Transcription

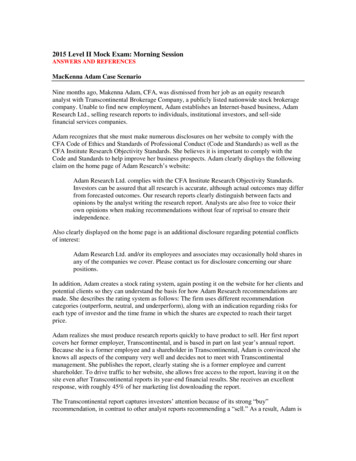

2015 Level II Mock Exam: Morning SessionANSWERS AND REFERENCESMacKenna Adam Case ScenarioNine months ago, Makenna Adam, CFA, was dismissed from her job as an equity researchanalyst with Transcontinental Brokerage Company, a publicly listed nationwide stock brokeragecompany. Unable to find new employment, Adam establishes an Internet-based business, AdamResearch Ltd., selling research reports to individuals, institutional investors, and sell-sidefinancial services companies.Adam recognizes that she must make numerous disclosures on her website to comply with theCFA Code of Ethics and Standards of Professional Conduct (Code and Standards) as well as theCFA Institute Research Objectivity Standards. She believes it is important to comply with theCode and Standards to help improve her business prospects. Adam clearly displays the followingclaim on the home page of Adam Research’s website:Adam Research Ltd. complies with the CFA Institute Research Objectivity Standards.Investors can be assured that all research is accurate, although actual outcomes may differfrom forecasted outcomes. Our research reports clearly distinguish between facts andopinions by the analyst writing the research report. Analysts are also free to voice theirown opinions when making recommendations without fear of reprisal to ensure theirindependence.Also clearly displayed on the home page is an additional disclosure regarding potential conflictsof interest:Adam Research Ltd. and/or its employees and associates may occasionally hold shares inany of the companies we cover. Please contact us for disclosure concerning our sharepositions.In addition, Adam creates a stock rating system, again posting it on the website for her clients andpotential clients so they can understand the basis for how Adam Research recommendations aremade. She describes the rating system as follows: The firm uses different recommendationcategories (outperform, neutral, and underperform), along with an indication regarding risks foreach type of investor and the time frame in which the shares are expected to reach their targetprice.Adam realizes she must produce research reports quickly to have product to sell. Her first reportcovers her former employer, Transcontinental, and is based in part on last year’s annual report.Because she is a former employee and a shareholder in Transcontinental, Adam is convinced sheknows all aspects of the company very well and decides not to meet with Transcontinentalmanagement. She publishes the report, clearly stating she is a former employee and currentshareholder. To drive traffic to her website, she allows free access to the report, leaving it on thesite even after Transcontinental reports its year-end financial results. She receives an excellentresponse, with roughly 45% of her marketing list downloading the report.The Transcontinental report captures investors’ attention because of its strong “buy”recommendation, in contrast to other analyst reports recommending a “sell.” As a result, Adam is

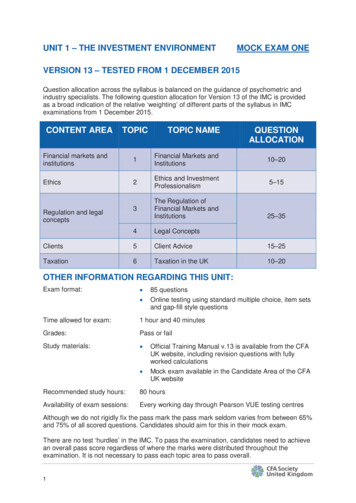

invited to participate in an interactive internet chat room discussion during which sherecommends a “buy” for Transcontinental. Because of limited time, she discloses only her formeremployment at Transcontinental and uses the rest of the time to advertise Adam Research. Onseveral occasions, Adam mentions her website’s URL.To expand Adam Research’s research capability after obtaining new clients, Adam hires twoanalysts. Recognizing the need to have written implementation policies because Adam is nolonger the only one writing research reports, she creates policies and provides them to the newemployees before posting them on the Adam Research website for clients to download. Thesepolicies are provided in Exhibit 1.Exhibit 1Adam Research Company Policies and ProceduresPolicy TypeDocument Content DescriptionResearch Objectivity PolicyThis document describes the process required to determinewhether there is independence and objectivity in the firm’sresearch, with instructions to make this policy available toall investors and employees. Procedures cited includesupervisory procedures to ensure compliance, annualattestation, and adherence to internal audit requirements.This document describes compliance policies andCompliance and Enforcement procedures to ensure research objectivity and lists allPoliciesactivities considered to be violations and the resultingdisciplinary sanctions, including dismissal from the firm.This document describes the policies designed to managecovered employees’ personal investments and tradingactivities to ensure the interests of the clients are alwaysplaced before the company, its employees, and theirPersonal Investments andimmediate families, including prohibition of front runningTrading Policiesand participation in subject company IPOs. In addition,covered persons are banned from trading against thecompany’s recommendations unless for financial hardshipreasons. All trades must be approved in advance.1.Which of the following initial claims made on the home page of Adam Research'swebsite least likely reflects the CFA Institute Research Objectivity Standards?A. Accuracy of research reportsB. Distinction between fact and opinionC. Independence of analysts' recommendationsAnswer A

The CFA Institute Research Objectivity Standards cannot ensure the accuracy of researchreports and recommendations, contrary to the statement made by Adam. Actual eventswill often differ from forecasts on which investment recommendations are made.CFA Level II“CFA Institute Research Objectivity Standards”Overview of the CFA Institute Research Objectivity Standards2.Adam Research's website disclosure regarding potential conflicts of interest leastlikely meets the recommendations for compliance with the CFA Institute ResearchObjectivity Standards concerning the:A. prominent display.B. plain language.C. comprehensiveness.Answer CThe disclosures given on the website are very brief and are not comprehensive orcomplete. They also are not designed to be informative, especially concerning shareownership of specific companies, because they require clients to contact Adam fordisclosure concerning share positions. The disclosure recommendations are verycomprehensive.CFA Level II"CFA Institute Research Objectivity Standards"Standard 10.0–Disclosures; Recommended Procedures for Compliance3.Which category of Adam Research's stock rating system could most likely beimproved to meet the recommendations for compliance of the CFA Institute ResearchObjectivity Standards?A. Investor riskB. Recommendation categoriesC. Time horizonAnswer BThe recommendation rating category used is relative, so a benchmark, index, or objectiveshould be clearly identified. Adam does not specify the benchmark used.CFA Level II"CFA Institute Research Objectivity Standards"Standard 11.0–Rating System; Recommended Procedures for Compliance4.The research report on Transcontinental most likely meets recommendations forcompliance with the CFA Institute Research Objectivity Standards with regard to:A. reasonable and adequate basis.B. timeliness of research reports and recommendations.

C. relationships with subject companies.Answer CAdam discloses her former relationship with the subject company as well as hershareholding in the company.CFA Level II"CFA Institute Research Objectivity Standards"Standard 6.0–Relationships with Subject Companies5.Did Adam's participation in an interactive internet chat room discussion most likelycomply with recommendations for compliance of the CFA Institute ResearchObjectivity Standards and Standards of Professional Conduct?A. No, because she is trying to manipulate the share priceB. No, because she did not make sufficient disclosuresC. YesAnswer BAdam failed to make sufficient disclosures by not informing the audience of hershareholding in the subject company, as required by the CFA Institute ResearchObjectivity Standard 2.0–Public Appearances. Additionally, she should have disclosed tothe audience whether a written research report is available, the approximate cost, andhow a reader might acquire the report.CFA Level II"CFA Institute Research Objectivity Standards"Standard 2.0–Public Appearances; Recommended Procedures for Compliance6.Which of Adam Research's mentioned company policies and procedures given inExhibit 1 least likely complies with the CFA Institute Research Objectivity Standards?A. Compliance and EnforcementB. Research ObjectivityC. Personal Investments and TradingAnswer AAdam failed to include monitoring and audit procedures and recordkeeping requirements.To be in full compliance with the Research Objectivity Standards, Adam would need toaddress all eleven components of the standard requirements.CFA Level II"CFA Institute Research Objectivity Standards"Standard 9.0–Compliance and Enforcement

Golden Island Case ScenarioGolden Island is a flourishing country because of tourism. The island is governed by a GovernorGeneral, a parliamentary body of elected legislators, and a couple of agencies to regulate theisland’s economic and social environment. Recently, prospectors in the mountain range borderingthe southern coast of the island discovered large deposits of gold, silver, and platinum. Thegovernment is concerned that development of these deposits will harm the tourist trade. ElenaTrippi has been asked to participate in a series of fact-finding sessions conducted jointly by theisland’s ministries of finance and tourism. This blue-ribbon fact-finding committee has beenmeeting weekly for the past two months.Trippi began a recent meeting of the committee by presenting a summary of Golden Island’scurrent financial and economic conditions. Comparing Golden Island with other developingnations, she presents these conditions in Exhibit 1.Exhibit 1Current Financial and Economic ConditionsRelative to other developing nations, Golden Island1. has a relatively low level of capital per worker.2. does not have competitive financial markets. The island’s single commercial bank also acts as the central bankof Golden Island.3. has a relatively low rate of savings and investment.4. has a low level of literacy (about half the population is illiterate).5. has well-established property rights.6. tightly regulates capital flows into and out of the economy.Trippi states that these conditions do not necessarily cause great harm to the tourist industry. Butthe mining and processing of gold, silver, and platinum will require re-examination of economicpolicies and circumstances. In particular, Trippi is concerned about the issue of tariffs becauseGolden Island has relatively high tariffs on capital goods.Trippi states:Golden Island will benefit from continuing to protect domestic capital goods bymaintaining its relatively high tariff on non-domestic capital goods. High tariffs havelittle impact on foreign direct investment (FDI), and they generate revenue for thegovernment.Rishi Chatterjee is Golden Island’s Interim Deputy Minister for Tourism. He states that he is notvery knowledgeable about the gold business but believes that developing the island’s golddeposits will affect the relative value of its currency, the sona (Sn). The current exchange rate ofthe sona against the US dollar is Sn8.50/USD. Chatterjee states that increased FDI will cause thesona to strengthen against world currencies. Tourism will be harmed because goods and servicespriced in sonas will appear more expensive to the non-domestic visitors who make up the bulk ofthe tourist trade.

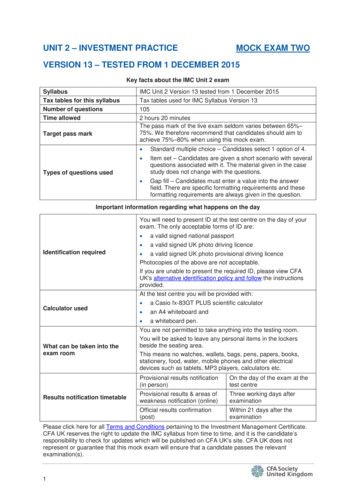

Trippi shows the committee Exhibit 2, which contains data from the currency exchange marketsrelative to the sona. On the basis of this data, Trippi states that markets currently anticipate thatthe sona will weaken, not strengthen, against both the dollar and the British pound.Exhibit 2Exchange Rates, Interest Rates, and Inflation RatesGolden IslandCurrent SpotRatesSn8.50/USDOne-YearInterest Rate(%)6.5One-YearInflation Rate(%)3United KingdomGBP0.62/USD4.051.63.51.3United StatesGolden Island’s Minister of Finance and president of the Central Bank is Rajiv Sengupta. He isconfident that Golden Island can allow the mining district to proceed with little or no damage totourism. He states:We can use free market mechanisms to control potential pollution from the mines.Because there will be at least 4, and possibly more than 10, mining companies operatingin the mining district, we can design an exchange wherein the companies can trade“pollution rights.” The government will set the total maximum amount of variouspollutants that might occur from mining operations, revising that total from time to time.The companies will bid on rights that will allow them a certain level of that totalpollution. If a company exceeds the level to which it has a “right” , it will be fined. Byallowing the trading of these rights on an exchange, the resulting “price of pollution” willreflect the most efficient allocation of resources related to the mining district.Sengupta addresses the issues of potential inflation as the island transitions to greater growth. Heassures the committee that Golden Island’s central bank stands ready to use monetary tools toprevent such inflation.7.How many of the current financial and economic conditions listed in Exhibit 1 at leastpartially explain why Golden Island faces limited economic growth?A. All six are limitations on growth.B. Exactly five of the six are limitations on growth.C. Exactly three of the six are limitations on growth.Answer BAll of the factors except “well-established property rights” represent limitations togrowth. Hence, exactly five factors are limitations.CFA Level II“Economic Growth and the Investment Decision,” Paul KutasovicSections 2.1 and 2.7

8.Trippi’s statement regarding tariffs is best described as:A. correct.B. incorrect, because high tariffs support increases in FDI.C. incorrect, because eliminating high tariffs on manufactured goods will increaseGolden Island’s physical capital and cont

2015 Level II Mock Exam: Morning Session ANSWERS AND REFERENCES MacKenna Adam Case Scenario Nine months ago, Makenna Adam, CFA, was dismissed from her job as an equity research analyst with Transcontinental Brokerage Company, a publicly listed nationwide stock brokerage company. Unable to find new employment, Adam establishes an Internet-based business, Adam Research Ltd.,