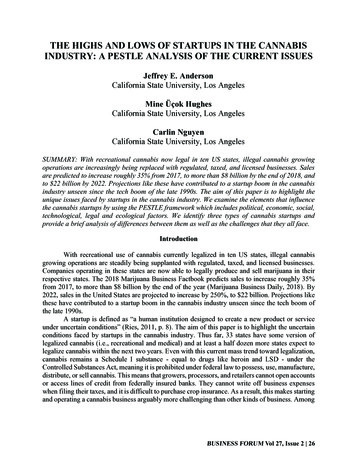

Transcription

Accounting 1Chapters 1 to 11Class HandoutsFor ProfessorHoward J. LevineNote: This packet should be brought to class every week. If youforget or misplace it you can reprint the set by going to the Valley Collegeweb site and navigating to Howard Levine’s instructor page:http://www.lavc.edu/hlevine

Transparency Master 1-3ETHICS CASELauren Smith is the controller for Sports Central, achain of sporting goods stores. She has been askedto recommend a site for a new store. Lauren has anuncle who owns a shopping plaza in the area oftown where the new store is to be located, so shedecides to contact her uncle about leasing space inhis plaza. Lauren also contacted several othershopping plazas and malls, but her uncle's storeturned out to be the most economical place tolease. Therefore, Lauren recommended locating thenew store in her uncle's shopping plaza. In makingher recommendation to management, she did notdisclose that her uncle owns the shopping plaza.Page 2 of 51

Transparency Master 1-4ETHICS CASEJohn Jones is the chief accountant for theSouthwest district office of Security Life InsuranceCompany. While preparing the fourth-quarter salesreport, John overheard the company president saythat he would close Security's Phoenix office if itdid not meet its fourth-quarter sales quota. John'sbest friend from college works at the Phoenix office.Anxious to find out whether the office was injeopardy, John immediately finished the Phoenixoffice's report, only to find that it showed sales 25%below the quota. Later that afternoon, the companypresident called John for Phoenix's sales results.John told the president that he had not finishedpreparing the sales report for the Phoenix office.John wanted time to compile data that mightconvince the president to continue operations inPhoenix, despite lagging sales.Page 3 of 51

Transparency Master 1-5ETHICS CASETech-Smart Computer Company recentlydiscovered a defect in the hard disks installed in itsmodel R24 computer. The hard disk head in theseunits retracts too violently when the computers areturned off. As a result, the hard disks are destroyedafter the computer is turned on and offapproximately 500 times. Tech-Smart has sold 4,000model R24 computers nationwide.The marketing department at Tech-Smart contactedmost of the 4,000 owners of the model R24computer and discovered that 20% (or 800) usedtheir computers in businesses that operated 24hours per day. These customers never turn theircomputers off; therefore, the defect should notdamage their hard disk units.Judy Govan, Tech-Smart's controller, has beenasked to determine the cost to correct the hard diskproblem and to recommend a course of action.After studying the marketing department's report,Judy decides to recommend that Tech-Smartreplace the hard drives only in the 3,200 units usedby customers who actually turn off their computers.Page 4 of 51

Transparency Master 1-6ETHICS CASETom Brown, the controller for MicroTech SoftwareCompany, is responsible for preparing thecompany's financial statements. He learns thatsales for the first quarter of the year have droppedso dramatically that the company is in danger ofbankruptcy. As a result, he applies for anaccounting position with another software companythat competes with MicroTech. During his jobinterview, Tom is asked why he wants to leaveMicroTech. He replies truthfully, "The company'ssales are down another 10% this quarter. I fear theywill go out of business." At that time, MicroTechhad not released its sales results to the public.Page 5 of 51

Transparency Master 1-10WRITING EXERCISE1. Sally Vertrees purchased a personal computerfor use at home. Sally owns a dental practice.She occasionally uses the computer for a taskrelated to her dental practice; however, thecomputer is used primarily by Sally's children.Can the computer be recorded as an asset in theaccounting records of Sally's dental office? Whyor why not?2. Jason Thompson purchased an office building10 years ago for 780,000. The building was justappraised at 1.25 million. What value should beused for the building in Jason's accountingrecords? Support your answer.Page 6 of 51

Transparency Master 1-11THE ACCOUNTING EQUATIONAssets Liabilities EquityORThe Cost of theItems Used inRunning a BusinessWhere the Funds toBuy Those ItemsCame from, EitherCreditors or Owners Example: A business buys a 20,000 delivery vanby using 5,000 cash as a down payment andfinancing the rest.Assets 20,000 Liabilities Equity 15,000 5,000Page 7 of 51

Transparency Master 2-1Assets Liabilities Stockholders’ EquitySTOCKHOLDERS’ EQUITY ACCOUNTSAccountUsed to RecordCommon StockOwner’s InvestmentsRetained EarningsEarnings That Have NotBeen Paid Out as Dividends to ShareholdersDividendsEarnings Distributions toOwnersRevenueRevenues from CustomersExpenseExpenses Incurred in theProcess of GeneratingRevenuesPage 8 of 51

Transparency Master 2-4POSTING ENTRIES INTO T ACCOUNTSMark Gordon decided to start a business as a disc jockey for wedding receptions,reunions, and other parties. His business is called Music Express. Record the following journal entries for Music Express and post these entries to the appropriateT accounts.a. Issued common stock to Mark for 7,000.b. Purchased 5,700 of stereo equipment on account.c. Paid for an advertisement in local newspapers, 500.d. Paid cash for supplies, 75.e. Received 1,000 cash from customers for music provided at class reunions.f.Paid for stereo equipment purchased in (b).g. Provided music at a wedding reception; the bride's father was billed 300.Payment is due in 30 days.h. Paid wages of an assistant, 150.i.Received cash from the customer billed in (g).j.Paid cash dividend to Mark, 575.CashAccounts PayableCommon StockRetained EarningsDividendsAccounts ReceivableFees EarnedSuppliesWages ExpenseStereo EquipmentAdvertising ExpensePage 9 of 51

Transparency Master 2-9Where Is the Answer—The Journal or the Ledger?The answers to the following business questions canbe determined by examining accounting records. Foreach question, state whether the answer can be foundin the journal or the ledger.1. A business owner has decided to purchase a pieceof equipment costing 1,500. He wants to knowwhether the business has enough cash to pay forthe equipment.2. The company checkbook shows that a 750 checkwas written on March 28. The owner wants to knowwhy that check was written.3. A personnel manager wants to know the total hercompany has spent on employee wages so far thismonth.4. The marketing manager of a company wants toknow the cost of a special full-page ad placed inThe Wall Street Journal during the first week ofDecember last year. The company frequently advertises in a variety of newspapers and magazines.Page 10 of 51

Transparency Master 2-12WHAT'S WRONG WITH THIS?Journal Entries:T Accounts:a. Cash . 8,000Common Stock.8,000b. Supplies .Cash .200c. Cash .Fees Earned .550a.200c.550d. Wages Expense. 1,340Cash .1,340e. AccountsReceivable .Fees Earned .200FeesEarned810810Suppliesb.Common Stocka. 00b.550d.6,970200c.500WagesExpensed. 1,340Trial BalanceCash .Accounts Receivable.Supplies .Common Stock .Fees Earned .Wages Expense .Page 11 of 51DebitCreditBalances Balances6,9708102008,8105001,3409,8108,810

Transparency Master 3-1MONTHLY EXPENSES—LOAN APPLICATIONAssume that you are filling out a loan application. Theapplication asks you for your total monthly committedexpenses for housing, transportation, insurance, anddebt repayment. After reviewing your checkbook, youcompile the following list:Rent . 575 each monthUtilities .110 each month–level billingCar payment .250 each monthCar insurance .480 every 6 monthsLife insurance .240 paid once per yearVISA .60 each month (to pay offFlorida vacation takenlast year)What is the total amount to be included on the loanapplication?Page 12 of 51

Transparency Master 3-3ARTISAN STONE AND BRICKDuring May, Artisan Stone and Brick laid a stone patiofor Louise McCowan for a fee of 1,200. The job tookone full week. Artisan’s expenses associated with thejob are as follows:1. Decorative stones, 400. These stones were purchased on account. They will be paid for in June.2. Cement, two 10 bags. The bags were purchasedand paid for in April.3. Wages paid to assistants, 200. These wages werepaid at the end of the week.In addition, Artisan spends approximately 600 permonth on rent, utilities, and insurance for its office.Compute Artisan’s profit on the job, using the matching principle.Page 13 of 51

Transparency Master 3-5ACCRUALS AND DEFERRALS1. An accrued expense occurs when you use anitem or a service before you have paid for it.List four expenses that you typically pay “after the fact.”2. An accrued revenue occurs when you haveearned revenue but you have not yet receivedpayment. List two examples of revenues thatyou earn before you receive payment.3. A deferred expense occurs when you pay foran item or a service before it is actually used.List four expenses that you typically pay inadvance.4. A deferred revenue occurs when you receivea payment before you have actually earned it.List two times that you have been paid for aservice or merchandise in advance.Page 14 of 51

Transparency Master 4-7FINANCIAL STATEMENTSIncome StatementRevenues– Expenses(from the work sheet)(from the work sheet)Net IncomeRetained Earnings StatementBeg. Retained EarningsBalance Net Income– Dividends Paid(from the work sheet or retainedearnings account in the ledger)(from the income statement)(from the work sheet)End. Retained Earn. BalanceBalance SheetCurrent Assets(from the work sheet) Property, Plant & Equip. (from the work sheet)Total AssetsCurrent Liabilities Long-Term Liabilities(from the work sheet)(from the work sheet)Total Liabilities Common Stock Retained Earnings(from the work sheet)(from the retained earn. statement)Total Stockholders’ EquityTotal Liabilities andStockholders’ EquityPage 15 of 51

Transparency Master 4-10WRITING EXERCISEKeith Martin is the controller for Daniels Printing Service. Keith has been putting in a lot of overtime; therefore, Mr. Daniels has allowed Keith to hire an assistant.Keith's assistant is a bright, high-school graduate, buthe has never taken an accounting class. Keith is tryingto decide which accounting activities could be delegated to his assistant. Keith is willing to give the assistanta few simple instructions on how to complete each task,but he doesn't have time to teach the assistant to be anaccountant.For each task listed, state whether Keith should continue to do the work or delegate the task to his assistant.Explain each answer.1. List the account balances from the general ledger inthe Trial Balance columns of the end-of-periodspreadsheet.2. Add the Debit and Credit columns of the trial balance.3. Make the adjusting entries on the spreadsheet.4. Complete the spreadsheet.5. Prepare the formal financial statements using the data from the Income Statement and Balance Sheetcolumns of the spreadsheet.6. Journalize and post the adjusting entries.Page 16 of 51

Transparency Master 5-1The Income Statement—An Expanded ViewSingle-StepIncomeStatement(Chapters 1–4)Multiple-StepIncomeStatement(Chapter 5)RevenuesRevenue from Sales– Expenses– Cost of Goods SoldGross Profit– Operating ExpensesNet Income{Operating Expenses:Selling Expenses Administrative ExpensesTotal Operating ExpensesIncome from Operations Other Revenue(i.e., Interest, Rent)– Other Expenses(i.e., Interest)Net IncomePage 17 of 51

Transparency Master 5-6TWO INVENTORY SYSTEMSPERPETUAL: The inventory account is increased when inventory is purchased. The inventory account is decreased when inventory is sold to a customer. Therefore, the inventory account always (perpetually) shows the amount of inventory onhand.PERIODIC: Purchases of inventory are recorded in a purchases account. Inventory is not removed from the accountingrecords when it is sold. Therefore, the amount of inventory on handmust be determined by taking a physical inventory count.SUMMARY:The perpetual inventory system requires moreaccounting entries, but it provides more up-todate information for managing inventory.Page 18 of 51

Transparency Master 5-9CALCULATING COST OF GOODSSOLD UNDER A PERIODICINVENTORY SYSTEMInventory, Beg. of Year Cost of Goods PurchasedMerchandise Available for Sale– Inventory, End of YearCost of Goods SoldPage 19 of 51Purchases– Purchases Returns &Allowances– Purchases DiscountsNet Purchases Transportation InCost of GoodsPurchased

Transparency Master 5-20FREIGHT TERMSFOBFOBShipping Point DestinationOwnership (title)passes to buyerwhen merchandiseis .Delivered tofreight carrierReceivedby buyerTransportationcosts are paidby .BuyerSellerRisk of loss duringtransportationbelongs to .BuyerSellerPage 20 of 51

Transparency Master 5-21Freight Terms and DiscountsLogan Appliances purchased 8,000of merchandise, 2/10, n/30, FOBshipping point. The seller prepaid theshipping charges of 200. If Loganpays for this merchandise within thediscount period, how much shouldLogan remit to the seller?Page 21 of 51

Transparency Master 6-2ITEMS INCLUDED IN INVENTORYAll inventory on hand when the physical inventory is taken Merchandise in transit that was purchasedFOB shipping point Merchandise in transit that was sold FOB destination Merchandise on consignment in other locations that is still owned by the company taking the inventory count– Merchandise included in the inventory onhand that belongs to another company but isbeing held on consignmentInventory shown on the financial statementsPage 22 of 51

Transparency Master 6-12PERIODIC INVENTORY SYSTEM1. When inventory is purchased, this purchase is recorded in the accounting records.2. When inventory is sold, the sales revenueis recorded in the accounting records.However, the cost of goods sold is notrecorded and the inventory item sold isnot removed from the accounting records.3. Therefore, the accounting records showhow much inventory has been purchased,but they do not show how much inventory is left on hand.4. A physical inventory is taken to determine the inventory on hand at the end ofthe accounting period. At that time, thecost of inventory sold is determined.Page 23 of 51

Transparency Master 6-13Cost of Goods SoldPurchases– Purchase Returns & AllowancesBeginning Inventory– Purchase Discounts Cost of Goods PurchasedNet PurchasesMerchandise Available for Sale Transportation In– Ending InventoryCost of Goods PurchasedCost of Goods SoldPage 24 of 51

Transparency Master 6-15COMPARISON OFINVENTORY METHODSMethodAdvantagesDisadvantagesFIFOEnding inventory amounton balance sheetapproximates currentreplacement costsCreates “illusory profits”during times of highinflationLIFOMatches current costsagainst currentrevenues on incomestatementEnding inventory amounton income statementmay be substantiallydifferent from currentreplacement costDuring inflationaryperiods, reduces incometaxesAverage Easy to understandCostYields same answerwhether prices start at 1and increase to 2 or startat 2 and decrease to 1Page 25 of 51Ending inventory amounton income statementmay not represent currentreplacement costLose tax advantageavailable from LIFO whenprices are rising

Transparency Master 6-20ESTIMATING INVENTORY—GROSS PROFIT METHODUse the following data to estimate GoodingCompany’s ending inventory:Beginning inventory . 10,000Purchases. 60,000Sales . 95,000Gross profit on sales .40%Page 26 of 51

Transparency Master 7-3SEPARATING DUTIES FORRELATED OPERATIONSWhat risk do you have if the followingoccur?1. Salesperson (paid on a commission basis) is responsible for granting credit.2. Purchasing agent orders supplies, inspects supplies to verify that the correctitems and quantity were received, and authorizes payment of the vendor’s invoice.3. Worker in a donut shop takes a customer’s order, packs his or her donuts in abag or box, rings the order on a cash register, and takes the customer’s money.Page 27 of 51

Transparency Master 7-4SEPARATING OPERATIONS,CUSTODY OF ASSETS, ANDACCOUNTINGWhat risk do you have if the followingoccur?1. A department store allows its credit customers to pay their bills in person at thestore’s credit department. Duties of thecredit department’s clerk include accepting cash payments, giving customerscredit for their payments in the store’saccounting records, and following up onany overdue accounts.2. An accounts payable clerk for a hospitalreviews all vendor invoices to make surethe hospital has been billed accurately,prepares checks to pay the invoices,mails the checks, and makes the entriesnecessary to record the payments in thehospital’s accounting records.Page 28 of 51

Transparency Master 7-13BANK DEBIT AND CREDIT MEMOSA bank makes credit entries (issues credit memos) for the following:1. Deposits made by electronic funds transfer (EFT)2. Collections of notes receivable for a company3. Proceeds for a loan made to a company by thebank4. Interest earned on a company’s account5. Corrections (if any) of bank errorsA bank makes debit entries (issues debit memos) for the following:1. Payments made by electronic funds transfer (EFT)2. Service charges3. Customer checks returned for nonsufficient funds(NSF)4. Corrections (if any) of bank errorsPage 29 of 51

Transparency Master 7-14BANK RECONCILIATIONCash Balance onBank Statement –Deposits notrecorded by bankChecks that havenot cleared /– Bank errorsAdjusted balance*Cash Balance onDepositor’s Records –Collections madeby bankNSF checks–Service charges–\ Depositor’s errorsAdjusted balance**These should agree.Page 30 of 51

Transparency Master 7-15BANK RECONCILIATIONPrepare a bank reconciliation for CartwrightCompany as of October 31, using the followinginformation:Cash balance on October 31 bankstatement . 10,410Cash account balance in generalledger .9,890Deposit made on October 31, notrecorded on bank statement .1,865Note collected by bank ( 1,200 plus 60 in interest) .1,260Outstanding checks: No. 567, 800;No. 569, 452.1,252Debit memorandum from bank for aNSF check written by J. Lane inpayment of his account .100In addition, Cartwright recorded Check No. 548written for 152 in payment of the October utilitybill as 125 in the cash payments journal.Page 31 of 51

Transparency Master 7-17PETTY CASHAllied Plumbing Supply decides to establisha petty cash fund of 150 on January 1. Thepetty cash fund will be replenished whenever the fund reaches a balance of 20 orless. On February 10, the fund is replenished and the following receipts for itemspaid out of the petty cash fund are recorded:office supplies, 34; postage, 28; storesupplies, 12; a minor repair on officeequipment, 52; and the cost paid to FedExto send an urgent letter, 10.Page 32 of 51

Transparency Master 8-1JOURNAL ENTRIES FORUNCOLLECTIBLE ACCOUNTS—ALLOWANCE METHODBlocker Company estimates its uncollectible accounts based on ananalysis of receivables. On December 31, a junior accountant prepared the following aging schedule for the company's 88,000 in outstanding receivables.EstimatedUncollectible AccountsAge IntervalAmount%AmountNot due .1–30 days past due .31–60 days past due .61–90 days past due .Over 90 days past due . 58,65013,2208,9304,0003,200 88,0002%4%20%30%50% 1,1735291,7861,2001,600 6,288The Allowance for Doubtful Accounts currently has a 210 debit balance.1.2.Prepare the adjusting entry to record the company's estimate ofuncollectible accounts.Prepare the journal entry to write off the following accounts:T. Donaldson . 700J. Kyle .450D. Mize .1,0003.Prepare the journal entry to record receipt of the 450 owed by J.Kyle.4.Write an answer to the following question: What circumstanceswould cause the Allowance for Doubtful Accounts to have a debitbalance prior to adjustment?Page 33 of 51

Transparency Master 8-3JOURNAL ENTRIES FORUNCOLLECTIBLE ACCOUNTS—DIRECT WRITE-OFF METHOD1. Richard Ellis purchased 500 in merchandise on account, terms n/30.2. After 6 months, the Richard Ellis accountwas written off as uncollectible.3. David Sans purchased 280 worth ofmerchandise on account, terms n/30.4. Received notice that David Sans had filedfor bankruptcy; therefore, his accountwas written off.5. One year later, received 280 from DavidSans as payment on his account.Page 34 of 51

Transparency Master 8-5PROMISSORY NOTESCalculate the due date, interest, and maturity value for these promissory notes.Note #1: 5,000, 90-day, 8% promissory notedated September 28Note #2: 25,000, 180-day, 11% promissorynote dated April 2Page 35 of 51

Transparency Master 9-1COST TO ACQUIREFIXED ASSETSAdvanced Technology, a computer manufacturer, purchased a machine that applies computer chips to circuit boards, using a process known as Surface MountTechnology (SMT). The costs associated with acquiring the SMT machine are listed below. Where shouldeach cost be recorded in the accounting records?Purchase price . 150,000Transportation .1,200Engineer's fee to set up andadjust the machine torequired specifications .2,000Electrician's fee to install a newpower outlet required bythe SMT machine .800Repairs made to wall as a resultof damage during installationof the new power outlet.500Cost of chips and circuit boardused to test the new machinebefore it is used in production .300Cost of 3-year service contractrequiring the manufacturer ofthe SMT machine to make anyrepairs needed, at no cost .3,000Page 36 of 51

Transparency Master 9-3COST OF LAND ACQUIREDAS A BUILDING SITEWhen land is acquired as a building site, all costs to purchase theland and prepare it for the new building are considered a cost of theland.Indicate whether the following costs should be recorded in the land,building, or land improvements account.CostExplanation 200,000Purchase price paid for land and old warehouse building. The warehouse building will be torn down, and anew manufacturing plant will be erected in its place. Theland has an appraised value of 125,000; the warehouseis appraised at 75,000.5,000Closing costs associated with purchasing the land andwarehouse.20,000Cost to tear down and remove old warehouse building.8,000Cash received from selling a crane and other salvageable materials from the old warehouse.11,000Cost to level the land prior to construction of the newbuilding.25,000Cost to excavate land for the foundation of the new building.60,000Fees paid to architect to design the new building.540,000Fees paid to contractor for erecting the new building.7,000Interest paid on construction loan before the building iscompleted.5,000Repair as a result of windstorm damage duringconstruction.12,0008,000Cost of parking lot adjacent to the building.Cost of landscaping to beautify building and parking lot.Page 37 of 51

Transparency Master 9-4COST OF LAND ACQUIREDAS A BUILDING SITESolutionIndicate whether the following costs should be recorded in the land, building, orland improvements account.Amount Recorded inLandCostExplanationLandBuilding Improve. Expense 0005,00012,0008,000Purchase priceof land and oldwarehouse.Closing costs.Cost to tear downold warehouse.Cash received fromselling salvageablematerials from oldwarehouse.Cost to level land.Cost to excavateland for foundationof new building.Architect's feesfor new building.Buildingcontractor's feesfor new building.Interest paid onconstruction loanbefore the buildingis completed.Repair as a result ofwindstorm damageduring construction.Cost of parking lot.Cost of landscaping. 200,0005,00020,000(8,000)11,000 25,00060,000540,0007,000 5,000 12,0008,000Page 38 of 51

Transparency Master 9-6DEPRECIATION CALCULATIONSSTRAIGHT-LINE AND UNITS-OFACTIVITY METHODSAt the beginning of the current year, Lucianno's Pizza purchased a car to be used indelivering pizzas. The car cost 14,000. Itwill be used for 5 years, after which its residual value will be about 2,000. In those 5years, Lucianno's estimates that the car willbe driven 80,000 miles.1. Calculate depreciation for all 5 years, using the straight-line method.2. Assume that the car was driven 10,000miles in year 1; 15,000 in year 2; 18,000 inyear 3; 20,000 in year 4; and 17,000 inyear 5. Calculate depreciation, using theunits-of-activity method for all 5 years.Page 39 of 51

Transparency Master 9-8DEPRECIATION CALCULATIONSDOUBLE-DECLINING-BALANCEMETHODABC Marketing recently purchased a machine that cost 80,000. The machine is expected to last 4 years and have a residualvalue of 6,000.Calculate the depreciation expense to berecorded each year under the doubledeclining-balance method.Page 40 of 51

Transparency Master 9-10CAPITAL AND REVENUEEXPENDITURESType of ExpenditureOrdinary Repairs andMaintenance—maintaining anasset in currentworking conditionCapital orRevenueAccountingTreatmentRevenueDebit an expenseaccountBetterment—increasingoperating efficiency orcapacityCapitalDebit fixed assetaccountExtraordinary Repairs—extending the servicelife of an assetCapitalDebit accumulateddepreciation accountPage 41 of 51

Transparency Master 9-11CAPITAL AND REVENUEEXPENDITURESClassify each of the following expenditures as a capital or arevenue expenditure.Name the specific account that would be debited to recordeach d1. Purchasing a fax machine2. Adding an air purificationsystem to the HVAC systemin an office building3. Painting the interior wallsof an office building4. Installing an overheadcrane in a warehouse5. Replacing the motor of amachine6. Paying for a service call torepair photocopy machine7. Upgrading the processoron a PC to allow the computerto process data more quicklyPage 42 of 51

Transparency Master 9-13INTANGIBLE ASSETSDefinitionLegal LifePatentExclusive right to produce andsell goods with one or moreunique features20 yearsCopyrightExclusive right to publish andsell a literary, artistic, ormusical compositionLife of author 70 yearsTrademarkA name, term, or symbolused to identify a businessand its productsIndefinite life;registrationrenewedevery 10 yrs.GoodwillIntangible asset that iscreated from such favorablefactors as location, productquality, reputation, andmanagerial skillIndefinite lifePage 43 of 51

Transparency Master 9-14INTANGIBLE ASSETSIntangibleAccounting TreatmentPatents& CopyrightsAmortized over useful life(not legal life)Trademarks& GoodwillNot amortized; value iswritten down if impairedPage 44 of 51

Transparency Master 9-15DEPRECIATION, DEPLETION,AMORTIZATION—THREE WORDS THATREPRESENT THE SAME CONCEPTDepreciation, depletion, and amortization all represent the process ofallocating the cost of a long-term asset to expense over its useful life.Applies toJournal Entry to RecordMethods UsedDEPRECIATIONFixed assets(e.g., machinery,buildings)Depreciation ExpenseStraight-line,Accumulated Depreciation Natural resources Depletion Expense(e.g., mineralAccumulated Depletiondeposits, metalore)Units-of-activityAMORTIZATIONIntangible assets(patents ©rights)Amortization ExpensePatents or CopyrightsPage 45 of 51Straight-line

Transparency Master 10-2JOURNAL ENTRIES TO RECORD APROMISSORY NOTEThe following transactions occurred between SpokeCompany (the seller) and Bryden Company (the buyer).Apr. 19Spoke Co. sold 80,000 in merchandise toBryden Co. on account, with terms n/30.May 19Spoke Co. granted Bryden Co. a 90-day extension on the account receivable. BrydenCo. signed an 80,000, 10%, 90-day note asevidence of the time extension.Aug. 17Bryden Co. paid Spoke Co. the amount dueon the note.1. Prepare the journal entries used by Spoke Company to record the sale and the note receivable. Assume that the cost of goods sold to Bryden Company was 50,000.2. Prepare the journal entries used by Bryden Company to record the purchase and the note payable.Page 46 of 51

Transparency Master 10-7WRITING EXERCISEComExpress Airlines provides the followingfringe benefits to its employees:1. Each employee earns two days of paidsick leave for each 160 hours he or sheworks for the company.2. Each employee is also permitted to flyfree of charge on any ComExpress flightthat is not fully booked with customers.The employee may take as many flights inthe course of a year as he or she wishes.For each benefit, state whether or not an accounting entry would be needed at the endof the year to accrue the cost of the benefit.State your justification for each answer.Page 47 of 51

Transparency Master 11-2TYPES OF BONDS

Accounting 1 Chapters 1 to 11 Class Handouts For Professor Howard J. Levine Note: This packet should be brought to class every week. If you forget or misplace