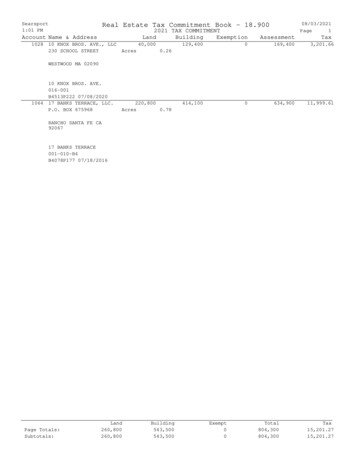

Transcription

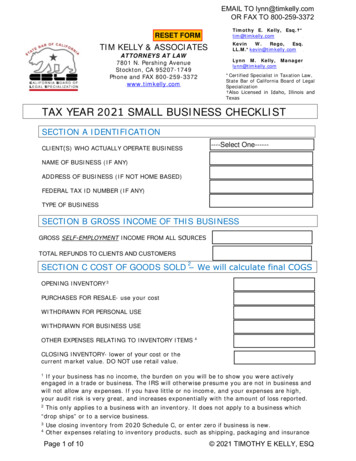

PRINT FORMEMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372RESET FORMTimothy E. Kelly, Esq.†*tim@timkelly.com31T31TTIM KELLY & ASSOCIATESATTORNEYS AT LAW7801 N. Pershing AvenueStockton, CA 95207-1749Phone and FAX q.LL.M.*kevin@timkelly.com31T31T1T31TLynn M. Kelly, Managerlynn@timkelly.com31T31T*Certified Specialist in Taxation Law,State Bar of California Board of LegalSpecialization†Also Licensed in Idaho, Illinois andTexasTAX YEAR 2021 SMALL BUSINESS CHECKLISTSECTION A IDENTIFICATION----Select One------CLIENT(S) WHO ACTUALLY OPERATE BUSINESSNAME OF BUSINESS (IF ANY)ADDRESS OF BUSINESS (IF NOT HOME BASED)FEDERAL TAX ID NUMBER (IF ANY)TYPE OF BUSINESSSECTION B GROSS INCOME OF THIS BUSINESS1GROSS SELF-EMPLOYMENT INCOME FROM ALL SOURCESP0FPTOTAL REFUNDS TO CLIENTS AND CUSTOMERS2SECTION C COST OF GOODS SOLD – We will calculate final COGSP 1FPOPENING INVENTORY 3P2FPPURCHASES FOR RESALE- use your costWITHDRAWN FOR PERSONAL USEWITHDRAWN FOR BUSINESS USEOTHER EXPENSES RELATING TO INVENTORY ITEMS4P3FPCLOSING INVENTORY- lower of your cost or thecurrent market value. DO NOT use retail value.If your business has no income, the burden on you will be to show you were activelyengaged in a trade or business. The IRS will otherwise presume you are not in business andwill not allow any expenses. If you have little or no income, and your expenses are high,your audit risk is very great, and increases exponentially with the amount of loss reported.1This only applies to a business with an inventory. It does not apply to a business which“drop ships” or to a service business.234Use closing inventory from 2020 Schedule C, or enter zero if business is new.Other expenses relating to inventory products, such as shipping, packaging and insurancePage 1 of 10 2021 TIMOTHY E KELLY, ESQ

EMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372PRINT FORMSECTION D GENERAL BUSINESS EXPENSESACCOUNTING (BOOKKEEPING – DO NOT INCLUDE OUR FEES)ADVERTISING, MARKETING AND PROMOTIONSBAD DEBTS5P4FPBANK FEES, CREDIT CARD FEES AND MERCHANT FEESCOMMISSIONS 12PPINDEPENDENT CONTRACTORS 6P5FPENTER ON SCHEDULE ACONTRIBUTIONS AND DONATIONS 7P6 FPHEALTH & FRINGE BENEFITS FOR EMPLOYEES 8P7FPINSURANCE- GENERAL BUSINESSINSURANCE- ERRORS & OMISSIONSINSURANCE – WORKERS COMPENSATIONINSURANCE – LIFE OR DISABILITYNOT DEDUCTIBLE 0TOTAL INSURANCEINTEREST – LINES OF CREDIT/CREDIT CARDSINTEREST – MORTGAGE (NOT FOR HOME OFFICE) 9P8FPJANITORIAL EXPENSE 10P9FPLAUNDRY AND CLEANING 11P10FPLEGAL AND PROFESSIONAL FEES (INCLUDING TAX FEES)LICENSES AND PERMITSBad debts may only be deducted where the amount was originally included in income.Must be supported by a Form 1099 you have issued where any individual is paid over 600per year56If you are a service business, gift certificates for your services are not a deduction.This includes EMPLOYEE health insurance, employee food served on your premises,employee parties, awards, etc. This does not include health insurance for the businessowner.78This entry applies where you own your own office space outside of your home.Office cleaning (but not for your home office)11This means dry cleaning of distinctive uniforms (clothing not suitable for street wear,cleaning of towels/linen).910Page 2 of 10 2021 TIMOTHY E KELLY, ESQ

EMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372PRINT FORMOFFICE EXPENSES12OUTSIDE SERVICES (PAID TO OTHER BUSINESSES)POSTAGEPRINTING AND COPY EXPENSEPROFESSIONAL MEMBERSHIPSRETIREMENT CONTRIBUTIONS FOR EMPLOYEESRETIREMENT CONTRIBUTIONS FOR OWNER(S)RENTAL OF VEHICLES, MACHINERY OR EQUIPMENTRENTAL OF SPACE OR PROPERTYREPAIRSSECURITYSELF-EMPLOYED HEALTH INSURANCE PREMIUMSSTART UP EXPENSES- READ FOOTNOTE CAREFULLY 14P13 FPSUPPLIES (do not include inventory held for sale)PAYROLL TAXES - COMPLETE WORKSHEET ON PAGE 7 0P11TAXES – PROPERTY (NOT FOR HOME OFFICE)PTAXES- SALES TAX IF INCLUDED IN GROSS INCOMEThis means expendable office supplies. Do not include capital assets, which are itemsdesigned to last over a year and which exceed 300 in cost.1213This would include an alarm at your separate office. Do not use this entry for a homeoffice.14Start up expenses are those expenses which would have been deductible if you wereactively engaged in a trade or business, but which were incurred before the start ofbusiness. Examples include, education so long as it does not qualify you for the new tradeor business, travel, meals and entertainment, mileage, telephone, etc. Start up expensesDO NOT include the purchase of any capital asset (see Section G of this checklist) as theseitems are only considered placed into service after the actual start of business.15CAUTION – Include only employer portion of FICA and Medicare, plus FederalUnemployment Tax (FUTA), State Unemployment (SUI) and State Training Tax (ETT). DONOT INCLUDE – any amount deducted from the employee’s wages, such as federal or statewithholding, employee share of FICA and Medicare, or California SDI. This information isavailable from your payroll service. Be very careful here if you are not clear on what toinclude. This has caused large audit adjustments in the past because of accuracy!Page 3 of 10 2021 TIMOTHY E KELLY, ESQ

EMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372PRINT FORMCOMMUNICATIONS - TELEPHONE 16 -BUSINESS(EXCEPT CELL PHONE)P15FPCOMMUNICATIONS 17 -CELL PHONE(BUSINESS USE PORTION ONLY)P16 FPCOMMUNICATIONS – INTERNETCOMMUNICATIONS – OTHER 0TOTAL COMMUNICATIONSTOOLS AND TOOL MAINTENANCETRAVEL 18BUSINESS MEALS WITH CLIENTSP17F19P18 FPACTUAL AMOUNT OF TRAVEL MEALS(MUST BE AWAY FROM HOME OVERNIGHT)OR PER DIEM 20 .TO BE CALCULATED BY OUR FIRM – JUST COMPLETE CITIES ANDNIGHTSP19 FCITYPNUMBER OFNIGHTSM&I RATE PER IRSTOTAL 0.00 0.00 0.00 0TOTAL USING PER DIEM METHODUNIFORMS (Clothing which is not suitable for street wear)UTILITIES (NOT FOR HOME OFFICE) 21P20 FPWAGES PAID TO EMPLOYEES16Do not include basic home telephone service cost. Any communications related deductionmust be carefully supported to break out personal and business use.17As with all telephone expenses, this deduction must clearly break out business frompersonal use. Do not just include 100% as it will damage your credibility in an audit.18DO NOT INCLUDE MEAL EXPENSES – Include airfare, hotel, rental car and localtransportation expenses. You must maintain a record of the reason for the travel, includingcorrespondence and conference information in order to establish the business purpose ofthe travel. You must retain a copy of a receipt for any lodging expense.19You must have receipts for all expenses over 75. In addition, you must have a recordof who, where, when, how much and thebusiness purpose of every expense.20For 2021 the “high-low” rates are 71/ 60, respectively21This is for separate offices. For home office enter this in Section G.Page 4 of 10 2021 TIMOTHY E KELLY, ESQ

EMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372PRINT FORMBOOKS, PUBLICATIONS AND MAGAZINESCONTINUING EDUCATION 22P21 FPDEMO GOODS (NOT HELD FOR SALE) 23P22FPGIFTS TO CLIENTS (LIMITED TO 25 PER PERSON)ONLINE SUBSCRIPTIONS - PROFESSIONAL REFERENCESOFTWARE AND SOFTWARE SUPPORTSECTION E OTHER BUSINESS EXPENSESTHOSE EXPENSES YOU ARE UNABLE TO CATEGORIZE ABOVE-THESE WILL BE LISTED AS “OTHER EXPENSES”ALSO SEE SECTION I FOR CHILD CARE AND SECTION J FOR REAL ESTATE SALES EXPENSESDESCRIPTION OF EXPENSEAMOUNT OF EXPENSEIf there are travel expenses, list them separately under travel and meals-travel. Tosubstantiate continuing education keep all correspondence, confirmations and a copy of theconference/educational program/class brochure or program.23Do not include any item already listed as withdrawn from inventory for business.22Page 5 of 10 2021 TIMOTHY E KELLY, ESQ

EMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372PRINT FORMSECTION F VEHICLE EXPENSESVEHICLE NUMBERONETO USE FLAT RATE MILEAGE COMPLETEONLY THE FIRST FIVE LINESYEAR AND MAKEVEHICLE NUMBERTWOTOTAL MILEAGE DURING THE YEAR FOR BUSINESS ANDPERSONAL REASONS –ALL MILES DRIVENTOTAL MILES DRIVEN FOR BUSINESS DURING THEYEAR – BUSINESS MILES ONLYDEDUCTIBLE DMV FEES (LABELED AS VEHICLE LICENSEFEEINTEREST PAID ON ANY LOANS SECURED BYTHE VEHICLETO USE THE OPTIONAL ACTUAL EXPENSES METHOD (REQUIRED FOR ANY VEHICLE YOUHAVE ELECTED TO USE ACTUAL EXPENSES FOR IN A PRIOR YEAR), ALSO COMPLETE THEBELOW QUESTIONSDATE PLACED IN SERVICE(ONLY REQUIRED FOR THE FIRST YEAR IN SERVICE)LOWER OF COST OR VALUE ON DATE PLACED INSERVICETOTAL ANNUAL FUEL COST FOR ALL DRIVINGDO NOT ADJUST FOR BUSINESS MILEAGE!TOTAL ANNUAL INSURANCE COSTTOTAL ANNUAL REPAIR & MAINTENANCE COSTOTHER EXPENSES (TIRES/CAR WASH, ETC.)TOTAL DMV FEESSECTION G TOTAL HOME OFFICE EXPENSESDO NOT ADJUST FOR BUSINESS RATIO –WE DO THAT!DATE FIRST PLACED IN SERVICE (REQUIREDONLY FOR THE FIRST YEAR OR FOR NEW CLIENTS)LOWER OF COST OR FAIR MARKET VALUE ON THEDATE FIRST USED AS A HOME OFFICE (REQUIREDONLY FOR THE FIRST YEAR OR FOR NEW CLIENTS)SIZE OF HOME OFFICE AREA IN SQUARE FEET 24P23FPTOTAL LIVING AREA OF THE HOME IN SQ. FEET 25P24FPFOR NON-OWNERS, ENTER TOTAL RENT FOR 2021The home office area need not be an entire room, but nonetheless the area designatedmust be used exclusively for the business and no other purpose. Storage space used forinventory may be included, even if it is a garage or outside structure.2425Do not include the garage unless the storage rule in the previous footnote applies.Page 6 of 10 2021 TIMOTHY E KELLY, ESQ

PRINT FORMEMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372TOTAL FLOOD AND HAZARD INSURANCE PAID 26P25FPTOTAL ANNUAL UTILITIES PAID 27P26 FPTOTAL OF OTHER HOME RELATED EXPENSESANNUAL HOA DUES PAIDPAYROLL TAXBREAKDOWNWORKSHEETCAUTION – Include only employer portion of the five taxes listed below. BESURE NOT TO INCLUDE – any amount deducted from the employee’s wages,such as federal or state withholding, employee share of FICA and Medicare, orCalifornia SDI. This information is available from your payroll service. Be verycareful here and ask for help if you are not clear on what to include.FICA (Social Security Tax) - Employer's share onlyMedicare Tax (Employer's share onlyFUTA - Federal Unemployment TaxSUI - State Unemployment Insurance taxCTT - California Training TaxTOTAL PAYROLL TAXES 0SECTION H CAPITAL EXPENDITURES A capital expenditure is any personalproperty designed to last more than one year in service, and which costs more than 300.DESCRIPTION OF ITEMDATE PLACED INSERVICE IN 2021COST OF ITEMBe sure to include any insurance premiums paid through a lender’s impound account.Utilities include electric, gas, water, sewer, trash, cleaning, alarm and cable. Utilities DONOT include gardening, pool maintenance or home telephone line.2627Page 7 of 10 2021 TIMOTHY E KELLY, ESQ

EMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372PRINT FORMSPECIALIZED SUPPLEMENTAL INFORMATIONSECTION I – CHILD CARE PROVIDERS ONLYDAYS IN BUSINESS DURING THE YEAROR CHECK THE BOX FOR A FULL YEAR/ 365 DAYSORHOURS OPEN FOR BUSINESS IN 2021 INCLUDING PREP & CLEAN-UPTOYS AND EQUIPMENT PURCHASED28P27FPEXTRA HOMEOWNERS/AUTO ********************************FOOD – USING ACTUAL EXPENSE AND NOT THE PER DIEM METHODORFOOD USING IRS TIER I PER DIEM (YOU MUST KEEP A LOG OF MEALS SERVED)MEALBREAKFASTSNACK 1LUNCHSNACK 2DINNERSNACK 3TOTALANUMBER OF MEALSSERVED DURING THEYEARBAxBPER DIEM RATETOTAL 1.33 0.00 0.74 0.00 2.49 0.00 0.74 0.00 2.49 0.00 0.74 0.00 0.00Do not enter capital expenditures (anything lasting more than a year, such as acomputer), here. Enter these items in Section G.28Page 8 of 10 2021 TIMOTHY E KELLY, ESQ

PRINT FORMEMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372SECTION J REAL ESTATE SALES AGENT SUPPLEMENTAL EXPENSESCAUTION: BE VERY CAREFUL WHEN REPORTING REAL ESTATE PROFESSIONAL EXPENSES.DO NOT INCLUDE EXPENSES WHICH ARE DEDUCTED PRIOR TO THE PAYMENT OF THEAMOUNTS REPORTED ON THE FORM 1099-MISC ISSUED BY YOUR BROKER(S). SINCETHESE AMOUNTS HAVE ALREADY BEEN DEDUCTED FROM REPORTING INCOME,DEDUCTING THEM A SECOND TIME MAY EXPOSE YOU TO SUBSTANTIAL TAX, PENALTY ANDINTEREST. ONLY EXPENSES PAID FOR BY YOU VIA CHECK OR CREDIT CARD COUNT ASEXPENSES. DEDUCTIONS BY THE BROKER ARE ONLY DEDUCTIBLE IF THEY COME OUT OFTHE AMOUNT REPORTED ON THE BROKER FORM 1099.PROFESSIONAL FEES (TOTAL COMBINED BOARD FEES)MLS FEES (IF DIFFERENT THAN BOARD FEES)BUYER ACCOMODATIONSLOCKBOX EXPENSESSTAGING OR OPEN HOUSE EXPENSESPHOTOGRAPHY EXPENSESECTION K ESTIMATED PAYMENTS MADE FOR THE 2021 TAX YEARIRS PAYMENTPage 9 of 10DATE PAID TO IRSSTATE PAYMENTDATE PAID-STATE 2021 TIMOTHY E KELLY, ESQ

PRINT FORMEMAIL TO lynn@timkelly.comOR FAX TO 800-259-3372CIRCLE ONEDO YOU WANT TO CONTRIBUTE TO A SEP-IRA?YESNO or circle MAXIMUMIF YES, HOW MUCH?DO YOU WANT A CONTRIBUTION DEADLINEOF APRIL 15, 2022 OR OCTOBER 15, 2022?4/15/2210/15/221. The maximum amount of SEP-IRA contribution is limited by net income. If your maximumallowed is less than the amount you have requested, we will use the lower amount. If there is a lossno SEP-IRA contribution is permitted.2. Be aware the October 15, 2022 deadline will extend the IRS statute of limitations by six months.3. In order to elect a deadline of October 15, 2022 to fund a SEP-IRA we must be notified beforethe actual return is filed and before April 15, 2022.NOTES AND COMMENTSPage 10 of 10 2021 TIMOTHY E KELLY, ESQ

Start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business, but which were incurred before the start of business. Examples include, education so long as it does not qualify you for the new trade or business, travel, meals and entertainment, mi