Transcription

Retiree HandbookPublic Employees' Retirement System of MississippiProviding Benefits for Life

Our MissionProviding secure benefits to our membersand consistently delivering quality service by meeting ourcustomers’ needs; operating efficiently and transparently;investing and managing assets prudently; and acting in theCenter Cover Photo Credit: Anissa Thompsonbest interest of all members.2www.pers.ms.gov

WelcomeWhether you worked your career as an educator,physician, county supervisor, engineer, clerk,accountant, or as one of the myriad of other publicemployees serving the state of Mississippi, oneof the most valuable benefits of your employmentwas knowing you had a secure retirement futurewith the Public Employees’ Retirement System ofMississippi (PERS).PERS is Mississippi's retirement system for stateagencies, public schools, community colleges, anduniversities, as well as counties, cities, and otherparticipating political subdivisions. We believe thatMississippi’s public employees deserve a strongretirement system.Since established by the Mississippi Legislature in1952, PERS has worked to accomplish its missionof providing secure retirement benefits by closelymonitoring investments, studying possibilities forplan adjustments, recommending changes to theLegislature, and following a strong chain of checksand balances that starts with the MississippiConstitution and ends with the people we serve.Providing secure retirement benefits is only onepart of our agency’s mission. We also strive toprovide quality service.Moreover, we want you to know about yourretirement system. This handbook is one ofseveral valuable tools we provide for retireesto learn about PERS. Along with our website,newsletters, annual reports, and educationalopportunities, we have a team of dedicated andtrained staff who can respond to you personally viaphone and in person. We listen carefully to yourquestions and seek to understand your needs.We strive to treat each person—from new hiresto long-time retirees—with dignity, respect, andcompassion.We hope this handbook will be helpful to you,and we encourage you to share any suggestionstoward improving this handbook or any of ourservices. PERS is your retirement system andyour future.Ray HigginsExecutive DirectorProviding Benef its for Lifewww.pers.ms.gov3

Public Employees’ Retirement Systemof Mississippi 429 Mississippi StreetJackson, Mississippi 39201-1005 800.444.7377601.359.3589 customerservice@pers.ms.govwww.pers.ms.gov Visitor parking is available in the parkinggarage behind the PERS Building at 429Mississippi Street. Entrance to the parkinggarage is from President Street, betweenYazoo Street and Mississippi Street.8:00 a.m. to 5:00 p.m., Monday - Friday MEMPHISI-220NCARTHAGEFORTIFICATION ST.AMITE ST.CAPITOL ST.PEARL ST.NORTH STATE ST. YAZOO ST.PRESIDENT ST.HIGH ST.CAPITOLMISSISSIPPI ST.25 LAKELAND DR. I-55475 4HATTIESBURGBROOKHAVENI-55I-20MERIDIAN49 VICKSBURG 80www.pers.ms.gov

Table of ContentsWelcome. 3Changing Options after Retirement. 16Your Retirement System: A Brief Overview. 7Disability Retirement Benefits. 16Staying Informed. 8Insurance Options. 18Your Monthly Benefit Allocation. 10Planning for Physical/Mental Incapacity. 19Cost-of-Living Adjustment Estimate Calculator. 12Keeping Your Account Up to Date. 19Base Options Quick Comparison Chart. 14Returning to Work. 20Staying Involved with PERS and Others. 23After Your Death or a Beneficiary's Death. 23Appendix. 26Discover More OnlineAlong with this handbook, PERS providesonline resources for retirees. Look for thepointing finger symbol (at left) throughoutthis handbook to guide you to resourcesfound at www.pers.ms.gov.www.pers.ms.gov5

6www.pers.ms.govPhoto Credit: Charlie Godbold, Godbold & Company Photography

Your Retirement System: A Brief OverviewThe Public Employees’ Retirement System ofMississippi (PERS) is a governmental definedbenefit plan qualified under Section 401(a) of theInternal Revenue Code. PERS was established bythe state Legislature in 1952 to provide benefits toeligible Mississippi public employees working forstate agencies, universities, community colleges,and public schools, as well as counties, cities, andother participating political subdivisions.Unlike a defined contribution plan (e.g., a 401(k)type plan) where a participant’s retirement benefitis based on contributions and any investmentearnings accumulated in that participant’s account,a defined benefit plan determines a member’sretirement benefit using a formula based onthe member’s average compensation, yearsof creditable service, and the benefit paymentoption selected at retirement. PERS is a trust fundoperating on a fiscal year calendar from July 1through June 30. All funds are held in trust for theexclusive benefit of the members.Funding for PERS comes from member andemployer contributions and investment earningson those contributions that accumulate over time.As a defined benefit plan, PERS has access toprofessional investment management, whicheliminates the need for members to manage theircontributions in the markets. Defined benefit plansare designed based on strength in numbers,automatic participation, and pooled risk so thatmembers are guaranteed to receive lifetimebenefit payouts at retirement, regardless of marketdownturns. In addition, PERS provides disabilityand survivor protection.PERS is administered by its 10-member Boardof Trustees, which includes the state treasurer,one gubernatorial appointee who must be awww.pers.ms.govmember of PERS, two state employees, twoPERS retirees, one representative of publicschools and community/junior colleges, onerepresentative of the state’s institutions of higherlearning, one representative of municipalities,and one representative of counties. Under theguidance of a consulting actuary, the PERS Boardmonitors funding to ensure the financial soundnessof the plans administered and compliance withthe guidelines established by the GovernmentalAccounting Standards Board. The PERS Boardalso appoints the executive director to serve as theagency's chief executive officer.Along with PERS, the Board administers: Mississippi Highway Safety Patrol RetirementSystem (MHSPRS), established in 1958; Mississippi Government Employees'Deferred Compensation Plan & Trust (MDC),established in 1973 with administrationtransferred to PERS in 1974; Municipal Retirement Systems (MRS) —17 fireand police and two municipal employee plans,closed plans with administration transferred toPERS in 1987; PERS-sponsored Retiree Medical and LifeInsurance Plans, authorized in 1988; Supplemental Legislative Retirement Plan(SLRP), established in 1989; and Optional Retirement Plan for the Institutions ofHigher Learning (ORP), established in 1990.Read more about all PERS PlansDetails on all the plans administered byPERS can be found at www.pers.ms.gov.7

Staying InformedPERS is here to serve you, whether you are amember, retiree, or beneficiary. We encourage youto contact us and to use our printed and onlineresources. Our Customer Service Center, website,newsletters, and other communication materialsare reliable sources for information and answersto questions.Customer Service CenterPERS’ Customer Service Center analysts assistcallers with questions and concerns. The centeris open from 8 a.m. to 5 p.m. weekdays (exceptstate holidays). Call 800-444-7377 or 601-3593589.News ReleasesPERS news releases keep you up to date on whatis happening with the agency. All news releasesare posted online for the public to view.eUpdatesPERS eUpdates are emailed news alerts thatinclude information about legislative, regulatory,and retirement plan changes; leadership updates;and more. Visit www.pers.ms.gov to subscribe andreceive PERS news relevant to you.Publications and ReportsOur financial and actuarial reports are posted onour website and provide detailed information aboutPERS.HandbooksAlong with this handbook, PERS provideshandbooks to members, employers, and membersof the Supplemental Legislative RetirementPlan and the Mississippi Highway Safety PatrolRetirement System. All handbooks are availableonline and in print.GuidesPERS has created a library of various guidesthat address the needs of members from allstages of employment. From the guide for PERSnewcomers to the guide for retirees who wantto return to employment with a PERS-coveredemployer, these guides are quick reference toolsfor answering commonly asked questions. Allguides are available online and in print.RegulationsIn addition to retirement law, PERS Boardregulations provide guidance on the way PERSoperates on a day-to-day basis. All currentregulations are posted on the PERS website.Safeguarding Your IdentityWe take precautions to protect your identity andkeep your information safe. Though your SocialSecurity number may be used over the phoneto verify your identity when you call us, we willnever share that number or any of your personalinformation with anyone but you. In the case that aSocial Security number is not sufficient verification,we may ask you to provide additional identifyinginformation that only you would know.8Find all PERS Resources OnlineNews releases, publications and reports,handbooks, and regulations can all befound at www.pers.ms.gov.www.pers.ms.gov

WebsiteOur website, www.pers.ms.gov, is a valuableresource for employers, members, retirees, andthe public.The latest news can be found in the PERSUpdates section of the home page.Our Forms Library provides quick access to mostforms, including many listed in this handbook.Along with news and forms, our website includesinformation about the leadership of your retirementsystem, with biographical information about ourBoard of Trustees and Executive Staff.Moreover, we have links on our site to take youdirectly to pertinent information you may need asa retiree of PERS. Our retiree resources pagelinks directly to policy providers and, from ourhome page, you can link directly to MississippiGovernment Employees' Deferred CompensationPlan & Trust, Social Security, the Internal RevenueService, and Medicare.We are continually working to improve ourwebsite, and we welcome feedback from ourmembers and retirees to let us know how we canbetter serve them online.www.pers.ms.gwww.pers.ms.govov9

Your Monthly Benefit AllocationNo matter your benefit option, you receive amonthly benefit plus an annual Cost-of-LivingAdjustment (COLA) for life once you retire.PERS issues retirement payments for each monthon the first day of that month that is not a weekendor bank holiday. Service and disability retirementbenefits are payable to eligible members effectivethe first of the month after receipt of a completedretirement application or after termination ofcovered employment, whichever is later. A yearlylisting of benefit payment dates is available on thePERS website or by contacting PERS.Mandatory Direct DepositDirect deposit of your monthly benefit paymentis mandatory. Prior to retirement, you shouldhave signed up for direct deposit then receiveda written confirmation of your first deposit. Yourbank statement serves as a confirmation of allsubsequent deposits.To revise direct deposit information, you mustcomplete and submit Form 21, Direct DepositAuthorization, which may be obtained from thePERS website or by contacting PERS. You willreceive a written confirmation any time the amountof your deposit changes. Your bank statement willserve as a confirmation of all subsequent deposits.Your initial direct deposit, as well as direct depositchanges, will be effective within two months afterPERS receives the completed request. Benefitpayments will be issued as checks by mail untildirect deposit takes effect.Missed Check PaymentsThough direct deposit is mandatory, specialcircumstances may allow you to have benefitsissued by check. These are mailed on the lastworking day of the previous month. Should you10not receive your check, you must contact PERS inwriting (providing your name, last four digits of yourSocial Security number, current mailing address,and signature) to stop payment and have anothercheck issued. Once PERS receives notice, PERSwill place a stop payment order on the check andissue a replacement check, but only if your checkhas not cleared the bank and if 10 mailing dayshave elapsed from the date the check was mailed.If you receive your check after you have sent yourwritten notification, inform PERS immediately.If you receive your check after receiving thereplacement, return the extra check to PERS.Cost-of-Living AdjustmentThe Cost-of-Living Adjustment (COLA) helpsmaintain your purchasing power as a retiree nomatter how long you live after retirement anddespite the effects of inflation.Retirees and beneficiaries who have beenreceiving benefits for at least one full fiscal yearreceive a COLA. See pages 12 and 13 to readmore about how this benefit is calculated and towork your own calculation.You may have elected to receive your COLAmonthly. If you did not, your COLA is paid in anannual lump sum on or about December 15. If youwant to switch to monthly payments, you mustcomplete and submit Form 20, Election of MonthlyView Benefit Payment Dates andDownload Form 21You may visit PERS online to view thepayment schedule for both direct depositand check issuance. You also may goonline to download Form 21,Direct Deposit Authorization.www.pers.ms.gov

Cost-of-Living Adjustment, which can be foundonline. Choosing monthly payments is irrevocable.contributions when paid with after-tax dollars. Refundpayback or service credit purchase paid through arollover is classified as a taxable contribution.State TaxesYou may elect to have no federal income taxeswithheld, to withhold income tax based uponmarital status and exemptions, and/or to haveadditional federal income tax withheld.Retirement benefits are not subject to MississippiState Income Tax; however, benefits paid byPERS to you as a resident of another state may besubject to taxation in that state.Federal Taxes and WithholdingEach January, PERS issues an annual InternalRevenue Service (IRS) Form 1099-R to eachretiree who received benefits during the priorcalendar year. These income tax statementsprovide information on benefits paid and amountswithheld for federal income tax. A copy of the formshould be included with federal income tax filings,if any federal tax is withheld.Retirees living in states where pension income istaxed may also be required to file the appropriate1099-R copy with state income tax returns.Member contributions paid prior to July 1, 1982,were taxed before being posted to accounts andare exempt from federal taxation when issued asbenefits. Calculation of the non-taxable portion ofthe benefit is based on the age of the retiree atretirement using factors provided by the IRS.A portion of a refund payback or other service creditpurchase cost paid by a member is also postedto a member’s account in the form of non-taxableTo make changes to your tax withholding statusafter retirement, complete and submit Form 17,Certificate of Withholding Preference, whichmay be obtained from the PERS website or bycontacting PERS.In the absence of submitted tax withholdinginformation, PERS automatically withholdstaxes based on a status of “married with threewithholding exemptions.”Payer’s Federal Identification NumberThe specific nine-digit number for each retirementplan PERS administers is listed below and shouldbe used when filing taxes.Public Employees' Retirement System ofMississippi: 64-6001557Municipal Retirement Systems: 64-0746030Mississippi Highway Safety Patrol RetirementSystem: 64-6176426Supplemental LegislativeRetirement Plan:64-6190947Download Forms 17 and 20You may download Form 17,Certificate of Withholding Preference,and Form 20, Election for Monthly Costof-Living Adjustment, from the PERSwebsite.www.pers.ms.gov11

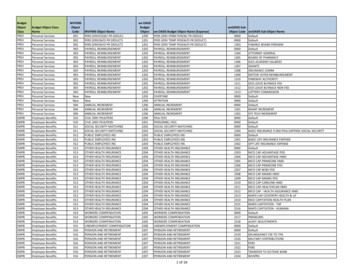

Cost-of-Living Adjustment Estimate CalculatorPERS retirees and beneficiaries who have beenreceiving benefit payments for at least one fullfiscal year are eligible to receive an annualCost-of-Living Adjustment (COLA). If you retiredeffective July 1, you would be eligible for the COLAduring the fiscal year beginning 12 months later onJuly 1. If you retired effective August 1, you wouldbe eligible for the COLA during the fiscal yearbeginning July 1, 23 months after the effectivedate of retirement.compounded for each fiscal year thereafter,beginning with the fiscal year in which you turnage 55 (Retirement Tiers 1 through 3) or 60(Retirement Tier 4). (See the Appendix for simpleand compounded COLA interest rates for years inretirement.)The COLA is equal to 3 percent of yourannual base benefit for each full fiscal year ofretirement prior to the year in which you reachage 55 (Retirement Tiers 1 through 3, see tablebelow) or 60 (Retirement Tier 4), plus 3 percentwho retired at age 52, has been retired for 16 fullfiscal years, and is receiving a gross monthly basebenefit of 750 under each Retirement Tier.Use the table at right to calculate your currentfiscal year COLA based on your monthly basebenefit. The Example Figures shown at rightillustrate how this formula works for a memberPERS Retirement TiersAs outlined in the chart below, your date of hire andentry into PERS dictate your Retirement Tier.12Retirement TierHire/Entry DateTier 1June 30, 1992, or earlierTier 2July 1, 1992, through June 30, 2007Tier 3July 1, 2007, through June 30, 2011Tier 4July 1, 2011, or laterwww.pers.ms.gov

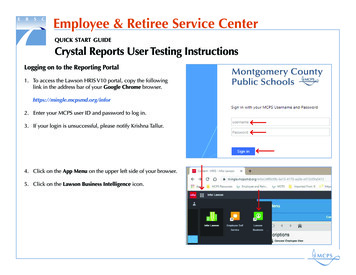

CalculationYour FiguresExample FiguresTiers 1-3Tier 4See page 25 to determine Retirement TierMultiplyMonthly BaseBenefit by 12 Monthly Base Benefitx12Multiply by 12xAnnual Base Benefit750.0012 x750.0012 9,000.00 9,000.00Years in Retirement prior to 55 or 603.008.003.00%3.00%3.00%Simple Rate9.00%24.00%Simple Rate9.00%24.00% MultiplyFiscal years retiredprior to age 55(Tiers 1-3) or 60(Tier 4) by 3.00%xMultiply by 3.00%x MultiplySimple Rate byAnnual Base Benefitfor Simple InterestxAnnual Base Benefitx 9,000.00 Factor 1x 9,000.00 810.002,160.00 Look UpCompoundedRate (Appendix)13.00Years in Retirement since 55 or 608.00Compounded Rate46.85%26.68%Compounded Rate46.85%26.68% MultiplyCompoundedRate byAnnual BaseBenefitxAnnual Base Benefitx 9,000.00Factor 2 4,216.50Factor 1 x 9,000.00 2,401.20 AddFactor 1 toFactor 2 Factor 2Est. Current FY COLAwww.pers.ms.gov 810.00 4,216.50 5,026.50 2160.00 2401.20 4,561.2013

Base Options Quick Comparison Chart14PERSBaseOptionHow Benefits ArePaid to You andto BeneficiariesNumberof AllowedBeneficiariesRestrictionson NamingBeneficiariesMaximumRetirementAllowance OptionSingle Life AnnuityMaximum benefit for life for you,any remaining balance refundedto beneficiaries after your deathMultipleNoneOption 1Pro-RatedSingle Life AnnuityReduced benefit for life for you,any remaining balance refundedto beneficiaries after your deathMultipleNoneOption 2100 percentJoint/Survivor AnnuityReduced benefit for life for you,beneficiary receives your samemonthly amount for life after yourdeath, unless limited by IRC Section401(a)(9)OneMust be a personOption 3100 percentJoint/Survivor AnnuityReduced benefit for life for you,beneficiaries each receive 50 percentof your monthly amount for life afteryour death, unless limited by IRCSection 401(a)(9)TwoEach must be a personOption 475 percentJoint/Survivor AnnuityReduced benefit for life for you,beneficiary receives 75 percent ofyour monthly amount for life afteryour deathOneMust be a personOption 4A50 percentJoint/Survivor AnnuityReduced benefit for life for you,beneficiary receives 50 percent ofyour monthly amount for life afteryour deathOneMust be a personOption 4B10-, 15-, and 20-YearCertainReduced benefit for life for you, afteryour death beneficiaries receive yoursame monthly amount for up to 10,15, or 20 years from your effectivedate of retirementMultipleNonewww.pers.ms.gov

Provisionsto ChangeBeneficiariesProvisionsto ChangeBase Option*InternalRevenueLimitationsPartialLump SumAvailabilityYou may changebeneficiaries atany timePop-Down if you marry afterretirement while receivingthe Maximum RetirementAllowance**NoneYes, if eligibleYou may changebeneficiaries atany timePop-Down if you marry afterretirement while receivingbenefits under Option 1**NoneNoYou may not changeyour beneficiary exceptwhen Popping UpPop-Up if your Option 2beneficiary dies or if youdivorce your Option 2beneficiaryPossible limit onbeneficiary benefit ifyour beneficiary is notyour spouseYes, if eligibleYou may not changeyour beneficiariesYou may not change youroptionPossible limit onbeneficiary benefitsYes, if eligibleYou may not changeyour beneficiary exceptwhen Popping UpPop-Up if your Option 4beneficiary dies or if youdivorce your Option 4beneficiaryNoneYes, if eligibleYou may not changeyour beneficiary exceptwhen Popping UpPop-Up if your Option 4Abeneficiary dies or if youdivorce your Option 4AbeneficiaryNoneYes, if eligibleYou may changebeneficiaries atany timeYou may not change youroptionPossible based on your Yes, if eligibleage at retirement* For explanation of Pop-Up and Pop-Down provisions, see page 16.** Must apply for the Pop-Down within one year of the date of the marriage.www.pers.ms.gov15

Changing Options after RetirementIf you selected Option 3 or Option 4B atretirement, you cannot change your option afterretirement; however, the other retirement optionscontain Pop-Up and Pop-Down provisions thatallow retirees to change options and beneficiarydesignations under certain limited circumstances.Pop-Up ProvisionPop-Down ProvisionThe Pop-Up Provision allows a retiree whoselected Option 2, Option 4, or Op›tion 4A tochange to the Maximum Retirement Allowanceif the designated beneficiary predeceases theretiree or if the retiree divorces the designatedThe Pop-Down Provision allows a retiree who selectedthe Maximum Retirement Allowance or Option 1 tochange to Option 2, Option 4, or Option 4A to providebeneficiary protection to a new spouse marriedafter the retiree selected the Maximum Retirementbeneficiary. (All options require that at least onebeneficiary be named.)Allowance or Option 1. The retiree must apply for thisprovision within one year of the date of the marriage.Disability Retirement BenefitsDisability retirement benefits provide you with asecure income if you become permanently sickor injured while employed and can no longerperform the essential duties of your job. Disabilityretirement benefit options are the same as serviceretirement benefit options, except that disabilityretirees are not eligible for the Partial Lump SumOption (PLSO). For more information, you maydownload the PERS Disability Retirement Guide.Continuing QualificationIf you are a disability retiree, you may berequired to submit to medical reexaminations (orreevaluations) on a regular basis. If the MedicalBoard determines that you are no longer qualifiedfor disability benefits through either a medicalevaluation or documented earnings ability, yourdisability benefits will be subject to termination bythe PERS Board of Trustees.Income RestrictionsAs a disability benefit recipient, you may work andearn no more than the difference between youraverage compensation before retirement and thebenefit amount paid after retirement, excludingCost-of-Living Adjustments. This limitation appliesto earned income only, not passive income suchas interest income or Social Security income. Youare required annually to submit copies of yourincome tax returns, Internal Revenue ServiceForm(s) 1040, and other supporting incomeearnings documents.16Download PERS DisabilityRetirement GuideYou may visit PERS online to downloadthe PERS Disability Retirement Guide.www.pers.ms.gov

www.pers.ms.gov17Photo Credit: Anissa Thompson

Insurance OptionsFor the convenience of retirees, PERS withholdspremiums from benefit payments for insuranceplans sponsored by the agency or by the state.For more information, contact DFA’s Office ofInsurance at 866-586-2781 or 601-359-3411 orvisit knowyourbenefits.dfa.ms.gov.State-Sponsored InsurancePERS-Sponsored InsuranceThe State and School Employees’ Life andHealth Plan is administered by the MississippiDepartment of Finance and Administration (DFA).DFA should be contacted regarding participation.The PERS-sponsored Retiree Medical InsurancePlan is a supplement available only to retireescovered under Medicare Part A and Part B. Ifeligible, you may apply for this plan within 60 daysof retirement. After retirement, you may applywithin 60 days of eligibility or during annual openenrollment.The PERS-sponsored Retiree Group Term LifeInsurance Plan is available to benefit recipientsage 45 to age 90 with age-based premiums. Youmay apply during annual open enrollment.The Retiree Medical Insurance Plan and RetireeGroup Term Life Insurance Plan are underwrittenand administered by Transamerica Premier LifeInsurance Company of Cedar Rapids, IA. Formore information, call 800-634-0168.Tax Exclusion forPublic Safety OfficersThe Federal Pension Protection Act of 2006provides for a special tax exclusion of upto 3,000 annually for health insurancepremiums paid directly from PERS or anyother retirement plan to the insuranceprovider of an eligible retired publicsafety officer. For details, visit www.irs.gov.Photo Credit: Charlie GodboldGodbold & Company Photography18www.pers.ms.gov

Planning for Physical/Mental IncapacityIn the event you become physically or mentallyincapacitated, you may need someone you trust tohave legal authority to act on your behalf regardingyour retirement account.Durable Power of AttorneyRepresentative PayeeShould you become physically or mentallyincapacitated before a durable power of attorneycan be filed, a Form RPR, Representative PayeeRequest, may be filed on your behalf. ContactPERS for more information.By executing a durable power of attorney, you maygive someone broad or limited legal authority overyour personal, legal, and financial affairs, includingthe power to apply for retirement or disabilitybenefits on your behalf. You may wish to consulta legal professional to decide whether this is rightfor you.Keeping Your Account Up to DateThough you are retired, you have a responsibilityto keep your PERS account information current.Having your correct address on file meansPERS can easily reach you if the need arises,and keeping other information up to date makestransitions and processing smoother for you andyour loved ones down the road.For your convenience, several forms are availableon the PERS website to help you update yourinformation. You also may contact PERS directlyto have these forms mailed to you.Form 1C, Change of Information, is available tochange your name, address, phone number, emailaddress, marital status, and/or family information.Form 1B, Beneficiary Designation, is available toamend your beneficiary listing, if applicable.Form R, Application for Recalculation of Benefits,www.pers.ms.govis available to change your benefit optionselection, if eligible.Form 17, Certificate of Withholding Preference, isavailable to change the tax withholding status ofyour benefit.Form 21, Direct Deposit Authorization, is availableto change information on the bank account towhich your monthly benefit payment is deposited.Download Forms 1C, 1B, R,17, 21, and RPRYou may download from the PERSwebsite Form 1C, Change of Information;Form 1B, Beneficiary Designation;Form R, Application for Recalculationof Benefits; Form 17, Certificate ofWithholding Preference; Form 21, DirectDeposit Authorization, and Form RPR,Representative Payee Request.19

Returning to WorkNo PERS retiree (whether service or disability)may return to covered employment for at least 90consecutive calendar days from his or her effectivedate of retirement without terminating retirement (seepage 21 for rules applying to local elected officials).If you decide to return to employment with acovered employer after you retire, you and theemployer must notify PERS in writing withinfive days of the reemployment and provide theconditions under which you are being reemployed.Notification must be repeated each new fiscal yearof post-retirement employment.Once you choose to return to work with a coveredemployer, you must either: come out of retirement and become, onceagain, a contributing member of PERS(benefits will be recalculated, if applicable,upon subsequent retirement) or return to employment with a covered employerunder limited reemployment conditions, asexplained in this section. You must file Form4B, Reemployment of PERS Service RetireeCertification/Acknowledgement, or Form 9C,County/Municipal Elected Official ReemploymentAcknowledgement/Election, as applicable. Bothforms are on the PERS website.For more details about returning to coveredemployment (including employment througha third-party), visit PERS online to view BoardRegulation 34, Reemployment after Retirement,and PERS' Thinking of Returning to Work? guide.Withdrawal from ServiceThe mandatory 90-day break in service requiredby retirees before returning to employment witha PERS-covered employer must begin witha complete withdrawal from service, which isdefined by statute as the complete severanceof employment in state service of any member20by resignation (including retirement), dismissal, ordischarge. The member and employer should notmake any pre-arranged agreements regarding postretirement employment.The Internal Revenue Service (IRS) requires anemployee who participates in a governmentalpension plan to have a break in service. The IRSdefines "retire" to mean "stop working." Employeeswho retire with the exp

Cost-of-Living Adjustment Estimate Calculator . 12 Base Options Quick Comparison Chart.14 Table of Contents Discover More Online Along with this handbook, PERS provides online resources for retirees. Look for the pointing finger symbol (at left) throughout this handbook to guide you to resources found at www.pers.ms.gov.