Transcription

Chapter 10: Depreciation Depreciation––––A decrease in value of an asset each yearA non-cash cost (no money changing hands) that affects income taxesAn annual deduction against before-tax incomeA business expense the government allows to offset the loss in valueof business assets Usually you pay for the asset “up front”, but depreciate itover time (e.g., a new truck) Depreciation deductions reduce the taxable income ofbusinesses and thus reduce the amount of tax paid Government allows some choice among depreciation methods– Firm wants to use the method that will minimize its taxable income– To do so, it must understand how the depreciation methods workEIN 435410 - 1Fall 2003DepreciationExample A firm has 1,000,000 of taxable income. If its tax rate is 25%, it wouldpay 250,000 in taxes ignoring depreciation– If it can deduct 50,000 in depreciation charges, its net taxableincome is 950,000. Thus it would pay taxes of 0.25 (950,000) 237,500– Depreciation saves 250,000 – 237,500 12,500 0.25(50,000) Joe invests 10,000 with a 10% return. His taxable income is 1,000– If you are in the 25% tax bracket, U.S. takes 250, so your net returnis 750 7.5%– If you could have found an 8% investment for your 10,000 that wasnot taxable, you would have made a better choice (800 750)– Taxable vs. tax-free investments Taxes (Chapter 11) are essential to consider in realistic economicanalyses. First we must understand how depreciation worksEIN 435410 - 2Fall 20031

DepreciationEconomic depreciationthe gradual decrease inutility in an asset withuse and timeDepreciationAccounting depreciationThe systematic allocationof an asset’s value inportions over itsdepreciable life—oftenused in engineeringeconomic analysisEIN depreciationTaxdepreciation10 - 3Fall 2003Depreciation Important reasons for depreciation include– deterioration (wear on parts that affect its functionality)– obsolescence (product becomes outdated) Economic depreciation can mean– a decrease in market value or value to the owner Accounting depreciation is defined as the systematicallocation of the cost of an asset over its depreciable life– This period may differ from the useful life Accountant definition is used for determining taxableincome. It is this definition that is most important to us NOTE: While many things depreciate, some things,including land, do not. The value of land can change, but itis not because of depreciationEIN 435410 - 4Fall 20032

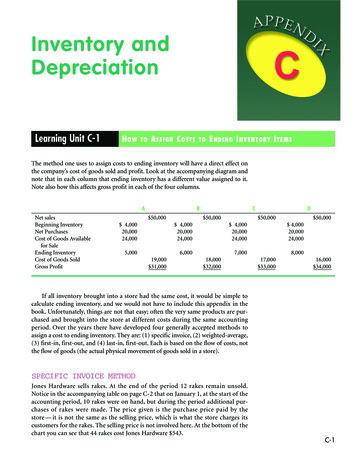

Depreciate or Expense? A business asset can be depreciated if:1) It is used for business purposes to produce income2) It has a determinable useful life that is longer than one year3) It is an asset that decays, gets used up, wears out, becomes obsolete,or loses value to the owner from natural causesExample (Pizza Parlor)Joe runs a pizza parlor. He classifies some of his cost items as follows:Cost ItemPizza dough, toppingsDelivery vanEmployee wagesFurnishings for dining roomNew baking ovenUtilities for refrigeratorEIN 4354Type of tedExpensedReasonLife 1 yr, loses value immediatelyMeets 3 depreciation requirementsLife 1 yr, loses value immediatelyMeets 3 depreciation requirementsMeets 3 depreciation requirementsLife 1 yr, loses value immediately10 - 5Fall 2003Items to Expense Examples of Expensed Items––––LaborUtilitiesMaterialsInsurance Expensed items are (often recurring) expenses in regularbusiness operations. They are consumed over short periods(e.g., monthly or biweekly salaries) Expenses are subtracted from business revenues, when theyoccur, for tax purposes Expenses reduce income taxes – businesses can write offtheir full amounts when they occurEIN 435410 - 6Fall 20033

Items to Depreciate First, we define what constitutes business property. Eachclass has different depreciation rules (will be discussed )Business Property can be classified as either: Tangible property, which can be seen, touched, and felt– Real property (think “real estate”) includes land, buildings, and allthings growing on, built on, constructed on, or attached to the land– Personal property includes equipment, furnishing, vehicles, officemachinery, and anything that is tangible excluding those assetsdefined as real property. (Note “personal” does not refer to beingowned by a person or being private.) Intangible property, which includes all property that hasvalue to the owner but cannot be directly seen or touched– Examples include patents, trademarks, trade names, and franchisesEIN 435410 - 7Fall 2003Assets to DepreciateExamples of depreciable business assets: – Copy machines, computer networks, pc's, .– Buildings and interior furnishings– Production equipmentMany different types of properties that wear out, decay, or lose value canbe depreciated as business assetsExamples of non-depreciable business assets: EIN 4354– Land– Leased property (only the owner may claim depreciation expenses)Land does not wear out, lose value, or have a determinable useful life.In fact, it often increases in valueDepreciation on tangible property used for both business and personalactivities (e.g., home office) can be taken only in proportion to the usefor business expensesAssets subject to depletion (covered later in this chapter)10 - 8Fall 20034

Sample Depreciation CalculationsExampleA PC costs 1,800. Its annual depreciation charges are 800, 600,and 350 for three years.Year0123 DepreciationBook Value 1,800 1,000 400 50 800 600 350 1,800 is called the initial cost or cost basisDn denotes the depreciation deduction in year t. ThusD1 800, D2 600, D3 350nDepreciation charges made to date Dn* i 1 DiBook Value at end of year n, Bn (or also called BVn)– The remaining unallocated cost of an asset– Bn Cost Basis – Depreciation charges made to date I Dn*EIN 435410 - 9Fall 2003Calculating the Cost BasisCost Basis CalculationCost of new holepunching machine(Invoice price) FreightCost Basis with Trade-In Allowance 62,500Old hole-punching machine(book value)Less: Trade-in allowance725 Installation labor2,150 Site preparation3,500Cost Basis(for depreciation) 68,875Unrecognized gainsCost of new hole-punchingmachineLess: Unrecognized gainsFreight5,000 1,000 62,500(1,000)725Installation labor2,150Site preparation3,500Cost Basis(for depreciation)EIN 4354 4,00010 - 10 67,875Fall 20035

Depreciation MethodsBook Depreciation Methods (Only options before 1981):– Used for reporting net income to investors/stockholders– Required an estimate of the asset’s useful life and salvage value– Straight Line (SL)– Sum-Of-Years Digits (SOYD)– Declining Balance (DB)– Units-of-Production (UOP)Tax Depreciation Methods (Available after 1981):– Often used for calculating income taxes paid to the IRS– Modified Accelerated Cost Recovery System (MACRS) First method was ACRS (1981 – 1986) Salvage values assumed to be zero; estimates no longer required Property class lives were created to categorize assets Recovery periods accelerated, capital costs deducted morequicklyEIN 435410 - 11Fall 2003Straight Line DepreciationExample An asset has a cost of I 900, a useful life of N 5 years, and anEOL salvage value of S 70. Compute depreciation as follows:Annual depreciation charge Dn (I – S)/N 830/5 166 The book value of the asset decreases by 166 each year!Straight line depreciation is the simplest and best knownYear012345TotalEIN 4354Initial Book ValueCost 900 734568402236Depreciation 166 166 166 166 166 83010 - 12EOY Book Value 900734568402236Salvage Value 70Fall 20036

Straight Line DepreciationExample (continued)We can visualize the change in book value over time as follows.Initial CostI 900Book ValueSalvage ValueUseful LifeS 701 2345NAll depreciation methods can depict the book valuedeclining over time– I – S is the total depreciation charge– With N 0 the graph starts with cost basis I, and decreases overtime until it has salvage value S at the end of its useful lifeEIN 435410 - 13Fall 2003Straight Line Depreciation – Intangible PropertyExample EIN 4354Veronica’s firm bought a patent in April. It was not acquired as part ofacquiring a business. The firm paid 6,800 for the patent. They mustdepreciate it using SL depreciation over 17 years, with no salvage value.Annual depreciation is 6800/17 400First-year depreciation must be prorated over the 9 months of ownershipTherefore the first-year depreciation is (9/12) 400 300. In lateryears the depreciation can be 40010 - 14Fall 20037

Sum-Of-Years Digits (SOYD) DepreciationExampleAn asset has a cost of I 900, a useful life of N 5 years, and anEOL salvage value of S 70. Compute depreciation as follows:Year012345Life, FOYMultiplier543215/154/153/152/151/151Total I-SDepreciation 870870870870870 27722116611155 830EOY Book Value 90062340223612570For N years, 1 2 N N(N 1)/2The multiplier for year n is thus(N 1-n)/[N(N 1)/2] 2(N 1-n)/[N(N 1)]And the depreciation charge is:Dn ( I S ) 2 ( N n 1) N ( N 1) EIN 435410 - 15Fall 2003Sum-Of-Years Digits (SOYD) DepreciationSOYD Book Value1000900800700600EOY BookValue5004003002001000012345Years EIN 4354SOYD (and DDB shown later) depreciation causes largerdecreases in book value in earlier years than in later yearsWould a firm prefer SOYD or SL depreciation?10 - 16Fall 20038

Declining Balance (DB) Depreciation For straight line depreciation with N years, the rate ofdecrease each year is 1/NDeclining balance depreciation uses either 150% or 200% ofthe straight-line rate. Since 200% is twice the straight-linerate, it is called double declining balance (DDB)The DDB depreciation amount, Dn, in any year is:Dn It can be shown, in general, for DDB, thatDn 22( Bn 1 ) ( I Dn* 1 )NN2I 2 1 N N n 1For 150% declining balance depreciation, just replace each“2” in the DDB formula by “1.5”EIN 435410 - 17Fall 2003Example: DDB DepreciationYear012345TotalMultiplierDnI Dn* 12/52/52/52/52/51900540324194116Bn 900540324194116703602161307846 830DDB Book Value 1,000 800 600 400 200 0012345YearsEIN 435410 - 18Fall 20039

DDB: Dealing with Salvage ValuesDDB Only YearI DDn0123459005403241941163602161307846*n 1DDB w/ switch to SL (SV 0)Bn 90054032419411670I Dn* 9797Bn 900540324194970DDB ignores salvage valuesIf the salvage value (S) of this example had not been 70, amodification of DDB would be necessary. Either,1. Stop further depreciation when the B equals S, or2. “Switch over” from DB depreciation to straight line We can skip these modifications because MACRSautomatically incorporates the switch from DB to SLEIN 435410 - 19Fall 2003Unit Of Production (UOP) Depreciation Occasionally, the recovery of depreciation on an asset ismore closely related to use than timeFor any year, do the following:– Compute the ratio of the yearly production of the asset to its totallifetime production– Multiply the ratio and (I-S) to get unit of production (UOP)Dn EIN 4354Service units consumed during year n(I S)Total service unitsThis method is not acceptable for general use indepreciating industrial equipment. It might be useful formachinery that processes natural resources when theresources are exhausted before the machinery wears out10 - 20Fall 200310

Example – UOP DepreciationExampleThe equipment will be used in a sand and gravel pit. The pit will be inoperation during a five-year period while a nearby airport is built. Thepit will then be shut down, and the equipment removed and sold. Theairport will need 40,000 cubic meters of sand and gravel. I-S 830.Year12345 m3 .1UOP deprec. 8316633216683The actual UOP depreciation charge in any year is basedon the actual production for the year, and not the scheduledproductionEIN 435410 - 21Fall 2003Modified Accelerated Cost Recovery System(MACRS) Depreciation MACRS has major advantages––––– Salvage values are assumed to be zero!!“Property class lives” are less than the “actual useful lives”Recovery periods acceleratedCapital costs deducted more quicklyLarger tax deductions in early yearsPersonal Property– DB depreciation with switchover to SL– Half-year convention Real Property– SL Method– Mid-month conventionEIN 435410 - 22Fall 200311

MACRS Property Classes In 1971, the U.S. Treasury Dept. published guidelines for about 100broad asset classes. The useful life range were called the AssetDepreciation Range (ADR)The ADR midpoint lives were somewhat shorter than the actual averageuseful livesIn MACRS, ADR’s are grouped into a smaller set of property classesTable 10.1 (excerpt) Asset Guideline Classes – Asset DepreciationIRS assetclass00.1100.1200.2200.24100.25EIN 4354Asset descriptionOffice furniture, fixtures &equipmentInformation systems:computers/peripheralAutomobiles, taxisLight general purpose trucksRailroad cars & locomotivesClass life(years)ADRMACRS propertyclass (years)GDSADS107106563415557661510 - 23Fall 2003Table 10.2: MACRS Property ClassesThe table illustrates how all personal property (except real estate) falls intoone of six classes. All real estate is in one of two classesProperty class3-Year Property5-Year Property7-Year Property10-Year Property15-Year Property20-Year PropertyProperty Class27.5 years39 yearsEIN 4354Personal property Special handling devices for food and beverage mfg. Special tools Property with ADR midpoint life of 4 years or less Automobiles and trucks Aircraft Computers All other property not assigned to another class Office furniture, fixtures & equipment Property with ADR midpoint life of 10 years or more and less than 16 years. Assets used in petroleum refining & certain food products. Property with ADR midpoint life of 16 years or more and less than 20 years. Telephone distribution plants; Municipal sewage treatment plants; Property with ADR midpoint life of 20 years or more and less than 25 years. Municipal sewers; Property with ADR midpoint life of 25 years and more.Real property (real estate)Residential rental property (excludes hotels and motels)Nonresidential real property10 - 24Fall 200312

MACRS Depreciation StepsI.II.EIN 4354Determine that the property is eligible for depreciationCalculate its depreciation deductions over its life, using1) Cost basis (I) of the property– The cost to obtain and place the asset in service fit for use– For real property the basis may also include certain fees andcharges the buyer pays as part of the purchase, and amountsthe seller owes that you pay (such as back taxes)2) Property class and recovery period of the asset– Each asset is placed in a MACRS Property Class, thusdefining the recovery period and the depreciation percentagefor each year– Table 10-1 lists class lives for several depreciable assets– Table 10-2 lists the MACRS property classes3) Asset’s placed-in-life service date– Depreciation begins when the business asset is placed inservice10 - 25Fall 2003MACRS Depreciation Steps Find a property class based on information given in theproblem or named asset found in Tables 10-1 or 10-2– 7-year class for all property not otherwise assigned(catch-all class)Given the MACRS property class, the placed-in-servicedate, and cost basis, compute depreciation deductions asfollows:Dn I rnwhereDn depreciation deduction in year nI cost basis being depreciatedrn appropriate MACRS percentage rateEIN 435410 - 26Fall 200313

Table 10.3: MACRS Depreciation for PersonalProperty – Half-Year Time ConventionTable 10-3 gives the yearly depreciation percentages (rt ) for the six personalproperty classes (3,5,7, 10, 15 and 20 years).Recovery year123456 20213-yr.5-yr.7-yr.10-yr.15-yr.20-yr.classMACRS Percentage Rate for each Property .376.235.2854.4612.231Due to the half-year convention, depreciation percentages continue for one yearbeyond the property class life. Percentages in the first and last years are halved,which assumes all assets are placed in service at the mid-point of the first yearThe sum of the rn values in any column is 100%. MACRS fully depreciates assetsat the end of the recovery period, where the assumed salvage value is zeroEIN 435410 - 27Fall 2003MACRS Percentage Rates Three assumptions are important:– Salvage value 0. The entire cost basis is depreciated– The first and last years of the recovery period are each ½ years– The DB rate is 200% for 3,5, 7 and 10 year property; it is 150% for15 and 20 year property MACRS percentages are based on the DB method,switching over to SL at the optimal point, thus givng thelargest depreciation each yearA half-year of depreciation is allowed in– the first recovery year, and– the last recovery year or when the property is retired from service,whichever comes first (assets may be retired early!!)EIN 435410 - 28Fall 200314

Tables 10.4: MACRS Depreciation for RealProperty (Real Estate)Table 10-4: Recovery Percentages for Residential Rental PropertyMonth placed in service:Recovery Year12 3.6362.778* Also all even years 12 through 26** Also all odd years 13 through 27Table 10-5: Recovery Percentages for Nonresidential Rental PropertyMonth placed in service:12 101112Recovery .5642.564400.1070.3212.0332.2472.461Note: Useful lives are 27.5 years for residential rental property, and 39 years fornonresidential real property. Depreciation is straight line using the mid-monthconvention.EIN 435410 - 29Fall 2003MACRS Percentage RatesExampleA 5-year MACRS property asset has an installed and “made ready foruse” cost basis of 100.Year123456EIN 4354DDB CalculationSL Calculation½ (2/5)(100-0) 20(2/5)(100-20) 32.00(2/5)(100-52) 19.20(2/5)(100-71.20) 11.52½ (100-0)/5 10.00(100-20)/4.5 17.78(100-52)/3.5 13.71(100-71.20)/2.5 11.5211.52½ (11.52) 5.7610 - 30MACRS (rn) %Rates20.00 (DDB)32.00 (DDB)19.20 (DDB)11.52 (either)11.52 (SL)5.76 ll 200315

MACRS ExamplesExampleUse the MACRS method. Calculate the yearly depreciation allowancesand book values for a firm that has purchased 150,000 worth of officeequipment. The equipment qualifies as depreciable property.Estimated salvage value is 30,000.Input Data–––––The assets qualify as depreciable property, and MACRS appliesI 150,000The assets are being placed in service in year 1Ignore the salvage value (0 with MACRS)Look up office equipment in Table 10-2 as 7-year property. Obtainthe MACRS percentages from Table 10-3. Calculate thedepreciation amounts, and update the book value:Bn I Dn*EIN 435410 - 31Fall 2003MACRS ExamplesExample (continued)Year 4.46%100.00% EIN 4354I 150,000 150,000 150,000 150,000 150,000 150,000 150,000 150,000Dn 21,435 36,735 26,235 18,735 13,395 13,380 13,395 6,690Cum. Dn* 21,435 58,170 84,405 103,140 116,535 129,915 143,310 150,000Bn 128,565 91,830 65,595 46,860 33,465 20,085 6,690 0 150,000Can also be calculated using VDB functions in Excel10 - 32Fall 200316

Spreadsheets and DepreciationDepreciation techniqueSLDBSOYDMACRSEXCEL FunctionSLNDDBSYDVDBArguments of VDB Function:(cost,salvage,life,start period,end period,factor,no switch) cost:this is just what we have denoted by B salvage:use 0 (MACRS assumes no salvage) life:use 3, 5, 7, 10, 15 or 20 (years) start period: (starting period: must have same units as life) end period: (ending period: must have same units as life) factor:use 2 for recovery periods of 3, 5, 7 or 10 years;use 1.5 for recovery periods of 15 or 20 years no switch: leave this blankEIN 435410 - 33Fall 2003MACRS ExamplesExample (Non-residential Real Property)The JMG Group invests in a hotel resort in April. JMG paid 2.0million for the hotel, and 500,000 for the grounds. JMG sold theresort five years later in August. What is the depreciation deduction ineach of years 1 through 6? What was the final book value of the hotel?Input Data– Hotels are non-residential real property– Hotels are depreciated over a 39-year life– Table 10-4 has the percentages by year placed in service in month # 4, year 1: 1.816% years 2-5: 2.564% sold in month #8, “year 40” values: 1.603%– I 2,000,000– Ignore the information on the landEIN 435410 - 34Fall 200317

MACRS ExamplesExample (continued)Year nrn1.816%2.564%2.564%2.564%2.564%1.603%123456I 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 2,000,00013.680% Dn 36,320 51,280 51,280 51,280 51,280 32,060Cum. Dn* 36,320 87,600 138,880 190,160 241,440 273,500Bn 1,963,680 1,912,400 1,861,120 1,809,840 1,758,560 1,726,500 273,500Book value when sold: 1,726,500EIN 435410 - 35Fall 2003MACRS ExamplesAdditional ExampleA house is purchased on October 1 to be used as a rental. The 200,000 purchase price represents 150,000 for the house and 50,000 for the land. Compute the MACRS depreciation for the firsttwo calendar years by exact calculation and compare with Table 10-4.Year 1 Table value 0.758% (150,000) 1137SL depreciation (2.5/12) [(150000 – 0)/27.5] 1137– We use the house value of 150,000 and a useful life of 27.5 years– Mid-month convention (count from mid-October until end of year)Year 2 EIN 4354Table value 3.636% (150,000) 5454SL depreciation (150,000 – 0)/27.5 545410 - 36Fall 200318

MACRS vs. Previous Depreciation Methods Depreciation deductions benefit a firm after taxes. Theyreduce taxable income and taxesThe time value of money ensures it is better to takedepreciation deductions as soon as possible, assuming thesame tax rate applies to the company in every yearIn general, MACRS, which allocates larger deductionsearlier in the depreciation life, provides more economicbenefits than previous historical methodsEIN 435410 - 37Fall 2003Depletion Depletion is the exhaustion of natural resources as a result oftheir removal. Depletion covers things such as– mineral properties (digging up minerals)– oil and gas wells (producing petroleum or natural gas)– standing timber (cutting down trees) The reason for depletion is essentially the same as the reasonfor depreciationThe depletion allowance is based on two distinct methods ofcalculating depletion:– Cost depletion– Percentage depletion EIN 4354Except for standing timber and most oil and gas wells,depletion is calculated by both methods and the larger valueis taken as depletion for the year. For standing timber andmost oil and gas wells, only cost depletion is allowed10 - 38Fall 200319

Cost Depletion Cost depletion is computed in the same manner as UOPdepreciation:Cost Depletion (Adjusted basis of mineral property) (number of units sold)Total number of recoverable unitsExample EIN 4354A lumber company buys a tract of timber for 35,000; 5,000 for theland, and 30,000 for the value of the estimated 1.5 million board-feet ofstanding timber. The company cut 100,000 board-feet of standing timberthe first year. What was its depletion allowance for the year?Depletion allowance per board foot of timber ( 35,000 - 5,000)/(1,500,000 board-ft) 0.02The depletion allowance for the year is100,000 0.02 2,00010 - 39Fall 2003Percentage Depletion Percentage depletion is an alternate method of calculating thedepletion allowance for mineral property and some oil or gaswellsThe allowance is a certain percentage of the gross incomefrom the property during the year– This is an entirely different concept from depreciation– While depreciation is an allocation of cost over the useful life,percentage depletion is an annual allowance of a percentage of thegross income from the property EIN 4354It is possible that the total depletion of the property may bemore than the cost of the propertyThe percentage depletion allowance in any year is limited tonot more than 50% of the taxable income from the property,computed without the deduction for depletion10 - 40Fall 200320

Table 10.5: Percentage Depletion Allowance forSelected ItemsType of depositLead, zinc, sulphur, uraniumOil & gas (small producers only)Gold, silver, copper, iron oreCoal & sodium chlorideClay and shale (for making sewer pipe or bricks)Clay (used for roofing tile), sand, gravel, stoneMost other minerals and metallic oresEIN 4354Percent221515107.551410 - 41Fall 2003Example – Percentage DepletionExampleA coal mine has a gross income of 250,000 for the year. Miningexpenses equal 210,000. What is the allowable percentage depletiondeduction?Solution Coal has a 10% depletion allowancePercentage depletion deduction is computed from gross mining incomeComputed percentage depletion:10% of 250,000 25,000Allowable depletion deduction is limited to the smaller of the computedpercentage depletion and the 50% of taxable income limitationTaxable income limitation:Taxable income is 250,000 - 210,000 40,00050% of 40,000 20,000The allowable percentage depletion deduction is 20,000EIN 435410 - 42Fall 200321

Steps in Computing DepletionCompute percentdepletion(appropriate % xgross income)Compute 50% oftaxable incomewithout depletionallowanceSelect the smaller asAllowed PercentageDepletionCompute cost depletion(based on suitabledepletion unit) Select thelarger as theDepletionAllowanceFor standing timber and most oil and gas wells, only cost depletion isallowedEIN 435410 - 43Fall 2003Percentage Depletion vs. Cost Depletion(Example 10.12)Percentage DepletionGross income from sale of 45,000ouncesDepletion percentage 16,425,000Cost depletion 15%Computed percentage depletion 2,463,750Gross income from sale of 45,000ounces 16,425,000Less mining expenses12,250,000Taxable income from mineDeduction limitationMaximum depletion deductionEIN 4354 ( 30,000,000/300,000)(45,000) 4,500,000Allowable deduction 2,088,0004,175,000 50% 2,088,00010 - 44Select cost depletionwith 4,500,000Fall 200322

Repairs and ImprovementsPrinciple: Treat repairs andimprovements as depreciableitems. Adjust depreciationamounts as follows:Book Depreciation:Change the current bookvalue and spread the valueover the extended life.Tax Depreciation:Treat the repairs orimprovements as separateMACRS properties.EIN 435410 - 45Fall 200323

Straight Line Depreciation Example An asset has a cost of I 900, a useful life of N 5 years, and an EOL salvage value of S 70. Compute depreciation as follows: Annual depreciation charge Dn (I – S)/N 830/5 166 The book value of the asset decreases by 166 each year! St