Transcription

NEGOTIATED LARGE TRADE (NLT) FREQUENTLY ASKED QUESTIONS (FAQ)1. What is NLT?NLT is an off-market trading facility that allows Trading Participants or their clients to arrangeand transact orders away from Trading System.2. What are the benefits of NLT?NLT allows trades to be done at a single price and it minimizes the possible price impact andtime delays that may occur when transacting orders of large size on the exchange. NLTs alsoallows for matching of large trades during off-exchange hours. These trades, however, will onlybe cleared as the following day’s trades (see Q12 below).3. Who can use the facility?A Trading Participant may use the NLT facility to execute a NLT on behalf of a client account,house proprietary account or registered futures trader account. In executing a NLT, a TradingParticipant has to comply with section 99(1) of the Capital Markets and Services Act 2007(CMSA) which provides, amongst others, that a Trading Participant must not, as principal, tradewith a person who is not a Trading Participant unless he first informs that person in writing thathe is acting in the transaction as principal and not as agent. As an example, a Trading Participantmust not take the other side of its client’s order unless the Trading Participant first informs thatclient in writing that he is taking the other side of the order as principal and not as agent.4. Are there any account restrictions in conducting NLT?Only separate parties are permitted to conduct NLT. In this context, separate parties are definedto be those who have (i) accounts which belong to different beneficial owners; or (ii) accountswhich are under separate control.The Trading Participants must undertake all reasonable steps to verify that this requirement ismet and retain copies of all relevant documentary evidence relied on by the Trading Participantsin its verification process.Examples of accounts which are under separate control are: Treasury and Structured Products division of a bankMarketing and Purchasing division of a Refinery5. Can NLT be conducted for a combination strategy trade involving both futures and options?Yes. Parties are required to provide the delta value used to determine the number of futures andoptions contracts, and will also need to comply with the minimum volume threshold for theoptions leg. The combination strategy trade involving the futures and options must be executedbetween the same counterparties (i.e. a party may not conduct the futures leg with onecounterparty and the options leg with another counterparty). Trading Participants are requiredto provide the required information to the Exchange and maintain supporting documentation.

6. Can the NLT be conducted at any price?No, NLTs can only be conducted at a price that falls within the daily price limit of the underlyingfutures contract. This price must be mutually agreed to by the two parties to the transaction. Forfutures or options contracts that do not have price limits, the NLT trades shall be conducted at afair and reasonable price.7. Do position limits apply for NLT?The speculative position limits imposed on each futures and options contract per client orParticipant as specified in Schedule 3 of the Rules of Bursa Malaysia Derivatives Berhad remainapplicable and the positions arising from the NLTs are aggregated with the positions establishedduring on-exchange trading.8. Are all BMD derivative contracts eligible for NLT?Yes9. What is the minimum volume threshold for NLT?Please refer to no.16.2.6 of Bursa Malaysia Derivatives trading TradingManual v4.1 final.pdf)10. Will a facility fee be imposed on NLT transactions?In addition to the current exchange and clearing fees relevant to each contract, there will be afacility charge of RM0.20 per contract capped at twice the minimum volume threshold. Forexample, the maximum facility charges for FCPO will be for 400 (200X2) contracts which isequivalent to RM80.

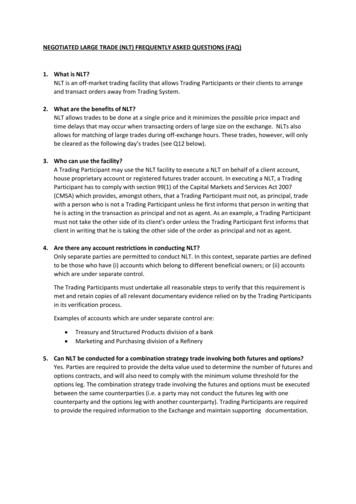

11. What is the process for NLT?The diagram below shows the trading flow for using the NLT facility.

12. How is the NLT reported to the Exchange?For NLTs executed during exchange trading hours and before the cut off time, the broker for theseller and the broker for the buyer are obliged to call DEO after the trade has been agreed tonotify the Exchange of the terms of trade. The details include the contract, price, quantity andcounterparty information. After reporting the trade, both buyer broker and seller broker willhave to fax or email a completed official NLT Facility Trade Registration form to DEO forconfirmation of the proposed transaction. Participants should not submit the NLT Facility TradeRegistration form to DEO for validation until all details of the trade have been agreed.To ensure same day trade registration, the NLT Facility Trade Registration form needs to besent to DEO latest by 4.00pm (for FKLI, FKB3, FMG5 and OKLI contracts) and by 5.00pm (forFCPO and OCPO contracts). NLT Facility Registration forms received by DEO after these timesshall be processed on the next business day as the following day’s trade.After the form is sent to DEO, Participants must also immediately create the pending NLT in theDCS before market close. NLTs created in the DCS after market close will not be registered byDCSO.NLTs transacted during the lunch break shall be processed after the market opens for theafternoon trading session.13. Can the same Trading Participant do NLT for 2 clients?Yes, as long as the account requirements for the clients are met as mentioned in Q4 and Q5.14. Where can I find the NLT registration form?The registration form can be found on the website using the link as provided egistration Form-1.pdf15. What is the expected timeframe for NLT registration?During market hours, the whole process should take no more than 1 hour from the time ofsubmission of the registration form of the NLT provided that the forms contain all the necessaryinformation.16. Are there any periods when NLT is unavailable for certain contracts?For physically delivered spot month contracts like the Crude Palm Oil futures contract, NLT willnot be permitted once the contract enters the spot month.For cash settled contracts (e.g. KLCI futures, 3-Month KLIBOR futures and 5-Year MSG futures),NLT may be conducted at any time.

17. How is the NLT settled?All NLTs after clearing and settlement are futures/options positions and will therefore besubject to the futures/options daily settlement price and final settlement prices applicable tothe regular market. In the event the contract is a physically delivered contract, the NLTs will besettled by delivery of the underlying at expiry.18. Will my NLT transaction be made public?Only the volume and time of registration of the NLTs shall be made public and will bebroadcasted via email messaging.19. Will the volume be updated on a real-time basis in the trading system?The volume will not be updated in the trading system. It will only be reflected at the end-of-daymarket data reporting which is published on the following day.20. Are there instances where the NLT may be rejected?The NLT may be rejected if it does not comply with the Rules of Bursa Malaysia DerivativesBerhad and the Trading Participants’ Manual. To illustrate, below are some examples ofcircumstances where a NLT may be rejected: Price of the transaction is deemed to be not fair and reasonable.Position limits are breached.Financial standing of the Clearing Participant and/or end-client if transaction results in anegative monetary position.Requirement that only separate parties are permitted to conduct NLT has not been met.The minimum volume threshold required for NLT is not metIn the case of a combination strategy trade, the futures leg and options leg are notexecuted between the same counterparties21. Can the NLT be amended or cancelled once the registration form has been submitted?Before the NLT is registered, the transaction can be amended or cancelled provided that boththe buyer and the seller mutually agree to do so. Instruction must be received from both thecounterparties to the NLT. In the event of cancellation, the Trading Participants must informDEO to hold on to the registration and to resubmit the original registration form with a note tocancel that is signed by the same signatories.22. Can the NLT be mutually cancelled once it has been registered?The NLT cannot be cancelled once it has been registered. The 2 parties will be required to enterinto another NLT to reverse the first transaction.23. Can omnibus accounts participate in NLT?Omnibus accounts can participate in NLT as long as the first level sub-account is declared.

[End of FAQ]

house proprietary account or registered futures trader account. In executing a NLT, a Trading Participant has to comply with section 99(1) of the Capital Markets and Services Act 2007 (CMSA) which provides, amongst others, that a Trading Participant must not, as principal, trade with a person who is not a Trading Participant unless he first informs that person in writing that he is acting in .