Transcription

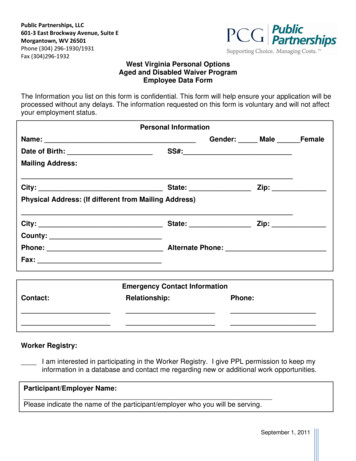

Public Partnerships, LLC601‐3 East Brockway Avenue, Suite EMorgantown, WV 26501Phone (304) 296‐1930/1931Fax (304)296‐1932West Virginia Personal OptionsAged and Disabled Waiver ProgramEmployee Data FormThe Information you list on this form is confidential. This form will help ensure your application will beprocessed without any delays. The information requested on this form is voluntary and will not affectyour employment status.Personal InformationName:Date of Birth:Gender: Male FemaleSS#:Mailing Address:City: State: Zip:Physical Address: (If different from Mailing Address)City: State: Zip:County:Phone: Alternate Phone:Fax:Emergency Contact InformationContact:Relationship:Phone:Worker Registry:I am interested in participating in the Worker Registry. I give PPL permission to keep myinformation in a database and contact me regarding new or additional work opportunities.Participant/Employer Name:Please indicate the name of the participant/employer who you will be serving.September 1, 2011

Public Partnerships, LLC601-3 East Brockway Avenue, Suite EMorgantown, WV 26501Phone (304) 296-1930/1931Fax (304) 296-1932West Virginia Personal OptionsAged and Disabled Waiver ProgramMedicaid Direct Service Worker AgreementThis agreement outlines the terms and conditions of providing services for a Personal Optionsparticipant(s). The parties to this agreement are: The West Virginia Department of Health andHuman Resources - Bureau for Medical Services (WVDHHR-BMS); Public Partnerships, LLC(PPL); and the Direct Service Worker (Employee).Direct Service Worker ResponsibilitiesThe Direct Service Worker agrees to:1. Adhere to policies and procedures of the West Virginia Aged and Disabled Waiverand Personal Options, including meeting the minimum requirements foremployment;2.Provide services for payment only after approved by PPL, provide only servicesauthorized in the participant’s approved spending plan, and maintain and submitaccurate and timely timesheets, invoices, and documentation to PPL for servicesand activities performed;3.Report changes in participant conditions (including hospitalizations and reasons fordiscontinuation of services such as placement in a rehabilitation facility or nursinghome), and report allegations or suspicion of abuse, neglect, and exploitation asrequired by applicable laws and regulations;4.Authorize PPL to withhold Federal and State taxes and legal obligations, acceptpayment from PPL as payment in full for services rendered and not request orrequire additional payment from the participant, and refund PPL in full in the eventof over-payment for services rendered.AcknowledgementsDirect Service Worker understands and acknowledges that employment is with the participant,and not the WVDHHR – BMS or PPL. No principal-agent or employer-employee relationship iscontemplated or created with the State of West Virginia or PPL by this agreement or byprovision of services. The direct service worker shall not be eligible to participate in anybenefit program provided by WVDHHR or PPL. To the extent allowed by law the provideragrees to hold harmless, release and forever discharge the State of West Virginia and PPLfrom any claims and/or damages that might arise out of any actions or omissions by the directservice worker.SignaturesDirect Service WorkerDatePublic Partnerships, LLCDateNote: PPL is signing this agreement as the sub-agent to the WV DHHR - BMS, which serves as thegovernment fiscal/employer agent.September 1, 2011

Public Partnerships, LLC601-3 East Brockway Avenue, Suite EMorgantown, WV 26501Phone (304) 296-1930/1931Fax (304) 296-1932West Virginia Personal OptionsAged and Disabled Waiver ProgramEmployment AgreementPurpose and Parties to AgreementThis agreement confirms the conditions of employment between the following:Participant (Employer)Direct Service Worker (Employee)Starting Hourly Wage: (to be determined by your Employer)Starting Mileage Reimbursement Rate: (to be determined by yourEmployer; if applicable)Mutual ResponsibilitiesBoth parties agree to adhere to all policies and procedures of the Aged and Disabled Waiverprogram and Personal Options.Employer ResponsibilitiesThe employer shall: Verify employee qualifications, including criminal background check, required training,and current certification in Cardio-Pulmonary Resuscitation (CPR); Schedule employee to provide services for payment only after being authorized byPublic Partnerships, LLC (PPL); Orient, train, schedule, and supervise employee; Provide a safe workplace free from excess hazards, employment discrimination, andharassment; Request employee to perform permitted and planned for duties, as determined in theParticipant Directed Service Plan. The employee should not perform prohibited servicessuch as administering medication, dressing wounds, and tube feeding; Notify employee in advance if services are not required or if participant is no longereligible for services; Verify services provided by employee by reviewing and approving timesheets, invoices,and documentation of services rendered, and ensuring submission to PPL; Accept responsibility for payment of services not authorized in approved spending plan.Employee ResponsibilitiesThe employee shall: Complete mandatory pre-employment training and on-going annual training, whichincludes 4 hours of on-the-job or training focused on enhancing your direct servicedelivery knowledge; Be punctual, neatly dressed, and respectful of employer’s person, belongings, familymembers, and acquaintances; Use employer’s personal property only if agreed upon by both parties;September 1, 2011

If providing transportation services, furnish employer with proof of valid driver’s licenseand minimum automobile liability insurance;Report allegations or suspicion of abuse, neglect, and exploitation as required byapplicable laws and regulations;Maintain confidentiality of all participant information as defined by the Health InsurancePortability and Accountability Act (HIPAA) and only release information with the writtenconsent of the participant;Notify the employer in advance if not able to provide services as scheduled or if quittingemployment;Complete accurate timesheets, invoices, and documentation to employer for review andsignature.AcknowledgementsEmployee understands and acknowledges the following: Employee is employed by the participant. Employee is not employed by the State ofWest Virginia or PPL. Employment is “at-will”. No guarantee or promise of continued employment is intendedor implied by this agreement. In accordance with the Fair Labor Standards Act, employee is considered a domesticemployee providing homecare companionship services to a household employer, and istherefore not entitled to overtime pay for hours worked in excess of 40 hours per weekfor a single employer. In West Virginia household employers are not required to obtain worker’s compensationinsurance coverage. Employers may not use funds from the approved budget forworker’s compensation coverage. Employee is responsible for informing the employer of any non-workplace injury thatwould interfere with the performance of their duties. The employee is responsible forreporting workplace injuries to the employer within 24 hours. IMPORTANT: Any false claims, statements, documents or concealment of material factsby employer or employee may be considered Medicaid fraud and will be reported forreview and potential prosecution under applicable Federal and State laws.Payment for Services and Work PerformedPPL shall pay the employee for services provided by the employee and verified by theemployer in accordance with the rate specified in the approved spending plan in effect at thetime of service provision.Termination of AgreementEither party may terminate this agreement by notifying the other party and the PPL resourceconsultant in writing.SignaturesBy signing below, the Employer and Employee agree to the above terms and conditions.Participant (Employer)DateEmployeeDateSeptember 1, 2011

Application for Tax Exemptions Based on Age, Student Status, and Family RelationshipState Worked: West VirginiaProgram: AD Personal OptionsParticipant Name: Employer Name:Employee Name:Employee Date of Birth: / /Employees providing domestic services, such as personal assistance, may be exempt from paying certain federal andstate taxes based on the employee’s age, student status, or family relationship to the employer. In some cases, theemployer may also be exempt based on the employee’s status. If you and your employer qualify for these exemptionsyou must take them. PCG Public Partnerships will determine the tax exemptions that apply to you and to your employer(see enclosed guidelines). Employee – Please answer all the following questions based on your age, student status, andrelationship to the employer:1.Are you a non-resident alien temporarily in the United States on an F-1, J-1, M-1, or Q-1 visa admitted to the USfor the purpose of providing domestic services?Yes, that description fits my status.No, that description does not fit my status.2.Are you the child of the employer (includes adopted children)?Yes, my employer is my parent (mother or father).No, my employer is not my parent.3.Are you the spouse of the employer?Yes, my employer is my spouse (husband, wife).No, my employer is not my spouse.4.Are you the parent of the employer (includes adopted children)?Yes, my employer is my child (son or daughter).No, my employer is not my child.5.If you answered “Yes” to Question 4, check any of the following that apply. If you answered “No”, proceed toQuestion 6.Yes, I also provide care for my grandchild or step-grandchild in my child’s home.Yes, my grandchild or step-grandchild is under age 18, or has a physical or mental condition that requirespersonal care of an adult for at least four continuous weeks during the calendar quarter in which services areperformed.Yes, my child (son or daughter) is widowed or divorced and not remarried, or living with a spouse who hasa mental or physical condition which prohibits the spouse from caring for my grandchild for at least fourcontinuous weeks during the calendar quarter in which services are performed.6.Are you under the age of 18 or do you turn 18 this calendar year?Yes, I am under 18 or am turning 18 this calendar year.No, I am over 18.If you answered “Yes” to Question 6, answer the following question. If you answered “No”, skip this section.Is the job of performing household services (personal assistance) your principal occupation? Note: Do notanswer “Yes” if you are a student.Yes, performing household services is my principal occupation.No, performing household services isnot my principle occupation, or I am a student.IMPORTANT: You must notify PCG Public Partnerships if your status changes.Employee Signature: Date: / /Submit to:Revised: 6/1/12Form TE 20PCG Public Partnerships, LLCFinancial Operations1 Cabot Rd, Suite 102Medford, MA 02155

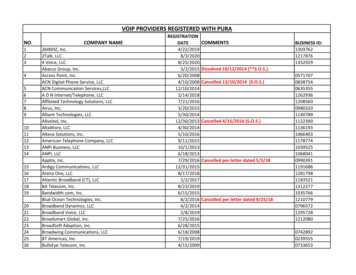

Guide to Tax Exemptions Based on Age, Student Status, and Family RelationshipEmployee Copy – Keep for your recordsEmployees providing domestic services such as personal assistance may be exempt from paying certain federal and statetaxes based on the employee’s age, student status or family relationship to the employer. In some cases, the employermay also be exempt from paying certain taxes based on the employee’s status. IMPORTANT: Please see IRS Publication:#926 – Household Employer’s Tax Guide, and IRS website article: “Foreign Student Liability for Social Security andMedicare Taxes” for additional information.IMPORTANT: These exemptions are not optional. If the employee and employer qualify for these tax exemptions they mustbe taken. If the employee’s earnings are exempt from these taxes, the employee may not qualify for the related benefits,such as retirement benefits and unemployment compensation. The questions regarding family relationship refer to the relationship between the employee and the employer ofrecord (common law employer). In some cases, the program participant is the employer of record. In othercases, the employer of record may be someone other than the program participant. Check program rules. Program rules may prohibit some types of employees. For example, most Medicaid-funded programs do notpermit a spouse to be paid as an employee for providing services to a spouse. Check program rules. PCG Public Partnerships will determine the tax exemptions that apply to the employee and employer based onthe information provided by the employee. PCG Public Partnerships cannot provide tax advice.Tax Exemptions for Non-Resident StudentsFor a non-resident student in the United States on an F-1, J-1, M-1, or Q-1 visa admitted to the US for thepurpose of providing domestic services, the employer and employee are exempt from paying FICA (SocialSecurity and Medicare taxes) and the employer is exempt from paying FUTA (Federal Unemployment Tax) onwages paid to this employee. The employer may also be exempt from paying State UnemploymentInsurance, depending on the rules in the state.Tax Exemptions for Children Employed by ParentFor a child under 21 employed by his or her parent, the employer and employee are exempt from paying FICA(Social Security and Medicare taxes) and the employer is exempt from paying FUTA (Federal UnemploymentTax) on wages paid to this employee until the child (employee) turns 21 years of age. The employer may alsobe exempt from paying State Unemployment Insurance, depending on the rules in the stat e.Tax Exemptions for Spouses Employed SpousesFor a spouse (husband, wife, or domestic partner in some states) employed by his or her spouse, theemployer and employee are exempt from paying FICA (Social Security and Medicare taxes) and the employeris exempt from paying FUTA (Federal Unemployment Tax) on wages paid to this employee. The employermay also be exempt from paying State Unemployment Insurance, depending on the rules in the state.Revised: 6/1/12Form TE 20PCG Public Partnerships, LLCFinancial Operations1 Cabot Rd, Suite 102Medford, MA 02155

Tax Exemptions for Parents Employed by ChildrenFor a parent employed by his or her child and answering “No” to any of the additional questions underQuestion #6 regarding caring for a grandchild or step grandchild, the employer and employee are exemptfrom paying FICA (Social Security and Medicare taxes) and the employer is exempt from paying FUTA (FederalUnemployment Tax) on wages paid to this employee. The employer may also be exempt from paying Stat eUnemployment Insurance, depending on the rules in the state.For a parent employed by his or her child and answering “Yes” to all of the additional questions regardingcaring for a grandchild or step grandchild, the employer is exempt from paying Federal Unemployment Tax(FUTA) on wages paid to this employee. The employer may also be exempt from paying State UnemploymentInsurance, depending on the rules in the state.Tax Exemptions for Employee under Age 18For employees under the age of 18 or turning 18 in the calendar year: If the employee is a student, domesticservices are deemed not to be the employee’s principle occupation and the employer and employee areexempt from paying FICA (Social Security and Medicare taxes).Employment RelationshipStatusForeign Student on VISA in USfor Purpose of ProvidingDomestic ServiceChild Employed by ParentSpouse Employed by SpouseParent Employed by ChildEmployee Under 18 or TurningAge 18 in Calendar YearFederal Insurance ContributionsAct - Social Security andMedicare Taxes(FICA)FICA exemptFederal Unemployment TaxActState UnemploymentInsurance(FUTA)FUTA exempt(SUI)See footnote (1)FICA exempt only until 21stbirthdayFUTA exempt only until 21stbirthdaySee footnote (2)FICA exemptFUTA exemptSUI exempt (3)FICA exempt only if not alsocaring for dependent child of theemployer (employee’sgrandchild)FICA exempt through year of 18thbirthday only if enrolled as a fulltime studentFUTA exemptSUI exempt except in NY andWA. See footnote (4)Not ApplicableNot Applicable(1) Foreign student in the United States on F-1/J-1 VISA is exempt from SUI in the following states: PA, WA.(2) Child under 18 employed by parent is SUI exempt in the following states: CA, IL, MA, ME, NJ, NV, OH, OR, PA, SC, TN, WA, WV.Child under 21 employed by parent is SUI exempt in the following states: AZ, GA, IN, KS, NY, OK, VA, WY, and District ofColumbia.(3) For California only, a registered domestic partner employed by his/her re gistered domestic partner is SUI exempt.(4)Parent employed by child is SUI exempt in all states and the District of Columbia with the exception of N Y and WA.Revised: 6/1/12Form TE 20PCG Public Partnerships, LLCFinancial Operations1 Cabot Rd, Suite 102Medford, MA 02155

Public Partnerships, LLC601-3 East Brockway Avenue, Suite EMorgantown, WV 26501Phone (304) 296-1930/1931Fax (304) 296-1932West Virginia Personal OptionsAged and Disabled Waiver ProgramConfidentiality AgreementI, (Employee), understand that in the performanceof my duties for (Participant/Employer), I will haveaccess to privileged information about the member I am serving, and that such informationmay include medical, insurance and other confidential/personal information.I agree to restrict my use of such information to the performance of my duties.I will not discuss the member’s name, or otherwise reveal or disclose information pertaining tothe member, except when in direct contact with representatives of the West Virginia Bureau forMedical Services, the West Virginia Bureau of Senior Services, West Virginia Medical Institute,Public Partnerships, LLC, or , and then only for the purpose of assisting themember.I hereby acknowledge my obligation to respect the member’s privacy and confidentiality of theinformation pertaining to the member, and to exercise good faith and integrity in all dealingswith the member and their personal information in performance of my duties.I also understand that any unauthorized use or disclosure of information pertaining to themember may result in my immediate suspension or dismissal and may subject me to civilliability for breaching the member’s right to privacy.Employee SignatureDateMarch 12, 2013

WV ADW Personal OptionsPhone: 304-381-3100 or 1-888-775-9801TTY: 1-800-360-5599Admin Fax: 1-866-388-1626Employee Application forDifficulty of Care Federal Income Tax ExclusionEmployee Name:Employee ID:Participant Name:Participant ID:SECTION A – Applying for a Difficulty of Care Federal Income ExclusionCertain payments received by an individual care provider for providing Medicaid services in the provider’shome are considered Difficulty of Care payments excludable from federal income tax. To determine if youare eligible for the income exclusion, complete the following steps. If you are eligible, PPL will not report thepayments as income and will not withhold federal income taxes.STEP 1: Review information regarding the Difficulty of Care Federal Income Tax Exclusion. Informationis available on PPL’s website at: http://www.publicpartnerships.com.STEP 2: Check all that apply: I provide services to the individual participant in my home. I do not have a separate home where I reside. This is the home where I reside and regularly perform the routines of private life,including shared meals and holidays with family.STEP 3: If all of the above do NOT apply, you are not eligible for the Difficulty of Care Federal IncomeTax Exclusion. Do NOT send in this form.STEP 4: If all of the above apply, you are eligible for the Difficulty of Care Federal Income TaxExclusion. Complete the information below, sign, and return to PPL.Under penalties of perjury, I declare that I am an individual care provider receiving payments under a stateMedicaid Home and Community-Based Services program. I live in the home with, and I provide services to,the individual listed at the top of this form.Employee Signature//Date Complete the below section ONLY if you are TERMINATING your exclusion. SECTION B – Terminating Difficulty of Care Federal Income Tax ExclusionUnder penalties of perjury, I declare that I no longer reside with an individual that I provide services to andwho is receiving payments under a state Medicaid Home and Community-Based Services program.Employee Signature//Date that I no longer qualify for the exclusionPlease mail the completed form to 601-3 East Brockway Ave., Suite E, Morgantown, WV 26501or fax it to 1-866-388-1626.

WV ADW Personal Options601-3 E Brockway Ave, Suite EMorgantown, WV 26501Phone: 304-381-3100Fax: 304-296-1932WEST VIRGINIA AGED AND DISABLED WAIVER PROGRAMFLSA Live-in Exemption FormThe United States Department of Labor (US DOL), Fair Labor Standards Act (FLSA), requires household employers to payemployees overtime pay for hours worked over 40 per workweek unless the employee qualifies for an exemption.Please use this form to notify PCG Public Partnerships if the employee qualifies for the live-in exemption from overtimepay. You may also use this form to revoke the exemption when the employee no longer qualifies for the exemption.PARTICIPANT NAME:PARTICIPANT ID:EMPLOYEE NAME:EMPLOYEE ID:STEP 1: DETERMINE IF THE EMPLOYEE QUALIFIES FOR THE LIVE-IN EXEMPTION FROM OVERTIME PAYThe live-in exemption: Applies only to the participant/employee pair based on the “Residency Test” (below); and Applies to all services provided by the employee for that participant.Residency Test: A live-in employee is exempt from overtime pay if the employee “ resides on the employer's premises eitherpermanently or for extended periods of time”. “Employer’s premises” means the household where employed.“Permanently”, or “ extended periods of time” means the employee lives, works, and sleeps in the householdwhere employed for at least five (5) days a week (120 hours) or more.STEP 2: CERTIFY THE EMPLOYEE’S ELIGIBILITY FOR THE LIVE-IN EXEMPTION FROM OVERTIME PAYPlease check the box below if the employee qualifies for the live-in exemption. YES, the employee qualifies for the live-in exemption for overtime pay. All hours, including overtime (over 40hours per workweek), will be paid at regular hourly rates for all services.Please sign and submit this form to:Fax: 1-866-388-1626 or Mail to Public Partnerships, 601-3 E Brockway Ave, Suite E, Morgantown WV 26501Do NOT submit this form if the employee does NOT qualify for live-in exemption fromovertime pay.STEP 3: SIGN AND AUTHORIZEBy signing, we understand that it is our responsibility to inform PCG Public Partnerships when the employee no longerlives with the participant. Both parties must sign to claim the exemption. Only the participant/representative must signto revoke the exemption.PARTICIPANT/REPRESENTATIVE SIGNATUREDATEEMPLOYEE SIGNATUREDATE Complete the below section ONLY if you are TERMINATING the employee’s live-in exemption. I declare that the employee no longer qualifies for the live-in exemption from overtime pay.PARTICIPANT/REPRESENTATIVE SIGNATUREDATEPlease sign and submit this form to:Fax: 1-866-388-1626 or Mail to Public Partnerships, 601-3 E Brockway Ave, Suite E, Morgantown WV 2650110.12.16

Public Partnerships, LLC – WV ADW601-3 East Brockway Avenue, Suite EMorgantown, WV 26501Phone (304) 296-1930/1931Fax (304) 296-1932AUTHORIZATION TO WITHHOLD CITY SERVICE FEESInstructions: Check the box next to the statement that best describes where you will work, and your statusregarding weekly city service fees for Charleston, Fairmont, Huntington, Morgantown, Parkersburg or Weirton.Please submit to PCG Public Partnerships. Please note the form must be complete for each participant you workfor within each of the cities listed above.Employees that select Prior Payment must complete and submit this form annually (by December 31). If thisform is not submitted, PCG Public Partnerships will withhold the required weekly withholding.EMPLOYEE INFORMATIONEmployee ID:Employee Name:Participant Name:Participant ID:My place of employment under the Personal Options Program is in (please check burgRomneyWeirtonI understand that I am required to have a City Service Fee withheld from my pay check for working for theparticipant listed above. I authorize PCG Public Partnerships to withhold the weekly City Service Fee from mypay check and to send the amount withheld to the city selected above.Based upon your city service fee selection above, please select one of the following (only if applicable):Prior Payment* (a copy of a current pay stub with proof of withholding must be submitted)I already have the weekly City Service Fee deducted from my pay from another employer in the samecity in which I work. If you have the fee withheld from another employer, please provide youremployer’s name/place of employment: .*Please note this must be completed and submitted annually (by December 31). If this form is notsubmitted, PCG Public Partnerships will withhold the required weekly withholding.FairmontI live in and work in city of Fairmont. Please provide your physical address and a copy of proof ofresidency (i.e. driver’s license):Street AddressCityZip CodeI no longer work in the city limits of Charleston, Fairmont, Huntington, Morgantown, Parkersburg,Romney, or Weirton.IMPORTANT: As an employee, it is your responsibility to notify PCG Public Partnerships if your CityService Fee status changes. Changes to withholdings will NOT be done automatically.SIGNATURESEMPLOYEE SIGNATUREDATEPARTICIPANT/REPRESENTATIVE SIGNATUREDATE

Public Partnerships, LLC601-3 E. Brockway Ave.Morgantown, WV 26501866.429.3465866.388.1626 (fax)West Virginia Personal OptionsAged and Disabled Waiver ProgramTransportation InvoiceInstructions:1. This invoice must be completed and submitted each pay period. Please do not put dates formore than one pay period on a single invoice. If more space is needed for a single pay period,use additional sheets as needed. Make sure transportation is reflected on MonthlyHomemaker Documentation form.2. The participant/employer must review, approve, and sign the invoice.3. The invoice must be faxed to (866) 388-1626 or Mail to: Public Partnerships, LLC, WVPO AD,601-3 E. Brockway Ave., Morgantown, WV 26501Participant Name:Participant ID#:Employee Name:Employee ID#:Pay Period Start Date:Pay Period End Date:Service Code: A0160Rate: (The maximum rate is defined by West Virginia Bureau for Medical Services)Date:MilesDriven:Travel Time(hrs):Destination:Purpose of Travel:Total:Signatures:I verify that I have a current valid driver’s license and motor vehicle insurance as required by WestVirginia State Law and that the billing for services provided is accurate and complete.Employee Signature:Date:Participant Signature:Date:March 28th, 2012

PUBLIC PARTNERSHIPS, LLC EMPLOYEE TIMESHEET (Fiscal Management for West Virginia Personal Options)Participant's ID:Participant's Name:336Service (Fill one)Homemaker Base RateEmployee's ID:Employee's Name: FAX:PPL @ 1-866-388-2286Week 1PUBLICPARTNERSHIPS,WVPO,6 AdmiralsChelsea, MA02150WVPOAD, 601-3 E.BrockwayAve. WayMorgantown,WV26501} MAIL: PPL,Begin: Monday (mm/dd/yy)T i m e::::::::::::::MonTueWedThuFriSatSunINAM/PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMT i m e::::::::::::::OUTAM/PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PM//Total Hours::::::::::::::By signing below, I certify that I have provided the services tothe employer during the times described on this timesheet.336Date (mm/dd/yyyy)://Week 2Employee Signature:End: Sunday (mm/dd/yy)T i m eINTueWedThuFriSatSunAM/PMAM PM::::::::::::::MonVersion 1.1 080907AM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMT i m e::::::::::::::OUT/AM/PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PMAM PM/Total Hours::::::::::::::By signing below, I certify that "I" received the hours of serviceas reported and the hours do not exceed my monthly plan.Date (mm/dd/yyyy):/Employer Signature:/WARNING: Falsifying a signature or reporting hours not worked is Medicaid fraud.

USCISForm I-9Employment Eligibility VerificationDepartment of Homeland SecurityU.S. Citizenship and Immigration ServicesOMB No. 1615-0047Expires 08/31/2019 START HERE: Read instructions carefully before completing this form. The instructions must be available, either in paper or electronically,during completion of this form. Employers are liable for errors in the completion of this form.ANTI-DISCRIMINATION NOTICE: It is illegal to discriminate against work-authorized individuals. Employers CANNOT specify whichdocument(s) an employee may present to establish employment authorization and identity. The refusal to hire or continue to employan individual because the documentation presented has a future expiration date may also constitute illegal discrimination.Section 1. Employee Information and Attestation (Employees must complete and sign Section 1 of Form I-9 no laterthan the first day of employment, but not before accepting a job offer.)Last Name (Family Name)Apt. NumberAddress (Street Number and Name)Date of Birth (mm/dd/yyyy)Middle InitialFirst Name (Given Name)U.S. Social Security Number-Other Last Names Used (if any)StateCity or TownZIP CodeEmployee's Telephone NumberEmployee's E-mail Address-I am aware that federal law provides for imprisonment and/or fines for false statements or use of false documents inconnection with the completion of this form.I attest, under penalty of perjury, that I am (check one of the following boxes):1. A citizen of the United States2. A

2. Provide services for payment only after approved by PPL, provide only services authorized in the participant’s approved spending plan, and maintain and submit accurate and timely timesheets, invoices, and documentation to