Transcription

Access a world of market opportunity.Diversify and take advantage of current market opportunities with contracts covering allmajor asset classes including forex, stock indexes, agricultural commodities, energy,metals and interest rates. Learn more in the CME Group Resource Center under IBExchange Tutorials.Trade CME Group markets: Equivalent market exposure with lower capital requirements No uptick rule or short selling restriction Around the clock markets eliminate overnight gap risk inherent in other markets Financial safeguards of a regulated exchangeThe CME Group is a trademark of CME Group Inc. The Globe Logo, CME and Globex are trademarks of Chicago Mercantile Exchange Inc. The Chicago Board ofTrade are trademarks of the Board of Trade of the City of Chicago. NYMEX is a registered trademark of New York Mercantile Exchange, Inc. All other trademarks arethe property of their respective owners. 2010 CME Group. All rights reserved1

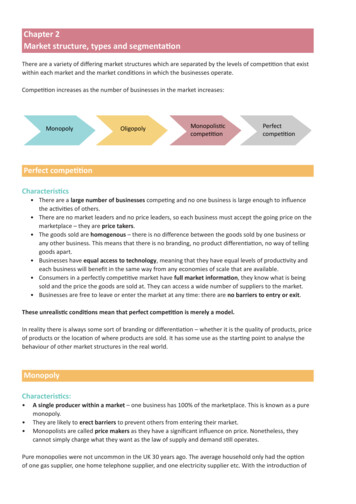

COMEX (Globex)ProductGoldmiNY GoldE-Micro GoldSilvermiNY SilverHigh Grade CopperSize100 oz50 oz10 oz5,000 oz2,500 oz25,000 lbsCodeGCQOMGCSIQIHGTypeFutures / OptionsFuturesFuturesFutures / OptionsFuturesFutures / FinancialPhysicalCodePLPAUXHRCTypeFutures / OptionsFutures / ancialFinancialNYMEX (Globex)ProductSizePlatinum50 ozPalladium100 ozUxC Uranium Swap Futures250 lbsSteel Coil, U.S. Domestic HR 20 Short Tons 2010 CME Group. All rights reserved2

E-Micro Gold Futures The launch of the E-Micro Gold Futures contract, though still in it’sinfancy, has shown significant promise to becoming a successfuland useful product for the retail and institutional customer. The dramatic increase in the price for Gold and the notional valuefor the Gold Futures contract has made the E-Micro Gold Futurescontract more attractive to smaller retail investors Physical Delivery makes Gold futures contracts more attractive asthe appeal of Gold as an investment is ultimately dependent on it’sstatus as an asset with limited supply. In the psychology of themarket, physical delivery implies that its limited availability issafeguarded. Liquidity, as measured by bid/ask spreads on quote size, isgreatest when overseas markets are open. This includes the 4:00p.m. to 9:00 p.m. period when European markets are most active.The afternoon (2:00 a.m. to 4:00 a.m.) also exhibits an increase inliquidity as arbitrage with the ETF markets becomes most active.** Times are in Singapore time zone 2010 CME Group. All rights reserved3

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDiNapoli Levels- Advanced Fibonacci AnalysisUsing Fibonacci Levels toIdentify Turning Points inMetal MarketsPresented by Jason ZengPinpoint your Entry,Stop placement,and Profit Objectivesahead of market action.http://www.fibtradercn.comemail: fibtradercn@gmail.comDisclaimer: The information contained herein is subject to change without notice and was obtained from sources believed to be reliable, but is notguaranteed as to accuracy or completeness. Those using the materials for trading purposes are responsible for their own actions. No guarantee ismade that trading signals or methods of analysis will be profitable or will not result in losses. It should not be assumed that performance will equalor exceed past results.4 4

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comMetals markets have been experiencingan explosive bull runsince the end of 2008 5

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comGold - an explosive bull run since the end of 2008 6

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comSilver - an explosive bull run since the end of 2008 7

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comCopper - an explosive bull run since the end of 2008 8

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comMetals markets have been experiencingan explosive bull market since the end of 2008Along with the metals prices gettinghigher and highermore and more traders join the game 9

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comMany Successful traders masterTechnical Analysis10

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comThree major Technical Analysis Schools:WD Gann TheoryElliott Wave PrincipleFibonacci Trading Methods11

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comWD Gann theory and Elliott wave principleare good trading methodsThis presentation will focus onFibonacci trading methods12

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comNot the regular Fibonacci trading methods,But an Advanced Fibonacci Trading Method:DiNapoli-Levels13

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing the advanced Fibonacci Trading Method DiNapoli-LevelsTo identify markets’ turning points ahead of time:1) What is DiNapoli-Levels?2) What advantages does DiNapoli-Levels have?3) How to use it to identify the metal markets turning points?4) Current Gold market analysis14

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.com1) What are DiNapoli-Levels?15

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDiNapoli-Levelswas created by Mr. Joe DiNapoli in themid-1980’sIt is one of three leading indicatorsMr. DiNapoli developed16

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comFIBONACCI NUMBERS1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233,610, 987, 1597, 2584, 4181, 6765,10946, 17711, 28657, 46368, 75025,121393, 196418, 317811 . . . . . . .17

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comFIBONACCI TOOLS Fibonacci Arcs Fibonacci Circles Fibonacci Fans Fibonacci Time Counts Fibonacci Regression Most Fibonacci Clusters18

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comPOPULAR FIBONACCI RATIOSRETRACEMENT RATIOSX.146X.236X.090.382 *EXPANSION RATIOS.618 *1.00 *X1.500X1.382.500X1.618 *.618 *2.618X19

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comHere's What DiNapoli-Levels Use . . .TWO RETRACEMENT RATIOSRATIOSTHREE EXPANSION.382.618.6181.001.61820

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comBASIC RETRACEMENT ANALYSIS UTILIZING THE TWOMAJOR RATIOS .382 AND .61821

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comFIBNODE EQUATIONSHere are the equations relatingto the above criteria.FIBNODE EQUATIONSF3 B - .382(B-A)F5 B - .618(B-A)F3 is the 3/8 Fibnode or .382retracement .F5 is the 5/8 Fibnode or .618retracement .22

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comBASIC RETRACEMENT ANALYSIS UTILIZING THE TWOMAJOR RATIOS .382 AND .61823

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDiNapoli-Levels:F3 0.382 RetracementF5 0.618 Retracement24

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comBASIC FIBONACCI EXPANSION ANALYSIS UTILIZING THETHREE MAJOR EXPANSION RATIOS .618, 1.0, AND 1.618:ACXO POPBCO PCO PBCOPACHART 6BCHART 6AXO P25

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comOBJECTIVE POINT EQUATIONSOBJECTIVE POINT EQUATIONSOP B - A COBJECTIVE POINTCOP .618 (B -A) CCONTRACTED OBJECTIVE POINTXOP 1.618 (B - A) C EXPANDED OBJECTIVE POINT26

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comBASIC FIBONACCI EXPANSION ANALYSIS UTILIZING THETHREE MAJOR EXPANSION RATIOS .618, 1.0, AND 1.618:27

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDiNapoli-Levels:COP 0.618 ExpansionOP 1.0 ExpansionXOP 1.618 Expansion28

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comAdvancedD-Levels29

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDropping your time frameweeklydailyReactionnot visible inthe weekly30

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comADVANCED FIBONACCI ANALYSIS WITH 2 REACTIONSB0F3F51AFCONFLUENCE KF3F5LINEAGE MARKINGS231

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comADVANCED FIBONACCI ANALYSIS WITH 3 REACTIONSF3 Reaction LowsF3F56 Fibnodes2 Confluence Areas12F3K1F5F3K2F5332

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comADVANCED FIBONACCI ANALYSIS33

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDiNapoli-Levels:Agreement the area of logical objective points(COP, OP orXOP) and finnodes (F3 or F5) getting closer to each other34

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comADVANCED FIBONACCI ANALYSIS35

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDiNapoli-Levels:Confluence the area of F3 and F5 nearing each other36

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDiNapoli-Levels:Retracement: F3 0.382 & F5 0.618Expansion: COP, OP and XOPConfluence Area - KAgreement Area - A37

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.com2) What advantages do D-Levels have?38

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comD-Levels vs. Regular Fibonacci Levels1-Quality2-Clarity3-Ease of useTraders need a plan that allowsthem to pull the trigger!39

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comD-Levels vs. Regular Fibonacci Levels - Quality40

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comD-Levels vs. Regular Fibonacci Levels - Quality41

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comD-Levels vs. Regular Fibonacci Levels - Clarity42

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comD-Levels vs. Regular Fibonacci Levels - Clarity43

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comD-Levels vs. Regular Fibonacci Levels – Ease of UseQuality, Clarity and Ease of Use Combined !44

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comD-Levels vs. Regular Fibonacci Levels1-Quality2-Clarity3-Ease of useTraders need a plan that allowsthem to pull the trigger!45

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.com3) How to use D-Levels to identify themetals markets turning points?46

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.com3) How to use D-Levels to identify themetals markets turning points?A. Gold futures marketB. Silver futures marketC. Copper futures market47

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.com1) Using D-Levels to identify Gold market turning pointsMr. Joe DiNapoli’s famousGold market prediction48

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning pointsJoe’s original chart – South Africa TV interview49

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning pointsGold Top728Joe’s original chart50

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning points1026728Joe first visit ChinaJoe’s original chart51

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning points1033Massive drop after 1033 was hitJoe’s original chart52

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning points53

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning points54

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning points159055

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning pointsLow risk/high reward entry areasduring the Gold bull run56

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning pointsLow risk/high reward entry areas – After Gold hit the COP 72857

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning pointsLow risk/high reward entry areas – After Gold hit the OP 102658

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Gold market turning pointsLow risk/high reward entry areas59

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.com2) Using D-Levels to identify Silver market turning points60

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Silver market turning points49094982Caught the recent top!61

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Silver market turning pointsCaught the recent support!62

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.com3) Using D-Levels to identify Copper market turning points63

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Copper market turning pointsCaught a major top 36264

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Copper market turning pointsCaught a major top 36265

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Copper market turning pointsCaught a major top 36266

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Copper market turning pointsCaught a major top 36267

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Copper market turning pointsCaught a retracement bottom 27268

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Copper market turning pointsFrom 272 to the recent top 46269

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comUsing D-Levels to identify Copper market turning points444448Caught the recent top 462 and various support levels70

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comD-Levels have been every effective toidentify the metal markets’ turning points71

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.com4) Current Gold market analysis What would I like to trade72

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comFirst of all, I would like to briefly talk aboutthe importance of selecting right instrumentsto participate in the marketsMany Chinese traders suffered big lossesduring the sudden drop of the Gold and Silvermarkets in early May this year73

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comThe importance of selecting right instruments to participate the metal markets49094982Silver’s huge drop in a week74

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comThe importance of selecting the right instruments to participate in the metal marketsCME metals products are good choices toparticipate in the metals marketsfor futures traders Transparent Volume Liquidity Global 24-hour access75

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comCurrent Gold market analysisYearly Chart76

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comCurrent Gold market analysisQuarterly Chart77

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comCurrent Gold market analysisMonthly Chart78

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comCurrent Gold market analysisSupportedat D-LevelWeekly Chart79

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comCurrent Gold market analysisDaily Chart80

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comDiNapoli Trading Method is amodulated judgmental trading systemDiNapoli-Levels (narrow definition) is only one ofthree Mr.DiNapoli’s leading indicators9 Directional SignalsOS/OB analysisEntry and stop tacticsetc 81

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comWhere and how to learnmore about theDiNapoli-Levels?82

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comTHE BEST SINGLE SOURCE TO LEARN DiNapoli-Levels83

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comTHE BEST SINGLE SOURCE TO LEARN DiNapoli-LevelsThe book has been translated into many languages– this is the Chinese translation84

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comMr. Joe DiNapoli and Me in US Traders Expo85

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comBesides the books,Joe DiNapoli and I alsoprovide training seminars86

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comFibtrader.comYou can find the book, software and other products there87

Using Fibonacci Levels to Identify Turning Points in Metal hinese Website88

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comMy email address:fibtradercn@gmail.com89

Using Fibonacci Levels to Identify Turning Points in Metal Marketsfibtradercn.comThank you!90

Direct Access TradingWorldwide91

Why IB Global Offerings Best Execution Low Costs Superior Trading Technology Risk Management Comprehensive Reporting Strength & Security92

IB’s Trader Workstation (TWS)The Professional’s Gateway to the World’s Markets93

Scale traderThe TWS ScaleTrader is a flexible, automated tradingalgorithm that lets you scale into a large position withoutbeing subject to increasingly deteriorating prices, or tradecontinually over a specified price range to capture a userdefined profit offset amount.94

Chart Trader95

Perry TsePhone: 852 2156 7990Fax: 852 2509 4102Interactive Brokers LLC Hong KongSuite 1512 Two Pacific Place, 88 Queensway,Admiralty, Hong ers.com When you apply for the application, please selectPerry Tse as the sales representative, so i can assistyou on structural matters.96

Fibonacci trading methods. 12. Using Fibonacci Levels to Identify Turning Points in Metal Markets fibtradercn.com Not the regular Fibonacci trading methods, But an Advanced