Transcription

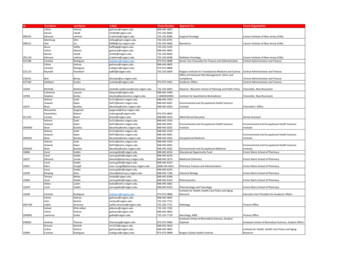

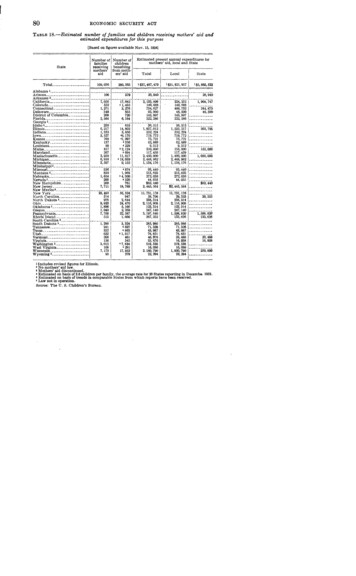

80ECONOMICILL-EstimatedTABLESECURITYACTnumber of families and children receiving mothers’ aid andestimated expenditures for this purpose[Basedon figuresavailableNov.15, 19341zzzstateNumberfar %rzp;;;;s ofaidNumbero.fchildrenbenefitingfr;m& Irll h,Estimatedpresent annualmothers’aid, localTotal Total.--Alabama*- - .---- ---------------. -------.Arizona .IArkansasz------ ------.- ------.- ----- -------------CaliforniaColorado.- .Connecticut.Delaware.Districtof ColumbiaFlorida-----------.----.-------(ieorgia -. . - . . - .- . . .-.Zii) . -.- Idaho 6 - .nlinois.--.-------.----.--------Indiana-. .IIowa--.-----.------------------109,036280,565106 I3797, g;1,27134817,6424 1,4353,2768556,E6,2171,332 I3,527768137 I61914,8023,856‘9,170‘1,9974 3564 2294 2,1244 69411,817’ 18,0399.152Kansas . .Kentuckv. . .LouisianaisMaine--- .267Maryland. .Massachusetts . .2;;:Michigan. .3: 597Minnesota.-.--.--.-----.---.MississiDoia- . . .I. . i . .336’ 874Misso&i )1,969Montana6 . . .l!E‘4.300Nebraska. .4520NevadeJ . .260761New Hampshire. .7,71118,789New Jersey.-.-.-------------.New Meaicos.--.---.--------- . . . . New York .)“4:;/Xiort.h Carolina.2,644NorthDakotaa . I24,470Ohio.-e-e5,166OklahomaJ. .2,259Oregon.-.-.---.--.-.- .--22,587Pennsylvania. . . .Rhode Island. . -. - .1,666South Carolma. - - -. - I . . .3.3241.290 ISouth Dakota6 . . .241i627Tennessee---.-.-.-- --------4 863332Teras - . .--. ---.62241,617Utah . . . .206Vermont . - -136z.kVirginia. . .- .3,013Washington6-‘7,834108‘281West Wyomings-. /95 IW5 -expendituresand StateLocalstatex 31,621,9571 37,487,4791 5,865,52-z-. - -.- --- - -/24;25iel 9,688. . 2489,752244,87546,50046.500143,997. ---- --222,286--- - -. -. ---. - -.36,315 --1,533,217303,795352,224. . .719,77275,721 . .62.@9-- --- -.-.9;312 .I-- . .155, OOQ155, aim117,459. . .1,400,00 1,050, ooo2,448,962--1,138,176. . .‘%%143: 997222.286-. --.36,3151, pii7;:: ;;;62: 8899,312310, ooo117,4592,450, ow2,448,9621,138,176- - - 93,440213,623272,03644,035 82,4402,445,564I. -.-- -- -. -.I93,440213,623272,03644,035. . . -- - 401, gg.29,353.-- --1,598.820133,626. 2,445,564. . .-. -- -. -.- .-11.731,1765% 706238,3142 ;g, ;y247: 1403, 197,640267,252. . - - ,0862.180,79022,284-285,98671.3!2843,98778,651. .-- -. .23,488E% 538519:16.0861,930,79022,294- -. -!Y.?“”--- ---250, OfMI1 Includesrsvisedfigures for Illinois.2 No mothers’aid lawJ Mothers’aid discont&ed.in Decembc4 Estimatedon basis of 2.6 childrenper family, the average rate for 20 States reporting1 Estimatedon basis of trends in comparableStates from whichreportshave been received.8 Law not in operation.Source:The U. S. Children’sBureau.1933.

ECONOMICTABLE19.-FundsDelaware. . . .Pennsylvania. . . .Maine---.--.-.-.-.------.Massachusetts. .New Hampshire. .-.Rhode Island .-.Illinois. . . . .-.-.Connecticut.-.-.--New Jersey . .Wisconsin. . . . . .Maryland. . . .Minnesota.- . . .SouthDakota . . .Arizona. . . . . . .-.-.New York . . . . .Virgini. . . . . .--- . . .Kermcky. . . .,Michigan. . . . .Missouri. .Texas.-.Tdont,ana .---.--.---.Cleoreia . . -. . .NorthDakota .-. .NorthCarolim.Washington--- -- .Mississippi. . . . .Wyoming-. .Louisiana.-.- . .Kunsas. . . . . .West Virginia.- . . .aawaii--.-.-.-.-.-.-.----California. . . . .Florida . . .Ohio. . . . . daho-.---.-.--.-.-.----South Carolina .Tennessee - - .Alabama.--.-.-----------Arkansas.Colorado. . .Indiana .Nebraska . .Nevada. . .New Mexico.Oklahoma .Utah-. . - - .Vermont. .4111,504.Ol 6,504.0163,!310.9910, Om 00‘4 m: ;y68.810.9915,000. no.12,98X. 3114,076.28. - der1928stateFederal64: 173: 860.6642,355.9620.5oil. no5, ooo. 00TABLEPercentimcr1934funds 1S. 008.02132,621.9825, ooo. 0078 2i.5. 0020: 976.6224,276.28io, MM. 001 32,760.04118, 163. 5550,752. 0433, 5x. 0047,ooo.oor, 500. 0019,507.42210,041. 7s75 ii4.004;: b97.481 fi4,741.1149,lSG. Sl77,902.5224,400.0064,435.898. 090. 0049,519.668,387.OO49,076.581 10,000.0030,042.oo35,wo.oo40.443.48l&451.921 0.oo;2 5;; Iwork ITotal81ACTfor State maternal and child-healthstate1 For four States (California.Source.The U. S. Children’sSECURITY31, 284. 5527,751. fi219.277.0026,099. fi57,500.oo12,263. 7180,041. ,700.0035,451.106, X0.0027,260. 565, 000. 0022,076. 587, 500.007,521.OO20,000. oc19,571.7411,725.9631.290.0016,531.7223,585.5715, 283.4621,085.317, 500. oc21,355.6525.767.0025,836.9521,817.5110,000. oc31,927. oc11, M)o. oc10, 522. Oc12.430.3323,679.4f12, mo. o(5,000. ocMichigan,7,253. 71130,000.0050,000.0021,298.8430,000. WI25,ooaoo36,452. 0410, 760. .oo22, 29,748.4312,250.OO21,213.605,OOO.OO16,355.6530, om no38,336.9516,817.515, om cand Wyoming),so: 850.0021,620.5024.69; 070.0129.10%872.5243, 350.00 .1 ,372.OO25,200.00;f”““.“”. . . . . . -. - .------. . .--“:’BUSINESS69.1Et77: 177.477. s78.82;82.984. 412,620.00I - - - .are given.CONDITIONS*11923 25 xIndexIndexIndex119108101of industrialproduction1. .of factorypay rolls 2 .3. . . - . -of factoryem loymentcar- Poadmgs 2 . . .of freightof departmentstore sales (value)2. . . .of constructioncontractsawarded(value)8of exports(vslue)3. . . .- . . . .of bank debits outsideNew York City . . .‘Surveyof Current Business, February1934, p. 3, and Decem ber 1934, p. 3.1 Unadjusteda Unadjusted1 Adjustedfor seasonal variation;variation.for seasonalfor seasonal variation.adjustedfor numberof working:z117115140days.23.433.333.936. 046.647. 150. 751.655. 357. 059. 761.8 ,:“zY?iE”o:2:046.cll2,912. 001929 5gure-s10. 312. 114.6nn n‘“. ”b‘ . 15,150.w2,500.oo7,000. cm8,ooo.oJl9, 140.004, loo. 0012, 225. 007,330. no10,048.Oo4,701.ooeconomic statistics20.-GeneralOF10:2CKJ.O070. ow. 0032,760.OO80.879. Ml23, 000.3814,277 0020,900.35 33, cm 001;67, ;3 ;193219;oLz;)lo2:94:s96. 1

ECONOMIC82OTHER9; Numberof gainfulworkers,Estimateof Committee10. Per capitafull-timeiVational73d Gong.,11. Averageincome,factoryECONOMICDATASeptemberon EconomicSecurity.1934-ewage,ll;3T11and salariedIncome,19%‘Q-%, Letter2d sess., p. 19.weeklyACTeconomic gsemployeesfromActingper wageearner-------Secretaryof Commerce,S. Dot.OLD-AQEFifteenthCensusof old-age16. Amountpaidof the U. S., 1930, vol.pensionersII,60 yearsof age and over--70 yearsp. 576.of age and over.-65 years of age and over.-Population,19311934-eData for 1931 from Monthly Labor Reoiew, June 1932, p. 1261. Data for 1934 com piled by Committeeon EconomicSecurityfrom latest availableinformation.in DATA1930 -----14. Number 1,475 1,199124,1929.1932-e1934.Data forSurvey CurrentBusiness,February1934, p. 7, and December1934, p. 7.1934 for first 10 months.12. Index of cost of living(1913 100)DecemberDecemberJuneMonthly Labor Reoiew, August 1934, p. 526.13. Population,50,277, OIN----.--.;;;‘Z :76,339180,003 16,173,20731,192,492Data for 1931 from MonthlyLabor Reuieu’, June 1932, p. 1261. Data for 1934 com piled by Committeeon EconomicSecurityfrom latest availableinformation.NATIONAL16. NationalincomepaidINCOMEout .The Notional Income,1935, releaseJan.STATISTICS14, 1935, p. 6, Department1929. 82,3oO,ooO,OOO1933-w 46,800, Ooo, OCHIof Commerce.17. Nationalincome paid out. -------------1933- 46,800,Ooo, 000Wages ------------------- 004ooONet rents thdrawals- - . .--- - . .7,9OO,ooO,ooOThe National Income, 19%. release Jan. 14, 1935, p. 6, Departmentof Commerce.18. Nationalincomepaldout.- -1932 418,894,060,ooOBusinesssavings or losses ------------.-.--9.629, Ooo, 000Incomeproduoed . . - . . - - - - - 39,365,C0O,000National Income, f9.9&%, letter from ActingSecretaryof Commerce,S. Dot. 124,73d Gong., 2d sass., p. 10.WHOLESALE,19. NetwholesaleFinalBureau20. NetretailBureauANDMANUFACTURINGSALESUnited Bates Summaw of Wholesale Trade in 19% Departmentof the Census,sale -.of the Census,valuep. 7.The1929 figuresUnited States Summary21. GrossRETAIL,sales . .-----------------------------------------ofp. 3.of manufacturedhavebeen revised.1929.- 49,114,653,Ooo1933-e 25,037,225,000of Commerce,the Retail Census for /9.?3, Departmentproducts1929. 68,950,108,0601933 32,030,504,000of Commerce,. . . -------.---------------Censor ofi%fanu actures:193% DepartmentThe 1929 figures have bean revised.of Commerce,LIFE-INSURANCEBureauof the Census,1929. 69,960,909,7121933-e 1,358,840,382p. 1.STATISTICS22. Aggregatelifeinsuranceinforce- - - .1933 97,985,043,747Ordinery --------.--------------------.---------------. .-------------------.--71,918,82Q,lS2Industrial- - -- .-17,154,472,848Group . . . Co., Year-Book-LifeInsurance,1934.23Averagesize of life-insurancepolicy in force, 1933:Ordinary .-.- - .-.-.-. --- - . Industrial. .--.-. .-. -- - --- - Computedfrom SpectatorCo. Year-Book-LifeInsurance, 1934.24. SurrenderedSpectatorAlso letterpoliciesandloans,life insoranre.Co., Year-Book-LifefromSpectatorCo.Insurance, 1934. 2, ;1933. 4,394,948,987

ECONOMICTABLE 2Q.-GeneralSECURITY83ACTeconomic statistics-ContinuedSAVINGS ESTIMA4TES‘2E. Annualsavings throuehlife insurance. . . . .New ---------------------Renewalpremiumpannents.- . - . . ------SpectatorCo., Year-Book-LifeIn uranee,1934.1933-.26. Savings1929. 28,218,OGO,C4M193%24,281, CAM, 000Dataand othertimefor all in United 2,950.465,899234.954. 1962,715.511.703States.Statistical Abstract of the Unifed Stats, 1933, P 242, table 252.Dr. WITTE. I want to make one further observation that I think isfundamentalin understandingthis problem-thatthe cost of supporting the old people is necessarily very great, whether met bythemselves or by someone else.At present life expectancy, a man who is 65 years old still has, inthe average case, 11 or 12 years ahead of him, and a woman 15 years.That is a long period.To give a pension of only 25 a month to the man 65 years of agefor the rest of his life, allowing for 3-percent interest, you have tohave a capital sum at the age of 65 of 3,300; for a woman, a capitalsum of 3,.600.I am cltmg these figures to illustrate that necessarily, and regardlessof a,ny action that you may take, the cost of supporting the aged inthe future generations and those now already old, will require a con siderable part of the total current income.A large percentage of the aged are dependent upon others for support.Estimates prior to the depression, selected studies in differentStates, indicated that from 30 to 50 percent of the aged were depend ent, in whole or in part, upon the support of others.At this time, as a result of the depression, that percentage has un doubtedly risen. The old people have lost ‘their savings, just likemany other people, and for old people that mea.ns an irreparable loss.That does not mean that this number of people are dependent uponthe public for support.In a newspaper account which I noted thismorning, the Committee’sreport was so interpreted.The greatnumber of old people who. are dependent have been and we expectThis bill does notwill continue to be supported by their children.contemplate that where children are able to support their parentsthey should not do so. This bill contemplates that where old peopledo not have means to support themselves and no ,children able tosupport them, they shall be supported by the public in a decent andhumane way through a pension system.ThereAt the present time the picture is something of this kind.are about 100,000 old people in public almshouses; a slightly largernumber in private institutionsfor the aged, many of whom are payingtheir own way. There are about 140,000 old people, not all of them.pensions under industrial pension systems;over 65, who are receivinThere are about 45,000about 15,000 under tra f e-union systems.pensioners at this time under the United States Employees’ Retire ment Act, and 3,000 under State retirement acts; about 25,000 underteachers’ pension laws, many of whom are under 65; a considerablenumber which we cannot estimate definitely,are in receipt of firsmen’s and policemen’s pensions; a much larger number are in receiptof veterans’ pensions.

84ECONOMICSECURITYACTAt this time about 180,000 people are pensioned under generalState old-age-pensionlaws.There are approximately700,000people over 65 years of age who are on Federal emergency relief atthis time, mostly as members of families rather than as independentunits.There are, in some parts of the country, a considerable number ofold people who are on relief entirely from local sources who are notincluded within the Federal emergency relief lists.On relief in one form or another are probably somewhat less thanor somewhere between-eightor nine hundred thousand people.That is the largest group of the aged t,hat are not supported by theirown children, who are dependent.There are State old-age-pension laws at this time in 28 States, inAlaska, and in Hawaii.Eight of these laws are optional, that is,they apply only in counties which have elected to come under theState old-age-pension system.In 4 of the States with old-age-pension laws no pensions are actuallybeing paid at this time and practically no pensions in another State.There has been a very rapid increase in the old-age-pension laws sincethe de ression set in. In 1933 there were nine new laws. FromDecem pber 1933 to October 1934 there was an increase in the numberof pensioners under State old-age-pensionlaws from 115,000 to180,000.In most of the laws, the counties are required to pay all or a partof the expense. In some States the States pay the entire expense.More commonly, the expense is sha.red between the States and thecounties.Fourteen of these States have a 70-year age limit at the presenttime.One has an age limit of 68, and the balance an age limit of 65.The residence requirements are usually .lO or 15 years in the State,and the latter is the more common.Delaware ha.s a 5-year limit,Arizona a 35-year limit.Those are the extremes.There are property qualificationsin all of the laws. Nowhere arepensions paid where an applicant has more than 3,000 worth ofproperty.That limit is lower in some States.The maximumpension is commonly 30 a month, sometimesThere areexpressed as 1 a day. There are none that are higher.some that are lower.For instance, North Dakota has a maximumpension of 150 per year.The pensions actually granted averaged a little more than 19 in1933. That was the actual average.That is a low figure, but Icall your attention to the fact that for families on emergency relief,the average allowance has been 23 per month.With old peoplewho are on relief included within these families, it is difficult to figureout an allowance for these old people in excess of 5 to 8 a monthThat is about the average that the Federalat the present time.Government is expending, as near as we can estimate, for the 700,000people who are on relief.The a.verages range from 24.35 in Massachusettsand 22.16 inNew York, the two top States, to 56.13 in Indiana, and 58.15 inColorado, all the way.between.Taking a year up to October 1934, the cost of all States for old-agepensions was 53 1,OOO,OOO.

ECONOMICSECURITYACT85There are included within the pension laws at the present time con siderably more than two-thirds of the total population of the country;that is, the States that have pension laws that are operative have morethan two-thirdsof the entire population.Under the laws now inoperat’ion, they have been expending or are expending at this time 31,000,000 per year.As for foreign countries, most of the European countries havecontributoryold-age annuitysystems under which annuities arepaid, toward which contribut,ionsare made by the employers, theemployees, and sometimes by the Government.Quite a few countriesin addition, have noncontributorypension systems.For instance,England has both a. cont)ributory annuity system and a noncontribu tory pension system.England started with a noncontributorypen sion system for people in need, just as our American States havestarted with noncontributorypension systems for people in need.The costs became so great that in 1925 England supplemented thenoncontributorypension system with a contributoryannuity system.France has had the same experience.In other English-speakingcountries n.t this time there are only noncontributorysystems.Forinstance, in Canada there is a national old-age pension law underwhich the national government shares with the provincialgovern ments the cost of noncontributorypensions for people in need. Thepensions everywhere in foreign countries are low. In England thenoncont’ributorypension is 10 shillings a week, half a pound, 52.50a week. In Canada t’he national pension is 520 per month at thistime, shared between the Dominion and the Provincial Governments.With that, I have finished my introduction,and I shall be glad toanswer any questions on this factual data that any member may have,if that procedure is within the motion that, you gentlemen passed, orI shall pass on to the subjects in the bill.Mr. HILL. Are you going to take up the provisions of this bill, withrelation to each particular subject?Dr. WITTE. Right now. I gave a factual background to show theproblem that we are trying to meet, and if you have questions on theproblem, I should be glad to answer them.Mr. HILL. The committee has made the rule on that.We wantyou to proceed with the bill, taking up the first subject, and when youfinish that, there will be some questions.Mr. WITTE. As I stated in the introduction,there are three separateprovisions made for old-age security in this bill.Title I deals withFederal grants in aid for noncontributorypensions paid by the State.Title, III and section 405 in title IV deal with the compulsory con Title V deals with voluntary annuities.tributoryannuity system.Coming now to title I, the Federal grants in aid for noncontributory,old-age pensions paid by the States, an appropriationis contemplatedin section 1 of 50,000,000 for the first year and 5125,000,000 for thesecond and subsequent years. That is to cover one-half of the costof the noncontributorypensions paid by cooperating States, andone-half of their costs of administration,with this limitation:The limitationis that the Federal Government will not pay morethan 15 per month toward the pension of any individual,nor will itpay an administrativecost in excess of 5 percent of the amount spentfor pensions.The total administrativecost may not exceed 10

86ECONOMICSECURITYACTpercent, or, if it does the State will pay more than the Federal Govern ment.The Federal Government pays one-half, but not more than5 percent.The total administrativecost may not exceed 10 percent,or, if it does, the State will pay more than the Federal Government.The Federal Government pays one-half,.but not more than 5 percent.The grants in aid are made on conditions specified in section 4, onpage 3. The requirement is that the State law must either be Statewide in operation, and if it is to be administered through counties, itThe present eight laws, whichmust be mandatory on the counties.are optional, will have to be changed in that respect.It is a further requirementthat the State itself shall participatein a substantialdegree in the costs. Some States now carry t.hewhole cost; the more recent laws generally provide that the Statesshall carry the whole cost. Many of the older laws provided thatthe entire cost shall be paid by the counties.Those laws haveremained in many counties entirely inoperative, because the countieshave not been able to bear the burden.In the States where there are State-wide financial provisions, thelaws have been operative.Wh ere there are not State-wide provisions, they have often been inoperative.We require, next, that some State authoritymust be designatedwith whom the Federal Governmentcan deal-whichwill haveresponsibilityfor the administration-forat least the supervisoryadministrationof the pension laws.We further provide that the State authorityshall make suchreports as are required by the Federal administrator.Then comes the most importantprovision, that the State lawsmust meet-thecondition that they must, in order to receive anyassistance, take care of those who are United States citizens and whohave resided for 5 years within t,he State, but these 5 years must havebeen within the last 10 years before the application.A person whowas born within a State, then moves out, and later comes back,does not necessarily have to be included, but a person who has beena resident within the State for 5 years within the last 10 years beforehe applies, must be taken care of.Pensions must be paid to people whose income is insufficientfortheir support; in the language of the bill, “is inadequate to providea reasonable subsistence compatible with decency and health.”Thatis the standard of the New York law, and of the Massachusetts lawwhich are in actual operation.You appreciate, of course, in that connection, that noncontrib utory old-age pensions will necessarily vary with the need of theindividual,for an old couple that owns its own home does not needto be provided with enough for rent, whereas an old couple thatdoes not must also be given rent.It is a question of the circum stances under which they live in each case, and, obviously the needsof the old people will vary in different commumtles.These figures that I cited to you are averages. The average inNew York State, in 1933, was 22.16, but in New York City theaverage of all grants was in excess of 40. Obviously in a largercity the cost is greater; very generally in the metropolitancenters,

ECONOMICSECURITYACT87people do not own their own homes, whereas in the rural areas andin the smaller towns, it is very common that an old couple is takenThey may reside with chil care of as far as shelter is concerned.dren, if the children are able to support them, and to the degree thatthey can support them their needs are less than they would be ifthe children were not able to do anything for them at all.We say that the State law must atThen there is an age limit.this time grant pensions at least to all people who meet these otherqualifications,who are over 70 years of age, and, after 1940, to allpeople who are over 65 years of age. Just about one-half of theWeStates now have 70-year limits, and the others 65-year limits.permit the 70-year age limit to be retained in the first 3 years,after which we say we will not give any Federal aid to any State thatdoes not have a limit of at least 65 years of age.Now, some items as to cost, because I take it that you wouldlike to have a statement of costs.Obviouslycosts are to a considerable extent a matter of guess.We cannot tell-wecan guess for a future time what will be theratio of dependency; what will be the tendency, for instance, in thismatter of whether children will continue to support their parentsto the extent that they do now.Actuaries that we employed-andactuaries guess high, that istheir business, to be on the safe side-estimatedon the assumptionthat if 15 percent of all the aged people would qualify in the veryfirst year-andto date in none of the States is the percentage ofthose that qualified as high as 15 percent, although it is close to 15percent in New York State-andon the assumption that the wholecountry would be covered, and that the grant would average 25per month, which is far more than they have averaged-theyhaveaveraged 19-withthese assumptions,the first year you wouldrequire 136,000,000.On the other hand, the States have actually spent 31,000,000,Those States have more than twoand half of that is 15,500,000.thirds of the total population of the United States.Beyond question there is always lag in getting laws into oper&.ion,in getting people on the lists, so that the Committee’sestimatewas that in the first year the cost would probably be 50,000,000.That est,imate some people think is too high.For instance, Mr.Epstein, who, more than any other person in this country,hasstudied this problem of old-a,ge security, says that 50,000,000 isfar beyond what will be needed in the first year. The Dill-Cannerybill, which was reported favorably to the House of Representativesin the last Congress, providedfor a Federal appropriationof 10,000,000.If you feel that you will reach theIt is a matter of judgment.figures that the actuaries regard as the outside possible cost, youwould need 136,000,000. If you figure on the past, 50,000,000 wouldseem to be adequate in the first year, allowing for the expected lagin getting the laws into opera,tion.In the second year we contemplate that 125,000,000 will probablybe needed.

88ECONOMICSECURITYACTThe costs will mount; that has been the experience everywhere.Ifyou start with a pension system, you can expect that graduallypeople will rely more and more on the pensions.Likewise, we have to contemplate that this depression has createdThe people that area tremendous havoc with peoples’ savings.now middle-aged or more, or at least many of them, are completelywiped out. They have only a short period of life in which they canmake adequate provision for t,heir old ag.e. The situation that weare facing in the immediate future certainly is a great deal worsebecause of the depression that we have been in.Then, again, these figures will mount because you have this con-.stantly growing number of the aged. Actuarial estimates which contemplate that in time 50 percent of all the aged will qualify for pen sions, and which contemplate that there will be an average grantof 25 a month, are to the effect that by 1980 the Federal part of thecost of the pensions, if not supplemented by a contributorysystemwill be approximately 1,300,000,000.Now, again those may be gusses. In European countries the figureof 50 percent is being approximated;50 percent of the total number ofaged depending upon the public for support.In England it is higherthan 50 percent, and I think that we can t’ake these figures, whichare the best estimates that t*he most competent actuaries can make,allowing for a margin of safety, but whether we take them as gospeltruth or not, I think it is very evident that the cost. of the pensionswill become a very large c,ost in years to come.Let me repeat, too, that whether you enact pension laws or not,that cost is there. This growing number of old people will have to besupported by the generation then living, and whether you do it in theform of pensions or in some other way, there is no way of escaping thatcost.Now, I would like to pass, if I may, to the contributoryannuitysystem, which you will find in title III and in section 405.Mr. LEWIS. What page?Dr. WITTE. Title III is on page 15. Section 405 is on page 24.On the contributorysystem, the plan provided in the bill, which thereport states is one plan that might be consideredwe wish to makethis quite clear that the Committee’s report suggests alternativesand we are prepared to submit other alternatives if you so desirebut the plan outlined in the bill, which on the whole seemed to theCommittee the plan that is most desirable, although that is a matterof judgment, is a contributoryold-age annuity system which is toapply to all employed persons who will be under 60 years of age whenthe plan takes effect, excluding nonmanual workers who earn morethan 250 a mouth.Mr. JENKINS. Where is that?Dr. WITTE. You will find that in the definitionof “employer”,on page 20, subsections 4 and 5.Mr. VINSON. And 6.Dr. WITTE. This plan is to be supported by what the bill calls anearnings tax and excise tax on pay rolls.It is a contributorysystem.Mr. TREADWAY. Where does that appear?Dr. WITTE. In section 301, on page 15, and section 302, on page 16.Mr. TREADWAY. You are startin

To give a pension of only 25 a month to the man 65 years of age for the rest of his life, allowing for 3-percent interest, you have to have a capital sum at the age of 65 of 3,300; for a woman, a capital sum of 3,.600. I am cltmg the