Transcription

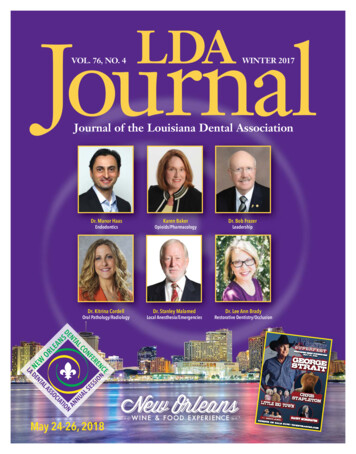

LDAJournalVOL. 76, NO. 4WINTER 2017Journal of the Louisiana Dental AssociationDr. Manor HaasEndodonticsDr. Kitrina CordellOral Pathology/RadiologyKaren BakerOpioids/PharmacologyDr. Stanley MalamedLocal Anesthesia/EmergenciesDr. Bob FrazerLeadershipDr. Lee Ann BradyRestorative Dentistry/OcclusionMay 24-26, 201869423-48411 Cover Winter Journal.indd 112/20/17 3:04 PM

PARTNERSHIP. INTEGRITY. INNOVATION.WORKING HARD TO DELIVER THE VERY BEST INPATIENT EXPERIENCE AND PRACTICE LIFESTYLE.REVOLUTIONIZE HOW YOUR TEAM AND PATIENTS EXPERIENCE DENTISTRY.At Patterson Dental, we are proud to connect you with innovative toolsand resources so that you can focus on providing expert dental care.69423-48411 Cover Winter Journal.indd 212/20/17 3:04 PM

CONTENTSVOLUME 76NUMBER 4EDITORDr. David N. Austin230 Carroll Street, Suite 2Shreveport, LA 71105(318) 861-4549E-mail: daustin1@comcast.netMANAGING EDITORAnnette B. DroddyLDA Headquarters7833 Office Park Blvd.Baton Rouge, LA 70809(800) 388-6642 Toll-free(225) 926-1986 Local Line(225) 926-1886 FaxE-mail: annette@ladental.orgWeb site: http://www.ladental.orgBUSINESS MANAGERDr. William M. Hall, Jr.3100 Woodlawn AvenueShreveport, LA 71104(318) 865-1469E-mail: dr802@bellsouth.netEDITORIAL BOARDDr. Gary CaskeyDr. Gary L. RobertsDr. Brian D. BasingerLDA OFFICERSDr. David HildebrandtPresident1430 Old Spanish Trl., Ste. 10Slidell, LA 70458(985) 643-0304Winter 2017Editorial2Understanding Louisiana’s Medicaid Impact on Dentistry3President6Executive Director8Last Chance Seminar10Louisiana Dental Services (LDS)14Technology Tidbit: ProSites15Louisiana State Board of Dentistry16LA Mission of Mercy (LaMOM)18LDA Events19Dental Lifeline Network20LDA Foundation21News22LA Dental Hygienists’ Association24Wealth Management26New Orleans Dental Conference/LDA Annual Session272018 LDA Partners28Sharon ElliottDirector of MembershipDevelopmentLouisiana Dental Political Action Committee (LADPAC)30LSU School of Dentistry32Tisha WhiteDirector of AccountingADA Annual Session34Classifieds35LSU C.E. Calendar37LDA C.E. and Events Calendar38Last Page40Dr. Daniel A. WeaverPresident-Elect715 W. College St.Lake Charles, LA 70605(337) 478-3123Dr. Robert E. BarsleySecretary-Treasurer345 S. 4th St.Ponchatoula, LA 70454(504) 619-8693Dr. L. Stephen OrtegoSpeaker of the HouseP.O. Box 766Ball, LA 71405(318) 640-1470LDA STAFFWard BlackwellExecutive DirectorAnnette B. DroddyAssistant Executive DirectorJeanne ParrDirector of Conference ServicesCandice CastroExecutive AssistantDr. Nelson DalyPast President4450 Bluebonnet Blvd., Ste. BBaton Rouge, LA 70809(225) 927-5248A MEMBER PUBLICATIONOF THE AMERICAN ASSOCIATIONOF DENTAL EDITORSJOURNAL of the Louisiana Dental Association (USPS284620) is publishedquarterly at 230 Carroll St., Suite 2, Shreveport, LA 71105, in March, June, September and December, and is the official publication of the Louisiana Dental Association. Opinions and statements expressed, however, are those of the writerand not necessarily those of the Association. Original articles published hereinbecome the property of this publication. Subscription price is 18 per year formembers, 30 per year for non-members and 65 per year for foreign subscribers. Periodicals postage paid at Baton Rouge, Louisiana, and additional mailingoffices.The publication of an advertisement in the LDA Journal is not to be construedas an endorsement or approval by the Louisiana Dental Association or any of itscomponent associations of the product or service being offered.Postmaster: Send address changes to Louisiana Dental Association, 7833 OfficePark Blvd., Baton Rouge, LA 70809.Established in 1878, the Louisiana Dental Association (LDA) is the largest professional health organization for dentists in Louisiana. It is a statewide grassrootsorganization whose purpose is to promote, advocate, and protect the dental professional. The LDA has over 1,900 members.Copyright 2017, LDA.69423-48412 Insides Winter Journal.indd 1On the cover: The New Orleans DentalConference and LDA Annual Session will beheld May 24-26, 2018, at the Hyatt RegencyHotel, near the Superdome. New Orleanswill be filled with fun and food that weekendas the Bayou Country Superfest will be heldat the Superdome (featuring country musiclegend George Strait) and that is the sameweekend as the New Orleans Wine & FoodExperience. Pictured on the cover are justa few of our top-notch speakers: Dr. ManorHaas, Endodontics; Karen Baker, Opioids/Pharmacology; Dr. Bob Frazer, Leadership;Dr. Kitrina Cordell, Oral Pathology/Radiology;Dr. Stanley Malamed, Local Anesthesia/Emergencies; and Dr. Lee Ann Brady, Restorative Dentistry/Occlusion.LDA members can view the Journalonline at www.ladental.org.12/22/17 2:43 PM

LDAeditorialDr. David N. AustinEditor, LDA JournalHealthy Louisiana Medicaid Plans and the Impacton DentistryWhoa there. Perhaps you didn’t know this – I suredidn’t.Healthy Louisiana (previously called Bayou Health)is the way most of Louisiana’s Medicaid and LaCHIPrecipients receive health care services. In HealthyLouisiana, Medicaid recipients enroll in a Health Plan.These Plans differ from one another in several ways,including their provider networks, referral policies,health management programs and extra services andincentives offered. Each of these Plans is accountable tothe Louisiana Department of Health (LDH).Healthy Louisiana features five health plans,and each offers dental benefits for Adults 21years and older, beyond the traditional adultdenture services and dental care for childrenand adolescents that have been available underMedicaid in Louisiana previously.The five Healthy Louisiana plans are:1. Aetna Better Health2. Healthy Blue (formerly Amerigroup RealSolutions)3. Amerihealth Caritas Louisiana4. Louisiana Healthcare Connections5. UnitedHealthcare Community PlanA dentist is NOT required to be a certified providerwith MCNA (broad coverage to children under 21 yearsof age) to enroll as a Healthy Louisiana dental provider.Because of this, there is an opportunity for dentiststo participate in one or more of these HealthyLouisiana plans.The LDA has received many calls and emails fromdentists inquiring about the programs. We couldfind no one place that had all the information easilyaccessible for our members. So, in order to answer ourmembers’ inquiries, we decided to research and create adocument to provide the needed information.In order to find out more information or to signup, please refer to the tear-out page (pages 4-5) inthis issue. This information is also posted on the LDAwebsite at www.ladental.org/dentalmedicaid for easyaccess at any time. You can also visit this website for a269423-48412 Insides Winter Journal.indd 2complete listing of dental benefits covered by each ofHealthy Louisiana’s five health plans.In my opinion, it is important we remember that, notjust anyone can do the work we do. Many of our citizensare enrolled and need help. You may find that one ormore of these plans could be a fit within your practice.Visit www.ladental.org/dentalmedicaidfor a complete listing of dentalbenefits covered by each of HealthyLouisiana’s health plans.AmeriHealth Caritas LouisianaChange of Subcontractor for itsDental BenefitsEffective January 1, 2018, dental services will be transitionedfrom DentaQuest to DINA Dental. Dental providers who would liketo continue providing services to AmeriHealth Caritas Louisianamembers will need to contract with DINA Dental if you have notalready done so. To find out more about DINA Dental and toaccess their website go to www.fcldental.com/about-us. For moreinformation about contracting with DINA Dental, please call DINADental’s Provider Relations department at 1-877-587-9331 oremail at pr@fcldental.com.LDA Journal12/22/17 2:43 PM

UnderstandingLOUISIANA’S MEDICAIDIMPACT O N DE N T I S T RYOOn January 12, 2016, Gov. John Bel Edwards signed anexecutive order to expand Medicaid in Louisiana. Theexpansion has made Medicaid available to more than400,000 people living in Louisiana who did not previously qualifyfor full Medicaid coverage and could not afford to buy privatehealth insurance. Many of these Louisianans who qualify for fullMedicaid coverage are working adults who now have access toregular, preventative and primary care.THE FIVEHEALTHY LOUISIANAPLANS ARE:Aetna Better HealthHealthy Louisiana features five health plans to administermedical benefits. Each plan offers some limited dental benefitsfor adults 21 and older, beyond the traditional adult dentureservices and dental care for children and adolescents that havebeen available under Medicaid in Louisiana previously.Healthy BlueThree plans utilize third-party managers: Aetna and HealthyBlue use DentaQuest to manage their dental programs, whileAmerihealth Caritas uses DINA Dental Plans as its third-partymanager. United Healthcare and Louisiana Healthcare managetheir own programs. Dentists can be providers for as many, oras few, of the five plans as they choose; however, providers withLouisiana Healthcare must be affiliated with a FederallyQualified Health Center (FQHC).Louisiana HealthcareConnectionsPatients who qualify for full Medicaid automaticallyqualify for dental benefits through ManagedCare of North America (MCNA) Dental, and they areallowed to choose which Healthy Louisiana plan theyprefer for medical (and added adult dental) benefits.MCNA: Broad coverage for children under 21, withemphasis on basic preventative and primary care; foradults 21 and over, limited to dentures and partials.Healthy Louisiana Dental: Only for adults 21 years andolder.It is important to note that a dentist is not required to be acertified provider with MCNA to enroll as a HealthyLouisiana dental provider. MCNA and the five HealthyLouisiana plans are independent of one another, and eachrequires its own application process. A dentist must be acertified provider with MCNA to file claims and receivepayments for MCNA administered benefits. A dentist mustalso be a certified provider of one or more of the HealthyLouisiana dental plans in order to file claims and receivepayments for the benefits those plans administer.69423-48412 Insides Winter Journal.indd 3(formerly Amerigroup Real Solutions)Amerihealth CaritasLouisianaUnitedHealthcareCommunity PlanFor more information or to sign up to be a provider ofone or more of the Healthy Louisiana plans, contact thefollowing individuals: Aetna and Healthy BlueJacqueline Clouse, DentaQuest Louisiana ProviderNetwork Manager(888) 683-6725, ext. 2 or (865) taQuest – (844) 234-9834 Amerihealth Caritas Louisiana/DINATraci Lusignan – Provider Relations Representative(985) 774-5340 tlusignan@fcldental.comDonna Vogler – Director of Provider Relationsand Credentialing(281) 276-1061 dvogler@fcldental.com Louisiana Healthcare Connections:(866) 595-8133 or fill out the contract form online a-provider/contract-request-form UnitedHeathcare Community Plan(800) 822-5353 or (844) RE275-8751,www.uhcproviders.com12/22/17 2:43 PM

Visit www.ladental.org/dentalmedicaid for a complete listing ofdental benefits covered by each of Healthy Louisiana’s five health plans.A dentist who becomes a certified provider for one or more ofthe Healthy Louisiana plans is only a provider for theMedicaid Adult Dental Value-Added Service (VAS) portion ofeach company’s network. The dentist is not a member of thecompany’s regular or private dental insurance network.*Louisiana Healthcare Connections does not provide privateinsurance.Each of the Healthy Louisiana dental plan providers has a setfee schedule for approved benefits.DentaQuest and DINA contract with providersaccording to network agreements, and reimbursementrates are the same for all Adult Dental VAS plans thatthese third-party managers administer.Louisiana Healthcare Connections reimbursementrates are at the agreed upon FQHC rates identified in theFQHC fee schedules, since all dental benefits covered bythis plan must be provided at qualified FQHCs.United Healthcare reimbursement rates follow theLouisiana Medicaid fee schedule.By becoming a certified provider with one or more of theplans, the dentist agrees to the fee schedule rates for allcovered services despite the possibility of the rates being lowerthan their usual customary charge. A dentist may not bill thepatient the cost difference of the benefit if thereimbursement is less than the regular fee.However, a dentist may bill a patient for services providedoutside of the annual benefit limit or not covered by the planIF the dentist obtains a written waiver from the patient or thepatient completes a consent form provided by the healthplan PRIOR TO rendering the services.69423-48412 Insides Winter Journal.indd 4A dentist who signs up to be a certified provider forone or more of the Healthy Louisiana plans maybe obligated to accept all or certain Medicaidpatients who are part of that plan. Only HealthyBlue and AmeriHealth Caritas do not require theircertified providers to treat all Medicaid patients inthe system; but rather, they allow dentists tocustomize their panel status. Only these two plansallow dentists to decide whether they will treatexisting Medicaid patients only, all Medicaidpatients in each plan, or make case-by-casedeterminations.Must the Dental Provider Accept AllPatients In a Healthy Louisiana Plan?Healthy BlueNOProviders may customizetheir panel statusAmeriHealthCaritasNOProviders may customizetheir panel statusAetnaYESProviders must see allpatients who aremembers of the AetnaBetter Health of LouisianaMedicaid PlanLouisianaHealthcareConnectionsYESProviders must see allpatients with the FQHC’srestrictionsUnitedHealthcareYESProviders must see allpatients who aremembers of the UnitedHealthcare CommunityLouisiana Medicaid Plan12/22/17 2:43 PM

69423-48412 Insides Winter Journal.indd 512/22/17 2:43 PM

LDApresidentDr. David J. HildebrandtPresident, Louisiana Dental AssociationDental Insurance Issues Remain a PriorityDental insurance issues continue to be a hot buttontopic. Whenever I travel to our LDA componentmeetings, as soon as the subject of dental insurance isbrought up, everyone tells their latest horror story. Inmy 33 years of practice, dental insurance has alwaysbeen an issue. However, the last few years have broughtmore complaints and serious insurance misconductthan I have ever experienced. In the last LDA Journal,I asked for examples of the more egregious complaintsdentists have experienced with dental insurance. Thetwo most common areas of complaints about insurancedeal with periodontics and prosthodontics.Periodontics issues consistently deal with dentalinsurance companies setting their own standardsfor reimbursement. Frequently, these standards fallwell outside what is considered the standard ofcare. I heard numerous examples of patients with6-7 mm pockets being routinely denied for scalingprocedures. The typical insurance reason for denialis “the patient’s condition does not meet our criteriafor coverage.” The other typical reason for denyingcare is, “the x-rays do not show enough bone lossto meet our criteria.” In one discussion I have hadwith an insurance peer review dentist, I was toldunless there is 3-4 mm of bone loss evident onthe x-ray, your claim will be denied. That was thecriteria the company had arbitrarily picked as itsstandard. This is obviously a major deviation in thestandard of care. If we waited to treat our patientsuntil 3-4 mm of bone loss occurred, we could beliable for professional neglect. Not only are insurancecompanies denying coverage, they are now declaringthese treatments as not medically necessary.At a component installation that I attended, oneof our member dentists told me he recently had aninsurance company deny a claim for scaling. Hedescribed the patient as follows: the patient presentedwith purulent pockets, bleeding on probing andaverage pockets of 6-7 mm. The insurance denied theclaim due to lack of evident bone loss on the x-ray.669423-48412 Insides Winter Journal.indd 6The insurance company then advised the patient thatthe dentist had to pay back all payments the patienthad made for the procedure since the scaling wasnot medically necessary. It is my opinion that thisinsurance company is practicing mail order dentistryby diagnosing a dental condition without ever havingexamined the patient. The insurance companiesare all choosing their own independent criteria andseverely impacting the doctor patient relationship.Prosthodontics is the next most common areaof complaints. The typical example is that aninsurance company denies a claim for a crownsaying the tooth could have been restored with adental filling. Again, our members sent excellentexamples. One of the examples I received was anx-ray and a photograph showing three cusps missing.The insurance denied the crown citing not enoughdamage to justify a crown. Another example ofcrown denial occurred when a dentist had a patientwith a mesial distal fracture in a bicuspid tooth.The dentist could move the lingual cusp with anexplorer. The insurance denied the claim becausethe cusp was still present on the x-ray. Fixed bridgesare another area of insurance company issues. Themost common complaint occurs when the insurancecompany downgrades a fixed bridge to payment fora removable bridge. Then when the patient has anissue with another tooth in the same arch within 5years of the treatment, the insurance denies the claimusing the frequency clause.The ultimate irony in a claim I encountered involveda patient who was denied coverage for a crown. Thereason for the denial was the tooth had a questionableprognosis due to its periodontal condition. This sameinsurance company had just denied the patient’spreauthorization for periodontal treatment one monthearlier citing lack of evidence of disease.A different dental insurance issue I haveencountered deals with the marketing of dentalinsurance. We have been told about several companiesLDA Journal12/22/17 2:43 PM

marketing dental plans with outrageous exclusions.We had a patient requiring periodontal treatment.The patient showed us the pamphlet showing hehad periodontal coverage at 80%. However, whenour office called the insurance company to verifycoverage, we were advised the company only providedperiodontal coverage to patients under the age of 18.Another similar exclusion we found was a companywho only provided orthodontic coverage to patientsover 40 years old.So where do we go from here? Now that we havecollected this data, what is the solution? We recentlystarted the process of formulating a game plan. Wemet with the Deputy Insurance Commissioner forLouisiana. At the meeting our executive director,Ward Blackwell, and our LDA legal counsel presentedthe Deputy with issues such as those above. We areseeking advice on how to proceed. Are existing lawsand regulations sufficient to address the problemif the appropriate officials are simply made awareof certain practices that may be non-compliant?What options for constructive dialogue are there?Do current provisions for third party review needto be re-examined? What are the pros and cons oflegislation if other options are unproductive? Theseare just a few of the questions for which your LDA isworking hard to find answers.I look forward to working as your advocate tofight for your rights against these practices.Congratulations LDA Directorof Membership Sharon Elliottfor 10 Years of ServiceYour SolutionIRU DOO ƓQDQFLDO QHHGV/RXLVLDQDōV 7RS %XVLQHVV &UHGLW 8QLRQDANIELLE MAT THEWSBUSINESS LENDERcampusfederal.orgWinter 201769423-48412 Insides Winter Journal.indd 7225.769.8841712/22/17 2:43 PM

LDAexecutive directorWard Blackwell, M.J.Executive Director, LDAUPDATE: LDA Health Insurance FAQsA“FAQ sheet” about the LDA-sponsored healthinsurance plan for members that has been indevelop-ment for some time now was e-mailed to LDAmembers in early November. Interest in the plan hasremained very high since. So, I decided it might behelpful to include in this issue of the Journal an updatedversion of those FAQs, both for those who for whateverreason missed the first one and for those eager for thelatest information.1. Is the LDA going to again offer a healthinsurance plan for members?The changes in the insurance marketplace resultingfrom implementation of the Affordable Care Act (a.k.a.ACA, or Obamacare) have made it very difficult for ANYassociation to offer health insurance benefits to theirmembers. Nonetheless, LDA is committed to doingall we can to bring whatever relief we can to ourmembers. We have been working for more than twoyears now on innovative ways to address those challengesand again offer a health insurance plan to our members.2. What progress has been made on an LDAmembers’ health insurance plan?The only viable option LDA has been able to identifyin the current environment is basically to create our ownhealth insurance company. This would be in the form ofa type of self-insured plan called a Multiple EmployersWelfare Arrangement (MEWA). MEWAs are often morecapital-intensive to start and can be more risky to operatethan other types of insurance plans. Accordingly, LDApassed legislation to make it easier for an associationof professionals to form a viable MEWA. We have alsoengaged consultants, actuaries and lawyers to assemblethe mountains of necessary documentation, negotiatedcontracts with a number of vendors and subsequentlyfiled an extensive application with the LouisianaDepartment of Insurance to obtain a license to launchLDA Health Plan Trust (LDAHPT), a MEWA exclusivelyfor LDA members.3. What about President Trump’s executiveorder (EO) allowing for the creation of AssociationHealth Plans (AHPs) that provide health insuranceto members in multiple states? Wouldn’t that enableLDA to create a plan like it once had and get it upand running soon?869423-48412 Insides Winter Journal.indd 8President Trump’s EO directs the of Departmentsof Labor, Treasury and Health and Human Services toconsider proposing regulations or revising guidance asa means to improve access, increase choices and lowercosts for healthcare by several means. These meansinclude expanding the availability of AHPs. The orderdoes not immediately trigger any of these provisions butestablishes a specific timetable for the federal agenciesto report to the president on the feasibility of enactingsuch provisions. Should they be deemed feasible, theagencies would then initiate rulemaking to actuallyeffect the necessary changes. That would take manymonths - possibly years. In short, the impact - if any of the Trump EO on health insurance options for LDAmembers is at best well in the future.4. So, when will members be able to apply forcover-age under an LDAHPT plan?The unusual measures the LDA has been forced totake in order to circumnavigate the marketplace issuesrelating to the ACA make this impossible to predictprecisely. We had HOPED to have a plan in place beforethe end of 2017, but every step to resolve an issue hasseemingly revealed two more points to address, fromregulatory compliance to ensuring stable reserves. Onthe plus side, the possibility that a viable plan mayprove impossible to create seems very remote at thispoint. It is almost certainly a matter of when, notif. Our best advice to members is to be watchingcarefully for news about an LDAHPT plan in thenext few weeks, as a VERY big announcement willbe made as soon as an LDAHPT plan is approvedand ready.5. If an LDAHPT plan isn’t ready by the end ofthe year, won’t I need to get coverage somewhereelse and then be locked in for another year?The open enrollment period for exchange plans willbe closed by the end of this year. So, if an LDAHPTplan is not ready by the end of 2017, members willhave to choose another option for now in order toensure they have uninterrupted coverage. However, anLDAHPT plan is not like an exchange plan - memberswill be able to switch to an LDAHPT plan at anytime, not just during an open enrollment period.(Note: once in an LDAHPT plan, members will not beLDA Journal12/22/17 2:43 PM

able to change their plan type and coverage optionsexcept during an open enrollment period or within 30days of a qualifying event.) So, if an LDAHPT plan isready in January, members could apply for coverageunder the LDA plan at that time, regardless of whatother coverage they may have selected in late 2017.6. How will the LDAHPT plan compare to theplans on the market today?LDAHPT intends to have several plan options withbenefits that should be comparable to the types of plansour endorsed agency, Brown & Brown, has indicatedthe majority of LDA members have currently chosen.The LDAHPT should include several high deductible,HSA-eligible plans plus a couple of lower deductibleco-pay plans. Though final rates are not quite set yet,much of the focus in these final stages of developingthe LDAHPT has been on ensuring that it will offerrates that are significantly lower than for planswith comparable benefits from major carriers (e.g.,Blue Cross) for as many LDA members as possible.It is important to note that, since it will be a type ofself-insured plan, the rates for an LDAHPT plan willlikely range from significantly lower than comparableexchange plans to somewhat higher, depending uponthe underwriting on each application. Put another way,the LDAHPT plan will almost certainly be attractive toWinter 201769423-48412 Insides Winter Journal.indd 9members with good health histories (who likely haveseen some of the largest premium increases under theACA, on a percentage basis). But there simply is noviable way at this time for LDAHPT to be a great solution for all LDA members. Still, the LDA Board feltit was important for the LDA to try to help as manymembers as realistically possible. And, the hope is thata successful LDAHPT will evolve into an affordableoption for an ever-increasing number of members.7. Will an LDA plan include both group andindividual coverage options?No. A MEWA is designed for employers to offercoverage to employees. So, the only LDAHPT planoption will be group coverage. However, THISDOES NOT MEAN THAT AN LDA MEMBER WILLHAVE TO PAY TO COVER HIS/HER EMPLOYEESIN AN LDA PLAN. Basically, an employer in a MEWAhas to make the coverage available to his/her employees,but can pay all the premium, part of the premium ornone of it. And, if all employees decline the coverage,the employer can form a group of one (him/herself).The LDA’s endorsed agency, Brown & Brown, will assistLDA members in all the details required to tailor a planfor each practice.912/22/17 2:43 PM

LDAcouncil on dental educationJeanne ParrLDA Director of Conference ServicesJeanne Parr, Dr. Hal Crossley, and Dr. CraigCrawford (LDA’s Council on Dental Education chair).Record Attendance at Last ChanceSeminarThe 2017 LDA Last Chance Seminar December8 set a new record for attendance! Equallyinformative and entertaining, Dr. Hal Crossleydrew rave reviews from the more than 240 dentalprofessionals who braved snowy weather conditionsto come hear him speak at the Baton Rouge Marriott.Although online C.E. has become more and morepopular, LDA events continue to hold strong as weprovide great speakers at low prices. Our Last Chanceseminar, specifically, has continued to become verypopular. The seminar offers dentists a saving graceat the end of the year. They are able to earn upto 7 clinical hours in just one day and the cost isunbeatable (especially for LDA members).This year’s Last Chance Seminar featured not onlythe knowledgeable, crowd-pleasing speaker, Dr. HalCrossley, but also one of the first chances to satisfythe new state mandated opioid prescribing and abusemanagement C.E. rule.The LDA plans to offer the opioid managementcourse a few more times for anyone who missed thisfirst opportunity. Watch the LDA website at www.ladental.org/events for more info and opportunitiesto take the course before the 2018 and 2019 licenserenewal periods.Thanks to Our SponsorsPremier Events PartnersSustaining Events PartnerSupporters:Dr. David DeGenovaand Dr. Kristi Soileau.1069423-48412 Insides Winter Journal.indd 10AG Dental CPAs & AdvisorsCampus Federal Credit UnionCentral Louisiana AHECDelta DentalLDA FoundationLouisiana Dental Services, Inc. (LDS)LDA Journal12/22/17 2:43 PM

Dr. Tessa Madere Owens, Gabrielle Owens, and Dr. Chris Owens.Dr. Brett Madere, Dr. Chris Doucet, and Dr. David Priestly.Above: Judy Gaines from DeltaDental ready to throw a snowball.Left: Dr. Barton Frye andDr. Richard Wampold.Stormy Blair from Brown & Brown Association ServicesProfessionals and Sandy Oubre.Dr. Michael Cash and his daughter, Brianne Cash.Winter 201769423-48412 Insides Winter Journal.indd 111112/22/17 2:43 PM

Over 240 attendees!Dr. Bill Hadlock, Dr. Richard Atkins, and Dr. JeffHooton.Dan Romance from Tax Saving Professionals andDr. John Portwood.Ward Blackwell, Dr. Curtis Zeringue, and Dr. Buddy Quinn.1269423-48412 Insides Winter Journal.indd 12Dr. Kyle Slaven and Lauren Slaven.Dr. Jimmy Hammack, Dr. David Hughes, Dr. Doug Strictland, and Dr. MikeAnderson.LDA Journal12/22/17 2:43 PM

DDSGuard Practice Protection that’sDedicated to Dentistry.Ed Silva DDS, a Fortress DentistDDSGuard is the powerful insurance program that Fortress Insurance Company hasdesigned exclusively for the profession of dentistry. What makes DDSGuard different from otherdental practice liability insurance? Fortress has a depth of clinical expertise unmatched in theindustry, with firsthand knowledge of anesthesia, extractions, implants, and other complexprocedures increasingly common to modern dentistry.DDSGuard Policy Features Claims-made (free tail available) or occurrence coverage Consent to settle New to practice premium discount Patient safety education Risk Management resources Professional regulatory defense coveragesFortress Insurance Company Only insures the profession of dentistry Owned and operated by dentist

Dental Benefits Effective January 1, 2018, dental services will be transitioned from DentaQuest to DINA Dental. Dental providers who would like to continue providing services to AmeriHealth Caritas Louisiana members will need to contract with DINA Dental if you have not already done so. T