Transcription

Private Placement Memorandum – Executive Summary

Private Placement Memorandum – Executive Summary 2

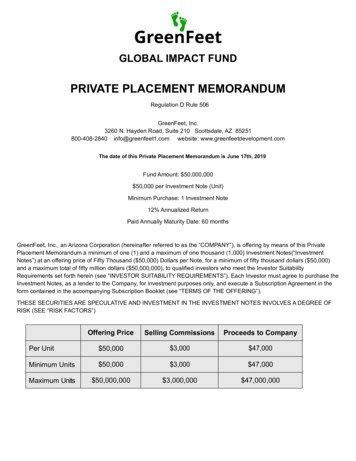

FUND OVERVIEWThe Bayakha Transformational Infrastructure Fund expects to make equity and empowerment financing/ structured equity investments into eight to ten qualifying, brownfield and late-stage greenfieldrenewable energy and other socio-economic infrastructure projects (such as water, transport, socialhousing, schools and hospitals) in South Africa (SA), primarily, and to a lesser extent, select parts of SubSaharan Africa (SSA).Key characteristics of the Fund include firstly its indefinite lifespan, and secondly the ability of Investorsto unilaterally subscribe for or redeem their investments at regular intervals pursuant to the withdrawalmechanics. Investors will also generally be free to transfer their interest on the secondary market.In South Africa, the Financial Services BBBEE Codes (2016) recognise that investment in infrastructurecontributes to economic growth and development, not only through infrastructure improvement, butalso in the development and transformation of capital markets and thus the financial sector itself. Thus,the term Transformational Infrastructure now forms part of the local investment lexicon.Bayakha thus seeks to respond to the demand for transformational infrastructure finance. To this end,two, high quality, operational projects, representing a total investment of R450 million have beensecured for The Fund’s first close by the management team. The projects form part of South Africa’sworld-renowned Renewable Energy Independent Power Producers Procurement Programme(REIPPPP).The objective of The Fund is to generate a minimum target internal rate of return (IRR) of 12% forinvestors (i.e. SA Consumer Price Index (CPI) 6%). The Fund will seek representation on the boards ofall project companies where a direct equity position is acquired thus participating in key decisions tomanage risk and enhance return to Investors.In so doing, Bayakha is perfectly positioned to respond to the growing demand for infrastructuredevelopment and provides a response to the attendant requirement for the emergence of specialistfund-management capabilities in this sector. Additionally, we recognise the unique funding challengesfaced by previously disadvantaged participants in the infrastructure sector and therefore seek to unlockinstitutional funding to support Black Industrialists i.e. operational, Black-owned businesses thatdevelop, operate and maintain the underlying assets that Bayakha seeks to invest in.Transformation therefore has a dual meaning in the context of Bayakha’s investments: transforming theownership patterns of the infrastructure sector and in tandem with that, transforming the nature andextent of infrastructure access for inclusive economic growth and development.Private Placement Memorandum – Executive Summary 3

SUMMARY OF FUND TERMSLegal Structure Of TheInvestment Vehicle En Commandite PartnershipOpen-ended fund structure with a targeted listing of the Fund (or othermonetization event) on or after year 10Equity Investment StrategyThe Fund will make equity, hybrid debt, quasi-equity and equity-relatedInvestments in renewable energy and other socio-economic infrastructure assetslocated in South Africa predominately and select opportunities in Sub-SaharanAfrica led by a high-quality management team with a track record of excellence.Targeted Return In ZARSA CPI 6% / circa 12% IRR over the duration of the contractTarget Fund SizeZAR 3.0 billionMeasurement PeriodsThe Fund will be assessed over rolling five-year periods ("Measurement Period")commencing from the first close.Underlying Investments Equity & Structured Equity InstrumentsMinority Investments in renewable energy power plants, transport projectsand water infrastructure.Investments in social infrastructure intended for the transformation ofunderdeveloped communities. Mandate Objectives Achieve Triple Bottom Line objectives: Green, Transformative & Profitable.Investment in high quality infrastructure assets and superior managementof those assets over the medium to long-term.Maximise investment Impact: Mobilise private institutional capital togenerate returns to investors and society in general. ClosesLiquidity And MonetisationIn respect of the first close, the Fund will target aggregate initial capitalcommitments ("Capital Commitments") from Investors of at leastZAR 500 million in aggregate. After the first closing date, for a period of18 months, the Fund may accept any new or additional Capital Commitments.Thereafter, the Manager may only accept additional Capital Commitments at thecommencement of each Measurement Period. FeesLimited. The open-ended nature of the fund allows for flexibility toexplore listing over the longer term at optimal times of the market cycle.Platform of scale diversifies risk and provides future optionality – yieldcos, green bonds etc.1.5% and 20% (Management fees and Performance fees)Private Placement Memorandum – Executive Summary 4

THE BAYAKHA TEAM & TRACK RECORDThe Team has considerable experience advising, structuring project finance transactions and investingin energy and infrastructure projects across the African continent. Through prior and current roles, theyhave collectively appraised over 100 infrastructure projects from the advisory, lender and shareholderperspectives. The team’s collective experience mirrors the sectors which the Fund will target andincludes a solid understanding of South African and Sub-Saharan debt and capital markets.Bayakha brings a team with substantial experience globally within the asset/fund management, water,transport and energy sectors, working to support a variety of organisations across the infrastructuresector supply chain, including government and regulatory bodies, technology providers, utilities andcorporations.The Investment Committee members bring together in excess of 80 years of combined experience inproject finance, corporate finance, asset management, impact evaluation, development, energy andinfrastructure across the African continent.Private Placement Memorandum – Executive Summary 5

Private Placement Memorandum – Executive Summary 6

INFRASTRUCTURE – AN EMERGING REAL RETURN ALTERNATIVE ASSET CLASSInfrastructure as an “alternative” (alternative to traditional listed equities, bonds and cash) asset class,first gained institutional investor acceptance in Australia (often as listed funds) where it has beenavailable since the mid-1990s, followed by Europe in the early 2000s (mostly private closed-endedfunds) and more recently, in the United States, where it is beginning to demonstrate its value1.The increased institutional investor interest in infrastructure is driven by cyclical and structural aspects.Cyclically, investors are facing an uncertain economic outlook and are seeking opportunities to diversifyrisk and return drivers. Structurally, National Budgets are also constrained, and thus, looking forward,the demands of fiscal consolidation suggest increased infrastructure investment is needed frompension funds and private institutional investors.Infrastructure DefinedIn the investment context, infrastructure typically includes economic infrastructure:Renewable EnergyTransport (rail, toll-roads, ports, airports)Utilities (e.g. power generation, energy distribution networks, water, sewage, waste);Communication (transmission, cable networks, towers satellites)In recent times however, the definition has broadened to include social infrastructure, which includes:Schools and other education facilitiesAffordable housingHospitals & HealthcarePrisonsIn South Africa, the Financial Services B-BBEE Codes (2016) recognise that investment in infrastructurecontributes to economic growth and development, not only via infrastructure improvement, but also inthe development and transformation of capital markets and thus the financial sector itself. Thus, theterm Transformational Infrastructure now forms part of the local investment lexicon.Transformational Infrastructure investment, in the context of the B-BBEE Codes, refers to debt financing,or other forms of credit extension to, or equity investments in South African projects in areas where gapsor backlogs in economic development have not been adequately addressed by traditional financialinstitutions. Such infrastructure projects fall can be found in the following sectors:EnergyTransportWater, waste water and solid wasteSocial infrastructure such as health, education, and correctional service facilitiesMunicipal infrastructure and 42- accessed on 20 January 2018.Private Placement Memorandum – Executive Summary 7

Returns from infrastructure investments are typically backed by long-term assets with excellentdemand inelasticity and development impact. Bayakha promotes an approach to infrastructureinvesting that recognises that infrastructure investments deliver financial returns AS WELL AS portfoliodiversification, economic development and social transformation. The graph below identifiesinfrastructure themes in relation to asset classes, demonstrating relative risk/return profiles.Infrastructure Assets & Themes: Risk/ Return ProfilesSource: Credit Suisse Asset Management: Can Infrastructure Investment Enhance Portfolio Efficiency?Figure 1:Risk / Return Profiles of Infrastructure InvestmentsIN SUMMARY: THE BENEFITS OF INVESTING IN INFRASTRUCTURE Diversification Benefits – low sensitivity and correlation to listed markets.Inflation Protection – predictable, inflation-linked revenue backed by long-term public-privatepartnership contracts and “real assets.”Socio-Economic Impact – directly improving access to critical infrastructure for thetransformation of developing economies and communities.Predictable Cash-flow streams – highly cash generative, driven by high barriers to entry,inelastic demand for services; low operating costs and high target operating margins.Risk Adjusted Return - Potential to achieve equity-like returns but with less volatility.Immune to economic cycles – relatively low risk.South African institutional investors are either not yet invested or are below their target allocation owingto the lack of: available investment vehicles, private infrastructure investment opportunities and investoreducation. Bayakha therefore provides a response to this allocation challenge, providing access to highquality assets that deliver all the benefits of Infrastructure Investments.Private Placement Memorandum – Executive Summary 8

SUPPORTIVE POLICY FRAMEWORK FOR EMPOWERMENT FINANCING IN INFRASTRUCTURE– AMENDED FSC BBBEE CODESTo drive transformation and inclusive growth within the infrastructure and fund management sectors;and recognising the unique position that financial institutions holds in the development of South Africa.The amended Financial Services B-BBEE Codes recognises that domestic investment in infrastructurecontributes to economic growth and development, not only via infrastructure improvement, but also inthe development of the local financial sector and capital markets.Two new unique elements exist in the amended FSC scorecard over and above the five elements in theCodes of Good Practise. These are Empowerment Financing and Access to Financial Services. TheEmpowerment Financing element, targeting local banks and insurers, presents a fund-raising tailwindfor Black infrastructure fund managers from Banks and Life Insurance companies.The Amended FSC BBBEE Generic Scorecard for Large EntitiesWeightingBanks & LifeShort TermStockOtherofficesInsurersExchanges ership23232325FS100Management Control20202020FS200Skills Development20202020FS300Procurement and ESD15353535FS4005555FS500Empowerment Financing & ESD25000FS600Access to Financial Services121200FS700120115103105ElementSocio Economic Development &Consumer EducationTotalCode SeriesReferenceFigure 2: The Amended FSC BBBEE Generic Scorecard for Large EntitiesTherefore, Empowerment Financing targets banks and local insurers to make investments ininfrastructure projects. This is measured as total balance sheet exposure for new loans written. Thetarget for the banking sector is based on an increment of R80bn additional Empowerment Financingbetween 01 January 2012 and 31 December 2017. Local banks will be responsible for R78.4bn of theincrement and International Bankers Association (IBA) member will be responsible for R1.6bn of theincrement. Further, Life Insurers can earn an additional 2 bonus points for investing 0.5% NPAT towardsthe funding of Black asset managers.Transformational Infrastructure projects (which account for 12 out of 25 points in EmpowermentFinancing) are projects which support economic development in under-developed communities andcontributes towards equitable access to economic resources.Private Placement Memorandum – Executive Summary 9

Such projects could be in the following al Infrastructure such as health, education and correctional service facilitiesAn additional 2 bonus points are awarded for the development of black asset managers. The table belowsummarises the B-BBEE scorecard to be used for large Banks and Life Insurance companiesgoing forward:Empowerment Financing ScorecardMeasurement etPointsInsurersTargets2.12.2Targeted Investments: Transformational Infrastructure Black Agricultural Financing Affordable Housing Black Business Growth and SME FundingB-BBEE transaction financing and Black Business12R 48 bn.12R 27 bn.3R 32 bn.3R 15 bn.Growth SME Funding2.3Empowerment Financing Total15Annual value of Supplier Development contributions7made by the measured entity2.4Annual value of Enterprise Development contributions2.51.8% of7NPAT3made by the measured entityTotal150.2% of1.8% ofNPAT3NPAT0.2% ofNPAT25251111Bonus Points

Private Placement Memorandum – Executive Summary 3 FUND OVERVIEW The Bayakha Transformational Infrastructure Fund expects to make equity and empowerment financing / structured equity investments into eight to ten qualifying, brownfield and late-stage greenfield renewable energy and other socio-economic infrastructure projects (such as water, transport, social housing, schools and