Transcription

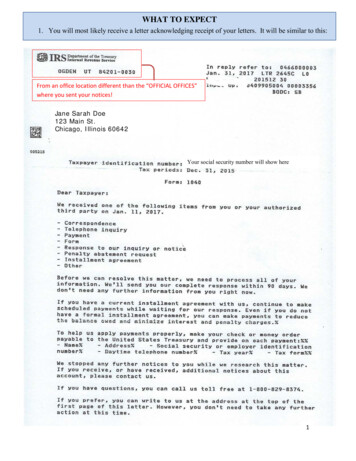

(CAB)

Our Vision:“To be the collective voice that protects, promotes and strengthens theregional banking sector. “The CAB (formerly Caribbean Association of Indigenous Banks) has beenestablished since 1974. It is managed by a Board of Directors elected by themember organisations and supported bya Secretariat of 5 staff members.

Our Mission:“Toproactively influence matters of interestto financial institutions through advocacy andeducation.”

Currently, the CAB represents 76 member institutions with an asset base inexcess of US 41 Billion, as at December 2016.Our membership compliment spans three (3) distinct categories, of General,Service and Associate members and includes three (3) Honorary Members - namelythe Caribbean Development Bank, CARICOM and the Caribbean Centre forMoney and Finance.Our membership institutions are spread throughout 20 countries, predominantlyin the Caribbean and South America, with some service members based inCanada and the USA.

Membership Benefits Include:Advocacy – We lobby and negotiate on behalf of ourmembers.AML – Assist in the strengthening and reinforcement ofAML/CTF through the establishment of the CaribbeanAnti Money Laundering (AML) Principles in 2009.Provide continuous training for industry professionals.Contacts - Access to CAB’s mailing list for businessdevelopment, social networking, information sharing etc.

Membership Benefits cont’d:Marketing - Wider branding and high value visibilitythrough advertisement in CAB’s Website, Social Mediaand Annual Caribbean Account Magazine.Concessions - Special discounted and concessionary ratesfrom vendors and training partners for Training,Seminars, Conferences, Advertising and other services.E-newsletter & Bulletins - Up to date information onwhat’s happening in the industry.

Membership Benefits cont’d:Exposure - Open invitation to submit articles for ourpublications, Newsletter, Website and Social Media toshare best practice.Secretariat Support - Dedicated Secretariat teamproviding professional member services and support.Member Development - Opportunities for professionaldevelopment and qualifications.Regional & International Reach - Represent CAB atlocal, regional and international meetings and encouragepolicy decisions at the highest levels.

Some of the things that we have done and are doing:AdvocacyHarmonization of Legislation— We are engaging regional partnerson the issue of harmonization of legislation on a number of areas such as; CreditBureau, Secrecy laws, Prudential Regulation, Common Financial ServicesRegulation, Accounting Standards, Corporate Governance, ConsumerProtection etc.

Advocacy contd.Correspondent Banking Relationships/De-Risking— The CAB has undertaken several interventions which includedcorrespondence to the Chair and Secretary General ofCARICOM, highlighting the issue of the threat of loss ofcorrespondent banking relationships and its impact on thelivelihoods of Caribbean people as well as the growth anddevelopment of the financial services sector.The CAB was the first organisation to raise the issue of Derisking within the CARICOM region.

Advocacy contd.Correspondent Banking Relationships—The CAB has been relentless in its advocacy on this issueincluding: Collaboration with many other stakeholders through partnerships,presentations & recommendations delivered at: Bahamas Institute of Financial Services Conference –Bahamas 2015 Caribbean Banking and the Caribbean International Financial ServicesSector Workshop – Curacao 2015.

Advocacy contd.Correspondent Banking/De-Risking Caribbean Policy Research Institute (CaPRI) Round TableDiscussion on Correspondent Banking – Jamaica 2016. Meeting of CARICOM’s Committee of Ministers of Finance on theCorrespondent Banking threat – Belize 2016. FATF Private Sector Consultative Forum – Austria 2016 World Bank Group ACAMS Stakeholder Dialogue on De-Risking –Washington 2016

Advocacy contd.Correspondent Banking/De-Risking Caribbean Central American Action in partnership with IDB & OASConference on Finance, FinTech & the Future of Banking in theCaribbean Basin – Washington 2016 Global Stakeholders Conference on Correspondent Banking, ‘Derisking’ and the Branding of Caribbean Countries as ‘Tax Havens’–Antigua 2016. IMF’s Caribbean Roundtable on Regional Solutions to theWithdrawal of Correspondent Banking Relationships Closed DoorMeeting – Barbados 2017. FIBA AML Conference – Miami 2017.

Advocacy contd.Correspondent Banking/De-Risking Partner in Inter-American Development Bank’s project:“Strengthening Financial Transparency: Rebuilding Trust inCorrespondent Banking in the Caribbean. Circulated IDB AML/CFTTraining Needs Survey – 2017. Research Paper – “Correspondent Banking and De-risking in theCaribbean. The unintended consequences of regulatory guidelinesand the threat to the indigenous banking sector.” Currently In Progress: Research Paper in collaboration with IDB –“De-Risking: Drivers of the Uneven Impact across the CaribbeanRegion.”

AML /CTFIn 2009, we launched the Caribbean Anti Money Laundering/Counter Terrorist Financing Principles & AssociatedGuidelines.We established a Caribbean Principles .html tofacilitate easy access and adoption for our members. The site liststhe names of the banks that have adopted the Principles and thestandards to which they subscribe.

AML /CTFMore recently, CAB has issued letters & Press Releases to relevant stakeholders,in response to the: EU’s 2015 “Action Plan for Fair and Efficient Corporate Taxation in theEU” District of Columbia’s 2015 Budget Support Act 2017 Illinois Home Bill 3419which all included Caribbean countries “blacklisted” as Tax Havens.

FATCA - Since the announcement by the United States of the enactment ofthe Foreign Account Tax Compliance Act (FATCA) into law on March 18, 2010,the CAB has been very concerned about the implications for financial servicesinstitutions in the Caribbean and the resultant impact on the economies of theregion as a whole.In early 2012, CAB developed a positionpaper to heighten the awareness andimplications of the Act for all relevantartiesparties and stakeholders. This paper was alsosubmitted to CARICOM.

Subsequently, CAB, in collaboration with PWC, made a presentation on FATCAat the 15th Meeting of the Council for Finance and Planning (COFAP), on the30th June 2012 , St Lucia . This resulted in the formation of a CARICOM TaskForce to formulate a plan of action which would facilitate a regional approachtowards compliance.Other FATCA activities. Training and awareness sessions, circulation ofupdates to members and regional partners.

InitiativesIn 2006, CAB develop ed and launched the Caribbean Association of AuditCommittee Members Inc (CAACM) to improve the investment environmentin the Caribbean region and to increase investor confidence in the integrity offinancial reporting and investor information through the continuousdevelopment of audit committee members.The CAB Secretariat continues to provide .operational support to the CAACM

TrainingSome of the areas in which CAB has conducted Training . Credit Risk Management - Introduction & Advanced (St Lucia)Enterprise Risk Management – Module 1 (Antigua)AMLCA & FATCA Implementation (Trinidad)AML Risk & Correspondent Banking (Curacao)Foundations of Loan Underwriting (St Lucia)Developing Cutting Edge Talent (St Lucia)Scaling Up SME Banking (St Lucia)The Compliance Challenge (Curacao)Advising Clients in a Highly Regulated Environment (Curacao)PLUS various Webinars on many hot topics.

CAB Banking Scholarships Our Goal .To provide members with an incentive to become qualified bankers. Our Purpose .To provide financial assistance to CAB member employees with an interest inpursuing continued education in banking The Award .UWI Scholarship Award : to pursue the BSc in Banking and Finance for 3academic years. Three (3) scholarships are awarded as follows:Eastern Caribbean* USD10,000North Western Region **USD10,000Southern Region ***USD10,000 The three scholarships are awarded every three (3) years. * Includes BVI** Belize, Cayman, Jamaica*** Guyana, Suriname, Trinidad and Tobago

Chartered Banker Scholarships Our Goal .To provide members with an incentive to become fully qualified bankers. Our Purpose .To provide financial opportunities to CAB member employees with aninterest in pursuing further education in banking The Award .CAB/Bangor University Scholarship Award : to pursue the Chartered BankerMBA (distance learning). Two scholarships have been offered to date:April 2016 15,500October 2017 15,500 Offered in partnership with Chartered Banker/Bangor University.

Graduate School of Business Scholarships Our Goal .To provide members with an avenue to develop as banking leaders. Our Purpose .To provide financial opportunities to CAB member employees with aninterest in studying general banking and management subjects. The Award .CAB/Graduate School of Banking at the University of Wisconsin-MadisonAward to pursue the three year Graduate School Program: Annual scholarships have been offered since 2004:Annual US 3,900 Offered in partnership with Graduate School of Banking at the University of Wisconsin-Madison.

Credit Skills Academy– In Collaboration with Keith Checkley & AssociatesWhat is it & How Can it Benefit You? On Line Learning Resource - accessible anytime, anywhere.Flexible Study with Personalised Study Plan and Study GuideTwo Course Levels – Foundation and AdvancedSuccessful completion results in accreditation (Associate/Senior Associate) and educationalcredit towards UK Chartered Banker statusEstimated study time for each course – 200 hours over a 1 year period (4 hours per week)Low Fees per Student –Non-Member: US 1,250Bankers Association Member: US 1125CAB Member: US 1,000No Books! All material is delivered online.Assessment Based on (all): 1. Learning Activities while studying2. Self-Assessment questions per unit3. A Final Test4. Personal Credit Case Assignment

CAB Insurance SchemeCAB and Howden have partnered to deliver a special Insurance Scheme for CAB members.Howden is part of Hyperion, an international insurance intermediary group that provides end-toend client solutions. Howden have the largest, wholly owned, international network of anyindependent broker with global reach that retains the local touch.The CAB Policy covers:Comprehensive CrimeProfessional Indemnity/Professional LiabilityPlastic Card RisksTrade Credit/PolicyElectronic Computer CrimeDirectors & Officers Liability InsuranceCyber SecurityKey Benefits:Substantial Reduction in PremiumsPolicy Wording Which Adequately Covers Your Risk

NetworkingOur annual conference provides an excellent forum for bankers, financial servicesprofessionals and partners such as Accountants, Lawyers, Correspondent Bankofficials, Regulators etc., to facilitate both business and personal development.We engage internationally recognised speakers on current topics so that our memberscan stay abreast of legislative, regulatory and market developments that will influenceor impact the future of the industry.

NetworkingSome of the topics covered at past conferences are: 21st Century Leadership – Creating the Self-Led OrganisationCorporate Governance and a Risk Management StrategyThe Role of Social Media in Building Customer RelationshipsRegional Financial Stability – Implications of Sovereign Debt Restructuring (PanelDiscussion)Deepening Collaboration between LAC countries for Economic Growth & Development.Emerging Cyber Global Threats and TacticsThe Changing Face of Consumer Banking – Exceeding Expectations and ManagingRiskCorrespondent Banking Relationships – Challenges & Solutions

CollaborationCAB is or has been engaged in collaboration with partners such as:CARICOMCOTACommonwealth SecretariatCentral BanksGovernmentsCaribbean-Central American ActionIMF, CARTACIFC, World Bank GroupAccounting FirmsTechnology ProvidersRegional Bankers Associations

Collaboration Contd.

We Have Strong Working Relationships with our ServiceMembers:

Our Service Members cont’d:

And our Partners:

Web: http://www.cab-inc.comTwitter: CABAssocFacebook: CABASSOCFor more information please contact us at(758) 452-2877;cab@candw.lcWebsite: http://cab-inc.com/Facebook: CABASSOCTwitter:CABAssocThank You!

Conference on Finance, FinTech & the Future of Banking in the Caribbean Basin –Washington 2016 Global Stakeholders Conference on Correspondent Banking, ‘De-risking’ and the Branding of Caribbean Countries as ‘Tax Havens’– Antigua 2016. IMF’s Caribbean Roundtable on Regional Solutions to the