Transcription

AnnualReportand Form 20-F20163

The energy we produce serves topower economic growth and liftpeople out of poverty. In the future,the way heat, light and mobility aredelivered will change. We aim toanchor our business in these changingpatterns of demand, rather than in thequest for supply. We have a realcontribution to make to the world’sambition of a low carbon future.ContentsStrategic reportCorporate governanceAdditional disclosuresOverview51 Contents52 Board of directors58 Executive team62 Introduction from the chairman64 Board activity in 201668 Shareholder engagement68 International advisory board69 Audit committee74 Safety, ethics and environmentassurance committee76 Remuneration committee78 Geopolitical committee79 Chairman’s committee79 Nomination committee80 Directors’ remuneration report and2017 policy111 Directors’ statements239 Contents Including information on liquidityand capital resources, oil and gasdisclosures, upstream regionalanalysis and legal proceedings.246810BP at a glanceChairman’s letterGroup chief executive’s letterThe changing world of energyHow we run our businessStrategy1418Our strategyMeasuring our 2016 progressPerformance202124303537404749Challenging global energy marketsGroup performanceUpstreamDownstreamRosneftOther businesses and corporate37 Gulf of Mexico oil spill38 Alternative energySustainability40 Safety43 Climate change44 Value to society44 Human rights44 Local environmental impacts45 Ethical conduct46 Our peopleHow we manage riskRisk factorsShareholder information271 Contents Including information on dividends, ourannual general meeting and share prices.280285288289290GlossaryNon-GAAP measures reconciliationsSignaturesCross-reference to Form 20-FInformation about this reportFinancial statements113 Contents114 Consolidated financial statementsof the BP groupGlossary Words with this symbol are definedin the glossary on page 280.126 Notes on financial statements187 S upplementary information on oiland natural gas (unaudited)215 Parent company financial statementsof BP p.l.c.Cautionary statementThis document should be read inconjunction with the cautionarystatement on page 269.

For a secure,affordableand sustainableenergy future.BP Annual Report and Form 20-F 20161

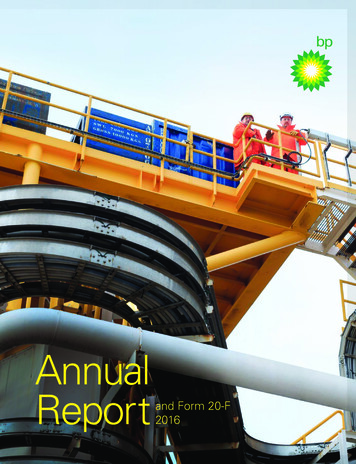

BP at a glanceWe are a global energy companywith wide reach across theworld’s energy system. We haveoperations in Europe, North andSouth America, Australasia, Asiaand n barrels of oil equivalent –proved hydrocarbon reservesa18,0006,000 retail sitesmarine voyages completedby BP-operated andchartered vesselsBP in actionSome highlights of our activitiesaround the world in 2016.Started up the PointThomson major project .Increased the number of M&SSimply Food and REWE convenience stores in Europeand launched BP fuels withACTIVE technology.Formed Aker BP, Norway’slargest independent oil and gasproducer with Det norske.Signed principles ofagreement on futuredevelopment of the ACG oilfield to 2050 in Azerbaijan.Started up two majorprojects in Algeria.Entered into a strategicpartnership with FulcrumBioEnergy – a company thatproduces sustainable jet fuelfrom household waste.Started up two majorprojects and sanctionedMad Dog phase 2 inthe Gulf of Mexico.Sanctioned our onshorecompression projectin Trinidad.More than doubled ourproduction of ethanolequivalent since 2011in renewables.2BP Annual Report and Form 20-F 2016Completed Whitingrefinery’s largest turnaround.Restarted AngolaLNG plant.Acquired interests in gasexploration blocks in offshoreMauritania and Senegal withKosmos Energy.BP and Rosneft separatelyagreed to buy interests inthe Zohr gas field in Egyptfrom Eni.

Strategic report – overviewData as at or for the year ended31 December 2016 unless otherwise stated.Performance 115m3.316profit attributable to BP shareholders(2015 6.5bn loss)million barrels of oil equivalent per day– hydrocarbon productiona(2015 3.2mmboe/d)tier 1 process safety events(2015 20) 2.6bn109%underlying replacementcost profit(2015 5.9bn)group proved reservesreplacement ratio a b(2015 61%)On a combined basis of subsidiariesand equity-accounted entities.b Including the impact of the Abu Dhabi onshore oilconcession renewal.a Agreed to extend the licencearea of the Khazzan gas fieldin Oman and renewed ourinterest in Abu Dhabi ADCOonshore oil concession.Completed a deal to conductexploration in East and WestSiberia with Rosneft.Announced two agreementswith China National PetroleumCompany for shale gasexploration in the SichuanBasin, and launched CastrolMAGNATEC engine oil withDUALOCK technology inDownstream.Gained approval todevelop the Tangguhexpansion project,adding a thirdLNG train .More informationAnnounced plans for a strategicpartnership with Woolworths to deliver fuel and convenienceoffers in Australia.Group performancePage 21UpstreamPage 24DownstreamPage 30RosneftPage 35Alternative energyPage 38See Glossary.BP Annual Report and Form 20-F 20163

Chairman’s letterDear fellow shareholder,2016 was a year of change on many fronts. The globalcommunity witnessed further challenges raised byeconomic, political and social forces, and many nationsexperienced internal stresses and tensions, whichremain present. In the energy world, our world, it hasbeen a period of transition. From a 12-year low in oilprices, to digital technologies that are transforming howwe work, and the drive to a lower carbon economy, ourteam has had to manage through a period of uncertainty,complexity and volatility.Against this backdrop, we have shown great resilienceand character: we returned to profit and maintained ourdividend. We had a good year in a tough environment.We have set a new strategic direction for BP – and wehave a great team carrying it out.The record since 2010BP’s performance in 2016 was based on the foundationsrebuilt following the 2010 Deepwater Horizon accident– an event that could have put the very existence of ourcompany at risk.Over the past six years, Bob Dudley and his team havesteered the business through the recovery from the crisisof 2010 and then through the response to lower oil andgas prices.We have shown great resilience and character: wereturned to profit and maintained our dividend. We had agood year in a tough environment. We have set a newstrategic direction for BP – and we have a great teamcarrying it out.During that period, safety has improved significantly. Theportfolio has been strengthened. Operating cash flowhas remained strong. The dividend has been restoredand increased. Investment for growth has continued,while capital and costs have been controlled. Therelationships on which we depend have been deepened.And all of this has been done while managing a chargeof 63 billion for the 2010 accident, for which the majorliabilities have now been clarified and for which we havea plan to manage the remaining payments and residuallitigation. All of this sets a firm base for the future, whichis bound to have its own challenges.2016 performance and shareholderdistributionsIn 2016 the team has again focused on the carefulstewardship of shareholders’ investments.We continued making progress in safety performance,with serious incidents and injury rates falling. Wedelivered strong cash flow, disciplined capital spendingand lower costs. We met our cost reduction target ayear early. New major projects took shape. And we havecontinued to invest in opportunities for future growth,securing a set of innovative portfolio additions as well asdivesting non-strategic assets.This performance enabled us to maintain the dividend at10 cents per ordinary share through 2016 and the board’spolicy remains to grow sustainable free cash flow anddistributions to shareholders.Looking aheadWe can now look forward and outward, and the boardand executive team have set out BP’s strategic prioritiesfor the future.Caption: Members of the boardexamine BP operations at Bakuin Azerbaijan.4BP Annual Report and Form 20-F 2016

As our BP Energy Outlook 2035 predicts, the growth inconsumption of oil will gradually slow and likely peak.This is a result of slowing demand growth, not limitedsupply, as was once thought. In a world of longer-termabundance, oil prices are likely to remain under pressure.Focus will shift to greater efficiency and low-costproduction. Gas will grow as a cleaner alternative tocoal. Advanced fuels and lubricants will help motoristsreduce emissions. Renewable energy will grow rapidly tobecome commercial at scale.As a global business, we plan to play our part in thisenergy transition. Our strategy provides BP with greateragility – combining lower cost oil production, increasinggas supply, greater market-led downstream activities,and growing renewables and venturing businesses.We are also proud to be playing a leading role amongour peers through the Oil and Gas Climate Initiative,where Bob’s chairmanship has seen an unprecedentedconvergence of national and international energycompanies to act on this issue.RemunerationAt the 2016 AGM, we heard a clear message fromshareholders on executive pay. During the past year wehave sought to address these concerns, recognizing theyreflect the concerns of society more broadly.The decisions we have taken, and for which we seekshareholder approval, mark a significant break from pastpolicy. The total pay for executive directors in 2016 ismuch reduced compared to 2015.The policy we propose for 2017 and beyond is a simplerapproach to executive remuneration and reduces thetotal amount executive directors can earn compared withthe previous policy. Executive reward will be driven evenmore closely than before by the company’s performanceand shareholder returns. I particularly want to emphasizethat the future remuneration of senior management willbe directly linked to the delivery of our new strategicpriorities, including BP’s contribution to the longer-termtransition in supplying lower carbon energy to drive theglobal economy.This new approach aims to take account of shareholderconcerns on the level of executive pay while recognizingthe clear need for a global business like BP to attractand retain the best talent. With those two primaryconsiderations in mind, my fellow board members andI believe the new policy to be appropriate, balanced andresponsive to all those we serve as a business.Governance and the boardToday’s world presents a range of risks – operational,commercial, geopolitical, environmental and financial. Onthe board, we aim to maintain the breadth and depth ofexperience needed to fulfil our critical role of monitoringand managing those risks, working with the executiveteam.In 2016 Nils Andersen joined us as a non-executivedirector, bringing considerable insight gained in theSee Glossary.Strategic report – overview 7.5bnOur refreshed strategy is designed to ensure BP is ‘goodfor all seasons’ in an uncertain environment. It enablesus to compete in a world of volatile oil and gas prices,changing customer preferences and of course, thetransition to a lower carbon future.total dividends distributedto BP shareholders6.0%ordinary shareholdersannual dividend yieldenergy, shipping and consumer goods industries. Hehas led major companies, including as chief executive ofA.P. Møller-Mærsk A/S and Carlsberg A/S.Cynthia Carroll and Andrew Shilston are standing downas directors at the forthcoming AGM. On behalf of theboard I thank them for the substantial contributionsthey have made to our work both in the board and itscommittees over the years in some difficult times.6.4%ADS shareholdersannual dividend yieldThe board is proposing that Melody Meyer is electedas a director at the AGM. Melody has had an extensivecareer in the global oil and gas industry with Chevron andwill bring experience of safe and efficient operations andworld class projects. We continue to work to increasethe diversity of the board as this enhances independentthinking and healthy challenge.ConclusionBP is a global business operating in over 70 countries. Todo this effectively over the long term, we need the trustof our shareholders that we will deliver value, but also thetrust of the societies where we work – both at home andacross the world.I believe this report, along with our SustainabilityReport, demonstrates BP’s progress in working forall stakeholders, shareholders, customers, partners,governments, employees and communities.Bob and his team have guided BP from a time of crisisin 2010 to a position where we have sound prospectsfor greater value creation and growth in the years ahead.Please join me in thanking Bob and his team for theirexceptional stewardship of BP. Thank you to the boardand to all our employees – and thank you all for yourcontinued support.We are now beginning a new journey.Carl-Henric SvanbergChairman6 April 2017Caption: Meeting employeesin Brazil.More informationCorporate governancePage 51BP Annual Report and Form 20-F 20165

Group chief executive’s letterDear fellow shareholder,In 2016 BP started to look forward again. It may havebeen one of the toughest years we have yet seen in thebusiness environment, with oil prices the lowest since2004. But it was a year when we turned the challengesinto opportunities, finding new ways to compete andgrow in a fast-changing industry. Over the last six years,we have been making BP safer, stronger and moreresilient. And in 2016 we once again began buildingfor growth and setting a course for a low cost, lowercarbon future.Our resultsOur top priority is always safety and in 2016 wecontinued the progress made in recent years, with 80%fewer serious incidents and a 40% lower injury rate thanin 2011. A good safety record is one sign of disciplinedoperations. Another sign is reliability – and here too wehave seen improvement, with upstream plant reliabilityof 95% – up from 86% in 2011 – and refining availabilityof 95.3%, maintaining our strong record in recent years.Since 2010, BP’s story has been one of recovery,rebuilding and resilience. Now we

2 BP Annual Report and Form 20-F 2016 BP in action BP at a glance We are a global energy company Scale with wide reach across the world’s energy system. We have operations in Europe, North and South America, Australasia, Asia and Africa. 74,500 72 17,810 employees countries million barrels of oil equivalent – proved hydrocarbon reserves a