Transcription

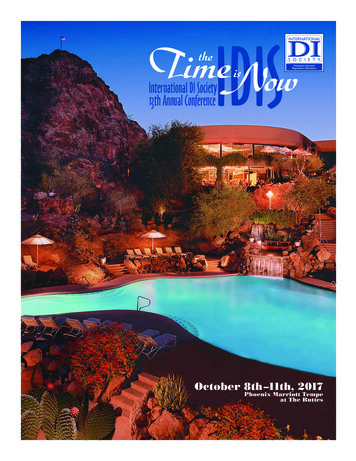

theIDISInternational DI Society13th Annual ConferenceDIINTERNATIONALNowisS O C I E T YProducers InsurersRegulators EducatorsOctober 8th–11th, 2017Phoenix Marriott Tempeat The Buttes

Day 1 - Sunday, October 8th, 20173:00pm - 4:00pmExhibitor Set Up4:00pmRegistration Opens5:00pm - 6:00pmWelcome ReceptionDinner on OwnThis is an open evening. Contact the Marriott front desk for dinnerreservations, available tours and transportation.Day 2 - Monday, October 9th, 20178:00amOngoing Registration8:00amExhibitors Open8:00am - 9:00amBreakfast9:00am - 10:00amGrand Opening10:00am - 11:00amGeneral Session11:00am - 11:30amExhibitor Refreshment Break11:30am - 12:30pmBreakout #1 - A-L11:30am - 12:30pmBreakout #2 - M-Z12:30pm - 1:30pmLUNCH1:45pm - 2:45pmBreakout #1 - M-Z1:45pm - 2:45pmBreakout #2 - A-L2:45pm - 3:00pmStretch Break3:00pm - 4:30pmJeoparDI!4:30pm - 5:30pmExhibitor Networking EventDinner on OwnThis is an open evening. Contact the Marriott front desk for dinnerreservations, available tours and transportation.

Day 3 - Tuesday, October 10th, 20178:00am - 9:00amBreakfast9:00am - 10:00amGeneral Session10:00am - 10:30amExhibitor Refreshment Break10:30am - 11:30amBreakout #3 - A-L10:30am - 11:30pmBreakout #4 - M-Z11:30am - 1:00pmAwards Luncheon1:15pm - 2:15pmBreakout #3 - M-Z1:15pm - 2:15pmBreakout #4 - A-L2:15pm - 3:15pmGeneral Session3:15pm - 3:30pmExhibitor Break3:30pm - 4:30pmTechnology Town HallDinner on OwnThis is an open evening. Contact the Marriott front desk for dinnerreservations, available tours and transportation.Day 4 - Wednesday, October 11th, 20178:30am - 9:30amWorking Breakfast w/ IDIS Annual General Meeting9:30am - 11:30amSpeed DI 6 Presentations (20 minutes each)11:30amConference AdjournsPlease note the 2017 Conference Schedule is subject to change and will be updated continuously up until theConference. If you have any comments or questions please contact the IDIS offices @info@internationaldisociety.com

MONDAY, OCTOBER 9th - 10:00am-11:00amMr. Ian Percy"Your Future Depends Not On the Problems You Solve, But On thePossibilities You See"Since the beginning of time a few certain people have seen possibilities no one else cansee. At times it's taken the rest of the world hundreds of years to catch up. From Archimedesin 200 BC to Elon Musk today. The thing is, if one person can do that, we all can! The question is how.You know how to solve problems, now learn to see your highest possibilities and a whole new world willopen to you. Ian Percy is an organizational psychologist and possibility expert. He is known to makepeople's brains hurt and they thank him for it.Ian Percy is the creator of The Infinite Possibilities Initiative, a process that applies proven principles from quantumand energetic science to system-wide transformation.Successful Meetings magazine declared him "One of the top 21 speakers for the 21st century." It's also why he has therare honor of being inducted into both the US and Canadian Speaker Halls of Fame. He's authored seven booksincluding the breakthrough book on leadership titled Going Deep, and The Profitable Power of Purpose that challengesthe typical corporate vision. His latest book Make Your Life a Masterpiece is a full color modern adaptation of JamesAllen's "As a Man Thinketh."Ian has both US and Canadian citizenship and lives in Scottsdale, Arizona where he has an interest in Quarter horsesand where golf constantly tests his commitment to 'possibility thinking'!MONDAY, OCTOBER 9th - 3:00pm-4:30pmAn Interactive Game Show How Much Do You Really Know About DI?Hosted by Courtney Wilson

TUESDAY, OCTOBER 10th - 9:00am-10:00amNate and Ian Sachs"Going Back to the Basics Needs Selling"How do you sell more product? Quit trying to sell the product and insteadsell the need! Both father and son will share their different perspectives on"Needs Selling".Nathan S. Sachs, CLU, ChFC, CFBS, CTP is the founder and owner of Blueprints For Tomorrow. He has fourdecades of experience in succession, contingency, and key employee retention, and is also an author, credentialednational speaker, and adviser to over two thousand entrepreneurs. Nate's overall goal is to get business owners towork on their business instead of in their business. In 1983, Nate moved to Phoenix, Arizona and in 1985, foundedBlueprints For Tomorrow in Scottsdale which specializes in working with closely held businesses. His company hasbuilt a network of successful clients who have created an invaluable strategic partnership with Blueprints For Tomorrow.Being an Indianapolis, Indiana native, Nate graduated from Indiana University with a degree in finance and waspresident of the Alpha Epsilon Pi fraternity. He went on to receive the Chartered Life Underwriting Designation fromAmerican College in Bryn Mawr, Pennsylvanian in 1985, the Chartered Financial Consultant designation in 1987,and the Certified Business Specialist designation in 1995. In 2014, Nate became a Certified Transition Planner withthe Transition Planning Institute in Boston, MA. With passion, Nate frequently lecturers across the country to businessowners on various topics, having spoken to over 500 organizations. He has published over 200 articles and is asought-after expert resource for publications about strategic business planning and exit strategies. Out of 150 speakersin their first year speaking for Vistage International, Nate received the Speaker of the Year award and to date, delivers75-100 presentations a year.Ian Sachs is the Director of Financial Services for Blueprints For Tomorrow. In this role, he is responsible for fosteringnew relationships while overseeing the development, management, and overall satisfaction of current clients. Workingdirectly with Nate, Ian assists with the creation and implementation of the Blueprints program - from initial conceptionthrough successful completion. Joining the family business in 2015, Ian is passionate about following in his father'sfootsteps and has fully immersed himself into the complex world of business planning. In addition to learning fromNate's four-decades of experience, Ian is currently pursuing several professional designations and is involved inprominent industry associations. Prior to joining Blueprints For Tomorrow, Ian worked at a national media agency indowntown Chicago. His creativity, relentless commitment to client service and work ethic propelled him into aleading role within the organization. When an opportunity at Blueprints For Tomorrow became available, he graciouslyaccepted and happily returned to Arizona where he currently lives with his wife. Ian graduated from Indiana Universitywhere he earned degrees in telecommunications and business and was an active member of his fraternity, SigmaAlpha Mu. Ian is currently involved with several philanthropic and community organizations and serves as the Presidentof the JNFuture Arizona of the Jewish National Fund.

TUESDAY, OCTOBER 10th - 2:15pm-3:15pmSteve Woods“The Future of DI Underwriting - Innovation or Disruption”The insurance world is changing, especially how products are being underwritten. Nottoo long ago discussions on data analytics, behavioral economics, wearables and automatedunderwriting engines were purely theoretical. We are now seeing these concepts beingbrought to market through new underwriting technology and processes. Come learn more about thesetopics and how they may be finding their way into your DI underwriting.Steve Woods is Vice President, Senior Account Executive at Gen Re. Steve is responsible for new business developmentand client account management for the Medicare Supplement and Individual Disability lines of business at Gen Re.Steve has 25 years’ experience in the insurance market place with 18 years focused on individual disability insurance.He has worked for multiple direct carriers and has held leadership roles in underwriting, guaranteed standard issueenrollment and implementation, training and distribution.Steve is a past board member of IDIS. He has a BS in Finance from Worcester State University and an MBA fromNorwich University.

TUESDAY, OCTOBER 10th - 3:30pm-4:30pmOpen Discussion and Q&A with three panelists who will share theirknowledge of technology, social media and online sales. Hosted bythe "DI Coach" and IDIS Social Media Chair Chris Carlson.Brandon Abe, CFPBrandon Abe is a Financial Planner with Planning Capital Management in Haddonfield, NJ. Prior tojoining Planning Capital Management, Brandon was a Financial Planning Analyst and PlanningConsultant at eMoney Advisor where he also served as a senior member of their Client ServicesGroup. He graduated York College of Pennsylvania with a Bachelor's degree in Marketing. Mr. Abepresented a national webinar in February of 2017 on “Integrating Technology and the Next Generationinto the Modern Financial Services Office” for the Society of Financial Service Professionals.Corey AndersonCorey has made it his life long quest to inform, promote and put in-force Disability, Life and LongTerm Care Insurance for the every-day person, while making it fun and enjoyable for not only theclient, but for himself as well. He is the proud father of four beautiful children Kate, Charlie, Maggieand Matty, and “couldn't live without his wife Stacey.” Corey explains “I feel I have an amazingcareer; I get to help people protect themselves and their loved ones should they become sick, hurt, ordie. To many, I am known as the DISABILITY INSURANCE GEEK. I love helping other agents andclients via my over 16 years of service in our insurance association, NAIFA, and 3 years on an advancement committeeat Benilde St. Margaret’s high school. I have done speaking engagements at my alma mater, St. Mary’s Universityand have taught over 75 continuing education classes to insurance professionals via NAIFA, LIMRA, and NAHU”.Corey does a large portion of his business using Electronic Only Sales.Benjamin Rosky, RHUBenjamin Rosky, RHU has been with L&A Services since 2000, and currently serves as agencymanager. L&A Services is a privately held independent insurance brokerage in Phoenix helpingArizona residents and businesses since 1985. Ben is an Arizona native, devoted husband and father,and an independent insurance broker proudly advising small businesses, individuals, and families.Mr. Rosky has transformed his practice using technological advancements.

BREAKOUT #1Ken Smith, CLU“Sales Lessons from the Masters”Ken's presentation will be based on his book, "Sales Lessons from the Masters." It is basedon sales principles from four of the greatest salespeople ever in the insurance industry,Frank Bettger, W. Clement Stone, Ben Feldman and Joe Gandolfo. Principles are like thelaws of nature. Principles work 100% of the time. My purpose is to bring sales principles to a new generationand remind long time advisors of principles.Ken Smith has 35 years' experience both in field and home office positions. Prior to starting Ken Smith SalesTraining & Consulting, he was Director of Health Product Sales with Assurity Life for over 12 years. Prior to that hewas with Mutual of Omaha over 10 years as first vice president.Ken Smith, author of Sales Lessons from the Masters, is an experienced insurance sales and marketing pro. Ken's 35plus year career has been spent in executive-marketing positions at several insurance carriers. And after many yearsof delivering exceptional presentations aimed at the producers who sold for those carriers, Ken is now introducing hisdynamic approach to the broader industry. Ken's field-tested approach to training zeroes in on sales concepts that canbe used with a wide variety of products.Ken's training incorporates sales principles from the masters of insurance sales—Frank Bettger, W. Clement Stone,Ben Feldman and Joe Gandolfo. The ideas of these four greats have had a huge impact on Ken's own successful salescareer, and not only does he understand their principles inside and out, he is eager to share those principles to help thenext generation of salespeople succeed.Ken has written numerous articles for insurance industry trade publications, and he has conducted many presentationsand training sessions on sales techniques, life insurance, supplemental health, critical illness, and disability income toa variety of audiences. His usual audience is made up primarily of producers and financial advisors. Ken also producesand posts regular producer-oriented videos that include sales ideas and sales concepts. These blogs are popularamong many producers and marketers in the insurance business and were highlighted at a LIMRA MarketingConference.Ken understands firsthand the challenges of the sales profession. He speaks hundreds of times each year to agentgroups.

BREAKOUT #2Eryka Morehead“Taking a Fiduciary Approach to Disability Insurance”Providing an independent and objective approach to disability insurance allows advisorsto provide a critical part of a holistic plan of wealth management services for those thatthey serve. Strategic, cutting-edge disability insurance solutions help advisors addressthis critical element of risk management. In this presentation, Eryka will be addressing how to effectivelyimplement the process and application of these objectives to provide the desired benefits to our clients.Eryka has worked on behalf of families and family-owned businesses her entire life. Growing up, she worked on herparents’ Christmas Tree Farm. Throughout college, she worked for a family-owned business. And for nearly tenyears, she has held various positions in the insurance industry. She spent 5 years with Farm Bureau Financial Servicesas a Regional Financial Consultant.During those years, she worked with their property and casualty agents’ clients across the state that needed everythingfrom disability and life insurance to estate and succession plans. Eventually, she worked her way up to the company’sDirector of Wealth Management and was responsible for leading her peers in fourteen additional states.Eryka founded Collaborative Planning in February 2016 in order to offer the best solutions possible to the clients ofwealth management firms. As a completely independent entity, Collaborative Planning can find the products andservices that are needed to mitigate the exact risks of a client’s situation. This gives wealth management advisors theopportunity to fully serve their clients in risk management products outside of their investment advice. And it givesEryka a sense of satisfaction, knowing that she’s able to help families and businesses across her native Midwest andthe entire country.Along with her product expertise, Eryka is a frequent speaker on a variety of topics. Some of her presentations haveincluded the Governor’s Ag Conference in Nebraska, the AG-ceptional Women’s Conference, and the eMoney Summit.

BREAKOUT #3Greg Nelson, ChFC, CEBS, DIFMegan Nelson Schenk“Megan’s Story: Making a DIfference”Understanding the importance of our role as companies, brokers and producersis paramount in making the DIfference in the lives our associates and ourclients. In this session, we will discuss not only the difference that we make to others, but also how we canhelp bridge the gap for our clients between understanding the importance of income protection, and theirtaking action to protect their most valuable financial asset. The story shared by Megan of her personalexperience with disability will help us all to see that the Time is Now for making that DIfference.Greg Nelson, President of Strategic Benefit Coach in Sandy, Utah. He is a Chartered Financial Consultant,(ChFC), aCertified Employee Benefits Benefit Specialist, (CEBS), a Group Benefits Disability Specialist, (GBDS), and a DisabilityInsurance Fellow, (DIF), specializing in Individual and Group Disability Benefits for over 25 years. He works withentrepreneurs, business owners, and other brokers nationwide in educating, developing, and implementing effectiveincome protection strategies, utilizing all types of disability products. Greg is the Father of two children, Chris and Meganthat have blessed his life with 6 grandchildren, ages 2 to 6. He is a Cum Laude graduate from Weber State University,with a degree in Psychology and Communications. He is currently launching the publication of his book, "The ForgottenInsurance—What Your Financial Advisor Should Be Telling You About Protecting Your Most Valuable Asset."Megan Schenk has been a licensed Insurance Agent for 4 years that has been working as an Administrative Assistantat Strategic Benefit Coach, where she has been a key employee in Sales & Marketing, as well as Customer Service forindividual and group clients. She attended Weber State University in Ogden, Utah, and won an International DECACompetition in Marketing. Megan and her husband, Barry, are the parents of 3 adorable children: Brayden, Age 6;Bryson, Age 3; McKayla Rose, Age 2. They live in Sandy, Utah and enjoy helping others and being with their family.

BREAKOUT #4Chuck Kofoed“A True DI Professional”In this presentation, Chuck will discuss the importance of knowing the contract provisionsabout the disability policies that we sell. Thoroughly understanding the definitions andbenefits of each helps us better match the right benefits to the right clients, as well ashelping our clients have realistic expectations at claim time. Chuck uses this knowledge and experienceto demonstrate what it is to be a “True DI Professional.”Chuck Kofoed has specialized in disability insurance planning since 1984. He assists agents in Utah, Idaho andWyoming and has personal insurance clients throughout the United States. For the past 12 years, Chuck has consistentlybeen a top disability insurance producer in Utah for the Guardian Life Insurance Company of America, one of thenation's leading DI carriers. Having experienced a disability claim before due to a car accident, he takes contract provisionsquite serious. He knows the fine print!WEDNESDAY, OCTOBER 11th - 9:30am-11:30am“The Producer and the Carrier”6 presentations - 20 minutes eachProducers and Representatives from some of the top DI carriers in the industrywill share Sales Ideas, Challenges, and Successes from the perspective of theproducer and the carrier.

on sales principles from four of the greatest salespeople ever in the insurance industry, Frank Bettger, W. Clement Stone, Ben Feldman and Joe Gandolfo. Principles are like the laws of nature. Principles work 100% of the time. My purpose is to bring sales principles to a new generation and remind long time advisors of principles.