Transcription

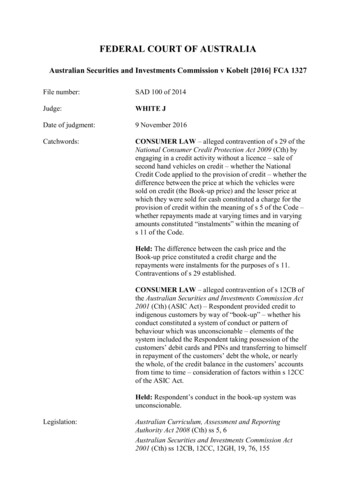

FEDERAL COURT OF AUSTRALIAAustralian Securities and Investments Commission v Kobelt [2016] FCA 1327File number:SAD 100 of 2014Judge:WHITE JDate of judgment:9 November 2016Catchwords:CONSUMER LAW – alleged contravention of s 29 of theNational Consumer Credit Protection Act 2009 (Cth) byengaging in a credit activity without a licence – sale ofsecond hand vehicles on credit – whether the NationalCredit Code applied to the provision of credit – whether thedifference between the price at which the vehicles weresold on credit (the Book-up price) and the lesser price atwhich they were sold for cash constituted a charge for theprovision of credit within the meaning of s 5 of the Code –whether repayments made at varying times and in varyingamounts constituted “instalments” within the meaning ofs 11 of the Code.Held: The difference between the cash price and theBook-up price constituted a credit charge and therepayments were instalments for the purposes of s 11.Contraventions of s 29 established.CONSUMER LAW – alleged contravention of s 12CB ofthe Australian Securities and Investments Commission Act2001 (Cth) (ASIC Act) – Respondent provided credit toindigenous customers by way of “book-up” – whether hisconduct constituted a system of conduct or pattern ofbehaviour which was unconscionable – elements of thesystem included the Respondent taking possession of thecustomers’ debit cards and PINs and transferring to himselfin repayment of the customers’ debt the whole, or nearlythe whole, of the credit balance in the customers’ accountsfrom time to time – consideration of factors within s 12CCof the ASIC Act.Held: Respondent’s conduct in the book-up system wasunconscionable.Legislation:Australian Curriculum, Assessment and ReportingAuthority Act 2008 (Cth) ss 5, 6Australian Securities and Investments Commission Act2001 (Cth) ss 12CB, 12CC, 12GH, 19, 76, 155

Consumer Credit (New South Wales) Act 1995 (NSW) s 5Consumer Credit (Queensland) Act 1994 (Qld)Credit Act 1984 (NSW) s 14(2)(b)Credit Act 1985 (ACT) s 14(2)(b)Credit Act 1987 (Qld) s 16(2)Credit Act 1984 (WA) s 14(2)(b)Evidence Act 1995 (Cth) ss 53, 54, 59, 60, 64(3), 69, 87(1),135, 136, 140National Consumer Credit Protection Act 2009 (Cth) ss 5,6(1), 29, 36National Credit Code ss 3, 4, 5, 10, 11, 12, 13, 17, 65, 204,325Second-Hand Vehicle Dealers Act 1995 (SA) ss 16(1), 17,23Second-hand Vehicle Dealers Regulations 1995 (SA)Second-hand Vehicle Dealers Regulations 2010 (SA)Cases cited:Alcan (NT) Alumina Pty Ltd v Commissioner of TerritoryRevenue (Northern Territory) [2009] HCA 41; (2009) 239CLR 27Attorney General of New South Wales v World BestHoldings Ltd [2005] NSWCA 261; (2005) 63 NSWLR 557Australian Competition and Consumer Commission v CGBerbatis Holdings Pty Ltd [2003] HCA 18; (2003) 214CLR 51Australian Competition and Consumer Commission v LuxDistributors Pty Ltd [2013] FCAFC 90Australian Securities and Investments Commission v CashStore Pty Ltd (in liq) [2014] FCA 926Australian Securities and Investments Commission vNational Exchange Pty Ltd [2005] FCAFC 226; (2005) 148FCR 132Blomley v Ryan (1956) 99 CLR 362Bridgewater v Leahy (1998) 194 CLR 457Briginshaw v Briginshaw (1938) 60 CLR 336Ceva Logistics (Australia) Pty Ltd v Redbro InvestmentsPty Ltd [2013] NSWCA 46Commercial Bank of Australia Ltd v Amadio (1983) 151CLR 447Dasreef Pty Ltd v Hawchar [2011] HCA 21; (2011) 243CLR 588Daw v Toyworld (NSW) Pty Ltd [2001] NSWCA 25Fry v Lane (1888) 40 Ch D 312Geeveekay Pty Ltd v Director of Consumer Affairs Victoria

[2008] VSC 50; (2008) 19 VR 512Guthrie (as liq of Ult Ltd (Rec Apptd) (In Liq)) v RadioFrequency Systems Pty Ltd [2000] WASC 152; (2000) 34ACSR 572Harrington-Smith on behalf of the Wongatha People v Stateof Western Australia (No 2) [2003] FCA 893; (2003) 130FCR 424Helby v Matthews [1895] AC 471Hoare v Rennie (1859) 5 H&N 19; 157 ER 1083Howell v Evans (1926) 134 LT 570Johnson v Smith [2010] NSWCA 306Jones v Barkley [1781] 2 Dougl 685; 99 ER 434Kakavas v Crown Melbourne Ltd [2013] HCA 25; (2013)250 CLR 392Kingston v Preston [1773] 2 Doug KB 689; 99 ER 487Lee v Butler [1893] 2 QB 318Lee v The Queen [1998] HCA 60; (1998) 195 CLR 594Louth v Diprose (1992) 175 CLR 621Paciocco v Australian and New Zealand Banking GroupLtd [2015] FCAFC 50; (2015) 236 FCR 199Paciocco v Australian and New Zealand Banking GroupLtd [2016] HCA 28; (2016) 333 ALR 569Provident Capital Ltd v Bortolin Papa (No 1) [2011]NSWSC 460Quick v Stoland (1998) 87 FCR 371Reynolds v Katoomba RSL All Services Club Ltd [2001]NSWCA 234; (2001) 53 NSWLR 43Sydneywide Distributors Pty Ltd v Red Bull Australia PtyLtd [2002] FCAFC 157; (2002) 234 FCR 549Tonto Home Loans Australia Pty Ltd v Tavares [2011]NSWCA 389; (2011) 15 BPR 29,699Walker v Consumer, Trader and Tenancy Tribunal of NewSouth Wales [2013] NSWSC 1432WJ Allan and Co Ltd v El Nasr Export and Import Co[1972] 2 QB 189Date of hearing:9-12, 15-18 and 23-26 June 2015 and 1 and 2 July 2015Date of last submissions:10 July 2015Registry:South AustraliaDivision:General DivisionNational Practice Area:Commercial and Corporations

Sub-area:Regulator and Consumer ProtectionCategory:CatchwordsNumber of paragraphs:627Counsel for the Applicant:Mr T Duggan SC with Ms N CharlesworthSolicitor for the Applicant:Australian Securities and Investments CommissionCounsel for the Respondent:Mr DA Trim QC with Mr H HeuzenroderSolicitor for the Respondent:Lempriere Abbott McLeod

ORDERSSAD 100 of 2014BETWEEN:AUSTRALIAN SECURITIES AND INVESTMENTSCOMMISSIONApplicantAND:LINDSAY KOBELTRespondentJUDGE:WHITE JDATE OF ORDER:9 NOVEMBER 2016THE COURT ORDERS THAT:1.The matter is adjourned to a date to be fixed by the Court for determination of reliefand costs.Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENTIntroduction[1]The evidence in the trial[10]Mintabie and Nobbys Store[18]Book-up system[24]Elements of the Book-up system[28]Purchase orders[78]Cash Advances[86]Travel expenses[88]Cancellation of key cards[89]The withdrawals on 14 December 2010[92]The February 2011 incident[98]Nobbys’ profit and loss statementsSection 29 of the NCCP Act[109][112]The contracts between Mr Kobelt and his customers[126]The price differential[132]Mr Kobelt’s determination of the purchase price[133]An alleged change of practice[138]The statements of Mr Kobelt’s solicitor[146]Assessment of the evidence concerning the alleged change of practice[154]The sale by instalments[173]The effect of the application of s 11[196]The position without applying s 11[199]Summary on s 29[210]Unconscionable conduct – the “system” case[211]Section 12CB of the ASIC Act[213]The conduct in question[228]Nobbys’ Book-up customers[235]Remoteness[240]The view[248]

-2Evidence from a financial counsellor[266]The Mimili Store manager[275]Mr Kobelt’s evidence as to customer characteristics[283]The Anangu witnesses[291]AH and AW[295]Customer B[320]Customer D[328]Ronny Brumby[336]Rhoda Pearson[361]ABS statistics[378]NAPLAN results[384]Anthropological evidence and statistical analysis[388]Findings as to the characteristics of the 117 customers[417]Mr Kobelt’s evidence[426]Mr Kobelt’s credibility[430]Practices at Nobbys[453]Mr Kobelt’s record keeping[458]Comparative interest rates[485]Use of Book-up by others[497]Evaluation[506]Relative strength of bargaining positions: s 12CC(1)(a)[507]Conditions not reasonably necessary to protect Mr Kobelt’s legitimateinterests: s 12CC(1)(b)[517]Centrepay[525]Direct debit[531]Payday payments[534]Employer deductions[537]The alternatives: summary[538]Understanding of documents: s 12CC(1)(c)[541]Absence of undue influence or pressure or unfair tactics: s 12CC(1)(d)[547]The cost of alternative but equivalent financial services: s 12CC(1)(e)[551]

-3Consistency of conduct to like service recipients: s 12CC(1)(f)[552]Willingness to negotiate terms and conditions: s 12CC(1)(j)[554]Acting in good faith: s 12CC(1)(l)[557]Other factors listed in s 12CC(1)[560]Non-compliance with the Code[562]Improvident spending[565]Demand sharing[574]Customers’ voluntary conduct[586]Absence of complaints[590]Centrelink loans[594]Mr Kobelt’s discretionary control[598]The “tying” effect of the conduct[603]Paciocco[608]Conclusion on unconscionability – the “system” case[611]Unconscionable conduct – the secondary case[625]Conclusion[627]WHITE J:Introduction1The respondent, Mr Kobelt, conducts a general store at Mintabie under the name “NobbysMintabie General Store” (Nobbys). Mintabie is in the far north of South Australia, beingabout 1,100 km north of Adelaide. It is located on an opal field which is part of an areaexcised by lease to the Government of South Australia from the Anangu PitjantjatjaraYankunytjatjara Lands (APY Lands).2As part of his business, Mr Kobelt sells second hand motor vehicles and provides credit tocustomers by way of “Book-up”.3The applicant (ASIC) alleges that Mr Kobelt’s conduct since 1 July 2011 in providing creditto purchasers of motor vehicles contravenes s 29 of the National Consumer Credit ProtectionAct 2009 (Cth) (NCCP Act). Section 29 prohibits a person from engaging in a “credit

-4activity” if the person does not hold a licence authorising the person to engage in the creditactivity.4In addition, ASIC alleges unconscionable conduct by Mr Kobelt in contravention of s 12CBof the Australian Securities and Investments Commission Act 2001 (Cth) (the ASIC Act) byhis conduct since at least 1 June 2008 in requiring, as a condition for his provision of credit topurchasers of cars or goods at Nobbys, that the customers provide him with a debit cardlinked to a bank account into which their income is paid together with the customer’spersonal identification number (PIN) relating to the card, and his later conduct in using thecard and the PIN periodically to withdraw all or nearly all of the monies in the account inreduction of the customer’s debt. With one exception, each of the customers in question is anindigenous resident on the APY Lands or in adjacent regions.5ASIC’s primary allegation is that Mr Kobelt’s conduct since at least 1 June 2008 in providingcredit and in making use of the debit card in the way just outlined in relation to at least 117 ofhis indigenous customers constitutes a system of conduct or pattern of behaviour within themeaning of s 12CB(4) of the ASIC Act which is unconscionable. This part of ASIC’s casedid not turn on the circumstances of any individual customer. ASIC’s secondary allegationwas that Mr Kobelt’s conduct in relation to Book-up in the case of four customers wasunconscionable. In order to protect the privacy of these customers, they were referred to inthe pleadings and in the evidence as Customers A, B, C and D. In fact, two persons compriseCustomer A as they are a husband and wife. I will refer to the husband as AH and to the wifeas AW.6Ultimately, ASIC did not press for findings on its secondary case.7ASIC seeks by way of relief the grant of declarations and injunctions, the imposition of civilpenalties and publicity orders.8For the reasons which follow, I am satisfied that ASIC has made good its allegations.Mr Kobelt did, in the period commencing on 1 July 2011 and continuing until at least April2014, contravene s 29(1) of the NCCP Act by engaging in credit activity within the meaningof s 6(1) of that Act when he did not hold a licence authorising him to do so.9Further, Mr Kobelt did, in the period commencing on 1 June 2008 and continuing until atleast July 2015, engage in a system of conduct or pattern of behaviour within the meaning ofs 12CB(4)(b) of the ASIC Act which was unconscionable within the meaning of s 12CB(1)(a)

-5of the ASIC Act. The system is the Book-up system which Mr Kobelt implemented atNobbys. I have said that the conduct continued until July 2015, because that is when the trialin the action was concluded.The evidence in the trial10A large amount of documentary evidence was tendered at the trial. ASIC led evidence from15 witnesses. With the exception of six Anangu witnesses, the evidence in chief of thesewitnesses was provided in writing, although in some cases there was some additional oralevidence in chief. Four of the witnesses were not required for cross-examination. Thesewere Ms Bretherick from the Commonwealth Bank of Australia (CBA), Mr Grant fromAustralia Post, Mr Holmes who was previously employed by ASIC, and Mr Mills fromWestpac Banking Corporation (Westpac).The witnesses who were required forcross-examination were Mr Marchese and Mr McCabe (both from ASIC), Mr Stauner,Mr Kilpatrick and Dr Martin. I indicate now that I regarded the evidence of Mr Marchese,Mr McCabe, Mr Stauner and Mr Kilpatrick as being honest, reliable and useful. Given thecriticisms made by Mr Kobelt of aspects of Dr Martin’s evidence, I will defer considerationof his evidence to later in these reasons.I observe, however, that notwithstanding hiscriticisms, Mr Kobelt’s final submissions relied to a not insignificant extent on the evidenceof Dr Martin.11The evidence of the six Anangu witnesses was taken in Marla.12Mr Kobelt gave evidence himself and adduced evidence from his former solicitor, Mr Proud,Professor Glonek (who has expertise in mathematical statistics) and from Mr Jorgensen (aforensic accountant).13In making my assessment of the evidence and of ASIC’s claims, I have had regard to s 140 ofthe Evidence Act 1995 (Cth) and to the approach discussed in Briginshaw v Briginshaw(1938) 60 CLR 336 at 361-3.14The transcripts of an examination of Mr Kobelt by ASIC pursuant to s 19 of the ASIC Actwas admitted into evidence pursuant to s 76 of the ASIC Act.15Much of the evidence concerning Mr Kobelt’s Book-up system and its operation was notcontentious. There were, however, distinct differences between the parties on some aspects,and it will be necessary to make findings concerning them.

-616For reasons of convenience, I will describe Mr Kobelt’s Book-up system using the past tense.It is to be noted, however, t

Sydneywide Distributors Pty Ltd v Red Bull Australia Pty Ltd [2002] FCAFC 157; (2002) 234 FCR 549 Tonto Home Loans Australia Pty Ltd v Tavares [2011] NSWCA 389; (2011) 15 BPR 29,699 Walker v Consumer, Trader and Tenancy Tribunal of New South Wales [2013] NSWSC 1432 WJ Allan and Co Ltd v El Nasr Export and Import Co [1972] 2 QB 189 Date of hearing: 9-12, 15-18 and 23-26 June 2015