Transcription

F E AT U R E D I N S I G H T SDELIVERING CONSUMER CL ARIT YHOW INDIANCONSUMERSN AV I G AT E T H E C A RBUYING JOURNEYA GLIMPSE INTO CAR PURCHASING PAT TERNSIN URBAN INDIABY: SUBHASH CHANDRA, EXECUTIVE DIRECTOR, NIELSEN INDIA 48% OF CONSUMERS SAY THEY SEARCH FORINFORMATION ONLINE BEFORE VISITING ORCONSULTING ANY OFFLINE MEDIUM 87% OF THE CONSUMERS RECONSIDER ONEPURCHASE DECISION FACTOR (BRAND, MODEL,FUEL TYPE, BUDGET, COLOUR ETC.) AT THE TIMETHEY BUY SALES STAFF AT SHOWROOMS CAN HEAVILYINFLUENCE (73%) LAST MINUTE CHANGES INDECISIONS AND GUIDE CAR BUYERS’ CHOICESToday, India’s auto sector is among the top 10 automotive markets inthe world and is poised to grow as income levels continue to increaseand finance becomes easily available. While the market has been sluggishoverall and produced very few individual successes, most manufacturersare looking at India as the next big hub. The potential is high because carpenetration is low compared to other countries.1Copyright 2014 The Nielsen Company1

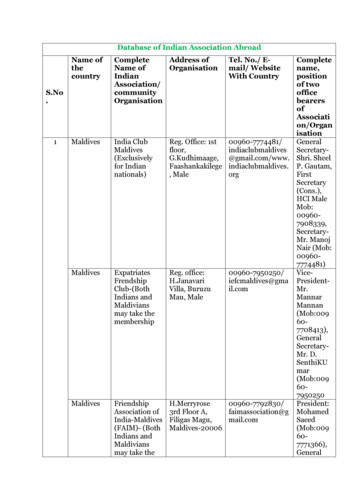

COUNTRIESCARS (PER rce: Society of Indian Automobile Manufacturers (SIAM)We recently conducted a survey to decode Indians’ car purchasepatterns, specially the behavioural aspects. To do so, we looked at thepurchase journey as a whole from the initial search to the final buy.The consumer’s first step once the need is triggered, is searching forspecific information.While word-of-mouth remains one of the most important sources ofinformation (used by 96 percent of consumers), other trends are alsogaining traction. Almost half of the consumers are now following theResearch Online, Purchase Offline (ROPO) method. Forty-eight percentof consumers said they searched for information online before visitingor consulting any offline medium.Of late, the Internet even plays a role in consumers’ other informationsources - including word-of-mouth. A large part of shoppers’conversations and discussions between family and friends is nowonline.During online searches, “technical specifications” topped the mostsearched information list; “car comparison” and “expert reviews” werethe other key details sought online. Consumers also compared differentcars they were considering and read expert reviews for their intendedpurchase.Offline, 39 percent visited the dealership and 36 percent spoke to theirlocal car mechanics for getting more information about vehicles.48 PERCENT OF CONSUMERS SAY THEYSEARCH FOR INFORMATION ONLINEBEFORE VISITING OR CONSULTING ANYOFFLINE MEDIUM.2FEATURED INSIGHTS UNLOCKING THE CAR PURCHASE JOURNEY

MANUFACTURERS NEED TO LOOK AT THE LOGICALEXTENSION OF BEING MORE ACTIVE ONLINE. ONE OF THEJAPANESE AUTO MANUFACTURERS IS PL ANNING TO KICKSTART ONLINE BOOKINGS IN INDIA WHERE SHOPPERSCAN BOOK THE CAR ONLINE BY MAKING A PAYMENT ANDTHEN COLLECT IT FROM A NEARBY DEALER.THE DECISION MAKERSAfter collecting information from all sources, 43 percent of consumersreported making their final decision on their own while 33 percent saidthey consulted their spouses and close family members. This mainlyreflects men’s decision-making habits—they’re more likely to makedecisions on their own (53% vs. 25% for women) while women aremore likely to ask their spouse and family members (48% vs. 24% formen). However, the number of women buyers is growing, especially inthe luxury segment. A report by car manufacturer Mercedes noted thatmore than 5 percent of its buyers in India are women.53433724258DECIDEDONMY OWNOPINIONFROMSPOUSE11111697OPINION FROMOTHER NDSOPINION FROMCOLLEAGUES &PEERS IN THEBUSINESS953DEALERSHIPEXPERIENCEFEMALEAll figures in %Source: NielsenCopyright 2014 The Nielsen Company3

The increase in women buying cars could reflect the growing femaleworking population and lifestyle changes. This clearly indicates thatwomen car buyers are the next segment that marketers need to focuson and highlights the importance of understanding gender-basedautomotive needs.THE L AST MILE SWITCHWhile most marketers think that the car shopper decides to buy a carbefore visiting the dealer, consumers aren’t as predictable as we think.13%Buyers can always be influenced—right up to the last moment oftheir purchase. Three out of five shoppers said they had finalisedtheir decision on the model, brand and fuel type before visiting theshowroom. However, when the time came to make their final purchase,a considerable number of consumers change their minds. A third ofbuyers who said they’d decided about fuel type, changed their decisionafter talking to the salesperson, family and friends.87%And it’s not only fuel type decisions that consumers change—44 percentchanged even the car model they were thinking of buying! In fact, ourstudies show that car buyers also look at models that they had not eveninitially considered.CHANGENO CHANGEFACTORS CHANGED FROM INITIAL PL AN56 COLOURAll figures in %Source: Nielsen4FEATURED INSIGHTS UNLOCKING THE CAR PURCHASE JOURNEY

THE SHOWROOM FACTORThe key factor driving consumers’ choice changes is the interactionwith the salesperson at the dealer showroom. We found that most ofthe shoppers who sought the salesperson’s advice were not satisfiedwith their knowledge related to the car’s features or their comparisonbetween two or more of the cars they considered.73605115SALESPERSONINFLUENCEBETTER NCEAll figures in %A FAMILY AFFAIRBuying a car in India remains a family affair. Almost all respondents wespoke to were accompanied by their spouse or another family member.This is likely a method of re-affirming that their intended decision isright.8344WENT WITHFAMILYWENT WITHFRIENDS21ALONE6WENT WITH A PERSONWELL-ACQUAINTEDWITH 4-WHEELERSAll figures in %Copyright 2014 The Nielsen Company5

THE BUYING CYCLESo how long does this all take? More than 90 percent of car buyersspend less than three months to decide, finalise and make the finalpurchase. Seventy-five percent of consumers buy a car just after visitingthree or less dealers. Out of them, 32 percent purchase one from thefirst dealer they had visited. Most consumers decide and purchase avehicle from either the first or second dealer that they visit.While the final purchase ends the consumer’s car buying journey, itmarks the start of their journey with the car. And when it comes toactual usage, 40 percent of consumers said they use their car morethan they had planned for before buying it. And amongst those who useit less, the key reason was not fuel price but traffic jams!6FEATURED INSIGHTS UNLOCKING THE CAR PURCHASE JOURNEY

ABOUT THE AUTHORSUBHASH CHANDRA,EXECUTIVE DIRECTORNIELSEN INDIASucheta Jha and Ajay Chourasia from the Nielsen Auto teamcontributed to this issue of Featured Insights.ABOUT NIELSENNielsen Holdings N.V. (NYSE: NLSN) is a global information andmeasurement company with leading market positions in marketingand consumer information, television and other media measurement,online intelligence and mobile measurement. Nielsen has a presencein approximately 100 countries, with headquarters in New York, USAand Diemen, the Netherlands.For more information, visit www.nielsen.com.Copyright 2014 The Nielsen Company. All rights reserved. Nielsenand the Nielsen logo are trademarks or registered trademarks ofCZT/ACN Trademarks, L.L.C. Other product and service names aretrademarks or registered trademarks of their respective companies.14/7554Copyright 2014 The Nielsen Company7

8FEATURED INSIGHTS UNLOCKING THE CAR PURCHASE JOURNEY

purchase. Seventy-five percent of consumers buy a car just after visiting three or less dealers. Out of them, 32 percent purchase one from the first dealer they had visited. Most consumers decide and purchase a vehicle from either the first or second dealer that they visit. While the final purchase ends the co