Transcription

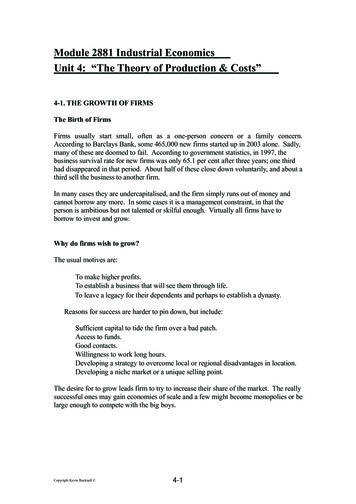

Module 2881 Industrial EconomicsUnit 4: “The Theory of Production & Costs”4-1. THE GROWTH OF FIRMSThe Birth of FirmsFirms usually start small, often as a one-person concern or a family concern.According to Barclays Bank, some 465,000 new firms started up in 2003 alone. Sadly,many of these are doomed to fail. According to government statistics, in 1997, thebusiness survival rate for new firms was only 65.1 per cent after three years; one thirdhad disappeared in that period. About half of these close down voluntarily, and about athird sell the business to another firm.In many cases they are undercapitalised, and the firm simply runs out of money andcannot borrow any more. In some cases it is a management constraint, in that theperson is ambitious but not talented or skilful enough. Virtually all firms have toborrow to invest and grow.Why do firms wish to grow?The usual motives are:To make higher profits.To establish a business that will see them through life.To leave a legacy for their dependents and perhaps to establish a dynasty.Reasons for success are harder to pin down, but include:Sufficient capital to tide the firm over a bad patch.Access to funds.Good contacts.Willingness to work long hours.Developing a strategy to overcome local or regional disadvantages in location.Developing a niche market or a unique selling point.The desire for to grow leads firm to try to increase their share of the market. The reallysuccessful ones may gain economies of scale and a few might become monopolies or belarge enough to compete with the big boys.Copyright Kevin Bucknall 4-1

4-2. THE MOTIVES OF FIRMS1. Profit maximisation.In economic theory, the main motive for a firm is to maximise profits. This is central tomainstream theory. It involves equating marginal cost with marginal revenue, whateverthe market situation the firm is experiencing.2. Revenue maximisationThis is another suggested goal. It would be possible for a firm to survive following thisgoal but it would grow more slowly and always be a bit at risk. A lusty profitmaximiser could seize an increasing share of the market, possibly driving the revenuemaximiser out in the longer term.Using our diagrams, instead of the firm seeking the point where MC MR as a profitmaximiser would, the revenue maximiser keeps expanding output as long as marginalrevenue is positive. It ceases to be positive where it cuts the horizontal axis at Q in thediagram below. As soon as it becomes negative, total revenue would start to fall, so thefirm stops.Price, costs,RevenueMCACPAR0QMRQuantityIn the above diagram, the revenue maximising quantity is thus OQ and the price is thenread off the demand curve: the firm chooses price OP.Because the firm reduces price until marginal revenue becomes negative, there is animplication for the elasticity of demand. If a price reduction leads to an increase in totalrevenue, we know that demand is elastic. If a price reduction leads to a fall in totalrevenue we know that demand is inelastic. As we switch from increasing to falling totalrevenue, the elasticity of demand must be neither – it is unit elastic at that point.4-2

3. Sales maximisationThis is a third suggested goal. It suffersfrom the same problem of the revenuemaximisers, in that the firm is vulnerable to profit seeking competitors.Such a firm will expand output until the average cost curve intersects the demand curve,as in the diagram below.Price, costs,RevenueMCACP0ARMRQQuantityThe firm produces OQ level of output and sells it for price P. This price is lower thanthe profit maximiser’s price, or the revenue maximiser’s price – as one would expect asmore sales is what it is all about.A variant of this model is that the firm may concentrate on maximising sales in theshort term in order to gain a larger share of the market so that in the long term it canearn more profits by switching its goal. It is a sort of long term profit maximiser usingthe route of short term sales maximisation!Another business variant model of the sales maximiser is that it is possible that whenthe firm becomes large, managers are taken on and they may prefer to maximise salesrather than profits. The shareholders would generally prefer higher profit but they havelittle say in day to day running of a company.4-3

4-3. THE EXTERNAL GROWTH OF FIRMS:MergersA firm may grow by merging with, or taking over, another firm. There are twodirections in which it can do this: horizontal and vertical. These refer to the position ofthe other firm within the structure of the industry.Horizontal mergersThis is when a firm merges with another at the same level within the industry. As anexample, if one video rental firm takes over another video rental firm. In effect theyexist at the same level and they do the same things. They are probably directly incompetition with each other, although some may be located differently. A recentexample of this occurred in 2004 when the supermarket Morrison took over Safeway;Morrison was strong in the north of England but lacked southern outlets. It is, as youwould imagine, difficult for a supermarket to obtain suitable land in or near cities, sothat a take-over or merger is the simplest way of expanding into a new area.Vertical mergersThis is when a firm takes over another which is earlier or later in the production processwithin the industry. As an example, a wholesaler of shoes might take over a shoe shopor chain of shoe shops, in order to provide itself with outlets. This is an example offorward merger. If it were to take over a shoe manufacturing company, it would be anexample of backward takeover. A current example of a backward merger is the effortin 2004 by the American Wal-Mart company, trading in Britain as Asda, to develop aclose partnership over a section of the milk supply industry at the farm level.Some such mergers are an effort to reduce risks and establish a safe source of supply oroutlet chain.However, many backward mergers by a dominant firm are an effort to reducecompetition and perhaps lead to a later take over the whole industry. Once a wholesalerowns an important manufacturing unit it can deny the produce to its own more directcompetitors or make them buy on less advantageous terms. There are fears that Asda’srecent efforts in the milk chain supply industry could lead to a less competitivesituation.Conglomerate mergersThis is where a company in one industry takes over one or more companies in a totallyunconnected industry. The result will be a conglomerate, or a company which spansseveral unconnected industries. A contemporary example is Richard Branson’s Virgin,which began as a mail order record retailer, then opened a retail store and branched outinto running railway trains (Virgin Rail) and airlines (Virgin Airways). He is also in tobook publishing, software publishing, clubs, travel, hotels, and cinemas. Some of these4-4

have loose connections, others none. In all he now owns over 150 companies andclaims that they all make money.4-5

4-4. MULTINATIONAL CORPORATIONSMultinational corporations (MNC’s) have grown in importance as globalisationproceeded and they are a factor in encouraging the globalisation process. An MNC istypically a huge corporation spanning several continents with one home base, whichmight be in the UK, the USA, Holland, France, Japan . it can be anywhere but isalmost always in the country in which it first began. Some are the result of mergers,horizontal or vertical, as a company in country A takes over an existing company in adifferent country. Others are the result of the original company in country A investingmoney in country B to build a factory or firm there.You will certainly have heard about a lot of MNC’s, even if you did not know thatthis is what they were! Well-known examples are Ford (motor vehicles), Unilever,Sony, IBM, Philips, and Reckitt and Colman.These large companies have huge sums to invest and the world is their oyster. Theyoften try to locate production where the manufacturing costs will be low, so recipientcountries include places like China, India, Indonesia, Pakistan and Thailand. Variousservice centres will normally be established to cover the different parts of the world.In the last half of the twentieth century, globalisation was rapid. It was assisted by ahuge fall in the costs of communication and finding information, as well as by tariffcuts and quota reductions or elimination. MNC’s took advantage and grew rapidly aspart of this; in addition they were responsible for pressuring governments to takeaction, such as tariff cuts, which helped the MNC’s to expand. By the end of the lastcentury, trade between multi-nationals themselves has been estimated to account forone third of world trade, and another third is made up of trade by MNC’s with nonaffiliates. They are indeed major players!We return to look at MNC’s, what they do and the arguments for and against them inUnit 6.4-6

4-5. AN INTRODUCTION TO PRODUCTION THEORY AND COSTSProduction theory underlies all the theory of the firm, it is related to resourceallocation, and it is where we get the supply curve from.We assume for simplification:A one-product firm.We can identify land, labour and the units of capital used, as well as costs.Land, labour and capital are homogeneous, which means they are all identical.Firms aim to maximise profits. Other models do exist, e.g. sales maximisation,but they are not a part of central economic theory.ProfitsProfits are not a dirty word!But what some people will do for profit can be very dirty indeed! It is alleged that theMafia in the USA will give you a cheap quote for removing and dealing with your toxicwaste - then they might just tip it into reservoirs to get rid of it, and not spend themoney to do it properly.The function of profits: (what are they for?)Profits are a signal - a high rate of profit in an industry is a signal that society valuesthat particular good or service highly and will pay a lot to get it. This tells us that moreresources should go into this industry that society values so much. Individual firmsmove in to get the profit and as a result, resources automatically go where they areneeded. Adam Smith was the first to see how a market economy allocates resourcesand publicise it; and this process was what he meant by “the invisible hand”.Losses are a signal that too much is being produced, that is, output should be reduced.This means that firms ought to leave that industry, as society does not value that goodor service so highly. Where profits are falling in an industry, it often means thatdemand has altered away from that good or service. The lower profits encourage somebusiness people to move out.The law of diminishing returns says that if one factor of production is increased,while holding all other factors constant, then after a point, the additions to output willstart to fall and ultimately total output will decrease.As an example, if you were to take your back garden and turn it to growing potatoes,you might start, say, with five people (N) plus five spades (K) and your garden (L).4-7

The resulting output may be 100 kg p.a. of King Edward’s potatoes.If you add a 6th person output (but no more spades or land) output might increase to180 kg – the new person can weed or water while the others dig, etc., so output willrise. The addition to total output is then180-100 or 80 kg. This is the marginal productof the sixth person.If you add a 7th person, output would still increase, perhaps to 250 kg – the addition tototal output is 250-180 or 70 kg, which is the marginal product of the seventh person.You can see the 70 kg just added is less than the 80 kg added earlier - i.e., the additionto total output from last person employed is falling, which is to say that returns arediminishing.You might object that these figures are merely invented – which is true. But think! Bythe time you get to the 200th person, standing in your back garden and only five spadesto work with, output is not going to be large! It is probably zero, in that there is noroom to plant, dig or anything as your garden is wall-to-wall people! At some earlierpoint, output must have reached a maximum then fallen to nothing.The point where output was at maximum might have been around the fifteenth ortwentieth person, and after this, more people began to be a nuisance. The new personmight start to gossip and distract the others; or perhaps they trip over the new comernow and then, so that output actually fell a little after he was employed. When totaloutput starts to fall, the marginal addition is negative, and total output starts to decreaseat that point.This law must hold – we can always add enough labourers to completely fill yourgarden, however large, and leave no room for growing potatoes at all. The same appliesto producing anything, for example, T-shirts. The table below shows a possiblescenario.SEEING THE LAW OF DIMINISHING RETURNS TO THE FACTORPRODUCTION LABOURWorkers per day101234567Output – T-shirts per Marginal product (T-shirtsdayper worker)23by (subtraction from col. 2)044 (4-0)106 (10-4)133 (13-10)152 (15-13)161 (16-15)14-2 (14-16)11-3 (11-14)4-8OFAverage product (Tshirts per worker)4 (col. 2 col. 1)4.005.004.333.753.202.661.57

You should observe that in the above table:1. As we add labour, total product increases.2. Marginal product rises at first, then falls steadily after that, and finally it becomesnegative.3. When the marginal product is above the average product, average product isincreasing; when marginal product is below the average product, average productisdecreasing.This is the property of averages, it has nothing to do with economics! When the amountadded exceeds the average, it must pull the average up.Let’s take an example of a Premier League soccer team week by week and see theaverage, total and marginal scoresSoccer Match: Average, Total, and Marginal Goals ScoredMatchNumber112345Goalsscored inmatch224103Total goals scored(adding col. 2)3267710Average goalsper match(col. 3 col. 1)42.003.002.331.752.0Marginal goalsper match(col. 2)524103If you examine the table you will see that when the margin is above the average, it pullsthe average up. And when the margin is below the average, it starts to pull it down.It not only applies to a team scoring goals, or indeed any set of figures, it works justthe same way in production. We can graph this too!As a firm adds labour, we can show the changes in marginal product (MP) andaverage product (AP) in a diagram.So looking at the T-shirt example the soccer scoring table you will see that theinformation on totals, marginals and averages follows a similar pattern.4-9

The average product and the marginal product curvesMP & APAPMP0Quantity of the factorWe can also draw a diagram of the total product curve.The total product curveTotal OutputTP0Quantity of labourWhy is it that shape?Before we hire any labour there will be no output, so the curve starts at the origin.At first, it is easy to produce, we can get the necessary workers and staff we need easily,and so the output curve increases and also accelerates upwards.Later on, we will start to encounter problems, so the growth in output slows, thenreaches a peak, and finally will fall.4-10

What sort of problems might be encountered? They could be things like:We will start to run out of machinery (remember that we are only increasinglabour, holding other factors constant) so that the relationship between thenumber of workers and the number of machines gets worse. In simple terms,the balance is wrong. In the example of your garden, the workers ran out ofspades and had to find something else to do you will recall.The emergence of bottlenecks in the factory – storage space for materials, semifinished and finished products perhaps.Possibly the workers cannot find parking space nearby, which annoys them, andthey then feel disgruntled and lower their efforts. This would not be the law ofdiminishing returns as such, but a loss of motivation.The production functionThe production function shows how many of the factors of production we must use toget various different levels of output. In other words, it shows the relationship betweendifferent inputs and the resulting output.We can see production function in several ways:1. We can see it in the generalised formO f (L, N, K) R(Which means “Output is related in some way to the inputs of land, labour, capital andthe catch-all remainder term”).2. We can see it as the total product curve above. In the diagram, as we increase the useof labour, we can watch total product increase. This is a simple, one factor model.3. We can also see it as a box of choices, using two factors of production labour andcapital.The production function as a box of choicesOne question is how can we produce using the resources we have got? How shall wecombine them? (this is called “the choice of technique”).The firm could use:1) A lot of capital and a little labour; or4-11

2) A lot of labour and little capital.Engineering information gives us the figures in the box that might look like:The Box of ChoicesCapital (across)Labour (down)1 worker2 workers3 workers4 workers5 workers1 machine9202633*352 machines182733*39413 machines2633*3842444 machines33*38424546You can see that we can produce 33 units of output in several different ways – the firmswill choose the cheapest method or the choice of technique to use, to maximise profits.If wages are low (relative to the cost of machines) the firm would use as more workersand fewer machines - four workers and one machine would do it (this is typical of adeveloping country like Indonesia).If wages are high (relative to the cost of machinery) the firm would choose to use moremachines and few workers – in this case two machines and one worker (this is typicalof a rich developed country like the UK or USA).COST CURVESSome definitions:Total Cost is what it says – total costs are all the costs of the firm (fixed variable)Fixed Costs are fixed, irrespective of output; they do not increase as output increases.Examples are the salaries of the managerial staff, the interest paid to the bank on themoney borrowed, or the local council tax.Variable Costs alter as output changes. Examples include the need to hire more labourto increase production; and using more raw materials to gointo the extra output.Clearly the variable costs must rise as output increases.Average cost is the total cost divided by output.4-12

Marginal cost is the addition to total cost from producing the last unit of output [or onemore unit – it is at the margin.]Price, CostsMCACOutput0For all the theory of the firm, and all market conditions, the AC and MC curveslook the same – you can always start by drawing the AC and MC CURVESwithout even thinking!Why are the shapes that way?When MC is below AC it pulls it down; when MC is above AC it pulls it up. Thismeans that the MC curve must cut the AC curve at the lowest point.The AC curve is U-shaped because when starting to produce, the fixed costs must beborn by a few units of output, so average costs must be high; as the firm produces more,the fixed costs are spread over more units of output, so AC falls. Then it reaches aminimum. Eventually the firm is trying to produce more than it was designed for, andaverage costs start to rise.We can depict this as the mirror image of average and marginal products – as physicaloutput increases so costs fall, but as average product and marginal product fall, socosts must rise.4-13

AP & MPAC & MCMPAPACMCOutput0Occasionally there might be a question in an exam asking about the relationshipbetween the two.4-14

4-6. THE DIFFERENT POSSIBLE MARKET CONDITIONSThe theory of the firm covers perfect competition, imperfect (or monopolistic)competition, and monopoly. These are increasingly less competitive in the orderlisted. Oligopoly is considered to be something of a special case.The Arrow of Competition:Monopolistic competitionPerfectCompetitionMonopolyOligopolyAs just pointed out, all firm diagrams start the same way!Price, CostsMCACOutput0The equilibrium position is where marginal cost marginal revenue!Why? Logic! If a firm is profit maximising, it continues an action, like expandingoutput, until it costs more to do it than it brings in as revenue. As long as revenueexceeds costs, it pays to go on doing it. As an example, if total revenue is 2,000 andoutput is such that the last unit sold increased costs by only 1,500 it clearly added 500 to revenue more than it cost to build and was worth doing. And another unitmight add 1,900 to costs but sold for 2,000 so was also worth it. The next unit,however, might add 2,050 to costs but bring in 2,000 – a loss of 50 so it would notbe worth it. When the last unit just adds 2,000 to costs and brings in an extra 2,000it is marginal – it makes no difference if we produce that last one or not.4-15

So what do we know?The cost at the margin (the addition to total cost from the last unit produced)increases as production rises (the MC curve).The revenue from the last unit sold is the marginal revenue (MR).Logic tells us that the firm will continue expanding output and watching MCrise until it equals what the firm receives from the marginal unit sold (MR).Therefore when MC MR it is the best the firm can do, so it stops there; it isin equilibrium.We use the MC curve to trace what happens if a firm changes its output level, for thatvery reason.PERFECT COMPETITION (the right hand end of the arrow above)Perfect competition is defined as a situation where there:Are many small buyers and sellers (firms) each too small to affect the price – thefirms are "price-takers".Is a homogeneous product [all are identical].Is free entry and exit. This means that firm can join or leave the industry – it is bothallowed and costs nothing.Is perfect knowledge.If we take out “perfect knowledge” (which never exists in the real world) and leave thefirst three assumptions, we get "pure competition”. It is less than perfect, but is still verycompetitive.The diagram of an individual firm:Price, CostsMCACP10Ot14-16Output

Equilibrium is where the marginal cost curve, MC, cuts the price line, P1. In perfectcompetition any of the tiny firms can sell more without having to lower its price – it istoo small to affect price! This means that the price line above is the marginal revenuealso. The firm always gets the same price at the margin.The price line is also the average revenue in perfect competition. It’s just the maths.Total revenue P x QAverage revenue TR QClearly if we multiply P by Q then divide the result by Q we must end up with Pagain!Perfect competitors are price takers!The price is set at the industry level by the total supply and demand curves, in the normalway. Each firm must accept it – because the industry is made up of lots and lots of smallidentical firms; none can affect price.The price is set in the industry by the demand of the consumers cutting the industrialsupply curve. Where does this supply curve come from? We get it by adding up all theMC curves of each little individual firm in the industry. All these MC curves added upare the industry supply curve as long as we are in perfect competition!How price is set at the industry level:Price is setin the industryby S & DEach tiny firm accepts that priceTiny firm 1Tiny firm 2PriceDPrice, CostsPrice, CostsSMCACP1P10Q1Quantity in millons0MCACP1QQuantity in hundreds4-170QQuantity in hundreds

And the small individual firms are price takers because they are too tiny to be able tochange it - and there is no point selling it for less than they could get.If demand for the product increases in the industry, it causes an increase in price andfirms move up the MC curve.Q. Why the MC curve?A. As was said above, because the firm is interested in increasing output as long as itbrings in a greater revenue than it costs to make the extra bit.How an increase in demand in the industry affects the perfectly competitivefirms:We first change the price in the whole industry as demand has increased then tracethis over to see what it would be like for an individual firm. The increased demand inthe industry causes price to increase; each small firm enjoys this sudden increase inprice - and of course its profit increases. The firm then increases output in order tobenefit from as a high a profit as it can manage.Each tiny firm enjoys a higher price- sliding up the MC curveDemand forthe productincreasesPriceD1Tiny firm 1D2Tiny firm 2Price, CostsPrice, CostsSMCACP2P10Q1 Q2Quantity in millionsMCP2P2P1P10Q1 Q2Quantity in hundreds0ACQ1 Q2Quantity in hundredsAbove the equilibrium point where MC cuts the price line P1 (which is also marginalrevenue and average revenue as explained earlier), the firm makes more than itsnormal profit. You can see that at P2 it is operating above the average cost curve.Normal profit is built into the average cost curve – without it the firm goes bust!Above the AC curve, the firm makes “excess profits” or “above normal profits”.However, firms can earn above normal profit like this in the short term only.Why is this? The above normal profit immediately attracts other firms to enter theindustry. After all, they have perfect knowledge which means they know about it!4-18

And the free entry and exit proviso means they can race in! And this means extraoutput, i.e., an increase in supply at the industry level, so price starts to fall back.This process bids away the profits all the way down to where we started where MC MR AC P1. So in the long term, under perfect competition, no above normalprofits are possible.Q. Can you take the diagram above, draw it for yourself, then increase the supplycurve until P2 falls back to P1? Try it now!What happens if price falls below AC? At this level, all the firms lose money andcontinue to do so until some firms go out of business. When they do, supplydecreases, so that price starts to increase, and this continues until the price is back tothe original equilibrium position.Average variable costs versus average total costsAverage variable costs must always be covered (they go directly into the particularitem one is selling); but average total costs are different. Average total costs includeall kinds of things, like new toner for the computer’s printer – these do not go directlyinto any particular item, they just have to be covered in the long run. So a firm cancontinue in business in the short run, as long as average variable costs are covered,even if average total costs are not. Anywhere between A and B in the diagram below,the firms are covering the variable cost of production and earning a little extratowards covering the long term total average costs. So it is worth staying in businessfor some time and hope that market conditions improve (prices rise) so that they willreturn to profitability. [This is a common multiple choice question].Price, CostsMCATCAVCBAOutput04-19

The advantages of perfect competitionResources are allocated in the most efficient way to meet market demand andmaximise consumer satisfaction.- This means that market mechanism works better.It is the cheapest way of using the factors of production we have.- Which says that we are at the lowest part of the AC curve.There is no cost of advertising, selling, marketing, or motions. These are often aform of waste to society as a whole, though beneficial for individual firms.Rapid change is possible to meet new consumer demands – it is very flexible.The interests of producers are the same as for consumers.Freedom to choose exists.It avoids all the wastes of monopoly.It prevents the emergence of a few rich and powerful people (Conrad Black?Robert Maxwell?) There are a lot of firms, all small, so that no major powerfulpersonality can rise and dominate others.The disadvantage of perfect (or pure) competitionIt produces what is demanded under the given distribution of income. We canimagine a scenario with a very few rich people with pet dogs or cats which dineextremely well on chicken and the like, while the masses starve.Spillovers and externalities can exist. These are costs caused to others, e.g. thedisposal of nuclear waste or toxic chemicals by dumping them in streams.No economies of scale possible - all the firms are too small.Perfect competition is consistent with a limited choice of range of goods;monopolistic competition may have a much wider range. An example ismotorcars – there are an awful lot of different models and competition is muchless than perfect.Little or no research and development is possible because there are no funds forit. Under perfect competition there are no surplus profits (in the long run theyare whittled away!) R&D is possible under monopoly because of the surplusprofits available.4-20

MONOPOLY – THE LEAST COMPETITIVE MARKET SITUATION (the lefthand end of the arrow of competition)Monopolistic re is some overlap between Unit 2 and Unit 4 on monopoly, so this may seemfamiliar to you.)WHAT IS A MONOPOLYDefinition: Technically it is a sole supplier, i.e., there is one firm in the industry. It isthe industry.But there are degrees of monopoly - if one firm supplies, say, 80 per cent, it is close to amonopoly and will usually act like one.Types of MonopolyEconomies of scale. One firm grows large, its cost curves are lower than theothers, so it is able to sell more; in the end it grows to become the sole firm.This is the so-called natural monopoly.2a) The law. The government may restrict the industry to one nationalised firm.An example was British Steel some decades ago in the UK.2b) Regulations. A trade union may have a monopoly over the supply of onekind of labour – the British Medical Association covers all doctors for instance.Agreement between firms, so that they all act together and behave as onemonopolist. This is often illegal but it happe

Module 2881 Industrial Economics Unit 4: "The Theory of Production & Costs" 4-1. THE GROWTH OF FIRMS The Birth of Firms Firms usually start small, often as a one-person concern or a family concern. According to Barclays Bank, some 465,000 new firms started up in 2003 alone. Sadly, many of these are doomed to fail.