Transcription

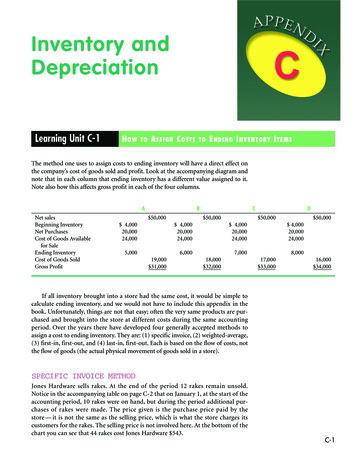

Inventory andDepreciationLearning Unit C-1H OWTOA SSIGN C OSTSTOE NDING I NVENTORY I TEMSThe method one uses to assign costs to ending inventory will have a direct effect onthe company’s cost of goods sold and profit. Look at the accompanying diagram andnote that in each column that ending inventory has a different value assigned to it.Note also how this affects gross profit in each of the four columns.ANet salesBeginning InventoryNet PurchasesCost of Goods Availablefor SaleEnding InventoryCost of Goods SoldGross ProfitB 50,000 4,00020,00024,000C 50,000 4,00020,00024,0005,000 50,000 4,00020,00024,0006,00019,000 31,000D7,00018,000 32,000 50,000 4,00020,00024,0008,00017,000 33,00016,000 34,000If all inventory brought into a store had the same cost, it would be simple tocalculate ending inventory, and we would not have to include this appendix in thebook. Unfortunately, things are not that easy; often the very same products are purchased and brought into the store at different costs during the same accountingperiod. Over the years there have developed four generally accepted methods toassign a cost to ending inventory. They are: (1) specific invoice, (2) weighted-average,(3) first-in, first-out, and (4) last-in, first-out. Each is based on the flow of costs, notthe flow of goods (the actual physical movement of goods sold in a store).SPECIFIC INVOICE METHODJones Hardware sells rakes. At the end of the period 12 rakes remain unsold.Notice in the accompanying table on page C-2 that on January 1, at the start of theaccounting period, 10 rakes were on hand, but during the period additional purchases of rakes were made. The price given is the purchase price paid by thestore — it is not the same as the selling price, which is what the store charges itscustomers for the rakes. The selling price is not involved here. At the bottom of thechart you can see that 44 rakes cost Jones Hardware 543.C-1

C-2INVENTORY AND DEPRECIATIONIn the specific invoice method, one assigns the cost of ending inventory by identifying each item in that inventory by a specific purchase price and invoice number.Items can be identified by serial number, physical description, or location. Using thismethod, Jones Hardware knew that six of the rakes not sold were from the March 15invoice and the other six were from the August 18 purchase. Thus 150 was assignedas the actual cost of ending inventory. If the total cost of goods available for sale is 543 and we subtract the actual cost of ending inventory ( 150), this method provides a figure of 393 for cost of goods sold.Specific Invoice MethodGoods Availablefor SaleUnitsJanuary 1 Beg. InventoryMarch 15 PurchasedAugust 18 PurchasedNovember 15 Purchased10920544Cost@@@@Calculating Cost ofEnding InventoryTotal 10121315 100 108 260 75 543Cost of Goods Available for SaleLess: Cost of Ending Inventory Cost of Goods SoldUnitsCostTotal66@ 12@ 13 727812 150 543150 393Let’s look at pros and cons of this method:Specific Invoice MethodPros1. Simple to use if company has smallamount of high-cost goods — forexample, autos, jewels, boats,antiques, etc.2. Flow of goods and flow of cost arethe same.3. Costs are matched with the salesthey helped to produce.Cons1. Difficult to use for goodswith large unit volume andsmall unit prices — for example,nails at a hardware store,packages of tooth paste at adrug store.2. Difficult to use for decisionmaking purposes — ordinarilyan impractical approach.WEIGHTED-AVERAGE METHODThe weighted-average method calculates an average unit cost by dividing the totalcost of goods available for sale by the total units of goods available for sale. Since wedon’t know exactly which items are left in ending inventory, we will calculate the average of all the goods we have available in order to come up with a fair approximationof the cost of the ending inventory.

INVENTORY AND DEPRECIATIONWeighted-Average MethodGoods Availablefor SaleJanuary 1 Beg. InventoryMarch 15 PurchasedAugust 18 PurchasedNovember 15 Purchased 54344 12.34UnitsCostTotal10920544@ 10 @ 12 @ 13 @ 15 10010826075 543weighted-average cost per unit12 rakes 3 12.34 148.08Cost of Goods Available for SaleLess: Cost of Ending Inventory Cost of Goods Sold 543.00148.08 394.92The pros and cons of this method:Weighted-Average MethodProsCons1. Weighted-average takesinto account the number ofunits purchased at each amount,not a simple average cost.Good for products sold inlarge volume, such as grainsand fuels.2. Accountant assigns an equalunit cost to each unit of inventory;thus, when the income statementis prepared, net income will notfluctuate as much as with othermethods.1. Current prices have no more significance than prices of goods boughtmonths earlier.2. Compared to other methods, themost recent costs are not matchedwith current sales.3. Cost of ending inventory is not asup-to-date as it could be usinganother method.FIRST-IN, FIRST-OUT METHOD (FIFO)In the FIFO method, one assumes that the oldest goods (rakes, in this case)are sold first. In other words, the first merchandise brought into the store tends tobe sold first. Indeed, it is often the sale of these items that prompts the store tobuy more of them — as they start to run out, the store purchases more. Whencosts are assigned in the FIFO method, the cost of the last items brought intothe store is assigned to ending inventory and the inventory sold is assigned tocost of goods sold. For example, using our Jones Hardware situation, the endinginventory of 12 rakes on hand are assigned a cost from the last two purchases ofrakes (purchases made on November 15 and some purchases made on August 8), 166. Using the FIFO method, it is always assumed that it is the most recently purchased merchandise that has not been sold. Look at how this works out in theaccompanying table on page C-4.C-3

C-4INVENTORY AND DEPRECIATIONFirst-In, First-Out (FIFO) MethodGoods Availablefor SaleUnitsJanuary 1 Beg. InventoryMarch 15 PurchasedAugust 18 PurchasedNovember 15 Purchased10920544Cost@ 10@ 12@ 13@ 15Calculating Cost ofEnding InventoryTotal 100 108 260 75 543Cost of Goods Available for SaleLess: Cost of Ending Inventory Cost of Goods SoldUnits7512CostTotal@ 13 @ 15 9175 166 543166 377If you are having difficulty with this, think of the inventory as being taken fromthe bottom layer first, then the next one up, and the next one up, etc.The pros and cons of this method:First-In, First-Out (FIFO) MethodPros1. The cost flow tends to follow thephysical flow (most businesses tryto sell the old goods first — forexample, perishables such as fruitor vegetables).2. The figure for ending inventoryis made up of current costson the balance sheet (sinceinventory left over is assumed tobe from goods last broughtinto the store).Cons1. During inflation this methodwill produce higher incomeon the income statement —thus more taxes to be paid.(We will discuss this later inthis appendix.)2. Recent costs are not matched withrecent sales, since we assume oldgoods are sold first.LAST-IN, FIRST-OUT METHOD (LIFO)Under the LIFO method, it is assumed that the rakes most recently acquired by Jonesare sold first. In other words, the last merchandise brought into the store is the first tobe sold. As an example of this method, think of a barrel of nails. It is the most recentlypurchased nails, which are at the top of the barrel, that are sold first — the nails at thebottom of the barrel are sold last. Note in the accompanying table on page C-4 thatthe 12 rakes not sold were assigned costs based on the old inventory of January andMarch that totaled 124, giving Jones a cost of goods sold of 419.

INVENTORY AND DEPRECIATIONLast-In, First-Out (LIFO) MethodGoods Availablefor SaleUnitsJanuary 1 Beg. InventoryMarch 15 PurchasedAugust 18 PurchasedNovember 15 Purchased10920544Calculating Cost ofEnding InventoryCostTotal@ 10@ 12@ 13@ 15 100 108 260 75 543Cost of Goods Available for SaleLess: Cost of Ending Inventory Cost of Goods SoldUnitsCostTotal10 @ 102 @ 12 100 2412 124 543124 419These are the pros and cons of this method:Last-In, First-Out (LIFO) MethodProsCons1. Cost of goods sold is stated at ornear current costs, since costs oflatest goods acquired are used.2. Matches current costs with currentselling prices.3. During periods of inflation thismethod produces the lowest netincome, which is a tax advantage.(The lower cost of ending inventorymeans a higher cost of goods sold;with a higher cost of goods sold,gross profit and ultimately net incomeare smaller, and thus taxes are lower.)1. Ending inventory is valued atvery old prices.2. Doesn’t match physical flow ofgoods (but can still be used tocalculate flow of costs).Now we will compare the methods that could be used by Jones Hardware to seethe cost of ending inventory and the assigned cost of goods sold.Comparison of Methods for Jones HardwareSpecific InvoiceWeighted-AverageFIFOLIFOCost of Ending InventoryCost of Goods Sold 150.00148.08166.00124.00 393.00394.92377.00419.00All four methods are acceptable accounting procedures, and each has its ownvirtues:1. The specific invoice method matches exactly costs with revenue — as wehave noted before, this is very important in the accrual basis of accounting.2. The weighted-average method tends to smooth out the fluctuations betweenFIFO and LIFO.C-5

C-6INVENTORY AND DEPRECIATION3. FIFO provides an up-to-date picture of inventory on the balance sheet, sinceit uses the latest purchases to calculate ending inventory.4. When prices are rising, LIFO shows the highest costs of goods sold and thusprovides some tax advantages.Learning Unit C-1 ReviewPROBLEM (SOLUTION AT END OF APPENDIX)Regis Company began the year with 300 units of product B in inventory with a unitcost of 40. The following additional purchases of the product were made: FIFO, LIFO, weightedaverage: April 1, 200 units @ 50 eachJuly 5, 500 units @ 60 eachAug. 15, 400 units @ 70 eachNov. 20, 200 units @ 80 eachAt end of year Regis Company had 400 units of its product unsold. Your task is to calculate cost of ending inventory as well as cost of goods sold by (a) FIFO, (b) LIFO, (c)weighted-average.Learning Unit C-2D EPRECIATION M ETHODSIn this unit we will look at different methods for computing depreciation. If you wantto check any of the concepts of depreciation, you can refer back to Chapter 4.When a company calculates its periodic depreciation expense, different methodswill produce significantly different results. Thus the method of depreciation chosenwill affect the net income for current as well as future periods, as well as the bookvalue (cost of asset less accumulated depreciation) of the asset on the balance sheet.Let’s assume that Melvin Company purchased a truck on January 1, 19XX, for 20,000, with a residual value of 2,000 and an estimated life of 5 years. The following are the four depreciation methods that Melvin Company could use:Think of residual value astrade-in value at end ofestimated life.1. Straight-line method.2. Units-of-production method.3. Sum-of-the-years’-digits method.4. Declining-balance method.STRAIGHT-LINE METHODThe straight-line method is simple to use, because it allocates the cost of the asset(less residual value) evenly over its estimated useful life. (At the time an asset isacquired, an estimate is made of its usefulness or useful life in terms of number ofyears it would last, amount of output expected, etc.) Let’s look at how MelvinCompany calculates its depreciation expense for each of the estimated 5 years of usefulness using the straight-line method. Take a moment to read the key points in theparentheses below the accompanying table.The formula:cost residual value 20,000 2,000 3, 600service useful life in years5

INVENTORY AND DEPRECIATIONEnd ofYearCost edDepreciation,End of YearBook Value,End of Year(Cost 2 Accum. Dep.)12345 20,00020,00020,00020,00020,000 3,6003,6003,6003,6003,600 3,6007,20010,80014,40018,000 16,40012,8009,2005,6002,000(Cost ofmachinedoesn’tchange)(Note thatdepreciationexpense is thesame eachyear)*The(Accumulateddepreciationincreases by 3,600 eachyear)C-7(Book value each yearis lowered by 3,600until residual value of 2,000 is reached)depreciation rate is 100 percent 5 years 20 percent. The 20 percent is then multiplied times the costminus the residual value.UNITS-OF-PRODUCTION METHODWith the units-of-production method it is assumed that passage of time does notdetermine the amount of depreciation taken. Depreciation expense is based on use, beit total estimated miles, tons hauled, or estimated units of production — for example,the number of shoes a machine could produce in its expected useful life. The accompanying table shows the calculations that Melvin Company makes for its truck usingthe units-of-production method (note that the truck is assumed to have an estimatedlife of 90,000 miles).The formula:cost residual value 20, 000 2, 000 .20 per mileestimated units of production90, 000 miles( .20) (no. of miles driven) Depreciation expense for periodEnd ofYearCost ofDeliveryTruck12345 20,00020,00020,00020,00020,000Miles Drivenin Year30,00021,00015,0005,00019,000(After 5 years,truck has beendriven preciation,End of YearBook Value,End of Year(Cost 2 Accum. Dep.) 6,0004,2003,0001,0003,800 6,00010,20013,20014,20018,000 14,0009,8006,8005,8002,000(Depreciationexpense isdirectly relatedto number ofmiles driven)SUM-OF-THE-YEARS’-DIGITS METHODThe sum-of-the-years’-digits method places more depreciation expense in the earlyyears rather than the later years in order to better match revenue and expenses, sincean asset’s productivity may be reduced in later years. For this reason it is called anDepreciation expense isdirectly related to use, notto passage of time.

C-8INVENTORY AND DEPRECIATIONaccelerated depreciation method. To use it, you multiply cost minus residual times acertain fraction. This fraction is made up of the following:1. The denominator: The denominator is based on how many years the asset islikely to last (say 5). You then add the sum of the digits of 5 years (1 2 3 4 5), which equals 15; 15 is the denominator. [There is also a formula touse for the denominator: N(N 1)/2, where N stands for number of years ofuseful life (in our case, 5 years). In our case the formula would look like this:5(5 1)/2 15.]2. The numerator: The years in reverse order are the numerator (in our case, 5,4, 3, 2, 1).Thus, in year 1 the fraction would be 5/15; in year 2, 4/15; in year 3, 3/15; in year 4,2/15; in year 5, 1/15. And in each year you would multiply this fraction times cost minusresidual to find the depreciation expense. This is shown in the accompanying table.End ofYearCostMinusresidual( )31 18,0003515 4,80010,8009,200(Fractionfor Year) YearlyDepreciationExpense 6,000AccumulatedDepreciation,End of Year 6,000Book Value,End of Year(Cost 2 Accum. Dep.) 14,000 ( 20,000 2 6,000)(20,000 2 2,000)218,0003415318,0003315 3,60014,4005,600418,0003215 2,40016,8003,200518,0003115 1,20018,0002,000(Fraction for year ismultiplied times costminus residual)(Depreciationexpense in firstyear is highest)(Each year depreciation accumulates by asmaller amount)(Book valuegoes down eachyear until resid-ual is reached)Take a moment to make sure you see how the figures for these calculations arearrived at before moving on to the next method.DOUBLE DECLINING-BALANCE METHODThe double declining-balance method is also an accelerated method, in which alarger depreciation expense is taken in earlier years and smaller amounts in lateryears. This method uses twice the straight-line rate, which is why it is called the doubledeclining-balance method.A key point in this method is that residual value is not deducted from cost in thecalculations, although the asset cannot be depreciated below its residual value. To calculate depreciation, take the following steps:

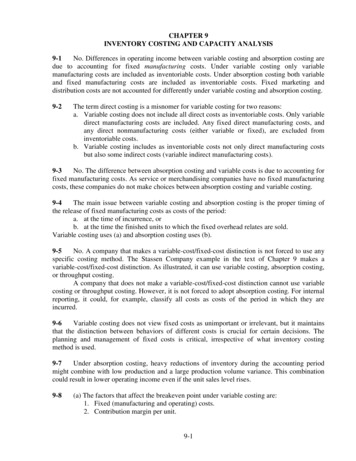

C-9INVENTORY AND DEPRECIATION1. Calculate the straight-line rate and double it:100% 2useful life2. At the end of each year multiply rate times book value of asset at beginningof year.Let’s look at how Melvin Company calculates the depreciation on its truck usingthis method.Note rate of .40 is notchanged (20% 3 2)AccumulatedDepreciation,Beg. of YearBook ValueBeg. of Year(Cost 2 Acc. Dep.)End ofYearCost1 20,000220,000 ,00017,4082,592 20,000(Originalcostremains thesame)Dep. Exp.(B.V. Beg. ofYear 3 Rate)AccumulatedDepreciation,End of YearBook Value,End of Year(Cost 2 Acc. Dep.) 8,000( 20,000 3 .40)4,800(12,000 3 .40)2,880(7,200 3 .40)1,728(4,320 3 .40)592 8,000 12,000(20,000 2 8,000)7,20012,800(8,000 4,800)15,680Depreciation islimited to 592,since the asset cannotdepreciate below theresidual value)4,32017,4082,59218,0002,000(The book valuenow equals theresidual value)Be sure to note the 592 in year 5 of depreciation expense. We could not take morethan the 592, or we would have depreciated the asset below the residual value.DEPRECIATION FOR TAX PURPOSES BEFORE THE TAXREFORM ACT OF 1986Over the years, the methods we have discussed have been used for financial reporting;they have not been used for tax purposes. For tangible assets bought prior to 1981, taxlaw allowed companies to use the declining-balance or sum-of-the-years’-digitsmethods for tax reporting. Beginning in 1981, the Accelerated Cost Recovery System(MACRS) began to be used. The MACRS is a simpler system, meant to stimulate economic growth by faster cost recovery.MACRS eliminates the concept of useful life and salvage value and establishes classesof depreciable property, dividing it into 3-, 5-, 10-, 18-, or 19-year property. The deductions for depreciation MACRS allows are shown in Table C-1 on page C-10. Using thistable, you can see that if Melvin Company used ACRS for its 20,000 truck (a light truckin the 3-year class) bought on January 1, the following depreciation would be recorded:19X119X219X3.25 20,000 5,000.38 20,000 7,600.37 20,000 7,400 20,000Note that Table C-1 isbefore the Tax Reform Actof 1986.

C-10INVENTORY AND DEPRECIATIONThe important points to remember are:1. ACRS is generally not acceptable in preparing financial reports, because itallocates depreciation over a much shorter period than estimated useful life.2. ACRS for tax reporting defers payment of income tax, since large amountsof depreciation are charged to earlier years.TABLE C-1 Accelerated Cost Recovery System:Annual Depreciation as a Percentage of OriginalCostFor Property in the1st year2nd year3rd year4th year5th year6th year7th year8th year9th year10th yearThree-Year Class1Five-Year Class22538371522212121Ten-Year Class38141210101099991Three-yearclass includes autos, some tools, and light trucks.class includes most machinery and equipment.3Ten-year class includes amusement parks, pipelines, and nuclear plants.2Five-yearMACRS AFTER THE TAX REFORM ACT OF 1986(GENERAL DEPRECIATION SYSTEM)This tax act generally overhauls the depreciation setup of property placed in serviceafter December 31, 1986. Look for a moment at Figure C-1. This is a chart that summarizes the Tax Reform Act update. As you can see, some new classes are introduced(7- and 20-year property); cars and light trucks are moved from the 3-year class to the5-year class; and office equipment moves from the 5-year class to the 7-year class.According to this act, classes 3, 5, 7, and 10 use 200 percent declining-balance,switching to straight-line, while classes 15 and 20 use 150 percent declining-balance,switching to straight-line. Both residential and nonresidential real property mustuse straight-line. Note that the recovery period is extended to 27 12 years for residential property and to 31 12 years for nonresidential property.Let’s use Table C-2 (which was developed for this tax law) to calculate depreciation on the purchase of a nonlux

C-2 INVENTORY AND DEPRECIATION In the specific invoice method, one assigns the cost of ending inventory by iden- tifying each item in that inventory by a specific purchase price and invoice number. Items can be identi