Transcription

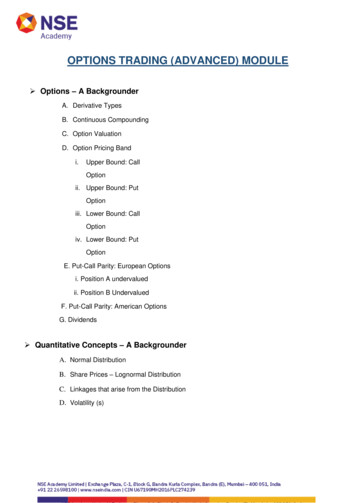

OPTIONS TRADING (ADVANCED) MODULE Options – A BackgrounderA. Derivative TypesB. Continuous CompoundingC. Option ValuationD. Option Pricing Bandi.Upper Bound: CallOptionii. Upper Bound: PutOptioniii. Lower Bound: CallOptioniv. Lower Bound: PutOptionE. Put-Call Parity: European Optionsi. Position A undervaluedii. Position B UndervaluedF. Put-Call Parity: American OptionsG. Dividends Quantitative Concepts – A BackgrounderA. Normal DistributionB. Share Prices – Lognormal DistributionC. Linkages that arise from the DistributionD. Volatility (s)

Binomial Option Pricing ModelA. Single Period BinomialB. Multiple Period BinomialC. European Put OptionD. Binomial Model for American OptionsE. Role of Volatility in ‘u’ and ‘d’ Black-Scholes Option Pricing ModelA.European Call OptionB.European Put OptionC.DividendsD.American Options Option Greeks Delta1.European Call on non-dividend paying stock2.European Put on non-dividend paying stock3.European Call on asset paying a yield of q4.European Put on asset paying a yield of q Gamma1.European Call / Put on non-dividend paying stock2.European Call / Put on asset paying a yield of q Theta 1.European Call on non-dividend paying stock2.European Put on non-dividend paying stock3.European Call on asset paying yield of q.4.European Put on asset paying yield of qVega

1.European Call / Put on non-dividend paying stock2.European Call / Put on asset paying yield of qRho1.2.European Call on non-dividend paying stockEuropean Put on non-dividend paying stock Volatility Historical Volatility (s)ARCH(m) Model Exponentially Weighted Moving Average (EWMA) GARCH Model Implied Volatility Basic Option & Stock PositionsA. Pay-off Matrix for Basic Option Positions Long Call Long Put Short PutShort CallB. Pay-off Matrix for Position in the Share Long Stock Short StockC.AssumptionsD.A Few Option Contract Intricacies Option Trading StrategiesA. The Strategies1. Single Option, Single Stocki. Protective Put

ii. Covered Putiii. Covered Calliv. Protective Call2. Multiple Options of Same Typei. Bull Spreadii. Bear Spreadiii. Butterfly Spreadiv. Calendar Spreadv. Diagonal Spread3. Multiple Options of Different Typesi. Straddleii. Strangleiii. Collarv. Range Forward - Longvi. Range Forward – Shortvii. Box Spreadviii. CondorB.Option ChainC.Contract FundamentalsD.Option Trading Intricacies1.Choice of Strike Price2.Choice of Expiry3.Roll Over and Covered Calls Exotic OptionsA.Asian OptionB.Bermudan OptionC.Compound Option

D.Binary OptionE.Barrier OptionF.Look back OptionG.Shout OptionH.Chooser Option Market IndicatorsA. Put-Call RatioB. Open InterestC. Roll-overD. Volatility

Basic Option & Stock Positions A. Pay-off Matrix for Basic Option Positions Long Call Short Call Long Put Short Put B. Pay-off Matrix for Position in the Share Long Stock Short Stock C. Assumptions D. A Few Option Contract Intricacies Option Trading Strategies A. The Strategies 1. Single Option, Single Stock i. Protective Put