Transcription

CALSTRS RETIREE PAID THROUGH ACCOUNTS PAYABLEProcess for STRS Retirement DeskCalSTRS retirees are subject to a yearly (July I -June 30) limit on earnings (ED Code24216.6). Districts and COE's are responsible to report tbe creditable earnings of retiredmembers to CalSTRS. Please see ED Code 24216-24221 for what constitutes creditableservice. When a contract for professional services is submitted to the Business Office fora retired CalSTRS member the COE process is as follows:Contracts will come from the Director of Fiscal Services. Check membership via socialsecurity number on REAP.Print out REAP account screen and attach to contract. Return the contract to Director ofFiscal Services. Normally, the contract is not moved forward and the retiree is paidthrough payroll. If an exception is made, the Director of Fiscal Services will informaccounts payable to forward the invoice to the retirement desk.If member is retired, any invoices, along with the CalSTRS Retiree Earnings paidthrough Accounts Payable Form (see attached form), will be forwarded to retirementdesk for reporting. The invoice an1ount will be included on the next CalSTRS retirementreport. The date of service on the retirement report will be when "earned" not when paid.It is the employee's responsibility to keep track of their creditable earnings, not theemployer. The employer must inform the retiree of the annual earnings limit and thatthese earnings are subject to the limit. The Director of Fiscal Services will inform thedepartment and the department will inform the retiree.COUNTY RESPONSIBLITIESWhen a district has a CalSTRS retiree that they have paid through accounts payable thedistrict must submit the CalSTRS Retiree Earnings paid through Accounts Payable Formalong with a copy of the invoice to the Sonoma County Office of Education STRSRetirement desk. The invoice amount will be reported on the next CalSTRS retirementreport with the appropriate earning dates.

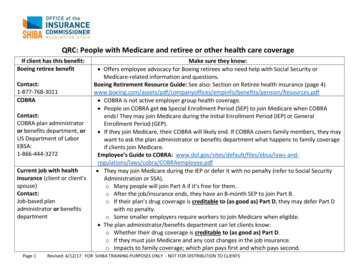

CALSTRS RETIREE EARNINGS PAID THROUGH ACCOUNTS PAYABLEDate:To: SCOE Retirement Desk / Carol Mahan / Fax#578-0487From District:Contact Person:Phone number:EmailAddress:CalSTRS Retiree Name:Social Security#:.STRS Retirement Date:Amount Paid:Period Worked:Type of Work Performed:Basis of Pay: DailyMonthlyAnnually(circle one)Please attach a copy of the paid invoice to this document.Please note:CalSTRS retirees that perform creditable service and are paid through accounts payable mustbe reported to CalSTRS. If you have paid a CalSTRS retiree through accounts payable pleasefill out this form immediately after processing the payment and send it into the Sonoma CountyOffice of Education, STRS Retirement Desk.Please make sure the CalSTRS retiree has been informed of the annual earnings limit and is awarethat these earnings are being reported to CalSTRS for the time period they have been earned (notnecessarily when paid) and will count against the annual earnings limit.

Join CalSTRS? Join CalPERS?Decide which retirement system is best for you2013–14

On Our Cover:Raymond teaches general math and pre-algebra to 6th and 7thgraders at a middle school in Southern California. His teachinginspiration is coach John Wooden. Next to his classroom doorhangs a poster of Wooden’s “Pyramid of Success” so hisstudents can learn about qualities that build toward success,including loyalty, initiative and self-control. Raymond has been aCalSTRS member for 12 years.ContentsChoosing Your Retirement System4Your Questions Answered5Dual Membership12The California Public Employees’ Pension Reform Act of 2013 made significant changesto the benefits for members first hired to perform CalSTRS creditable activities on orafter January 1, 2013, and who never before performed CalSTRS creditable servicesunder a different retirement system, including Social Security. As a result, CalSTRS nowhas two benefit structures: CalSTRS 2% at 60: Members first hired on or before December 31, 2012. CalSTRS 2% at 62: Members first hired on or after January 1, 2013.For more information, see the Member Handbook 2013, available atCalSTRS.com/publications.The California Public Employees’ Pension Reform Act of 2013 also made changesto CalPERS benefits for members first hired on or after January 1, 2013. For moreinformation, visit CalPERS.com.Note: Pending legislation would allow individuals who were CalPERS members on orbefore December 31, 2012, and who become CalSTRS members within six months ofleaving CalPERS coverage, to fall under the CalSTRS 2% at 60 benefit structure.This guide is based on the California Teachers’ Retirement Law and the California Public Employees’ RetirementLaw as of January 1, 2013. If there is a conflict between this information and the law, the law prevails.

As you begin your new position, use this booklet to help youdecide which retirement system is the best choice for you toachieve your retirement goals.Contact CalSTRSAsk your employer for a copy of the CalSTRS Member Handbook or find the currentCalSTRS Member Handbook at CalSTRS.com/publications.Go online to CalSTRS.com for more information. Check to see if pending or new legislation may affect your decision at CalSTRS.com/legislation, CalSTRS.com/funding orcontact your union or legislative representative.Call CalSTRS at 800-228-5453.Contact CalPERSAsk your employer for the School Member Benefit publication, What You Need to KnowAbout Your School Benefits.Go online to CalPERS.ca.gov for more information and any legislative changes underconsideration.Call CalPERS at 888-CalPERS (888-225-7377).Join CalSTRS? Join CalPERS? 2013–143

Choosing Your Retirement SystemThis brochure outlines the differences between CalSTRS and CalPERSif you are changing from a job covered by one retirement system to ajob covered by the other retirement system. For example, if you are in aclassified position covered by CalPERS and accept a certificated positioncovered by CalSTRS, you may be eligible to choose to join CalSTRS orremain with CalPERS. Ask your employer or call your current retirementsystem for eligibility requirements. This important choice is yours.Staying With Your CurrentRetirement SystemTo remain with your current system, submit theRetirement System Election form to your newemployer within 60 days of your effective datein your new position. Ask your new employerfor the form or go to CalSTRS.com to download or order a copy.Changing Your RetirementSystemDo nothing for 60 days and you automaticallybecome a member of the retirement systemcovering your new position.If you decide to become a member of theretirement system covering your new position,here are some additional choices to consider: If eligible, you may retire from your formersystem and become an active memberof the new system. If you’re not eligibleto retire, you may keep your account withthe old retirement system and have dualmembership in both systems. You canlater retire from both systems at the sametime. For more information, see page 12. You may take a refund of your contributions in the old system. CalSTRS andCalPERS have different rules about takinga refund. If you take a refund, you lose allrights to benefits from that system unlessyou later redeposit your contributions plusinterest.Note: If you retire with CalSTRS, there is arestriction that you cannot work in a classified position after retirement except as ateacher’s aide under certain circumstances.Please contact your employer to determine ifyour position would be considered a classifiedposition.You have 60 days from the effective dateof your new position to complete andsubmit the paperwork to stay with yourprevious retirement system. If you donothing, you will become a member of thenew system.4Join CalSTRS? Join CalPERS? 2013–14

Your Questions Answered1. How is my retirement benefit calculated?3. When can I retire?CalSTRS & CalPERSBoth systems calculate your retirement benefit basedon your years of service (service credit) in the retirementsystem, your retirement age (age factor) and your finalcompensation:CalSTRSCalSTRS 2% at 60: You can retire at age 55 with five yearsof service credit or as early as age 50 with 30 yearsof service credit, or under the special circumstances ofconcurrent retirement with another pension system.Service credit X Age factor X Final compensation Basic retirement benefitCalSTRS 2% at 62: You can retire at age 55 with fiveyears of service credit.The DifferenceAge factors are different for each system.CalPERSYou can retire at age 50 with five years of service credit.If you became a new member on or after January 1, 2013,you must be at least age 52 to retire. New membersinclude members who have a break in service greater thansix months between the separation date from a previousemployer and the appointment date with a new employer.2. How is my final compensationdetermined?CalSTRSCalSTRS 2% at 60: Final compensation is based on yourhighest three consecutive school years of annual salaryif you have fewer than 25 years of service credit, or yourhighest 12 consecutive months of annual salary if youhave 25 or more years of service credit. The cap oncompensation that can be counted toward your retirementbenefit is 255,000 for 2013.CalSTRS 2% at 62: Final compensation is based on yourhighest annual salary for three consecutive school years,regardless of years of service credit. The cap on compensation that can be counted toward your retirement benefitis 136,440 for 2013.CalPERSFinal compensation is based on your highest average fulltime monthly pay rate for 12 or 36 consecutive monthsof employment, depending on your collective bargainingagreement or employer contract, and may include specialcompensation. CalPERS uses your full-time pay rate, notyour earnings.If you were first hired on or after January 1, 2013, thereis a cap on compensation used to calculate your benefitequal to 113,700 in 2013.The DifferenceFinal compensation is calculated differently for eachretirement system, and each system has a differentcompensation cap.The DifferenceMinimum retirement ages and years of service aredifferent for each retirement system.4. What annual adjustments are made tomy benefit?CalSTRSYour retirement benefit is increased each year by 2 percentof your initial retirement benefit beginning September1 after the first anniversary of your retirement. TheLegislature can reduce or eliminate this adjustment ifeconomic conditions dictate. CalSTRS also pays quarterlysupplemental payments when your benefit falls below 85percent of purchasing power. In addition, the Legislaturehas periodically authorized ad-hoc annual benefitadjustments.CalPERSBeginning May 1 of your second calendar year of retirement, your initial benefit is increased up to 2 percent peryear, compounded annually, unless the rate of inflationis lower. CalPERS pays monthly supplemental paymentswhen the benefit falls below 75 percent of purchasingpower. In addition, the Legislature has periodically authorized ad-hoc adjustments.The DifferenceThe CalSTRS annual benefit adjustment is notcompounded; the CalPERS annual benefit adjustment iscompounded annually to reflect inflation and does nothave a fixed rate. CalSTRS purchasing power protection is85 percent and paid quarterly; CalPERS purchasing powerprotection is 75 percent and paid monthly.Join CalSTRS? Join CalPERS? 2013–145

5. Can I work in education after I retire?CalSTRSIf you return to work after retirement in a position withthe California public school system, there are restrictionsunder state and federal law: You cannot work in a classified position except, undercertain circumstances, as a teacher’s aide. If you exceed the annual postretirement earningslimit, CalSTRS will withhold your gross monthly retirement benefit until we collect all earnings in excessof the limit. The postretirement earnings limit forthe 2013–14 fiscal year is 39,903. There is a verynarrow exemption from this limit. (See “After YouRetire” in the CalSTRS Member Handbook.) If you return to CalSTRS-covered employment within180 days of your retirement date, CalSTRS will reduceyour retirement benefit dollar for dollar by the amountyou earn, up to your retirement benefit earned in thatperiod. There is a very narrow exemption from thisrequirement if you have reached normal retirementage. (See “After You Retire” in the CalSTRS MemberHandbook.)If you received a retirement incentive and return towork for the employer that offered the incentive withinfive years of your retirement, you will lose the additional service credit you received under the retirementincentive.You can continue to receive your full CalSTRS retirementbenefit with no earnings limit if you take a job in privateschool, private industry, public school outside of California,or the University of California or California State Universitysystems (See “After You Retire” in the CalSTRS MemberHandbook.)CalPERSIf you’re a certificated employee, stay in CalPERS, thenretire and accept a temporary assignment in a classified or certificated position in a school, you can workup to 960 hours in a fiscal year as a retired annuitant.Accepting a permanent part-time position (even if fewerthan 960 hours in a fiscal year) or working more than 960hours requires reinstatement to active employment.A 180-day waiting period is required for all retired annuitants employed on or after January 1, 2013, except undera certain specified exemption approved by a county officeof education. The 180-day waiting period starts from thedate of retirement. If under normal retirement age (age55 if the highest retirement formula is 2 percent at 55),you must have a bona fide separation before accepting atemporary assignment.See the Employment After Retirement publication in theForms & Publication Center at CalPERS.ca.gov.6Join CalSTRS? Join CalPERS? 2013–14The DifferenceRetirement benefits from both plans can be affected bypostretirement work. For CalSTRS retirees, this meanswork in a certificated position; CalPERS retiree work limitations affect both classified and certificated positions.6. Do I have disability benefits?CalSTRSYou have disability benefits under one of the CalSTRSdisability benefit programs: Coverage A or Coverage B.Coverage A: hired on or before October 15, 1992, unlessyou elected Coverage B before April 1993; Coverage B:hired after October 15, 1992.If you have five years of service credit (or one year ifinjured by a violent act on the job), your disability benefitgenerally is 50 percent of your final compensation, plus10 percent for each eligible child, up to 90 percent of yourfinal compensation. Coverage A: At normal retirement age your disabilitybenefit ends and you may apply for service retirement.You’ll receive an ongoing benefit equal to the lesser ofyour disability benefit or your retirement benefit. If you are over age 45 with fewer than 10 years ofservice credit, your disability benefit is 5 percentof your final compensation multiplied by your yearsof service credit. For example, with seven years ofservice credit, your benefit would be 35 percent ofyour final compensation. Coverage B: You’ll receive a disability benefit for aslong as your disability continues.CalPERSIf you have between five and 10 years of service credit—or 18.5 years or more of service credit—your disabilityformula is 1.8 percent X years of service credit X finalcompensation. If you have between 10 and 18.5 yearsof service credit, your disability retirement benefit maybe improved up to 331/3 percent of final compensation.When you qualify for service retirement, you’ll receiveyour service retirement benefit if the amount is greaterthan the disability retirement. You also may be eligible fordisability benefits under Social Security.The DifferenceDisability benefits paid by CalSTRS are generally higherthan those paid by CalPERS, but CalPERS membersalso may be eligible for disability benefits under SocialSecurity. In addition, CalSTRS benefits increase if thereare dependent children; CalPERS provides no coverage fordependent children.

7. What is my total retirement contribution?9. Do I participate in Social Security?CalSTRSCalSTRS 2% at 60: You pay 8 percent of your earningstoward retirement, plus 1.45 percent for Medicare.CalSTRSNo, and any Social Security benefits you earned in otheremployment or received as a spouse may be reducedwhen you start receiving your CalSTRS retirement benefit.CalSTRS 2% at 62: Your contribution rate for 2013is 8 percent, plus 1.45 percent for Medicare. Thecontribution rate is subject to change based on thenormal cost of the plan.CalPERSThe percentage of your contribution is fixed by law and isgenerally intended to be an amount that will cover half ofthe normal cost of the benefit earned per year. Normalcost will vary by benefit type. You also pay 1.45 percentfor Medicare, and most members pay 6.2 percent forSocial Security on earnings up to 113,700 for 2013.The DifferenceCalSTRS members contribute up to 9.45 percent of theirsalary toward their retirement benefit and earn no creditsfor Social Security benefits. Most CalPERS members payand earn credits for Social Security benefits; therefore,you may contribute a higher percentage of your salary.8. What is my employer’s contribution?CalSTRSYour employer contributes 8.25 percent of your salary plus1.45 percent for Medicare. Employer contributions are notcredited to your Defined Benefit account, but are deposited in the Teachers’ Retirement Fund to help fund thebenefits to all members and their beneficiaries. They arenot refundable to you.CalPERSYes, if you were hired after 1959. However, there arespousal Social Security exceptions.The DifferenceCalSTRS members neither contribute to nor earn SocialSecurity benefits. Also, CalSTRS-covered service mayreduce previously earned Social Security benefits. Contactthe Social Security Administration at 800-772-1213or visit socialsecurity.gov to learn more. Most schoolemployee members of CalPERS contribute to SocialSecurity.10. Will I have health coverage in retirement?CalSTRS and CalPERSIf you are covered by the Public Employees’ Medical andHospital Care Act, you’re eligible for health benefits if youare enrolled upon separation and retire within 120 daysof your separation date. If you get health care from othersources, coverage depends on your bargaining agreement.The DifferenceThere is no difference.CalPERSThe rate of your employer’s contribution varies year toyear. These contributions are paid into your employer’saccount. They are not shown on your account balance andare not refundable to you.The DifferenceCalSTRS employer contributions are a fixed percentageset by law. CalPERS employer contributions are adjustedperiodically.Join CalSTRS? Join CalPERS? 2013–147

11. Do I earn an extra monthly benefit for along career?CalSTRSCalSTRS 2% at 60: With 25 years of service credit, yourbenefit is based on your highest year of salary (with fewerthan 25 years of service credit, it is based on the averageof your highest three consecutive years).With 30 or more years of service credit, your age factoris increased by 0.2 percent. This is called a career factor.The maximum combined age factor and career factor is2.4 percent.With at least 30 years of service credit earned on orbefore December 31, 2010, your benefit is increased bya longevity bonus:Service Creditat RetirementLongevity Bonus30 years31 years32 years 200/month 300/month 400/monthCalSTRS 2% at 62: These benefit enhancements are notavailable.12. What are the age factors?CalSTRS and CalPERS have different age factors. The agefactor is the percent of final compensation you’re entitledto receive for each year of service credit.Age Factor Comparison for Members First HiredBefore January 1, 2013AgeCalSTRS* CalPERSAgeCalSTRS* CalPERS501.10 †1.10571.642.126511.16 †1.28581.762.188521.22 †1.46591.882.250531.28 †1.64602.002.314541.34 6463 2.402.50*Career factor: Add 0.2 percent to the age factor for 30 years of servicecredit, up to 2.4 percent.†Must have 30 or more years of service credit to retire.Age Factor Comparison for MembersFirst Hired On or After January 1, 2013AgeCalSTRSCalPERSCalPERSCalPERS retirement benefit is based on the highestaverage pay rate during any consecutive 12 or 36 monthperiod. CalPERS uses your full-time pay rate, not yourearnings.52**1.0053**1.1054**1.20551.161.30The DifferenceCalSTRS offers a career factor and longevity bonus formembers under the CalSTRS 2% at 60 benefit 20652.402.30662.402.40672.402.50**CalSTRS members under the 2% at 62 benefit structurecannot retire earlier than age 55.8Join CalSTRS? Join CalPERS? 2013–14

13. Can I buy additional service credit?CalSTRSYou must complete your purchase prior to your retirementdate. Service credit you can purchase:The DifferenceBoth retirement systems allow you to buy service creditfor certain activities. In some cases an activity may becovered by one system and not the other. You mustcomplete your purchase of CalSTRS service credit beforeretirement. You can continue making payments forCalPERS service credit after retirement. Redeposit of withdrawn funds. Certain active U.S. military service. Job Corps or Peace Corps service (certain restrictionsapply). Teaching in a publicly supported and administeredCalifornia university not already credited. Maternity or paternity leave. Sabbatical leave. Family medical leave under the federal Family andMedical Leave Act and the California Family Rights Act.CalSTRSIf you made retirement contributions to CalSTRS on orafter January 1, 2001, as a Defined Benefit member, youmay have a Defined Benefit Supplement account. YourDefined Benefit Supplement account provides additionalincome for retirement. Service prior to membership in part-time or substitutework.Your Defined Benefit Supplement account receives fundsfrom two sources: Fulbright Teacher Exchange Program. Out-of-state or foreign school service. Certificated teaching in a child care center, school forthe blind or deaf, or in a Native American school inCalifornia.Earnings in excess of one year of service credit. Yourcontributions and most of your employer’s contributions from your earnings in excess of one year arecredited to your Defined Benefit Supplement account. Special limited-term payments or one-time retirementincentive payments. Your contributions and most ofyour employer’s contributions on these payments arecredited to your Defined Benefit Supplement account. Prior service covered under the CalSTRS Cash BalanceBenefit Program.CalPERSYou must request to purchase service credit prior to retirement; you can make payments into retirement. Servicecredit you can purchase:14. Does my system accumulate funds forme in a supplemental account?CalSTRS 2% at 60: There is a compenstion cap of 255,000 for 2013 on contributions to your DefinedBenefit Supplement account. Redeposit of withdrawn funds. Military service. Peace Corps, AmeriCorps or AmeriCorps VISTA service. Educational or sabbatical leave. Temporary job-related disability or illness. Maternity or paternity leave. Service prior to membership while serving a qualification period or while employed on a temporary,seasonal or less than half-time basis.From January 1, 2001, to December 31, 2010, one-fourthof your 8 percent contribution to CalSTRS was redirectedto your Defined Benefit Supplement account; this redirection did not affect your CalSTRS retirement benefit.Now, your entire 8 percent contribution is credited to yourDefined Benefit account. Comprehensive Employment and Training Act serviceafter July 1, 1979.CalPERSCalPERS does not have a supplemental account. Employment as an elected or appointed official. Leave to work in a local, state or foreign governmentalagency or nonprofit organization. Lay-off periods from public agency employment. Service for time spent working for an employer beforeit began contracting with CalPERS. Alternate Retirement Program, if applicable. Serious illness.CalSTRS 2% at 62: Your Defined Benefit Supplementaccount receives funds from the first source if your earnings are under the compensation cap. Your account doesnot receive funds from the second source.The DifferenceCalSTRS members have a supplemental account forretirement; CalPERS members do not.Join CalSTRS? Join CalPERS? 2013–149

15. Can I purchase a previous refund?You can only purchase a refund from the system thatissued it. You cannot redeposit a CalPERS refund intoCalSTRS or vice versa.CalSTRSIf you terminate CalSTRS membership, receive a refundof contributions and interest, and later return to CalSTRSor a retirement system that offers concurrent retirementwith CalSTRS—such as CalPERS—you can purchase all orsome of the service credit. The cost will include interestyour refund would have earned. If you received more thanone refund, multiple refund costs are combined for a totalcost.CalPERSIf you terminate CalPERS membership, receive a refundof contributions and interest, and later return to CalPERSor become a member of a reciprocal retirement system—such as CalSTRS—you can purchase all or some of theservice credit represented by the refund. The cost willinclude interest your refund would have earned. If youreceived more than one refund, you may repurchasethe service credit represented by the refund in reversechronological order.The DifferenceCalSTRS combines multiple refunds; CalPERS allows youto repurchase multiple refunds in reverse chronologicalorder.16. What benefits do my survivors receive if Idie before I’m eligible to retire?CalSTRSIf you have Coverage A (you were a member on or beforeOctober 15, 1992, and you did not elect Coverage B) andhave at least one year of service credit, your designatedone-time death benefit recipient may receive a lump-sumpayment, currently 6,163. In addition, for a survivingspouse or registered domestic partner with dependentchildren, the monthly survivor benefit equals 40 percent ofyour final compensation plus 10 percent of final compensation for each eligible dependent child under age 22, fora benefit up to 90 percent of your final compensation.Your surviving spouse or partner with no eligible dependent children receives either a lump-sum payment of youraccumulated Defined Benefit contributions and interest ora monthly lifetime benefit. The calculation is based on theprojected service credit and final compensation you wouldhave accrued had you retired at normal retirement age. Ifthe monthly benefit is paid before normal retirement age,the amount is actuarially reduced.10Join CalSTRS? Join CalPERS? 2013–14If you have Coverage B (you became a member on or afterOctober 16, 1992) and at least one year of service credit,your designated recipient may receive a lump-sum deathbenefit, currently 24,652. If a monthly survivor benefit isnot payable, a lump-sum refund of your contributions andinterest is paid to your designated one-time death benefitrecipient. Your surviving spouse or partner can choosebetween the lump-sum refund of your contributions andinterest, or a monthly survivor benefit based on your ageand your partner’s or spouse’s age as of the date youwould have reached normal retirement age. This monthlybenefit would be one-half of the modified survivor benefit.If your spouse or partner elects the lump-sum refund, nobenefits are payable to dependent children. If you havedependent children and your surviving spouse or partnerreceives a monthly benefit, an additional benefit, equal to10 percent of your final compensation, is paid for eachchild under age 21, up to 50 percent for five or morechildren.CalPERSYour survivors receive the basic death benefit equal to areturn of your contributions and interest, plus a month ofaverage monthly earnings for each year of service up tosix months’ salary.If you’re not covered by Social Security, you may be eligiblefor the 1959 survivor benefit which is an additionalbenefit of up to 1,800 per month payable to an eligiblesurviving spouse or registered domestic partner who hascare of unmarried children under age 22, to unmarriedchildren under age 22, to an eligible surviving spouseor partner over age 60, or to dependent parents. To beeligible, you must have been paying a fee, generally 2per month. If you’re covered by Social Security, you maybe eligible for survivor benefits through the Social SecurityAdministration rather than through the 1959 SurvivorBenefit program.The DifferenceUnder CalSTRS, your surviving spouse or registereddomestic partner may choose a lump-sum payment ora monthly benefit, with additional provisions for dependent children. CalPERS pays a monthly benefit to yoursurviving spouse, partner or unmarried children only ifcertain requirements are met. Social Security may alsoprovide survivor benefits to survivors of CalPERS memberscovered by Social Security.

17. What benefits do my survivors receiveif I’m eligible to retire, but die before Iretire?CalSTRSIf you didn’t elect a preretirement option beneficiary, yoursurvivors receive the same coverage as question 16. Ifyou elected a preretirement option, your option beneficiaryreceives benefits based on the option you elected plusthe one-time death benefit. You can choose from fouroptions for your Defined Benefit account, and your optionbeneficiary can choose from one of several annuities or alump-sum payment for your Defined Benefit Supplementaccount. You must be eligible for retirement to elect apreretirement option beneficiary.CalPERSYour survivors receive the Basic Death Benefit equal toa return of your contributions and interest, plus up tosix months’ pay. Alternatively, your spouse or registereddomestic partner (to whom you have been married or inpartnership for at least one year before your death orbefore the occurrence of the injury or the onset of theillness that resulted in your death), or your children under18, can receive a monthly benefit equal to 50 percent o

inspiration is coach John Wooden. Next to his classroom door hangs a poster of Wooden's "Pyramid of Success" so his students can learn about qualities that build toward success, including loyalty, initiative and self-control. Raymond has been a CalSTRS member for 12 years.