Transcription

List of State Residual Insurance Market Entitiesand State Workers’ Compensation FundsOn November 26, 2002, President Bush signed into law the Terrorism Risk Insurance Actof 2002 (Public Law 107-297, 116 Stat. 2322). Section 102(6)(A)(iv) of the Act providesthat insurers required to participate in the Program include State residual marketinsurance entities or State workers’ compensation funds. These entities are generallyreferred to as “residual market mechanisms.”Treasury published a final rule in the Federal Register at 68 FR 59715 (October 17, 2003)that addressed issues associated with the participation of residual market mechanismsunder the Program. In particular, Section 50.30(c) of the final rule provides that Treasurywill release and maintain a list of state residual market mechanisms that are mandatoryparticipants in the Program. As Treasury indicated in its discussion of the final rule, wewill maintain and continue to update the list from time to time.It should be noted that the list that follows is intended to provide guidance and certaintyto those entities that are required to participate in the Program. The list was developed inconsultation with the National Association of Insurance Commissioners, and it reflectsTreasury’s efforts to identify residual market mechanisms that are required to participatein the Program. However, the list is not exclusive, and a residual market mechanism thatmeets the requirements for Program participation should not assume that because it hasbeen excluded from the list that it is excluded from Program participation. If a residualmarket mechanism has questions regarding their inclusion or exclusion from this list, ortheir overall participation in the Program, they should contact the Terrorism RiskInsurance Program, Suite 2100, Department of the Treasury, 1425 New York .Ave., NW.,Washington, DC 20220 (202-622-6770).

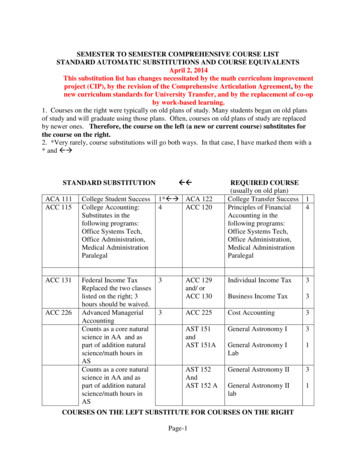

List of State Residual Market Entities and State Workers’ Compensation Funds (October 17, rkers’ CompensationNational Workers’ CompensationReinsurance Pool (NWCRP)NWCRPNWCRPConnecticutNWCRPThe California State CompensationInsurance FundPinnacol Assurance Fund(previously known as the ColoradoCompensation Insurance AuthorityFund)NWCRPDelawareNWCRPDistrict ofColumbiaNWCRPFloridaFlorida Workers’ CompensationJoint Underwriting AssociationNWCRPColoradoGeorgiaHawaiiIdahoHawaii Employers’ MutualInsurance Company, Inc.NWCRPIllinoisNWCRPAutomobileAlabama Commercial AutoInsurance ProcedureAlaska Servicing Carrier ProgramArizona Commercial AutoInsurance ProcedureArkansas Special Risk ProgramCalifornia Commercial AutoInsurance ProcedureColorado Commercial AutoInsurance ProcedurePropertyAlabama Insurance UnderwritingAssociation (Beach Plan)Connecticut Commercial AutoInsurance ProcedureDelaware Commercial AutoInsurance ProcedureD.C. Auto Insurance PlanConnecticut FAIR PlanFlorida Automobile JointUnderwriting AssociationGeorgia Commercial AutoInsurance ProcedureHawaii Joint Underwriting ProgramIdaho Commercial Auto InsuranceProcedureIllinois Commercial Auto InsuranceProcedureArkansas FAIR PlanCalifornia FAIR Plan AssociationInsurance Placement Facility ofDelaware (FAIR Plan)District of Columbia PropertyInsurance Placement Facility (FAIRPlan)Citizens Property InsuranceCorporationGeorgia Underwriting Association(FAIR Plan)Hawaii Property InsuranceAssociationIllinois FAIR Plan AssociationIllinois Mine Subsidence FundLiability

StateIndianaWorkers’ CompensationNWCRPAutomobileIndiana Commercial AutoInsurance ProcedureIowaNWCRPKansasNWCRPKentuckyThe Kentucky Employers’ MutualInsurance AuthorityIowa Commercial Auto InsuranceProcedureKansas Commercial Auto InsuranceProcedureKentucky Commercial AutoInsurance ProcedureLouisianaLA Workers’ Compensation CorpLouisiana Commercial AutoInsurance ProcedureMaineMaine Employers’ MutualInsurance Company (MEMIC)The Injured Workers’ InsuranceFund of MarylandMassachusetts Workers’Compensation Assigned Risk PoolMaine Commercial Auto InsuranceProcedureMaryland Automobile InsuranceFundCommonwealth AutomobileReinsurersThe Michigan Workers’Compensation Placement FacilityThe Minnesota State Fund MutualInsurance CompanyMichigan Automobile InsurancePlacement FacilityMinnesota Commercial AutoInsurance ProcedureMarylandMassachusettsMichiganMinnesotaThe Minnesota Workers’Compensation ReinsuranceAssociation2PropertyIndiana Basic PropertyUnderwriting Association (FAIRPlan)LiabilityIndiana Mine Subsidence FundIowa FAIR Plan AssociationKansas All-Industry PlacementFacility (FAIR Plan)Kentucky FAIR Plan andReinsurance AssociationKentucky Mine Subsidence FundLouisiana Insurance UnderwritingAssociation (Beach Plan)Louisiana Joint Reinsurance Plan(FAIR Plan)Joint Insurance Association (FAIRPlan)Massachusetts Property InsuranceUnderwriting Association (FAIRPlan)Michigan Basic Property InsuranceAssociation (FAIR Plan)Minnesota FAIR PlanMinnesota Joint UnderwritingAssociation

StateMississippiWorkers’ CompensationMississippi Workers’Compensation Assigned Risk PlanAutomobileMississippi Commercial AutoInsurance ProcedureMissouriThe Travelers Insurance Company1MontanaNebraskaThe Montana State CompensationInsurance FundThe Travelers Insurance Company2NevadaNWCRPNewHampshireNew JerseyNWCRPMissouri Joint UnderwritingAssociationMontana Commercial AutoInsurance ProcedureNebraska Commercial AutoInsurance ProcedureNevada Commercial AutoInsurance ProcedureNew Hampshire Commercial AutoInsurance ProcedureNew Jersey Commercial AutoInsurance ProcedureNew Mexico Commercial AutoInsurance ProcedureNew York Special Risk DistributionProgram/New York Public AutoProgramNorth Carolina Reinsurance FacilityNew MexicoNew YorkNorth CarolinaNWCRPNew Mexico Workers’Compensation Assigned Risk PoolThe New York State InsuranceFundNWCRPPropertyMississippi WindstormUnderwriting Association (BeachPlan)LiabilityMississippi FAIR PlanMissouri Property InsurancePlacement Facility (FAIR Plan)New Jersey Insurance UnderwritingAssociation (FAIR Plan)New Mexico Property InsuranceProgram (FAIR Plan)New York Property InsuranceUnderwriting Association (FAIRPlan)North Carolina InsuranceUnderwriting Association (BeachPlan)North Carolina Joint InsuranceReinsurance Association (FAIRPlan)1Travelers retains all losses unless the ratio of paid losses to collected premiums exceeds 100%. If that occurs the Missouri Aggregate Excess of LossReinsurance Mechanism will spread the excess losses among all insurers writing workers’ compensation business in Missouri (See § 287.896 and Regulation 20CSR 500-6.700).2The only losses that would be spread to the voluntary market would be if there was a single loss in excess of 10 million.3

StateNorth DakotaOhioWorkers’ CompensationThe North Dakota Workers’Compensation BureauThe Ohio Bureau of Workers’CompensationAutomobileNorth Dakota Commercial AutoInsurance ProcedureOhio Commercial Auto InsuranceProcedurePropertyOhio FAIR Plan AssociationOhio Windstorm Reinsurance PoolOhio Mine Subsidence FundOklahomaOregonThe Oklahoma State InsuranceFund (a.k.a. CompSourceOklahoma)NWCRPPennsylvaniaThe Pennsylvania State Worker’sInsurance FundPuerto RicoSouth CarolinaThe State Insurance FundCorporation of Puerto RicoThe State Workers’ CompensationInsurance Fund a/k/a The BeaconMutual Insurance CompanyNWCRP3South DakotaNWCRPTennesseeTennessee Aggregate Excess ofLoss Reinsurance MechanismThe Texas Workers’ CompensationInsurance Fund a/k/a Texas MutualInsurance CompanyThe Workers’ Compensation Fundof UtahRhode IslandTexasUtah3Oklahoma Commercial AutoInsurance ProcedureOregon Commercial AutoInsurance ProcedurePennsylvania Commercial AutoInsurance Procedure/Pennsylvania Pooled CommercialAssignment ProcedureAssigned Risk PlanOregon FAIR Plan AssociationRhode Island Commercial AutoInsurance ProcedureRhode Island Joint ReinsuranceAssociation (FAIR Plan)South Carolina Commercial AutoInsurance ProcedureSouth Carolina Wind and HailUnderwriting Association (BeachPlan)Commercial Auto InsuranceProcedureTennessee Commercial AutoInsurance ProcedureTexas Automobile Insurance PlanUtah Commercial Auto InsuranceProcedureEffective May 1, 2003.4Insurance placement Facility ofPennsylvania (FAIR Plan)Tennessee Mine Subsidence FundTexas Windstorm InsuranceAssociation (Beach Plan)Liability

StateVermontWorkers’ CompensationNWCRPVirgin IslandThe Government Insurance Fund ofthe Virgin IslandsNWCRPVirginiaWashingtonWest VirginiaWisconsinWyomingAutomobileVermont Commercial AutoInsurance ProcedureVirginia Commercial AutoInsurance ProcedureThe Washington State Fund (Part ofthe Washington Department ofLabor & Industries)The West Virginia Workers’Compensation Fund (Part of theWest Virginia Workers’Compensation Division)Washington Commercial AutoInsurance ProcedureThe Wisconsin CompensationRating BureauThe Wyoming Division of Worker’Safety & CompensationWisconsin Special Risk ProgramWest Virginia Commercial AutoInsurance ProcedureWyoming Commercial AutoInsurance Procedure5PropertyVirginia Property InsuranceAssociation (FAIR Plan)Virginia Mine Subsidence FundWashington FAIR PlanWest Virginia Essential PropertyInsurance Association (FAIR Plan)West Virginia Mine SubsidenceFundWisconsin Insurance Plan (FAIRPlan)Liability

Maryland Automobile Insurance Fund Joint Insurance Association (FAIR Plan) Massachusetts Massachusetts Workers' Compensation Assigned Risk Pool Commonwealth Automobile Reinsurers Massachusetts Property Insurance Underwriting Association (FAIR Plan) Michigan The Michigan Workers' Compensation Placement Facility Michigan Automobile Insurance