Transcription

Becoming theBanker of TomorrowAn article based on the book“Becoming the Banker of Tomorrow: A Five-Land Journey”by Ayalla Reuven-Lelong

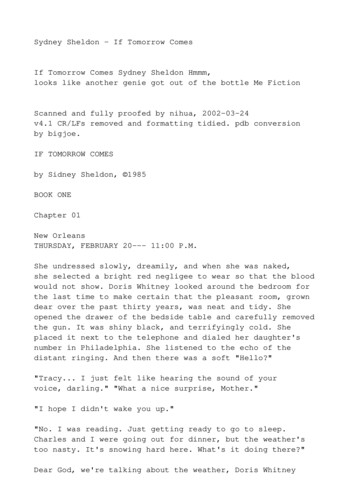

Banks never had to face more concerns about thefuture of their workforce than they do today. Thechallenge of disruptive technologies will maketomorrow’s banking workforce unrecognizable.Yet most bank leaders focus mainly on businessmodels and technological transformation andhardly invest any time and effort in their talentstrategy.Bank leaders should consider that in this newreality in which automation and robots will domost of the repetitive work, the banker of thefuture will need to be flexible, purpose-driven,creative, entrepreneurial, customer-centric,cooperative and a lifelong learner. Bank leadersmust realize that the future of their banks isdependent mainly on their ability to attract,retain and develop the right type of talents. Thisis especially relevant as banks are no longerperceived as a very appealing workplace by manytalented young people nowadays.One of the main challenges of many banks isthat, in order to create a culture suitable forthe new era of the workplace, the top leaderswill need to lead by example. To do that, theleaders themselves will have to possess the rightmindset and be entrepreneurial, creative, flexible,cooperative, full of passion and purpose-driven.Unfortunately, our data shows that most bankershave a long way to go to get there. Cultivating theskills of tomorrow takes time, and there are noshortcuts.The C-suite and top leaders of all banks must takethis journey very seriously and put in the timeand effort for self- development. Only by goingthrough this journey will banks be able to preparetheir workforce for the new era.Becoming the Banker of Tomorrow: A Five-Land JourneyThe Five-Land Model describes a metaphorical journey that we should all go through in order to cultivatethe skills of tomorrow. This model is based on cutting-edge theories on the plasticity of the brain, thefuture of business and leadership in the era of complexity.It is also based on interviews with dozens of CEOs, C-suite members and top leaders, as well as on thewriter’s own experience in implementing change management processes in different industries, mainlyin professional services and financial sector.The Banker as one who is both an engineer and an artist: criticaland strategic thinker, analytical and methodological; yet alsointuitive, visionary, creative, relationship driven and passionateabout his/her area of expertise, clients and employees.The Banker as one who is a lifelong learnerin 5 areas: professional, emotional,technological, business and leadershipMINDSET LANDARTGINEER LANDEQ LANDBecoming the Bankerof TomorrowI-21The Banker as one who re-inventshim/herself and develops a compelling andwinning value proposition (both forhim/herself and for his/her team)SUSTAINABILITY LANDThe Banker as one who understands his/her own emotional world,successfuly manages hi/her emotions and adapts to differentsituations. One who encourrages change, solves problems, works inmulticultural teams and is an inspiring leader. One who builds closerelationships with his/her clients and becomes their Trusted Advisor.2 Becoming the Banker of TomorrowThe Banker as one who can succeed over time in the gushing white waters - whofinds deep purpose in his/her work, takes ownership over his/her career, connectswith sponsors and mentors in order to learn and develop, positively frames achallenging reality (both for him/herself and his/her team) and understands that onehas to maintain one s own wellbeing

“Don’t be a know-it-all;be a learn-it- allSatya Narayana Nadella, Microsoft CEOBankers and the Mindset LandThis land is based on the theory and book ofStanford University Professor Carol Dweck,“Mindset: The New Psychology of Success”. Inher book, Prof. Dweck describes two differenttypes of mindsets: A fixed mindset and a growthmindset.A growth mindset attitude is a prerequisite forsuccess in a new reality where change hasbecome the new normal.The banker as a trusted advisor and businesspartner for banking customers is not a newconcept. To help their organizations succeed in thenew reality, all banking professionals, from backoffice clerk to bank CEO, will have to think and actas “Whole advisors” for both external and internalcustomers, contributing to a customer centricculture.People with a fixed mindset attitude assume thatour character, talents, intelligence, and creativeability are static givens, which are unchangeablein any meaningful way. Therefore, they tend tostay in their comfort zone and resist any change orpersonal development process. These people willfigure out very soonthat their personalThe banker of the future wil need to have a growthvalue proposition ismindset attitude and become a lifelong learner in fivedepreciating.The first field of the“Whole Advisor” modelis the Professional field.The bankers of the futuredifferent fields, which together comprise the “Whole will still need to haveOn the other hand,and develop skills andAdvisor” model.people with a growthcompetencies related tomindset attitudetheir profession such asbelieve that their most basic abilities are notcorporate/ retail banking, treasury, operations,fixed and can be developed through dedicationcompliance, and risk management.and hard work. They enjoy challenges and seefailure not as evidence of unintelligence, butThe second field in which bankers will needas a heartening springboard for growth and forto become lifelong learners is Technology andstretching their existing abilities. These peopleInnovation. Bankers of the 21st century will needare willing to step out of their comfort zones andto be smart users of the new technologies thatput in the effort and practice to develop new skillsincreasingly penetrate the world of banking fromand competencies. As a result, they will inventthe communications and tech industry.and reinvent themselves and maintain their ownwinning personal value proposition.Becoming the Banker of Tomorrow 3

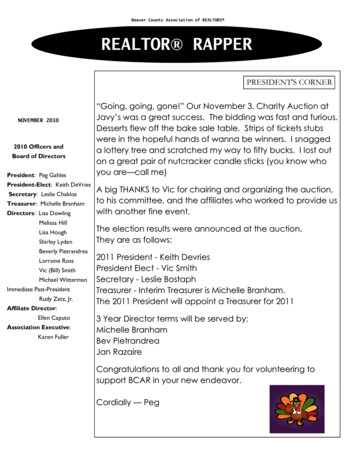

FIXED MINDSET- Something you re bornwith- Something to avoid- Unnecessary- Get defensive- Blame others- Fixed- Could reveal lack ofskill- Take it personal- Get discouraged- Tend to give up easily- Something you dowhen you are not goodenoughSKILLSCHALLENGESEFFORT- Come from hard work- Should be embaraced- Essential- Useful- Can always improve- An opportunity to grow- A path to mastery- Something to learn fromFEEDBACK- More persistantSETBACKS- Uses as a wake-up callto work harder nexttime- Identify areas to improveGROWTH MINDSETUnfortunately, a significant portion of bankers fearthese new technologies and are not prepared toembrace them. They must however understandthat they have no choice, as this is the direction towhich the banking world is headed.The third field of the “Whole Advisor” model isLeadership. To become the first choice of theirstrategic clients and most talented employees,bank leaders will have to demonstrate leadershipskills. Above all, they need to think of themselvesas inspirational leaders. And it starts on the inside.Leaders need to find, deep within themselves,their own personal vision and their own sense oftrue purpose in the profession. Vision and a senseof purpose are critical factors in creating endlesspassion and preventing burnout. In addition,leaders still need to have managerial capabilities,since they have to manage their teams, theirclients, their time and their careers.Next, the fourth field of the “Whole Advisor”model is Soft Skills. Nowadays, leaders mustbelieve in their ability to develop their own setof soft skills, which are so very critical to theirsuccess. This is especially crucial when it comesto employees’ engagement, passion and grit. Softskills are also indispensable for leading change,building relationships with clients and becoming atrusted advisor.It is not enough to just say “clients come first”, asmany leaders do. Any bank needs to ensure thatall of its leaders and employees have adequateemotional intelligence in order to build meaningfulrelationships with their clients and especially tocreate WOW moments.4 Becoming the Banker of TomorrowMany people mistakenly think that thanks tovarious new technologies, especially with thepervasiveness of online and digital banking,bankers will no longer need to build meaningfulrelationships with their clients. On the contrary– the use of technology enables bankers to freethemselves from repetitive, routine tasks and toengage more creatively with their customers.They have thus more opportunities to differentiatethemselves by focusing on client relationships andhigher-quality services.And, last but not least, comes the field ofBusiness Value Proposition. Many bankingprofessionals, especially those working in supportfunctions, who are not interacting directly withclients, do not feel that business development isa natural part of their job. They tend to focus oncompliance and operational aspects, not keepingin mind the big picture and the final customers ofthe bank.Still, in order to help their organization succeed inthe market place, all banking professionals needto have an understanding of how local and globaltrends may affect the preferences and needsof their bank’s clients in the coming years, andto keep an open mind. They should also knowwhich are the most important business issues onthe C-suite’s table, which keep them up at night.Whenever possible, they should offer valuable andcreative solutions to these issues. They shouldinvest the time and effort to build a meaningfulnetwork and to act as trusted advisors for theirmanagement and for their internal and externalclients. Thus, they will be able to develop awinning personal value proposition for themselvesand to contribute to a winning business valueproposition for their bank.

Ten strategies to develop a Growth Mindset10Think about yourself as a lifelong student and learn onenew thing every week.01Continuously invest inyour professional andpersonal development.0209Take one obstacle and thinkabout four ways you can turnit into an opportunity.When coming across a newtopic, ask open questionsand demonstrate curiosity.08Share your success storiesand the “not there yet”ones; emphasize the learningcurve.03Seek others’ perspectiveand use it for your nextjump (areas for enrichment).0704Test and learn; allow forfailure in the pursuit ofknowledge.Make challenges yournew best friend.0605Stay up to date and agile inyour area of expertise.Place effort before talentand view failure in adifferent light.Becoming the Banker of Tomorrow 5

“The future belongs to a different kind of person witha different kind of mind: artists, inventors, storytellerscreative and holistic ‘right-brain’ thinkers whoseabilities mark the fault line between who gets aheadand who doesn’t.“Daniel Pink, author and thought leader on the topic of leadershipBankers and the Artgineer LandThe Artgineer Land is based on the Whole Brainconcept; the left hemisphere and the righthemisphere. In the new era of the workplace,we all need to be Artgineers – both engineersand artists. Critical and strategic thinkers,analytical and methodological (engineers); yetalso intuitive, visionary, creative, relationshipdriven and passionate (artists). This land relieson theories of brain function lateralization,the physical division of the brain into twohemispheres, each characterized by differentfunctions. Although considered to be largelymetaphorical in nature, the model is an effectiveway of describing and understanding differentthinking styles and decision-making patterns,which are complementary to each other. Theleft, rational hemisphere is related to analytical,problem-solving, and logical abilities. The right,metaphorical hemisphere is related to feelings,imagination, abstractions and associations, vision,creativity and holistic thinking.In contrast to the 20th century in which successbelonged to employees and leaders who displayedstrong left-brain skills, success in the new era ofthe workplace requires using both parts of thebrain and, in particular, right-brain related abilities.Throughout the past hundred years, those whowere inclined to use the left part of their brainhad an advantage in the organizational world.Rational thinking and technical skills were heldat high regard. Those with pure knowledge ontheir hands, such as engineers, economists,accountants, and lawyers rose to the top of thepyramid, benefiting from high salaries, excellentworking conditions, respect and prestige.This period is almost over. In the new era ofthe workplace, many of the roles fulfilled bysuch highly skilled professionals are at risk ofdisappearing.6 Becoming the Banker of TomorrowThis day may still be in the future, but part of thistransformation has already begun. This is truefor the banking world as well. Most of the tasksof bankers with a so-called left-brain tendencyare repetitive and analytical. Such people – theengineer type – rely on facts, numbers, details,and the checking of the applied aspect ofthings. These repetitive and analytical tasks willeventually be performed by computers and bigdata technologies.On the other hand, banking professionals with aright-brain tendency, but who are also driven by avision, and who are intuitive, inspirational, creativeand expressive, who look at the bigger picture –the artistic type – will be more and more in need.The successful bankers of the future will see thebig picture and will be able to connect the dotsand be very creative and innovative. By doingthat, they will be able to provide their clientswith a winning value proposition. They will putrelationships at the heart of their everyday life andwill do their best to maintain positive relationshipswith their team members and clients, basedon trust and respect. They will do their best tohelp their clients and team members succeed,and that is where they will focus their energy.The bankers of the future will have a strongemotional connection to their field of activity andexpertise and will be driven to do their best, asthey will want to be meaningful and wish to havea long-term impact on their environment. Theywill have a strong vision and will invest their timeand energy in places where their impact could begreater and always look for the next thing acrossall the five fields of the ‘Whole Advisor’ model.They will have a tendency for exploration, whichwill drive them to go out of their way to find newareas of interest, to break the boundaries of thepresent, and to search for new opportunities for

their organization, their clients and their teams.Such people are constantly looking for newchallenges, and as a result, they leave theircomfort zone on a regular basis. Their creativityand their ability to think outside the box leadthem to discover new ways of improving theirperformance. They focus on the opportunitiesinstead of the obstacles and are actively seekingchallenges in order to achieve excellence. Theylook for people with similar interests becausethey understand that the more they expand theirnetwork of contacts, the greater their chanceof learning from others. Finally, they seek outmeaningful relationships with relevant figuresin their field of expertise in order to reach newinsights, to learn and improve, irrespective of theirlevel of knowledge.These Artgineers will be the biggest asset of anybank. In his book “The Future of Management“,Gary Hamel notes that the abilities that contributethe most to the success of business organizationsare passion (35%), creativity (25%) and initiative(20%). They exceed intelligence (15%) anddiligence (5%). Obedience, which was also tested,makes no contribution to organizational success.These findings are particularly relevant for banks,where the compliance culture is prevalent.While compliance remains highly importantfor banks and all their stakeholders, includingcustomers, regulators and shareholders, thenew reality demands that bankers should useboth parts of the brain, as their work and theirenvironment has become much more complex.Without a doubt, the leaders that will be able tomake their banks succeed in the marketplace willbe those with a strong right-brain tendency. Thischange, in fact, marks the end of the managementera and the beginning of the leadership era. Inthe management era, the predominant use of theleft-brain was a prerequisite. In the leadership era,at the beginning of the 21st century, an additionalprerequisite for success is a simultaneous andintensive use of the right-brain. In other words, awhole-brain outstanding performance. A leadermust work with people – connect with thememotionally, create a sense of trust and empathyand make them willingly walk the extra mile forhim or her, and for the organization. Many studiesfind that people are not actually committed toorganizations, but rather to their managers. DanielPink discusses in his book “Drive” how leaderscan motivate their employees in three ways:through autonomy, mastery and purpose. Withouta doubt, only leaders who succeed in using theirwhole brain will be able to do so.Becoming the Banker of Tomorrow 7

Ten strategies to develop the Whole Brainand become an ArtgineerChallenge the status quo!Be curious, ask moremeaningful questions.01Ask others to question andchallenge your stories, even ifyou stand behind them.02Connect your team’s goals tothe bank’s vision and strategy.03Talk about your organizationalstory and inspire others to do it.04Use recognition andcelebration to energize andinspire.05Provide recognition forinnovative ideas and turn theminto actions.06Spend quality time with peoplewho share the same passion asyours.07Talk with your team membersabout their personal vision.0809Think about one thing that yourclients might need, and whichdoes not exist in the market yet.8 Becoming the Banker of Tomorrow10Hold regular brainstormingsessions and encouragecreativity in your workingenvironment.

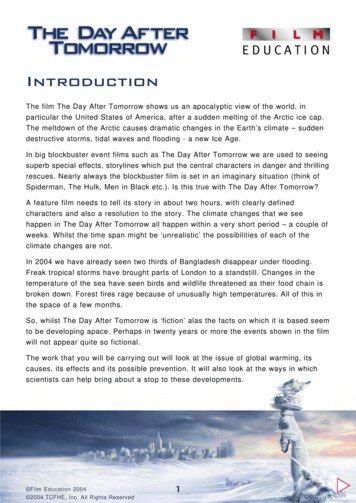

“In the Fourth Industrial Revolution, emotionalintelligence is especial y needed to gainnew competency and fluency.”Prof. Klaus Schwab – “Shaping the Fourth Industrial Revolution”Bankers and the Emotional Intelligence LandEQ stands for Emotional Quotient, similarly toIQ, the Intelligence Quotient. Measuring one’semotional intelligence comes from the relativelynew recognition of the fact that emotions areimportant in every aspect of our life, includingthose that were previously considered to beentirely analytical or logical by nature. Today,emotions are increasingly recognized as aninseparable part of the thinking processes whichare part of our professional lives.Overall, emotional intelligence is a set of socialand emotional skills that enables an optimalaction, which leads to desirable results – individualand group effectiveness, synergy, as well asthe recognition of challenges and the ways toaddress them. Our emotional intelligence modelconsists of 10 subscales, divided into four groups:Emotional Awareness & Management relates tounderstanding, accepting and managing our ownemotions. Social Skills relates to our abilities inunderstanding emotions of others and managinginteractions and relationships. Adaptability relatesto our ability to understand situations objectivelyand to handle changes and uncertainty. SelfActualization relates to our determination, passionand influence.In the new era of the workplace the ability tounderstand one’s own emotions and those ofothers, to be flexible in the fast-changing reality,to show determination while facing growingchallenges in a competitive world, and to leadwith both head and heart, are crucial for personaland organizational success in a disruptive andturbulent reality.While in the 20th century emotional intelligencewas only perceived as “nice- to-have” andsometimes even frowned upon, it is nowadaysa critical element of personal and professionalsuccess in the new era of the workplace.Emotional intelligence is a scientific concept,based on more than 30 years of detailed research.The largest emotional intelligence center islocated at Yale University.In his insightful book “Shaping the FourthIndustrial Revolution“, the president of the WorldEconomic Forum, Prof. Klaus Schwab says thatemotional intelligence is especially needed inthe Fourth Industrial Revolution. According toProf. Schwab, leaders and employees will needto become comfortable with the unknown andremain both hopeful and alert about what comesnext. They will need to be creative in how theyrespond to the complexity of the systems aroundthem and yet remain humble enough to know thatthey cannot know it all.There is nowadays reputable evidence thatemotional intelligence is one of the biggestpredictors of performance in the workplace anda strong driver of leadership. Without a goodamount of emotional intelligence, many bankerswill find it difficult to achieve their personal andprofessional goals, mainly as leaders. As DanielGoleman puts it, “Without it, a person canhave the best training in the world, an incisive,analytical mind, and an endless supply of smartideas, but he still won’t make a great leader.”Young bankers joining the industry will very quicklydiscover this themselves. They join organizationsthat are full of smart, hardworking and ambitiousprofessionals and they will quickly realize thatthey need more than IQ and a great education todifferentiate themselves.Even more than it is today, emotional intelligencewill be a critical ability for all bankers in the nextdecades. Banks that will continue to lead in thefuture will need to create a culture of augmentedintelligence: the best partnership between peopleand artificial intelligence. This partnership shouldenhance, scale and upgrade human activities.Becoming the Banker of Tomorrow 9

Artificial intelligence Emotional intelligence Augmented intelligenceOnly bankers with high emotional intelligenceare able to do well in this new environment,as they are aware of their emotions and theirthoughts in various situations. They have abetter understanding of their emotions andcan manage them successfully (emotionalself-awareness is the foundation of emotionalintelligence). They are also proactive and candemonstrate self- regulation, acting by choicerather than by emotional hijacking. Working inthe finance industry that is constantly scrutinizedby regulators, authorities and the larger public,in a highly competitive market where the qualityand speed of services is a key differentiator(considering that the products themselves barelydifferentiate banks in the marketplace), with newtrends changing business models every day, theability of bankers to understand and manage theirown emotions is critical.Bank leaders and bank professionals who masteremotional intelligence are aware of their values,purpose and knowledge, which enables them toset challenging yet realistic objectives and striveto attain them. They have a high sense of selfactualization and a growth mindset. They strive forconstant learning and development and are notafraid to take risks and step out of their comfortzone. Their ability to clearly and assertivelyexpress their opinions and needs both in theorganization and with their customers enablesthem to achieve their objectives. They are flexibleand adapt easily to changes; they know how toact, even in stressful situations, how to remainoptimistic and happy and how to communicatethese feelings to their employees. Theyunderstand the emotions of others (employees,colleagues and superiors), recognize their needs,provide them with an appropriate response, buildpositive and productive relationships and becomethe trusted advisors of their clients. They create ashared vision and successfully motivate others tojoin in.The banking industry needs leaders who are notonly adaptable themselves but are also able tohelp others adapt to change in an industry thathas already undergone tremendous change andwill continue to transform itself dramatically in thecoming years.Many leaders and professionals in the bankingworld now realize that it is time to shift focusfrom developing mainly technical and professionalskills to other areas. With the banking industrybeing the backbone of any economy, havingworkforces and leaders who are actively focusingon developing their emotional intelligence skillswill certainly make a lasting impact.SELF-AWARENESS &MANAGEMENT Emotional Self-Awareness and ExpressionSelf-RegardSelf Regulation and ManagementSOCIAL SKILLS EQInterpersonal RelationshipsEmpathySELF-ACTUALIZATION DeterminationPassion & InfluenceADAPTABILITY Reality Testing and Problem SolvingFlexibilityStress and Uncertainty Management10 Becoming the Banker of Tomorrow

Seek and develop relationships withcolleagues from other departments anddemonstrate trust in your everyday life.10Keep a journal of your feelingsand talk more about youremotions and feelings.Actively build meaningful relationships withyour colleagues and clients and do yourbest to create a positive and constructiveenvironment.09070806Think about how your values,beliefs and assumptions influenceyour behavior and your interactionswith others.Take inventory before you go to bed –feelings, thoughts, small achievements andnext jumps (areas of enrichment).0504Show that you truly care about others’ feelingsand thoughts.Practice self- compassion and humility –be humble enough to know that no one isperfect.03Take full responsibility for your feelingsand practice responding, rather thanreacting.0201Demonstrate flexibility in yourthinking and behavior.Reflect on your professionaland personal blessings andshare this with a friend.Ten strategiesto developEmotionalintelligenceBecoming the Banker of Tomorrow 11

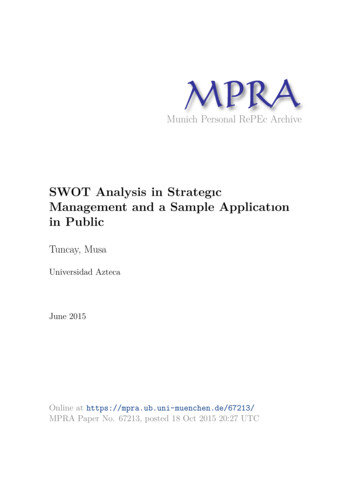

“Our research shows that purpose well-beinghas a high correlation with social, financial,community, and physical well-being.Peter Choueiri, President, Healthways InternationalBankers and the Sustainability LandThe fast-changing and disruptive reality in thenew era of the workplace is often described asstormy weather or turbulent water rapids. TheSustainability Land relates to our ability to “stayon the boat” when there is a big risk of fallinginto the gushing waters. It is about success inthe long term. The rate and pace of changes weare all facing now are not easy and take a toll oneveryone. No one can run a marathon at sprintspeed for a long time without proper resources.The land is based on the work of many thoughtleaders on the topic of well- being, optimism(Professor Seligman), and career success in achanging, complex and dynamic reality (Barsh andCranston).They have a strong feeling that their personalsuccess is also based on their positive influenceon all their stakeholders: team members,clients, shareholders and the society at large.Bankers with a high sense of purpose are highlycommitted to their work and believe that whatthey are doing is meaningful. They feel that theyare very competent in their jobs and have a highsense of giving and meaning. The sense of higherpurpose helps leaders inspire and motivate theiremployees, build relationships based on trustwith their clients and contribute to the advance ofsociety at large. This sense of meaning will helpthem overcome most of the obstacles and stay onthe boat in the white-water rapids.The following five components of thesustainability land are therefore crucial for oursuccess in the new era of the workplace. First,our ability to find a sense of Higher Purpose in ourwork and life. Second, our ability to choose to lookat the glass half full (Optimism). Third is our abilityto take full ownership of our career by building andmaintaining a personal winning value proposition(Proactive Career Management). Fourth is ourability to build and maintain a wide network ofrelationships, so people will support us duringboth good and challenging times (Social Capital).And last but not least, we also need to proactivelytake care of ourselves – get enough sleep, eatwell, exercise and engage ourselves in activitiesthat contribute to our well-being and our level ofhappiness (Well Being).Optimism and Positive Framing:Optimism is a crucial ability in the ever- changingreality, when obstacles will be on the way mostof the time. Optimism plays a role in almost everyaspect of one’s professional life, regardless ofits field of specialization – when facing clients,colleagues, superiors or subordinates, as well aswhen leading organizational change managementprocesses or innovative processes.Optimistic bankers can find opportunities indifficulties, seeing problems and obstacles ina way that encourages creative solutions andinnovation. The way in which they choose to viewand interpret the world influences their personaland professional achievements. It is importantto note that “positive framing” does not meanputting on a pair of rose-colored glasses, butrather the ability to see the facts as they areand still being able to emphasize the positive.Leaders who positively frame their reality canlead their teams towards feelings of capability andability, rather than submission and helplessness.This ability helps everyone to keep going in thestormy weather, especially in today’s environmentwhere banks are facing widespread scrutiny andcriticism.Staying on the boat when in the gushing whitewatersHigher Purpose:The bankers of tomorrow need a high sense ofpurpose. Such bankers no longer assess theirsuccess based only on traditional factors such asgood financial performance, or a low number ofcustomer complaints.12 Becoming the Banker of Tomorrow

Components ofSustainability LandHigher PurposeWell BeingProactive CareerManagementOptimism &Positive FramingSocial CapitalSocial Capital:This dimension relates to bankers’ ability to puttime and effort into building significant networksand create meaningful relationships with peopleof various backgrounds. Studies indicate thatpeople who have strong social networks and goodmentors tend to progress faster, earn more and bemore satisfi

Bankers and the Mindset Land This land is based on the theory and book of Stanford University Professor Carol Dweck, "Mindset: The New Psychology of Success". In her book, Prof. Dweck describes two different types of mindsets: A fixed mindset and a growth mindset. People with a fixed mindset attitude assume that