Transcription

An innovation guide under More Homes, More Choice:Ontario’s Housing Supply Action Planontario.ca/housinginnovationLife leasehousingPractical informationabout owning a life lease

Disclaimer: The terms of each life lease agreement may vary from one project to another. Thisguide covers the common practices with a focus on the market value model (see section formodels of life lease housing).Please read a life lease agreement closely before signing it. If you are considering a life leasepurchase, you should seek the advice of qualified professionals, including legal counsel.This guide is for information only and offers a summary of legislation that is subject to change. Itis not a legal interpretation of the legislation. The guide, as well as any links or information fromother sources, is not a substitute for specialized legal or professional advice. The user is solelyresponsible for any use or application of this guide.

IntroductionIn life lease housing, the buyer purchases aninterest in that property—which gives the buyerthe right to occupy a unit for a long period oftime, often for their lifetime.Like condo owners, the buyer pays a lump-sumpurchase price, and then continues to pay: property taxes monthly fees for maintenanceLife leases are usually priced lower thansimilarly sized condominiums in the area.This could be due to the lack of availability ofconventional mortgages and the exemptionfrom land transfer taxes.Life lease housing is usually developedand operated by non- profit or charitableorganizations called “sponsors.”Life lease buyers are often seniors looking tomove into smaller homes.BenefitsPeople choose life lease housing for: affordability fewer home maintenance responsibilities access to social and recreationalprograms a sense of community (for example,seniors, religious or cultural groups) care and meal services offered by thesponsor on site, if availableLife lease interestIn life lease housing, the buyer does not ownthe property. The life lease holder holds aninterest in that property.The life lease interest gives the holder theright to occupy (live in) a unit, rather than ownthe unit itself. The life lease sponsor ownsthe property.If a life lease holderpasses awayIf the holder passes away, their inheritorgets the life lease interest, but not the rightto occupy the unit. The inheritor can benefitfrom the sale of the life lease, but they cannotautomatically move into the home.The inheritor may be able to apply to move intothe life lease unit—the decision is up tothe sponsor.Example: Veronika, a 72-year-old, has passed away and her son Shawn, aged 53, inherits herlife lease interest. As the sole inheritor of Veronika’s estate, Shawn applies to live in the lifelease unit, but does not satisfy the age eligibility (65 years).Shawn decides to sell the life lease interest. He plans to purchase his own life lease unit whenhe’s old enough to satisfy the age eligibility requirement.Life lease housing 3

Types of life lease housingLife lease housing can take on a variety offorms. Each model is based on how the initialprice is set and how the life lease interest isthen resold. The five basic models are: market valueprice indexfixed valuedeclining balancezero balanceMarket valueMarket value life lease projects are popular inOntario. If the holder sells the life lease interestfor more than they originally paid for it, theholder (or their estate) makes a profit. If theholder sells the interest for less, then the holder(or their estate) incurs a loss.Most market value life lease agreements allowthe holder to transfer the life lease interest totheir estate. This means that, technically, thelease lasts longer than “life.” While the holder’sinheritors may profit on the sale of the lease,they may not move into the unit without firstapplying to the sponsor and meeting thesponsor’s eligibility criteria.The holder (or their estate) is responsible forselling the life lease at a rate the market willbear. The sponsor may assist by assessing unitvalue, contacting prospective buyers from thewaiting list and brokering the sale. The sponsorretains a percentage of the sale price as anadministrative fee. If the holder also retains areal estate agent, their fee is additional.BenefitsIf real estate values go up, the holder can makea profit on the sale.The value of the life lease is not tied to the ageor length of occupancy of the resident.ConsiderationsIf real estate values go down, the holder canlose money.If the holder passes away, their inheritors willhave to sell the unit and pay monthly feesuntil the unit is sold. This may be an importantconsideration if they live far away.Life lease housing 4

Price indexFixed valueThe sponsor purchases the life lease backfrom the holder (or their estate) over thelength of their occupancy. The sponsorincreases the original amount paid byan annual price index factor, usually theConsumer Price Index. The sponsor retainsa percentage of the sale price as anadministrative fee.This is also called the “no gain” model. Thesponsor purchases the life lease back fromthe holder (or their estate) for the sameamount originally paid when the holderpurchased the life lease. The sponsorretains a percentage of the amount as anadministrative and refurbishing fee.BenefitsEven if real estate values go down, the holderis guaranteed not to lose money.If the holder passes away, their inheritors donot have to worry about selling the home orpaying monthly fees.ConsiderationsThe holder’s estate will no longer hold thelife lease interest once it is fully repaid bythe sponsor.If real estate values go up, the holder (andtheir estate) will not profit.BenefitsEven if real estate values go down, the holderis guaranteed not to lose money.If the holder passes away, their inheritors donot have to worry about selling the home orpaying monthly fees.ConsiderationsThe holder’s estate will no longer hold thelife lease interest once it is fully repaid bythe sponsor.If real estate values go up, the holder (andtheir estate) will not profit.Since this model does not take inflation ormarket value into account, the money theholder invested loses its value over time.Life lease housing 5

Declining balanceZero balanceThe amount the holder pays up front isbased on the value of the unit and their lifeexpectancy. The amount the holder or theirestate will receive declines by a specificamount each year until it reaches zero. Aswith the zero balance model, this model maybe thought of as prepaid rent.The holder pays an amount upfront designedto prepay rent for the rest of their expectedremaining life. The amount paid is basedon the value of the unit and the holder’s lifeexpectancy.BenefitsThis is the least expensive form of lifelease housing.BenefitsThe initial payment is typically lower than itis for market value, price index, or fixedvalue models.The holder’s right to occupy the unit lasts fortheir lifetime, even after the redemption valuedeclines to zero.If the holder passes away, their inheritors donot have to worry about selling their home orpaying their monthly fees.ConsiderationsThe holder’s estate will no longer hold the lifelease interest once it is fully repaid bythe sponsor.If real estate values go up, the holder willnot profit.If the holder passes away, their inheritors donot have to worry about selling the home orpaying monthly fees.ConsiderationsThe holder’s estate does not inherit the lifelease interest, which returns to the sponsor atthe end of their occupancy.No residual value is paid to the holder or theirestate if the holder passes away or decidesto move elsewhere.If a health issue forces the holder to leaveearlier than expected, this may or may notimpact the amount of money that the holderor their inheritors receive back from theirinitial payment.If a health issue forces the holder to leaveearlier than they expected, this may or maynot impact the amount of money that theholder or their inheritors receive back fromtheir initial payment.Life lease housing 6

Features and differencesServices offeredLength of leaseMost sponsors provide a basic level ofmaintenance that includes mowing lawns andshovelling snow. Some sponsors also changefurnace filters, fix plumbing or electrical wiring,or monitor both the interior and exterior of thehome while lease holders are away.A life lease typically lasts until:Other sponsors offer a wider range of servicesincluding laundry, housekeeping and meals,and help with bathing, transportation andreminders to take medication. These additionalservices may be included in the monthly feesor may be offered on an optional basis for anextra fee.Religious or cultural communitySome projects offer a specific religious orcultural environment. Buyers of these life leaseinterests are often attracted by the option ofliving somewhere that offers: services in a language other than Englishor French programs that are specific to a culture the end of the lease holder’s life the lease holder decides to moveFixed term leaseA small minority of projects set a fixed term(for example, 49 years). The life lease does notexpire at the end of the term—it is meant to berenewed if the occupancy goes past the term.Carefully review the life lease agreement tosee how the duration of occupancy is defined.If a fixed term is specified, ask about therenewal process.Spouse takeoverIf a lease holder who passes away has aspouse, then the life lease is usually extendedfor the term of the life of the spouse.The surviving spouse must meet the sponsor’seligibility criteria. They may also have to pay atransfer fee.Example: Kai, a 68-year-old life lease holder, dies and is survived by his spouse Lin, aged 63.The eligibility for residing in the life lease community is having a minimum age of 65.Lin applies to the life lease sponsor to be allowed to live in the unit. The life lease sponsordecides to be flexible and allow Lin to continue residing in the unit.Lin is required to pay a transfer fee and sign a new life lease agreement with the sponsor.Life lease housing 7

Difference between rental,ownership and life leasesAll models of life lease housing share somecharacteristics of both rental and ownership.See table 1 for some of the similarities anddifferences between rental, condominiumownership and market value life leasehousing models.Table 1: Life lease compared to other housing formsFeaturesRentalCondominium ownership Market value life leaseOwn propertyNoYesNoHave equityNoYesYesRegistered on title to landNoYesSometimes but rarely.Pay monthly feeYesYesYesParticipate in management NoYesSometimes. Usually aresidents’ council makesrecommendations tothe board.Life lease housing 8

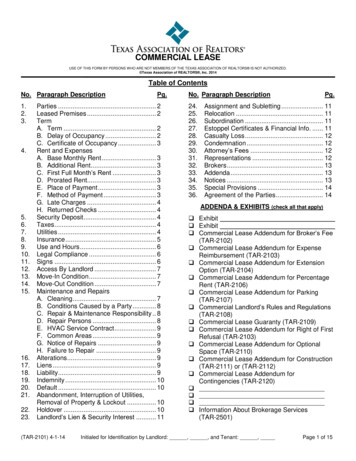

Difference between life leasesand land leasesThere is another form of housing with a similarname, land lease housing, which may beconfused with life lease housing. To help youunderstand the similarities and differencesbetween life leases and land leases, please seetable 2.Table 2: Difference between life leases and land leasesTopicLand leaseLife leaseOwnershipIn a land lease, the dwelling isowned by the resident and theland on which the dwelling sitsis leased.Life lease ownership meansholding an “interest in property”providing the right to live in theunit, usually for the duration ofthe lease holder’s life or until thelease holder decides to move.PaymentRent is paid to the land owner(landlord) of the land leasecommunity, and landlords mayprovide services and facilities tothe community that are intendedfor the common use andenjoyment of the tenants andthat are included in their rent.Life lease holders purchasetheir units by paying a lump sumupfront and then pay monthlyfees for maintenance andproperty taxes.TransferOwned homes can be boughtand sold by successive residentswho, in turn, rent the lot fromthe landlord.Life leases can be sold by thelife lease holder and inherited byheirs. However, while inheritorsmay profit from a sale of thelease, they cannot move intothe unit without first applying tothe sponsor and meeting theireligibility criteria.The Residential TenanciesAct (RTA)The RTA applies to mobilehome parks and land leasecommunities.The RTA does not apply to lifelease housing, when there is adirect relationship between alease holder and theproject sponsor.Life lease housing 9

Housing providers and residentsHousing providersMost life lease housing projects in Ontario areowned and operated by established non-profitand charitable organizations, including: faith-based groupscultural associationsservice clubsseniors’ organizationshousing providersSponsors may work with the resident to helpthem identify options for a new home in longterm care or another type of accommodationthat provides support to seniors. Discuss theseoptions and any other eligibility criteria with thesponsor before purchasing a life lease interest.AssessmentMany of these organizations provide otherforms of accommodation as well. For example,a sponsor may also offer long-term care,retirement homes and/or social housing. Manylife lease projects are located on the same landas these other forms of accommodation.When assessing a resident’s ability to liveindependently, sponsors consider the person’sindividual needs and circumstances.Sponsors look at whether residents:Most non-profit developers of life lease housingcontinue to own and manage the project afterconstruction is completed.Housing residentsLife lease housing is generally marketed toseniors and older adults. Different sponsorshave different ways of defining this age group.Ability to live independently can do basic tasks on their own (forexample, cooking, eating, dressing,bathing) have access to supports that enablethem to live independently (for example,regular visits by family members orsupport workers who help with basictasks, ability to hire a live-in caregiver,etc.) pose a potential danger to themselvesor to others in the building (for example,forgetting that the oven is on, leaving atap running)The sponsor will discuss concerns directly withResidents in life lease housing must be able tothe resident. The sponsor may also requestlive independently.a meeting with the resident’s family and/or aOnce a resident begins to need a higher level of formal assessment by a doctor, occupationaltherapist or social worker.care than is available (from the sponsor, familymembers, live-in caregivers, and/or visitingsupport workers), the resident is often nolonger able to stay in the life lease unit.Life lease housing 10

Ending the leaseLife lease agreements usually give thesponsor the ability to end the resident’slease with only 30 days notice if the sponsordetermines that the resident is no longer ableto live independently. In practice, this israrely used.any physical and mental disabilities up to thepoint of undue hardship. Some sponsors may: help the resident connect with externalsupport workers or community supportservice agencies provide services such as meal delivery,phone reminders to take medications,and assistance with bathing (additionalfees may apply)Under the Ontario Human Rights Code, lifelease sponsors have a duty to accommodateExample: Farval is a 73-year-old woman who has lived in Henlin Gardens Housing, a life leaseproject, for the past 15 years. Two years ago, her health started to fail.Henlin Gardens Housing staff provided her with a phone call each morning to remind her totake her medication. Henlin Gardens Housing did not have a meal program, so Farval’s familybegan to bring her meals. A home care worker came three times a week to assist Farval withbathing and personal care.One month ago, Farval accidentally left the stove on and a roll of paper towels caught fire.A community support service agency worked with Farval and her family to find her a roomin a nearby long-term care (LTC) home. The LTC home estimated that the wait would be twomonths. The family has hired a live-in caregiver and the sponsor has agreed to let her stay untila room becomes available at the LTC home.When residents come to the point where they need more care than they can access in theircurrent home, sponsors may work with them (and their families, where appropriate) to helpthem identify more suitable accommodations.Living arrangementsto live with them. Sponsors may makeexceptions to this rule.AgeYour spouse’s age should not affect your abilityto buy the life lease if you are both planning tolive there. In most life lease projects, either youor your spouse must meet the age criteria.Care-giversMost life lease projects allow caregivers tomove into a resident’s home. The caregiver maybe a: family member over the age of 18 professional support workerChildrenSponsors generally do not permit life leaseholders to invite their children or grandchildrenThe sponsor’s approval is needed for this.Life lease housing 11

Other factors to considerRulesAs an informed consumer, consider thefollowing factors before deciding to buy alife lease:All sponsors have rules that govern residents’behaviour. For example, sponsors may placerestrictions on smoking or limits to the number,type or size of pets that residents may have.Income and assetsBuying a life lease requires a large upfrontpayment. When considering whether thispayment is affordable, the potential buyershould also consider whether the additionalongoing costs are also affordable. Thesecosts include the monthly fees charged bythe sponsor.Property taxes and utility bills may also need tobe paid separately, as well as any costs for careand meal services.SublettingMost life lease sponsors do not allow residentsto sublet their units. This is another aspect toconsider when deciding whether to purchase alife lease interest.In instances where sponsors do allowsubletting, they usually require that the personsubletting the unit: meets the eligibility criteria establishedby the sponsor can live independently is aware of and agrees to follow theterms and conditions of the lifelease agreementLifestyleAll life lease projects have their owncommunity environment. Before buying a lifelease, a person should consider whether theexisting community at a life lease project is agood match with their interests and lifestyle.A person may buy a life lease in a project evenif they are not a member of the ethnic, cultural,linguistic or religious community it serves.To make sure that everyone is bound by thesame terms, the sponsor may ask the life leaseholder and the person subletting to sign a newagreement or an amending agreement.Life lease housing 12

General rules and proceduresEach life lease housing project is different. Forexample, living in a life lease townhouse isdifferent from living in a life lease apartment.The marketing materials received from thesponsor usually give a good sense of what lifewould be like in a specific life lease community.All life lease projects provide residents witha “rules and regulations” document thataddresses the way residents are to treatthe property.SmokingMany life lease projects place limitations onsmoking. This is more common in apartmentstyle buildings than in townhouse-styledevelopments.PetsMost life lease projects permit residentsto keep pets, but they often imposecertain restrictions.The resident may need permission from staffbefore moving a pet into their home. The lifelease project may also have rules about thesize, type and number of pets.Service animals are exempt from these typesof restrictions under the Ontario Human RightsCode and the Accessibility for Ontarians withDisabilities Act, 2005. This means that if aresident has a visual impairment, the sponsormust accept their seeing-eye dog even if it islarger than what the rules normally allow.RenovationsIf you are planning to renovate, it is a good ideato start by checking the rules.Most sponsors will require you to submit arequest outlining your renovation plans. Theywill check that proposed renovations willnot negatively impact the property’s structure,electrical wiring or plumbing. You mustwait until you receive written permission tostart renovations.Some sponsors may have a list of pre-approvedcontractors to choose from.FinancesSome sponsors provide regular updates aboutthe finances of the project, others do not. Mostwill share this information with lease holderswho request it.Sponsors may share financial information withresidents by:Life lease housing 13

presenting the information at a meetingto which all residents are invited providing documents to the residents’committee delivering documents to each life leaseholder’s mailboxOperationsBoard of directorsOften, a life lease board is responsible forthe life lease project and other services thenon-profit organization offers. In some cases,residents may serve on the board of directors.Residents’ committeeLife lease projects have some form of residents’committee or advisory council. This group mayorganize activities or raise issues with staff orthe board on behalf of residents.Residents’ committees play an advisory role,while the final decision rests with the board ofdirectors.Monthly feesLife lease residents pay a fee each month forthe provision of certain services. Sponsors mayrefer to these fees by names such as: cleaning and maintenance of commonareas and common elements (forexample, hallways, parking lots, offices,street lights, pool or worship space, etc.) insurance on the life lease project’scommon elements services such as recreational activities,chaplain services and health andwellness programsmaintenance feecommon feeoccupancy feeoccupant chargemonthly operating expenseThese will vary from project to project. It isa good idea to ask a sponsor for a writtenstatement of what the monthly fees cover anddo not cover.What is usually not coveredWhat is usually covered reserve fund contributions (to repair orreplace common elements) regular reserve fund studies property management (for example,garbage disposal, lawn mowing andsnow shoveling)Life lease housing property taxespersonal contents insurancecable television and internetutilities used in your suite or townhouse(for example, heat, electricity, water andair conditioning) services such as housekeeping,personal support and bus trips to localshopping centres repairs, renovations, or replacementsof specific elements of your home 14

(for example, fixing appliances, paint,installing a grab bar, or replacing therefrigerator) expenses related to the common areas:the costs associated with the commonareas are normally distributed amongall units number of support services andoperating expenses included: themonthly fee will be higher or lowerdepending on whether: services are included or optional(for example, daily meals andhousekeeping services)Calculating monthly feesThe monthly fee is typically based on an annualoperating budget that establishes the breakeven cost of operating the project.The amount of the monthly fee is determinedby three main factors: size of the home: a life lease sponsorwill often calculate the cost of eachresident’s monthly fee by charging acertain amount per square foot expenses are included or billedseparately (for example, utilities andproperty taxes)Example: Inga is interested in purchasing a life lease and is advised that in addition to thepurchase price, there is a monthly fee calculated at 50 cents per square foot.Inga’s monthly fee for an 800 square-foot unit would therefore be 400 per month.Fee increasesUnlike rental housing, there is no law in Ontariothat limits how much a life lease project cancharge for monthly fees.Most life lease sponsors are non-profitorganizations whose goal is to maintain astable, happy, and healthy community, andraising fees dramatically would work againstthis goal.On rare occasions, the monthly fee is raised bya more substantial amount to cover significantincreases in costs of operation or to cover newor unexpected costs, such as major repair work.Cost of support servicesand activitiesLike rental housing or condominium housing,monthly fees in life lease projects are usuallyraised by a small amount each year to passalong the increased costs of operation.Some life lease projects provide many supportservices and recreational activities, othersprovide only a few and some provide nosupport services. Some of these services andactivities are included in the monthly fee andothers the resident pays for if they choose touse them.The sponsor usually gives residents advancenotice of an increase in the monthly fee.Some programs are a blend of these two types.For example, a life lease project may include aLife lease housing 15

certain number of meals in the monthly fee but The sponsor will usually provide a brochuregive the resident the option of buying additional that lists the kinds of programs and services ameals if they wish.resident can expect if they move in.Example: Michel’s monthly fee of 675 includes daily breakfast and he usually cooks the restof his meals. When necessary, Michel has the option of buying lunch and dinner from the lifelease dining room at 15 per meal, paid monthly.Reserve fundLike the reserve fund of a condominiumcorporation, the reserve fund of a life leasecorporation is an account set aside by the lifelease sponsor for future capital repairs andreplacements to the building.Most common elements of a building can beexpected to wear out and require replacementover time. To ensure they have the moneyto pay for these capital projects, mostorganizations put money into a reserve fundeach month.The sponsor works to keep the reserve fund ata level that can cover expected replacements,with some additional money to coverunexpected repairs.Reserve fund studyTo determine how much money needs to beput aside each year, many organizations hire aprofessional to carry out a reserve fund study.Reserve fund studies are usually preparedafter three to five years of occupancy and thenupdated every three to five years.While condominiums are required by law toconduct regular reserve fund studies, life leasesponsors are not required to conduct reservefund studies—though many sponsors doconduct such studies.Life lease housing 16

Buy a unitUnit that is already builtIf you are considering buying a life lease unitthat has already been built, you may want toconsult your lawyer or real estate agentto help you obtain and understand thefollowing information.are other bills to be paid in addition to yourmonthly fees.Reserve fundConfirm how much money is currently held inthe reserve fund and find out: whether a professional outside of yourorganization was hired to conduct aregular reserve fund study when the last study was conducted,what it found and request a copy whether the last reserve fund studyidentified needed repairs if the current reserve fund is adequate tocover needed repairs any restrictions on the use of thereserve fundSale and resale processMake sure you understand what model theproject adopts. For example, market value priceindex or declining balance models.If you are purchasing a life lease interestin the project, make sure you understandany applicable land transfer tax paymentrequirements.You should also be clear on the resale process.For example, find out: the percentage of the resale priceretained by the sponsor as a transfer fee(also called an administrative fee) if the sponsor retains any other feesfrom the resale price, such asrefurbishing chargesMonthly expensesMake sure to confirm: cost of monthly maintenance fees how changes to monthly feesare determined if there is a limit to annual increasesRequest a breakdown of what the monthly feescover, how the fees are calculated and if thereFinancial informationRequest a copy of the life lease project budgetfor the current year and, if available, the nextyear. Confirm that residents can obtain a copyof the budget each year.Request the last annual audited financialstatements and the auditor’s report onthe statements and information about anyborrowings of the life lease corporationor sponsor.Find out the policy on the use of surplus fundsand if there are opportunities for residentsto provide input prior to decisions on majorexpenditures, such as:Life lease housing capital repairs 17

replacements remodeling expansions repairing replacingConfirm which building features residents areresponsible for, if any.LiabilitiesFind out whether the corporation (life leaseproject or sponsor) is involved in anylegal actions.Request information on any anticipatedsubstantial changes in the corporation’s assetsor liabilities.InsuranceRequest a document confirming the insuranceon the property and confirm details about theinsurance coverage for the life lease project,such as: what is covered and what is not coveredby the sponsor whether residents need to carryinsurance for the contents of theirunit (for example, furniture, personalpossessions) whether residents need to cover anyaccidental damages that residents maycause any other types of insurance thatresidents need to carry if residents will be notified of anychanges in the insurance coverage forthe buildingRepairsConfirm which building features the life leasesponsor is responsible for: maintainingRules and regulationsRequest a copy of any by-laws or rules, find outhow the rules and regulations are developedand learn what input residents have intosetting them.Determine whether a residents’ committee oradvisory council is in place, and if residents siton the board of directors.Find out what level of input residents have inthe operations of the life lease project.Ask for information on the process in placefor resolving disputes between residents orbetween residents and the life leaseproject’s managers.Services and programsRequest information on the kinds of servicesprovided at the life lease project. Find out whatis mandatory and what is optional.Ask about the kinds of recreationalactivities provided.Getting a

real estate agent, their fee is additional. Benefits. If real estate values go up, the holder can make a profit on the sale. The value of the life lease is not tied to the age or length of occupancy of the resident. Considerations. If real estate values go down, the holder can lose money. If the holder passes away, their inheritors will