Transcription

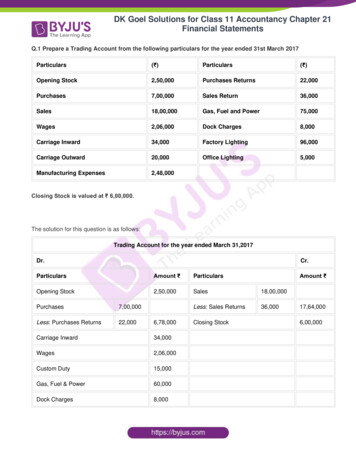

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQ.1 Prepare a Trading Account from the following particulars for the year ended 31st March 2017Particulars( )Particulars( )Opening Stock2,50,000Purchases Returns22,000Purchases7,00,000Sales Return36,000Sales18,00,000Gas, Fuel and Power75,000Wages2,06,000Dock Charges8,000Carriage Inward34,000Factory Lighting96,000Carriage Outward20,000Office Lighting5,000Manufacturing Expenses2,48,000Closing Stock is valued at 6,00,000.The solution for this question is as follows:Trading Account for the year ended March 31,2017Dr.Cr.ParticularsAmount ParticularsOpening Stock2,50,000Sales18,00,000Less: Sales Returns36,000Purchases7,00,000Less: Purchases Returns22,0006,78,000Carriage Inward34,000Wages2,06,000Custom Duty15,000Gas, Fuel & Power60,000Dock Charges8,000Closing StockAmount 17,64,0006,00,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsManufacturing Expenses2,48,000Factory Lighting96,000Gross Profit (Balancing Figure)7,69,00023,64,00023,64,000Q. 2(A) From the following information, prepare the Trading Account for the year ended 31st March, 2017:Adjusted Purchases 15,00,000; Sales 21,40,000; Returns Inwards 40,000; Freight and Packing 15,000; Packing Expenses on Sales 20,000; Depreciation 36,000; Factory Expenses 60,000; ClosingStock 1,20,000.The solution for this question is as follows:Trading Account for the year end March 31, 2017Dr.Cr.ParticularsAmount ParticularsAdjusted Purchases15,00,000Sales21,40,000Freight & Packing15,000Less: Return Inwards40,000Factory Expenses60,000Gross Profit (Balancing Figure)5,25,00021,00,000Amount 21,00,00021,00,000Note: Since closing stock is already adjusted in purchases. Therefore, the closing stock will not be on the Creditside of Trading AccountAdjusted Purchases Opening Stock Net Purchases – Closing Stock

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQ.2(B) Calculate Gross Profit from the following information: Closing usted Purchase5,50,000The solution for this question is as follows:Dr.Cr.ParticularsAmount ParticularsAmount Adjusted Purchase5,50,000Sales6,88,000Wages40,000Gross Profit (Balancing Figure)98,0006,88,0006,88,000Note: Since the adjusted purchases are already given, the stocks will not be considered while calculating GrossProfit.

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQuestion 3(A)Calculate cost of goods sold from the following: Opening Stock40,000Wages & Salaries10,000Net Purchases50,000Rent Paid15,000Net Sales1,90,000Closing Stock15,000The solution for this question is as follows:Cost of Goods Sold Opening Stock Purchases Direct Expenses – Closing StockCost of Goods Sold 40,000 50,000 10,000 – 15,000 85,000Question 3(B)Ascertain cost of Goods Sold and Gross Profit from the following: Opening Stock32,000Purchases2,80,000Direct Expenses20,000Indirect Expenses45,000Closing Stock50,000Sales4,00,000Sales Returns8,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsThe solution for this question is as follows:Gross Profit Net Sale- Cost of Goods SoldCost of Goods Sold Opening Stock Net Purchases Direct Expenses – Closing StockCost of Goods Sold 32,000 2,80,000 20,000 – 50,000 2,82,000Net Sale Sales – Sales Return 4,00,000 – 8,000 3,92,000Therefore, Gross Profit 3,92,000 – 2,82,000 1,10,000Q.4 Calculate Gross Profit on the basis of the following information: Purchases6,80,000Return Outwards30,000Carriage Inwards20,000Carriage Outwards15,000Wages50,0003/4 of the goods are sold for 6,00,000.The solution for this question is as follows:Cost of Goods Sold Opening Stock Net Purchases Direct Expenses – Closing StockNet Purchases Purchase – Purchase Return 6,80,000 – 30,000 6,50,000Direct Expense Carriage Inwards Wages 20,000 50,000 70,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsCost of Goods Sold 0 6,50,000 70,000 – 0 7,20,0003/4th of the goods is sold for 6,00,000Cost 3/4th of the sold goods 3/4th X 7,20,000 5,40,000Gross Profit Net Sale - Cost of Goods Sold 6,00,000 – 5,40,000 60,000Q.5(A) Calculate Closing Stock and Cost of Goods Sold:Opening Stock 5,000; Sales 16,000; Carriage Inwards 1,000; Sales Returns 1,000; Gross Profit 6,000; Purchase 10,000; Purchase Returns 900.The solution for this question is as follows:Cost of Goods Sold Net Sale – Gross Profit 15,000 – 6,000 9,000Cost of Goods Sold Opening Stock Net Purchases Direct Expenses – Closing Stock9,000 5,000 (10,000 900) 1,000 – Closing StockClosing Stock 15,100 – 9,000 6,100Q.5(B) Calculate Closing Stock from the following:Particulars( )Particulars( )Opening Stock38,000Sales3,60,000Purchases3,40,000Return Inwards5,000Return Outwards4,000Gross Loss20,000Freight Inwards26,000The solution for this question is as follows:Cost of Goods Sold Net Sale – Gross Profit (3,60,000 – 5,000) 20,000 3,75,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsCost of Goods Sold Opening Stock Net Purchases Direct Expenses – Closing Stock3,75,000 38,000 (3,40,000 -4,000) 26,000 – Closing StockClosing Stock 4,00,000 – 3,75,000 25,000Q.6 From the following information, prepare the Trading Account for the year ended 31st March, 2017: Cost of Goods Sold12,10,000Opening Stock50,000Closing Stock80,000Carriage Inwards15,000Sales15,00,000The solution for this question is as follows:Trading AccountDr.Cr.ParticularsAmount ParticularsAmount Cost of Goods Sold12,10,000Sales15,00,000Gross Profit (Balancing Figure)2,90,00015,80,00015,80,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQ.7(A) Calculate gross profit and cost of goods sold from the following information:Net Sales 8,00,000Gross Profit is 40% on SalesThe solution for this question is as follows:Gross Profit 40% of sale 40/100 X 8,00,000 3,20,000Cost of Goods sold Sales – Gross Profit 8,00,000 – 3,20,000 4,80,000Q.7(B) Calculate gross profit and cost of goods sold from the following information:Net Sales 12,00,000Gross Profit33 ½ %The solution for this question is as follows:Gross Profit 33 ½ % on sale 100 / 3X100 X 12,00,000 12,00,000 / 3 4,00,000Cost of Goods sold Sales – Gross Profit 12,00,000- 4,00,000 8,00,000Q.8 Calculate the gross profit and cost of goods sold from the following information:Net Sales 9,00,000Gross Profit is 20% on cost.The solution for this question is as follows:Gross Profit 20% on cost or 15th on cost15th on cost 16th on sales

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsTherefore, Gross Profit 16 X 9,00,000 1,50,000Cost of Goods Sold Sales – Gross Profit 9,00,000 – 1,50,000 7,50,000Q.9 Ascertain the value of the closing stock from the following: Opening Stock1,20,000Purchases during the year9,30,000Sales during the year15,60,000Rate of Gross Profit40% on SalesThe solution for this question is as follows:Gross Profit 30% on costLet the cost of sold goods be ‘x’Gross Profit And Gross profit Cost of Goods Sold Opening Stock Net Purchases Direct Expenses – Closing Stock15,00,000 4,80,000 13,60,000 0 – Closing StockClosing Stock 18,00,000 – 15,00,000 3,40,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQ.10 Calculate Net Sales and G.P. from the following:Cost of Goods Sold 4,50,000G.P.25% on SalesThe solution for this question is as follows:Gross Profit 25% on sales or 1/4th on sales14 on sales 13rd on costGross Profit 13 X 4,50,000 1,50,000Cost of Goods sold Sales – Gross Profit4,50,000 Sales – 1,50,000Sales 6,00,000Q.11 Prepare Profit and Loss Account for the year ended 31st March, 2017 from the following particulars:Particulars( )Particulars( )General expenses12,000Gross profit7,69,000Charity3,000Carriage Outwards20,000Office Lighting5,000Office Expenses16,000Law Charges5,800Fire Insurance Premium18,000Advertisement14,200Telephone Expenses13,500Bank charges1,200Establishment expenses2,500Commission7,000Miscellaneous Expenses7,100Rent, Rates and Taxes30,000Discount Received6,200Interest on investments12,000Traveller’s salary60,000Sundry Receipts6,000Repair4,300Indirect expenses2,100Commission Cr.2,000Printing and Stationery1,500

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsThe solution for this question is as follows:Profit and Loss Account for the year ended March 31, 2017Dr.Cr.ParticularsAmount ParticularsAmount General Expenses12,000Gross Profit7,69,000Charity3,000Interest on Investments12,000Office Lighting5,000Sundry Receipts6,000Law Charges5,800Discount Received6,200Advertisement14,200Commission Received2,000Bank Charges1,200Commission7,000Rent, Rates and Taxes30,000Indirect Expenses2,100Printing & Stationery1,500Carriage Outwards20,000Office Expenses16,000Fire Insurance Premium18,000Telephone Expenses13,500Establishment Expenses2,500Miscellaneous Expenses7,100Traveller’s Salary60,000Repair4,300

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsNet Profit5,72,0007,95,2007,95,200Q.12 Calculate the amount of gross profit, operating profit and net profit on the basis of the followingbalances extracted from the books of M/s Rajiv & Sons for the year ended March 31, 2017. Opening Stock50,000Net Sales11,00,000Net Purchases6,00,000Direct Expenses60,000Administration Expenses45,000Selling and Distribution Expenses65,000Loss due to Fire20,000Closing Stock70,000The solution for this question is as follows:

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsTrading Account for the year ended March 31, 2017Dr.Cr.ParticularsAmount ParticularsAmount Opening Stock50,000Net Sales11,00,000Net Purchases6,00,000Closing Stock70,000Direct Expenses60,000Gross Profit (Balancing Figure)4,60,00011,70,00011,70,000Profit and Loss Account for the year ended March 31, 2017Dr.Cr.ParticularsAmount ParticularsAmount Administration Expenses45,000Gross Profit4,60,000Selling & Distribution Expenses65,000Loss by Fire20,000Net Profit3,30,0004,60,0004,60,000Working Note:Operating Profit Net Profit Non-Operating Income Non-Operating Expenses 3,30,000 0 20,000 Rs 3,50,000Operating Profit Net Profit Non-Operating Income Non-Operating Expenses 3,30,000 0 20,000 Rs 3,50,000Since, loss by fire is a non-operating expense, therefore, it is added to the net profit to appear on the operatingprofit.

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQ.13 Calculate the operating profit from the following: Net Profit5,00,000Dividend Received6,000Loss on sale of Furniture12,000Loss by Fire50,000Salaries1,20,000Interest on Loan from Bank10,000Rent Received24,000Donation5,100The solution for this question is as follows:Operating Profit Net Profit Non-Operating Income Non-Operating ExpensesNon-Operating Income Dividend Received Rent Received 6,000 24,000 30,000Non-Operating Expenses Loss on Sale of Furniture Loss by Fire Interest on Loan Donation 12,000 50,000 10,000 5,100 77,100Operating Profit 5,00,000 30,000 77,100 5,47,100Operating Profit Net Profit Non-Operating Income Non-Operating ExpensesNon-Operating Income Dividend Received Rent Received 6,000 24,000 30,000Non-Operating Expenses Loss on Sale of Furniture Loss by Fire Interest on Loan Donation 12,000 50,000 10,000 5,100 77,100Operating Profit 5,00,000 30,000 77,100 5,47,100

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsNote: Salary is an operating expense and taken while evaluating net profit, so, it will not be calculated now.Q.14 A merchant has earned a Net Profit of 57,200 for the year ended 31st March 2017. Other balancesin his Ledger are as under: Dr. Balances Cr. Balances Cash at Bank4,800Bills Payable3,200Cash in Hand1,200Creditors61,300Furniture and 0Closing Stock70,000Motor Car40,000Building1,50,000Plant and Machinery1,20,000Bills re his Balance Sheet as at 31st March, 2017.The solution for this question is as follows:

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsTrading AccountDr.Cr.ParticularsAmount ParticularsOpening Stock40,000Sales1,27,000Less: Sales Returns1,500Purchases60,000Less: Purchases Returns1,27558,725Wages10,000Freight inwards1,000Gross Profit (Balancing Figure)50,775Amount 1,25,500Closing Stock35,0001,60,5001,60,500Profit and Loss AccountDr.Cr.ParticularsAmount ParticularsAmount Discount Allowed350Gross Profit50,775Bank Charges100Discount Received800Salaries7,000Freight Outwards1,200Rent, Rates and Taxes2,000Advertisement2,000Net Profit38,92551,57551,575

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsBalance SheetAmount LiabilitiesCapital1,13,075Add: Net Profit38,925AssetsAmount Fixed Assets1,52,000Current LiabilitiesPlant & Machinery90,000Current AssetsSundry Creditors20,000Sundry Debtors45,000Bills Payable5,000Cash at Bank7,000Closing Stock35,0001,77,0001,77,000Q. 15 Following is the Trial Balance of Sh. Damodar Parshad as at 31st March, 2016: Dr. Balances( )Cr. Balances( )Stock 1-4-201510,000Discount Received750Purchases58,000Return Outwards2,600Wages4,700Sales98,650Returns Inwards3,520B/P3,000Carriage on Purchases2,360Sundry Creditors5,600Carriage on Sales710Creditors for Rent500Office Salaries4,800Capital40,000Rent and Taxes2,400Loan from X10,000Cash1,100Commission1,200Bank Balance7,820

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsBad-debts600Discount allowed640Land and Building20,000Scooter6,600Scooter Repairs850B/R3,500Commission1,800Sundry Debtors25,400Interest on X‘s Loan1,500Drawings6,0001,62,3001,62,300Prepare a Trading and Profit and Loss Account for the year ended on 31-3-2016 and the Balance Sheet asat that date. The Stock on 31st March, 2016 was 22,000.The solution for this question is as follows:

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsTrading Account of Sh. Damodar ParshadDr.Cr.ParticularsAmount ParticularsOpening Stock10,000Sales98,650Less: Return Inwards3,520Purchases58,000Less: Return Outwards2,60055,400Wages4,700Carriage on Purchase2,360Gross Profit (Balancing Figure)44,6701,17,130Closing StockAmount 95,13022,0001,17,130

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsProfit and Loss AccountDr.Cr.ParticularsAmount ( )ParticularsAmount ( )Carriage on sales710Gross Profit44,670Office Salaries4,800Discount Received750Rent & Taxes2,400Commission1,200Bad Debts600Discount Allowed640Scooter Repairs850Commission1,800Interest on X’s Loan1,500Net Profit33,32046,62046,620

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsBalance Sheetas on March 31, 2016Amount ( )LiabilitiesAssetsAmount ( )Capital40,000Fixed AssetsAdd: Net Profit33,320Land & Building20,000Less: Drawings6,000Scooter6,600Loan from X67,32010,000Current LiabilitiesCurrent AssetsCreditors5,600Closing Stock22,000Bills Payable3,000Debtors25,400Creditors for Rent500Bills Receivable3,500Cash at bank7,820Cash in hand1,10086,42086,420Q.16 From the following balances extracted from the books of Sh. Badri Vishal on 31st March, 2017,prepare a Trading Account, P & L A/c and a Balance Sheet. Closing Stock valued on that date was 15,000.Dr.Cr.( )( )CapitalHousehold Expenses1,28,20010,000SalesReturn inwardsReturn outwards1,80,0004,0006,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsPurchases1,50,000Cash at Shop1,600Bank OverdraftInterest on Overdraft15,0001,500Creditors17,800Stock at the Commencement18,000Freight8,500Rent and Taxes7,000Debtors32,600Commission3,000Freehold property30,000Sundry expenses3,900Salaries and wages20,000Life Insurance Premium1,800Insurance Premium1,600Motor ge inwards2,000Carriage outwards800Power2,200Audit Fee1,700Lighting2,0003,50,0003,50,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsThe solution for this question is as follows:Trading Account of Sh. Badri VishalDr.Cr.ParticularsAmount ParticularsOpening Stock18,000Sales1,80,000Less: Return Inwards4,000Purchases1,50,000Less: Return Outwards6,0001,44,000Freight8,500Carriage Inwards2,000Power2,200Gross Profit (Balancing Figure)16,300Amount Closing Stock15,0001,91,0001,91,000Profit and Loss Account for the year ended March 31, nt (Rs)(Rs)Interest on Overdraft1,500Gross Profit16,300Rent & Taxes7,000Commission Received2,200Commission3,000Interest Received800Sundry Expenses3,900Net Loss (Balancing Figure)22,200Salaries & Wages20,000Insurance Premium1,600

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsCarriage Outwards800Audit Fees1,700Lighting2,00041,50041,500Balance Sheet as on March 31, 2017Amount LiabilitiesAssetsAmount Capital1,28,200Fixed AssetsLess: Net Loss22,200Freehold Property30,000Less: Drawings*11,800Motor Vehicle39,800Typewriter8,00094,200Current LiabilitiesCurrent AssetsCreditors17,800Closing Stock15,000Bank Overdraft15,000Debtors32,600Cash in hand1,6001,27,0001,27,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQ.17 From the following balances of the Ledger of Sh. Akhileshwar Singh, prepare Trading and Profit &Loss Account and Balance Sheet: Dr. Cr. Stock on 1-4-201630,000Stock on 31-3-201746,200Purchases and Sales2,30,0003,45,800Returns12,50015,200Commission on Purchases1,200Freight and Carriage26,000Wages and Salary10,800Fire Insurance Premium820Business Premises40,000Sundry Debtors26,100Sundry Creditors26,700Goodwill8,000Patents8,400Coal, Gas and Power12,100Printing and Stationery2,100Postage710Travelling Expenses4,250Drawings7,200Depreciation1,000General Expenses8,350Capital89,760

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsInvestments8,000Interest on InvestmentsCash in Hand8002,570Banker’s AccountCommission5,2004,600Loan on MortgageInterest on Loan30,0003,000B/P2,280B/R4,540Income Tax3,000Horses and Carts20,300Discount on Purchases1,6005,21,740The solution for this question is as follows:4,4005,21,740

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsTrading Account of Sh. Akhilesh SinghDr.Cr.ParticularsAmount ParticularsOpening Stock30,000Sales3,45,800Less: Sales Return12,500Purchases2,30,000Less: Purchases Return15,200Amount 3,33,3002,14,800Freight and Carriage26,000Commission on Purchases1,200Wages & Salaries10,800Coal, Gas and Power12,100Gross Profit (Balancing Figure)38,4003,33,3003,33,300

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsProfit and Loss AccountDr.Cr.ParticularsAmount ParticularsAmount Fire Insurance Premium820Gross Profit38,400Printing & Stationery2,100Interest on Investments800Postage & Telegram710Commission Received4,400Travelling Expenses4,250Discount Received1,600Depreciation1,000General Expenses8,350Commission4,600Interest on Loan3,000Net Profit20,37045,20045,200

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsBalance SheetAmount LiabilitiesAssetsAmount Capital89,760Fixed AssetsAdd: Net Profit20,370Goodwill8,000Less: Income tax3,000Business Premises40,000Less: Drawings7,20099,930Patents8,40030,000Horses and Carts20,300Loan on MortgageCurrent LiabilitiesCurrent AssetsCreditors26,700Closing Stock46,200Banker’s Account5,200Debtors26,100Bills Payable2,280Cash in Hand2,570Bills Receivable4,540Investment8,0001,64,1101,64,110

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQ.18 From the following balances prepare Final Accounts as at 31st March 2017: Particulars( )Particulars( )Stock 1-4-201623,500Freight In1,100Purchases46,800Freight Out3,000Sales1,30,000Rent (Factory 1/3, Office 2/3)7,500Productive Expenses27,000Legal Expenses800Unproductive Expenses5,800Miscellaneous Receipts500Trade Expenses1,200Sundry Debtors30,000Returns In6,600Sundry Creditors16,100Returns Out2,800Donation600Loose Tools7,200Bad-Debts4,750Trade Marks5,000Bad-Debts Recovered4,000Discount Cr.2,100Bank Charges2,800Salaries9,600Loan on Mortgage20,000Fixed Deposit with Punjab National Bank10,000Interest on Loan2,400Cash in Hand1,300Motor Vehicles50,000Leasehold Land60,000Capital1,37,450Life Insurance Premium6,000Value of Closing Stock was 36,500 on 31st March, 2017.

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsThe solution for this question is as follows:Trading Account for the year ended March 31, 2017Dr.Cr.ParticularsAmount ( )ParticularsOpening Stock23,500Sales1,30,000Less: Return Inwards6,600Purchases46,800Less: Return Outwards2,80044,000Freight Inwards1,100Productive Expenses27,000Rent (1/3 of 7,500)2,500Gross Profit (Balancing Figure)61,800Amount ( )Closing Stock1,23,40036,5001,59,9001,59,900Profit and Loss AccountDr.Cr.ParticularsAmount ( )ParticularsAmount ( )Freight Outwards3,000Gross Profit61,800Unproductive Wages5,800Discount Received2,100Trade Expenses1,200Misc. Receipts500Salaries9,600Bad Debts Recovered4,000Rent (2/3 of 7,500)5,000Legal Expenses800

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsDonation600Bad Debts4,750Bank Charges2,800Interest on Loan2,400Net Profit32,45068,40068,400Balance SheetLiabilitiesAmount AssetsAmount Capital1,37,450Fixed AssetsAdd: Net Profit32,450Trade Marks5,000Less: Drawings (Life Insurance Premium)6,0001,63,900Fixed Deposit with PNB10,00020,000Motor Vehicles50,000Leasehold Land60,000Loan on MortgageCurrent LiabilitiesSundry CreditorsCurrent Assets16,1002,00,000Closing Stock36,500Sundry Debtors30,000Cash in Hand1,300Loose Tools7,2002,00,000

DK Goel Solutions for Class 11 Accountancy Chapter 21Financial StatementsQ.19 Arrange assets in the order of permanence:Sundry Debtors, Stock, Investment, Land and Building, Cash in Hand, Motor Vehicle, Cash at Bank,Goodwill, Plant and Machinery, Furniture, Loose Tools, Marketable Securities.The solution for this question is as follows:Assets in the order of Permanence1. Goodwill2. Land and Building3. Plant and Machinery4. Motor Vehicle5. Loose Tools6. Furniture7. Investment (Long-term)8. Stock9. Sundry Debtors10. Marketable Securities (Short-term)11. Cash at Bank12. Cash in Hand

Gross Profit 40% of sale 40/100 X 8,00,000 3,20,000 Cost of Goods sold Sales – Gross Profit 8,00,000 – 3,20,000 4,80,000 Q.7(B) Calculate gross profit and cost of goods sold from the following information: Net Sales 12,00,000 Gross Profit