Transcription

Dave Ramsey’sGuideBudgeting

ContentsIntroductionHow to Makea Budget35Using theEnvelopeSystemPaycheckFrequency911Families andBudgetsYou Make ItAll Work1417DAVE RAMSEY’S GUIDE TO BUDGETING 2

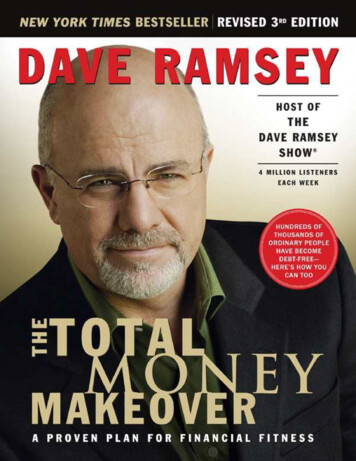

IntroductionCongratulations! You’ve already started.Started? You may be thinking. What do you mean?We mean that by reading this guide, you’ve taken the most important steptoward giving yourself a solid financial future. You are already making progress.You’ve started.When you make a budget, you take the first step toward getting control of yourmoney so you can build wealth. Without a budget, it’s a lot harder to get throughDave Ramsey’s seven Baby 5BabyStep6BabyStep7 1,000 starter emergency fund in the bankPay off all debts smallest to largest with the debt snowballFully funded emergency fund of three to six months of expensesInvest 15% of pretax income into retirement savingsInvest for kids’ college savingsPay off the houseBuild wealth and give a bunch awayNow let’s get ahold of your money and tell it what to do.DAVE RAMSEY’S GUIDE TO BUDGETING 3

IntroductionWhat Is Most Important?Your biggest wealth-building tool is yourincome, and the best way to harness thepower of your income is the monthlybudget. Not investing or saving for college(though those things are important). It’sthe budget, because from the budget flowseverything else. If you want to invest moneyin a mutual fund, you make room for that 100 or 500 in the monthly budget. Wantto get out of debt? List your debts in yourspending plan. You get the idea.The sad thing is that lots of people rank abudget only slightly higher than the BlackPlague. Budgets to them mean no fun, breadand water for every meal, and custom-fittedstraitjackets. What they don’t realize isthat a spending plan is the fastest way towherever you want to go, from simply takingcontrol of your money to getting out of debt.Many people don’t make a budget becausethey are afraid of what they will find. Ifsomeone has overspent to the point that theynow face a mountain of debt and little or nosavings, they might be shamed into stoppingright there. Don’t fall into that trap.A Lesson From HollywoodIn the 1996 movie Ransom, Mel Gibson’scharacter’s son has been kidnapped (imaginethat kind of emotional turmoil). Before hegoes out to negotiate his son’s release witha bag of money, an FBI agent gives himsome helpful advice. “This here’s a businesstransaction,” the FBI agent tells him. “You’rea businessman; he’s a businessman. This isbusiness.” He’s trying to get Gibson to takeemotion out of the situation so he can thinkclearly and do what needs to be done. Givemoney. Get son. Simple.We are not denying the emotion that youmay be feeling. Whether it’s fear, anger,shame or something else, that feeling is veryreal. The right time to apply that emotionalenergy is when you have a plan in place.Put your fear or anger aside long enoughto get the numbers on paper—a businesstransaction. Once that’s done, bring youremotion back and apply that passion andenergy to the plan you’ve made.DAVE RAMSEY’S GUIDE TO BUDGETING 4

How to Makea BudgetYou can make a budget any way thatworks for you. It might be just ayellow pad and pen, or maybe it’sa spreadsheet. You might choose Dave’sawesome budget forms or our super helpfulGazelle Budget tool. Pick your favorite.You must make a new budget for each month.Every time that calendar flips, there arenew birthdays, holidays, insurance bills, taxrefunds (we’ll talk about that later), gas bills,proms and so on. There is no such thing asa “perfect” budget that works the same wayevery month.If you are married, do not separate yourincomes. The preacher said, “And now youare one.” That includes your income! You areworking together toward a goal that benefitsboth of you, so it doesn’t matter if one of younets 1,000 a month and the other bringshome 10,000. You are now an 11,000household.If you want to win with money, you’ve gotto do the details. Every month. So let’s getstarted.IncomeOn one side of the page, list all your incomesources for the month. That includes: Paychecks Income from a small business Side jobs Freelance work Residual income Child supportThere may be other nooks and cranniesthere that we didn’t cover, but theoverarching rule is this: If you receive moneyduring the month, write it in your incomecategory. There’s really no such thing as“found money.” If you take it in, you shouldwrite it down.If you are married, then both of you sit downwhen it is time to make the monthly budgetand have a Budget Committee Meeting.Both of you have input and an equal say.The person who is more detail-oriented (thenerd) can take the lead and write down thenumbers, but the more laid-back person(the free spirit) also has a vote and mustcontribute. None of this, “Whatever you wantto do, honey,” stuff.Once the budget is agreed upon, pinkyswear and spit-shake that you’ll stick to it.By making the spending plan together, youput your word to doing what’s on the paper.If you don’t, it’s breaking your word, so don’tstray from the plan.DAVE RAMSEY’S GUIDE TO BUDGETING 5

How to Make a BudgetOutgoNow let’s do a breakdown of the flip side of your budget.Most people get a little scared when they get to this partbecause they know in the back of their minds that theyspend a lot more than they earn each month. It can bepainful and scary, but if you look at your outgo and thentake steps to correct any overspending, it works everysingle time.Tax RefundsIf you get a big check from UncleSam at tax time, that’s actually abad thing. Why? Because it’s justmoney that you’ve overpaid, and nowWashington is giving it back to you.It’s not a gift. It never belonged to thegovernment in the first place.Let’s say you went to the grocerystore with 20 and purchased a 5item. You didn’t notice the cashiergiving you back two 5 bills insteadof a 10 and a 5. Thus, you overpaidfive bucks. The next day, the storemanager calls you. They realized theerror and will send the money to you.At this point, have you made a freefive bucks? Of course not! You arejust getting back what is yours.Overpaying on taxes works the sameway. It’s letting the government useyour money interest free for one year.Instead of a 3,000 tax refund,change your withholdings at work soyou get that money in your paycheck.That’s 250 each month that you canuse to attack your debt or accomplishyour goals.Write down every single expense you have eachmonth. Rent, food, cable, phones and everything inbetween. Your expenses vary from one month to thenext, which is why you make a new spending plan eachmonth. A gift budget might be high in December and lowin April. The car budget might spike in the months whereyou have to renew the tags and pay insurance. Focus onone month at a time.Start EarlyMake your budget a couple of days before the monthbegins. That gives you the feeling of control. Youdon’t have that feeling of control if it’s July 7 and noJuly budget has been made. Instead, have your Julyspending plan finished by June 29. Don’t let the monthsneak up on you.When you make a purchase, write it down in your budgetform that day. It only takes 60 seconds, and you can do itright when you get home. A quick way to make a budgetinto a mess is to open your wallet or purse and find aweek’s worth of receipts in there.As far as reconciling your checking account goes, internetbanking is the way most people handle it nowadays.The convenience of banking any time of day or night is agood thing, but be careful to not view your money as justdigits on a screen. You must keep emotionally connectedto your money so that you don’t overspend. Spendingcash hurts, so you spend less. If you are detached fromyour money and just see numbers on a screen going up ordown, you become less sensitive to it, which is not good.DAVE RAMSEY’S GUIDE TO BUDGETING 6

How to Make a BudgetThe Goal Is ZeroThe point of a zero-based budget is to makeincome minus the outgo equal zero. If youcover all your expenses during the monthand have 500 left over, you aren’t done withthe budget yet. You must tell that 500 buckswhere to go. If you don’t, you lose the chanceto make it work for you in the areas ofgetting out of debt, saving for an emergency,investing, paying off the house, or growingwealth. Tell every dollar where to go.Doing so makes a huge difference. Accordingto surveys we’ve conducted in FinancialPeace University classes, people who do azero-based budget (versus those who don’t)pay off 19% more debt and save 18% moremoney! Just from having a plan! The sooneryou make a zero-based budget part of yourmoney-handling strategy, the sooner you’llstart to see your debt go down and yoursavings go up.Five Money GotchasAnd as you probably figured, if you arespending more than you make each month,you have to start cutting stuff. Use coupons,sell items that you don’t need or havepayments on, and stop going out to eat.Here are some common areas that eat yourmoney up: Eating out. Start eating leftovers. Stayingaway from restaurants can literally saveyou a couple hundred dollars a month. Car payments. You can buy a quality carfor 2,000, and it will get you around townjust fine. And you won’t miss that 500payment. Groceries. Clipping coupons, waiting forsales, and buying generic brands are hugedifference makers in your spending plan. Utilities. Shut the lights off when youleave the room. Entertain yourself witha book instead of the TV. Those are just acouple of ways to save, but they are big. Clothing. We don’t need new clothes asoften as we think we do, and buying fromgarage sales and consignment stores cansave you enough to make your jaw drop.Cash Flowing EmergenciesAs you get better at budgeting and paying offdebt, you’ll become better and more capableof adjusting to cover emergencies.When you have your 1,000 emergencyfund in place (Baby Step 1), you can coverminor emergencies with the stroke of a pen.But you can also look at small emergencies(maybe 50 or 100) and adjust your budgetto cover them. As your money position getsstronger, you can cash flow more.Here’s a good rule of thumb for determiningif you can cash flow an emergency or if youneed to dip into your rainy day fund: If youcan cut up to 10% off items in your budgetto pay for something that comes up, thencash flow it. Otherwise, go for the savings.DAVE RAMSEY’S GUIDE TO BUDGETING 7

How to Make a BudgetHere’s an example. Let’s say you have someexpense for 100 pop up on the 10th of themonth. Within your spending plan for thatmonth, see if you can cut 10% from the otherline items in your budget to come up withthe money. If you have 500 allocated forgroceries, see if you can slice that down to 450. That will put you halfway toward thegoal. If gas will cost you 200 that monthand you can trim 20 bucks off by catching acarpool to work, now you’re up to 70. Lookat your other budget items to cut out a totalof 30 more in order to cover the emergency.The second month it will work better,but there will still be hiccups. Again, giveyourself time to learn the process and don’tbe discouraged. You are further along thanyou were before, so focus on how muchyou’ve learned—because quite frankly, youdon’t have much further to go before you’llhave this budgeting thing down pat.But if the expense is 300 and you can’treach that amount without cutting morethan 10% off all of your line items, then headto the emergency fund.It’s a good idea to have a little padding inyour checking account in case someonemakes a math error in the register. You don’twant to overdraw your account, so keepinga safety net of 50 or 100 in there is asmart idea (although you still need to do azero-based budget and watch your moneyclosely).Practice Makes PerfectBudgeting is a process. Imagine a parentteaching their son or daughter how to catch abaseball. In the first few days, there are goingto be a lot of drops because the child is justlearning. They’re bound to be frustrated andwant to quit, but if they want to get better at it(and they will), they just keep practicing.Likewise, you must get a feel for how yourhousehold numbers work before you becomea budgeting expert. It will happen. The firstmonth, you will probably feel lost and thebudget may seem like it doesn’t work. Don’tgive up.By the third month, you should have apretty firm grasp on the process. Smalltweaks may need to happen here and there,but nothing like when you first started. Youknow where the money is going. Feel thatsense of power yet?DAVE RAMSEY’S GUIDE TO BUDGETING 8

Using theEnvelope SystemOne Extra StepYou don’t have to save up any money to start usingthe envelope system. Here’s how you do it. Let’ssay you have budgeted 500 a month for groceries.When you receive your paycheck, write yourselfa check for 250, cash it, and put the cash in anenvelope. On that envelope, write “groceries.” Nomoney—and we mean NO MONEY—comes out ofthat envelope except to pay for food at the store.If you go food shopping and leave the envelope athome by mistake, turn the car around and go backto the house to get it.Make sure to take enough money to cover yourgroceries for that trip. If you take 150 and youtally up a bill for 160, take some things out ofthe cart. Bring any change back and put it in theenvelope. When you get paid again, write another 250 check. That’s your 500 for the month forfood. If you want to go to the store but don’t haveenough money, then raid the fridge for leftovers.Use the envelope systemfor items that tend to bustyour budget.Getting a RewardCommon examples include:If you have money left over in an envelope at theend of the month, congratulations! You came inunder budget for that item that month. So for that,it’s all right to celebrate (within reason). Rewardyourself if you’d like by going out to dinner orrolling the money over to the next month so youhave an extra big food budget. Food (grocery store) Restaurants Entertainment Gasoline ClothingGetting that reward is important because it keepsyour spirits up. It’s tough to live on a beans-and-ricelifestyle. But you’re making it work! Great job!DAVE RAMSEY’S GUIDE TO BUDGETING 9

Using the Envelope SystemDon’t Cheat on Your EnvelopesBe careful not to borrow from other envelopes. When it comes to the envelope system, itcan be very tempting to borrow cash from one envelope to fund some other activity. Forexample, if you use up all your “eating out” money, don’t be surprised if some inner voice tellsyou to reach behind that envelope for the one that’s marked “clothing.”C’mon just a little it won’t hurt you.You must remember that the very purpose of the envelope system is to curb your spendingand teach you discipline. When you run out of grocery money, you eat leftovers instead ofgoing food shopping. If you see your gas money is slipping away faster than the remainingdays of the month, then limit your trips or even carpool. If you have a crisis come up in themiddle of the month or something happens and you absolutely have no other choice but toshift envelope funds around, then call an emergency budget committee meeting with yourspouse. Talk to each other and figure out the best course of action, adjust the budget, and bein agreement on it. Both of you must be involved; it’s a committee decision.DAVE RAMSEY’S GUIDE TO BUDGETING 10

PaycheckFrequencyFor someone who gets paid on the sametwo days each month, this isn’t such abig deal. But what if you get paid everytwo weeks and have those “magic months”twice a year that contain three paychecks?What if you have an irregular income? Howabout a household where you both are paiddifferently? We’ve got all that covered.If you get paid on the 10th and yourmortgage is taken out on the first, thenwork your budget until the next paycheck.For example, money received on April 10will cover all expenses for the next 30 days(such as your May 1 mortgage payment, foodand all other expenses) until May 10. At thatpoint, your May paycheck will take care ofeverything until June 10, and so on.BimonthlyWe’ll identify the different types of paydayshere as well as how to work them on amonth-to-month basis. If you are a twoincome family and your spouse is paiddifferently than you are, then each of youchoose your section and figure out how towork your particular payment schedule, thencombine your paycheck with your husbandor wife and work it from there.MonthlyThis is the easiest one of all. One paycheckequals one month’s expenses. Wheneveryour check comes in, use it to budget for thenext month. For example, if you get paid onthe first of April, then your mortgage, foodand all other expenses for that month arecovered by that paycheck.This one is perhaps the most common form.You get paid on or around the same twodays each month, such as the 15th and 30th.The best way to work this is to treat thepaycheck on the 30th as the first paycheckfor the following month. That’s because itcan be confusing to make a budget at thefirst of the month when you don’t get paiduntil the 15th.For example, if you receive paychecks onAugust 15 and 31, then the 31st paycheckcounts as the first money for September.So to work your entire September budget,you’ll use the August 31 paycheck and theone from September 15. The paycheck onSeptember 30 counts as the first moneytoward October, and the October 15th is thesecond paycheck for it.By doing it this way, you already have apaycheck in place by the time you turn thecalendar. You can attack the bills in the firsthalf of the next month without wonderingwhich paycheck is supposed to cover what.DAVE RAMSEY’S GUIDE TO BUDGETING 11

Paycheck FrequencyWeeklyThis kind of paycheck is just what the nameimplies. You get paid once a week on thesame day. Just like with the “biweekly” paystructure (next entry), there will be somemonths where you get an extra check. In thiscase, five paychecks instead of four.Each paycheck you get, save a quarterof your house payment out of it. If yourmortgage note is 1,000 a month, then save 250 from each check. For the months withfive checks, put that extra 250 toward yourcurrent Baby Step. Then work your month’sbudget with each subsequent paycheck.BiweeklyThis type of pay schedule can be especiallyfrustrating because sometimes the checkswill come on the 1st and 16th. Other timesit will be the 10th and 24th, and you aren’tsure what money is supposed to cover whatbills in what month. Still other times, it willgive you three paychecks in a month. It’smore to work with, but finding what to dowith all the cash can be a head-scratcher.First off, remember that you’ll have at leasttwo paychecks in any given month. If youare paid on the 9th and 23rd, don’t panicthat the checks arrive too late for some billsand too early for others. There are at leasttwo checks per month. That will keep yougrounded.The key to having enough money whenthe pay cycle is weird is to look at the twoweek period in front of you. If March 25 ispayday and your mortgage is due on April1, then that March 25 paycheck covers yourremaining expenses for March plus the Aprilhouse payment and any expenses until yournext check. Therefore, look at how muchmoney you need for the next five or sixdays and subtract that from your paycheckamount. Whatever is left is money that you’lluse for the next month.Here’s an example. You get paid on Friday,March 25, and the paycheck is 2,300.You estimate that it will take 400 to getyou through the rest of March (coveringfood, gas, bills, etc.). You also have a housepayment of 1,100 due at the beginning ofApril. That means you need 400 for March,so put that into March’s budget. Then take 1,100 to cover the April house payment, andthe remaining 800 of the 2,300 paycheckcovers your bills until the April 8 paycheckcomes in.If you get three paychecks, the formula issimilar. Let’s say you get paid on Friday,September 2, as well as the 16th and 30th. Bythe time you get that last check, September’sbudget is done and you are on to October.When that happens, look at your budgetfor the first couple of weeks in October anddetermine what bills will be due, how muchyou’ll need for food, gas, etc. Once you havethat number, subtract it from that thirdSeptember paycheck, and whatever is leftover is the extra money that you can puttoward debt, savings or something else.Irregular IncomeThis type of paycheck usually applies topeople who work on commission or areDAVE RAMSEY’S GUIDE TO BUDGETING 12

Paycheck Frequencysmall-business owners. Some months maybe outstanding and others are anything but.The strategy here works a little differently.When you sit down to make your budget, youmake what’s called a prioritized spendingplan. You list expenses in order of priority.The cable bill is not as important as eating,for example, so it goes further down the listthan food.Setting Priorities With Irregular IncomeDave talks about maintaining the Four Wallsbefore anything else. When you have anirregular income budget, the first budgetitems you should cover are:1. Food2. Shelter and utilities (mortgage, electricbill, etc.)3. Clothing (within reason)4. Transportation (gas for the car)Here’s how you make a prioritized spendingplan. List all your budget items for themonth, just like when you make a regularbudget. When they are all listed, look themover and number them according to theirimportance. Following the Four Walls, you’dplace a “1” beside “Food.” By doing this,you are saying that if you only have enoughmoney to pay for one item on the list, it willbe food. Keep moving down the list untileverything is numbered. Then rewrite thelist in order by number. Now you’ve got aprioritized spending plan.Here’s the second step. Beside each line item,write the amount of money you realisticallywant to spend on that item. Spend down thelist (on paper) until your money runs out forthat month.Now, step number three. When you get paid,start at the top of your list and work yourway down.Draw a LineOnce you have spent all your income for themonth, draw a line at the place where themoney ran out. Everything below the linedoesn’t get paid because the money has runout. If you cover everything and have moneyleft over, use that extra cash to walk yourselfup the Baby Steps.Over the Hill, Through the ValleyIt is also a good idea during those goodmonths to set up a hill-and-valley fund. Ahill-and-valley fund is a savings accountwhere you put aside extra money to get youthrough the lean times. It’s one step downfrom an emergency fund. With an emergencyfund, you only use it when the transmissiongoes out or a roof starts leaking. The hilland-valley fund is there to help you meetmonthly expenses when you run short.If you are a straight-commission salespersonwith a 5,000 household budget and you earn 7,500 one month, put that extra 2,500 intothe bank. That way, when a month comesalong where you only earn 3,000, you havereserve savings at hand to cover expenses.DAVE RAMSEY’S GUIDE TO BUDGETING 13

Familiesand BudgetsAnd Now You Are OneIf you are about to get married, it’simportant to remember to not—werepeat, NOT—combine your moneyuntil you are married. You’ll have plenty oftime to learn how to budget together onceyou are wed. But until the vows have beenexchanged and the legality of the marriage isbinding, don’t mix the money.The reason is because if something goeswrong, you’ve got a mess. Maybe one of yougets cold feet and wants out. Don’t think itcan’t happen, because it’s happened manytimes before. Perhaps you discover debtthat your fiancé has been hiding from you,and trust issues suddenly come up. If yourpaychecks are going into a joint accountand the other person closes the account andtakes your money, you end up with lots ofanger and no recourse.Get yourselves into some good premaritalcounseling before tying the knot, and don’tintertwine your money. It’s also a good ideato attend Financial Peace University and learnhow to properly bring your finances togetherafter you are wed.Leave No One BehindOnce you are hitched, remember that havingyour spouse there can help keep you honestabout how you spend. If you took a roadtrip, you would not leave your husband orwife behind. In that same vein, think ofhow they would feel if you made a budget,then spent money how you wanted and leftthem behind. Somebody in your householdwould be pretty upset about that. When youmade the budget, you signed a pact with theother person to not spend any money exceptwhat’s on that piece of paper. If you dootherwise, you have broken your word, andit will hurt your spouse.A Little Bundle of JoyIf you are expecting a baby and one of youwants to stay home (presuming you are bothworking outside the home), you should startpreparing now. Believe it or not, you can geta good idea of the money situation while thebun is still in the oven. Simply live off theincome of whoever will continue earning thepaycheck while saving 100% of the otherperson’s income for as long as you get it.Let’s look at Mike and Amanda. Mikeearns 50,000 a year and Amanda makes 35,000. If they are expecting a child, thenthey should spend the months beforehandDAVE RAMSEY’S GUIDE TO BUDGETING 14

Families and Budgetsliving on Mike’s income and depositing allof Amanda’s paychecks into savings (notinvesting, but just a simple savings accountat their bank).If Mike and Amanda have debt, then it’sall right to stop paying extra on their debtsnowball (see below) while they pile upsome cash for the little one’s arrival. Onceeveryone comes home from the hospitalhealthy and happy, then they can take thatgigantic pile of saved cash and throw it atthe debt. If anything happens that requires alonger hospital stay, they’ll have the moneywaiting there.There are multiple benefits to living on oneincome like this before the baby arrives. Wealready mentioned the savings. It will alsogive you an idea of whether or not you canmake it on one salary and how much you’llneed to scale back on lifestyle. It can helpyou identify sore spots in your budget thatshould be eliminated. If you can pay a car offin a year and a half on two salaries but noton one, then this could be a cue to sell the carand accelerate your snowball.Prioritizing RightIf you are a single parent, realize how vital itis for you to prioritize. Your main concernsare feeding the kids, keeping the lights onand gas in the car, and making sure there’s aroof overhead. Focus on survival and livingwithin your means because overspending tokeep up a lifestyle will only sink you deeperinto the mud each month. And it’s a lot easierto get in than to get out.More than likely, money is tight when youare the only parent. There are plenty ofcoupon websites and other places onlinewhere you can get a deal on food or neededitems around the house. Never buy anythingwithout first putting it through your “deal”filter. The more you look for deals, the betteryou’ll get at it, and the less time and energy itwill take. And the more money you’ll have.If you are going back to work after the childis born, be ready to factor childcare into thebudget. Unless you have a nearby relativewho is willing to watch your child for free,you’ll have to pay.Single ParentOne word: tough.That can just as easily describe a singleparent as it does their situation. When youare responsible for raising one or more kids,working, running the household, paying thebills, helping with the homework, and allthings in between, it can wear on you. Youhave no choice but to be tough.Likewise, come up with inexpensive andcreative ways to have fun with your kids.You don’t need to take them on expensivevacations or buy the latest toys for Christmasin order for them to have a happy childhood.DAVE RAMSEY’S GUIDE TO BUDGETING 15

Families and BudgetsFour WallsConcentrate on maintaining the Four Walls (food,shelter/utilities, clothing and transportation). Fromthere, focus on walking up the Baby Steps.Many times, after a divorce, parents make the gravemistake of trying to keep a house they can’t afford. Therationale, they say, is that the kids have been throughso much that they don’t want to move them to a newneighborhood and turn their world even more upsidedown. That thinking is certainly understandable, but itcan do a lot of harm long term.Sinking fundsA sinking fund happens when yousystematically save for an expensethat doesn’t occur every month. Forexample, let’s say you plan to spend 1,000 on Christmas and it’s thebeginning of March. You have 10months to save, so if you put aside 100 a month to be able to pay forChristmas with cash, then that is yourChristmas sinking fund. If you save 90 monthly for the car insurance billthat is due in six months, then that’syour car insurance sinking fund. It’syour choice where to put the actualmoney as you build a sinking fund.It can be a simple savings accountat your bank or cash in a cookie jar.The important thing is to make surethat you separate it from your othermoney so that it doesn’t get spent onsomething else.As you make your budget, look a fewmonths out and see what expensesare coming that need a sinking fund,then build those into your monthlybudget so they don’t sneak up on you.If you and your ex were living in a house that you couldonly afford together, then you need to move. That’s notpleasant news, but if the loss of income means you’llbe paying half of your take-home pay to a mortgagepayment, you won’t be able to survive. Even worse, youmight borrow money to sustain a certain lifestyle andmake things even worse in the years to come.An Inconvenient TruthChild support can be a touchy subject because everyonehas a different opinion of how it should be used. Oneperson says it’s for college savings, another says it’s forchild-specific items or activities, and so on.Just remember that every time you put gas into your carso you can drive the kids to school, you are supportingthem. If you use it to get out of debt so you can free upmore money, you are supporting them. The point is tohave th

Dave Ramsey’s seven Baby Steps: BaBY Step 1 1,000 starter emergency fund in the bank BaBY Step 2 pay off all debts smallest to largest with the debt snowball BaBY . to surveys we’ve conducted in Financial Peace University classes, people who do a zero-based budget (versus those who don’t) pay off 19% more debt and save 18% more money .File Size: 2MBPage Count: 17