Transcription

edited & designed by netscribes (India) private limitedNo part of this publication may be reproduced either in print or electronic form without the express permission of Hunt Partnersthe hunt reportw w w. h u n t - p a r t n e r s . c o mB E I J I N GIH O N G K O N GIM U M B A IIS H A N G H A I

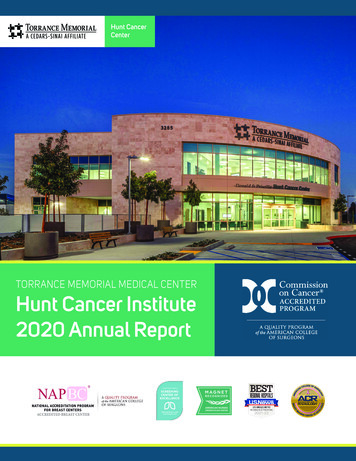

the hunt reportFOREWORDDear Reader,We are delighted to present the seventh issueof The Hunt Report, a half-yearly industryroundup of key trends impacting executivehiring across industries.This issue captures people movement andanalysis of 19 key industries. The policy paralysisfurther heightened by the 2014 GeneralElections, has led to a virtual stagnation inmost sectors.The report is aggregated for your benefit andassesses the impact of these industry trendson human-capital and their implications on theleadership talent movement.We hope you find the Report insightful. Wewelcome your comments and feedback atthehuntreport@hunt-partners.comHappy Reading!The Knowledge Management TeamHunt PartnersDecember, 2013

IN THIS ISSUEThe Hunt Report, a half-yearly update, evaluates the keybusiness trends in industry practices, ranging fromReal Estate to Insurance. This issue of The Hunt Reportanalyses the impact of these significant business trendson the executive hiring process and the leadershipmovements in nineteen industry verticals.CONTENTS IPg 6AUTOMOTIVEReeling from theslowdownPg 8ELECTRICALBullish prospectsPg 10ENGINEERINGChallenges andopportunitiesVOL VIIPg 12CHEMICALSGrowth opportunitiesPg 14CONSUMERMARKETINGThe rise of theDigital CMOPg 16E-COMMERCEIndia logs inPg 18COUNTRY FOCUS:MALAYSIAMalaysia in thelimelightPg 20COMMERCIALBANKINGCredit watchPg 22INSURANCEMixed bag of goodies

the hunt reportPg 24INVESTMENTMANAGEMENTWinds of changePg 30MEDICAL DEVICESAND TECHNOLOGYHigh on the listPg 36CONVENTIONALPOWERPower cutPg 26PAYMENTSFillip to growthPg 32HOSPITALSHealthy outlookPg 38RENEWABLE POWERRenewed prospectsPg 28PRIVATE BANKINGTrends incompensationPg 34PHARMACEUTICALSRiding high onsuccessPg 40LOGISTICSHeadwinds aheadPg 42PORTSTurbulent winds

AUTOMOTIVEReeling fromthe slowdownAs the sector continues to face sluggish growth,companies are trying to buck the trend throughrestructuring and management reshuffles. However,hiring continues to be muted across levelsbySuresh Raina and Uday BrocaIn the first half of 2013-14, the automotive sector continued to reel from one of its worstslowdowns in the last decade. Hiring continues to be muted across all levels withexecutive placements being either mission critical or replacement hires. Multipleproduct recalls of over 300,000 vehicles in the past year have further led to a negativesentiment surrounding the sector.Mandatory vehicle recall on the cardsRestructuring and reshufflesGeneral Motors recalled over 100,000Chevrolet Tavera cars, resulting in somesenior-level exits across the US andIndian powertrain operations. Fordrecalled over 150,000 units of its Figoand Classic models. The government isnow planning to introduce a mandatoryvehicle recall for auto makers, apingpolices followed in developedeconomies. This would significantlyimpact hiring, as both Indian andmultinational companies are nowfocussing on higher standards in testing,quality and product engineering.Taking a cue from Honda’s growth, majorreshuffles have taken place at HeroMotorcorp with the reallocation ofportfolios. With Deepak Mokashi nowheading International Business andSanjeev Shukla promoted to leadNational Marketing, Hero is leaving nostone unturned to retain its top position.Stability in two-wheelers.pg 6The two-wheeler sector is stable with asignificant increase in demand fromdomestic and international markets.Honda grew by over 35 percent, claimingthe second highest market share. Withtwo new plants in Gujarat and Bangalore,it also plans to add 3,000 employeesacross levels.On the other hand, Bajaj Auto isconcentrating on the internationalmarkets of Africa and Latin America,where it is witnessing robust growth.Senior Indian talent is filling up theCountry Manager positions, withlocal hiring taking place at juniorand mid-levels.

the hunt reportPEOPLE MOVEMENT Vijay Deshpande has moved toSkoda India as HR Director fromHindustan Coca Cola Beverages,where he was the Zonal Head – HR.Vineet Sahni is now the CEO atLumax. Previously, he was Presidentat Varroc Lighting Systems.Vimal Sumbly has joined TriumphMotorcycles as Managing Directorafter being the General Manager Sales at Bajaj Auto.Kenichiro Yomura, who waspreviously General Manager –Middle East at Nissan Motors, isnow Managing Director of NissanMotors India. The slowdown has led to a significantshakeup of senior leadership across mostmajor players. Mahindra & Mahindra(M&M) has undertaken a completerestructuring exercise, merging its twoloss-making businesses (two-wheelerand commercial vehicles) into the moreprofitable Auto & Farm Equipment (AFS)division. Ashok Leyland has conducted arevamp wherein the business has beensplit into three distinct units in a bid tomake the organisation more nimble.Rajive Saharia will now oversee the Trucksbusiness, with T Venkataraman handlingthe Bus Division and CG Belsare takingresponsibility of the Power Solutionsvertical. It will be interesting to see whichof the two strategies prove to besuccessful in the long run.Facing the repercussions of the domesticmarket slowdown, Tata AutoCompSystems too recently exited multiplejoint ventures, including that withJohnson Controls and Yazaki.Ford India has beefed up its sales andmarketing team after the successfullaunch of the EcoSport. Expatriate talentis being relocated to India to strengthenthe local team. A part of Ford US since1996, Raj Sarkar is now Vice President –Marketing at the organisation. He waslast associated with the Lincoln GlobalBusiness Team. Chennai as an investment hubDuring the last 12 months, Indonesia andThailand trumped India in attractingfresh investments of overIn another development, Mahindra ceded 34,000 crore from auto majors Honda,control of Systech, its auto componentsToyota, Nissan and Ford. Oragadam indivision, to Spanish auto-componentsChennai is an apt example of how Indiagiant, CIE Automotive. The deal will create can win back these investments. Thea combined business valued atstate government’s policies provide a 17,000 crore, and M&M will holdconducive environment in this hub, witha minority stake of 13.5 percent ininvestments growing by over 30 percent.CIE Automotive.Investments of over 5,000 crore havealready poured in, leading to a creationDespite a massive restructuring exerciseof over 10,000 jobs.and a new leadership team, Tata Motorscontinues to struggle in both passengercars and commercial vehicles.KR Murali will head JohnsonControls India as CEO after itssplit from TACO. He waspreviously the President atAramada Johnson Controls.Arnaud Lesschaeve hasmoved to GKN Driveline to takeup the role of President – APAC.He was earlier with FaureciaEmission Controls Asia as VicePresident.Gregory Edwards, who waspreviously the President ofNanyang MBA StudentExecutive Committee, will nowhead dealer development forHarley Davidson Asia.Pankaj Dhingra has joinedNissan Motors as GeneralManager – Global Mergers. Hewas earlier a Venture Partner atAugment Ventures.pg 7

ELECTRICALBullishprospectsWhile the consumer durables sector managed to escapethe impact of the downturn, other segments continue tolag behind. The government’s move to allow Chineseservice centre shops will intensify competitionbySuresh Raina and Rajesh KumarThe electrical sector continues to be impacted by the economic downturn. Whilesome of the sectors such as power generation (equipment manufacturers) are stilllagging, the consumer durables sector managed to maintain its growth riding onsustained demand. Overall, the sector is bullish about the long-term prospects.Under pressureThe power sector, comprising generation,transmission and distribution sub–sectors, is under pressure due to rawmaterial related issues. It is expected togrow by approximately six percent in2013-14 as compared to four percent forthe previous year. The power T&D sectorhas seen some orders flow in, while thecapital goods companies expect toreceive orders worth 24,000 crore as thegovernment has revived the Ultra MegaPower Projects programme.The companies are expanding theirfootprints globally. Some of the majordevelopments in the sector areas follows: Power Grid Corporation of IndiaLimited won an order to manageEthiopian Electric Power Corporation. Alstom T&D bagged an order of 105 crore to supply transformers tothe NTPC Nabinagar power project.pg 8 Alstom won an order from GVK worth 840 crore to supply hydro turbinesto the Ratle power project.Kalpatru Power Transmission has wonnew contracts whose combinedvalue is estimated to be 6.2 billion.AION Capital partners has acquiredminority stakes in Jyoti International,a mid-size company in EPC contractsfor power transmission, with aninvestment of US 23 million.The power sector is highly regulated andcapital intensive. The competition fromChinese companies is intensifying. Thegovernment’s move allowing Chinesecompanies to open service centre shopswill further intensify competition. In thenext six months, we do not expect anymajor movements with respect to talent,with people preferring to stay in theircurrent positions. The governmentoutlook, which will influence talentmovement, will also become clear in thecoming months.

the hunt reportPEOPLE MOVEMENT Sanjeev Gambhir is now CEO –India for Allied Moulded Products.He was previously Head – Sales &Marketing, with Pentair TechnicalProducts.Apratim Das is now ChiefOperating Officer – Fan Division, forXenitis Infotech Ltd. Earlier he wasAVP – Operations with Eon Electric.Ullas Sharma, who was earlierCountry Manager - Key Accountswith Emerson Network Power, hasmoved to Johnson Controls asDirector - Product Management.Lipika Verma has moved toSchneider Electric as Director –Rewards, from her earlier positionas Vice-President - Compensation& Benefits at GE Capital. Electrical: Consumer durables,lighting, drivesThe consumer durables market is ridingon the demand from the rural marketsand urbanisation. Some salient highlightsfrom the sector: Halonix Limited sold its generallighting business to Actis for 160 crore. French Company Delfingen Industriesacquired Kartar Wire Industries. Toshiba is planning to buy majoritystakes in Vijai Electricals forUS 200 million. Warburg Pincus sold its 8.35 percentstake in Havells India for 730 crore.On the talent front, requirement ofsenior talent for business roles willremain high.Instrumentation: Automation,switchgearsThe switchgear sector is forecast togrow at a CAGR of 15 percent. Animportant element in this sector isenergy efficient systems.Schneider, ABB and others are workingclosely with BEE to popularise energyefficient systems. Some other majordevelopments are as follows: CG opened a research centrefocusing on high power sub-stationequipment. GE Capital is planning to sell its10 percent stake in C&S Electric. CG and PT Prima Layanan to form a51:49 joint venture to manufactureHV switchgear in Indonesia. IBM is designing smart grid solutionsfor Tata Power Delhi Distribution, ajoint venture between Tata Powerand the Delhi Government. Sriraman Bhashyam hasexited Indecomm Technologyas Director, Talent Acquisition.He is now Director at SevaSwitchgear Pvt. Ltd.S Parthsarthy, who wasearlier with HoneywellTechnology Solutions Inc asCentre Head, is now SeniorDirector & Centre Head forFlextronics.RJ Aranha-Shenoy is nowCEO at GroValue IndustriesLimited. Earlier he was GeneralManager – Aftermarket &Global Partners with HoneywellInternational.We expect a positive trend towardsautomation and energy efficiency. ITcompanies like IBM and electricalcompanies like Honeywell, ABB aredeveloping capabilities in this vertical,and will require talent in application andproject execution.pg 9

ENGINEERINGChallenges andopportunitiesThe sector maintained its slow pace of growth, beingseverely hit by stalled and delayed projects. Indian firmsare now seeking growth in global markets, just as foreignplayers have again turned their attention to investing inthe countrybySuresh Raina and Uday BrocaAs a continuation of the previous financial year, the engineering sector in Indiamaintained its growth through a period of slowdown in the first half of 2013-14.However, the sector has been hit severely with many large-scale projects across theinfrastructure space stalled due to policy, regulatory clearances, lack of demand andcapital. Marquee projects such as Arcelor Mittal’s 12 million tonne project in Odisha andPosco’s 30,000-crore project in Karnataka have been shelved. Besides these, many smallerprojects in infra, mining, power and ports have been either delayed or completely shelved,forcing companies to look at innovative solutions for growth.pg 10Talent churnOpportunities abroadAnother fall out of the slowdown ispressure on the bottom line of thesecompanies along with cash flowchallenges, resulting in companiesfinding it difficult to meet debtcommitments as well as day-to-dayoperational expenses. Organisations arewitnessing senior talent churn. LalitVidhani, who was earlier Head – Financeat Suzlon Group, has moved to SunilHitech Engineers as Chief FinancialOfficer. Rajeev Palsule and TanmoyMondal of Lanco Infratech have movedon. Rajeev has joined WalchandnagarIndustries as Vice President – Material,while Tanmoy has joined JiwanramSheoduttrai Group as ChiefOperating Officer.More and more Indian firms areincreasingly looking at both organic andin-organic growth in internationalmarkets, including traditional ones likethe US, Europe and emerging marketsacross Latin America and Africa. KirloskarBrothers subsidiary SPP Pumpsinaugurated its seventh plant, a state-ofthe-art facility in Atlanta, US. Apollo Tyresis presently evaluating a US 2.5 billionacquisition of Cooper Tires. If the dealgoes through the combined entity wouldbe the seventh largest tyre company inthe world. PCM Group recently acquiredRail.One, a German Rail Infra andEngineering firm.

the hunt reportPEOPLE MOVEMENT Sameer Nagpal has beennominated by Shalimar Paints asManaging Director and CEO. Hewas earlier the Business Head forResidential Solutions at IngersollRand.Sunil Mathur has been elevatedas India CEO for Siemens. He wasearlier its Chief Financial Officer.Srinivas Batni is now VicePresident – Marketing at MittalCorp. He was earlier Chief ofMarketing at Pennar India.Rohit Gambhir has moved toESAB India as Vice President – Sales& Marketing. He was earlier theBusiness Head for India & Exportsat Stanley Black and Decker. With slow domestic demand, Indianengineering firms are keen to investabroad both for market access as welltechnology transfer. This trend has a hugeimpact on talent, especially at theexecutive level, as in many casescompanies prefer to send senior Indiantalent to manage internationaloperations while hiring locally for juniorand mid-level positions. It has becomecrucial for Indian talent to become moreglobal in nature in order to takeadvantage of this situation. Indianmanagers with overseas experience willtherefore continue to be in demand.India in focus againAn interesting outcome of rupeedepreciation is that MultinationalCorporations, especially from the US, areagain looking at India as a favourableinvestment destination in the mid- tolong-term perspective, as fundamentally,the Indian growth story still persists. Thecompanies are looking both at thedomestic Indian market as well as exportsdue to availability of cheaper, skilledman-power, resources and overalleconomies of scale.Several new foreign players have enteredthe Indian market: Delfingen recentlyacquired Kartar Wires, Emerson groupadded Virgo Valves to its existingportfolio, Mitsubishi-Hitachi recentlybought Concast India, and HarscoCorporation is considering freshacquisition targets.The Indian ship building industry comesacross as a silver lining in an otherwisebadly hit sector. The industry is growingat a CAGR of over 25 percent, withdemand coming both from thecommercial and defence segment.The Shipping ministry is promotingcluster-based shipyards by offeringincentives. Pipavav Defense has recentlyraised US 150 million through a LondonStock Exchange listing to support itsexpansion plans. Gopal Mahadevan has movedfrom Thermax to become thenew Chief Financial Officer atAshok Leyland.Robert Zhu is now ManagingDirector at Kennametal – APAC.He was earlier President, TycoFire & Security – APAC.John Baron is now VicePresident – Global Aftermarketat Ingersoll Rand. He was earlierRegional Director – APAC atElliot Company.Anthony Farmer has moved toVolvo Construction Equipmentas Director of ProductMarketing for APAC. He wasearlier Product Director forTerex Germany.Admiral KC Sekhar, earlier theManaging Director at GardenReach Shipbuilders andEngineers is now ChiefOperating Officer at PipavavDefence.pg 11

CHEMICALSGrowthopportunitiesThe export driven agri-chemical sector has goodprospects, with patent expirations attracting globalplayers to India. Decorative paints are driving theindustrial paints segment, while speciality chemicals hasshown healthy growthbySuresh Raina and Rajesh KumarThe economy is still feeling the pressure of the slow down, aggravated by rupeedepreciation and general election sentiments. However, respite is expected fromgood monsoons that have helped boost growth in rural markets.Agri-Chemical: major growth driverAccording to Tata Strategic ManagementGroup (TSMG) estimates, the AgriChemical segment is expected to growby 12-13 percent and reach 39,000 croreby 2017. This is majorly an export-drivensector focused on the US, UK andEuropean markets. Furthermore, patentexpiration is prompting MNC players tolook for partners in India. Japanesecompanies have already initiated effortsin this direction.This sector provides good opportunitiesfor growth, and sub-sectors like fertilisers,pesticides and neem-based chemicalsshow growth projections in the range of8-14 percent. Since the market is pricesensitive, new product development andefficient operations will help to increasemargins. Talent will be in demand forsenior leadership levels, primarily forbusiness development, operations andR&D activities.PaintsSome developments in the sector: Tata Chemicals introduced two newproduct formulations in the cropnutrition portfolio. Japanese firm ISK, in collaborationwith United Phosphorus, is doingtrials of new pesticides. Otsuka Agritechno formed a jointventure with Insecticides India forjoint R&D activities.pg 12The paint industry is estimated to reach 50,000 crore by 2016, as per anAC Nielson estimate. The industrial paintsegment is presently impacted bysluggish demand in the automotive andother infrastructure-based sectors.Decorative paints are driving the sector,with strong growth due to demand fromboth urban and rural segments.

the hunt reportPEOPLE MOVEMENT Sumantra Sen is now Directorwith Colourtech Products PrivateLimited. Earlier he was with DSEIndia as Principal – BusinessConsultant.Devpal Sisodia has joined DICCorporation as Regional CIO – AsiaPacific, moving on from RelianceInfrastructure EPC, where he wasHead – IT.Prasanna Ganesh is now GeneralManager – Regional BusinessServices, India with ClariantChemicals. He was earlier RegionalMarket and Application Manager –Surface Protection SolutionChemicals, Asia Pacific, withDupont.Anand Vora, who was earlier ChiefFinancial Officer – India with BungeIndia is now Chief Finance Officerwith United Phosphorus.Suresh Babu is now Head –Compensation and Benefits (SouthAsia) for BASF India Limited. Earlierhe was Deputy General Manager –HR (Compensation & Benefits) withGeneral Motors Technical CentreIndia.Rakesh Goyal is now VicePresident – Operations at NationalPeroxide Limited. He moved onfrom his role as Vice-President –Operations with Jesons IndustriesLimited.Some developments in the sector: Heubach Colour and Toyo Ink are inpartnership for setting up a pigmentmanufacturing unit. AkzoNobel, riding on strong demandfor paints in China, is making significant investments. Asian Paints is looking fordownstream integration, by investing 120 crore (increasing its stake to51 percent) in Sleek International. A new product launch by NipponPaints to build on its environmentfriendly platform. Henkel inaugurates its InnovationCentre, especially targeting theSpeciality chemicalsautomotive and transportationThe speciality chemicals sector isindustry in Pune.doing well and expected to grow toUS 60-70 billion by 2020 as per a TSMGThe decorative paint segment will require estimate. These chemicals, used majorlyinnovative and eco-friendly products, and in food, FMCG and pharmaceuticalshence more emphasis on R&D activities. industries, continue to see good demand.The talent requirement for this particular Therefore, the sector is growing at asegment will be in terms of sales,healthy rate of 10-12 percent.marketing and business development.Capacity enhancements and formationof new joint ventures will lead tochurning of talent at higher levels. Seniorhiring requirements in the next sixmonths will be in operations and productdevelopment functions.Some key highlights ofthe sector: BASF has expanded theSingapore-based productionfacility to produce newantioxidants. Tata Chemicals, optimisticabout speciality chemicals, isinvesting in thenutraceuticals business. Clariant is expanding thecapacity of its Roha plantin Maharashtra. Kanoria Chemicals andMomentive Chemicals willform a joint venture forjoint production ofspeciality chemicals. Celanese is expandingpolyacetal manufacturingfacilities in Asia.pg 13

CONSUMER MARKETINGThe rise of theDigital CMOThe digital CMO may soon be here to stay. Digitalmarketing, with its contextually relevant and measurableimpact, is set to expand further, bringing into focus thelimited talent available todaybySunit Mehra and Praful NangiaThe changing demographics and an ever evolving technology landscape haveaffected businesses in many ways. However, the most profound impact of this hasclearly been on the Chief Marketing Officer (CMO).Gone are the days when the return onmarketing investment was ambiguousand afforded reprieve to the CMO fromtrue accountability. Today, digitalmarketing allows the measurement ofeach and every parameter of a campaignto arrive at the quantifiable impact.According to the Gartner study, by 2015,25 percent of organisations would prefer tohave a Digital Marketing Head in additionto the CMO. Interestingly, research alsosuggests that the CMO’s technology budgetwill exceed that of the Chief InformationOfficer (CIO) in the next few years.Advent of social mediaThere are enough examples available toconvince even the most die-hard criticsthat the early adopters have quantifiabledata to back the efficacy of these channels,mostly to the detriment of theircompetitors who refuse to accept thischange. This makes it extremely necessaryfor marketing teams to push the caseharder within their managementcommittees as well as in the Board rooms.In addition, the advent of social mediahas transformed the manner in whichadvertisement dollars are being spent.The latest Gartner report reveals that thetraditional analogue spends still outstripthe resources allocated to digitalmarketing, which is not in any way asurprise. However, as more and moreChief Executives discover the power ofthe digital medium, we expect to see apendulum shift. This is not to say thatanalogue is on its way out, but that thereis definitely more awareness about thepotency of the digital medium.pg 14A number of incumbents have admittedthat digital marketing as a medium isgrossly underutilised in India. This is notdue to any aversion, but lack of talent.There was a time when digital marketingwas outsourced. But now, more and moreCMOs prefer to have an in-house teamleading the digital initiative.

the hunt reportPEOPLE MOVEMENT The non-conformist Digital CMOSimultaneously, the leadership team alsohas to consider the fact that the DigitalCMO is a non-conformist. He or she maynot necessarily have attended thesavviest of MBA schools; they may noteven be visible power dressers whoautomatically command space on theexecutive floor. Rather, he or she wouldtypically be a fast thinker and a person ofaction, with a deep connect to theconsumer. They could be individuals whoare not afraid of experimenting and canchange the marketing strategy every day(or hour), rapidly moving to the next bididea if the existing one does not work. In an internal move at Disney UTVInteractive, Sameer Ganapathy,who was the Executive DirectorMovie Channels and ChannelDistribution, Media Networks isnow the Chief Operating Officer.Arvind Pal Singh has joinedValueFirst Digital Media as theContent, Creative &Communication Head. He wasearlier National Creative Director atPurple Focus.Vikas Katoch, has moved to Affleas National Sales Head, Digital. Hewas earlier associated with KomliMedia as National Sales Head,Video Advertising.Prashant Kripps who waspreviously with Komli Media asNational Head, Publisher Groupshas joined Affle as Head – PublisherDevelopment and ManagementDigital.SV Sunilkumar has moved toHavas Media as Business Head,Digital, Mumbai. He was previouslythe Principal Consultant at Infosys.Ranjan Nautiyal, earlier the SeniorCreative Director at Oglivy andMather is now with Cheil as theGroup Creative Director.P Murali Gopal has moved toCheil as Senior Creative Director.He was earlier with RediffusionWunderman as Creative Director.While we do see progressive CMOs whohave embraced the digital revolutionwholeheartedly, there are also theThere is a general convergence of viewsdisbelievers who remain unwilling today.that the digital medium offersConversations with the Board and Chiefopportunities to engage consumersExecutives reflect that they are cognisantacross the physical and virtual worlds,of this changing scenario and are nowand enables the marketing team totarget contextually relevant experiencesbeginning to pose the right questions totheir CMO. We believe that as more andand offers. This has already beenperfected to the level of an art by leading more companies take to the digital space,e-commerce companies and is also being there will be a rush for the limited talentavailable, which today is mostlyadopted by a few progressive globalconcentrated around new-age industries.FMCG majors.pg 15

E-COMMERCEIndialogs inRapid maturity of the e-commerce sector has broughtout the importance of new skill sets such as ITarchitecture and analytics, and triggered demandfor talentbySunit Mehra and Praful NangiaIt does not come as a surprise that India’s political and bureaucratic leadership hasmissed some of the most transformational trends in infrastructure, education,healthcare and sanitation since the country’s independence. On the other hand, India’sleading business houses have always managed to identify emerging trends and investin business opportunities, such as in power generation, airports, airlines and retail, toname a few.Number crunchIn the backdrop of these investmentopportunities, the following statisticsare of interest: Over 50 percent of India’s populationis under the age of 25, and over65 percent is below the age of 35. India is among the top three fastestgrowing internet markets in the world,with over 125 million users. An ASSOCHAM and comScore studypredicts more accelerated growth forthe country, reaching 330-370 millionusers over the next two years, makingIndia the second largest audienceafter China.Going by the above data, the internetboom in India is already evident. Yet,large Indian corporations are scepticaland continue to view the e-commercespace as a fad or a premature idea.pg 16Although this is similar to the generalworld view on the sector, new andinnovative companies such as Amazonand Alibaba have established theirpresence and carved out a niche inthe sector.New skill sets in demandThese instances of success have openedup the playing field for young, aggressiveand ambitious entrepreneurs, who havethe backing of venture capital (VC) firms.VC firms, in a way, are filling the void thatcomes naturally to a large business.Explosive growth in the e-commercesector, pegged at 40-50 percent CAGR,has fuelled demand for an entirely newset of skills, prime among which are ITarchitecture, engineering, customerrelationship management, and analyticsand marketing.

the hunt reportPEOPLE MOVEMENT Most e-commerce businesses arecompeting with one another to acquirecustomers, thus learning the significanceof analytics, business intelligence andmarketing in the journey. Interactionswith business leaders continuouslyhighlight the importance and theinherent lack of talent in the country. Thecurrent, insatiable demand for thesespecialised skill sets and thecorresponding limited availability isreminiscent of the telecom and ITeSboom and the resulting rush to acquirethe best available resources.As was the case with most new-agesectors in India since the 1990s, mostbusiness leaders are now attemptingto bring in talent from other maturesectors, and invest in training them forcritical functions.India, China attracting talentGiven the scarcity of talent and ourunderstanding of the sector, we firmlyhold the view that focus on maturemarkets of North America and Europe fortalent in analytics and big data should behigh on the priority list. In an internal move at TripAdvisor,Marc Charron has become thePresident, Business. He was earlierPresident – APAC.In another internal move, KarimTemsamani, who was VicePresident, New Products andSolutions, Americas at Google, hasmoved up the ladder to hold thepost of President, Asia-Pacific.Kashyap Dalal, who was thefounder and CEO of Inkfruit.comhas co-founded Zovi.com and alsoholds the post of Chief ProductOfficer there.Vivek Shah, who had co-foundedFetise

igital CMOD Pg 16 E-COMMERCE . IBM is designing smart grid solutions for Tata Power Delhi Distribution, a joint venture between Tata Power . and the Delhi Government. We expect a positive trend towards . automation and energy efficiency. IT companies like IBM and electrical