Transcription

ENAD GLOBAL 7 AB (PUBL)INTERIM REPORTJANUARY-SEPTEMBER 2021ENAD GLOBAL 7 AB (PUBL)1Interim Report, January-September 2021

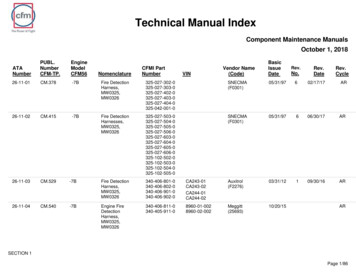

INTERIM REPORT - JAN-SEP 2021SUMMARY COMMENTSQ3 2021 was a period of transition for EG7. After a period of extraordinary M&A driven growth, the companytook necessary steps to reorganize and prepare for a transition to a sustainable organic growth strategy. Withthe world class portfolio of live games and the iconic IPs we have successfully acquired, the company is verywell-positioned to utilize these assets for sustainable organic growth plans while we continue to aggressivelyseek a more tailored M&A strategy for our next phase of growth.For Q3 2021, EG7 performed according to plan, successfully navigating the challenges posed by thereorganization and transition. Net revenue for the period was SEK 409 million, increasing by 409 % over thesame period last year, primarily driven by the key acquisitions over the last 12 months. Adjusted EBITDAcame in at SEK 89 million, representing a 22% margin. Both figures were in-line with the provided guidancerange for the period. For Q4 2021, the company is on track, and we are reiterating our guidance.Ji Ham, Acting CEO, EG7FINANCIAL HIGHLIGHTS Net revenue of SEK 409.4 (80.5) million in Q3 2021, representing 409% growth over Q3 2020. For theperiod comprising January to September 2021, net revenue amounted to SEK 1,097.4 (374.0) million.Adjusted EBITDA of SEK 88.8 (-2.0) million, growth by SEK 90.8 million for Q3 2021, andSEK 278.6 (33.7) million for the first nine months of 2021.EBITDA of SEK 78.3 (25.0) million, an increase of 213% y-o-y in Q3 2021, and SEK 262.1 (60.7) million forthe first nine months of 2021.EBITA of SEK 64.5 (21.6) million in Q3 2021, and SEK 228.5 (50.4) million for the first nine months of 2021.EBIT of SEK 12.0 (21.2) million in Q3 2021, and SEK 95.6 (49.3) million for the first nine months of 2021.Net profit of SEK -28.2 (-13.7) million in Q3 2021, and SEK -13.7 (13.3) year to date.Net debt of SEK -35.3 (320.2) million, comprised of SEK 442.2 million of cash position andSEK 406.9 million of total debt.Adjustment of non-recurring cost items affecting comparability of SEK 10.5 million comprised of (i)SEK 5.5 million of restructure related severance and expenses and (ii) SEK 2.3 million M&A and financingrelated expenses and (iii) SEK 2.7 million prior period’s capitalized development costs.Cash-flow from operations SEK 85.6 (2.4) million.Indicative Guidance for Q4 2021 Net revenue: SEK 450-500 million. EBITDA: SEK 95-110 million.KEY METRICSQUARTERACCUMULATEDLTMFULL T 2020–SEP 2021JAN-DEC20203 months3 months9 months9 months12 months12 monthsNet revenueNet revenue 93.2199%569.8276%EBITDAAdjusted EBITDAEBITDA margin, 0%214.0290.022.4%12.645.17.9%EBITAdjusted EBITEBIT margin, 38.4114.48.8%-7.824.74.3%Profit before taxNet profitEarnings per share 13.30.30-107.4-125.0-1.44-95.3-98.0-1.28SEKmENAD GLOBAL 7 AB (PUBL)2Interim Report, January-September 2021

COMMENTS FROM THE CEOmodel. These changes went into effect at theend of August and since then the companyhas transitioned well, working closely witheach business unit leadership to successfullyeffectuate these changes. Going forward, theparent company organization will becomprised of the group level leadership, tosecure long-term shareholder values and rolesnecessary for a listed company, includingCEO, CFO, investor relations, corporatedevelopment and support roles; while theoperational leadership will reside with eachbusiness unit.The overall group management approach willbe one of partnership with each businessunit, finding a balance between the top-downgroup vision and the bottoms-up strategyspecific for each business unit. All thebusiness unit leadership and key stakeholdershave fully welcomed this approach. WhileEG7 has been very successful in acquiring keybusinesses and assets, there are sufficientdifferences amongst the portfolio companieswhere “one size does not fit all” for auniform strategy or operational structure tobe as effective. By adopting decentralizationand empowering each business unitleadership vs. “forcing” collaborations, weexpect to drive more value creation for eachunit and also for the overall group goingforward.Ji Ham, Acting CEO, Enad Global 7 AB (PUBL)A solid quarter in-line with the guidanceFor Q3 2021, EG7 produced SEK 409 million ofnet revenue, a growth of 409% from the sameperiod last year. Adjusted EBITDA for theperiod came in at SEK 89 million,representing a 22% margin. Despite thereorganization process contributing to ashort-term friction, the company achieved itsnet revenue and EBITDA targets for theperiod. Our business units, includingDaybreak, Innova and Big Blue Bubble,delivered strong performance for the period.Partially offsetting the overall strength of theGame Segment was Piranha with lower salesfor MechWarrior 5 on PlayStation. Thebusiness for Petrol and Sold Out in ourService Segment are getting back to formwith solid project deliveries for the periodand a strong outlook for Q4 2021.Transitioning to growth strategy beyondjust M&ASince 2018, EG7 has demonstratedextraordinary growth, acquiring 6 businessessuccessfully and growing net revenue to SEK1.3 billion for the LTM Sep-21 period fromSEK 73 million in 2018. However, we believeit is important to rebalance our growth plansbeyond 100% M&A. The market dynamics havebeen shifting over the last two years. In 2020with the significant boost from the pandemic,the gaming industry experiencedextraordinary growth to USD 178 billion,representing 23% growth year-over-year. 2021has been another strong year with the overallindustry holding steady at the elevated levelreached in 2020. With such sustained growth,the industry enjoyed overall valuationexpansion. Additionally, the pace ofconsolidation picked up during the sametime, resulting in less availability ofattractive assets today. Based on thesechanges, we believe it is important that thecompany invests in a sustainable long-termRecalibration and getting back on trackDuring the quarter, the company reorganizedits management team at the holdingcompany. Robin Flodin, the founder and CEO,transitioned out together with other seniormanagers, including the Chief CommercialOfficer and the Chief Operating Officer. Thisreorganization reflected the Board’s decisionto change the operational approach. After acareful consideration, the Board determinedthat the more optimal path for long-termshareholder value creation was throughdecentralized operations versus a centralizedENAD GLOBAL 7 AB (PUBL)3Interim Report, January-September 2021

organic growth plan to better balance ourgrowth in parallel with our continuing focusand efforts around M&A.notch development talent across NorthAmerica and Europe with studios fromDaybreak, Piranha, Toadman and Antimatterproviding resources necessary for variousexciting new projects across the group.Furthermore, arguably our most importantcompetitive strength and differentiation isour world class IP portfolio. We have accessto some of the best known original and thirdparty IP brands in the world, includingEverQuest, H1Z1, Planetside, DC Comics,Lord of the Rings, Dungeons & Dragons, MySinging Monsters and Marvel. By leveragingthese pools of assets and talent, we arehighly confident and excited to bring new andexciting products to market.Well-positioned for sustained long-termgrowth through investing in our futureEG7 is very well positioned for long-termgrowth with its portfolio of assets. Ourdiversified and long-life cycle live gamesportfolio from Daybreak, Big Blue Bubble andInnova provide a sustainable foundation ofpredictable and stable revenues and cashflows. Along with strong continuing industrygrowth, our service businesses are poised totrack or exceed market growth goingforward. We have access to pools of top-ENAD GLOBAL 7 AB (PUBL)4Interim Report, January-September 2021

EG7 BUSINESS OVERVIEWA leading global MMO developer and publisherDaybreak represents one of the most prolific MMO developers in the world having developed 13MMOs throughout its 24-year history, including EverQuest, the very first fully 3D MMORPG thatpioneered the genre. Daybreak currently operates a portfolio of 7 live service titles, which providea strong foundation of consistent revenues and profitability for the group. Additionally, with theaddition of Innova in Q2 2021, the overall live service portfolio expanded by 12 more titlescurrently on the 4game platform. MMOs published by Innova, include some of the biggest MMOs inthe world, including Lineage 2, Black Desert Online and Blade & Soul. Combining Daybreak, Innova’stitles, My Singing Monsters and MechWarrior Online, EG7 currently operates 21 live service titles,making EG7 one of the biggest live service game publishers and operators in the world.Iconic, world class brandsEG7 is home to some of the most iconic IPs – both first-party and third-party brands. Key first party brands include:o EverQuest, considered to be one of the three most iconic fantasy MMO brands in theworld together with World of Warcraft and Ultima Online.o H1Z1, the very first battle royale game that was credited as one of the inspirationsfor Fortnite, with over 40 million life-to-date (LTD) registrations.o Big Blue Bubble’s My Singing Monsters, which has over 82 million LTD registrationson mobile and now expanding to PC and console.Top tier global third party brands:o DC Comics from Warner Brothers with continuing pipeline of content fromblockbuster feature films and TV shows.o The Lord of the Rings, arguably the most iconic classic fantasy IP, primed forresurgence with the new Amazon series on its way.o The Dungeons & Dragons from Wizards of the Coast, with a world-wide passionatefan base and a new feature film on its way.o 4game’s third party brands, including Lineage, Black Desert Online, Blade and Souland more.These iconic brands for our games differentiate our products competitively and also provide greatopportunities to leverage them further for continuing content development and new futureproducts.Scalable proprietary digital platformInnova’s 4game platform is one of the leading free-to-play (F2P) PC online platforms in Russia andCIS. The 4game platform’s features and capabilities are highly scalable with opportunities toexpand beyond Innova’s region out to other key markets such as EU and Latin America. In additionto the regional expansion opportunities, 4game can scale with additional products, including selectDaybreak titles and new MMOs coming to market. Daybreak is working closely with Innova to bringsome of its key titles to 4game in the coming quarters.Robust game development capabilities and live operations expertiseWe have 8 game development and live operations studios across North America and Europe in thegroup: Antimatter Games, Piranha, Toadman Studios, Big Blue Bubble, Dimensional Ink, StandingStone, Rogue Planet and Darkpaw. Passionate and talented game makers at these studios are coreof what drives our success. In addition to the 21 live games, we currently have a pipeline of 10 newand reinvestment projects underway to be showcased in the near future.Creative, marketing and distribution expertise and capabilitiesPetrol has been responsible for some of the most iconic imageries in gaming with the Call of Dutykey art each year and many other AAA product creative work over its history. With a lengthy clientlist that is “who’s who” in gaming and beyond, Petrol continues to stamp their mark across theindustry, creating visual masterpieces that produce lasting impressions.ENAD GLOBAL 7 AB (PUBL)5Interim Report, January-September 2021

Sold Out brings a wealth of experience and knowledge in publishing and distribution for premiumtitles. Sold Out extends the groups publishing and distribution capabilities beyond digital and liveservice. The group has already leveraged Sold Out’s capabilities for Piranha’s MechWarrior 5 andwill continue to benefit from Sold Out’s capabilities for our future premium titles going forward.Net Revenue and Adjusted EBITDA 21Net Revenue2Q213Q21Adjusted EBITDA29045111199570718964LAST 12 MONTHS1,2933Q204Q201Q212Q21Net RevenueENAD GLOBAL 7 AB (PUBL)3Q21Adjusted EBITDA6Interim Report, January-September 2021

SUMMARY BY SEGMENTGame SegmentComprised of our live service business, premium games and game studios. In Q3 2021, the GamesSegment contributed net revenues of SEK 250.3 million, representing 61% of total for the group.Adjusted EBITDA for the period was SEK 65.7 million, representing 74% of the group total.DAYBREAKDaybreak currently operates 7 live titles. For Q3 2021, Daybreak contributed net revenues andadjusted EBITDA of SEK 169.7 million and SEK 62.4 million, respectively. Daybreak provided thelargest contribution amongst the group companies with a net revenue contribution of 41% andadjusted EBITDA contribution of 70% for the period. The summer months are typically the lowestperiod seasonally for Daybreak’s live service titles due to the vacation time and limited contentupdates. Other than the typical seasonal trends, Daybreak’s titles continue to demonstrate theirstable and strong profitability.BIG BLUE BUBBLEIn September 2021, Big Blue Bubble’s My Singing Monsters generated the highest monthly revenueover the last 5 years along with its 9th anniversary celebration. Additionally, the Big Blue Bubbleteam has been developing several new products, including My Singing Monsters Playground,launching on Steam, PlayStation, Xbox and Nintendo Switch in early November 2021, and PowerChord, releasing in December 2021 on Steam as an early access title. For Q3 2021, Big Blue Bubblecontributed net revenue and adjusted EBITDA of SEK 31.6 million and SEK 18.3 million,respectively. These represented 8% of net revenue and 21% of adjusted EBITDA for the group.PIRANHAPiranha celebrated the return of MechWarrior 5 on PlayStation for the first time in over 20 years.Net revenue and adjusted EBITDA for the quarter came in at SEK 47.6 million and SEK -8.4 million,respectively. Although the community reception was very positive, the overall sales on PlayStationhad low impact, resulting in an operating loss for the quarter. Piranha has largely finished itsdevelopment on MechWarrior 5 with limited residual effort for future maintenance. In Q4 2021, asthe team further ramps down on MechWarrior 5, the plan is to fully utilize Piranha’s talented teamto staff various key projects for the group such as the Lord of the Rings Online update.TOADMAN STUDIOS AND ANTIMATTER GAMESBoth studios are mainly focused on new product development. Key titles in the pipeline includeBlock N Load 2, Evil v Evil, Minimal Effect, IGI and ‘83. The team is continuing to make progress andare working towards the release of Block N Load 2 and Evil v Evil in the short-term future. Theremaining titles are currently estimated for release in the 2023 to 2024 timeframe based on theircurrent status. For the quarter, the studios contributed net revenue and adjusted EBITDA ofSEK 1.3 million and SEK -6.7 million, respectively.Service SegmentComprised of Innova, Petrol and Sold Out. For Q3 2021, the Service segment contributed netrevenues and adjusted EBITDA of SEK 159.1 million and SEK 30.9 million, representing 39% and 35%of the group total, respectively.INNOVAInnova currently publishes 12 titles on the 4game platform. Net revenues and adjusted EBITDAcontribution for the quarter were SEK 55.2 million and SEK 17.6 million, representing 13% and 20%of group total, respectively. Similar to Daybreak’s live games, the summer months are also aseasonal trough for Innova’s portfolio. Compared to Daybreak, the seasonality impact is morepronounced for Innova due to its regional concentration in Russia and CIS, which tends to haveslower business activity during the summer vacation season. Other than the normal seasonalslowdown, Innova portfolio continues to perform well.PETROLPetrol had a strong Q3 2021 with project deliveries for 26 games during the quarter. Some of theproject highlights included creative and marketing consultancy for Aliens: Fireteam Elite, Tales ofENAD GLOBAL 7 AB (PUBL)7Interim Report, January-September 2021

Arise and Cookie Run: Kingdom titles. For Q3 2021, net revenue and EBITDA for Petrol came in atSEK 35.0 million and SEK 2.8 million, respectively. Petrol’s robust pipeline going into Q4 2021includes on-going projects with over 30 clients.SOLD OUTSold Out’s business was the most heavily impacted by the pandemic. Given its primary business is inphysical unit distribution, the retail store closures/restrictions and delays in game development/releases resulted in Sold Out’s product release timeline being pushed back. As a result, the firsthalf of the year for Sold Out was challenging. However, as expected, Sold Out began to see anuptick in activity in Q3 2021 with 8 titles successfully shipped, generating SEK 68.9 million of netrevenue and SEK 10.5 million EBITDA for the quarter. Sold Out should benefit further from thephysical distribution rebound and new products on track for releases in Q4 2021.SEKmQU A RTERLY A D J U STED EBI TD AQ U A RTERLY NET REVENU 1.3; 0%2Q21Holdings31.6; 13%169.7; 68%BBBDBPiranhaToadmanQ3 '21 SERVICE SEGMENT NETREVENUE MIX35.0; 22%55.2; 35%68.9; 43%InnovaENAD GLOBAL 7 AB (PUBL)SoldoutPetrol866-8Q3 '21 GAME SEGMENT NET REVENUE MIX47.6; 19%31Interim Report, January-September 20213Q21

NEW GAME PIPELINEThe group currently has multiple products under development in various stages of completion. Inaddition to our diversified and stable portfolio of 21 long lifecycle, live service titles, we are wellpositioned with a strong pipeline of products lined up for release from the immediate future in Q42021 to long-term. The following chart illustrates the current pipeline of projects by business unitand the estimated timing for nnouncedAAAMMORPGENAD GLOBAL 7 AB (PUBL)9Interim Report, January-September 2021

FINANCIAL OVERVIEWNet revenue and operating profitJUL-SEPSEKmNet revenueAdjusted EBITDAEBITDAAdjusted EBITEBIT% MarginsAdjusted EBITDA marginEBIT marginAdjusted EBIT marginEBIT marginJAN-SEPJAN-DEC20212020% CHG20212020% %negNet revenue in Q3 2021 came in at SEK 409.4 million, representing a 409% growth year-over-year.Year-to-date net revenue was SEK 1,097.4 million, up 193% from the year before. The growth wasprimarily driven by contributions from the four new acquisitions made over the last year.Adjusted EBITDA and adjusted EBIT were SEK 88.8 million and SEK 22.5 million for the quarter,representing 22% and 6% margins on net revenue, respectively. Adjustments for non-recurring itemswere added to normalized operating profits for comparison purposes. The total adjustment amountamounted to SEK 10.5 million, comprised of SEK 5.5 million of severance and reorganization costsSEK 2.3 million M&A and financing related expenses and, SEK 2.7 million prior period’s capitalizeddevelopment costs.Capitalized development costsJUL-SEPSEKmBeginning balanceAcquired capitalized developmentcostsCapitalized development costAmortization of productdevelopmentFXEnding 90.00.0184.4For Q3 2021, the total development costs capitalized were SEK 26.9 million. This represented anincrease in capitalized development cost of SEK 16.8 million or 167% from the same period lastyear. The increase is due to both increasing investment in existing products under development andnew in-progress projects that came together with the acquisitions made since last year.ENAD GLOBAL 7 AB (PUBL)10Interim Report, January-September 2021

The amortization of product development cost was SEK -7.9 million for the period. Thisamortization was largely due to the MechWarrior 5 release. Along with its full commercial release,the development expenses capitalized for the project has been amortizing.The net ending balance of capitalized development cost as of the end of the quarter was SEK 300.1million.Financial netJUL-SEPSEKmNet interest expenseDiscount interest expense earn-outFinancing feesFX effectsFinancial .4-5.86.1-20.1-28.4-30.0-29.1-87.5The financial net amount for Q3 2021 was SEK -32.7 million compared to SEK -6.6 million for thesame period last year. The change in financial net was primarily due to the discounted interest ratefor the earn-out and FX effects. The financial net amount comprised of SEK -6.2 million of netinterest expense on bank debt and SEK 17.2 million FX effects.FinancingSEPTEMBERSEKmTotal debtCash and cash equivalentsNet debt20212020406.9-442.2-35.3220.6-540.8-320.2EG7 ended the quarter with a strong liquidity and credit position. The company had total debt ofSEK 406.9 million at the end of Q3 2021. Net of SEK 442.2 million of cash and cash equivalents, thenet debt balance was SEK -35.3 million.Cash flowJUL-SEPJAN-SEPJAN-DECSEKmOperating profit (EBIT)Adjustment for non-cash flow itemsFinancial, netTaxes paidOperating cash flows before balance sheet cashflow 9.1-19.7-9.41.2-7.8-11.8-72.5-40.3-132.5Change in net working capitalCash flow from 2,468.0998.41,084.9CashCashCashCashflow from investment activitiesflow from financing activitiesflow for the periodand cash equivalents, end of periodFor Q3 2021, EG7 had a net cash outflow of SEK -108.9 million. The cash flow from operations wasSEK 155.2 million compared to SEK -10.6 million for the same period last year. The positive cashflow from operations was offset by SEK -53.5 million of investing activities andSEK -141.1 million of financing activities. The largest component of investments was the capitalizeddevelopment expenses. For financing activities, SEK 141.1 million of outflow was due to arepayment of SEK 100 million of bank debt during the quarter. Overall, the company maintained astrong liquidity position with SEK 439.6 million of cash and cash equivalents available as of the endof Q3 2021.ENAD GLOBAL 7 AB (PUBL)11Interim Report, January-September 2021

FINANCIAL REPORTSIncome Statement – GroupQUARTERACCUMULATEDFULL N-DEC20203 months3 months9 months9 months12 .9Other revenue7.729.725.145.344.5Total .712.6-13.8-3.4-33.6-10.3-15.2Operating profit before amortization of intangibleassets (EBITA)64.521.6228.550.4-2.6Amortization of acquisition-related intangible assets-41.7-0.1-110.6-0.4-4.3Amortization of other intangible assets-10.8-0.2-22.3-0.7-0.9Operating profit (EBIT)12.021.295.649.3-7.8Financial net-32.7-6.6-78.5-20.1-87.5Profit before 08938,126,57084,787,48234,354,82239,670,424SEKmNet revenueOwn work capitalizedOperating expensesCost of goods soldOther external expensesPersonnel expensesOther expensesOperating profit before depreciation andamortization (EBITDA)Depreciation of tangible assets and right-of-useassetsTax expense for the periodNET PROFITEARNINGS PER SHAREEarnings per share before and after dilution(SEK)Average number of shares before and afterdilutionThe net profit for the period is attributable in its entirety to the parent company's shareholders.ENAD GLOBAL 7 AB (PUBL)12Interim Report, January-September 2021

N-DEC-28.211.0-13.713.3-98.0Translation difference64.5-7.8186.9-22.2-66.6Deferred tax-8.62.6-18.72.62.6Other comprehensive income for the period55.9-5.2168.2-19.6-64.0Comprehensive income for the period27.75.8154.5-6.3-162.0SEKmNet profit for the periodItems that will be reclassified to profit or lossThe comprehensive income for the period is attributable in its entirety to the parentcompany's shareholders.ENAD GLOBAL 7 AB (PUBL)13Interim Report, January-September 2021

Balance Sheet – GroupSEKm2021-09-30 2020-09-30 2020-12-31 2020-01-01NoteASSETSNon-current assetsGoodwill3,680.1303.12,292.8318.3Other Intangible non-current assets1,215.4132.7843.4105.243.97.924.89.0Deferred tax assets545.62.126.22.2Right-of-use 297.6463.912.722.86.912.1Tangible non-current assetsFinancial non-currents assets5Total non-current assetsCurrent assetsInventoryCurrent receivables5223.773.0210.471.4Cash and cash 2163.24,435.7685.23,108.2163.2Deferred tax liabilities255.20.49.10.0Liabilities to credit institutions403.3208.99.1204.2Other liabilities230.036.7114.840.6Provisions for .51,361.1134.76,270.61,108.84,602.4653.2Total current assetsTOTAL ASSETSEQUITY AND LIABILITIESEquityEquity attributable to the parent company's shareholdersTotal equityNon-current liabilitiesTotal non-current liabilities5Current liabilitiesLiabilities to credit institutionsOther liabilitiesProvisions for earnoutTotal current liabilities5TOTAL EQUITY AND LIABILITIESENAD GLOBAL 7 AB (PUBL)14Interim Report, January-September 2021

Cash Flow Statement- AN-DEC2020SEKm3 months3 months9 months9 months12 monthsOperating profit (EBIT)12.021.295.649.3-7.8Financial net-32.6-9.1-78.5-19.7-72.5Adjustments for non-cash flow ge in operating receivables-10.657.31.4-7.5-85.2Change in operating liabilities-56.7-29.3-106.4-41.848.2Cash from flow changes in working capital-69.512.9-109.8-61.1-32.6Cash flow from operating 0.3-1,304.5Cash flow from financing activities-141.1409.3-127.1530.22,468.0CASH FLOW FOR THE PERIOD-108.9397.4-660.4440.1998.4Cash and cash equivalents at start ofperiod546.1144.71,087.5105.7105.7Cash flow for the 84.9QUARTERACCUMULATEDFULL YEAROPERATING ACTIVITIESTax paidCash flow from operating activities beforechanges in working capitalChanges in working capitalChange in inventoriesINVESTMENT ACTIVITIESCash flow from investment activitiesFINANCING ACTIVITIESExchange rate differencesCash and cash equivalents at end of periodSpecification of cash and cash equivalentsTotal cash balanceof which are blockedCash at the end of the periodENAD GLOBAL 7 AB (PUBL)15Interim Report, January-September 2021

Change in Equity – GroupEQUITY ATTRIBUTABLE TO THE SHAREHOLDERS OF THE PARENT COMPANY2021JAN-SEP2020JAN-SEP3,108.2163.2The net profit of the period-13.713.3Other comprehensive income for the Opening balanceChanges in equity during the periodRights issueFirst consolidation of OOO ArtplantClosing balanceENAD GLOBAL 7 AB (PUBL)16Interim Report, January-September 2021

Income Statement – Parent CompanyQUARTERACCUMULATEDFULL N-DEC20203 months3 months9 months9 months12 months1.01.86.08.711.110.410.338.627.540.7Other revenue0.01.00.02.527.1Total .9Other external expenses-2.4-4.5-26.9-19.1-36.0Personnel -62.7-32.6-26.9Financial net77.1-6.7106.3-20.0-99.0Profit before -8.9-3.112.645.4-18.834.8-55.6-112.7SEKmNet revenueOwn work capitalizedOperating expensesCost of goods soldOther expensesOperating profit before depreciationand amortization (EBITDA)Depreciation and amortizationOperating profit (EBIT)AppropriationsTax expense for the periodNET PROFITENAD GLOBAL 7 AB (PUBL)17Interim Report, January-September 2021

Balance Sheet – Parent .9131.5447.5905.225.9Total current assets2,046.5464.62,245.952.8TOTAL 1,085.93,886.7672.5ASSETSNon-current assetsIntangible non-current assetsTangible non-current assetsFinancial non-currents assetsTotal non-current assetsCurrent assetsCurrent receivablesCash and cash equivalentsEQUITY AND LIABILITIESEquityNon-current liabilitiesCurrent liabilitiesEQUITY AND LIABILITIESENAD GLOBAL 7 AB (PUBL)18Interim Report, January-September 2021

NOTES TO THE INTERIM REPORTNote 1 Accounting PrinciplesThis interim report regards the Swedish parent company Enad Global 7 AB,

Singing Monsters and Marvel. By leveraging these pools of assets and talent, we are . the world, including Lineage 2, Black Desert Online and Blade & Soul. Combining Daybreak, Innova's titles, My Singing Monsters and MechWarrior Online, EG7 currently operates 21 live service titles, . Innova's 4game platform is one of the leading free .