry over the long-term. We expect the uptick in transaction volume in the firstquarter to persist as investors seek to gain market share.Long Term Care Company EV/EBITDALong Term Care M&A Transaction 202010.0x5.0x0.0x201620172018LTMSource: CapIQSource: CapIQNotable Long Term Care TransactionsDate ClosedBuyer / Investor11/17/2020Arsenal Capital PartnersBest Value Healthcare LLCIndependent senior living in Florida3/9/202111/17/2020CareTrust REIT, Inc.(NasdaqGS:CTRE)Buena Vista Care CenterFour Post-Acute Care Facilities in TexasSkilled nursing facilities11/2/2020Eagle Arc PartnersVarious20 Skilled Nursing Facilities12/22/2020Livingston Street Capital, LLCAlta at Regency CrestIndependent senior living in Maryland2/1/2021New Haven Assisted Living andMemory Care48-unit memory care facilityat 747 Alpine DriveAssisted living / memory care3/23/2021Sabra Health Care REIT, Inc.(NasdaqGS:SBRA)100-unit senior housingfacility in Augusta, GeorgiaAssisted living11/25/2020SRZ Management282-bed skilled nursing facilitySkilled nursing facility2/2/2021The Ensign Group, Inc.(NasdaqGS:ENSG)Operations of Nursing Facilityin San AntonioOperations of AdventHealthCare Center San MarcosTwo skilled nursing facilities2/12/2021Welltower Inc. (NYSE:WELL)HarborChase of JacksonvilleAssisted livingTargetDescriptionEdgePoint 2000 Auburn Drive, Suite 330 Beachwood, OH 44122 (800) 217-7139 www.edgepoint.com

Q4 2020 Q1 2021HEALTHCAREPublic Company Comparisons Trading MultiplesSource: CapIQ, public trading data as of November 20, 2020Source: CapIQ, public trading data as of May 24, 2021Representative EdgePoint Healthcare TransactionsEdgePoint is an independent, advisory-focused,investment banking firm serving the middle market.EdgePoint 2000 Auburn Drive, Suite 330 Beachwood, OH 44122 (800) 217-7139 www.edgepoint.com

Urological Associates Of Southern Arizona, P./ Arizona Institute of Urology Urology practice in AZ 11/2/2020 Middlesex Urology Middlesex Health Urology Urology practice in T Other 1/7/2021 Smile Partners (Silver Oak Service Partners) PEDIA Dentistry practice 3/3/2021 3/3/2021 .