Transcription

Mackinac Center for Public Policy1GREATDEPRESSIONPRESIDENT HOOVERbelieved government shouldplay no role in the economy.GOVERNMENT PROGRAMS helped lowerunemployment by putting many Americansto work.These and othermyths aredispelled by thefacts in this essayby economistLawrence W.FRANKLIN ROOSEVELT’S “NewReed.Deal” saved America from theWrittenby:failure of free-market capitalism.Lawrence W. ReedGreat Myths of the Great Depression

2Mackinac Center for Public PolicyGreat Myths of the Great Depression

Mackinac Center for Public Policy3GREAT MYTHS OF THE GREAT DEPRESSIONby Lawrence W. ReedMany volumes have been writtenabout the Great Depression of 19291941 and its impact on the lives of millions of Americans. Historians, economists, and politicians have all combedthe wreckage searching for the “blackbox” that will reveal the cause of thislegendary tragedy. Sadly, all too manyof them decide to abandon their search,finding it easier perhaps to circulate ahost of false and harmful conclusionsabout the events of seven decades ago.Consequently, many people today continue to accept critiques of free-marketcapitalism that are unjustified and support government policies that are economically destructive.How bad was the Great Depression? Over the four years from 1929 to1933, production at the nation’s factories, mines, and utilities fell by morethan half. People’s real disposable incomes dropped 28 percent. Stock pricescollapsed to one-tenth of their pre-crashheight. The number of unemployedAmericans rose from 1.6 million in 1929to 12.8 million in 1933. One of everyfour workers was out of a job at theDepression’s nadir, and ugly rumors ofrevolt simmered for the first time sincethe Civil War.“The terror of the Great Crash hasbeen the failure to explain it,” writeseconomist Alan Reynolds. “People wereleft with the feeling that massive economic contractions could occur at anymoment, without warning, withoutcause. That fear has been exploited eversince as the major justification for virtually unlimited federal intervention ineconomic affairs.”1Old myths never die; they just keepshowing up in college economics andpolitical science textbooks. With onlyan occasional exception, it is there youwill find, decked in all its arrogant splendor, what may be the twentieth century’sgreatest myth: Capitalism and the freemarket economy were responsible forthe Great Depression, and only government intervention brought aboutAmerica’s economic recovery.A Modern Fairy TaleStudents today are frequentlytaught that unfettered free enterprisecollapsed of its own weight in 1929,paving the way for a decade-long economic depression full of hardship andmisery. The story is typically presentedas follows: An important pillar of capitalism, the stock market, crashed anddragged America into depression.President Herbert Hoover, an advocateof “hands-off,” or laissez-faire, economic policy, refused to use the powerof government to intervene in theeconomy and conditions worsened asa result. It was up to Hoover’s successor, Franklin Delano Roosevelt, to ridein on the white horse of government intervention and steer the nation towardrecovery. The apparent lesson to bedrawn is that capitalism cannot betrusted; government needs to take anactive role in the economy to save usfrom catastrophe.But those who propagate this version of history might just as well top offtheir remarks by saying, “AndGoldilocks found her way out of the forest, Dorothy made it from Oz back toKansas, and Little Red Riding Hoodwon the New York State Lottery.” Thepopular account of the Depression asGreat Myths of the Great Depressionoutlined above belongs in a book of fairytales and not in a serious discussion ofeconomic history, as a review of the factsdemonstrates.The Great, Great,Great, Great DepressionTo properly understand the eventsof the time, it is factually appropriate toview the Great Depression as not one,but four consecutive depressions rolledinto one. Professor Hans Sennholz haslabeled these four “phases” as follows:2I.The Business CycleII. The Disintegration of the WorldEconomyIII. The New DealIV. The Wagner ActThe first phase explains why thecrash of 1929 happened in the first place;the other three show how governmentintervention kept the economy in a stupor for over a decade. Let’s considereach one in turn.PHASE I: THEBUSINESS CYCLEThe Great Depression was notthe country’s first depression, thoughit proved to be the longest. Severalothers preceded it. In 1819, after three years ofcurrency inflation caused by the fed-

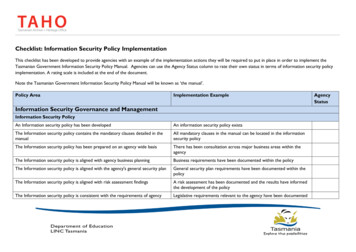

4Mackinac Center for Public Policyerally chartered Second Bank of theUnited States, the economy fell apart.Pumping Up the Volume The slump of 1836-37 occurredas the inflationary distortions of thecentral bank era were liquidatedwhen President Andrew Jackson prevented the re-charter of the SecondBank, calling it a “money monster.”Most monetary economists, particularly those of the “Austrian School,”Reckless money and credit expanhave observed the close relationship be- sion constituted what economist Bentween money supply and economic ac- jamin M. Anderson called “the begintivity. When government inflates the ning of the New Deal”4 —the name formoney and credit supply, interest rates the better-known but highly intervenat first fall. Businesses invest this “easy tionist policies that would come latermoney” in new production projects and under President Franklin Roosevelt. Thea boom takes place in capital goods. As monetary authorities were actively mathe boom matures, businesscosts rise, interest rates readjustupward, andprofitsaresqueezed. Theeasy-money effects thus wearoff and the monetary authorities,fearing price inflation, slow thegrowth of, oreven contract,the money sup- UNEMPLOYMENT SKYROCKETED after Congress raised tariffs andply. In either taxes in the early 1930s and stayed high as policies of the Rooseveltcase, the ma- administration discouraged investment and recovery during the restnipulation is of the decade.enough to knockout the shaky supports from underneath nipulating the economy, partly to stimuthe economic house of cards.late a boom at home and partly to assistthe Bank of England in its professedThis basic business cycle outline desire to maintain pre-World War I exapplies as perfectly to the events of the change rates.1920s as it does to all of the earlierboom-bust cycles in U. S. history. TheThe flood of money drove interestfingerprints on the door to the Great De- rates down, pushed the stock market topression belong primarily to the “money dizzy heights, and gave birth to themonster” of the twentieth century: the “Roaring Twenties.” The economy wasFederal Reserve System, known also as having a party, the Federal Reserve wasthe “Fed.”spiking the punch, and a good time washad by almost all.One of the most thorough and meticulously documented accounts of theFew could read the handwriting onFed’s inflationary actions prior to 1929 the wall. Relatively stable prices in theis America’s Great Depression by Pro- 1920s masked the monetary inflationfessor Murray Rothbard. Using a broad to a considerable extent and lulledmeasure that includes currency, demand many people into thinking that the situand time deposits, and other ingredients, ation was sustainable. Substantial cuts In 1857 the economy retrenched after a decade of money andcredit expansion on behalf of stategovernments that had forced theirdebt obligations onto the state banking systems. In 1873, a post-Civil Wardownturn followed the excesses ofthe government’s rampant “greenback” inflation. The Panic and Depression of1893-95 hit the country after Congress force-fed the economy for yearswith depreciating silver and papernotes. And in 1921, a brief but sharptumble took place after several yearsof credit and currency expansion toaccommodate the spending for WorldWar I.The common thread woventhrough all of these earlier debacleswas disastrous manipulation of themoney supply by government. Forvarious reasons, government policieswere adopted which ballooned thequantity of money and credit in theeconomy. A boom resulted, followedlater by a painful day of reckoning.None of these depressions, however,lasted more than four years and mostof them were over in two. The calamity that began in 1929 lasted atleast three times longer than any ofthe country’s previous depressionsbecause the government compoundedits monetary errors with a series ofharmful interventions.Great Myths of the Great DepressionRothbard estimated that the money supply was bloated by more than 60 percent from mid-1921 to mid-1929.3

Mackinac Center for Public Policyin income tax rates enacted in theCoolidge years spurred investment andreal economic growth, which in turnyielded a burst of technological advancement and entrepreneurial discoveries of cheaper ways to produce goods.This explosion in productivity offsetmuch of the Fed’sinflationary impacton prices (with thenotable exceptionsof stocks andFlorida land).tremendous boom to colossal bust. Afew observers argue that this horrendous deflation was the Fed’s intent allalong, but most economists believethat the Fed badly miscalculated. Theresult is a manifest failure of government monetary policy in either case.5money supply—saw that the party wascoming to an end. Baruch actually began selling stocks and buying bonds andgold as early as 1928; Kennedy did likewise, commenting, “only a fool holdsout for the top dollar.”6The masses of investors eventuallysensed the change in Fed policy and thenthe stampede was underway. In a special issue commemorating the 50th anniversary of the stock market collapse,U. S. News & World Report described itthis way:But the distortions and bad investments beingfostered by themonetary inflationwould sooner orlater have to be corrected. Every artificial money andcredit expansion introduces imbal- PEOPLE WHO ARGUE that the free-market economy collapsedof its own weight in the 1930s seem utterly unaware of the criticalances in economic role played by the Federal Reserve System’s grossrelationships that mismanagement of money and credit.send false signalsand set the economyup for an eventual fall—a fall that isThe most comprehensive chronicleonly made worse when government of the monetary policies of the periodshifts its policy from one of monetary can be found in the classic work ofease to monetary contraction.Nobel Laureate Milton Friedman and hiscolleague Anna Schwartz, A MonetaryHistory of the United States, 1867-1960.Friedman and Schwartz argue concluThe Bottom Drops Outsively that the contraction of the nation’smoney supply by one-third betweenBy late 1928, it was becoming August 1929 and March 1933 was anclear that the Federal Reserve was tak- enormous drag on the economy anding the punch away from the party. It largely the result of seismic incompechoked off the money supply and tence by the Fed. The death in Octoberraised interest rates. For example, the 1928 of Benjamin Strong, a powerfuldiscount rate (the rate the Fed charges figure who had exerted great influencemember banks for loans) was in- as head of the Fed’s New York districtcreased four times, from 3.5 percent bank, left the Fed floundering withoutto 6 percent, between January 1928 capable leadership—making bad policyand August 1929. For the next three even worse.5years, the Fed presided over a moneysupply that actually shrank by 30 perAt first, only the “smart” money—cent! This deflation following the in- the Bernard Baruchs and the Josephflation wrenched the economy from Kennedys who watched things likeGreat Myths of the Great DepressionActually the Great Crash was by nomeans a one-day affair, despite frequentreferences to Black Thursday, October24, and the following week’s BlackTuesday. As early as September 5,stocks were weak in heavy trading, after having moved into new high groundtwo days earlier. Declines in early October were called a “desirable correction.” The Wall Street Journal, predicting an autumn rally, noted that “somestocks rise, some fall.”Then, on October 3, stocks sufferedtheir worst pummeling of the year. Margin calls went out; some traders grewapprehensive. But the next day, pricesrose again and thereafter seesawed fora fortnight.The real crunch began on Wednesday,October 23, with what one observercalled “a Niagara of liquidation.” Sixmillion shares changed hands. The industrial average fell 21 points. “Tomorrow, the turn will come,” brokers toldone another. Prices, they said, had beencarried to “unreasonably low” levels.But the next day, Black Thursday, stockswere dumped in even heavier selling . . .the ticker fell behind more than 5 hours,and finally stopped grinding out quotations at 7:08 p.m.7At their peak, stocks in the DowJones Industrial Average were selling for

619 times earnings—somewhat high, buthardly what stock market analysts regardas a sign of inordinate speculation. Thedistortions in the economy promoted bythe Fed’s monetary policy had set thecountry up for a recession, but other policies and impositions to come would soonturn the recession into a full-scale disaster. Congress was playing with fireat the same time stocks were taking abeating: On the very morning of BlackThursday, the nation’s newspapers reported that the political forces for highertrade-damaging tariffs were makinggains on Capitol Hill. The stock marketcrash was only a symptom—not thecause—of the Great Depression: Themarket rose and fell in almost direct synchronization with what the Fed and Congress were doing.Buddy, Can YouSpare 40 Million?Black Thursday shook Michiganharder than almost any other state.Stocks of auto and mining companieswere hammered. Auto production in1929 reached an all-time high ofslightly more than five million vehicles, then quickly slumped by twomillion in 1930. By 1932, near thedeepest point of the Depression, theyhad fallen by another two million tojust 1,331,860—down an astonishing75 percent from the 1929 peak.Thousands of investors everywhere, including many well-knownpeople, were hit hard in the 1929crash. Among them was WinstonChurchill. He had invested heavilyin American stocks before the crash.Afterward, only his writing skills andpositions in government restored hisfinances.Clarence Birdseye, an early developer of packaged frozen foods, soldhis business for 30 million and putMackinac Center for Public Policyall his money into stocks. He waswiped out.William C. Durant, founder ofGeneral Motors, lost more than 40million in the stock market and woundup a virtual pauper. (GM itself stayedin the black throughout the Depressionunder the cost-cutting leadership ofAlfred P. Sloan.)Jesse Livermore, one of the bigtime speculators of the era, shot himself. A few others did the same orjumped from windows: The suiciderate rose until 1932.Though the modern myth claimsthat the free market “self-destructed”in 1929, the wild manipulation of thecurrency by the Federal Reserve showsthat government, far from a disinterested bystander, was the principal culprit of the stock market crash.PHASE II:DISINTEGRATIONOF THE WORLDECONOMYIf this crash had been like previous ones, the hard times would haveended in three years at the most, andlikely sooner than that. But unprecedented political bungling insteadprolonged the misery for over 10years.Unemployment in 1930 averageda mildly recessionary 8.9 percent, upfrom 3.2 percent in 1929. It shot uprapidly until peaking out at more than25 percent in 1933. Until March of1933, these were the years of President Herbert Hoover—the man thatanti-capitalists depict as a championof noninterventionist, laissez-faireeconomics.Great Myths of the Great Depression“The greatestspending administrationin all of history”Did Hoover really subscribe to a“hands off the economy,” free-marketphilosophy?His opponent in the1932 election, Franklin Roosevelt,didn’t think so. During the campaign,Roosevelt blasted Hoover for spending and taxing too much, boosting thenational debt, choking off trade, andputting millions on the dole. He accused the president of “reckless andextravagant” spending, of thinking“that we ought to center control of everything in Washington as rapidly aspossible,” and of presiding over “thegreatest spending administration inpeacetime in all of history.”Roosevelt’s running mate, John NanceGarner, charged that Hoover was“leading the country down the path ofsocialism.”8 Contrary to the modernmyth about Hoover, Roosevelt andGarner were absolutely right.The crowning folly of the Hooveradministration was the Smoot-HawleyTariff, passed in June 1930. It came ontop of the Fordney-McCumber Tariff of1922, which had already put Americanagriculture in a tailspin during the preceding decade. The most protectionistlegislation in U. S. history, SmootHawley virtually closed the borders toforeign goods and ignited a vicious international trade war. Professor BarryPoulson describes the scope of the act:The act raised the rates on the entirerange of dutiable commodities; for example, the average rate increased from20 percent to 34 percent on agriculturalproducts; from 36 percent to 47 percent on wines, spirits, and beverages;from 50 to 60 percent on wool andwoolen manufactures. In all, 887 tariffs were sharply increased and the actbroadened the list of dutiable commodities to 3,218 items. A crucial part

Mackinac Center for Public Policyof the Smoot-Hawley Tariff was thatmany tariffs were for a specific amountof money rather than a percentage ofthe price. As prices fell by half or moreduring the Great Depression, the effective rate of these specific tariffsdoubled, increasing the protection afforded under the act.9Smoot-Hawley was as broad as itwas deep, affecting a multitude of prod-U. S. plants making cheap clothing outof imported wool rags went home jobless after the tariff on wool rags rose by140 percent.10Officials in the administration andin Congress believed that raising tradebarriers would force Americans to buymore goods made at home, which wouldsolve the nagging unemployment problem. But they ignored an important prin-PRESIDENT HERBERT HOOVER is mistakenly presented in standard history texts as alaissez-faire president, but he signed into law so many costly and foolish bills that one ofFranklin Roosevelt’s top aides later said that “practically the whole New Deal wasextrapolated from programs that Hoover started.”ucts. Before its passage, clocks hadfaced a tariff of 45 percent; the act raisedthat to 55 percent, plus as much as another 4.50 per clock. Tariffs on cornand butter were roughly doubled. Evensauerkraut was tariffed for the first time.Among the few remaining tariff-freegoods, strangely enough, were leechesand skeletons (perhaps as a political sopto the American Medical Association, asone wag wryly remarked).Tariffs on linseed oil, tungsten, andcasein hammered the U. S. paint, steel,and paper industries, respectively. Morethan 800 items used in automobile production were taxed by Smoot-Hawley.Most of the 60,000 people employed inciple of international commerce: Tradeis ultimately a two-way street; if foreigners cannot sell their goods here, then theycannot earn the dollars they need to buyhere. Or, to put it another way, government cannot shut off imports without simultaneously shutting off exports.You Tax Me, I Tax YouForeign companies and their workers were flattened by Smoot-Hawley’ssteep tariff rates and foreign governments soon retaliated with trade barriers of their own. With their ability tosell in the American market severelyGreat Myths of the Great Depression7hampered, they curtailed their purchasesof American goods. American agriculture was particularly hard hit. With astroke of the presidential pen, farmersin this country lost nearly a third of theirmarkets. Farm prices plummeted andtens of thousands of farmers went bankrupt. A bushel of wheat that sold for 1.00 in 1929 was selling for a mere 30cents by 1932.With the collapse of agriculture,rural banks failed in record numbers,dragging down hundreds of thousandsof their customers. Nine thousandbanks closed their doors in the UnitedStates between 1930 and 1933. Thestock market, which had regainedmuch of the ground it had lost sincethe previous October, tumbled 20points on the day Hoover signedSmoot-Hawley into law and fell almost without respite for the next twoyears. (The market’s high, as measured by the Dow Jones IndustrialAverage, was set on September 3,1929, at 381. It hit its 1929 low of198 on November 13, then reboundedto 294 by April 1930. It declined againas the tariff bill made its way towardHoover’s desk in June and did not bottom out until it reached a mere 41 twoyears later. It would be a quarter-century before the Dow would climb to381 again.)The shrinkage in world tradebrought on by the tariff wars helped setthe stage for World War II a few yearslater. In 1929, the rest of the world owedAmerican citizens 30 billion.Germany’s Weimar Republic was struggling to pay the enormous reparationsbill imposed by the disastrous Treaty ofVersailles. When tariffs made it nearlyimpossible for foreign businessmen tosell their goods in American markets, theburden of their debts became massivelyheavier and emboldened demagogueslike Adolf Hitler. “When goods don’tcross frontiers, armies will,” warns anold but painfully true economic maxim.

8Free Marketsor Free Lunches?Smoot-Hawley by itself should layto rest the myth that Hoover was a freemarket advocate, but there is even moreto the story of his administration’s interventionist mistakes. Within a monthof the stock market crash, he convenedconferences of business leaders for thepurpose of jawboning them into keeping wages artificially high even thoughboth profits and prices were falling.Consumer prices plunged almost 25 percent between 1929 and 1933 whilenominal wages on average decreasedonly 15 percent—translating into a substantial increase in wages in real terms,a major component of the cost of doingbusiness. As Hillsdale College economist Richard Ebeling notes, “The ‘highwage’ policy of the Hoover administration and the trade unions . . . succeededonly in pricing workers out of the labormarket, generating an increasing circleof unemployment.”11Hoover dramatically increasedgovernment spending for subsidy andrelief schemes. In the space of one yearalone, from 1930 to 1931, the federalgovernment’s share of GNP soared from16.4 percent to 21.5 percent.12 Hoover’sagricultural bureaucracy doled out hundreds of millions of dollars to wheat andcotton farmers even as the new tariffswiped out their markets. His Reconstruction Finance Corporation ladled outbillions more in business subsidies.Commenting decades later on Hoover’sadministration, Rexford Guy Tugwell,one of the architects of FranklinRoosevelt’s policies of the 1930s, explained, “We didn’t admit it at the time,but practically the whole New Deal wasextrapolated from programs that Hooverstarted.”13In September 1931, with the moneysupply tumbling and the economy reeling from the impact of Smoot-Hawley,Mackinac Center for Public Policythe Fed imposed the biggest hike in itsdiscount rate in history. Bank depositsfell 15 percent within four months andsizable, deflationary declines in thenation’s money supply persisted throughthe first half of 1932.Compounding the error of high tariffs, huge subsidies, and deflationarymonetary policy, Congress then passedand Hoover signed the Revenue Act of1932. It doubled the income tax for mostAmericans; the top bracket more thandoubled, going from 24 percent to 63percent. Exemptions were lowered; theearned income credit was abolished; corporate and estate taxes were raised; newgift, gasoline, and auto taxes were imposed; and postal rates were sharplyhiked.semblance to what President Rooseveltactually delivered.Washington was rife with both fearand optimism as Roosevelt was swornin on March 4, 1933—fear that theeconomy might not recover and optimism that the new and assertive president just might make a difference. Hu-Can any serious scholar observe theHoover administration’s massive economic intervention and, with a straightface, pronounce the inevitably deleterious effects as the fault of free markets?PHASE III: THENEW DEALFranklin Delano Roosevelt wonthe 1932 presidential election in a landslide, collecting 472 electoral votes tojust 59 for the incumbent HerbertHoover. The platform of the Democratic Party, whose ticket Rooseveltheaded, declared, “We believe that aparty platform is a covenant with thepeople to be faithfully kept by the partyentrusted with power.” It called for a25-percent reduction in federal spending, a balanced federal budget, a soundgold currency “to be preserved at allhazards,” the removal of governmentfrom areas that belonged more appropriately to private enterprise, and anend to the “extravagance” of Hoover’sfarm programs. This is what candidateRoosevelt promised, but it bears no reGreat Myths of the Great DepressionAMERICANS VOTED for FranklinRoosevelt in 1932 expecting him to adhereto the Democratic Party platform, whichcalled for less government spending andregulation.morist Will Rogers captured the popular feeling toward “FDR” as he assembled the new administration: “Thewhole country is with him, just so hedoes something. If he burned down theCapitol, we would all cheer and say,well, we at least got a fire started anyhow.”14“Nothing tofear but fear itself”Roosevelt did indeed make a difference, though probably not the sort ofdifference for which the country hadhoped. He started off on the wrong footwhen, in his inaugural address, heblamed the Depression on “unscrupulous money changers” and said nothing

Mackinac Center for Public Policyabout the role of the Fed’s mismanagement and little about the follies of Congress that had contributed to the problem. As a result of his efforts, theeconomy would linger in depression forthe rest of the decade. Adapting a phrasefrom nineteenth-century writer HenryDavid Thoreau, Roosevelt famouslydeclared in his inaugural address that,“We have nothing to fear but fear itself.”But as Professor Sennholz explains, itwas FDR’s policies to come that Americans had genuine reason to fear:In his first 100 days, he swung hard atthe profit order. Instead of clearingaway the prosperity barriers erected byhis predecessor, he built new ones ofhis own. He struck in every known wayat the integrity of the U. S. dollarthrough quantitative increases andqualitative deterioration. He seized thepeople’s gold holdings and subsequently devalued the dollar by 40 percent.15tion of the Federal government under ademocracy to limit its activities to thosewhich a democracy may adequatelydeal, such for example as national defense, maintaining law and order, protecting life and property, preventing dishonesty, and . . . guarding the publicagainst . . . vested special interests?16New Dealing fromthe Bottom of the DeckCrisis gripped the banking systemwhen the new president assumed officeon March 4, 1933. Roosevelt’s actionto close the banks and declare a nation-Frustrated and angered thatRoosevelt had so quickly and thoroughly abandoned the platform onwhich he was elected, Director of theBureau of the Budget Lewis W. Douglas resigned after only one year on thejob. At Harvard University in May1935, Douglas made it plain thatAmerica was facing a momentouschoice:Will we choose to subject ourselves—this great country—to the despotism ofbureaucracy, controlling our every act,destroying what equality we have attained, reducing us eventually to thecondition of impoverished slaves of thestate? Or will we cling to the libertiesfor which man has struggled for morethan a thousand years? It is importantto understand the magnitude of the issue before us . . . . If we do not elect tohave a tyrannical, oppressive bureaucracy controlling our lives, destroyingprogress, depressing the standard of living . . . then should it not be the func-ROOSEVELT WAS a spellbinding speakerand an inspiration to many. Unfortunately,historians with a statist bias have assessedhis 12 years in office more in terms of thehigh-sounding rhetoric than by actualresults.wide “banking holiday” on March 6(which did not completely end until ninedays later) is still hailed as a decisiveand necessary action by Rooseveltapologists. Friedman and Schwartz,however, make it plain that this supposed cure was “worse than the disease.”The Smoot-Hawley tariff and the Fed’sunconscionable monetary mischief wereprimary culprits in producing the conGreat Myths of the Great Depression9ditions that gave Roosevelt his excuseto temporarily deprive depositors of theirmoney, and the bank holiday did nothing to alter those fundamentals. “Morethan 5,000 banks still in operation whenthe holiday was declared did not reopentheir doors when it ended, and of these,over 2,000 never did thereafter,” reportFriedman and Schwartz.17Congress gave the president thepower first to seize the private goldholdings of American citizens and thento fix the price of gold. One morning,as Roosevelt ate eggs in bed, he andSecretary of the Treasury HenryMorgenthau decided to change the ratio between gold and paper dollars.After weighing his options, Rooseveltsettled on a 21-cent price hike because“it’s a lucky number.” In his diary,Morgenthau wrote, “If anybody everknew how we really set the gold pricethrough a combination of lucky numbers, I think they would be frightened.” 18Roosevelt also singlehandedly torpedoed the London Economic Conference in 1933, which wasconvened at the request of other majornations to bring down tariff rates andrestore the gold standard.The federal government and itsreckless central bank had already mademincemeat of the gold standard by theearly 1930s. Roosevelt’s rejection of itremoved most of the remaining impediments to limitless currency and creditexpansion, for which the nation wouldpay a high price in later years in the formof a depreciating currency. SenatorCarter Glass put it well when he warnedRoosevelt in early 1933: “It’s dishonor,sir. This gr

Kansas, and Little Red Riding Hood won the New York State Lottery." The popular account of the Depression as GREAT MYTHS OF THE GREAT DEPRESSION outlined above belongs in a book of fairy tales and not in a serious discussion of economic history, as a review of the facts demonstrates. The Great, Great, Great, Great Depression