Transcription

ALLTHATGLITTERSIS NOTGOLDAN ANALYSIS OF US PUBLIC PENSION INVESTMENTS IN HEDGE FUNDSELIZABETH PARISIAN, AFT and SAQIB BHATTI, ROOSEVELT INSTITUTE

pleyear- ‐by- esponsibleforanEstimated tudied.Specifically,wefoundthat: nearlythree- ofpensionfundsanestimated ormance,hedgefundmanagerscollectedanestimated everydollarofnetreturntothepensionfund.1

diatelytakethefollowingsteps: hlow- ‐feealternatives. ofit- relation.Thisnewfindingreflectscorrecteddata.2

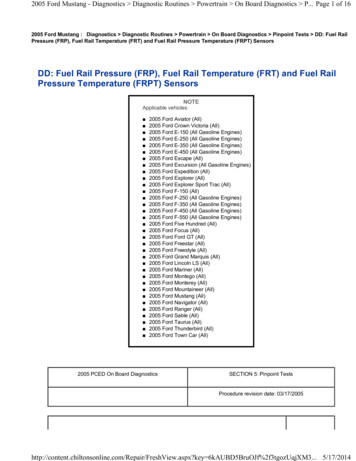

egulated,high- sandvolatilityprotectionfortheirinvestors.Asofmid- ‐2014, dgefunds,2andone- ddirectlybythepensionfunds,weconductedasimpleyear- ‐by- aswellasthe2008financialmeltdown—withawell- inghedgefundfeeswasdauntingduetoseveralfactors: www.ft.com/intl/cms/s/2/6252febe- ‐b150- ‐11e4- ‐831b- /samples/2015- ‐Preqin- ‐Global- ‐Hedge- ‐Fund- ‐Report- ‐Sample- ‐Pages.pdf.3

eedatawastoback- t: lythree- upofpensionfundsanestimated nouranalysispaidanestimated aidanestimated rdollarofnetreturnforasame- oduceapproximatelymorethandoublethereturnsofasame- ntlyseekinvestmentsthatprovidethehighestlong- alsoforpublicemployees,public4Asame- rrelation.Thisnewfindingreflectscorrecteddata.4

wo- ‐and- asispointisequaltoone- com/terms/t/two and m/news/2015/01/14/do- ‐pension- ‐funds- ‐add- entofLabor,www.dol.gov/ebsa/publications/401k employee.html.75

arkets,providingamorefavorablerisk- g/doi/pdf/10.2469/cp.v29.n4.4,pages14- ‐23.6

e29,2014,www.ft.com/intl/cms/s/0/b5ad4370- ‐fde7- ‐11e3- ‐acf8- essment,”IPAGBusinessSchoolworkingpaper2014- ‐103,www.ipag.fr/wp- ‐content/uploads/recherche/WP/IPAG WP 2014 egy”(April7,2015),alfaalliance.info/wp- ‐content/uploads/2015/04/Morgan- ‐Stanley- ‐on- ‐US- ‐strategy.pdf,22.7

orcapital,and,asaresult,investorslostanestimated andScottPatterson,“AHedge- com/rational- ‐irrationality/how- ‐do- ‐hedge- ‐funds- ‐get- ‐away- ‐with- ‐it- ‐eight- ndHedgeFundRisk,”1.8

overfive- ‐and10- whichleftitwitha17percentlossyear- ‐to- ntyear- ‐to- entinSeptemberandoff12.8percentyear- ‐to- .5percentyear- ‐to- anddown6.6percentyear- ‐to- (Hoboken,NJ:JohnWiley&Sons,2012),85- ytimes.com/2015/09/04/business/dealbook/a- ‐choppy- ‐august- ‐tested- ‐hedge- ‐funds- ‐and- ‐many- ‐stumbled.html? r 1.21MadisonMarriage,“ ‘ChaosandCarnage’ThreatenEmergingMarket- ,www.ft.com/intl/cms/s/0/308566c4- ‐5245- ‐11e5- ‐b029- e- ‐funds- ‐suffer- ‐biggest- ‐losses- ‐since- ‐the- ‐financial- ‐crisis.html.23SveaHerbst- .reuters.com/article/2015/10/01/us- ‐hedgefunds- ‐einhorn- /sites/nathanvardi/2015/10/01/billionaire- ‐bill- ‐ackmans- ‐hedge- ‐fund- ‐plunges- ‐12- ‐5- ‐in- ‐september/.25SveaHerbst- ‐Bayliss,“RPT- /2015/10/04/hedgefunds- ‐returns- ‐idUSL1N1222TK20151004.26Herbst- ‐Bayliss,“HedgeFundMoguls.”27Herbst- ‐Bayliss,“HedgeFundMoguls.”9

approximately 638billioninassetsundermanagement(AUM),and reported.Thepensionfundsincludedinthisanalysisare: nthisgrouphad 58billionintotalfundAUMand atareflectingtheprevious12- ‐monthperiod.Methodology10

rison,overtime,againstanotherwisewell- lpensionfundnetreturnsusingasame- ountforallfees(management,performance,pass- thodologytoestimatecosts:281. gassumptions: at1.8percentofassetsundermanagement(AUM). t18percentofgrossreturnlessmanagementfees.2. 1

3. hedgefundfees,40basispointsisused.4. omanagersfortheirhedgefundinvestmentsthanforasame- sanestimated ing: lythree- upofpensionfunds aidatotalof aid rnforasame- ng,Aug.15,2012,www.governing.com/blogs/by- ‐the- ‐numbers/gov- ‐state- ‐pension- ‐funds- ‐pay- ‐wall- ‐street- ‐investment- ‐fees.html31Asame- shedgefundassetallocation.3012

ame- ementfeesforasame- lowergrossreturnsintheaggregatethanasame- edgeFundFeesandNetReturnsvs.Same- eturntopensionfundFeescapturedbymanagers 934million 7.1billion 20.2billion sandlowreturnscomparedwithasame- onfund,seeourfund- ‐by- tscorrecteddata.3313

ensionfundswherewefoundsignificantcorrelation:14

ata.FIXEDINCOME:UNCORRELATEDRETURNSFO

all that glitters is not gold an analysis of us public pension investments in hedge funds eliz