Transcription

CONSUMER PROTECTIONA consumer’s guide toAUTO INSURANCE

About the Oregon Division of Financial Regulation .The Division of Financial Regulation protects Oregonians’ access to fair productsand services through education, regulation, and consumer assistance. It is part of theDepartment of Consumer and Business Services, Oregon’s largest consumer protectionand business regulatory agency.We regulate: Banks and credit unions Check cashing Debt management services Financial and investment advisors Insurance industry Mortgage industry Money transmitters Pawnshops Payday and title lenders SecuritiesWe make sure: Your insurance companies, banks, and credit unions are financially sound You are treated fairly Your insurance claims are handled promptly and accurately and the companies honortheir policies All financial, insurance, and mortgage professionals are held to high standards Insurance rates are not too high, not too low, and appropriate for the benefits beingprovidedOur consumer advocates are here to helpProtecting your financial life can be complicated, and getting the answers you needcan sometimes be frustrating. That is why the Oregon Division of Financial Regulationhas a dedicated team of consumer advocates here to help, free of charge.Oregonians are encouraged to contact our advocates one of three ways to askquestions, check a license, or file a complaint. Call 888-877-4894 (toll-free) Email dfr.insurancehelp@oregon.gov, or dfr.financialserviceshelp@oregon.gov Visit dfr.oregon.gov

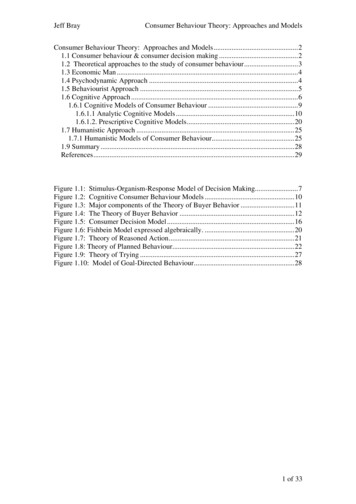

ContentsChoosing an insurer. 2Auto insurance basics. 2Underwriting standards.2Credit scoring.3Rating categories.3Types of coverage.4Extra liability coverage.4Your right to be treated fairly.4What to do if youcan’t get coverage.4A safety net for consumers.5Required coverages.5Proof of insurance.6Filing a claim . 6Dealing with total-loss claims. 7Saving money on auto insurance. 8Auto insurance questions and answers.10Words to know.121

Choosing an insurerFitch Inc.800-893-4824www.fitchratings.comAuto insurance helps protect you and yourfamily from losses resulting from motor vehicleaccidents. Oregon law requires every car drivenon public roads to be covered by automobileinsurance.The cost for coverage varies widely amongcompanies doing business in Oregon. That’s whyit’s important to shop around when choosing aninsurance company.This booklet can help you make an informeddecision. It includes information about whatkinds of coverage are required, how to shop forinsurance, and tips to hold down your costs.Comparison shopping takes a little more time,but it can save you money.However, cost is just one factor to considerwhen choosing an insurance company. It’s alsoimportant to look at the company’s financialcondition and how it treats its policyholders.A company’s financial information is availablefrom the following organizations that rate insurancecompanies. The organizations may charge a fee forthese services.Moody’s Investor Services212-553-0377www.moodys.comStandard & Poor’s Rating Information eet.com Ratings, Inc.800-289-9222www.weissratings.comOne source of information about howcompanies treat their policyholders is theConsumer Guide to Oregon InsuranceComplaints, which annually ranks insurers (top25) from best to worst based on the number ofconsumer complaints received by the Division ofFinancial Regulation. To request a copy, call 503947-7984 or 888-877-4894 (toll-free). The guideis also on our website, dfr.oregon.gov.A.M. Best Co.908-439-2200www.ambest.comAuto insurance basicsUnderwriting standardsInsurance companies typically review thefollowing when deciding whether to insure you: Driving record Car make and model Prior insurance coverage Consumer credit historyUnderwriting standards are rules insurancecompanies use to decide whether to insureyou. A company may reject your application forcoverage if your circumstances do not meet thecompany’s underwriting standards or risk factors.Drivers with the lowest risk factors are least likelyto have a claim, so they receive the lowest ratesfor insurance.2

Credit scoringhave a right to a free copy of your credit reportfrom the credit bureau. If you find an error in yourcredit report and arrange with the credit bureau tocorrect it, you can ask the insurer to reconsider.Credit information is available from three creditbureaus:Many insurance companies look at aconsumer’s credit history to decide whether toissue an auto or home insurance policy or howmuch to charge. This practice is known as creditscoring or insurance scoring.Insurance scoring has been controversial, anda number of states, including Oregon, have placedlimits on its use. In Oregon, insurers can’t use apolicyholder’s credit information to raise premiumsat renewal. (This does not apply to premiums forcommercial lines.) Also, the law prohibits insurersfrom canceling or refusing to renew existingpolicies because of credit history problems.Insurers can use credit information whendeciding whether to issue a new policy, but onlyif they can document that it helps them predictfuture claim costs and fairly price their products. Atthe same time, they must demonstrate that creditinformation is used as part of an evaluation systemthat also relies on other relevant factors.Oregon insurers and producers (agents) musttell consumers how the company uses creditinformation before running credit checks. If acompany uses credit information to prescreenapplicants, the company must notify you of thisbefore running a credit check. Equifax800-685-1111www.equifax.com Experian888-397-3742www.experian.com TransUnion800-888-4213www.transunion.comIf there are mistakes, ask the credit bureau tocorrect the information.Rating categoriesIf you are approved for coverage, theinsurance company will place you in one of threebasic categories of drivers: preferred, standard, ornonstandard.Preferred: This category is for driversconsidered the best risks, which usually meansthe safest drivers. Preferred drivers havemaintained clean driving records for the pastthree years and pay the lowest rates.Standard: This category is for driversconsidered moderate risks. Rates for standarddrivers are higher than those for preferred drivers.People in this category usually drive “family” carsand have reasonably clean driving records.Nonstandard: This category is for driversconsidered high risk. They pay the highest ratesfor insurance. This category may include driversyounger than 25, with little experience, historiesof tickets or accidents, poor premium-paymentrecords, and convictions for driving recklessly orunder the influence of alcohol or other drugs.If an insurer uses credit information to makean “adverse” decision, such as not to offer the bestrate or not to offer a policy, the insurer must giveyou specific reasons for the adverse action. You3

Types of coverageExtra liability coverageWhen you purchase an auto insurance policy,you’re really buying several types of coverage.There are seven basic types:You can buy a separate personal umbrellapolicy to provide extra liability protection if youare sued. An umbrella policy benefit will startpaying when your other policy’s liability limitsare exhausted. For example, if you lose controlof your car and cause an accident that kills oneperson, seriously injures four others, and damagesseven vehicles and one residence, the liabilitydamages from this accident likely will exhaust thelimits of your auto policy. A personal umbrellapolicy provides additional liability protection. Bodily injury liability coverage pays fordamages other people incur if you or someoneyou allow to drive your car causes an autoaccident. Examples of damages includemedical expenses, rehabilitation, funeral costs,settlement of lawsuits, and legal expenses. Property damage liability coverage pays fordamage to other people’s property if you orsomeone you let drive your car causes an autoaccident. It usually pays for repair or actualcash value (ACV) of others’ property and yourlegal expenses. Personal injury protection (PIP) coverage paysfor medical, rehabilitation, funeral, and childcare expenses, as well as for loss of earningsand in-home help if you and your passengersare injured in an accident, regardless of who isat fault. Uninsured and underinsured motoristbodily injury coverage pays medical,rehabilitation, and funeral expenses, loss ofearnings, and other damages if you or yourfamily are involved in a vehicle, bicycle, orpedestrian accident caused by an uninsured orunderinsured motorist or a hit-and-run driver. Uninsured motorist property damagecoverage pays for damage to your auto causedby an uninsured driver. This optional coveragegenerally duplicates your collision coverage,but may be a good buy if you have a highdeductible on your collision coverage or don’thave collision coverage. Collision coverage pays for repairing yourvehicle in a collision or rollover. Comprehensive coverage pays for damage toyour vehicle resulting from theft, vandalism,windstorms, fire, hail, etc.Your right to be treated fairlyAn insurance company cannot deny, refuse torenew, limit, or charge more for coverage becauseof your race, color, religion, or national origin.A company also cannot deny, refuse to renew,limit, or charge more for coverage becauseof your age, gender, marital status, domesticpartnership status, disability, or partial disabilityunless the refusal, limitation, or higher rateis “based on sound underwriting or actuarialprinciples.”In addition, a company cannot unfairlydiscriminate between individuals of the same(rate) class and essentially the same hazard (risk)in its rates, policy terms, benefits, or in any othermanner unless the refusal, limitation, or higherrate is “based on sound actuarial principles.”What to do if youcan’t get coverageIf you are an individual or company havingdifficulty buying automobile liability insurance,you may qualify for coverage under the assignedrisk pool through the Automobile Insurance Planof Oregon.You can get more information or help bycontacting your insurance producer (agent) orbroker. The agent should be able to arrangecoverage through the Western AssociationAutomobile Insurance Plans, P.O. Box 7917, SanFrancisco, CA 97104, 800-227-4659.4

A safety net for consumersMost states, including Oregon, have a safetynet to protect insurance consumers from financialloss if an insurance company becomes insolventand is unable to pay claims. Oregon’s safety net iscalled the Oregon Insurance Guaranty Association.Established by state law, the association is generallycomposed of licensed insurance companies doingbusiness in the state. It pays covered claims ofOregon policyholders and other claimants upto 300,000 if an Oregon-licensed insurancecompany becomes insolvent. Claims are paidaccording to the terms of the original insurancepolicy, and the association won’t pay any claim theinsurance company would not have paid.Medical services: Treatment is consideredreasonable and necessary unless a providerreceives a denial notice within 60 calendar daysof claim notice. After that, the burden of provingthat treatment was not reasonable and necessaryis on the insurance company.Loss of earnings: This benefit is availableif your injury prevents you from returning towork. It begins on the 14th day of your disability.You receive up to 70 percent of wages up toa maximum benefit of 3,000 a month for 52weeks.Essential services: If you are not employed,you are entitled to reimbursement of reasonablyincurred expenses for the essential services thatyou would normally perform. You will receiveup to 30 a day for up to 52 weeks. This benefitbegins on the 14th day of disability.Funeral expenses: You will be paid forreasonable and necessary funeral expenses withinone year of the date of injury up to a maximumbenefit of 5,000.Oregon law and your insurance policy allowPIP benefit disputes to be resolved by arbitrationas long as both parties agree at the time of thedispute. Know your PIP limit. Carefully review thiscoverage and consider raising your limit.Required coveragesOregon law requires every vehicle driven onpublic roads to be covered by auto insurance.Nevertheless, millions of dollars in damage iscaused each year by uninsured drivers. Thisincludes damage to vehicles and medical care forthose injured in accidents.Oregon’s mandatory-insurance law requiresthat drivers have at least these minimum coverages:Bodily injury (BI) liability 25,000 per person, 50,000 per accident forbodily injury to others.Property damage (PD) liability 20,000 per accident for damage to theproperty of others.Personal injury protection (PIP)PIP is Oregon’s version of no-fault insurance.It allows you and your passengers, no matter whocaused an accident, to have insurance coveragefor “reasonable and necessary” medical, dental,hospital, surgical, ambulance, and prostheticservices incurred within two years after the dateof an injury up to a maximum of 15,000.In Oregon, minimum PIP benefits includelimited coverage for loss of earnings, funeralexpenses, essential services, and child care.Uninsured motorist bodily injury(UMBI) and underinsured motorist(UIM) coverageThese coverages require your insurancecompany to pay all expenses that would normallybe paid by the other person’s company if you arehurt by an uninsured or underinsured motorist.5

Proof of insuranceState law requires, at a minimum, thiscoverage be no less than 25,000 per person, 50,000 per accident for bodily injury to youand your passengers caused by an uninsured orunderinsured driver.In Oregon, if you are in an accident and theother party is at fault, you can use that person’sliability coverage, as well as your UIM, to covercosts if the cost of your claim exceeds the otherparty’s liability limits, even if their liability limit isequal to your underinsured motorist coverage.Remember, these are the minimumcoverages required by Oregon law, not levelsof coverage recommended by the Division ofFinancial Regulation.Oregon law requires drivers to carry proofof liability insurance. The law also requires yourinsurance company to send you an insurance cardthat shows the effective date and expiration dateof your policy. Keep this card in your vehicle at alltimes.Driving without liability insurance could resultin fines, suspension of driving privileges, andimpounding of your vehicle.If a judge convicts you of driving uninsured,you will have to file proof of financial responsibilitywith the Driver and Motor Vehicle Services (DMV)for three years or face suspension of your license.This is in addition to any fines you must pay.Filing a claimStep 1: Understand your policyOregon law requires you to file an OregonAccident and Insurance Report directly with DMVwithin 72 hours (three days). Accident report formsand detailed instructions are available at policedepartments, sheriff offices, DMV field offices,and on DMV’s website www.oregon.gov/ODOT/Forms/DMV/32.pdf.Before you have a loss, sit down and carefullyread your insurance policy. If you have anyquestions about what is or is not covered, callyour producer (agent) or company.Step 2: Exchange informationIf you are involved in an accident, get theother driver’s name, address, phone number,insurance carrier, and insurer’s phone number.Be prepared to give the same information aboutyourself to the other driver. You can find insurers’telephone numbers on proof-of-insurance cards.Step 5: Notify your insurerContact your insurance company aboutthe accident as soon as possible. An insuranceadjuster will determine who caused the accident.If the accident was not your fault, you can haveeither your insurance company or the at-faultdriver’s insurance company handle the repair orreplacement of your vehicle. If you use the otherdriver’s company, you will not have a claim onyour automobile policy and you will not have topay a deductible.Step 3: Identify witnessesAsk witnesses to the accident for their namesand phone numbers in case their account of theaccident is needed.Step 4: File an accident reportIf the accident causes any injury or death, ormore than 1,500 damage to your vehicle or anyproperty, or more than 1,500 damage to anyvehicle and a vehicle is towed from the accident,6

Step 6: Don’t release insurers too earlyAppraisal clause: Most auto insurancepolicies include an appraisal clause, which canbe used to help settle disputes about physicaldamage claims between you and your insurancecompany. (The appraisal clause doesn’t apply forclaims you file with the other party’s insurancecompany.) If you can’t reach an agreement withyour company, you or your insurer can initiate theappraisal clause. Your appraiser and your insurer’sappraiser then select an independent umpire totry to resolve the dispute. Check your policy orask your producer (agent) or insurance companyfor more information about the appraisal clause.Don’t relieve your insurance company of itsresponsibility until the damages are settled toyour satisfaction. For example, revert to yourinsurance coverage if the other party’s insurancecompany questions its policyholder’s negligenceor offers an unacceptable settlement.Step 7: Consider these settlement factorsBodily injuries: You may be entitled to amonetary settlement for injuries caused byanother liable party. It can take several days forsome injuries to become apparent.Damages: The insurance company isresponsible to pay for the reasonable cost ofrepairs to your vehicle. An insurance adjuster willassess the damage. Usually, insurance companiesand auto body shops negotiate disagreementsabout what should be repaired. If you disagreewith their conclusions, you have the right toobtain another estimate at any auto body shop.Dealing with total-loss claimsInsurers can declare a vehicle is a total losswhen they don’t feel it is economically feasibleto restore a vehicle to its original condition. Aninsurance company may provide reimbursementfor a vehicle that is a total loss by offering acomparable vehicle in your local area or bypaying a cash settlement based on your vehicle’sfair market value. There are various acceptablemethods insurers can use in determining thevalue of your car. They also must tell you howthey determined the value if you request thisinformation. Here are some tips to deal with totalloss claims:1. You may file a total-loss claim with your owninsurance company or the insurance companyof the other person involved in the crash. Theinsurance company of the other person hasthe right to investigate the accident facts andaccept or deny responsibility for damages toyour vehicle.2. The insurer will prepare a valuation of yourvehicle and will then make an offer to you.You should have an idea of what your vehicleis worth. If you feel the value is not what youbelieve to be the correct value, you must provea higher value.3. Request a copy of the valuation and carefullygo over it. Correct any information that needsto be fixed, advise the insurance companyof the correction, and have the company runanother valuation.4. Check your local newspaper for privateparty vehicle sales and dealership sales ofcomparable vehicles. Also check the Internet(e.g., Edmunds and Auto Trader).5. If you filed with your own insurer and you donot agree with the value it is offering, you canask for the appraisal process (See appraisalclause above).7

6. You can ask to be paid the undisputed amount(the amount the insurance company offered)and advise the insurer you are continuing yoursearch for comparable vehicles.7. If you want to keep your vehicle and have itrepaired, know that the company is responsibleonly for the cost to repair or replace, whicheveris less. You can ask to keep the salvage and ifthe company agrees, it will send you the checkminus the salvage value of the vehicle.8. If you need a rental car, what the insurerowes you for the rental depends on thecircumstances. If you have rental car coverageunder your policy, your insurer owes you thepolicy coverage (based on the policy language).The other party’s insurer owes only for thereasonable length of time to complete therepairs to the damaged vehicle. This reasonabletime does not necessarily include the time ittakes an insurer to complete the investigation.9. The insurer usually pays storage fees at thebody shop up to the day it makes the offer toyou. If you do not accept the offer at that time,you may be responsible for future storage fees.The insurance company might also ask youto move your vehicle before settling the claimin order to reduce or avoid storage charges.If you do not agree to move the vehicle, youmay be responsible for those additional storagecharges.Saving money on auto insuranceBefore you buyDiscountsTalk with your producer (agent) or insurancecompany about insurance costs before you buy acar. Certain makes and models, especially sportscars, are higher risks for insurance companies andcost more to insure.You can save money on auto insurance bytaking advantage of discounts. Ask your producer(agent) or company if you qualify for discounts forany of the following: You insure two or more cars on a policy. Your auto and home insurance are on the samepolicy or with the same company. Your child younger than 25 has good grades inschool. Your child has completed a driver-educationcourse. You’ve completed a defensive-driving course. You’re a mature driver between 50 and 65. Your vehicle has air bags, an anti-lock brakingsystem, other safety equipment, or anti-theftdevices. You’re a low-mileage driver. You’re in a carpool.Comparison shoppingAsk several companies for quotes. By shoppingaround, you may find several hundred dollars’difference between quotes. Be sure to compareidentical coverages when comparing policies.CoveragesDrop collision coverage on cars that costmore to repair than they are worth. For example,consider carrying only liability coverage for carsvalued at less than 1,000.Increase your deductible. Take the highestdeductible you can afford on collision andcomprehensive coverage.8

You haven’t gotten any traffic tickets in threeyears. You haven’t been in any accidents in threeyears. You have a favorable credit history.Paying premiumsDriving recordReview your policy periodically and updatecoverage accordingly.Notify your producer (agent) immediatelyif you move, substantially reduce your annualmileage, sell your car, change your maritalstatus, or change the number of drivers in yourhousehold.You can save on service charges by payingpremiums in full rather than on a quarterly ormonth-to-month basis.Reviewing your policyMaintain a good driving record. Your premiumsare directly related to your driving record.Under Oregon law, an insurance companycan use only the last three years of your drivingrecord when deciding whether to issue or renewa policy or determining your premium. If you hadan accident or a violation, and your rates havegone up or your policy has been assigned to anonstandard insurer, talk with your insuranceproducer (agent) or company. If it has been morethan three years since your accident or violation,you may qualify for a lower rate. If not, considerchanging companies.Young singles on their ownAvoid performance or “turbo cars.” A turboengine can add more than 10 percent to yourpremium.Take a defensive-driving course.Older driversDrivers 55 and older must be given a discountif they complete a state-certified safe drivingcourse.Parents of teenagersIf your teenagers don’t own cars, make sureyour insurer understands which cars they aregoing to be driving and if it will be occasionalor principal use. If they do own cars, considercovering them under your policy. Otherwise, theywill probably have to pay higher premiums.Check into discounts such as those listed onthis page. If your young driver goes to schoolmore than 100 miles away — without a car —you may qualify for another discount.9

Auto insurance questions and answersWhy does my insurance cost more than myproducer (agent) said it would?Why is it harder to get insurance if drivers inmy household have bad driving records?This is called a misquote. Determining yourpremium depends on many factors, includingwhere you live, the kind of car you drive, howmuch you drive, how much coverage you want,your driving record, and your age.Many companies won’t insure you if you livewith a relative who has a poor driving record.If your teenager has a poor driving record, youmay have trouble getting a preferred rate becausehe or she is defined as an “insured” underyour policy. Some companies will exclude thisperson by name from the insurance policy. Manycompanies will not insure anyone in the familyunless every driver in the household meets theirrequirements.If an error is made in reporting any ofthese facts, your rates won’t be quotedcorrectly. Misquotes can also happen if yourproducer (agent) makes a mistake in applyingthe company’s rating system. Auto insurancemisquotes can happen when your applicationinformation differs from your actual drivingrecord.What do insurance companies consider whenthey decide whether to cancel or not renewpolicies?Companies ask states’ motor-vehicle divisionsto verify the records of drivers they insure.Insurance companies evaluate the risksassociated with each policyholder to determineif you are a “good risk” or if your policy shouldbe canceled or not renewed. Some of the areasinsurance companies review: Claims. Do you file claims frequently or forlarge amounts? Driving record: Do you have a bad drivingrecord (speeding, driving under the influence,etc.)?If you told your insurance producer (agent)you have a perfect driving record, and you don’t,your insurance company will charge higherpremiums than your producer (agent) quotes.To avoid misquotes, provide accurateinformation about your driving record and anyother facts affecting the cost of insurance, such asthe make of your car or how far you commute towork. Verify all information before signing theapplication.How does my driving record affect myinsurance premium?The premium you pay is a direct reflectionof your driving record for the past three years.Insurance companies order driving records fromthe Oregon DMV and from other states whereyou have been licensed. Statistics show thatdrivers with tickets and accidents are more likelyto have accidents than drivers with clean records.My car was “totaled.” Why didn’t my policypay what I think my car was worth?Most auto insurance policies pay the actualcash value (ACV) of a vehicle totaled in anaccident. The ACV is equal to the market value ofan auto immediately before the accident.Insurers must use a fair and reasonablemethod to determine the value of your car. Theyalso must tell you in writing that informationabout how they determined the value is availableif you request it.10

Why didn’t I get a notice that my insurancepolicy was canceled?Tell the insurance company what you believemakes your car worth more than the insureris willing to pay you. It may come down tonegotiations between you and the insurancecompany. Note: An insurance company will notcompensate you for your car’s sentimental value.What happens if my loan was more than myinsurance company says my car was worth?The value of a car is sometimes less thanthe balance on your car loan. There can beseveral reasons for this. Interest rate changesmay have increased the amount of your loan.Rebates may not have applied to the purchaseprice or poor maintenance of the auto may havereduced its value. The insurance company basesits payment on the actual cash value (ACV) of thecar at the time of the loss, not on the amount ofyour loan.Your company must send you a notice atleast 10 days before canceling your policy fornonpayment. If your policy has been canceledor “nonrenewed” for a reason other thannonpayment, the company must give you at least30 days’ advance notice. An explanation of thereasons for the cancellation or nonrenewal mustbe part of or accompany the notice.Under Oregon law, insurance companies mustbe able to prove notice was sent, but not that youreceived it. It is your responsibility to tell yourinsurance company if your address changes. Keeptrack of your payments.What’s the difference between comprehensiveand collision coverage?Comprehensive coverage typically coversdamage from fire, theft, explosion, glass breakage,animal collision, and other incidents not coveredby collision coverage. Collision is usually definedas colliding with another object or overturning.Most auto policies have a lower deductiblefor comprehensive coverage than for collisioncoverage. If you have an older car that may costmore to repair than it is worth, consider thefollowing to save money: Raise your deductible. Drop your collision coverage, orcomprehensive coverage, or both.You can purchase a special type of insurancecalled “Guaranteed Auto Protection,” or GAP,when you buy a car and GAP may help incase of loss if you owe more on your leaseor loan balance than the ACV of the vehicle.This coverage is sometimes available as anendorsement to your regular auto insurance. Youragent can tell you if your company offers

Consumer Guide to Oregon Insurance Complaints, which annually ranks insurers (top 25) from best to worst based on the number of consumer complaints received by the Division of Financial Regulation. To request a copy, call 503-947-7984 or 888-877-4894 (toll-free). The guide is also on our website, dfr.oregon.gov. Auto insurance basics