Transcription

SECTOR UPDATEPHARMACEUTICALSCustomer consolidation: Horizontal to verticalIndia Equity Research PharmaceuticalsIn past 5 years, the US Healthcare has undergone frenzied round ofconsolidation, wherein negotiating power of retailers & payers hasincreased versus hospitals & pharmaceuticals manufacturers, leading toacute pricing pressure. The first wave of horizontal consolidation sawemergence of 2-3 large players. In the second wave, wholesalers, retailersand PBMs formed buying consortiums to align purchasing power,subsequently garnering 85% market share. However, anti-trustauthorities have blocked the latest initiatives of further concentrationleading to the third wave of vertical consolidation to gain mass. Webelieve vertical consolidation will improve efficiency - PBMs (middle men)will be eliminated, and create a behemoth with enormous negotiatingpower. CVS Health (CVS), the largest pharmacy chain in US, is looking toacquire Aetna, a healthcare insurance company. Entry of Amazon inhealthcare distribution is a potential threat to incumbent pharmaciesgiven its deep pockets and willingness to forego profits for years. Thesedevelopments do not augur well for generic companies as pricingpressure will aggravate, and may pass on to pharmaceuticals suppliers.Vertical integration will add to woesCVS, which commands 23% of the US prescription drug sales market and owns thebiggest PBM in US, is said to have made a bid to acquire Aetna—a health insurancecompany. This is envisaged to bring greater pricing transparency, improve healthoutcomes and lower prices for customers. It will also clip market power of PBMs byeliminating middle men in the healthcare supply chain. If we extrapolate this trend,Wellcare, Centene and Humana (healthcare insurance firms) could be potentialacquisition targets. The integration also seems to be a bid to reinforce the fort beforeentry of a formidable player like Amazon in drug distribution. However, it may not begood news for drug manufacturers as it will further tilt the balance against them.Generic industry not yet ripe for consolidationConsolidation in the generic industry still looks difficult as the number of genericmanufacturers is increasing in the system. Even though cost of filing has jumped andmargins in the US business have declined significantly, smaller players who haveinvested in the business set up for the US market find the market lucrative for its sizeand profitability. The number of filings and approvals will keep rising in the system,which will keep eroding the negotiating power of generic players.Prefer companies with complex generics pipelineFDA’s focus on faster approvals to cut drugs prices is likely to increase competitiveintensity. However, companies with complex generics pipeline, which face lowcompetition, will benefit from faster approvals. We continue to prefer players withstrong complex generics pipelines over the next 2-3years before that also gets flooded.Top Pick: Dr. Reddy’s.Edelweiss Research is also available on www.edelresearch.com,1Bloomberg EDEL GO , Thomson First Call, Reuters and Factset.Deepak Malik 91 22 6620 3147deepak.malik@edelweissfin.comAnkit Hatalkar 91 22 6620 3097ankit.hatalkar@edelweissfin.comArchana Menon 91 22 6620 3020archana.menon@edelweissfin.comNovember 21, 2017Edelweiss Securities Limited

PharmaceuticalsUS drug distribution channel: Changing dynamicsThe dynamics among key stakeholders (retailers, wholesalers/distributors, PBMs andinsurance companies) in the US drug distribution channel have evolved over the past fewyears: (1) horizontal consolidation: Consolidation among peers at each level has led toemergence of 2-3 large players with majority market share. Considering the already highconcentration and the Department of Justice (DOJ) blocking latest initiatives, opportunitiesfor further consolidation appear to be low; (2) vertical relationships: Wholesalers, large drugretailers and PBMs have formed alliances (buying consortiums) to align purchasing andenhance their negotiating power. Post the recent WBAD-Econdisc alliance, the top 3 sourcinggroups will have 85% market share and, therefore, impact of any further alliances will below; and (3) vertical consolidation/integration: Players are looking to integrate acrossdifferent lines of businesses, e.g., insurance players acquiring/setting up own PBMs. Verticalconsolidation is still at nascent stage and probability of vertical consolidation going ahead ishigh.Fig. 1: Changing dynamics in the US drug distribution channelWave 1(past 5 years)Wave 2(gainedmomentumover past 2-3years)Wave 3Players at each stage of the distribution channelmerge/acquire peers to increase market shareHorizontalConsolidationCurrently, top 2-3 players at each level have majoritymarket shareWholesalers, retailers and PBMs form ‘Buyingconsortiums’ to align purchasing and enhancenegotiating powerVerticalrelationshipsTop 3 sourcing groups have 85% market shareVerticalconsolidationPlayers integrate different lines of business (eginsurance players acquiring/setting up own PBM)DoJ has blocked latest initiatives.Opportunities for furtherconsolidation low.Recently, Econdisc (8% marketshare) joined WBAD alliance andnow contributes 33% market share.Most of the major alliances havealready been formed and impact offurther alliances would be lowCVS is looking to acquire Aetna,which will make it the first playerwith presence across all stages ofthe distribution channel.Vertical consolidation is still atearly stages, yet to play out.Source: Company, Edelweiss researchWave 1: Horizontal consolidationHorizontal consolidation at each level has led to emergence of 2-3 large players with majoritymarket share. Among retail pharmacies, the top 3 pharmacy chains i.e., CVS, Walgreens andExpress scripts, already dispense 50% scripts. Further, this is bound to increase asWalgreens completes acquisition of 40% of Rite Aid stores. The wholesaler/distributorindustry is more concentrated with the top 3 distributors cornering 85% market share.Among PBMs, the top 3 players have 65% share of claims. Concentration at the insurancelevel, with the top 10 players with 50% market share, is relatively lower as the DOJ has notbeen approving recent mergers/consolidations (Aetna-Humana and Anthem-Cigna).Considering concentration is already high and DOJ has been blocking latest initiatives,probability of further pressure due to more horizontal consolidation seems low.Refer Appendix (page 8) to understand the US drug distribution channel2Edelweiss Securities Limited

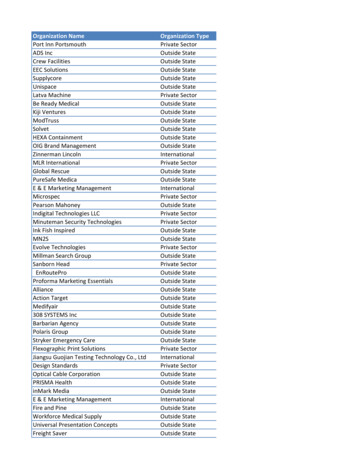

Sector UpdateChart 1: Top 3 pharmacies have 50% shareWalgreens15%CVS Retail14%Others46%Walmart5%CVS MailOrder9%CardinalHealth21%ExpressScriptsMail OrderPharmacy11%Chart 3: Top 3 PBMs have 65% share of claimsExpressScripts29%Others34%Chart 2: Top 3 distributors have 85% share of pharma salesOthers15%McKesson33%AmerisourceBergen31%Chart 4: Top 10 insurance players have 50% market shareUnitedHealth Group11% Anthem9%Aetna4%Cigna5%Others52%Humana9%Optum Rx13%CVS Health24%Magellan1%Centene3%HealthNet3%Molina Wellcare2%2%Source: USC Schaeffer, Edelweiss researchNote: Based on 2015 dataWave 2: Vertical relationships among various stakeholders:Although the traditional distribution chain model creates channel conflict among differentstakeholders as they negotiate for prices, rebates, discounts, getting listed on formulariesetc., different stakeholders have started collaborating to develop vertical relationships.1.3Buying consortiums: Wholesalers, large drug retailers and PBMs have forged ‘buyingconsortiums’ to align their drug purchasing. Aggregating volumes enhances negotiatingpower of the consortium and enables it to obtain favourable prices. Currently, the top 3sourcing groups have 70-85% market share. Among recent deals, while impact of theMcKesson-Walmart deal (announced in May 2016) is visible, in the Econdisc-WBAD(announced in May 2017) deal, we understand, negotiations for new products havealready begun and complete impact should be apparent by mid CY18.Edelweiss Securities Limited

PharmaceuticalsFig. 2: ‘Buying consortiums’ have tilted the balance in favour of distribution channelTop 3 sourcing entities have 85% market shareRetailersWholesalers20%CVS HealthPBMsSourcing entity5%25%Cardinal Health18%33%7%8%6%10%25%8%Market shareSource: Company, Edelweiss research2.Pharmacies and wholesalers: Large pharmacy retailers are now shifting from selfwarehousing to establishing direct store deliveries from a wholesaler (Mckesson-Rite Aidagreement in February 2014 and AmerisourceBergen-Walgreens Boots Alliance in May2013). In addition, wholesalers and retailers have also aligned their generics purchasing.Large pharmacies have historically purchased generics directly from manufacturersrather than via the wholesale channel. However, the reduced acquisition cost from theseretail-wholesale purchasing relationships has encouraged pharmacies to forge genericpurchasing agreements with wholesalers.3.PBMs and pharmacies: The traditional PBM model creates 2 sources of channel conflictwith retail pharmacies: (1) PBMs’ determination of pharmacy reimbursement rates &dispensing directly affects a pharmacy’s revenue & profitability; (2) PBMs’ mailpharmacy absorbs dispensing profits that may otherwise be earned by a retail networkpharmacy. However, these parties have formed alliances that benefit both parties andminimise conflicts.PBMs join buying consortiums to benefit from the combined purchasing power, resultingin lower drug costs. Pharmacies partner with PBMs to become their preferred pharmacypartner to bag incremental volumes, albeit at reduced margins. Moreover, PBMs andpharmacies also align to form mail and specialty pharmacy businesses (Walgreens andPBM Prime Therapeutics formed a mail and specialty company AllianceRx WalgreensPrime).4Edelweiss Securities Limited

Sector UpdateWave 3: Vertical consolidationCompanies after forming vertical partnerships are now going for vertical integration byintegrating the different lines of healthcare business: Insurers acquiring PBMs: United Healthcare acquired Catamaran (PBM) for USD13bn tobulk up its pharmacy-benefit business. Catamaran, the fourth-largest pharmacy-benefitmanager in the US by volume of prescriptions processed, merged into UnitedHealthGroup’s OptumRx unit—the industry’s third-largest and part of the company’s Optumhealth-services arm. Insurers setting up PBMs: Anthem, the second largest health insurer, will launch its ownPBM IngenioRx in partnership with CVS, effective January 2020. The move comes asAnthem’s contract with Express Scripts expires at 2019 end following a high-profiledispute between the two. Rather than renew with Express Scripts or hand off themanagement of prescriptions entirely to another PBM, Anthem said it has formed apartnership that will give the health insurer "complete control" over its formulary, thepreferred list of drugs that is covered for its customers. Pharmacies and PBMs: CVS was the first to establish significant scale across 2 supplychain horizontals with the merger of CVS pharmacies and the Caremark PBM in 2007.Moreover, PBMs and pharmacies also align to form mail and specialty pharmacybusinesses. Walgreens and PBM Prime Therapeutics formed a mail and specialtycompany AllianceRx Walgreens Prime. Wholesalers and insurance companies: Now, distributors are looking to acquireinsurance companies to gain more negotiating power and protect their turf against aformidable player like Amazon.Probability of vertical consolidation in future is high Opportunities for further horizontal consolidation low: Top US health insurers havetried a variety of merger/consolidation options in the past few years. Both AetnaHumana (USD37bn) and Anthem-Cigna (USD48bn) deals were blocked by DOJ earlier thisyear. In absence of such consolidation opportunities, the interest in vertical alignment isexpected to grow for both health-plans and PBMs. Currently, just one integrated PBM-insurance player: UnitedHealth Group is the onlylarge-scale healthcare player which owns both health plan and PBM assets. Theintegrated model enables alignment of spends across medical and pharmacy, which isbecoming increasingly relevant and can result in membership gains. The Aetna-Humanadeal would have enabled Aetna to grow an OptumRx kind of PBM asset; instead, now itis looking to merge with CVS. Currently, it has agreement with CVS for PBM services. Anthem’s new PBM and a possible CVS-Aetna deal could pressurise other players tointegrate:a.5CVS has an integrated platform across retail, PBM and a distributor joint venture(with Cardinal Health), providing CVS with an advantage. Adding a health plan to itsassets portfolio will provide strategic advantage to CVS over UnitedHealth GroupOptumRx. With Aetna’s existing PBM relationship with CVS, the integration risk forthe acquisition is low. Risk of a challenging integration would have been different ifthe Aetna-Humana deal had materialised or if it had continued to drag for a muchlonger period. This will also pressurise other large health plans and PBMs to fill gapsin their portfolios.Edelweiss Securities Limited

Pharmaceuticalsb.Anthem issued an RFP earlier this year to replace Express Scripts as its PBM. Bothhave been working under a 10-year pricing contract since 2009, when ExpressScripts had agreed to buy Anthem's struggling in-house PBM for USD4.7bn. In FY17,Anthem sued Express Scripts for USD15bn damages and the ability to end itscontract, saying that Express Scripts overcharged it by USD3bn annually. Thecompany is losing its biggest client to CVS. Given the circumstances, Express Scriptsshould be aggressively scouting for a health plan.How do these alliances impact drug manufacturers?1.Price erosion: Generic pharma companies have been grappling with pricing pressure dueto consolidation in the distribution channel in the US. Typically, when 2 drug purchasersenter into a joint sourcing agreement, existing purchasing agreements with generic drugmanufacturers are aligned in such a way that the lowest rate that was provided to eitherof the 2 purchasers is now applicable to both. Further, for new agreements, aggregationof demand increases the negotiating power of purchasers and negatively impacts drugmanufacturers.Over the past few years, as wholesalers, retailers and PBMs have entered into jointsourcing agreements and formed buying consortiums, pricing pressure on the genericpharma market has intensified. This is reflected in declining gross margins of key players.Chart 5: Gross margins for drug manufacturers have been 6675.4gross margin (%)46.5gross margin (%)gross margin (%)5156gross margin (%)56FY15Q2FY18Sun Pharma56FY15Q2FY18Dr Reddy'sSource: Company, Edelweiss researchNote: Generic business margin for Teva and Dr Reddy’s, company level margin for Mylan and Sun Pharma2.6Working capital: In the US market, while drugs are sold by manufacturers at list price(gross price), the actual price they receive (net price) after factoring in rebates and otherdiscounts paid to middlemen in the supply chain is much lower. Typically, while drugmanufacturers are required to pay rebates before they receive the gross price, i.e., thecash outflow in the form of rebates, needs to be made before they receive the cashinflow. Rising consolidation in the distribution channel has resulted in higher rebates anddiscounts. Total amount of drug rebates and discounts catapulted to USD127bn in 2016from USD39bn in 2008. This has increased the working capital requirements of drugmanufacturers.Edelweiss Securities Limited

Sector UpdateAmazon’s entry: Potential disruptorIn what could be a major disruption in the US pharma distribution system, media reportsindicate that Amazon is mulling entry in the US pharma distribution chain. Although Amazonhas not confirmed this, its possible entry has been a subject of speculation for months. As perearlier media reports, the company has hired a lead to devise a strategy in this regard and isin discussions with PBMs, while the most recent ones suggest that the company has beenapproved for wholesale pharmacy licenses for at least 12 states.Amazon is a wild card. It's unclear when or how the company will enter the market, or even ifit will. It could choose multiple routes. If it chooses to operate through a PBM, Amazon couldeither acquire/ partner with a large PBM or may even choose to learn the business model bypartnering with a smaller PBM. There are already reports that Amazon, with its 350,000employees, is trying to administer its own health plan internally as its own PBM. On the otherhand, it could also leverage its chain of whole food stores to establish in-store pharmaciesthat could also act as mail order fulfilment centers. Amazon’s strong distribution network andexisting customer base could give it an upper hand.If and when Amazon enters the pharma distribution business, generic drug manufacturersmay also be impacted. However, given that the prescription drug market is highly regulatedand requires approvals, threat due to Amazon’s entry could be some time away and it wouldbe premature to judge the impact at this juncture.Generic industry not yet ripe for consolidationConsolidation in the generic industry still looks difficult as the number of genericmanufacturers is increasing in the system. Even though cost of filing has increased andmargins in the US business have declined significantly, smaller players who have invested inthe business set up for the US market find the market attractive for its size and profitability.The number of filings and approvals will keep rising in the system, which will keep erodingthe negotiating power of generic players.Prefer companies with complex generics pipelineOverall, in addition to the price erosion due to customer consolidation, impact of fasterapprovals will also persist. The new USFDA commissioner, Scott Gottlieb, is focused on givingfaster approvals to reduce drug prices. While on one hand this will increase the competitiveintensity, on the other, companies with complex generics pipeline will benefit over the next2-3 years before that also gets flooded. Hence, we continue to prefer companies with strongcomplex generics pipelines.7Edelweiss Securities Limited

PharmaceuticalsAppendixUnderstanding the US drug distribution channelFig. 1: US pharmacy distribution and reimbursement systemSource: Drug Channels1.Distribution: Distributors/wholesalers purchase drug products from manufacturers and ship them to retailers, wherepatients access their prescription medications. The retail pharmacy market can be divided into 3 major categories: chainpharmacies & mass merchants with pharmacies, independent pharmacies and mail-order pharmacies.2.Financing: Payers, the financing source for drug benefits, can include public sources (generally Medicare or Medicaid) orprivate sources (private health insurance and out-of-pocket payments). PBMs act as an intermediary and help payersmanage their drug benefits. They determine which pharmacies will be in the plan’s network, develop the formulary (list ofcovered medications) and negotiate price rebates with drug manufacturers. Manufacturers provide these rebates inexchange of having specific medications listed on the formulary. By aggregating purchasing and administration for planmembers, they are able to save significant costs through negotiating discounts on drugs with pharmaceuticalmanufacturers themselves.8Edelweiss Securities Limited

Sector UpdateEdelweiss Securities Limited, Edelweiss House, off C.S.T. Road, Kalina, Mumbai – 400 098.Board: (91-22) 4009 4400, Email: research@edelweissfin.comADITYANARAINAditya NarainHead of Researchaditya.narain@edelweissfin.comDigitally signed by ADITYA NARAINDN: c IN, o EDELWEISS SECURITIESLIMITED, ou HEAD RESEARCH,cn ADITYA NARAIN,serialNumber a1c30092792c20, postalCode 400005,2.5.4.20 f423fd58c07b02, st MaharashtraDate: 2017.11.21 12:15:16 05'30'Coverage group(s) of stocks by primary analyst(s): PharmaceuticalsAurobindo Pharma, Cadila Healthcare, Cipla, Divi's Laboratories, Dr.Reddys Laboratories, Glenmark Pharmaceuticals, Ipca Laboratories, Lupin, NatcoPharma, Sun Pharmaceuticals Industries, Torrent PharmaceuticalsRecent ResearchRecent ResearchDateCompanyTitlePrice (INR) RecosDateCompanyTitlePrice (INR) Recos02-Jan-14IPCAThe growth prescription;729Buy15-Nov-17 LaboratoriesIpcaChallenges526ReduceVisitNote persist;Laboratories Result Update23-Dec-13TorrentAggressive M&A valuations to480Hold14-Nov-17 PharmaSunPerformancein-linewith526BuystrainROCE; EventUpdatePharmamuted expectations;17-Dec-13RanbaxyReceivesapproval for generic418HoldResult UpdateLaboratories Felodipine ;14-Nov-17Cadila EdelFlashgLialda launch drives a strong448BuyHealthcare quarter; Result UpdateDistribution of Ratings / Market CapRating InterpretationEdelweiss Research Coverage UniverseRating Distribution** 1stocks under review 50bnHold16167ReduceRatingTotal11240Between 10bn and 50 bn 10bn1566211Expected toBuyappreciate more than 15% over a 12-month periodHoldappreciate up to 15% over a 12-month periodReducedepreciate more than 5% over a 12-month periodOne year price 161,500Nov-16(INR)Market Cap (INR)BuyDr Reddy Labs9Edelweiss Securities Limited

PharmaceuticalsDISCLAIMEREdelweiss Securities Limited (“ESL” or “Research Entity”) is regulated by the Securities and Exchange Board of India (“SEBI”) and islicensed to carry on the business of broking, depository services and related activities. The business of ESL and its Associates (listavailable on www.edelweissfin.com) are organized around five broad business groups – Credit including Housing and SMEFinance, Commodities, Financial Markets, Asset Management and Life Insurance.This Report has been prepared by Edelweiss Securities Limited in the capacity of a Research Analyst having SEBI RegistrationNo.INH200000121 and distributed as per SEBI (Research Analysts) Regulations 2014. This report does not constitute an offer orsolicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Securities asdefined in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 includes Financial Instruments and CurrencyDerivatives. The information contained herein is from publicly available data or other sources believed to be reliable. This report isprovided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Theuser assumes the entire risk of any use made of this information. Each recipient of this report should make such investigation as itdeems necessary to arrive at an independent evaluation of an investment in Securities referred to in this document (including themerits and risks involved), and should consult his own advisors to determine the merits and risks of such investment. Theinvestment discussed or views expressed may not be suitable for all investors.This information is strictly confidential and is being furnished to you solely for your information. This information should not bereproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or inpart, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen orresident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or usewould be contrary to law, regulation or which would subject ESL and associates / group companies to any registration or licensingrequirements within such jurisdiction. The distribution of this report in certain jurisdictions may be restricted by law, and personsin whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the dateof this report and there can be no assurance that future results or events will be consistent with this information. This informationis subject to change without any prior notice. ESL reserves the right to make modifications and alterations to this statement asmay be required from time to time. ESL or any of its associates / group companies shall not be in any way responsible for any lossor damage that may arise to any person from any inadvertent error in the information contained in this report. ESL is committedto providing independent and transparent recommendation to its clients. Neither ESL nor any of its associates, group companies,directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequentialincluding loss of revenue or lost profits that may arise from or in connection with the use of the information. Our proprietarytrading and investment businesses may make investment decisions that are inconsistent with the recommendations expressedherein. Past performance is not necessarily a guide to future performance .The disclosures of interest statements incorporated inthis report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed inthe report. The information provided in these reports remains, unless otherwise stated, the copyright of ESL. All layout, design,original artwork, concepts and other Intellectual Properties, remains the property and copyright of ESL and may not be used inany form or for any purpose whatsoever by any party without the express written permission of the copyright holders.ESL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason includingnetwork (Internet) reasons or snags in the system, break down of the system or any other equipment, server breakdown,maintenance shutdown, breakdown of communication services or inability of the ESL to present the data. In no event shall ESL beliable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses orexpenses arising in connection with the data presented by the ESL through this report.We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customerssimultaneously, not all customers may receive this report at the same time. We will not treat recipients as customers by virtue oftheir receiving this report.ESL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time totime, have long or short positions in, and buy or sell the Securities, mentioned herein or (b) be engaged in any other transactioninvolving such Securities and earn brokerage or other compensation or act as a market maker in the financial instruments of thesubject company/company(ies) discussed herein or act as advisor or lender/borrower to such company(ies) or have otherpotential/material conflict of interest with respect to any recommendation and related information and opinions at the time ofpublication of research report or at the time of public appearance. ESL may have proprietary long/short position in the abovementioned scrip(s) and therefore should be considered as interested. The views provided herein are general in nature and do notconsider risk appetite or investment objective of any particular investor; readers are requested to take independent professionaladvice before investing. This should not be construed as invitation or solicitation to do business with ESL.10Edelweiss Securities Limited

Sector UpdateESL or its associates may have received compensation from the subject company in the past 12 months. ESL or its associates mayhave managed or co-managed public offering of securities for the subject company in the past 12 months. ESL or its associatesmay have received compensation for investment banking or merchant banking or brokerage services from the subject company inthe past 12 months. ESL or its associates may have received any compensation for products or services other than investmentbanking or merchant banking or brokerage services from the subject company in the past 12 months. ESL or its associates havenot received any compensation or other benefits from the Subject Company or third party in connection with the research report.Research analyst or his/her relative or ESL’s associates may have financial interest in the subject company. ESL and/or its GroupCompanies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise in theSecurities/Currencies and other investment products mentioned in this report. ESL, its associates, research analyst and his/herrelative may have other potential/material conflict of interest with respect to any recommendation and related information andopinions at the time of publication of research report or at the time of public appearance.Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchangerates can be volatile and are subject to large fluctuations; ( ii) the value of currencies may be affected by numerous marketfactors, including world and national economic, political and regulatory events, events in equity and debt markets and changes ininterest rates; and (iii) currencies may be subject to devaluation or government imposed exchange controls which could affect thevalue of the currency. Investors in securities such as ADRs and Currency Derivatives, whose values are affected by the currency ofan underlying security, effectively assume currency risk.Research analyst has served as an officer, director or employee

McKesson-Walmart deal (announced in May 2016) is visible, in the Econdisc-WBAD (announced in May 2017) deal, we understand, negotiations for new products have already begun and complete impact should be apparent by mid CY18. Walgreens 15% CVS Retail 14% Express Scripts Mail Order Pharmacy 11% CVS Mai