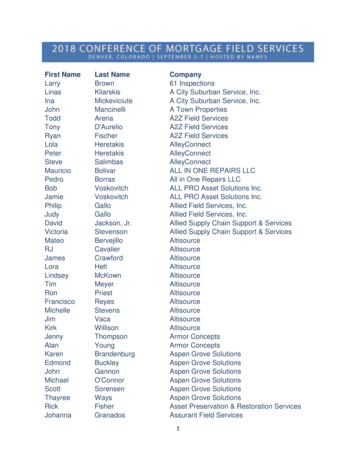

Transcription

ResidentialProperty ManagementProcedures ManualA practical guide for developing a property-specific procedures manualwritten byLarry E. McCarthypublished by Copyright 1999

Residential Property Management Procedures ManualAbout the AuthorLARRY McCARTHY,Capacity Building Program Director forCommunity Investment Corporation, beganhis property management career in 1971.Recognizing that spiraling costs of buildinglocked more families out of decent housingeach year, McCarthy decided to work onfinding solutions to the needs of lowerincome families. This decision led him tothe Illinois Housing Development Authority(IHDA) in 1978. During his four yearswith IHDA, he was involved with themanagement of more than 6,600 affordableapartments throughout Illinois and was amember of the agency’s team assigned toturn around troubled properties.McCarthy is a nationally recognizedaffordable housing management expert. Heserved for nine years as the President ofRESCORP Realty, Inc., which managed amulti-family rental housing portfolio in theChicagoland area. Under McCarthy’sguidance, that portfolio expanded from1,600 to more than 4,000 rental units.In July of 1991, a joint venture partnershipthat McCarthy formed between RESCORPRealty and Frank J. Williams Realty wasawarded the management of the ChicagoHousing Authority’s innovative Lake ParcPlace. Under McCarthy’s leadership, LakeParc Place received worldwide recognitionfor excellence in publicly funded housing.After touring Lake Parc Place, housingofficials from virtually every state in thenation as well as dozens of foreigniicountries praised the quality of the propertymanagement. Newsweek magazine calledLake Parc Place “A housing program thatactually works” and CNN described theproperty as “the best managed publichousing in the country”.McCarthy was the Chairman of theChicago Board of Realtors’ PropertyManagement Council from 1988 to 1989.He co-founded and served as President ofthe Property Management Resource Center,a non-profit corporation formed to provideproperty management expertise to groupswho develop low and moderate-incomehousing. In addition Mr. McCarthy hasbeen a member and director of theApartment Building Owners and ManagersAssociation (ABOMA) and a director of theChicago Association of Realtors, where healso served as Chairman of their Government Affairs Committee. He was a cofounder and served as a director of TheReal Estate Job Bank, an organizationdedicated to employment opportunities forminorities within the real estate industry.the Midwest region, which included over11,000 apartments in a five-state region.AcknowledgementsWe wish to thank the following individualswho have provided either materials that areincluded or assistance in the production ofthis manual. Sue BradyPreviously McCarthy worked for Draper &Kramer (D&K), Inc. where he oversaw aportfolio consisting of over 1,900 urbanand suburban residential apartments and400,000 sq. ft. of retail shopping centers.Prior to joining D&K, McCarthy was aregional Vice President with SecurityPacific, Inc. a property owner based inSeattle, Washington. He was responsible for Pam Gecan, American MarketingServices for her assistance in Marketing David A. Schucker of TheLeadership Council for Metro-politanOpenCommunities

ForewordCOMMUNITY INVESTMENT CORPORATIONCommunity Investment Corporation (CIC) is a mortgage banking firm created in 1974, by Chicago’sbanking community. Fifty-one banks, plus Peoples Gas, Fannie Mae, and the Untied MethodistPension Fund, share proportionally in each CIC loan.CIC’s mission is “to be the leading force in neighborhood revitalization through innovative financingprograms.” CIC is intended to serve as a catalyst for needed rehab lending and to foster the successof cost-effective developers.CIC specializes in multifamily rehabilitation lending. In its first 15 years of multifamily lending,1984 to 1999, CIC has made 1092 loans totaling 415 million in CIC funds on buildings with28,000 apartment units. CIC borrowers have received over 500 million in various financingprograms including no or low interest financing, tandem processed, and government secondmortgages. About 20% of CIC loans have government second loans.CIC takes pride in its ability to offer timely loan processing and support through its dedicated andexperienced loan officer, construction review and closing staff.CIC is committed to increasing the professional skills and knowledge of hands-on building ownersand property managers. In 1999 CIC will conduct fifteen basic level courses in property management and maintenance. The courses will be conducted over four consecutive evenings, three hoursper evening, throughout the Chicagoland area. Additional one evening courses are regularly held onseasonal topics such as landscaping (spring) or energy savings and heating systems (fall), plusregular topics related to rehabilitation.In the first ten of its twenty-five years, CIC helped pioneer single family rehab lending in low andmoderate income communities, providing 15 million in loans to rehabilitate 989 single familyunits. CIC also provided home ownership counseling and technical assistance to 2,500 families.Call CIC at (312) 258-0070 for information on loan products and rates, or to find out about trainingsessions near you.iii

Residential Property Management Procedures Manualiv

Table of ContentsIntroduction . page 21 New Property Take-Over . page 42 Tenant Selection Plan . page 93 Fair Housing . page 214 Marketing . page 365 Tenant Handbook . page 426 Rent Collection . page 517 Evictions . page 538 Enforcement . page 599 Illegal Activities. page 6010 Budgeting . page 6511 Maintenance . page 705

Residential Property Management Procedures ManualIntroductionThere was a time when theownership and managementof an apartment buildingwere largely unregulated. Landlordswere virtually free to rent and operatetheir property in any fashion theydeemed reasonable. All you reallyneeded was the money for a downpayment, a building to purchase, acooperative lender and you were inbusiness.Times have changed. Today’sapartment industry has becomeconsiderably more regulated. Landlords must comply with many FairHousing laws. In addition, somemunicipalities regulate the wayproperties are managed as well as themanner and speed in which landlordsservice the maintenance needs oftheir tenants. Among the requirements today’s landlords face are setminimum amounts of heat in thewinter and the installation of earlywarning devices to protect againstsmoke inhalation and carbon monoxide poisoning.PBThe task of managing residential realestate has grown increasingly dependent upon the ability to skillfullyoperate within both the demands ofthe marketplace and the laws thatregulate the industry. Today’sproperty manager must be able tocompete with the manager of thebuilding down the street for suitabletenants and, at the same time,comply with federal, state, countyand local fair housing laws. In manycities, including Chicago and smallermunicipalities, landlords mustcomply with tenant/landlord ordinances and with rules concerningillegal activities committed bytenants. Failure to comply can, insome cases, result in seizure of theproperty.The key to successful operation ofany property is planning. All property owners need a written planguiding the day-to-day operation oftheir buildings. In fact, the actualplanning should start prior topurchasing a property. Pre-purchaseplanning should include deciding inwhat neighborhood or area you wantto buy, what size building you wantto buy, and what mix of bedroom-sizeapartments you want. You will alsohave to decide whether you want tobuy a fix-it-upper, a brand newbuilding, or something in between.Additional planning should includehow and where to finance yourpurchase, how much equity you haveavailable and want to invest, andwhat improvements you want tomake upon closing the purchase.Once you’ve answered these questions, you’re ready to decide on ahost of management and maintenance issues including the preparation of written plan on how toaddress those issues. This manual isintended as a guide for owners andmanagers of multi-family buildingsfor use in creating an operationsmanual for their own specific property. This manual contains procedures and policies that have beenemployed in various types of buildings throughout the Chicago metropolitan area. With minor modifications, this procedures manual willserve the needs of most multi-familybuilding owners and managers.

When it comes to rental policies,every owner must recognize that therental policies you develop must bedocumented and enforced. Whetherthey are based on objective rules orsubjective preferences, rental policiesmust be put in writing and applied ina fair and equal manner to everyonewho inquires about, makes application for, or rents in your buildingNegligence in the operation of abuilding can and often will result inlegal liability for any violations.Ignorance of the laws is no defense.If you plan on owning or managingan apartment building, you must beaware of the rules and regulationsthat affect the way in which youoperate that building. Once youknow those rules and regulations, youmust manage yourself and your staffin a manner that will not jeopardizeyour business or the building.This manual is intended to enableyou to manage your property moreskillfully. The end result is that you’llbe better able to obey the law, achievefinancial success, and be a valuableasset to the community.7

Residential Property Management Procedures Manual1TNew Property TakeOver Proceduresaking over or assumingeither the ownership ormanagement of an apartment building requires a systematicapproach to the many tasks thatusually await a new manager orowner. There are numerous detailsbeyond the closing table that youmust learn and address in a timelyand proper fashion in order to insurethat you start out on the right path.If you are purchasing an existingproperty, the first step to a smoothtakeover is learning as much aspossible from the seller. You’ll usuallyfind that sellers are cooperative andwilling to take the time to answerquestions about the property. Tomake your information gatheringsession as effective as possible,prepare questions in advance andkeep detailed notes of the answersyou receive. The New ManagementAssignment Takeover Checklist atthe end of this section provides anexcellent starting point. It contains alist of the key information you’llwant to gather from the seller.PBTenants of a newly acquired buildingare also prime candidates to providevaluable information. Typically aproperty takeover will be the firstmeeting or communication betweenthe new management team and thetenants of the building. This can bean excellent opportunity for you toset a positive tone for your futuredealings with the tenants of thebuilding. If not carefully planned,the first meeting could be poorlyhandled and result in a combativeand potentially disruptive relationship with the tenants of the building.Many novice property owners ormanagers start out with the beliefthat it’s their building, and they’llrun it the way they see fit. Theyoften mistakenly start with attitudessuch as— “The tenants, after all, are justrenters who can be easily replaced.” “Why should I cooperate withrenters? They’re the enemy in theTenant Landlord Wars. It’s mybuilding. I’ll call the shots.”When properly approached, thetenants of the building can be amongyour most valued allies. Theytypically are more familiar with thephysical property than you are, andthey are certainly more aware ofpotential problem tenants. Tenantshelp you pay your mortgage andoperating expenses. If things go asplanned, they will put profit dollarsin your pocket. Many tenants takegreat pride in the place they havechosen to call home and will enthusiastically assist you in keeping thebuilding up and finding new tenantswhen you have a vacancy. Whywould you want to start out therelationship with your tenants on anantagonistic note when what youreally need and should want is a longterm harmonious relationship?

When a building was previouslymismanaged, has some tenants whomay be involved in illegal activities,or was allowed to fall into disrepair,tenant cooperation at initial takeoveris especially important. In these casesyou will face some tenants who areskeptical of your intentions andothers who don’t wish to upset thestatus quo. You will need to quicklyenlist the help of those tenants whoare most likely to cooperate in yourquest to improve the overall condition and reputation of the property.It can be useful to ask the samequestions of each of the groups(sellers, employees, vendors andtenants). You may end up withcompletely different answers basedon the varying perspectives. Whilethat may appear to be troubling, itcan also be insightful. For example,if you ask how well the hallways aremaintained, it’s not uncommon toreceive different impressions fromthe janitor and the tenants. In thisexample, the tenants’ impressions aremore reliable.Existing employees, as well asvendors who previously providedservices to the property are alsovaluable sources of information. Incases where little historic informationabout a building is available, theseindividuals can help you gain theinformation you need to make asmooth transition and get off to apositive start. They’ll also help youanswer questions like, “Where are thehidden flaws? What are the extraspecial maintenance needs? Howwere things handled in the past?”This is all important information thatcan assist you in future planning.You will want to learn about thetenants of the building from theseller, from the other tenants, andfrom the janitorial and maintenancestaff. You’ll learn which tenants aregood neighbors and which aren’t?You’ll also find out who might havesomeone living with them who is noton the lease? Which apartmentshave a high number of visitors at allhours of the day? Who plays theirmusic so loud that they disturb othertenants? Which tenants have gueststhat hang out in the hall and leavegarbage about? The answers yougather can prove very valuable as youmove forward.9

Residential Property Management Procedures ManualNew Management Assignment Takeover ChecklistLocation(s) of PropertyTake Over DateBuilding Phone NumberPrevious Management FirmContact Person(s)Telephone #Existing PersonnelVerify Occupancy:Are fully executed current leases in place?YesNoAre all rents current?YesNoIs there a list of all residents with both home &work phone numbers?YesNoHave the security deposit amounts been verified?With Lease Agreements?YesNoWith Tenants?YesPBNoAre there any pending legal actions involvingtenants?YesNoHave all vacant units been viewed to assure theyare vacant?YesNoAre all delinquent renters in possession of theunits they lease?YesNoHave all delinquent renters been served Termination Notices?YesNo

Services requiring assurance of continuation:Has the electric company been notified of changesand made final readings?YesNoHave you provided for ongoing janitorialservices?YesNoHas the gas company been notified of changes andmade final readings?YesNoHave you provided for ongoing maintenanceservices?YesNoHas the water company been notified of changesand made final readings?YesNoHave you provided for ongoing landscapeservices?YesNoHas the scavenger company been notified of thechange in ownership/management and billing?YesNoBuilding Code Issues:Are there any existing Notices of Violations?YesNoAre there proper locks on windows and doors?YesNoDoes each unit have an operating smoke detector?YesNoAre all windows and screens in good repair?YesNoAre carbon monoxide detectors in place?YesNoHas the building been properly registered withthe city?YesNoEmergency Procedures:Have you contracted with an answering service forafter hours?YesNoHave current residents been informed of anychanges that they’ll be required to make?YesNoHave emergency point people been identifiedand provide with your emergency proceduresplan?YesNoHave emergency service providers been identifiedand contracted with?YesNo11

Residential Property Management Procedures ManualReports from Previous Owner/Agent:Regulatory AgreementsFinancial ReportsInventorySecurity Deposit ListingWaiting ListsLegal ActionsCurrent BillingPersonnel RecordsService Contracts in Place:termstermstermstermsImmediate Actions Needed:Comments:Completed By DatePB

2STenant Selectionelecting tenants is likely tobe one of the first issues youface. It is also one of themost important issues in the operation of your building. You can limitmanagement difficulties by properlypreparing a Tenant Selection Plan andapplying it to everyone who inquiresabout renting at your building. Awell thought out plan will be farmore effective than the “gut instinct”approach to tenant selection. Yet thecommon reaction to the suggestionthat landlords need a Tenant Selection Plan is something like, “Why doI need a Tenant Selection Plan? I’ll justplace an ad in the paper and rent myvacant apartments to whoever respondsto the ad so long as they look like they’llbe good tenants”!There are many reasons to develop awell thought out Tenant SelectionPlan. A Tenant Selection plan willcreate objective measures that can beused to determine which applicantsare more likely to be good tenants.A good plan will, at least, review anapplicant’s: credit history previous landlord references number of people who will residein the apartment and will verify: employmentdamage repair costs. A loud andobnoxious tenant may also drivegood tenants from the building.Though it is possible to evict badtenants, eviction can take monthsand hundreds of dollars to accomplish.A good Tenant Selection Plan won’tguarantee that you will never rent toa bad tenant, but it can lessen thatrisk. A good plan carefully applied toevery applicant will also providesafeguards against possible violationof fair housing laws. income information.Failure to perform basic backgroundchecks can result in leasing anapartment to a bad tenant who notonly won’t pay rent but may alsodestroy your building and its reputation. The end result is a combinationof emotional stress, financial burdensfrom lost rental income, and possibleThe following sample tenant selection plan is intended as a guideline.The building owner and managersmust set the standards for occupancy,income, and previous rental andcredit history. The sections in bolditalics are areas that you shouldmodify to fit the standards youdecide upon.13

Residential Property Management Procedures ManualSample Tenant Selection PlanI. INTRODUCTIONThis Tenant Selection Plan outlines procedures that will be followed in selecting new tenants for the YourApartments building. All apartments within the property will be leased in accordance with all applicablefair housing laws regardless of race, color, creed, religion, sex, national origin, ancestry, familial status,military discharge status, marital status, age, sexual orientation, or handicap of the applicant(s).II. RENTAL UNITSYour Apartments will offer 6 rental units. The number of rental units at the property that are reserved forrental households are as follows:Size of UnitNumber of Units1 BR . 22 BR . 23 BR * . 1* One 3 BR apartment is designated as an owner/manager/model/office apartment and is not available for rent.III. SCHEDULING SHOWINGS OF AVAILABLE UNITSContacting Interested IndividualsWhen a unit becomes available, a showing will be scheduled with interested individual, generatedfrom a waiting list or an advertising program, on a first come, first served basis. Management willindicate what information the applicant should bring to complete a rental application.IV. THE APPLICATION PROCESSA. ApplicationEach prospective tenant will complete a written rental application. Management will charge a 100 application fee. If the applicant is accepted, the application fee will be credited toward thesecurity deposit. If the applicant is rejected, the application fee will be refunded within fourteen(14) days of the date of the rejection notice. If the applicant is accepted for occupancy but refusesa unit, the application fee will be forfeited.B. Credit Check FeeIn addition to the application fee, Management will charge a non-refundable credit check feeof 25.00.C. Verification of Information on ApplicationManagement will take the following actions with respect to all written applications:1. Order a written credit report.2. Request a Verification of Employment or Income.PB

D. Home VisitsAfter Management has completed all other steps in the application process, Management willconduct a home visit on all applicants living within a 25-mile radius of the building at the timeof the application.V. ELIGIBILITY REQUIREMENTSA. IncomeAnnual gross income of households in the building must be equal to or greater than the incomeguidelines attached to this PLAN.B. Households/Unit Size LimitationsThe unit applied for must have enough bedroom space to accommodate the applicant’s household.As a guideline, no more than two people will be permitted to occupy a bedroom. In selecting a unitsize for the applicant, management will balance the need to avoid over-crowding a unit with theobjective of maximum utilization of space. (Chicago’s building code requires a minimum of 125 sq.ft. of floor area per person)VI. SELECTION AND REJECTION CRITERIAThe fact that an applicant meets the eligibility requirements does not mean that the applicant will be asuitable tenant. The prospective tenant must be able to fulfill lease obligations. In making this determination Management will consider various criteria, along with any related explanations offered by the applicantconcerning the facts involved, including changes in circumstance. Rejection of an applicant may be basedon one or more of the following criteria:A. Insufficient/Inaccurate Information on ApplicationManagement will consider whether the applicant refuses to cooperate fully in aspects of his/herapplication process, or whether the information supplied has been intentionally falsified.B. Credit and Financial Standing1. Management will consider the applicants’ history of financial obligations, (including timelypayment of rent, outstanding judgments or a history of late payment of bills). If Managementrejects an application based upon the credit report, Management will give the applicant thereason for rejection and the name of the credit bureau that performed the credit check. Applicants will also be given the opportunity to have corrections made to the report.2. Management will take into account inability to verify credit references. It will take into accountspecial circumstances in which credit has not been established (income, age, marital status, etc.).Lack of credit history will not cause an applicant to be rejected, although, in such circumstances,Management may require that a person with a history of creditworthiness guarantee the lease.3. Management will consider whether the applicant demonstrates financial ability to pay themonthly rent for the apartment.15

Residential Property Management Procedures ManualC. History of ResidencyManagement will verify and document the previous two years of housing for each applicant,including applicants who were homeowners or lived with parents/guardians. As part of thisreview, Management will consider whether the applicant or any other person who will be livingin the unit either has a history of criminal conviction for acts that involved physical violence topersons or property, that endangered the health and safety of other persons; or that involvedthe manufacture or distribution of a controlled substance or is currently addicted to, orengaged in the illegal use of, a controlled substance. If an applicant is currently receiving treatmentfor addiction to a controlled substance, Management will not reject the applicant so long as he or she isacceptable as a tenant in all other respects. Management will consider all circumstances regardingcriminal activity as well as the period during which it occurred.D. Unsanitary HousekeepingManagement will consider unsanitary housekeeping by the applicant. This criteria is notintended to exclude households whose housekeeping is only superficially unclean or disorderlyif such conditions would not appear to affect the health, safety or comfort of other residents.VII.ACCEPTANCE/REJECTION PROCEDURESA. Acceptance NotificationEach accepted applicant will receive a written notification indicating the date that the rental unitwill be available for occupancy (Exhibit A).B. Rejection NotificationManagement will promptly send each rejected applicant a written rejection notice stating thereason(s) for rejection (Exhibit B).VIII. DOCUMENTATIONManagement will document every step of the tenant selection process. Applicant files will be maintained by Management which will include, but not limited to, copies of the following correspondence:Rental ApplicationCredit reportHousekeeping ReportEmployment/Income Verification (see page 17)Exhibit A - Acceptance Notice (see page 14)Exhibit B - Rejection Notice (see page 15)Exhibit C - Underwriting Worksheet (see page 16)Previous Landlord Verification (see page 19)Prepared By: Date:PB

2 TENANT SELECTIONThe Rental ProcessThe following basic steps shouldbe applied for everyone whomakes application for anapartment at your building. Sampleforms that you may use are includedin this section.RENTAL APPLICATIONS should becompleted and signed by everyoneinterested in renting an apartment atyour property. All sections of theapplication should be completed. Becertain that those individuals whowill be responsible for rent paymentssign the application and authorizeyou to investigate their credit history.Requesting and photocopying aphoto ID can help verify the identityof an applicant. Attach the photocopy to the application.The UNDERWRITING WORKSHEET in this section is a form usedto determine the applicants’ ability topay the rental amount you arecharging. Information about theapplicants’ income, and existing debtshould be measured against the rentand other associated housing expenses. A sample form is includedalong with suggested ratios of incometo rent and income to rent and otherdebt. When you stay within therecommended ranges, your chancesof receiving rents on a timely andregular basis are likely to increase.VERIFICATION OF EMPLOYMENT/INCOME forms guide youthrough the process of determiningthe employment status of theapplicants. This form should be filledin and signed by the applicant(s) inthe appropriate spaces. The propertyowner/manager can then mail or faxthe signed form to the personnel orhuman resource department of theemployer. To ensure that the employer completes the form, do notallow the applicant to hand carry theverification form to and from theemployer. You may have to performa telephone follow-up in cases wherea response is not received within fiveworking days.The CURRENT OR PREVIOUSLANDLORD VERIFICATIONFORM is used to determine theapplicants’ current rental status aswell as previous rental history. Thisform should be completed by theapplicant(s) and signed. The formshould then be faxed or mailed to thecurrent and a least one previouslandlord by the owner or manager.Again, do not allow the applicant tohand carry the form. Don’t besurprised if telephone follow-up onyour part becomes necessary.CREDIT REPORTS should beconducted on every applicant whohas sufficient income to qualify foryour apartment. Select a CreditBureau that can provide rapid service.Many companies can provide a reportwithin hours, while others mightrequire a day or two. Some bureauscan provide additional services suchas eviction court searches andcriminal background checks. However, it’s important to realize thatthey are likely to charge additionalfees for these services.If you want to obtain access to publicrecords such as eviction cases,judgments, liens, or criminal convictions, you may wish to visit thecounty building that serves your area.Often the public can use computerterminals for these backgroundchecks.Whatever methods you decide to use,you must apply the same procedurefor screening everyone applying forresidency at your property. Failure toapply the same procedures can resultin fair housing violations. Thefollowing forms can help in selectingtenants and may be modified for yourspecific property. We encourage youto choose selection criteria that canbe employed consistently andspeedily.17

Residential Property Management Procedures ManualEXHIBIT “A”ACCEPTA

Residential Property Management Procedures Manual PB Introduction here was a time when the ownership and management of an apartment building were largely unregulated. Landlords were virtually free to rent and operate their property in any fashion they deemed reasonable. All you really n