Transcription

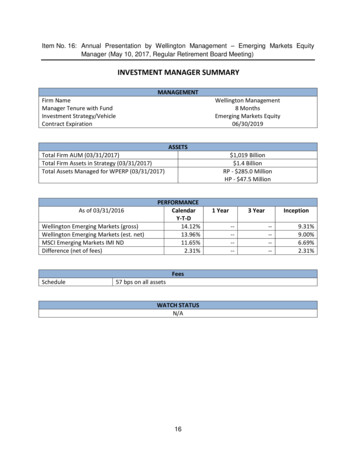

Item No. 16: Annual Presentation by Wellington Management – Emerging Markets EquityManager (May 10, 2017, Regular Retirement Board Meeting)INVESTMENT MANAGER SUMMARYFirm NameManager Tenure with FundInvestment Strategy/VehicleContract ExpirationMANAGEMENTTotal Firm AUM (03/31/2017)Total Firm Assets in Strategy (03/31/2017)Total Assets Managed for WPERP (03/31/2017)As of 03/31/2016Wellington Emerging Markets (gross)Wellington Emerging Markets (est. net)MSCI Emerging Markets IMI NDDifference (net of 3.96%11.65%2.31%57 bps on all assetsFeesWATCH STATUSN/A16Wellington Management8 MonthsEmerging Markets Equity06/30/2019 1,019 Billion 1.4 BillionRP - 285.0 MillionHP - 47.5 Million1 Year3 Year-----Inception-----9.31%9.00%6.69%2.31%

Cover-Full Image-InsideWMCNONOLos Angeles Departmentof Water and PowerEmerging MarketsSystematic Equity10 May 2017Michael P. McElroy, CFA Managing Director and InvestmentDirector, Equity Product ManagementCharles C. Ruch, CFA Managing Director and RelationshipManagerAAWellington Management Company LLP2001072239/451989 1/451989/399861

1

Representing Wellington ManagementTitle Line 2Michael P. McElroy, CFAManaging Director and Investment Director, Equity Product ManagementMike works closely with investors to help ensure the integrity of their investment approach. This includes meetingwith the team on a regular basis and providing oversight of portfolio positioning, performance, and risk exposures,as well as managing business issues such as capacity, fees, and guidelines.Prior to joining Wellington Management in 2013, Mike worked at Batterymarch Financial Management, where hewas senior portfolio manager and head of global equities.Mike received both an MS in management and an MS in transportation planning from the Massachusetts Instituteof Technology (1992), and a BS in applied mathematics from the Massachusetts Institute of Technology (1987). Inaddition, he holds the Chartered Financial Analyst designation.Charles C. Ruch, CFAManaging Director and Relationship ManagerCharlie works with clients in the western US, including endowments, foundations, public funds, and corporatepension plans. Charlie is responsible for assisting clients with long-term investment strategy and policy issues,evaluating portfolio risks and performance, and meeting with clients to discuss investment- and business-relatedissues on a regular basis.Charlie joined Wellington Management in 2006 as a portfolio communications manager, covering specificinvestment products and assisting with investment-related communications to clients. Prior to joining WellingtonManagement, he was a research associate at Oppenheimer & Co.Charlie graduated from Harvard Business School with an MBA (2005). He earned his BA in history and sciencefrom Harvard University (1997) and was a DAAD fellow at the Technische Universität München in Germany (1998).Additionally, Charlie holds the Chartered Financial Analyst designation.ALos Angeles Department ofWater and Power10 May 2017AA112001070596/451746 0/451746/451746Copyright 2017 All Rights Reserved

Wellington Management todayA trustedadvisor and strategic partner to clients worldwideTitleLine 2BY THE NUMBERSBusinessUS 1,019 billion of client assetsunder managementOWNERSHIP MODELLong-term perspective of aprivate partnership structureBUSINESS MODELSingular focus oninvestment management65 countries in which clients are basedAttract and retaininvestment talentDiversification by asset class,geography, and client typePeople and portfolios655 investment professionalsIndependent: No publicshareholders, no outside capitalResearch for clientbenefit only17 years of experience, on averageInterests aligned with clientsCommitment to bringing theright resources to each client2,150 clients163 partners all active at the firmINVESTMENT MODELComprehensive capabilitiesCultureOpen, collaborativeRigorous proprietary researchPerformance drivenCareer analystsProfessional/collegialGlobal resourcesHigh standards,ethics, and integrityEmpowered portfolio teamsGlobal diversity and inclusionHeritage: key dates1928 Wellington Fund – firstUS balanced fund1979 Establishment ofprivate partnership1994 First long – shortstrategy launchedContributorsto firmsustainabilityAs of 31 March 2017ALos Angeles Department ofWater and Power10 May 2017AA122000635965/452866 0/G1039/G1039Copyright 2017 All Rights Reserved

Depth, experience, and continuity create interpretation advantageTitle Line 2Avg years of professional experienceTotal number of investmentprofessionals: 6555613483313Avg years with Wellington ManagementInvestors draw on rigorous,proprietary researchCentralResearchWe conduct research throughfundamental; environmental,social, and corporate governance(ESG); quantitative; macro; andtechnical lensesEquitiesFixedIncomeMultiAssetGlobal Industry AnalystsQuantitative AnalystsGlobal DerivativesGlobal MacroanalysisTechnical AnalysisESG ResearchEquity Portfolio AnalystsPortfolio ManagementResearch AnalysisProduct Management516439Portfolio ManagementFixed Income StrategistsCredit Analysis621241Quantitative Analysis8Product Management41Portfolio Analysis28Portfolio ManagementResearch AnalysisProduct Management201813Equity and Fixed Income Traders57Management38Research Associates43Commo ditiesWFG/WAI11Wellington Funds Group and Wellington AlternativeInvestments As of 31 March 2017Portfolio ManagementCommodities AnalysisProduct Management122Management and DirectorsPortfolio Specialists960510152025ALos Angeles Department ofWater and Power10 May 2017AA132000003966/452866 0/G1039/G1039Copyright 2017 All Rights Reserved

Representative client listTitle Line 2Corporate Retirement PlansEndowments, Foundations, and Family OfficesAbbVie Inc.Air CanadaAmerican Electric Power SystemCanadian PacificCanada Post Pension PlanCargill, Inc.Chugai Pharma CPFCoINVEST LimitedDow ChemicalGaishoku-Sangyo JF Pension FundGeneral MillsGraymont, Inc.Hallmark Cards, Inc.International Paper CompanyMedtronic, Inc.Merck & CompanyMKS InstrumentsMolson Coors Brewing CompanyNational Provident FundPG&E CorporationRailways Pension SchemeRoll GroupRoyal Bank of CanadaSiemens CorporationSPF BeheerTELUSTextron, Inc.TransCanada PipeLinesChicago Symphony OrchestraMassachusetts Institute of TechnologyMercy HealthRenaissance Charitable FoundationStanhope CapitalUnited Jewish Welfare FundUniversity of KentuckyUS Olympic EndowmentPublic Sector, Sovereign, and Taft-HartleyAlberta Teachers’ Retirement FundBritish Columbia Investment Management CorporationFlintshire County CouncilGovernment of BermudaHospital Authority Provident Fund SchemeMassachusetts Laborers’ Pension FundOhio Carpenters’ Pension FundOklahoma Teachers Retirement SystemOregon Laborers – Employers Pension Trust FundState of OregonTreasurer of the State of North CarolinaSubadvisory RelationshipsGAMNikko Asset ManagementUOB Asset Management LtdVanguardInsurance (general account assets)As of 31 March 2017 Clients included on the listabove were selected based on client type, accountsize, and/or other nonperformance-based criteria toshow a list of representative clients. This list does notrepresent an endorsement of the firm or its services.Ballantyne ReHiscoxInfinity P&CMortgage GuarantyALos Angeles Department ofWater and Power10 May 2017AA142000635968/452866 0/G2911/G2911Copyright 2017 All Rights Reserved

Los Angeles Department of Water and PowerRelationshipTitleLine 2 reviewInvestment assignmentEmerging Markets Systematic EquityPortfolio inception30 September 2016Relationship teamCharles Ruch, CFA; Stephen Crisan, CFA31 March 2017Market valuesEmployees’ Retirement Plan portfolioEmployees’ Health Plan portfolioEMSE – total strategy AUMWellington – total firm AUM 285.1 million47.5 million1.4 billion1,019 billionALos Angeles Department ofWater and Power10 May 2017AA152001071356/451746 0/451746/451746Copyright 2017 All Rights Reserved

Emerging Markets Systematic EquityPortfolioTeamTitleLineManagement2David J. Elliott, CFA, FRMSenior Managing DirectorCo-Director, Quantitative Investment GroupPortfolio managementUniversity of Massachusetts (Amherst)1989, BS28 years of professional experience22 years at Wellington ManagementMark A. Yarger, CFAManaging DirectorQuantitative AnalystFactor modelsBabson College2008, MBA28 years of professional experience17 years at Wellington ManagementFrank Xia, CFAVice PresidentQuantitative AnalystRisk managementCarnegie Mellon University2006, MS14 years of professional experience10 years at Wellington ManagementMichael P. McElroy, CFAManaging DirectorInvestment DirectorBusiness managementMassachusetts Institute of Technology (Sloan)1992, MS30 years of professional experience3 years at Wellington ManagementALos Angeles Department ofWater and Power10 May 2017AA162000966784/452866 0/G2236/G2236Copyright 2017 All Rights Reserved

Emerging Markets Systematic EquitySpecializedTitleLine 2 research evolves the processDavid J. Elliott, CFA, FRMBS, University of Massachusetts, Amherst28 years experienceDonald S. TunnellMBA, University of Chicago29 years experienceFACTOR MODELS &SHORTINGFrank Xia, CFAMS, Beijing University, MS, Emory University,MS, Carnegie Mellon University14 years experienceChristopher R. Grohe, CFAMBA, Massachusetts Institute of Technology22 years experienceAndrew T. Liu, CFABA, Williams College6 years of experienceTom J. Bok, PhDPhD, Harvard University16 years TFACTOR TIMINGRESEARCH CHINELEARNINGResearch DataAnalyticsSharon Gu, CFAMS, Cornell University7 years experienceYang Du, PhDPhD, Northeastern University7 years experienceDavid Goddeau, PhDPhD, Massachusetts Institute of Technology35 years experienceKenneth J. VanderpoolBS, Columbia University6 years experienceOwen Lamont, PhDPhD, Massachusetts Institute of Technology25 years of experience“We seek to find investment opportunitiesin the gap between how markets shouldbehave and how they do behave.”– CHRISTOPHER GROHE, CFACheryl D. NortonMA, Bentley University20 years experiencePORTFOLIO OPERATIONALMANAGEMENTMARKETMICROSTRUCTUREMichael P. McElroy, CFAMS, Massachusetts Institute of Technology30 years experiencePORTFOLIOENGINEERINGPORTFOLIO ERSIGHTMark A. Yarger, CFAMBA, Babson College28 years experience“ Our research is ongoing.It is the ceaseless pursuit oftruth in a changing world.”– OWEN LAMONT, PhD“We all write code. We have no silos betweenfactor research and portfolio management.Self-sufficiency can eliminate bottlenecks andallows us to prototype and test ideas rapidly.”– TOM BOK, PhDALos Angeles Department ofWater and Power10 May 2017AA172000981350/451989 2/G1494/G1494Copyright 2017 All Rights Reserved

2

Emerging Markets Systematic Equity (EMSE)WhatLinerole2can EMSE play and what is our competitive advantage?TitleWhy should clientsconsider EMSE?Employs a systematic approach toinvesting in emerging markets equitiesSystematic approaches have historically beeneffective in emerging marketsLow alpha correlation with other emergingmarkets approachesConsistent historical performance across arange of market environmentsWhat is our competitiveadvantage?Contextual alpha modelUses a proprietary framework to weightfactors at the stock level based oncompany-specific indicatorsRisk managementA holistic approach based on EM-specific riskdrivers, which considers both historical andforward-looking indicators; enables portfoliorisk to be focused on stock-specific drivers andallows for more responsive risk adjustmentsTransaction cost managementEM costs average about twice those ofdeveloped markets; model integrates costconsiderations into every trading decisionALos Angeles Department ofWater and Power10 May 2017AA182000966782/436970 3/G2236/G2236Copyright 2016 All Rights Reserved

Emerging Markets Systematic EquityInvestmentTitleLine 2 philosophy, approach, and objectiveInvestment philosophyWe believe Certain stock-level factors are strongly associated with future relative performanceThe use of multiple factors is importantOptimizing the opportunity set requires managing the returns, risks and costsTools and techniques must constantly evolve to be successfulApproach and investment objectiveWe seek long-term results in excess of the MSCI Emerging Markets IMI benchmark. EMSE employs an integrated setof proprietary emerging markets alpha sources, a proprietary risk framework, and proprietary trading techniqueswhich seek to minimize cost in pursuit of a consistent alpha orientation with attractive upside and downside capture.ALos Angeles Department ofWater and Power10 May 2017AA192001074156/452866 0/451989/G2236Copyright 2017 All Rights Reserved

Emerging Markets Systematic EquityCollaboration:Systematic process benefits from fundamental insightsTitleLine 2“ Good ideas are the lifeblood of research. Having access to a deep team of experts at Wellington helps shape ourresearch agenda and improve our systematic process.” – Don TunnellConventional viewNew insight drivesquant researchOutcomes/Model enhancementsAll companies in a sectorgenerally respond to the samepricing and behavioral dynamicsA tech company behaves morelike a utility, with stable cash flowand dividendContextual model differentiatesstocks based on issuercharacteristics and importance ofspecific factorsCompanies that issue sharestypically underperform those thatbuy them backREITs tend to rely on issuingnew shares to fund their growthQuality factor signalsreconfigured for REITsALos Angeles Department ofWater and Power10 May 2017AA1102000975040/436669 0/G2236/G2236Copyright 2016 All Rights Reserved

Emerging Markets Systematic EquityInvestmentTitleLine 2 processOptimizermaximizes return/risk subject to costs3 proprietary modelsinform the optimizerProprietaryQuantitativeEquity (QE)ModelsProprietary RiskModel (QRM)ProprietaryTransactionCost ModelPortfolio reflectsoptimal expectedrisk adjusted returnafter costsPortfolioOptimization(Axioma/IPOPT)Alpha forecastRisk forecastEMSEportfolioTransactioncost prediction 150 names,Sector/Countryweights 5% of index,Tracking Risk 2 – 4%The characteristics presented are sought during theportfolio management process. Actual experience maynot reflect all of these characteristics, or may be outside of stated ranges. Axioma/IPOPT – optimizationtool that combines the inputs from the quantitative equity model, transaction cost model, and riskmodel. QRM – proprietary quantitative risk modelused in the process. QE Model – proprietary quantitative equity model used in the process.ALos Angeles Department ofWater and Power10 May 2017AA1112000966793/436970 3/G2236/G2236Copyright 2016 All Rights Reserved

Emerging Markets Systematic EquityQuantitativeTitleLine 2 Equity ModelSecurity evaluation – Diverse alpha sourcesFair valuePure valueManagement behaviorEarnings qualityContextualAlpha ModelStocks classifiedalong a spectrumof informationuncertainty andassigned uniquefactor weightsShort-Term ModelAims to predict relativeperformance of globalequities, with a time horizonof 1 – 4 weeksQE ModelForecastsLong-term momentumShort-term momentumALos Angeles Department ofWater and Power10 May 2017AA1122000966794/435618 1/G2236/G2236Copyright 2016 All Rights Reserved

Emerging Markets Systematic EquityProprietaryTitleLine 2 Quantitative Risk Model (QRM)Specifically tuned to proprietary alpha engineBenefitsImproved risk prediction accuracyFaster response to changes inrisk regimes80Total risk prediction: Market predicted vsrealized risk comparison (3-month windows)Standard deviation of returns (%)Realized riskPredicted risk (3rd party generic model)Potential outcomesMore efficient alpha transfer fromalignment with alpha modelPredicted risk (QRM)60Crowd avoidance via differentiatedportfolio et data represents the S&P 500 Index. Dataprovided is that of a third party. While data is believedto be reliable, no assurance is being provided as to itsaccuracy or completeness Sources: S&P, WellingtonManagement, third party risk modelALos Angeles Department ofWater and Power10 May 2017AA1132000688430/439672 3/G1494/G1494Copyright 2016 All Rights Reserved

Emerging Markets Systematic EquityHow Linewe controltransaction costsTitle2Sample ReportProprietary Transaction Cost ModelIntegrates cost considerations intoevery trading decisionTuned to our trading styleIncorporates country-specific fees,taxes, commissions and stamp dutiesMinimal-impact Execution ProcessPatient trade horizon/lowliquidity consumptionEfficient execution by our GlobalProgram Trading DeskTransaction Cost MonitoringProprietary cost reporting tooldelivers comprehensive costanalytics T 1Visualization tools summarizeexecution patterns and allow drilldown into individual ordersSample report is provided for illustrative purposesonly. Source: Wellington ManagementALos Angeles Department ofWater and Power10 May 2017AA1142000996277/440719 0/G1494/G1494Copyright 2016 All Rights Reserved

Emerging Markets Systematic EquityPortfolioand risk controlsTitleLineconstruction2Benchmark: MSCI Emerging Markets IndexPosition sizeNumber of holdingsRelative weight 3%Number of holdingsSector weightsOtherTypically within 5% of the MSCIEmerging Markets Index sector weightCashTypically 5%DerivativesTo equitize cashCountry weightsTypically 150Regular portfolio and risk reviews by ProductManagement and Investment Review GroupTypically within 5% of the MSCIEmerging Markets Index country weightMarket cap size limitationsWithin the range of the benchmarkThe characteristics presented are sought during theportfolio management process. Actual experience maynot reflect all of these characteristics, or may be outside of stated ranges.ALos Angeles Department ofWater and Power10 May 2017AA1152000576332/436970 3/G2236/G2236Copyright 2016 All Rights Reserved

Los Angeles Dept of Water and PowerSummaryTitleLine 2of guidelinesThe portfolios have been in compliance with investment guidelines since theinception of the accounts (September 2016) Benchmark: MSCI Emerging Markets IMI ND Permitted investments: securities of non-US companies doing business inemerging markets, including REITs and depositary receipts; ETF’s also permitted. Minimum market capitalization for eligible investments: 100 million 144A securities without registration rights limited to 10% of portfolio Non-currency derivatives are not permitted without the consent of the Plan Currency hedging permitted, up to 25% of portfolio value No greater than 7% invested in a single issuer Securities with greater than 10% of outstanding shares held by Wellington arenot permitted Turnover normally less than 200% for twelve month periods Trailing twelve month price-to-earnings normally within .5x range of benchmark Average dividend yield normally within .5x of benchmark Beta normally similar to benchmark on a rolling 24‑month basisALos Angeles Department ofWater and Power10 May 2017AA1162001070595/451989 1/451746/451746Copyright 2017 All Rights Reserved

3

Market OverviewUpdateandTitleLine2 OutlookWe believe the environment well-suited for systematic techniquesOur Emerging Markets stock selection model was solidly positive in Q1 2017Value and Momentum themes were strongest contributorsQuality theme slightly negative for quarter, reflecting a market more favorable tocompanies seeking capital and investing capitalCross-sectional correlations between stocks falling, which allows for stock selectionto be more effectiveALos Angeles Department ofWater and Power10 May 2017AA1172001074168/452866 0/451989/451989Copyright 2017 All Rights Reserved

Emerging Markets Systematic Equity CompositePerformanceTitleLine 2 in various market environmentsAverage gross excess monthly returns Sep 2009 to Mar 2017Gross perfo

May 10, 2017 · Corporate Retirement Plans AbbVie Inc. Air Canada American Electric Power System Canadian Pacific Canada Post Pension Plan Cargill, Inc. Chugai Pharma CPF CoINVEST Limited Dow Chemical Gaishoku-Sangyo JF Pension Fund General Mills Graymont, Inc. Hallmark Cards, Inc. International Paper Company Med