Transcription

Doing Business 2020TanzaniaEconomy ProfileTanzaniaPage 1

Doing Business 2020TanzaniaEconomy Profile of TanzaniaDoing Business 2020 Indicators(in order of appearance in the document)Starting a businessProcedures, time, cost and paid-in minimum capital to start a limited liability companyDealing with construction permitsProcedures, time and cost to complete all formalities to build a warehouse and the quality control and safetymechanisms in the construction permitting systemGetting electricityProcedures, time and cost to get connected to the electrical grid, and the reliability of the electricity supply andthe transparency of tariffsRegistering propertyProcedures, time and cost to transfer a property and the quality of the land administration systemGetting creditMovable collateral laws and credit information systemsProtecting minority investorsMinority shareholders’ rights in related-party transactions and in corporate governancePaying taxesPayments, time, total tax and contribution rate for a firm to comply with all tax regulations as well as postfilingprocessesTrading across bordersTime and cost to export the product of comparative advantage and import auto partsEnforcing contractsTime and cost to resolve a commercial dispute and the quality of judicial processesResolving insolvencyTime, cost, outcome and recovery rate for a commercial insolvency and the strength of the legal framework forinsolvencyEmploying workersFlexibility in employment regulation and redundancy costPage 2

Doing Business 2020TanzaniaAbout Doing BusinessThe Doing Business project provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational andregional level.The Doing Business project, launched in 2002, looks at domestic small and medium-size companies and measures the regulations applying to them through their lifecycle.Doing Business captures several important dimensions of the regulatory environment as it applies to local firms. It provides quantitative indicators on regulation forstarting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading acrossborders, enforcing contracts and resolving insolvency. Doing Business also measures features of employing workers. Although Doing Business does not present rankingsof economies on the employing workers indicators or include the topic in the aggregate ease of doing business score or ranking on the ease of doing business, it doespresent the data for these indicators.By gathering and analyzing comprehensive quantitative data to compare business regulation environments across economies and over time, Doing Business encourageseconomies to compete towards more efficient regulation; offers measurable benchmarks for reform; and serves as a resource for academics, journalists, private sectorresearchers and others interested in the business climate of each economy.In addition, Doing Business offers detailed subnational studies, which exhaustively cover business regulation and reform in different cities and regions within a nation.These studies provide data on the ease of doing business, rank each location, and recommend reforms to improve performance in each of the indicator areas. Selectedcities can compare their business regulations with other cities in the economy or region and with the 190 economies that Doing Business has ranked.The first Doing Business study, published in 2003, covered 5 indicator sets and 133 economies. This year’s study covers 11 indicator sets and 190 economies. Mostindicator sets refer to a case scenario in the largest business city of each economy, except for 11 economies that have a population of more than 100 million as of 2013(Bangladesh, Brazil, China, India, Indonesia, Japan, Mexico, Nigeria, Pakistan, the Russian Federation and the United States) where Doing Business also collected datafor the second largest business city. The data for these 11 economies are a population-weighted average for the 2 largest business cities. The project has benefited fromfeedback from governments, academics, practitioners and reviewers. The initial goal remains: to provide an objective basis for understanding and improving theregulatory environment for business around the world.To learn more about Doing Business please visit doingbusiness.orgPage 3

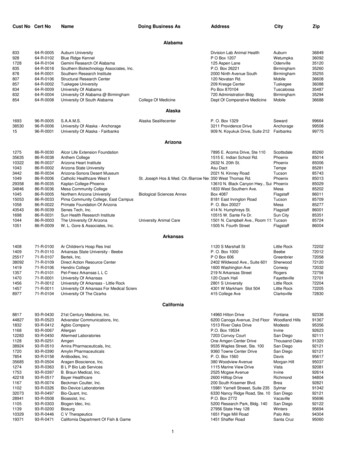

Doing Business 2020TanzaniaEase of Doing Business inTanzaniaRegionSub-Saharan AfricaIncome CategoryLow incomePopulation56,318,348City CoveredDar es SalaamDB RANKDB SCORE14154.5Rankings on Doing Business topics - ontractsResolvingInsolvencyTopic Scores74.457.974.950.165.050.0Starting a Business (rank)162Getting Credit (rank)Score of starting a business (0-100)74.4Score of getting credit (0-100)Procedures (number)1051.320.26765.061.739.1Trading across Borders (rank)182Score of trading across borders (0-100)20.2Strength of legal rights index (0-12)5Time to exportTime (days)29.5Depth of credit information index (0-8)8Documentary compliance (hours)96Cost (number)40.6Credit registry coverage (% of adults)0.0Border compliance (hours)96Paid-in min. capital (% of income per capita)0.0Credit bureau coverage (% of adults)6.1Cost to exportDealing with Construction Permits (rank)149Protecting Minority Investors (rank)105Border compliance (USD)Score of dealing with construction permits (0-100)57.9Score of protecting minority investors (0-100)50.0Time to exportDocumentary compliance (USD)Procedures (number)24Extent of disclosure index (0-10)2.02751,175Documentary compliance (hours)240Time (days)184Extent of director liability index (0-10)6.0Border compliance (hours)402Cost (% of warehouse value)5.4Ease of shareholder suits index (0-10)8.0Cost to export12.0Extent of shareholder rights index (0-6)3.0Documentary compliance (USD)Extent of ownership and control index (0-7)2.0Border compliance (USD)Extent of corporate transparency index (0-7)4.0Paying Taxes (rank)165Score of enforcing contracts (0-100)Score of paying taxes (0-100)51.3Time (days)515Cost (% of claim value)14.3Building quality control index (0-15)Getting Electricity (rank)Score of getting electricity (0-100)Procedures (number)Time (days)Cost (% of income per capita)Reliability of supply and transparency of tariff index (0-8)8574.94105690.85Registering Property (rank)146Score of registering property (0-100)50.1Procedures (number)8Enforcing Contracts (rank)Payments (number per year)59Time (hours per year)207Total tax and contribution rate (% of profit)43.8Postfiling index (0-100)48.4Quality of judicial processes index (0-18)Resolving Insolvency (rank)3751,3507161.76.0116Score of resolving insolvency (0-100)39.1Recovery rate (cents on the dollar)20.4Time (days)67Time (years)Cost (% of property value)5.2Cost (% of estate)Quality of the land administration index (0-30)7.5Outcome (0 as piecemeal sale and 1 as goingconcern)0Strength of insolvency framework index (0-16)9.03.022.0Page 4

Doing Business 2020TanzaniaStarting a BusinessThis topic measures the number of procedures, time, cost and paid-in minimum capital requirement for a small- to medium-sized limited liability company to start up andformally operate in each economy’s largest business city.To make the data comparable across 190 economies, Doing Business uses a standardized business that is 100% domestically owned, has start-up capital equivalent to10 times the income per capita, engages in general industrial or commercial activities and employs between 10 and 50 people one month after the commencement ofoperations, all of whom are domestic nationals. Starting a Business considers two types of local limited liability companies that are identical in all aspects, except that onecompany is owned by 5 married women and the other by 5 married men. The ranking of economies on the ease of starting a business is determined by sorting theirscores for starting a business. These scores are the simple average of the scores for each of the component indicators.The most recent round of data collection for the project was completed in May 2019. See the methodology for more information.What the indicators measureProcedures to legally start and formally operate a company(number) Preregistration (for example, name verification or reservation,notarization) Registration in the economy’s largest business city Postregistration (for example, social security registration,company seal) Obtaining approval from spouse to start a business or to leavethe home to register the company Obtaining any gender specific document for companyregistration and operation or national identification cardTime required to complete each procedure (calendar days) Does not include time spent gathering information Each procedure starts on a separate day (2 procedures cannotstart on the same day) Procedures fully completed online are recorded as ½ day Procedure is considered completed once final document isreceived No prior contact with officialsCost required to complete each procedure (% of income percapita) Official costs only, no bribes No professional fees unless services required by law orcommonly used in practicePaid-in minimum capital (% of income per capita) Funds deposited in a bank or with third party before registrationor up to 3 months after incorporationCase study assumptionsTo make the data comparable across economies, several assumptions about the business and theprocedures are used. It is assumed that any required information is readily available and that theentrepreneur will pay no bribes.The business:-Is a limited liability company (or its legal equivalent). If there is more than one type of limitedliability company in the economy, the limited liability form most common among domestic firms ischosen. Information on the most common form is obtained from incorporation lawyers or thestatistical office.-Operates in the economy’s largest business city. For 11 economies the data are also collected forthe second largest business city.-Performs general industrial or commercial activities such as the production or sale to the public ofgoods or services. The business does not perform foreign trade activities and does not handleproducts subject to a special tax regime, for example, liquor or tobacco. It is not using heavilypolluting production processes.-Does not qualify for investment incentives or any special benefits.-Is 100% domestically owned.-Has five business owners, none of whom is a legal entity. One business owner holds 30% of thecompany shares, two owners have 20% of shares each, and two owners have 15% of shareseach.-Is managed by one local director.-Has between 10 and 50 employees one month after the commencement of operations, all of themdomestic nationals.-Has start-up capital of 10 times income per capita.-Has an estimated turnover of at least 100 times income per capita.-Leases the commercial plant or offices and is not a proprietor of real estate.-Has an annual lease for the office space equivalent to one income per capita.-Is in an office space of approximately 929 square meters (10,000 square feet).-Has a company deed that is 10 pages long.The owners:-Have reached the legal age of majority and are capable of making decisions as an adult. If thereis no legal age of majority, they are assumed to be 30 years old.-Are in good health and have no criminal record.-Are married, the marriage is monogamous and registered with the authorities.-Where the answer differs according to the legal system applicable to the woman or man inquestion (as may be the case in economies where there is legal plurality), the answer used will bethe one that applies to the majority of the population.Page 5

Doing Business 2020TanzaniaStarting a Business - TanzaniaStandardized CompanyLegal formPrivate Limited Liability CompanyPaid-in minimum capital requirementNo minimumCity CoveredDar es SalaamIndicatorTanzaniaSub-SaharanAfricaOECD highincomeBest RegulatoryPerformanceProcedure – Men (number)107.44.91 (2 Economies)Time – Men (days)29.521.59.20.5 (New Zealand)Cost – Men (% of income per capita)40.636.33.00.0 (2 Economies)Procedure – Women (number)107.54.91 (2 Economies)Time – Women (days)29.521.69.20.5 (New Zealand)Cost – Women (% of income per capita)40.636.33.00.0 (2 Economies)Paid-in min. capital (% of income per capita)0.09.37.60.0 (120 Economies)Figure – Starting a Business in Tanzania – Score47.170.979.7100.0ProceduresTimeCostPaid-in min. capitalFigure – Starting a Business in Tanzania and comparator economies – Ranking and ScoreDB 2020 Starting a Business Score010082.7: Kenya (Rank: 129)80.1: Regional Average (Sub-Saharan Africa)79.4: Angola (Rank: 146)77.9: Malawi (Rank: 153)76.2: Botswana (Rank: 159)74.4: Tanzania (Rank: 162)Note: The ranking of economies on the ease of starting a business is determined by sorting their scores for starting a business. These scores are the simple average ofthe scores for each of the component indicators.Page 6

Doing Business 2020TanzaniaFigure – Starting a Business in Tanzania – Procedure, Time and CostTime (days)Cost (% of income per capita)162514Time (days)2012101581064Cost (% of income per capita)1852001234567*8*9* 10Procedures (number)* This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows thetime for women. For more information on methodology, see the Doing Business website (http://doingbusiness.org/en/methodology). For details on the proceduresreflected here, see the summary below.Page 7

Doing Business 2020TanzaniaDetails – Starting a Business in Tanzania – Procedure, Time and CostNo.1ProceduresVerify the availability of the proposed company nameAgency : Online Registration System, Business Registration and Licensing Authority (BRELA)A new company would have a business name and a company name. The company can havedifferent businesses or projects, which are registered under the umbrella of the company but canhave different names. Prior to registering the company, the availability of both the company nameand business name can be verified online at c.Time to CompleteLess than one dayAssociated Costsno charge(online procedure)Once it was verified that the names are not used by existing companies, the business foundersmay proceed with the incorporation of the company.2Obtain a notarized declaration of complianceAgency : NotaryEntrepreneurs visit the notary for notarization of the declaration of compliance. Notaries chargewithin the range of TZS 10,000-50,000 for notarial services for normal documents such as formNo. 14 b.1 dayTZS 10,000-50,0003Apply for company incorporation and obtain the certificate of incorporationAgency : Online Registration System, Business Registration and Licensing Authority (BRELA)The company will be registered online through the Online Registration System (ORS). To apply fora certificate of incorporation, a subscriber, secretary, or a person named in the articles ofassociation as a director must submit the following documents:- 14a (First Directors and Secretary and Intended situation of Registered Office)- 14b (Declaration of Compliance on Application for the Registration of a Company)- The Memorandum and Articles of Association are also filed with the forms.6 daysTZS 337,2002 daysno charge6 daysTZS 400,0004 daysno chargeAfter the forms are submitted, the registration is usually processed within 3-4 days and anelectronic version of the certificate of registration will be provided to the applicant. The registrationnumber will be the same as the company's tax identification number. The company registrationfees can be paid online and are as follows (based on share capital):- Share capital from 20,000 to 1,000,000: TZS 95,000.- Share capital from 1,000,000 to 5,000,000: TZS 175,000.- Share capital from 5,000,000 to 20,000,000: TZS 260,000.- Share capital from 20,000,000 to 50,000,000: TZS 290,000.- Share capital 50,000,000 and over: TZS 440,000.- Filing fee: TZS 66,000: 22,000 per document- Stamp duty fee: Original memorandum and articles of association: TZS 6,200 Every additionalcopy: TZS 5,000.4Obtain the taxpayer identification number (TIN) certificateAgency : Tanzania Revenue Authority (TRA)Once the company has been registered, the business founders must apply for tax registration atthe Tanzania Revenue Authority (TRA) and obtain a tax identification number (TIN). Theapplication for the TIN certificate is made by filling TIN application forms as follows: Application for the company. Application for each shareholder/director (in case any director has already issued with TINcertificates for other purpose, he or she cannot make another application. The same TIN numberwill be used).The application can be submitted online. To complete the tax registration, at least one of thedirectors of the company must be physically present at the tax office to give their fingerprints(biometric data). The applicant must visit TRA offices to pick up the TIN number in person. Thecompany will be required to declare its estimated income or turnover for the provision taxassessment for the particular year. At the TRA office, the tax officer may interview the companyfounders/directors and record their business and personal particulars.5Apply for a business licenseAgency : Ministry of Industy, Trade and Investment (MITI) or the Local Government Authorities(LGAs)The business license is either issued by the Ministry of Industry, Trade and Investment (MITI) orthe Local Government Authorities (LGAs), depending on the nature of business. Together with theapplication, the following documents must be submitted:1) Certificate of incorporation;2) Memorandum and Articles of Association;3) Proof of Tanzanian Citizenship;4) Proof of a suitable company premises;5) Taxpayer Identification Number (TIN).The cost of the license depends on the nature of the business, and it usually varies between TZS200,000 and TZS 1,000,000. For a medium-scale manufacturer and seller of goods, the licensecosts TZS 400,000.6Apply for the VAT certificateAgency : Tanzania Revenue Authority (TRA)VAT registration takes 3 to 5 days if the proposed company has over the threshold income of TZS100,000,000.Page 8

Doing Business 202078TanzaniaRegister for the workmen’s compensation insuranceAgency : Workers Compensation Fund (WCF) and Tanzania Insurance Regulatory Authority(TIRA)To register for workers’ compensation insurance, employers must complete the Workmen’sCompensation Tariff Proposal Form. This form should be completed once the firm begins hiringemployees and just before the firm becomes operational. However, because the insuranceindustry is privatized in Tanzania, employers may opt to take an insurance policy instead of theworkmen’s compensation claims.1 dayno chargeRegister with the Occupational Safety and Health Authority (OSHA)Agency : Occupational Health and Safety Authority (OSHA)Any person being the owner or occupier of a workplace shall, before operating, be required toregister such factory or work place. Therefore the applicant is required to complete the applicationform and provide the company's registration documents to OSHA. Prior to approving anapplication OSHA officials visit the premises for inspection on health and safety.10 days, simultaneousno chargeReceive inspection from the Occupational Safety and Health Authority (OSHA)Agency : Occupational Health and Safety Authority (OSHA)Prior to approving an application for the workplace, OSHA officials visit the premises for inspectionon health and safety. A certificate of registration and certificate of compliance will only be issuedonce the OSHA officials are satisfied that the premises are in safe and good habitable condition.1 day, simultaneousNo ChargeObtain Social Security registration numberAgency : Social Security Regulatory Authority (SSRA)SSRA is the regulatory authority for social security. Every employer in the formal sector is requiredto register his/her employees with any of the mandatory schemes, and it is the right of theemployee to choose the mandatory scheme to register under. These mandatory schemes areestablished by law and guaranteed by the Government to provide social security benefits toemployees. They include the National Social Security Fund (NSSF), the Parastatal Pensions Fund(PPF), the Local Government Authority Provident Fund (LAPF), and the Government EmployeesProvident Fund (GEPF).7 days, simultaneousno chargeThe application requires the following:- Name of occupier- Address- Nature of work- Total number of employees910Takes place simultaneously with previous procedure.Page 9

Doing Business 2020TanzaniaDealing with Construction PermitsThis topic tracks the procedures, time and cost to build a warehouse—including obtaining necessary the licenses and permits, submitting all required notifications,requesting and receiving all necessary inspections and obtaining utility connections. In addition, the Dealing with Construction Permits indicator measures the buildingquality control index, evaluating the quality of building regulations, the strength of quality control and safety mechanisms, liability and insurance regimes, and professionalcertification requirements. The most recent round of data collection was completed in May 2019. See the methodology for more informationWhat the indicators measureProcedures to legally build a warehouse (number) Submitting all relevant documents and obtaining all necessaryclearances, licenses, permits and certificates Submitting all required notifications and receiving all necessaryinspections Obtaining utility connections for water and sewerage Registering and selling the warehouse after its completionTime required to complete each procedure (calendar days) Does not include time spent gathering information Each procedure starts on a separate day—though proceduresthat can be fully completed online are an exception to this rule Procedure is considered completed once final document isreceived No prior contact with officialsCost required to complete each procedure (% of income percapita) Official costs only, no bribesBuilding quality control index (0-15) Quality of building regulations (0-2) Quality control before construction (0-1) Quality control during construction (0-3) Quality control after construction (0-3) Liability and insurance regimes (0-2) Professional certifications (0-4)Case study assumptionsTo make the data comparable across economies, several assumptions about the constructioncompany, the warehouse project and the utility connections are used.The construction company (BuildCo):- Is a limited liability company (or its legal equivalent) and operates in the economy’s largestbusiness city. For 11 economies the data are also collected for the second largest business city.- Is 100% domestically and privately owned; has five owners, none of whom is a legal entity. Has alicensed architect and a licensed engineer, both registered with the local association of architectsor engineers. BuildCo is not assumed to have any other employees who are technical or licensedexperts, such as geological or topographical experts.- Owns the land on which the warehouse will be built and will sell the warehouse upon itscompletion.The warehouse:- Will be used for general storage activities, such as storage of books or stationery.- Will have two stories, both above ground, with a total constructed area of approximately 1,300.6square meters (14,000 square feet). Each floor will be 3 meters (9 feet, 10 inches) high and will belocated on a land plot of approximately 929 square meters (10,000 square feet) that is 100%owned by BuildCo, and the warehouse is valued at 50 times income per capita.- Will have complete architectural and technical plans prepared by a licensed architect. Ifpreparation of the plans requires such steps as obtaining further documentation or getting priorapprovals from external agencies, these are counted as procedures.- Will take 30 weeks to construct (excluding all delays due to administrative and regulatoryrequirements).The water and sewerage connections:- Will be 150 meters (492 feet) from the existing water source and sewer tap. If there is no waterdelivery infrastructure in the economy, a borehole will be dug. If there is no sewerageinfrastructure, a septic tank in the smallest size available will be installed or built.- Will have an average water use of 662 liters (175 gallons) a day and an average wastewater flowof 568 liters (150 gallons) a day. Will have a peak water use of 1,325 liters (350 gallons) a day anda peak wastewater flow of 1,136 liters (300 gallons) a day.- Will have a constant level of water demand and wastewater flow throughout the year; will be 1inch in diameter for the water connection and 4 inches in diameter for the sewerage connection.Page 10

Doing Business 2020TanzaniaDealing with Construction Permits - TanzaniaStandardized WarehouseEstimated value of warehouseTZS 115,930,433City CoveredDar es SalaamIndicatorTanzaniaSub-SaharanAfricaOECD highincomeBest RegulatoryPerformanceProcedures (number)2415.112.7None in 2018/19Time (days)184145.4152.3None in 2018/19Cost (% of warehouse value)5.48.91.5None in 2018/19Building quality control index (0-15)12.08.911.615.0 (6 Economies)Figure – Dealing with Construction Permits in Tanzania – Score24.054.573.280.0ProceduresTimeCostBuilding quality control indexFigure – Dealing with Construction Permits in Tanzania and comparator economies – Ranking and ScoreDB 2020 Dealing with Construction Permits Score010075.6: Botswana (Rank: 44)67.6: Kenya (Rank: 105)65.3: Angola (Rank: 120)63.1: Malawi (Rank: 128)58.5: Regional Average (Sub-Saharan Africa)57.9: Tanzania (Rank: 149)Note: The ranking of economies on the ease of dealing with construction permits is determined by sorting their scores for dealing with construction permits. These scoresare the simple average of the scores for each of the component indicators.Page 11

Doing Business 2020TanzaniaFigure – Dealing with Construction Permits in Tanzania – Procedure, Time and CostTime (days)Cost (% of warehouse value)1602.5Time (days)14021201001.58016040Cost (% of warehouse 20212223* 24Procedures (number)* This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows thetime for women. For more information on methodology, see the Doing Business website (http://doingbusiness.org/en/methodology). For details on the proceduresreflected here, see the summary below.Page 12

Doing Business 2020TanzaniaFigure – Dealing with Construction Permits in Tanzania and comparator economies – Measure of Quality14Index otswanaKenyaMalawiSub-SaharanAfricaDetails – Dealing with Construction Permits in Tanzania – Procedure, Time and CostNo.1ProceduresTime to CompleteAssociated CostsObtain location plan from City Council - Ministry of LandsAgency : City Council (Ministry of Lands)BuildCo must write a letter to the City Council and the Ministry of Lands requesting a block plan,indicating the location of the land, street, ward, city, and region. If the plots are in an unplannedarea, it may take more than 90 days, since the City Council will need to re-survey the plot andproduce the location plan.7 daysTZS 5,000Obtain certified copy of the land rent receipts from the Tanzania Revenue AuthorityAgency : Tanzania Revenue Authority (TRA)This procedure is done through the Tanzania Revenue Authority (TAR), acting on behalf of TheMinistry of Lands, Housing and Urban Development.7 daysno chargeSubmit project brief and obtain EIA certificateAgency : National Environment Management Council (NEMC)In accordance with section VI of the Environmental Management Act (2004), Buildco must submitcopies of the project brief, the location plan, engage an independent expert to prepare EIA/EMP tobe submitted to NEMC to obtain the approval.30 daysTZS 70,000Obtain project clearance from the Fire DepartmentAgency : Municipal Council - Ministry of Home affairsOne of the requirements to obtain a building permit is to have a clearance from the FireDepartment, which is under the Ministry of Home Affairs. This clearance will attest that the correctfire fighting tools will be used.21 daysTZS 600,0005Request planning consent from the City CouncilAgency : City Council (Ministry of Lands)Once the preliminary drawings are completed BuildCo applies for a planning consent at theMunicipal Council.20 daysno charge6Request and obtain building permitAgency : City Council (Ministry of Lands)The documents required for obtaining a building permit are the following: Architectural/engineering drawings and calculations, including site layout and location plans,elevations, sections of the building including storm water drainage, fire protection, driveways andparking. All drawings should be signed by a registered professional architect and all the detailedstructural, electrical, plumbing and engineering installations by a registered professional engineer. Title deed showing ownership of land Receipts of payments of land rents and other statutory fees, and changes of land use if any38 daysTZS 1,439,991234Four copies of the documents must be submitted to the City Council for planning approvals. TheCity Council distributes three copies of the files

The project provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational and regional level. Doing Business The project, launched in 2002, looks at domestic small and medium-size companies and measures the regulations applying to them