Transcription

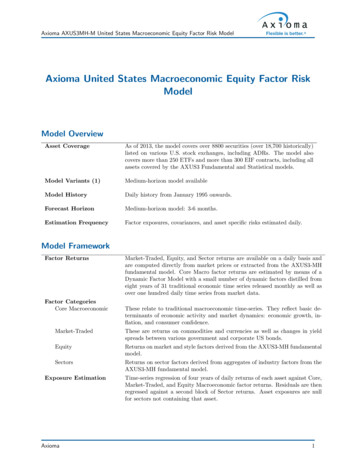

Axioma Global Multi-Asset Class Risk Model Fact SheetAXGMM Version 2.0March 20171IntroductionDRAFTAxioma’s Global Multi-Asset ClassModel offers users an intuitive decompositionof a multi–asset class portfolio. The model isdesigned for a broad-based analysis of globalmulti–asset class holdings. As such, the resolution of the factors targets understandingsources of risk across a broad portfolio, ratherthan, for example, analyzing smile risk acrossa volatility surface. The model contains factorsderived from an integrated set of pricing modelscalibrated to tradeable asset prices for a widerange of asset classes. This allows portfoliomanagers to analyze the risk and performance oftheir portfolios across all assets in a consistentand rigorous manner.The Global MAC Model combines the coverage of Axioma’s global equity risk model withcoverage of the fixed-income and commoditiesmarkets. Leveraging the expertise embedded inAxioma Robust Equity Models and an extensiveuniverse of fixed-income factors, the Global MACModel allows portfolio managers holding a widerange of assets to use a consistent set of modelsto analyze their risk and attribute performance.Axioma’s factor models are designed to separate and quantify systematic and idiosyncraticcomponents of risk. The systematic factors captured in the mode include: Yield curve Currencyerror). Moreover, since exposures are specifiedas sensitivities, asset managers can better understand the interplay among different risk factors.The Global MAC Model is produced by Axioma’s Enterprise Risk Platform Axioma Risk.This cloud-based platform allows extensive flexibility in factor definition, risk model construction, stress testing, risk analysis, and reporting.The Global MAC Model provides for a streamlined portfolio risk analysis, while Axioma Riskoffers a fully customizable enterprise risk system.2Top Level Structure of theGlobal MAC Risk ModelThe Global MAC Model is a linear, parametricrisk model composed of i) a global set of risk factors for which factor returns and an associatedcovariance matrix are computed; and ii) a set ofexposures to these risk factors for each asset inthe covered universe. If there are NA assets inthe portfolio and NF risk factors, we can definean NA NF exposure matrix B with the ith rowcontaining the exposures of asset i to all the factors. The portfolio risk (i.e. the volatility of theportfolio return) is then computed as σΠ wT BΣF B T w 1/2where ΣF is the covariance matrix of the factor returns and w is the vector of dollar posi Volatility Inflationtion weights for each asset. Axioma provides the Credit Commodity curvesfactor return covariance matrix and the expo Sector Countrysure matrix for a specific portfolio as the weekly Equity StyleGlobal MAC Model deliverable, while the userThe risk models facilitate both absolute and provides the universe and position data. All riskrelative decompositions of risk into either mar- and performance measures are derived from theseket risk or risk relative to a benchmark (tracking components. In the following sections, we firstAxioma1

describe the set of risk factors available in the 3.2 Global Fixed-Income Factor Modelmodel and then describe how the exposures toThe Global Fixed-Income Factor Model dethe risk factors are determined.rives rate curves, spread curves and volatility surfaces from market prices and estimates factors3 Risk Factors in the Global MAC that drive changes in the curves. The factors aredesigned to separate and quantify systematic andModelidiosyncratic components of risk. The systematicThe set of risk factors for the Global MAC factors within a typical fixed-income portfolio inModel is comprised of the Axioma Global Eq- clude changes in:uity Fundamental Model (the World-Wide Fun Sovereign ratesdamental Model, version 2.1), the Axioma GlobalFixed-Income Factor Model, and a commodity Swap spreadsmodel based on constant maturity futures curves,as well as volatility factors derived from swap Spot FX ratestion data. Details of the models for specific asset Corporate credit spreads by rating and ratclasses are described here.ing/GICS sector3.1Global Equity Fundamental FactorModel Break-even inflation ratesDRAFT Asset-backed security spreadsFor equities, the Global MAC Model imposes Covered bond spreadsa structure on the asset returns by identifyingcommon factors within the market that is, fac Other government, GRE and Supranationaltors that drive asset returns. Returns can thenspreadsbe modeled as a function of a relatively smallnumber of parameters, and estimating poten Derivatives: Swaption Volatilities, CDStially millions of asset covariances can thus bespreadssimplified to calculating a much smaller set ofnumbers.The table in Appendix B lists the number ofThe factors used in the Global Equity Funda- such curves/factors grouped by category.mental Factor Model fall into several broad catThe interest rate and spread factors have a hiegories:erarchical organization made up of spreads ontop of the government yield curves; i.e. swaps, Industry factors reflect a company’s line ofsupranational, ratings and industries. The factorbusiness.structure differs by asset class; the hierarchical Country factors reflect a company’s domi- structure for the spread factors is summarized inAppendix A. As the reporting currency of thecile.Global MAC Model is US dollars, the return of a Style factors encapsulate the financial char- fixed-income asset is decomposed into a local reacteristics of an asset e.g. a company’s size, turn and a currency return. Thus there exists andebt levels, liquidity, etc.additional risk factor for non-dollar denominatedassets.Calculation of the exposures to these factors isdescribed in the Section 4. Once the exposures3.2.1 Sovereign Bondsto these factors have been determined, factor reAt the root of the hierarchy are factors derivedturns are then calculated off a cross sectional regression model carried out on an estimation uni- from sovereign zero-coupon yields, extracted atkey rates on each currency’s sovereign yieldverse.Axioma2

curve. The risk of sovereign bonds, excludingthose of Eurozone countries, is driven solely bychanges in these key rates. The key points onthe curve are the 6m, 1y, 2y, 5y, 10y and 30ytenors. Interest-rate models are supplied for 37currencies worldwide.For the Eurozone, a base Eurozone sovereignzero-coupon curve is created using the lowestyielding sovereign issuances from Eurozone members. Individual Eurozone countries each havetheir own sovereign spread over the Eurozonebase curve, and each sovereign spread is againbased on the benchmark bonds.For Emerging Market countries issuing debtin USD, separate spread factors over the USsovereign curve are estimated, distinct from thelocal currency sovereign curve.3.2.2Interest Rate Swaps AA A BBB SUB-IG (Sub-Investment Grade)This common hierarchical structure allows for auniform analysis of assets across currencies andregions.Issuer sectors are defined using the GlobalIndustry Classification Standard (GICS R 1 )scheme also adopted in the Axioma Robust Equity Models. Unlike the equity models, the fixedincome models contain only sector-level GICSclassification. A proprietary algorithm linksbonds to the GICS sector of the equities issued bythe bond issuer, or it creates proxy assignmentsfor bond issuers without traded equities.Ratings spreads for each of the G7 currencies are implemented as factors for all corporatebonds. For sectors in currencies for which sufficient data are available at various rating levels,additional excess Ratings/Sector spreads are implemented as factors. Issuer spread curves, defined as excess spread over the Ratings and Ratings/Sector spreads, are used to compute specificrisk (idiosyncratic risk uncorrelated to other factors) for corporate bonds related to those issuers.Proxy logic is used to map corporate bonds thatare not captured explicitly by these factors (e.g.unrated bonds or bonds issued in non-G7 currencies).Bonds with optionality, such as callable bonds,also have exposure to an interest-rate volatilityfactor. In addition to the fixed-income factors,convertible bonds have exposure to the equityrisk factors.DRAFTIn addition to the movement of governmentyield curves, the risk in swap spreads (over theyield curve) is also captured. The risk factorsare changes in swap spreads at maturities corresponding to the key rates on the governmentcurve. AAA3.2.3Corporate BondsCorporate bonds are exposed to additionalspread-related risk factors. The spread factorsare layered so that Rating/Sector spreads arestated as spreads per sector in excess of the Rating spreads. (See the corporate section of Figure1 in Appendix A and the Rating/Sector curvecoverage in Appendix E.) The additional risk fac- 3.2.4 ABS (Asset-Backed Securities)tors for corporate bonds are:For US RMBS agency pass-through securi Ratings spreads per currency for the G7ties, a dynamic prepayment model is used whichprojects asset cash-flows as a function of cur Ratings/Sector spreads per currency when rent interest-rate factors and swaption volatilidata allowties. For other US ABS securities, investmentgrade spreads are estimated based on yields ob Individual issuer curves for issuers with suf- served in the markets. Axioma produces spreadsficient datafor eight different ABS securitization types corresponding to the underlying collateral. For exRating spread factors are generated for the G71currencies for the following Axioma compositeGICS is a registered trademark of MSCI and S&Prating buckets:Global Inc.Axioma3

ample, there is a specific spread factor for auto 3.3 Commoditiesloan securitization bonds. See Appendix A forCommodity futures contracts are modeled inthe full list of ABS categories covered.Axioma Risk using Constant Maturity Futures(CMF) curves. The model uses daily futures set3.2.5 Inflation-linked Bondstlement prices and maturities to construct theThe prices of inflation-linked bonds in individ- CMF curves as a set of interpolated nodes atual currencies are used to estimate real interest- fixed maturities. The nodes of the CMF curvesrate term structures. Break-even inflation curves are the risk factors, and the CMF curves are conare estimated as the difference between the nom- structed using the one day log returns of the fuinal sovereign rate curve and the real rate curve. tures prices.Inflation-linked assets are then modeled with exposure to nominal sovereign rate and break-eveninflation rate factors.3.2.6Covered BondsExposure Calculation in theGlobal MAC ModelCalculation of the sensitivity of an asset pricereturn to the various risk factors is handled differently across the broad asset groupings: Equity,Fixed-Income, and Commodities. Additional detail is also provided for computing exposure tocurrency and volatility risk factors.3.2.7DRAFTSpread factors for five European countries withsubstantial numbers of Covered Bond issuers areestimated from investment-grade Covered Bondmarket-yield data as spreads over each country’sswap curve. Spreads are available for Euro issuance as well as Swedish Krona issuance.4Other Government, GRE and Supranational BondsAdditional spread factors are estimated forthree US agency bond issuers as spreads over theUS sovereign curve. Ten spread factors over theCanadian sovereign curve are available for Canadian provincial bond issuers. For supranationalbond issuers, spreads over the swap curve are estimated for both USD and Euro issuance at theAAA and investment grade level. US municipal bond spread factors are proxied by the corresponding US corporate rating spread factors.3.2.8DerivativesVolatility factors are used to capture risk infixed-income derivatives, as well as bonds withoptions (callable bonds, pass-through mortgagesecurities, etc.). The model provides interestrate volatility for 19 currencies computed as the2 year 2 year at-the-money swaption volatility.For credit derivatives, the model usesindividual-name CDS spreads and CDS indexspreads as risk factors.Axioma4.1Exposure to Equity Risk FactorsExposure to the industry and country factorsin the equity risk model are binary, either 0 or1. These are determined by the GICS industryclassification of the company and the countryof incorporation. Exposure to the style factorsis computed based on a Z-score transformationof a combination of financial ratios or performance measures associated with the definitionof the style factor. The models are constructedto maximize the explanatory power of the stylefactors driven by the definitions of these exposures. Industry and country exposures are generally static, while most style factor exposures areupdated when new financial performance dataare released.4.2Exposure to Fixed-Income Risk FactorsFor all fixed-income rate and spread risk factors, the exposure is computed as the price returnsensitivity to changes in the factor. This requiresa pricing function PA (F1 , . . . , Fk ) for each assetA as a function of the relevant risk factors. The4

exposure to factor Fj is then defined asβj 1 PAPA Fjparameter choices for the covariance estimationcalculation are given here.(1)5.1Model HistoryFor sovereign rates and swap spreads, this corMonthly covariance matrix history from Janresponds to the negative of key rate durations(KRDs) at the six key rates. The exposures to uary 2012 onward; daily factor returns from Janthe other spread factors are computed as the neg- uary 2007.ative of spread durations. Axioma has implemented detailed pricing functions for all fixed5.2 Reporting Currencyincome assets covered and computes exposures tothe underlying risk factors based on these pricingUSD.functions.4.3Exposure to Commodity Risk Factors 5.3The covariance matrix for the model is estimated based on five years of daily factor-returndata using the following estimation procedure.The daily factor returns are aggregated into overlapping weekly returns, thus creating a time series of approximately 1250 observations of weeklyreturns. Note that weekly returns are usedto minimize the impact of asynchronous timingof returns reporting and potentially stale fixedincome pricing. Overlapping returns are used toensure that the model still responds quickly tomarket shocks, as well as to increase the effectivesample size used in the covariance estimation.An exponentially decaying weighting scheme isused to more heavily weight the recent return behavior. A half-life of 250 daily observations (oneyear) is used to compute both variances and correlations.DRAFTAs the risk factors for commodity future contracts are log-return CMF curves, the exposureof a contract with the same maturity as a nodepoint is exactly 1 (i.e. the volatility of the commodity future contract with maturity T is thesame as the volatility of the CMF curve at pointT ). When the maturity of the contract lies between two nodes, the contract has exposure tothe two surrounding nodes and each exposureis computed as the proportional linear distancefrom the maturity to the node maturity.Factor Volatility / Covariance Calculation Parameters4.4Exposure to Volatility and CurrencyRisk FactorsBecause the volatility and currency risk factors are computed as log returns, the exposure iscomputed asX PAβ (2)PA Xwhere X is either the volatility level σ or the spotexchange rate. For non-US dollar denominatedassets with no currency exposure other than thereporting currency exchange-rate risk, this formula corresponds to a currency risk exposure of 1.5.4Specific RiskGlobal MAC Model ParametersFor assets with sufficient data and idiosyncratic drivers of risk, specific risk (i.e. additionalvolatility uncorrelated with the factors in themodel) is estimated and included in the model.The methodology implemented varies by assetclass in the model:The Global MAC Model includes a covariancematrix estimated from the time series of the relevant factors for a given portfolio. Details of the For equity assets, specific risk is defined asthe volatility of the residual that is not explained by the factors.5Axioma5

Specific risk for fixed-income corporate securities is estimated, where the data are available, from single-name issuer-curve volatilities.6Data DeliverablesThe Axioma Global Multi-Asset Class Model isaccessible through Axioma’s SFTP site.1. Availability: The covariance and exposurematrices are updated weekly and availableto download via SFTP.2. Historical Coverage: A monthly historyof covariance and exposure matrices is available going back to January 2012. Daily factor returns are available going back to January 2007.DRAFT3. Data Format: Delimited text files (flatfiles)Axioma6

AFTDRAppendicesAxioma7

Fixed-Income Factor HierarchyAFTAppendix ADRFigure 1: Fixed Income Factor hierarchy for the Global MAC ModelAxioma8

Appendix BGlobal MAC Model: Curve and Factor StructureCurve/Factor TypeDefinitionCountReferenceCurveCommentsCO- Commodity FuturesConstant Maturity Futures63N/ASee Appendix DCurrencyCurrency Risk Factors92N/ASpot exchange rates for 92currencies.All exchangerates are relative to eturnFI- U.S. IG ABS spreadU.S. Investment Grade RatingSpread8Swap(USD)FI - Agency SpreadU.S. Agency Spread3FI- Break Even InflationSpread of Nominal over Realfor Zero Coupon12FI- CA Provincial SpreadCanadian Provincial Spreadover CA Sovereign10FI- Corporate Rating SpreadCorporate Rating Spread overSwap35SwapAUD, CAD, CHF, EUR,GBP, JPY, USD x 5 RatingCategoriesFI-Corporate Sector by RatingsSpreadSector Spread over RatingCategory202RatingCurveSee Appendix EFI- Covered Bond SpreadSpread over Swap7SwapFI-Sovereign ZeroSovereign Zero Coupon Curve37N/AFI-Sovereign Spread (EUR)Intra-EurozoneSovereignSpread over EU Sovereign15FI - Sovereign Spread (USD)EM Spread over US Sovereign21FI-Supranational SpreadSupranational Ratings Spreadover Swap4FI-Swap SpreadSwap Zero Spread40FI-Interest Rate Volatility2 Year 2 Year SwaptionVolatility19EQ-LocalEQ-MarketEQ-StyleTotal Curve CountTotal FI & Equity Factor CountAFTEQ-IndustryEquity Country Factors fromAXWW21 (Global Equity)ModelEquity Industry Factors fromAXWW21 (Global Equity)ModelEquity Local Market Residual Factor from AXWW21(Global Equity) ModelEquity Global Market Factorfrom AXWW21 (Global Equity) ModelEquity Style Factors fromAXWW21 (Global Equity)ModelDREQ-CountrySovereign(USD)Real (BEISpread Nominal Real)Sovereign(CAD)Airline, Auto, CMBS, CreditCard, Equipment, Home Equity, Manufactured Housing,Structured RMBS,US Agency Issuers - FHLB,FHLMC, FNMA8 DM Countries,Countries4 EMReturnTypeChangeinLogPriceReturnLog FXRateReturnChangein SpreadChangein SpreadChangein SpreadChangein SpreadChangein Spread21 EM Countries issuingUSD bondsChangein SpreadChangein SpreadChangein RateChangein SpreadChangein SpreadEUR AAA, EUR IG, USDAAA, USD IGChangein SpreadSovereign15 DM Currencies, 25 EMCurrenciesNA13 DM Currencies, 6 EMCurrenciesChangein SD)Swap(EUR),Swap(USD)DE, DE-Jumbo, DK, ES,FR, SE-EUR, SE-SEK14 DM Countries, EUR, 22EM Countries15 Eurozone Countries7321084Table 1: AXGMM Factor Definitions & CoverageAxioma9

Coverage of Developed landEURFranceEURGermanyEURGreeceEURHong w EURSloveniaEURSouth omGBPUnited StatesUSDTotal CountSovereignCurveDDDDDDDEuro SpreadDDDDDD15BEI Nodes (years)Swap Appendix C4Table 2: AXGMM Developed Market & Euro-Zone Sovereign CoverageAxioma10

Coverage of Emerging MarketsCurrencyArgent

Model The set of risk factors for the Global MAC Model is comprised of the Axioma Global Eq-uity Fundamental Model (the World-Wide Fun-damental Model, version 2.1), the Axioma Global Fixed-Income Factor Model, and a commodity model based on constant maturity futures curves, a