Transcription

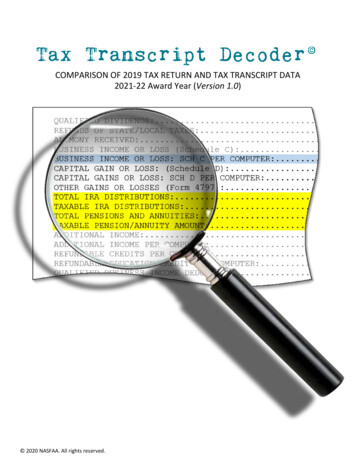

Tax Transcript Decoder COMPARISON OF 2019 TAX RETURN AND TAX TRANSCRIPT DATA2021-22 Award Year (Version 1.0) 2020 NASFAA. All rights reserved.

2020 by National Association of Student Financial Aid Administrators (NASFAA). All rights reserved.NASFAA has prepared this document for use only by personnel, licensees, and members. The information contained herein is protected by copyright.No part of this document may be reproduced, translated, or transmitted in any form or by any means, electronically or mechanically, without prior writtenpermission from NASFAA.NASFAA SHALL NOT BE LIABLE FOR TECHNICAL OR EDITORIAL ERRORS OR OMISSIONS CONTAINED HEREIN; NOR FOR INCIDENTAL ORCONSEQUENTIAL DAMAGES RESULTING FROM THE FURNISHING, PERFORMANCE, OR USE OF THIS MATERIAL.This publication contains material related to the federal student aid programs under Title IV of the Higher Education Act and/or Title VII or Title VIII of thePublic Health Service Act. While we believe that the information contained herein is accurate and factual, this publication has not been reviewed orapproved by the U.S. Department of Education, the Department of Health and Human Services, or the Department of the Interior.The Free Application for Federal Student Aid (FAFSA ) is a registered trademark of the U.S. Department of Education.NASFAA reserves the right to revise this document and/or change product features or specifications without advance notice.November 2020Information in this publication is current as of November 19, 2020.2

Tax Transcript Decoder Comparison of 2019 Tax Return and Tax Transcript DataFAFSA instructions direct applicants to obtain information from certain lines on IRS income tax returns and schedules. Forthe most part, the instructions identify the relevant lines on the tax form by line number. These line item numbers do notappear on IRS tax transcripts. Instead, each item is identified by name. When verifying FAFSA data using tax transcripts, it isimportant to identify the correct answer.The following pages contain a sample tax return and corresponding tax return transcript. Relevant line items have beenhighlighted as follows:Red: information to help cross-reference tax return line items with corresponding data on the tax return transcript.Yellow: tax return line items that are required verification data elements for the 2021-22 award year.Blue: tax return line items listed in the FAFSA instructions, which should be reviewed for potential conflicting information.2019 Tax Return Line Items for 2021-22 Verification1040 and Schedules2021-22FAFSA Question1040 Line 8b36 (S) and 84 (P)Income tax paid*1040 Line 14 minus Schedule 2, Line 237 (S) and 85 (P)Education credits1040 Schedule 3, Line 343a (S) and 91a (P)1040 Schedule 1, Line 15 Line 1944b (S) and 92b (P)1040 Line 2a44d (S) and 92d (P)1040 Lines (4a 4c) minus (4b 4d)(exclude rollovers)44e (S) and 92e (P)AGIIRA deductions and paymentsTax-exempt interest incomeUntaxed portions of IRA, pension, andannuity distributions (withdrawals)*2019 Tax Return Transcript Line Items for 2021-22 VerificationTax Transcript2021-22FAFSA Question“ADJUSTED GROSS INCOME PER COMPUTER”36 (S) and 84 (P)Income tax paid*“INCOME TAX AFTER CREDITS PER COMPUTER”minus“EXCESS ADVANCE PREMIUM TAX CREDITREPAYMENT AMOUNT”37 (S) and 85 (P)Education credits“EDUCATION CREDIT PER COMPUTER”43a (S) and 91a (P)“KEOGH/SEP CONTRIBUTION DEDUCTION”plus“IRA DEDUCTION PER COMPUTER”44b (S) and 92b (P)“TAX-EXEMPT INTEREST”44d (S) and 92d (P)AGIIRA deductions and paymentsTax-exempt interest incomeUntaxed portions of IRA, pension, andannuity distributions (withdrawals)*“TOTAL IRA DISTRIBUTIONS” plus“TOTAL PENSIONS AND ANNUITIES”minus“TAXABLE IRA DISTRIBUTIONS” plus“TAXABLE PENSION/ANNUITY AMOUNT”(exclude rollovers)*If negative, enter zero. 2020 NASFAA. All rights reserved.344e (S) and 92e (P)

FormSample IRS Form 1040, Page 1: Marcos and Carolina Tamez1040 U.S. Individual Income Tax Return 2019Department of the Treasury—Internal Revenue ServiceFiling StatusCheck onlyone box.Single Married filing jointly(99)Married filing separately (MFS)OMB No. 1545-0074IRS Use Only—Do not write or staple in this space.Head of household (HOH)Qualifying widow(er) (QW)If you checked the MFS box, enter the name of spouse. If you checked the HOH or QW box, enter the child’s name if the qualifying person isa child but not your dependent. Your first name and middle initialYour social security numberLast nameCAROLINA xxxxxxxxxxXXX XX 4672Spouse’s social security numberLast nameIf joint return, spouse’s first name and middle initialMARCOS SxxxxxxxxxxxxxxxxxxxxxxxxxXXX XX al Election CampaignCheck here if you, or your spouse if filingjointly, want 3 to go to this fund.Checking a box below will not change yourtax or refund.YouSpouseApt. no.Home address (number and street). If you have a P.O. box, see instructions.87412 W POLTAVA WAYCity, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).SPRINGFIELD, OR 99999Foreign country nameForeign province/state/countyStandardDeductionSomeone can claim:Age/BlindnessYou:You as a dependentIf more than four dependents,see instructions and here Your spouse as a dependentSpouse itemizes on a separate return or you were a dual-status alienWere born before January 2, 1955(1) First nameSpouse:Are blindDependents (see instructions):Was born before January 2, 1955(2) Social security number(3) Relationship to youXXX XX 6772XXX XX 8534SONSON 1Wages, salaries, tips, etc. Attach Form(s) W-2 .2aTax-exempt interest .2a3aQualified dividends .4aIRA distributions .4acPensions and annuities .5aSocial security benefits .6Capital gain or (loss). Attach Schedule D if required. If not required, check here.7aOther income from Schedule 1, line 9b8ab9.xxxxxxxx131,638.Is blind(4) if qualifies for (see instructions):Child tax creditCredit for other dependentsLast nameSAMUEL J TAMEZxxxxxxxxxxxxxxxxxxxxxxxxAMOS J TAMEZxxxxxxxxxxxxxxxxxxxxxxxxxxStandardDeduction for— Single or Marriedfiling separately, 12,200 Married filingjointly or Qualifyingwidow(er), 24,400 Head ofhousehold, 18,350 If you checkedany box underStandardDeduction,see instructions.Foreign postal code.12b3ab Ordinary dividends. Attach Sch. B if required3bb Taxable amount.4bxxxxxxxx131,638.xxxxxxxx131,6384c xxxxxxxxx131,638d Taxable amount.4dxxxxxxxx131,638.5ab Taxable amount.5b. 6.7aAdd lines 1, 2b, 3b, 4b, 4d, 5b, 6, and 7a. This is your total income. 7bAdjustments to income from Schedule 1, line 22.8,124xxxxxxxx141,352.8aSubtract line 8a from line 7b. This is your adjusted gross income. 8bxxxxxxxx141,352Standard deduction or itemized deductions (from Schedule A) .33,714107,638Form 1040 (2019).33,714910Qualified business income deduction. Attach Form 8995 or Form 8995-A .11aAdd lines 9 and 10 .11a.11bbxxxxxxx131,638 *1,590b Taxable interest. Attach Sch. B if required.Taxable income. Subtract line 11a from line 8b. If zero or less, enter -0-For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.10Cat. No. 11320B*Income earned from work: IRS Form 1040–Line 1 , Schedule 1–Lines 3 and 6 , Schedule K-1 (IRS Form 1065)–Box 14 (Code A). If any individual earning item isnegative, do not include that item in your calculation. 2020 NASFAA. All rights reserved.4

Sample IRS Form 1040, Page 2: Marcos and Carolina TamezPage 2Form 1040 (2019)12ab13ab If you have aqualifying child,attach Sch. EIC. If you havenontaxablecombat pay, seeinstructions.Tax (see inst.) Check if any from Form(s): 18814 24972 3Add Schedule 2, line 3, and line 12a and enter the totalChild tax credit or credit for other dependents .Add Schedule 3, line 7, and line 13a and enter the total.Subtract line 13b from line 12b. If zero or less, enter -0-.15Other taxes, including self-employment tax, from Schedule 2, line 10 .16Add lines 14 and 15. This is your total tax .17Federal income tax withheld from Forms W-2 and 109918Other payments and refundable credits:.12b15,397 13b.144,059xxxxxxxx11,338 4,00013a14.15,39712a. . . . .IncomeTax Paid*.1040. Line. .14. .minus. . . . . . Schedule 2, Line 2.17*If negative, enter zero15aEarned income credit (EIC) .18abAdditional child tax credit. Attach Schedule 8812.18bcAmerican opportunity credit from Form 8863, line 8.18cdSchedule 3, line 14 .18deAdd lines 18a through 18d. These are your total other payments and refundable credits. 18e19Add lines 17 and 18e. These are your total payments . 19Refund20If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid .20Amount of line 20 you want refunded to you. If Form 8888 is attached, check here.Direct deposit?See instructions. bRouting number dAccount numberAmountYou OweThird PartyDesignee21a. .c Type:.22Amount of line 20 you want applied to your 2020 estimated tax .23Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions24Estimated tax penalty (see instructions) .Checkingxxxxxxxx11,33811,2911611,29121a Savings22 . 472324 Do you want to allow another person (other than your paid preparer) to discuss this return with the IRS? See instructions.Yes. Complete below.No(Other thanpaid preparer)Designee’sname SignHereUnder penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true,correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.Your signature Joint return?See instructions.Keep a copy foryour records.Phoneno. DateCarolina M. TamezYour occupation04/15/2020 ADMINISTRATORSpouse’s signature. If a joint return, both must sign.DateSpouse’s occupation04/15/2020 MANAGERPhone no.PaidPreparerUse OnlyPersonal identification number (PIN)If the IRS sent you an IdentityProtection PIN, enter it here(see inst.)If the IRS sent your spouse anIdentity Protection PIN, enter it here(see inst.)Email addressPreparer’s namePreparer’s signatureDatePTINCheck if:3rd Party DesigneeFirm’s nameFirm’s addressSelf-employedPhone no. Firm’s EIN Go to www.irs.gov/Form1040 for instructions and the latest information. 2020 NASFAA. All rights reserved. Form51040 (2019)

Sample IRS Form 1040 Schedule 1: Marcos and Carolina TamezSCHEDULE 1(Form 1040 or 1040-SR)Department of the TreasuryInternal Revenue ServiceOMB No. 1545-0074Additional Income and Adjustments to Income2019 Attach Goto Form 1040 or 1040-SR.to www.irs.gov/Form1040 for instructions and the latest information.AttachmentSequence No. 01Your social security numberName(s) shown on Form 1040 or 1040-SRAt any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in anyvirtual currency? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Part I12ab345678Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . .Alimony received . . . . . . . . . . . . . . . . . . . . . . . .Date of original divorce or separation agreement (see instructions) Business income or (loss). Attach Schedule C . . . . . . . . . . . . . . .Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . .Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E .Farm income or (loss). Attach Schedule F . . . . . . . . . . . . . . . .Unemployment compensation . . . . . . . . . . . . . . . . . . . .FORM 1099 MISC INCOME 8124Other income. List type and amount .12a.345679Combine lines 1 through 8. Enter here and on Form 1040 or 1040-SR, line 7a.89Part IIYes NoAdditional Income.xxxxxxx131,638 *xxxxxxx131,638 *8,1248,124Adjustments to Income1011Educator expenses. . . . . . . . . . . . . . . . . . . . . . . . . . .Certain business expenses of reservists, performing artists, and fee-basis government officials. AttachForm 2106 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12Health savings account deduction. Attach Form 8889 . . . . . . . . . . . . . . . .13Moving expenses for members of the Armed Forces. Attach Form 3903 . . . . . . . . . .14Deductible part of self-employment tax. Attach Schedule SE . . . . . . . . . . . . . .15Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . .16Self-employed health insurance deduction . . . . . . . . . . . . . . . . . . . .17Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . . . .18a Alimony paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .b Recipient’s SSN. . . . . . . . . . . . . . . . . . . . . c Date of original divorce or separation agreement (see instructions) 19IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . .21Tuition and fees. Attach Form 8917 . . . . . . . . . . . . . . . . . . . . . .22Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 or1040-SR, line 8a . . . . . . . . . . . . . . . . . . . . . . . . . . . .For Paperwork Reduction Act Notice, see your tax return instructions.Cat. No. 71479F101112 xxxxxxx131,638131415 e 1 (Form 1040 or 1040-SR) 2019*Income earned from work: IRS Form 1040–Line 1 , Schedule 1–Lines 3 and 6, Schedule K-1 (IRS Form 1065)–Box 14 (Code A). If any individual earning item isnegative, do not include that item in your calculation. 2020 NASFAA. All rights reserved.6

Sample IRS Form 1040 Schedule 2 (not filed by Carolina and Marcos)Part IIncome Tax Paid*1040 Line 14minusSchedule 2, Line 2*If negative, enter zero 2020 NASFAA. All rights reserved.7

Sample IRS Form 1040 Schedule 3: Marcos and Carolina TamezSCHEDULE 3Department of the TreasuryInternal Revenue ServiceOMB No. 1545-0074Additional Credits and Payments(Form 1040 or 1040-SR)2019 Attach to Form 1040 or 1040-SR.Go to www.irs.gov/Form1040 for instructions and the latest information.AttachmentSequence No. 03Name(s) shown on Form 1040 or 1040-SRPart I1234567Nonrefundable CreditsForeign tax credit. Attach Form 1116 if required . . . . . . . . . . .Credit for child and dependent care expenses. Attach Form 2441 . . . . .Education credits from Form 8863, line 19 . . . . . . . . . . . . .Retirement savings contributions credit. Attach Form 8880 . . . . . . .Residential energy credit. Attach Form 5695 . . . . . . . . . . . .Other credits from Form: a3800b8801cAdd lines 1 through 6. Enter here and include on Form 1040 or 1040-SR, line 13bPart II891011121314Your social security number.1234567Other Payments and Refundable Credits2019 estimated tax payments and amount applied from 2018 return . .Net premium tax credit. Attach Form 8962 . . . . . . . . . . .Amount paid with request for extension to file (see instructions) . . . .Excess social security and tier 1 RRTA tax withheld . . . . . . . .Credit for federal tax on fuels. Attach Form 4136 . . . . . . . . .Credits from Form: a2439bReservedc8885dAdd lines 8 through 13. Enter here and on Form 1040 or 1040-SR, line 18dFor Paperwork Reduction Act Notice, see your tax return instructions. 2020 NASFAA. All rights reserved.8.Cat. No. 71480G59xxxxxxxxx131,63859891011121314Schedule 3 (Form 1040 or 1040-SR) 2019

Itemized DeductionsSCHEDULE A(Form 1040 or 1040-SR)(Rev. January 2020)Department of the TreasuryInternal Revenue Service (99)OMB No. 1545-0074to www.irs.gov/ScheduleA for instructions and the latest information. Attach to Form 1040 or 1040-SR.Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16.Name(s) shown on Form 1040 or 1040-SRMedicalandDentalExpensesTaxes YouPaid1234Caution: Yourmortgage interestdeduction may belimited (seeinstructions).AttachmentSequence No. 07Your social security numberCaution: Do not include expenses reimbursed or paid by others.Medical and dental expenses (see instructions) . . . . . . .141,352Enter amount from Form 1040 or 1040-SR, line 8b 2Multiply line 2 by 7.5% (0.075) . . . . . . . . . . . . .Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . . .5 State and local taxes.a State and local income taxes or general sales taxes. You may includeeither income taxes or general sales taxes on line 5a, but not both. Ifyou elect to include general sales taxes instead of income taxes,check this box . . . . . . . . . . . . . . . . . b State and local real estate taxes (see instructions) . . . . . . .c State and local personal property taxes . . . . . . . . . .d Add lines 5a through 5c . . . . . . . . . . . . . . .e Enter the smaller of line 5d or 10,000 ( 5,000 if married filingseparately) . . . . . . . . . . . . . . . . . . .6 Other taxes. List type and amount 7 Add lines 5e and 6InterestYou Paid2019 Go.8 Home mortgage interest and points. If you didn’t use all of your homemortgage loan(s) to buy, build, or improve your home, seeinstructions and check this box . . . . . . . . . . . a Home mortgage interest and points reported to you on Form 1098.See instructions if limited . . . . . . . . . . . . . .13. .10,601. .5a5b5c5d6,20614,73678421,7265e10,0006. .8a.4710,0001023,1691454523,169b Home mortgage interest not reported to you on Form 1098. Seeinstructions if limited. If paid to the person from whom you bought thehome, see instructions and show that person’s name, identifying no.,and address . . . . . . . . . . . . . . . . . . . 8bc Points not reported to you on Form 1098. See instructions for special8crules . . . . . . . . . . . . . . . . . . . . .d Mortgage insurance premiums (see instructions) . . . . . . .8de Add lines 8a through 8d . . . . . . . . . . . . . . .8e9 Investment interest. Attach Form 4952 if required. See instructions .910 Add lines 8e and 9. . . . . . . . . . . . . . . . . . .Gifts toCharityCaution: If youmade a gift andgot a benefit for it,see instructions.11 Gifts by cash or check. If you made any gift of 250 or more, see11instructions . . . . . . . . . . . . . . . . . . .12 Other than by cash or check. If you made any gift of 250 or more,see instructions. You must attach Form 8283 if over 500 . . . .1213 Carryover from prior year . . . . . . . . . . . . . .1314 Add lines 11 through 13 . . . . . . . . . . . . . . . . . .23,169.230315.Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualifieddisaster losses). Attach Form 4684 and enter the amount from line 18 of that form. SeeTheft Lossesinstructions .1516 Other—from list in instructions. List type and amount OtherItemizedDeductions1617 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount onTotalForm 1040 or 1040-SR, line 9 . . . . . . . . . . . . . . . . . . . .17ItemizedDeductions 18 If you elect to itemize deductions even though they are less than your standard deduction,check this box .For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1040-SR.Cat. No. 17145C.33,714 Schedule A (Form 1040 or 1040-SR) 2019Note: Besides Schedules 1, 2, and 3, the school does not need to collect copies of IRS schedules of forms attached to the tax return, unlessthere is conflicting information in the student’s file that needs to be resolved. 2020 NASFAA. All rights reserved.9

SCHEDULE BDepartment of the TreasuryInternal Revenue Service (99)OMB No. 1545-0074Interest and Ordinary Dividends(Form 1040 or 1040-SR) Go1InterestPart IIAmountList name of payer. If any interest is from a seller-financed mortgage and thebuyer used the property as a personal residence, see the instructions and list thisinterest first. Also, show that buyer’s social security number and address 910680CAROLINA M TAMEZMARCOS S TAMEZ(See instructionsand theinstructions forForms 1040 and1040-SR, line 2b.)Note: If youreceived a Form1099-INT, Form1099-OID, orsubstitutestatement froma brokerage firm,list the firm’sname as thepayer and enterthe total interestshown on thatform.AttachmentSequence No. 08Your social security numberName(s) shown on returnPart I2019to www.irs.gov/ScheduleB for instructions and the latest information. Attach to Form 1040 or 1040-SR.123Add the amounts on line 1 . . . . . . . . . . . . . . . . . . .Excludable interest on series EE and I U.S. savings bonds issued after 1989.Attach Form 8815 . . . . . . . . . . . . . . . . . . . . . .4Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR,line 2b . . . . . . . . . . . . . . . . . . . . . . . . Note: If line 4 is over 1,500, you must complete Part III.List name of payer 521,5903041,590AmountOrdinaryDividends(See instructionsand theinstructions forForms 1040 and1040-SR, line 3b.)Note: If youreceived a Form1099-DIV orsubstitutestatement froma brokerage firm,list the firm’sname as thepayer and enterthe ordinarydividends shownon that form.Part IIIForeignAccountsand TrustsCaution: Ifrequired, failureto file FinCENForm 114 mayresult insubstantialpenalties. Seeinstructions.5Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR,line 3b . . . . . . . . . . . . . . . . . . . . . . . . 6Note: If line 6 is over 1,500, you must complete Part III.You must complete this part if you (a) had over 1,500 of taxable interest or ordinary dividends; (b) had aforeign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust.67a0Yes NoAt any time during 2019, did you have a financial interest in or signature authority over a financialaccount (such as a bank account, securities account, or brokerage account) located in a foreigncountry? See instructions . . . . . . . . . . . . . . . . . . . . . . . .If “Yes,” are you required to file FinCEN Form 114, Report of Foreign Bank and FinancialAccounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114and its instructions for filing requirements and exceptions to those requirements . . . . . .b If you are required to file FinCEN Form 114, enter the name of the foreign country where thefinancial account is located 8During 2019, did you receive a distribution from, or were you the grantor of, or transferor to, aforeign trust? If “Yes,” you may have to file Form 3520. See instructions . . . . . . . . .For Paperwork Reduction Act Notice, see your tax return instructions. 2020 NASFAA. All rights reserved.10Cat. No. 17146NSchedule B (Form 1040 or 1040-SR) 2019

Form2441Child and Dependent Care Expenses Department of the TreasuryInternal Revenue Service (99) OMB No. 1545-007410401040-SR. 20191040-NRAttach to Form 1040, 1040-SR, or 1040-NR.2441Go to www.irs.gov/Form2441 for instructions and thelatest information.AttachmentSequence No. 21Your social security numberName(s) shown on returnYou cannot claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet therequirements listed in the instructions under “Married Persons Filing Separately.” If you meet these requirements, check this box.Part I1Persons or Organizations Who Provided the Care—You must complete this part.(If you have more than two care providers, see the instructions.)(a) Care provider’sname(b) Address(number, street, apt. no., city, state, and ZIP code)CHILDREN'S LEARNING CTR(c) Identifying number(SSN or EIN)1234 LINCOLN AVE.EUGENE, OR 99999(d) Amount paid(see instructions)XXXXXXXXX294.00Did you receive Complete only Part II below.Nodependent care benefits? Complete Part III on the back next.YesCaution: If the care was provided in your home, you may owe employment taxes. For details, see the instructions for Schedule 2(Form 1040 or 1040-SR), line 7a; or Form 1040-NR, line 59a.Part II2Credit for Child and Dependent Care ExpensesInformation about your qualifying person(s). If you have more than two qualifying persons, see the instructions.First(c) Qualified expenses youincurred and paid in 2019 for theperson listed in column (a)(b) Qualifying person’s socialsecurity number(a) Qualifying person’s nameLastSAMUELTAMEZXXX XX 6772294AMOSTAMEZXXX XX 853403Add the amounts in column (c) of line 2. Don’t enter more than 3,000 for one qualifying personor 6,000 for two or more persons. If you completed Part III, enter the amount from line 31 . .45Enter your earned income. See instructions . . . . . . . . . . . . . . . . .If married filing jointly, enter your spouse’s earned income (if you or your spouse was a studentor was disabled, see the instructions); all others, enter the amount from line 4 . . . . . .67891011Enter the smallest of line 3, 4, or 5 . . . . . . . . . . .Enter the amount from Form 1040 or 1040-SR, line 8b; or Form1040-NR, line 35 . . . . . . . . . . . . . . . .7Enter on line 8 the decimal amount shown below that applies to the amount on line 7If line 7 is:But notoverOverDecimalamount is 85677,9502948X . 0.20141,352If line 7 is:OverBut notover 3,00043,000—No limitDecimalamount is.27.26.25.24.23.22.21.20Multiply line 6 by the decimal amount on line 8. If you paid 2018 expenses in 2019, see theinstructions . . . . . . . . . . . . . . . . . . . . . . . . . . . .Tax liability limit. Enter the amount from the Credit Limit Worksheetin the instructions . . . . . . . . . . . . . . . .1015,397Credit for child and dependent care expenses. Enter the smaller of line 9 or line 10 here andon Schedule 3 (Form 1040 or 1040-SR), line 2; or Form 1040-NR, line 47 . . . . . . . .For Paperwork Reduction Act Notice, see your tax return instructions.Cat. No. 11862M9115959Form 2441 (2019)Note: Besides Schedules 1, 2, and 3, the school does not need to collect copies of IRS schedules of forms attached to the tax return, unlessthere is conflicting information in the student’s file that needs to be resolved. 2020 NASFAA. All rights reserved.11

Page 2Form 2441 (2019)Part IIIDependent Care Benefits12 Enter the total amount of dependent care benefits you received in 2019. Amounts you received asan employee should be shown in box 10 of your Form(s) W-2. Don’t include amounts reported aswages in box 1 of Form(s) W-2. If you were self-employed or a partner, include amounts youreceived under a dependent care assistance program from your sole proprietorship or partnership .13 Enter the amount, if any, you carried over from 2018 and used in 2019 during the grace period.See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . .14 Enter the amount, if any, you forfeited or carried forward to 2020. See instructions15 Combine lines 12 through 14. See instructions . . . . . . . . . . . .16 Enter the total amount of qualified expenses incurred in 2019 for thecare of the qualifying person(s) . . . . . . . . . . . .1617 Enter the smaller of line 15 or 16 . . . . . . .18 Enter your earned income. See instructions . . .19 Enter the amount shown below that applies to you. If married filing jointly, enter your spouse’searned income (if you or your spouse wasa student or was disabled, see the. .instructions for line 5). If married filing separately, seeinstructions.}.1718294053,688.1977,950.200 All others, enter the amount from line 18.20 Enter the smallest of line 17, 18, or 19 . . . . . . . . .21 Enter 5,000 ( 2,500 if married filing separately and you wererequired to enter your spouse’s earned income on line 19) . .121314 (1500.000.00 )0.215,00022 Is any amount on line 12 from your sole proprietorship or partnership?No. Enter -0-.Yes. Enter the amount here . . . . . . . . . . . . . . . . . . . . . .2323 Subtract line 22 from line 15 . . . . . . . . . . . . .024 Deductible benefits. Enter the smallest of line 20, 21, or 22. Also, include this amount on theappropriate line(s) of your return. See instructions . . . . . . . . . . . . . . . .25 Excluded benefits. If you checked “No” on line 22, enter the smaller of line 20 or 21. Otherwise,subtract line 24 from the smaller of line 20 or line 21. If zero or less, enter -0- . . . . . . .26 Taxable benefits. Subtract line 25 from line 23. If zero or less, enter -0-. Also, include this amounton Form 1040 or 1040-SR, line 1; or Form 1040-NR, line 8. On the dotted line next to Form 1040or 1040-SR, line 1; or Form 1040-NR, line 8, enter “DCB” . . . . . . . . . . . . . .22024025026027286,0000296,00030294To claim the child and dependent carecredit, complete lines 27 through 31 below.27 Enter 3,000 ( 6,000 if two or more qualifying persons) . . . . . . . . . . . . . .28 Add lines 24 and 25 . . . . . . . . . . . . . . . . . . . . . . . . . .29 Subtract line 28 from line 27. If zero or less, stop. You can’t take the credit. Exception. If you paid2018 expenses in 2019, see the instructions for line 9 . . . . . . . . . . . . . . .30 Complete line 2 on the front of this form. Don’t include in column (c) any benefits shown on line28 above. Then, add the amounts in column (c) and enter the total here . . . . . . . . .31 Enter the smaller of line 29 or 30. Also, enter this amount on line 3 on the front of this form andcomplete lines 4 through 11 . . . . . . . . . . . . . . . . . . . . . . .31294Form 2441 (2019)Note: Besides Schedules 1, 2, and 3, the

FAFSA instructions direct applicants to obtain information from certain lines on IRS income tax returns and schedules. For the most part, the instructions identify the relevant lines on the tax formby line number. These line item numbers do not appear on IRS t