Transcription

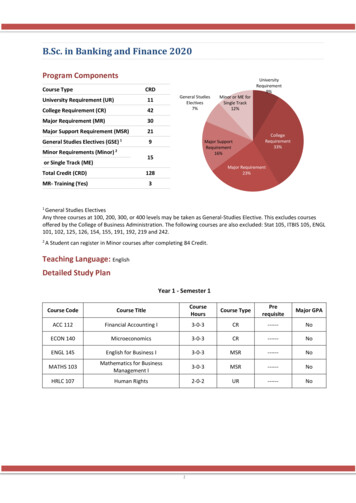

B.Sc. in Banking and Finance 2020Program ComponentsCourse TypeUniversityRequirement9%CRDUniversity Requirement (UR)11College Requirement (CR)42Major Requirement (MR)30Major Support Requirement (MSR)21General Studies Electives (GSE) 19Minor Requirements (Minor) 2General StudiesElectives7%Major SupportRequirement16%15or Single Track (ME)Total Credit (CRD)128MR- Training (Yes)3Minor or ME forSingle Track12%CollegeRequirement33%Major Requirement23%1General Studies ElectivesAny three courses at 100, 200, 300, or 400 levels may be taken as General-Studies Elective. This excludes coursesoffered by the College of Business Administration. The following courses are also excluded: Stat 105, ITBIS 105, ENGL101, 102, 125, 126, 154, 155, 191, 192, 219 and 242.2A Student can register in Minor courses after completing 84 Credit.Teaching Language: EnglishDetailed Study PlanYear 1 - Semester 1Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMajor GPAACC 112Financial Accounting I3-0-3CR------NoECON 140Microeconomics3-0-3CR------NoENGL 145English for Business I3-0-3MSR------NoMATHS 103Mathematics for BusinessManagement I3-0-3MSR------NoHRLC 107Human Rights2-0-2UR------No1

Year 1 - Semester 2Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMajor GPAACC 113Financial Accounting II3-0-3CRACC 112NoARAB 110Arabic Language Skills3-0-3UR------NoECON 141Macroeconomics3-0-3CRECON 140NoENGL 146English for Business II3-0-3MSRENGL 145NoMGT 230Organization and Management3-0-3CR------NoMATHS 104Mathematics for BusinessManagement II3-0-3MSRMATHS 103NoCourseHoursCourse TypePrerequisiteMajor GPA3-2-3MSR------No3-0-3UR------NoYear 2 - Semester 3Course CodeBIS 202HIST 122Course TitleComputers and BusinessInformation SystemsModern History of Bahrain andCitizenshipFIN 220Financial Management I3-0-3CRACC 113YesMGT 233Organizational Behavior3-0-3CRMGT 230NoMKT 261Marketing Management3-0-3CR------NoQM 250Introduction to Statistics3-0-3CRMATHS 104NoYear 2 - Semester 4Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMajor GPAISLM 101Islamic Culture3-0-3UR------NoFIN 221Financial Markets and Institutions3-0-3CRECON 141 &FIN 220YesMGT 437Business Ethics3-0-3CRMGT 233NoLAW 238Commercial Law3-0-3MSR------NoMKT 264Intermediate Marketing3-0-3CRMKT 261NoGSE XXXGeneral Studies Elective 13-0-3GSE------No2

Year 3 - Semester 5Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMajor GPAENGL 341Report Writing for Business3-0-3MSRENGL146NoFIN 320Financial Management II3-0-3MRFIN 220YesQM 350Operations Research3-0-3CRQM 250NoBANK 248Money and Banking3-0-3MRECON 141YesFIN 222Risk Management and Insurance3-0-3MRFIN220YesYear 3 - Semester 6Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMajor GPABANK 323Commercial Banking3-0-3MRFIN 221YesBANK 331Financial Analysis and CreditEvaluation3-0-3MRFIN 320YesFIN 424Investment Management3-0-3MRFIN 320YesSBF 270Islamic Banking and Finance3-0-3CRFIN 220NoGSE XXXGeneral Studies Elective 23-0-3GSE------NoYear 4 - Semester 7Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMajor GPABANK 411Islamic Financial Institutions3-0-3MRFIN 221YesFIN 425Corporate Finance3-0-3MRFIN 320YesFIN 435Portfolio Management andInternational Investment3-0-3MRFIN 424YesSingle Trackor MinorMajor Elective2or MinorMEMinorAs per list A/Completionof 84 CreditsYes3-0-3GSE XXXGeneral Studies Elective 33-0-3GSE------No3No

Year 4 - Semester 8Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMajor GPAFIN 498Internship and Graduation Project3-0-3MRCompletionof 111 creditsYesSingle Track orMinorMajor Elective2or Minor3-0-3MEMinorSingle Track orMinorMajor Electiveor Minor2Single Track orMinorMajor Elective2or Minor3-0-3Single Track orMinorMajor Elective2or Minor3-0-33-0-3MEMinorMEMinorMEMinorAs per list A/Completionof 84 CreditsAs per list A/Completionof 84 CreditsAs per list A/Completionof 84 CreditsAs per list A/Completionof 84 CreditsYesNoYesNoYesNoYesNoList A - Major Elective CoursesCourse CodeCourse TitleCourse HoursCourse TypePreRequisiteMajor GPABANK 312Bank Management3-0-3MEFIN 221YesFIN 313Trust Operations3-0-3MEFIN 221YesFIN 329Real Estate Finance3-0-3MEFIN 320YesBANK 410Electronic Banking3-0-3MEBIS 202YesBANK 412Global Banking and Finance3-0-3MEFIN 221YesFIN 421Capital Budgeting3-0-3MEFIN 320YesFIN 422Personal Finance3-0-3MEFIN 320YesFIN 423Financial Derivatives3-0-3MEFIN 424YesFIN 426International FinancialManagement3-0-3MEFIN 221YesFIN 427Seminar in Finance3-0-3MEFIN 320YesFIN 428Public Finance3-0-3MEECON 141 &FIN 221YesFIN 429Working Capital Management3-0-3MEFIN 320YesFIN 433Security Trading and MarketMaking3-0-3MEFIN 424YesFIN 434Financial Risk Management3-0-3MEFIN 222YesFIN 460Current Issues in Finance3-0-3MEFIN 320Yes4

FIN 480Financial modeling and Forecasting3-0-3MEECON 441YesMinorsList B – Minor CoursesMinor in Accounting (15 Credits)Course CodeCourse TitleCourseHoursCourse TypePreRequisiteMinor GPAACC 211Intermediate Accounting I3-0-3MinorACC 113YesACC 221Cost Accounting3-0-3MinorACC 113YesACC 231Auditing I3-0-3MinorACC 113YesACC 325Managerial Accounting3-0-3MinorACC 221YesACC 451Accounting Systems and Controls3-0-3MinorACC 211 &ACC 221YesMinor in Economics (15 Credits)Course CodeCourse TitleCourseHoursCourse TypeECON 340Managerial Economics3-0-3MinorECON 341Monetary Economics3-0-3MinorECON 427Seminar in Economics3-0-3MinorECON 440International Economics3-0-3MinorECON 441Econometrics3-0-3MinorPrerequisiteECON 140 &QM 250ECON 141 &MATHS 104ECON 141 &FIN 221ECON 141 &FIN 221QM 350Minor GPAYesYesYesYesYesMinor in International Business (15 Credits)Course CodeCourse TitleCourseHoursCourse TypeECON 440International Economics3-0-3MinorFIN 426International Financial Management3-0-3MinorFIN 221YesMGT 439International Business3-0-3MinorMGT 233YesACC 402International Accounting Issues3-0-3MinorACC 113YesMKT 463International Marketing3-0-3MinorMKT 261Yes5PrerequisiteECON 141 &FIN 221Minor GPAYes

Minor in Management (15 Credits)Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMinor GPAMGT 236Production Management3-0-3MinorMGT 230YesMGT 239Managing Small Business3-0-3MinorMGT 230YesMGT 340Supply Chain Management3-0-3MinorMGT 230YesMGT 430Human Resources and PersonnelManagement3-0-3MinorMGT 230YesMGT 434Strategic Management3-0-3MinorMGT 230 &completionof 96 creditsYesMinor in Marketing (15 Credits)Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMinor GPAMKT 263Promotion Management3-0-3MinorMKT 261YesMKT 268Personal Selling3-0-3MinorMKT 261YesMKT 362Marketing Research3-0-3MinorMKT 464Strategic Marketing3-0-3MinorMKT 465Services Marketing3-0-3MinorMKT 261 &QM250MKT 261 &completionof 90 CreditYesYesMKT 264YesMinor in Islamic Finance (15 Credits)Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMinor GPASBF271Islamic Law of Contracts3-0-3MinorSBF270YesSBF272Islamic Financial Services3-0-3MinorSBF271YesSBF369Islamic Commercial Jurisprudence I3-0-3MinorSBF271YesSBF469Riba and Forbidden Sales3-0-3MinorSBF271YesSBF472Islamic Insurance and RiskManagement3-0-3MinorSBF271Yes6

Minor in Entrepreneurship (15 Credits)Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMinor GPAENTR401Introduction to g eneurial Strategies3-0-3MinorENTR401YesENTR404Contemporary Issues ofEntrepreneurship3-0-3MinorENTR401YesENTR405New Venture Creation3-0-3MinorENTR401YesMinor in Business Analytics (15 Credits)Course CodeCourse TitleCourseHoursCourse TypePrerequisiteMinor GPAQM353Business Statistics3-0-3MinorQM350YesQM354Data Visualization3-0-3MinorQM250YesQM455Data Mining3-2-3MinorBIS202,QM250YesQM456Business Intelligence3-2-3MinorQM455YesQM457Big Data Applications and Analytics3-2-3MinorQM455YesGeneral Studies Elective Courses ListCourse REN 141303GSE------Basic Chinese Language303GSECHL 101EDTC 100Teaching and Learning Technology303GSE------EDPS 144Psychology of Learning and Memory303GSE------ART 133Fundamentals of Music and ItsAppreciation303GSE------ART 141Drawing and Painting213GSE------ART 221Traditional Music of Bahrain and ItsApplication303GSE------EDAR 126Playing on Piano and Org 1303GSE------JAPN 101Japanese Level I303GSE------Course CodeCourse TitleFREN 141French I30FREN 142French II3CHL 101Introduction to Chinese LanguageCHL 102Lec7

Course HoursLecPracCRDCourseTypePrerequisite3GSEJAPN 10103GSE------303GSE------Korean Language II303GSEKL 101TL 101Turkish Language303GSE------ENGL 130Introduction to Literature303GSE------PSYC 103Introduction to Psychology303GSE------PSYC 120Psychology of Marriage303GSE------PSYC 211Educational Psychology303GSE------PSYC 281Thinking Skills303GSEPSYC 103 orEDPS 241SOCIO 161Introduction to Sociology303GSE------SOCIO 181Introduction to Anthropology303GSE------SOCIO 191Citizenship, Identity and Globalization303GSE------SOCIO 224Sociology of Health303GSE------SOCIO 226Sociology of Arabian Gulf303GSE------HISTO 212Contemporary History of The Arab World303GSE------HISTO 281Landmarks of Islamic Civilisation303GSE------ARAB 141Modern Arabic Lit.303GSE------ARAB 242Arabic Poetry In The Renaissance Period303GSE------ISLM 114Quranic Sciences303GSE------ISLM 136Biography of The Prophet303GSE------ISLM 141Introduction to Shari'A303GSE------ISLM 252Islamic Doctrine303GSE------LAW 101Introduction to Legal Studies303GSE------LAW 102History of Law303GSE------LAW 106Constitutional Law I303GSE------PHYCS 181Elementary Astronomy233GSE------------GSE XXXOther electivesXX3GSEDepartmentApprovalCourse CodeCourse TitleJAPN 102Japanese Level II30GERM 101Introduction to German3KL 101Korean Language IKL 1028

Major Requirement Courses DescriptionsCourse Code:BANK 248Course Title:Money and BankingThe role of money, credit, interest rates, foreign exchange rates, and commercial banks and other financialinstitutions. Determinants of the money supply including the monetary base and its multiplier. Monetary andincome theory, and monetarist models. An examination of monetary policy including goals (price stability and fullemployment), targets and effectiveness.Course Code:FIN 222Course Title:Risk Management & InsuranceCovers the basic concepts of risk management and types of insurance; application of probability theory; sources anduses of funds for insurance companies; profitability of the insurance companies; competition in the insuranceindustry; the impact of the new World Trade Agreements on the insurance business.Course Code:FIN 320Course Title:Financial Management IIDetailed analysis of capital budgeting under conditions of uncertainty: cost of capital, capital structure, dividendpolicy, long-term financing, capital markets, investment banking, common stocks, preferred stocks, debtinstruments, leasing, convertibles, mergers and acquisitions, introduction to international finance, small companyfinance, and failure and reorganization.Course Code:BANK 323Course Title:Commercial BankingIntroduction to commercial banking, structure of banking system, internal organization of commercial banks, assetmanagement, liability management, capital management, financial analysis of bank's statements, credit analysis andloan policies, various types of loans, trust services of commercial banks and international banking.Course Code:BANK 331Course Title:Financial Analysis and Credit EvaluationStudies financial analysis techniques, assessing the impact of management decisions on a firm’s quality of earnings.Analysis of historical and future cash flows, liquidity analysis, and growth rate analysis, credit analysis, loanparticipation, methods of loan repayment, monitoring bank loans, problem loans, and securitization of bank loans.Course Code:BANK 411Course Title:Islamic Financial InstitutionsPrinciples of Islamic banking, alternatives of interest-free banking, application of alternative methods of investment,a comparative study with the conventional banking, current issues and future of Islamic banking. The structure ofthe industry, regulation of Islamic banks, accounting standards for Islamic banking, the role of Islamic banks in thedevelopment of an economy, and challenges facing Islamic banks.Course Code:FIN 424Course Title:Investment ManagementSecurities markets, sources of investment information, bond valuation, stock valuation, convertibles and warrants,investment strategies, portfolio theory and asset valuation, and market efficiency hypotheses.Course Code:FIN 425Course Title:Corporate FinanceCase applications of basic financial concepts, recent empirical and theoretical findings in the field of corporatefinance. Financial analysis and planning, capital expenditure analysis, capital structure and dividend policies,corporate structure and restructuring, mergers and acquisitions, financial restructuring, and international corporateequity offerings.Course Code:FIN 435Course Title:Portfolio Management and International InvestmentBasic concepts of modern portfolio theory, current empirical studies of asset pricing and internationaldiversification. The meaning of risk faced by international investors, elimination of risk, determination of the rate ofreturn requirements for risky assets, performance evaluation of portfolio managers, and strategies for portfoliomanagement.Course Code:FIN 498Course Title:Internship and Graduation Project in FinanceThe course offers students the opportunity to participate in real-life work experience in the Banking and Financefield. Students will be responsible for their own placement in an internship approved by the course instructor.Students will work under the supervision of the course instructor and the guidance of the trainer on a topic relevantto the Banking and Finance field. The final written report should include the final project report, the student trainingevaluation form, the attendance sheet, the Trainer evaluation form and the updated CV.9

Elective Courses (Single Track)Course Code:BANK 312Course Title:Bank ManagementIntroduction to commercial banking, structure of the banking system, internal organization of commercial banks,asset management, liabilities management, financial analysis of bank statement, credit analysis, capitalmanagement, security investments, bank regulations, electronic banking, management of trust department,management of bank liquidity.Course Code:FIN 313Course Title:Trust OperationsThe Course describes the basic services offered through bank trust departments. It shows why decisions for a bankbenefit. It examines trust department profitability and the recent trend to extend the market presence of trustoperations.Course Code:FIN 329Course Title:Real Estate FinanceFocuses on the concepts and techniques for analyzing financial decisions in property development and investment.Deals with real estate appraisal and sources of real estate financing. Advanced pricing techniques for complex realestate securities.Course Code:BANK 410Course Title:Electronic BankingThis course investigates the nature and functioning of computer based information systems in banking. Topicscovered will include hardware and software technology, system development process, economics of informationsystem. In addition issues related to the current and projected future role of ATM, POS and videotext deliverysystem. Other topics such as bank liability under an EFT system will also be covered.Course Code:BANK 412Course Title:Global Banking and FinanceA comprehensive look at international financial markets; foreign exchange markets; international banking;multinational firms; interest and markets in securities; international aspects of financial swaps; internationalmacroeconomics; monetary theory relevant to the understanding of international finance and banking.Course Code:FIN 421Course Title:Capital BudgetingImportance of capital budgeting: determination of cash flows; evaluating capital projects under conditions ofcertainty; evaluation of risky projects, portfolio effects and CAPM; capital rationing; special applications of capitalbudgeting to leasing, mergers and multinational investments.Course Code:FIN 422Course Title:Personal FinanceOverview of personal finance, basic concepts of personal financial planning, managing personal finances, protectingpersonal financial resources, investing personal wealth and controlling personal financial resources.Course Code:FIN 423Course Title:Financial DerivativesThe course provides a comprehensive coverage of financial derivatives with an analytical introduction to pricing,trading, and strategy; and the application of contracts. The examination of both the theoretical and empirical natureof selected financial assets will be made. In addition, orientation to the mechanics of participation in variousspeculative markets will the provided.Course Code:FIN 426Course Title:International Financial ManagementThis course covers issues related to both international financial markets and the financial operations of the firmwithin the international environment. Management of currency risk and political risk of multinational companies willbe discussed. Evaluation of international projects and raising money in global markets along with optimalmanagement of corporate funds internally in differential tax environment will be discussed.Course Code:FIN 427Course Title:Seminar In FinanceThe objective of this course is to provide an overview of major topics and recent developments in CorporateFinance. The course will cover classic papers and research that represent some of the most frontier developments inthe field. The course will prepare students to develop potential research topics and present a research paper inCorporate Finance.Course Code:FIN 428Course Title:Public Finance10

Overview of the economic role of government in modern society: government functions in resource allocation,income distribution and economic stabilization. Scope and control of public revenue, expenditure, and debt throughgovernment budget; and the impact of fiscal policy on governmental economic and financial functions and activities.Course Code:FIN 429Course Title:Working Capital ManagementThis course places emphasis on an evaluation of the costs and benefits resulting from the investment of funds inreceivables, inventories, and cash balances. Includes many case studies. Policies and procedures with respect todecision making; implementation and control are designed from the viewpoint of the financial manager.Course Code:FIN 433Course Title:Security Trading and Market MakingTheory and practice of securities trading at exchanges around the world. How trading and the design of marketsaffect liquidity, in-formativeness, transparency, volatility, and fairness. Analyzes alternative trading strategies andthe cost of trading. Examines innovations in security exchanges and regulatory policy. Provides hands-on tradingexperience using realistic trading simulations, electronic trading, and e-trade. Security trading at the stock marketsin the Gulf countries.Course Code:FIN 434Course Title:Financial Risk ManagementRisk management process, identification and evaluation of loss exposures, analysis of various risk control andfinancing techniques available to manage exposures, decision making under conditions of uncertainty, and controlmechanisms to monitor the results of a risk management program. Case studies, computer simulation.Course Code:FIN 460Course Title:Current Issues In FinanceReviews the most recent financial literature. Development of modern financial theory is also presented. A detailedreview of arbitrage pricing theory, pricing of contingent claims, option valuation model, modern portfolio theory,and agency theory.Course Code:FIN 480Course Title:Financial Modeling and ForecastingAn application of modern time-series techniques to a wide range of financial forecasting problems. Students willconstruct sound forecasts and use data and finance theory to identify time-series models. Autoregressive, movingaverage, seasonal and multivariate time series models. Detection and treatment of non-stationary. Practicalapplication of these methods to actual data in examples. The use of computers for data analysis and forecasting.Minor in Accounting (15 Credits)Course Code: ACC 211Course Title: Intermediate Accounting IThe environment of financial accounting and the development of accounting standards; conceptual frameworkunderlying financial accounting; review of accounting process; statement of income and retained earnings; balancesheet and statement of cash flows; cash; receivables; valuation of inventories; acquisition and disposal of property;plant and equipment; depreciation and depletion.Course Code: ACC 221Course Title: Cost AccountingCost terms and concepts; cost classification; job costing; process costing; standard costing; income effects ofalternative product costing methods; cost allocation.Course Code: ACC 231Course Title: Auditing IAn overview of auditing; professional ethics; audit evidence and documentation; the study and evaluation of internalcontrol; audit of cash; securities; receivables; inventories; fixed assets; current and long-term liabilities; proprietaryaccounts; income statement; the audit report.Course Code: ACC 325Course Title: Managerial AccountingIntroduction to cost behavior and cost-volume-profit relationships; relevant information and decision making; themaster budget; flexible budgets and variances; management control system and responsibility accounting.Course Code: ACC 451Course Title: Accounting Systems and ControlsAn analysis of systems and procedures; elements of the accounting system; design of books and forms; orderprocedures; sales procedures; cash receipts and disbursement procedures; accounts receivable procedures;accounts payable and payroll procedures; cost system and reports.11

Minor in Economics (15 Credits)Course Code:ECON 340Course Title:Managerial EconomicsThe application of economic theory and methodology to decision-making problems faced by private and publicinstitutions. How to combine the scarce economic resources of a business so that their resources are allocated inthe most efficient manner to maximize the value of their enterprise, theory and estimation of demand, productionand cost, market structure and pricing policies.Course Code:ECON 341Course Title:Monetary EconomicsTopics in monetary theory and policy, including foundations of monetary theory; monetary policy effects; inflation;international monetary system; money and economic growth; government debt and deficits; savings andinvestment.Course Code:ECON 427Course Title:Seminar in EconomicsThe objective of this course is to provide an overview of major topics and recent developments in Economics. Thecourse will cover classic papers and research that represent some of the most frontier developments in the field.The course will prepare students to develop potential research topics and present a research paper in Economics aswell as the different techniques researchers use to approach answering those questions.Course Code:ECON 440Course Title:International EconomicsIntroduction to international economics, why nations trade, the sources of comparative advantage, the commercialpolicy and the institutional aspects of the world trading system, exchange rates, exchange rate systems' impact onmoney and banking, and it studies theories of balance of payments adjustments and foreign direct investments.Course Code:ECON 441Course Title:EconometricsBasic econometric techniques, emphasizing the applications of least squares to cross section and time-series data.Covers mainly the simple and multiple linear regression model, the associated distribution theory and testingprocedures; corrections for autocorrelation, heteroskedasticity, multi-collinearity; and other extensions such assimultaneous equations. Students also apply the techniques to a variety of data sets using PCs.Minor in International Business (15 Credits)Course Code:ECON 440Course Title:International EconomicsIntroduction to international economics, why nations trade, the sources of comparative advantage, the commercialpolicy and the institutional aspects of the world trading system, exchange rates, exchange rate systems' impact onmoney and banking, and it studies theories of balance of payments adjustments and foreign direct investments.Course Code:FIN 426Course Title:International Financial ManagementThis course covers issues related to both international financial markets and the financial operations of the firmwithin the international environment. Management of currency risk and political risk of multinational companies willbe discussed. Evaluation of international projects and raising money in global markets along with optimalmanagement of corporate funds internally in differential tax environment will be discussed.Course Code: MGT 439 Course Title: International BusinessIntroduction to the environment of international business and to the operation of multinational firms; major topicsinclude basic concepts of world trade and investment problems; nature of international business; economic theoryand international business operations; management of primary activities in international firms; strategic and tacticsfor dealing with special problems and challenges arising in the global market.Course Code: ACC 402Course Title: International Accounting IssuesThis course will be introduced to some intermediate accounting topics such as the conceptual framework ofreporting, the accounting information systems, and financial statement related information. Also, students will beintroduced to the need and scope of international accounting; international diversity in accounting and comparativeaccounting practices; the accounting values related to measurement and disclosure and their association withnational societal values. Students will also be exposed to some analysis of foreign financial statements; IASB andinternational accounting standards.12

Course Code: MKT 463Course Title: International MarketingProblems of distribution and marketing in foreign countries: foreign markets surveys; promotion by governmentand private agencies; structural organization; marketing channels; foreign operations; foreign licensing; selection ofmarketing policies; techniques and financial instruments of foreign trade.Minor in Management (15 Credits)Course Code: MGT 236 Course Title: Production ManagementIntroduction to production and operations systems; system approach; business strategy; operations strategy; newproducts decision and design; supply chain management, total quality management; process decision and design;project planning and control; forecasting; inventory control.Course Code: MGT 239 Course Title: Managing Small BusinessEntre preneurship and a new venture start-up process, small business management, skills, concepts, knowledge andattitudes relevant to creating and building a new business venture. Class discussion and presentation of entrepreneurial related case studies form an integral part of the course learning process.Course Code: MGT 340 Course Title: Supply Chain ManagementAn overview of supply chain management (SCM); purchasing and e-procurement; managing supplier relationship;demand forecasting; capacity planning and inventory management; enterprise resource planning, transportationand distribution; customer relationship management; e-supply chain process integration, and recent issues in SCM.Course Code: MGT 430 Course Title: Human Resources and Personnel ManagementIntroduction to personnel theories, policies and techniques; job description and analysis; recruitment and selection;personnel testing and interviewing; supervision and control; building employee incentives and motivation;compensation and salary administration; manpower planning and human resources development; performanceappraisal; selected personnel applications using Gulf cases.Course Code: MGT 434 Course Title: Strategic ManagementIntroduction to strategic planning covering key concepts and techniques, organizational mission, goals, objectivesand scope of operations. Environmental scanning, strategy formulation and implementation with special referenceto functional applications on marketing, personnel, finance and other areas.Minor in Marketing (15 Credits)Course Code: MKT 263Course Title: Promotion ManagementThe meaning of promotion and its role in strategic planning in marketing; steps in promotion planning; marketsegmentation; promotion of the marketing mix; decision making by buyers; basic features of marketingcommunication; creation of great commercials; trade promotions and promotion media.Course Code: MKT 268Course Title: Personal SellingKnowledge and skills necessary for performing personal selling activities needed for effective marketing of products,providing customer care and establishing long-term relationships with customers; role of personal selling within anintegrated marketing system; types of personal selling requirements from effective personal selling; qualificationand skills of salespeople; selling process and the role of personal selling in creating customer value and loyalty.Course Code: MKT 362Course Title: Marketing ResearchAn introduction to marketing research procedures: definition of the marketing problem; scientific methods andmarketing research; types of research methods; planning research sampling methods; development of forms fordata collection; analysis of data; research report; follow-up.Course Code: MKT 464Course Title: Strategic MarketingUnderstanding of marketing strategy planning process within firms; marketing management problems encounteredby senior marketing managers; marketing opportunity assessment segmentation; competitive positioning andintegration of product service, price, promotion, distribution.13

Course Code: MKT 465Course Title: Services MarketingSome key issues of services marketing; ethical issues in services marketing; services marketing management;market

Mathematics for Business Management I 3-0-3 MSR ----- No HRLC 107 Human Rights 2-0-2 UR ----- No B.Sc. in Banking and Finance 2020 University Requirement 9% College . FIN 422 Personal Finance 3-0-3 ME FIN 320 Yes FIN 423 Financial Derivatives 3-0-3 ME FIN 424 Yes FIN 426 International Financial Management 3-0-3 ME FIN 221 Yes .